Abstract

In recent times, risk management relative to Enterprise-wide Risk Management (EWRM) is increasingly becoming more and more significant and crucial for big corporations across the world, including financial agencies. Many of the major financial companies have shifted from the traditional risk management approaches towards Enterprise-wide Risk Management (EWRM). It is thus important to analyze the extent to which financial agencies use EWRM practices and the manner in which EWRM can possibly improve the over all economic values of such organizations. This study incorporated a methodology whereby personal interviews were conduced amongst 40 respondents engaged in different functions in financial agencies. They were also required to answer questions that related to the functioning of financial agencies relative to the adoption of Enterprise-wide Risk Management (EWRM) programs in resolving issues of risk mitigation. On the basis of the outcomes of the survey it became possible to ascertain the kind of mechanisms adopted by financial agencies to effectively use Enterprise-wide Risk Management (EWRM systems to deal efficiently with risks in their organizations. The findings enable important insights about how EWRM procedures in financial agencies contributed to the over all improvement in economic performance and values of financial agencies. This study will provide strong evidence in regard to the relations amongst the financial agency and EWRM. Future research will benefit from this study because it makes it convenient to carry forward similar approaches and methodologies in further getting outcomes from new developments in the financial sector. The research process experienced some limitations in that validated scales could not be available in the context of many of the analyzed variables. Hence there is some apprehension whether the definitions of different constructs were entirely understood by all respondents in the survey.

Introduction

Background

The global financial crisis has underlined the large scale shortcomings in risk management and corporate governance of financial services companies across the world because of which the need has arisen for managements to introduce an efficient risk management structure within the organization. However, such exercises cannot be taken lightly as they directly impact the working of the entire organization. The International Standards organization had introduced ISO 31000, which is the improved measure of risk management in identifying an all embracing risk management structure with the objective of helping firms to efficiently manage risks by applying risk management processes at varied levels and in definite contexts of the organization’s functioning. ISO 31000 is characterized with describing the generic procedures of enterprise –wide risk management structures. It also relates with the characteristics of improved risk management and can be used for identifying the effectiveness of risk management procedures in any company. This research looks into the applications of knowledge management relative to EWRM in attempts to understand the effects of technological support and people interactions in a risk management environment, which involves several disciplines, profiles and groups of workers having diverse knowledge and experience while working in the same environment.

This study employed a quantitative research design for purposes of structuring the research process. It is recognized that this type of research design will help the researcher to examine the issues at hand since the research is largely interested in evaluating the relationship between variables. Quantitative studies are either descriptive or experimental, but this particular study will employ a descriptive approach since the subjects in this case are the representatives of financial institutions and will only be measured once.

This research aimed at achieving the objectives of making adjustments about the current activities of financial agencies and identifying the barriers in this sector while making comparisons amongst them in the context of risk perceptions and their solutions. On the basis of the literature review and the answers to questions that were forwarded to individual respondents via e-mail, it was proposed to ascertain the practices being followed by financial agencies relative to adopting EWRM programs.

In general, it can be said that respondents were in agreement that the EWRM is an important tool in adding value for organizations and in addressing issues relative to mitigation of risks. This is apparent from the fact that workers become better informed and can take decisions more confidently in avoiding risks and pursuing growth opportunities. This is perhaps true because businesses are able to ascertain the possible risks and then to resolve them by adopting an amalgamated approach through implementation of EWRM programs. The over all findings confirm that risk management forms an important element of responding to risks and that EWRM has been widely integrated for risk mitigation in the financial sector. The approach has been widely acknowledged across the financial sector as being a useful measure of risk mitigation and of maintaining a positive code of corporate governance. Effectiveness of risk management is dependent on executive support and capacity to participate or report on risk management strategies and approaches. Thus, documentation of risk profile of a financial agency provides direction into risk management which influences on rationale for risk implementation. The mechanism through which an agency implements risks is dependent on cost benefit analysis. The agency ought to identify associated risk costs that impact on risk management which paves way to identification of appropriate strategies for risk management.

A significant finding related to the fact that some companies perceive values of risk management in terms of both quantifiable and non quantifiable elements. The non quantifiable element relates to the organizational image and credibility while the quantifiable aspect can be perceived by way of fiscal values. Conversely, some respondents believe that values pertain to one capability in managing change and uncertainty, thus leading to opportunity that ultimately provides positive financial value to the organization.. Risk management is influenced by capacity to assign risk responsibilities to different employees that provides foundation for enterprise capacity to develop and implement risk safeguards for risk implementation process. This involves determination of risk levels that the organization might be exposed to. This has effect of guiding in risk mitigation actions and adoption of appropriate risk controls that not only protect the agency but also build stakeholder confidence.

People working in financial agencies and directly involved in the decision making process relating to setting up EWRM programs and eventually implementing all related activities are required to have the requisite EWRM knowledge by way of past experience and expertise in risk management and mitigation efforts. It is pertinent in this context that the benefit accruing from the adopted measures cannot be immediately evaluated after financial agencies start implementing EWRM programs. It is also important that managers in financial agencies should be in agreement about the ways in which value can be created and values formed in keeping with the objectives of the company, which create a framework for moving towards more efficient and methodical management of the given risks.

Research Objectives

- To determine technological, systematic and operational risks that affect performance of financial agencies hence or otherwise determine mechanism through which financial agencies have been structured towards achievement of best practices in management of operational, systematic and technological risks exposures

- To determine role of organizational fit towards financial agency achievement of human capital competencies, alignment of management structure and control towards support for risk management and mechanism software designs have been tailored towards maximization of economic benefit of EWRM.

- To determine the role of social commitment, human capital training and development and technological planning towards stakeholder confidence in a financial agency economic growth hence or otherwise determine influence of risk project management towards sustainability of risk control and mitigation of a financial agency.

Expected outcomes of the study

The study outcomes will contribute into determination of best practices that a financial agency ought to undertake towards EWRM. The findings of the study will play a leading role in determination of mechanism through which risks are exploited towards development of risk system requirements and capacity for a financial agency security requirements as well as mechanism financial agencies develop security concept of risk operations and strategic application of risks towards economic growth The findings of the study will identify rationale through which financial agencies have achieved sustainability of agency information technology systems towards compliance with regulations and capacity for data protection and encryption that support EWRM and ISO 31000: 2009. The findings of the study will help to identify financial agencies continuously upgrade the risk management information technology systems and rationale for financial agency variation of risk management processes, policies and procedures. The study will identify financial agency capability to manage change through identification of transformational risk operation procedures and processes and variability of the financial markets due to influence of globalization. The study will identify mechanism through which financial agencies dispose information and protocols and standards on information disposal for instance software, data and hardware. The findings will identify standards that inform information technology system change and level of risk security measures that are implemented and underlying systematic risks that may be encountered (Bowling, 2004).

