Introduction