Conceptual framework of study

The study will build on financial theory and theory of financial economics. Based on financial theory, a financial agency ought to undertake business processes that create value to stakeholders through demonstration of capability to achieve EWRM. The theory of financial economics affirms that stakeholders demonstrate confidence towards investments that could be perceived to have positive economic value added which implies financial agency management should not demonstrate capacity to hedge risks that investors can hedge at opportunity cost. Integration of financial theory into opportunity cost results into a scenario where a financial agency cannot invest or create stakeholder value through hedging risks if the price of internal capacity of bearing the risk is equivalent to price of external bearing of the risk. Although financial markets are imperfect, EWRM has been documented to contribute into capability to create economic value to the agency through management of instruments that demonstrate capability to manage enterprise-wide risk exposures.

Literature Review

Introduction

Financial companies across the world have to repeatedly manage and consider different aspects and means of risk irrespective of the type of risk and of whether they are good for the organization. Along with considering the different kinds of risks that organizations are exposed to, it is important to consider their capability to improve performance by adopting value based management practices. This implies the extent of the organization’s ability to improve the position of capital allocation and the ability to safeguard its reputation and credibility in order to achieve high standards of best practices. Financial companies are specifically required to recognize the risks and to evaluate them strategically by understanding all aspects of the risks faced currently and to avoid liabilities in the future. Additionally, they have to address and meet standards of corporate functioning and governance and manage possible crisis situations. It is equally important to consistently protect the business in order to protect shareholders’ interests and values.

EWRM assumes greater significance because competitive advantages in any financial agency are restricted in view of risks associated with potential losses that occur because of learning systems, communication of business values, restricted controls, cultural pressure, expansion and the increasing focus placed on information (Simoneou, 2006). Implementing EWRM is a dynamic procedure because the new strategies of controlling risks entail the analysis of new risks. Thus, risk control strongly impacts the implementation of EWRM measures (Ong, 2003). At the same time, feedback, experiences and knowledge in any company tend to flow in top/down and bottom/up directions. But EWRM implies that a policy relative to top/down direction has to be adopted in order to effectively implement the given procedures. Conversely, bottom/up direction has to be adopted in some situations so as to ascertain the associated risks and to make use of correct solutions to mitigate risks.

Research on EWRM

Lam (2003, p.68) argues that EWRM is instrumental towards sustainability of stakeholder confidence and trust. The capacity of an enterprise to manage financial risks and risk exposures depends on threats of risks that the financial enterprise encounters. Financial agencies ought to conduct risk analysis, risk evaluation and assessment in order to demonstrate capacity for financial risk determination. This provides foundation for a financial agency to adopt strategies that could maximize likelihood of exploiting values of the risks towards EWRM. Through risk assessment, a financial agency is positioned to identify direct and indirect impacts of a risk and its threat to the organizational reputation and image. This positions an enterprise to identify and determine adequacy of its financial risk planning, contingency planning and capacity of current risk controls to manage emerging risk concerns in the financial market with regard to insufficient financial reporting and internal control. Competencies in financial risk management have been document to depend on capacity of financial agency to document risks and identify its market risk profile which influences on level of the agency financial planning. Warner (2008) claims that risk prioritization provides basis for ranking risks based on their threats to affect enterprise business continuity. The capabilities to evaluate and rank risks depends on risks controls that the organization implements and the feasibility of the risk mitigation processes towards risk management (Pickett, 2006).

It is recognized by theorists that EWRM is instrumental towards sustainability of stakeholder confidence and trust. The capacity of an enterprise to manage financial risks and risk exposures depends on threats of risks that the financial enterprise encounters. Financial agencies ought to conduct risk analysis, risk evaluation and assessment in order to demonstrate capacity for financial risk determination. This provides foundation for a financial agency to adopt strategies that could maximize likelihood of exploiting values of the risks towards EWRM. Through risk assessment, a financial agency is positioned to identify direct and indirect impacts of a risk and its threat to the organizational reputation and image. This positions an enterprise to identify and determine adequacy of its financial risk planning, contingency planning and capacity of current risk controls to manage emerging risk concerns in the financial market with regard to insufficient financial reporting and internal control. Competencies in financial risk management have been document to depend on capacity of financial agency to document risks and identify its market risk profile which influences on level of the agency financial planning. Risk prioritization provides the basis for ranking risks based on their threats to affect enterprise business continuity. The capabilities to evaluate and rank risks depends on risks controls that the organization implements and the feasibility of the risk mitigation processes towards risk management.

Effectiveness of risk management is dependent on executive support and capacity to participate or report on risk management strategies and approaches. Thus, documentation of risk profile of a financial agency provides direction into risk management which influences on rationale for risk implementation. The mechanism through which an agency implements risks is dependent on cost benefit analysis. The agency ought to identify associated risk costs that impact on risk management which paves way to identification of appropriate strategies for risk management. Risk management is influenced by capacity to assign risk responsibilities to different employees that provides foundation for enterprise capacity to develop and implement risk safeguards for risk implementation process (Berenbeim, 2004). This involves determination of risk levels that the organization might be exposed to. This has effect of guiding in risk mitigation actions and adoption of appropriate risk controls that not only protect the agency but also build stakeholder confidence.

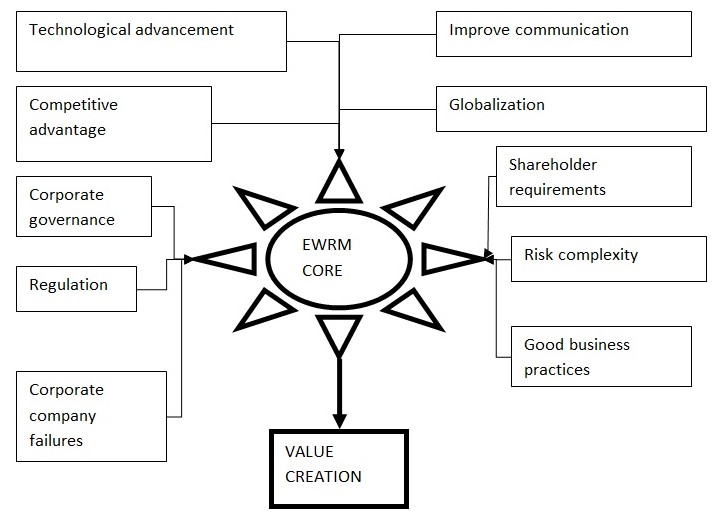

ISO (2009) argues that financial agency risk management planning is essential towards development of a risk mitigation plans as well as contingency plan. Risk planning integrates elements risk management approach; risk planning and risk execution and persons that are responsible. The persons are responsible for risk assessment and identification that includes determination of risk characteristics and threat they pose to the financial position of the agency. Identification of risk characteristics is dependent on capacity for qualitative risk analysis and capability to quantify risk threats that make it possible to rank order risks based on threats. Quantification of risks involves risk categorization through representation of risks in terms of a numerical value. Assigning risks a numerical value provides capacity for an agency to determine tactical and strategic processes that should involve form basis for risk intervention and mitigation (Bowling & Rieger, 2005). Risk management strategies (Berenbeim (2004) influences on risk monitoring and controls that an agency can implement towards achieving sustainable risk management. this involves capacity to track risks, monitor residual impacts of the risks that provides basis for identification of new risks that may be predisposed by secondary factors (figure 1).

The globalized business environment is increasingly facilitating innovative processes of global networking and of new business initiatives. However, this development has come at significant cost as risks are now more sophisticated as compared to before, and such circumstances require the introduction of new methodologies and strategies, which also includes risk management tools and technology that manages global businesses that are associated with a great deal of risk (Hussin, 1996). Therefore, organizations such as financial services companies have to face a lot of uncertainty and risk, which is evident from the several instances across the world whereby major crisis situations have ruined big corporations. Therefore, these eventualities must be viewed as being possible because they undoubtedly bring destructive outcomes on corporations that are often found to be struggling in attempts to stage a business recovery (Aven, 2003).

Unquestionably, the main objective of financial services companies is to maximize profits and by achieving a good bottom line, firms are able to provide guarantee of their ability to provide maximum share holder value at any given time. This aspect is very important because EWRM has to be adopted and put into operation when such programs contribute in eventually enhancing the anticipated wealth for shareholders (Manab et al. 2006). Therefore, it is important that organizations having wide options for investments will benefit from selecting investment options on the basis of precise risk adjusted rate applications of Enterprise-wide Risk Management in comparison to the availability under traditional risk management approaches. In this context, Smithson and Simkims (2005) conducted research relative to the available literature pertaining to the value relevance of specific risk management processes. They found that in effect, EWRM creates value for financial agencies by way of earnings, capital growth and capital efficiency, volatility of earning, management capability and share holder values. Thus, it is evident that EWRM is a multi step procedure involving both up and down side influences on all possible causes of risk. It also enables an integrated enterprise wide correlation adjusted process of dealing with risks (Banham, 2004). EWRM is also a value added tool in providing the crucial means to efficiently deal with share holder values (Hoyt and Liebenberg, 2006). Additionally, EWRM affords the essential elements to financial companies in order to effectively understand, manage and communicate the risk appetite and possible exposure faced by the company in general. EWRM does not just deal with responsibility; it mainly focuses on how people function in the organization and the ways in which they perceive the resultant strategies and growth in achieving the organization’s objectives (Picket, 2006). It is important to understand that the EWRM fundamentally assists in enhancing shareholder and stakeholder values and this aspect is relative to every kind of organization, including financial companies.

Before the financial company implements any risk management program it must be clear about its objectives relative to risk management. This is very important because it helps the organization in ascertaining the resources required for the purpose of mitigating risks. The respondents who were interviewed felt that implementing EWRM programs led to enhanced values by way of identifying and associating effectively with organizational goals. This reveals that the workers in the organizations were able to ensure that organizational resources were adequately safeguarded, the company’s reputation and credibility was sustained, regulatory requirements were complied with and the organization’s returns were maximized while ensuring that the potential impact of future loss is minimized, thereby protecting interests of shareholders. Along with considering the different kinds of risks that organizations are exposed to, it is important to consider their capability to improve performance by adopting value based management practices. This implies the extent of the organization’s ability to improve the position of capital allocation and the ability to safeguard its reputation and credibility in order to achieve high standards of best practices. Financial companies are specifically required to recognize the risks and to evaluate them strategically by understanding all aspects of the risks faced currently and to avoid liabilities in the future. Additionally, they have to address and meet standards of corporate functioning and governance and manage possible crisis situations.

Theoretical Framework

Monks (2002, p.117) claims that Enterprise-Wide Risk Management (EWRM) is a system of protocols, standards and recommendations that are structured towards enterprise capacity to consistently identify, evaluate, assess and implement measures meant to reduce risk opportunities and threats. In addition, Busco et al (2005) suggests that EWRM has structural relationship with Governance, Risk identification and Compliance (GRC) and has been embedded as a concept in ISO 31000:2009. The architecture for risk management is varied amongst different enterprises. This depends on risk exposures. Lam (2003) conclusion suggests that financial agencies risk architecture depends on agency investment on information technology and relevance of agency enterprise business processes towards risk management. Information technology impacts on financial agency capacity to implement internal controls. However, Fraser and Simkins (2010, p.18) claims that capability of financial agency to effectively adopt and implement EWRM depends on approaches to risk management, threats to risk management, political structure, competencies of its human capital and level of agency multi-faced strategies to risk management. Financial agencies ought to document and measure financial risks as a function of interests rate risks, risks in the market and capacity to manage credit risks. This is based on capacity for the financial agency to manage risks especially liquidity risks, management risks, possibilities of insurance risks, operating capital adequacy capability, diversification risks and alignment of EWRM to manage agency systemic risks (Archer, 2002).

Knowledge processes play an important role in risk management because it has the potential to improve working skills and the ability of individuals and teams to improve the ways in which knowledge and tools are shared (Wang et al, 2006). According to Singh and Premarajan (2007), risk management creates knowledge because new risks imply use of different ways to measure the risk and to ascertain the possible impacts of such risks. New and current risks are better understood by acquiring, synthesizing, codification and representing knowledge of risk. Risk management allows for storage and retrieval of knowledge through codification and representing knowledge of risk. EWRM eventually turns out to be a multidisciplinary structure that is developed within the department. It represents a holistic viewpoint of risks associated with the organization in requiring distribution and dissemination of knowledge, which supports individual workers, groups and the firm. Risk knowledge can be further used in reaping competitive advantages for financial agencies desirous of adopting the best possible practices and thereby develop methods and products relative to controlling risks.

According to Ipe (2003), there is a strong case for transferring knowledge in the cultural and trust environment of the organization and from these processes, sharing of knowledge impacts the implementation of EWRM by providing individuals and groups to connect with the organization, collaborate, produce disseminate and find new ways of innovation and acquiring knowledge. Small and Sage (2006) researched and found that knowledge sharing is as important as creation of knowledge. Issues that impact knowledge such as business processes, organizational structure, business contexts and motivation are also known to impact knowledge sharing. Effective implementation of EWRM requires a strong framework of learning processes, organizational culture, human resource networking, leadership and learning procedures. In this context, effective communication and knowledge sharing are dependent upon the integration and overlapping of the knowledge bases with people in the organization (Ballou, 2002). Adoption and efficient implementation of EWRM needs more than technology because a means has to be created along with the readiness amongst people to share with each other.

Financial institutions have to repeatedly analyze the risks faced by them very carefully and deal with all kinds of risks, irrespective of whether they are encouraging or not. Amongst the different kinds of risks faced by financial institutions is their capacity to increase profitability by introducing value based management techniques (Hoyt and Liebenberg, 2006). Such techniques include the company’s ability to improve allocation of capital, protection of organizational reputation and credibility, achieving standards of good practices, understanding and cautiously evaluating strategic risks, recognizing the extent of risks faced currently, avoiding personal liabilities, complying with standards of corporate governance, handling possible crisis situations and building the ability to stage business recovery. However, it is also important to have the capability to consistently preserve the ultimate security of shareholder values.

Organizational Fit of EWRM

Warner (2008) has held that financial agencies mostly fail to achieve competitive advantage from EWRM due to inadequacy of enterprise fitness to manage financial risks, technical risks, operational risks and control hazardous risks. This is dependent on capacity of agencies to redesign business processes that are structured towards bringing about organizational fit towards EWRM. As a result, financial agencies fail to comply with enterprise-Wide Designs and structures that could demonstrate capability of the agency to achieve data integration that could support EWRM. Berenbeim (2004, p.28) however indicates that inadequacy of financial agencies to manage entrepreneurial risks is fueled by insufficiency of competent human capital that could contribute into financial agency EWRM. Archer (2002, p.17) claims human capital deficiencies arises from insufficiency of human capital training and development towards sustainable EWRM. The problem of human capital has resulted into inability of financial business analysts to demonstrate required technological and operational competencies that could support EWRM. As a result, many financial agencies have failed to develop internal and external expertise that could drive management of agency risks and risk exposures. This however has been brought about by failure of financial agencies to recruit or retain employees that could develop sustainable systems for financial agency EWRM (Deloach, 2000).

Sobel and Reding (2004, p.28) have argued that deficiencies in financial agency risk management is driven by financial management corporate structure with regard to integration of risk management, governance and compliance with associated regulations. The management structure fails to contribute into capacity for risk management embedment to governance, and compliance due to absence of senior level management support towards risk management or incapacity of management to demonstrate support for risk control which is predisposed by secondary factors like inadequate communication channels that cannot support risk management. Constraints in vertical and horizontal integration have been identified to affect capacity for enterprise to invest in enterprise software system designs. As a result, financial agencies fail to comply with standard specifications in terms of data support that is required for sustainable EWRM. This implies, low level of integration in terms of human capital competence influences on financial agency capacity to achieve economic benefits associated with EWRM. The financial agencies (Busco et al, 2005, p.41) should incorporate user training and development which is vital towards end-user sufficiency to provide necessary capital support towards EWRM. This has affected capacity for stakeholders to invest in financial agencies and decreased book value of the agencies. Stakeholders however indicate that failure to adhere to demands for investment in the financial sector has been fueled by increased failure of financial agencies to report on their financial status which impacts negatively on their credit risk rating. Other authors cite technology planning and technological integration as contributing factors to shrinking market share of the financial agencies. As a result, investors have continued to demonstrate decreased confidence and trust on the sustainability of the financial agencies subject to interest rate volatilities, decreasing consumption structure and incapacity of the agencies to demonstrate sustainable technological management of constraints that predispose risks.

It is important to implement EWRM programs in the financial sector because they assume greater significance in view of the fact that competitive advantages in any financial agency are restricted because of risks associated with potential losses that occur due to the working of learning systems, communication of business values, restricted controls, cultural pressure, expansion and the increasing focus placed on information. Implementing EWRM is a dynamic procedure because the new strategies of controlling risks entail the analysis of new risks. Thus, risk control strongly impacts the implementation of EWRM measures. At the same time, feedback, experiences and knowledge in any company tend to flow in top – down and bottom – up directions. But EWRM implies that a policy relative to top – down direction has to be adopted in order to effectively implement the given procedures. Conversely, bottom – up direction has to be adopted in some situations so as to ascertain the associated risks and to make use of correct solutions to mitigate risks.

The business environment is increasingly becoming globalized and hence facilitates innovative processes of global networking and of new business initiatives. However, this development has come at significant cost as risks are now more sophisticated as compared to before, and such circumstances require the introduction of new methodologies and strategies, which also includes risk management tools and technology that manages global businesses that are associated with a great deal of risk. Therefore, organizations such as financial services companies have to face a lot of uncertainty and risk, which is evident from the several instances across the world whereby major crisis situations have ruined big corporations. Therefore, these eventualities must be viewed as being possible because they undoubtedly bring destructive outcomes on corporations that are often found to be struggling in attempts to stage a business recovery.

It is interesting to note that Enterprise-Wide Risk Management (EWRM) is now widely accepted by a large number of financial institutions across the world. Many organizations have already introduced and implemented EWRM programs wit the assistance of consulting firms that provide such services. EWRM enable the needed mechanism for financial agencies to efficiently evaluate, manage, utilize, finance and measure possible exposures to risk from different sources. The main focus is on ensuring that organizational objectives of improving stakeholder values in the short and long terms are fulfilled. EWRM approaches are mostly linked with the organization’s mission, vision and strategy. EWRM also promotes innovativeness and a culture that is less averse to risks whereby calculated risks can be taken in pursuing opportunities in order to improve performance of the overall organization.

It is important to underline an important aspect relative to the difficulties faced by financial companies in the current global business atmosphere that certainly bring changes by way of risk perceptions; more importantly at times when risks are now managed and dealt with in terms of portfolio bias to add value to the organization. Therefore, as a structured answer to the risks, it is now believed that it is crucial for financial companies to achieve success ultimately. This viewpoint is supported by the belief that risk is an essential component of change and risk management is the strategy used to cope with the impact of such change (Crockford, 2005). Such steps incorporate strategies of identifying risks, measuring risks, examining alternative risk management techniques, selecting effective risk management techniques and implementing the best possible risk management programs.

Different kinds of institutions in the financial services sector require examination of EWRM relationships for the entire financial sector. Banking services have been evolving from conventional deposit making organizations to financial corporations having diverse businesses and broader exposure. Financial agencies that comprise such financial corporations comprise of banking services, investment consultation, asset management and insurance. All these services imply different levels of risks for different services and need to have varied levels of business capacity to manage them efficiently. However, it is known that relationships between the current knowledge and EWRM are the same in the entire sector. In view of the unique characteristics of EWRM as a new concept, it is becoming increasingly popular amongst financial services companies because of the solutions it offers in mitigating unwarranted risks. This new approach appears to ensure that the risk is being dealt with on an enterprise wide basis whereby all activities are fully integrated within the working structure of the entire organization.

Theorists have argued that deficiencies in financial agency risk management are driven by financial management corporate structure with regard to integration of risk management, governance and compliance with associated regulations. The management structure fails to contribute into capacity for risk management embedment to governance, and compliance due to absence of senior level management support towards risk management or incapacity of management to demonstrate support for risk control which is predisposed by secondary factors like inadequate communication channels that cannot support risk management. Constraints in vertical and horizontal integration have been identified to affect capacity for enterprise to invest in enterprise software system designs. As a result, financial agencies fail to comply with standard specifications in terms of data support that is required for sustainable EWRM. This implies, low level of integration in terms of human capital competence influences on financial agency capacity to achieve economic benefits associated with EWRM. The financial agencies should incorporate user training and development which is vital towards end-user sufficiency to provide necessary capital support towards EWRM. This has affected capacity for stakeholders to invest in financial agencies and decreased book value of the agencies. Stakeholders however indicate that failure to adhere to demands for investment in the financial sector has been fueled by increased failure of financial agencies to report on their financial status which impacts negatively on their credit risk rating. Other authors cite technology planning and technological integration as contributing factors to shrinking market share of the financial agencies. As a result, investors have continued to demonstrate decreased confidence and trust on the sustainability of the financial agencies subject to interest rate volatilities, decreasing consumption structure and incapacity of the agencies to demonstrate sustainable technological management of constraints that predispose risks.

Methodology

Methodology of study

The methodology for this research is based upon the research philosophy that is about making analysis and application of mechanisms adopted by financial agencies relative to Enterprise-wide Risk Management (EWRM) and focusing upon how financial institutions can take initiatives of benefiting from EWRM. Such objectives have been achieved by examining the prevailing circumstances in the financial sector globally efficiently they cater to the needs and expectations of the financial sector. A critical evaluation is then possible of the different circumstances that prevail in the given company in comparison to other companies in the financial sector. This will also allow the research to recommend to associations of financial agencies about the possible solutions for improving EWRM under given situations.

The study was carried out through the use of probability sampling technique that involved use of attribute approach, deductive approach, factor analysis approach and Selective Content Analysis (Garvin, 1991). The probability sampling approach was used in order to make it possible to generalize the study outcomes on best practices for financial agency risk management. Quantitative approach made it possible to quantify study attributes, which made it possible to quantify attributes that have capability to contribute into sustainability of best practices in EWRM (Strauss & Glaser, 1967). Probability sampling was used in order to quantitatively measure mechanisms through which financial agencies implement EWRM. Attribute approach was used in the study in order to help in identifying elements that form structure for EWRM, identifying threats that affect EWRM and to propose strategies towards EWRM. This ensured that the study findings would present quantifiable parameters that could be used to develop strategies for EWRM and to identify new dimensions for EWRM based on emerging standards and regulations. Factor analysis approach was used to identify elements that affect EWRM as an element of enterprise internal control. This resulted in identification of factors that should form foundation for best practices in EWRM (Gibbons et al, 2007). Selective Content Analysis was used to conduct analysis of data on financial agency EWRM. Quantitative research method was used in order to make it possible to use random sampling during recruiting of the study respondents. Random sampling ensures that a greater population sample is represented in the study.

Research instruments

This study employed a quantitative research design for purposes of structuring the research process. It is recognized that this type of research design will help the researcher to examine the issues at hand since the research is largely interested in evaluating the relationship between variables. Quantitative studies are either descriptive or experimental, but this particular study will employ a descriptive approach since the subjects in this case are the representatives of financial institutions and will only be measured once.

Primary data was gathered by means of undertaking an online survey and personal interviews, specifically designed to measure the respondents’ perceptions, values, satisfaction, and opinion towards performance financial agencies and risk perceptions that could be resolved using EWRM measures. The objective is to ascertain technological, systematic and operational risks that impact performance of financial agencies. By determining the mechanisms by which financial agencies are structured it becomes possible recognizing the areas in which improvement can be made. It is known that a survey is effective when the researcher is particularly interested in descriptive assessment of a particular phenomenon as it is the case in this study. Secondary data was collected by means of undertaking a detailed review of related literature.

This research aimed at achieving the objectives of making adjustments about the current activities of financial agencies and identifying the barriers in this sector while making comparisons amongst them in the context of risk perceptions and their solutions. On the basis of the literature review and the answers to questions that were forwarded to individual respondents via e-mail, it was proposed to ascertain the following:

- The best practices in financial agencies relative to technological, systematic and operational risk exposures.

- Roles of organizational fit in the context of achievement of financial agencies relative to human capital competency, alignment of management structure and control in the context of support for risk management and software mechanism designs.

- Whether the designs have been so framed that they aim at maximizing economic benefits of EWRM

- The significance of human capital training, social commitments and development of technological planning towards stakeholder confidence in a financial agency.

- Whether economic growth influences project management risks and sustainability of risk control and mitigation of a financial agency.

This research used different characteristics that were present in every chosen company for the purpose of this survey. Individuals were also chosen from different financial agencies in order to a have a wide cross section of respondents in enabling the study to have a broad perspective while concluding the findings.

The study was designed to use structured closed questionnaires. Closed questionnaires are used in order to make it easier to compute study findings quantitatively (Hamel et al, 1993). This also made it possible to carry out data processing and quantitatively carry out study outcomes rank ordering. As a result of data rank ordering, it became possible to carry out inter-coder reliability (Gibbons et al, 2007). The questionnaires were presented to study respondents on the day of interview. Questionnaires were used as the favorable study instruments because they are easier to analyze and are compatible with any statistical software. Questionnaires were used because they are cost effective compared to face-to-face interviews. This would result into use of limited time in collecting data (Yin, 1993). Questionnaires were also used because they make it possible to reduce interviewer bias that can result into homogeneous data findings. Failure to use interview was meant to reduce possibility of interviewer influencing responses of the study respondents.

The measurement scale

The study used a Five point Likert scale. The nominal values of the Likert scale ranged from strongly disagree (one) to strongly agree (five). The nominal scale was used in order to form basis for carrying out geometric data analysis. This would make it possible to determine geometric mode and geometric mean that are important elements in determining moment of correlation, Karl Pearson Moment of Skewness and Kurtosis (Gibbons et al, 2007). The responses from 1 to 5 pertained to the following:

- Strongly Agree

- Tend to Agree

- Neither Agree nor Disagree

- Tend to Disagree

- Strongly Disagree

Study Sample

Different individuals were invited to respond and the sample population comprised of individuals that were professionals, managers and workers in the financial sector. There were 24 individual respondents chosen from the industry that represented five business houses and 16 were individuals that were to respond in the context of their individual perceptions. Company representatives from financial agencies were required to respond in the context of their activities and their performance in relation to varied parameters that were outlined in the questionnaire. There were 20 questions asked in the questionnaire that focused upon extracting information pertaining to risk perceptions in the financial sector and their solutions. The questionnaire was designed after conducting a mock pre-test by way of in-depth interviews amongst decision makers in different financial agencies. Attempts were made to represent the widest possible cross section of individuals and functionaries in relation to the financial sector. The criteria used for selecting firms rested on the willingness of a given firm’s manager to be interviewed and that the firm should have been involved in financial activities for three years. Individuals were selected amongst a wide base in attempts to include people that were aware of and directly involved with the financial sector. The average age of interviewed respondents was 34 years and 60 percent respondents were from financial agencies while the remaining 40 percent were individuals dealing with financial agencies.

Proposed Method of Data Collection

For this research, the triangulation approach has been used because of the wide scope of the study. It has involved the use of three methods namely; interviews, surveys and document search. The choice of interviews has been informed by the adaptability they offer. For example, the body language of the respondent can help in obtaining more information. The use of surveys is justified by the fact that they can be completed at the convenience of the respondent and can also reach many people. Document search will be helpful in finding information on previous work on the topic (Alvarez et al, 1990). The use of several methods will help in ensuring accuracy of the findings. The participating financial institutions were chosen at random. This reduces bias by giving every institution an equal chance of being selected. Document search was used to collect secondary data. The data can be obtained from journals, text books, libraries and internet sources. The sources will be vetted for accuracy and relevance before being.

Interviews were used to collect primary data and were conducted via video interviews. The interviews involved structured questions that guided the study as well as questions that transpired during the course of the interview. The questions aimed at capturing facts about the topic instead of personal opinion. The respondents were informed prior to the interviews about the purpose of the research and that their responses will be treated in the strictest confidence. They were categorically assured that their names or other details will not be shared with any third party and if at all there is any need to do so, prior permission will be taken from them. The following questions were asked from respondents that were chosen at random from amongst different financial institutions:

Questions

- What is your name?

- What is your age?

- Where do you work?

- What is your qualification?

- What do you feel about the present risk perceptions in your company in terms of technological, systematic and operational risks?

- Do you feel that such risks are affecting the performance of your company?

- What according to you is the biggest problem created by the financial crisis in terms of additional risks?

- What were the technological risks exposures in your company before the financial crisis?

- What according to you is the status of human capital competencies in your company?

- Have you personally suffered any personal hardships because of risk exposures in your company?

- Do you feel that risk management and mechanism software designs have been tailored towards maximization of economic benefit of EWRM in your company?

- What do you feel are the best practice your company ought to undertake towards EWRM?

- What is the extent of human capital training undertaken in your organization and are you satisfied with it?

- To what extent you feel your organization meets its role of social commitments?

- Does your organization engage in development and technological planning towards stakeholder confidence?

- What is the influence and extent of influence of risk project management in your organization?

- Does your organization adopt sustainability of risk control measures?

- What is the extent to which risks are exploited towards development of risk system in your organization?

- Has your company achieved sustainability of agency information technology systems?

Surveys were also used to collect primary data, which involved administering anonymous questionnaires to the respondents. The questionnaires were mailed to the respondents. The respondents were chosen mainly from amongst managers and associates of financial institutions after they were informed about the purpose of the research and that their responses will be treated in the strictest confidence. They were categorically assured that their names or other details will not be shared with any third party and if at all there is any need to do so, prior permission will be taken from them. A letter explaining the purpose of the study and how the questionnaires are to be completed were also mailed to the respondents. They were asked the following questions:

Questions

- What is your name?

- What is your age?

- Where do you work?

- What is your qualification?

- What do you feel about the present risk perceptions in your company in terms of technological, systematic and operational risks?

- Do you feel that such risks are affecting the performance of your company?

- What according to you is the biggest problem created by the financial crisis in terms of additional risks?

- What were the technological risks exposures in your company before the financial crisis?

- What according to you is the status of human capital competencies in your company?

- Have you personally suffered any personal hardships because of risk exposures in your company?

- Do you feel that risk management and mechanism software designs have been tailored towards maximization of economic benefit of EWRM in your company?

- What do you feel are the best practice your company ought to undertake towards EWRM?

- What is the extent of human capital training undertaken in your organization and are you satisfied with it?

- To what extent you feel your organization meets its role of social commitments?

- Does your organization engage in development and technological planning towards stakeholder confidence?

- What is the influence and extent of influence of risk project management in your organization?

- Does your organization adopt sustainability of risk control measures?

- What is the extent to which risks are exploited towards development of risk system in your organization?

- Has your company achieved sustainability of agency information technology systems?

The data was collected by using questionnaires and interviews. The questionnaires were provided to study respondents on the day of interview (Brearley, 1993). Primary data for the study in the case of individual respondents was collected by means of an online semi-structured questionnaire schedule. A questionnaire is desirable in a descriptive study basically because it is easy to administer the tool in an online setting. The tool has been designed to measure the respondents’ perceptions, attitudes, and values regarding risk perceptions and their solutions relative to using EWRM options and how these variables combine to enhance or lessen their opinion in the context of financial agency performance.

Apart from the ability to attain a high response rate, it is also easy to undertake a comparative analysis when using a questionnaire due to the fact that most items consist of closed-ended questions. The questionnaire used in this particular study was also subjected to thorough testing to ensure that issues of data validity and reliability are appropriately dealt with. Secondary data for this study was collected through a comprehensive review of literature, sourced from reliable sources, including textbooks and journals.

Procedure of data collection

The data collection was so managed that it was treated as a function of Delphi technique (Pyecha, 1988). The Delphi technique was utilized since it is compatible with attribute approach and factor analysis approach which are essential in determining factors that affect financial agency EWRM (Alvarez et al, 1990). The study employed both quantitative and qualitative data assessment techniques for gathering primary and secondary data. Quantitative assessment involved coding the data contained in the questionnaires and entering them into a statistical package known as SPSS. Afterwards, cleaning and analysis of the data was performed using the same package to generate frequency distributions and descriptive statistics that were used to answer the study’s main objectives. Data was presented in different forms and the qualitative data generated by the open ended questions was analyzed by using a process known as qualitative content approach. This method involves cleaning, coding, and evaluating responses that were given in either verbal or written communication so as to permit them to be considered quantitatively.

Limitations to the Studies

The proposed limitations could result from failure to determine the actual number of respondent that would finally complete the questionnaire independently. In office setting, work mates could complete the questionnaire which would result into different observation after the follow up study. This could affect reliability and validity of the study findings (Campbell, 1975). The main obstacle in the study was accessibility because the investigation was done in a number of situations. Contacting different companies at different places required a lot of time and financial resources. Access to secondary data can also be a challenge. While articles on the topic exist at the local libraries, it is important to access latest financials and data in order to get more accurate information. Since the materials in these libraries can only be used within the libraries, it became necessary to make several visits. Thus the libraries were visited throughout the week except on public holidays when they are closed.

While interviewing the key informants, they were a little reluctant to disclose some information such as the financial positions of their companies. Some respondents did not complete and submit the surveys in time. Ambiguity or unclear instructions in the surveys can also make it difficult to answer the questions. Hence the respondents may have rejected the questionnaires for such reasons. The information in some of the secondary sources of data is based on opinions instead of facts. Thus the information obtained from such sources might not be entirely helpful in making accurate conclusions. Finally, some of the respondents may have given inaccurate information due to lack of adequate knowledge on the topic.

The main concern in this study is confidentiality over the information given by the respondents. To ensure confidentiality, the surveys were anonymous and the names of respondents have not been mentioned in the dissertation. The information given by the respondents will be used for academic work only. It was also necessary to obtain permission before obtaining information from employees of various companies. The relevant authorities were contacted before retrieving information from government databases.

Method of data analysis

Geometric data analysis will be used as the main method of data analysis. This will involve geometrically determining the geometric mean of the quantitative data, followed by determination of geometric variance and geometric standard deviation. The frequencies of the classes above and below the modal class will be used in determination of the geometric mode (Feagin et al, 1991). The results will be used to geometrically determine moments of dispersion of the data namely Karl Pearson moment of skewness and Karl Pearson moment of kurtosis which will define the spread of the data about the geometric mean and geometric mode hence provide basis for symmetry of the distribution. The data findings of the geometric analysis will assume confidence interval for all comparative analysis (Gibbons et al, 2007).

Proposed ethical study perspective

The study was conducted so that it conformed to legal doctrine on research studies that involve use of human subjects through compliance with ethical principles for voluntary participation, anonymity, beneficence, malfeasance and autonomy (Garvin, 1991). The study respondents were informed on the rationale of the study, procedures of the study and expected outcomes of the study and associated ethical implications for their participation before their signatory for informed consent for participation (Hamel et al, 1993).

Implementation of Research

This research examined the implementation and execution of Enterprise-Wide Risk Management (EWRM) as an effective means of increasing the economic values attained by financial agencies. The main objective in this regard was to ascertain the ways in which financial agencies are able to actually implement the EWRM programs and benefit from them in addition to assessing the value impact of such programs. The research was successful in providing valuable information and knowledge about EWRM as a significant means to manage risks in financial agencies. To achieve the required ends, a qualitative approach that involved interviews and questionnaires was used in arriving at the given conclusions. Implementation of the research was a challenging task because financial agencies are exposed to a large number risks, major amongst them being market risks, credit risks, operational risks and strategic risks. Representatives from financial who were chosen as respondents for this research were open about responding to the questions in the survey. Additionally, these respondents were cautiously selected on the basis of their excellent reputation and credibility in the financial sector. They were also able to provide meaningful data about their companies.

Before the financial company implements any risk management program it must be clear about its objectives relative to risk management. This is very important because it helps the organization in ascertaining the resources required for the purpose of mitigating risks. The respondents who were interviewed felt that implementing EWRM programs led to enhanced values by way of identifying and associating effectively with organizational goals. This reveals that the workers in the organizations were able to ensure that organizational resources were adequately safeguarded, the company’s reputation and credibility was sustained, regulatory requirements were complied with and the organization’s returns were maximized while ensuring that the potential impact of future loss is minimized, thereby protecting interests of shareholders. The respondents also expressed the willingness to make improvements in strategic competitiveness and operations efficiency, which would also improve long terms values for share holders. It can thus be concluded in this context that EWRM helps in fulfilling the organization’s long term objectives and assists in identifying and managing risks in keeping with the organization’s structure and objectives. Risk management capabilities and approaches are strengthened and considerable assurance is provided against the occurrence of losses or misstatements. Eventually, EWRM promotes innovativeness and a culture that is less averse to risks whereby calculated risks can be taken in pursuing opportunities in order to improve performance of the over all organization.

Financial companies across the world have to repeatedly manage and consider different aspects and means of risk irrespective of the type of risk and of whether they are good for the organization. Along with considering the different kinds of risks that organizations are exposed to, it is important to consider their capability to improve performance by adopting value based management practices. This implies the extent of the organization’s ability to improve the position of capital allocation and the ability to safeguard its reputation and credibility in order to achieve high standards of best practices. Financial companies are specifically required to recognize the risks and to evaluate them strategically by understanding all aspects of the risks faced currently and to avoid liabilities in the future. Additionally, they have to address and meet standards of corporate functioning and governance and manage possible crisis situations. It is equally important to consistently protect the business in order to protect shareholders’ interests and values.

EWRM assumes greater significance because competitive advantages in any financial agency are restricted in view of risks associated with potential losses that occur because of learning systems, communication of business values, restricted controls, cultural pressure, expansion and the increasing focus placed on information. Implementing EWRM is a dynamic procedure because the new strategies of controlling risks entail the analysis of new risks. Thus, risk control strongly impacts the implementation of EWRM measures. At the same time, feedback, experiences and knowledge in any company tend to flow in top/down and bottom/up directions. But EWRM implies that a policy relative to top/down direction has to be adopted in order to effectively implement the given procedures. Conversely, bottom/up direction has to be adopted in some situations so as to ascertain the associated risks and to make use of correct solutions to mitigate risks.

Presentation and Analysis of Data

In this research there were 40 respondents that were well versed with the working systems in financial agencies and in keeping with their expertise and vast experience in the financial sector they were competent to respond with realistic opinions relative to the working of financial agencies and the applicability and advantages of using EWRM interventions in risk mitigation. The researchers conducted personal interviews to ascertain the different strategies through which EWRM operates in adding value to financial agencies. Most of the respondents were either risk managers or associated with the functioning and implementation of risk mitigation measures in financial institutions. Findings revealed that majority respondents were in agreement that EWRM is a value added system that contributes in enhancing economic values for financial agencies in several ways. From the responses receive in the survey it became evident that the following benefits are directly associated with EWRM programs:

- Top management of financial agencies is transparent and committed towards EWRM

- Top management aims at adopting more systematic management tools for mitigating risks

- Executive leaderships and relative support is evident in most financial agencies

- Financial agencies are eager to create additional competency levels within the entire organizational structure

- Management is mostly open about providing training and educational facilities for employees engaged in risk management

- There is a strong tendency towards creating an organizational culture that is conducive to being risk conscious.

The collected data was analyzed using statistical tools and the determinants to be measured included economic performance by way of profits of financial agencies, and in the case of institutions such as banks the data pertained to percentage of non-performing loans, credit creation and level of deposits. The responses from interviews and surveys were compiled in arriving at the given conclusions that are discussed in the analysis and discussion chapter of this research paper. The profitability of financial agencies and institutions were classified as small, medium and large and the results are presented in table I below.

Table I: Profitability of Financial Institutions by Size during 2008 and 2009

Table II: Profitability of Financial Institutions by Ownership during 2008 and 2009

It is evident from the analysis and the survey that Enterprise-Wide Risk Management (EWRM) is now widely accepted by a large number of financial institutions across the world. Many organizations have already introduced and implemented EWRM programs wit the assistance of consulting firms that provide such services. EWRM enable the needed mechanism for financial agencies to efficiently evaluate, manage, utilize, finance and measure possible exposures to risk from different sources. The main focus is on ensuring that organizational objectives of improving stakeholder values in the short and long terms are fulfilled. EWRM approaches are mostly linked with the organization’s mission, vision and strategy.

Comment and critique of the outcomes or findings

A significant finding related to the fact that some companies perceive values of risk management in terms of both quantifiable and non quantifiable elements. The non quantifiable element relates to the organizational image and credibility while the quantifiable aspect can be perceived by way of fiscal values. Conversely, some respondents believe that values pertain to one capability in managing change and uncertainty, thus leading to opportunity that ultimately provides positive financial value to the organization. In general, it can be said that respondents were in agreement that the EWRM is an important tool in adding value for organizations and in addressing issues relative to mitigation of risks. This is apparent from the fact that workers become better informed and can take decisions more confidently in avoiding risks and pursuing growth opportunities. This is perhaps true because businesses are able to ascertain the possible risks and then to resolve them by adopting an amalgamated approach through implementation of EWRM programs. The over all findings confirm that risk management forms an important element of responding to risks and that EWRM has been widely integrated for risk mitigation in the financial sector. The approach has been widely acknowledged across the financial sector as being a useful measure of risk mitigation and of maintaining a positive code of corporate governance.

Effectiveness of risk management is dependent on executive support and capacity to participate or report on risk management strategies and approaches. Thus, documentation of risk profile of a financial agency provides direction into risk management which influences on rationale for risk implementation. The mechanism through which an agency implements risks is dependent on cost benefit analysis. The agency ought to identify associated risk costs that impact on risk management which paves way to identification of appropriate strategies for risk management. Risk management is influenced by capacity to assign risk responsibilities to different employees that provides foundation for enterprise capacity to develop and implement risk safeguards for risk implementation process. This involves determination of risk levels that the organization might be exposed to. This has effect of guiding in risk mitigation actions and adoption of appropriate risk controls that not only protect the agency but also build stakeholder confidence.

Financial agency risk management planning is essential towards development of a risk mitigation plans as well as contingency plan. Risk planning integrates elements risk management approach; risk planning and risk execution and persons that are responsible. The persons are responsible for risk assessment and identification that includes determination of risk characteristics and threat they pose to the financial position of the agency. Identification of risk characteristics is dependent on capacity for qualitative risk analysis and capability to quantify risk threats that make it possible to rank order risks based on threats. Quantification of risks involves risk categorization through representation of risks in terms of a numerical value, which has been aptly demonstrated by the outcomes of the research.

The study outcomes contributed in determining the best practices that a financial agency ought to undertake towards EWRM. The findings of the study will assist a great deal in determining the role of mechanisms through which risks are exploited towards development of risk system requirements and capacity for a financial agency’s security requirements. It will also facilitate the development of mechanism that can be used by financial agencies to develop security concepts of risk operations and strategic application of risks towards economic growth. The findings of the study have identified rationale through which financial agencies have achieved sustainability of agency information technology systems towards compliance with regulations and capacity for data protection and encryption that support EWRM and ISO 31000: 2009. The findings of the study have successfully identified the reasons as to why financial agencies continuously upgrade the risk management information technology systems and rationale for financial agency variation of risk management processes, policies and procedures. The research has identified financial agency capability to manage change through identification of transformational risk operation procedures and processes and variability of the financial markets due to influence of globalization. The study has also identified mechanisms through which financial agencies dispose information and protocols and standards on information disposal, for example software, data and hardware. The findings have enabled the determination of standards that inform about information technology system change and level of risk security measures that are implemented along with underlying systematic risks that may be encountered in the given programs.

Conclusion

This research has provided valuable insights about why EWRM is a crucial concept in the management of risks on the enterprise-wide level amongst financial agencies. The concept is believed to be a strong tool that adds value and enhances the commercial strength of financial agencies. It is in order to emphasize here that the structure of risk management and related policies are crucial for any organization involved in risk management, especially financial agencies. The framework outlined in this research provided the required material and guidance for managing risks using EWRM systems. Further, the guidelines and given structure of EWRM make sit easy for managements to take the required actions. The research findings also reveal that support and assurance from the top management is very important so that all concerned parties are aware of getting help whenever required. The respondents in the survey clearly conveyed that on the whole, managements have to reveal their genuine concern about different issues relative to risk management. Additionally, they have to encourage and support the creation of an atmosphere in which people are more apprehensive about risks. The financial agency being examined should develop an acceptable culture of risk taking and dealing with them in terms of better management.

This research examined the implementation and execution of Enterprise-Wide Risk Management (EWRM) as an effective means of increasing the economic values attained by financial agencies. The main objective in this regard was to ascertain the ways in which financial agencies are able to actually implement the EWRM programs and benefit from them in addition to assessing the value impact of such programs. The research was successful in providing valuable information and knowledge about EWRM as a significant means to manage risks in financial agencies. The respondents in the survey also held that risk management actions that are executed by financial agencies must be structured and they should be strengthened for reducing losses in the future. Financial institutions should have the ability to judge whether it is justified to adopt given levels and systems of EWRM within the organization because efficient implementation adds value to shareholders as well as the company. The respondents felt that applications of EWRM in financial agencies should not be made just for the sake of compliance. It was interesting to note that the respondents believed that there are intangible issues relative to creation of value. Given that bottom line relates to liquidity and cash in hand for financial agencies, the respondents held that employees must always be in high morale and they should be constantly motivated so that they perform better at the work place. These are essential characteristics of EWRM in making it a value added tool. Financial agencies can create better assets out of its manpower by showing concern for them. Human capital has far greater potential in mitigating risks than other measures. It was also revealed during the research that risk communication amongst all functionaries and stake holders is a major aspect for the successful implementation of EWRM programs in financial agencies.

The research outcomes clearly indicated that people working in financial agencies and directly involved in the decision making process relating to setting up EWRM programs and eventually implementing all related activities were required to have the requisite EWRM knowledge by way of past experience and expertise in risk management and mitigation efforts. Other significant findings demonstrated that the benefit accruing from such measures cannot be quickly evaluated when financial agencies start implementing EWRM programs. Of equal significance is the fact that respondents were in agreement about all employees including managers and staff being considered as creating and forming value for the present status of the company, which create a framework for moving towards more efficient and methodical management of the given risks.

Financial agencies that have succeeded in reaping the benefits of EWRM are able to percolate all messages down the line to all workers. If a company fails to effectively communicate messages and initiatives to all workers relative to EWRM, negative perceptions will develop about the effectiveness of EWRM. The research also indicated that successful financial agencies appoint a Chief Risk Officer or Manager who takes care in ensuring proper liaison with workers and execution of a positive communications strategy. This research has affirmed that EWRM is a value added program for financial agencies in improving their performance and enhancing values of the organization and its stakeholders. The study will prove to be a valuable reference for financial firms while adopting EWRM programs, especially in terms of crucial situations whereby there is need to add values to the financial company in question. Moreover, this study will provide strong evidence in regard to the relations amongst the financial agency and EWRM. Future research will benefit from this study because it makes it convenient to carry forward similar approaches and methodologies in further getting outcomes from new developments in the financial sector.

The International Standards organization had introduced ISO 31000, which is the improved measure of risk management in identifying an all embracing risk management structure with the objective of helping firms to efficiently manage risks by applying risk management processes at varied levels and in definite contexts of the organization’s functioning. ISO 31000 is characterized with describing the generic procedures of enterprise wide risk management structures. It also relates with the characteristics of improved risk management and can be used for identifying the effectiveness of risk management procedures in any company. This research has looked into the applications of knowledge management relative to EWRM in attempts to understand the effects of technological support and people interactions in a risk management environment. It was found that the associated risks involve several disciplines, profiles and groups of workers having diverse knowledge and experience while working in the same environment.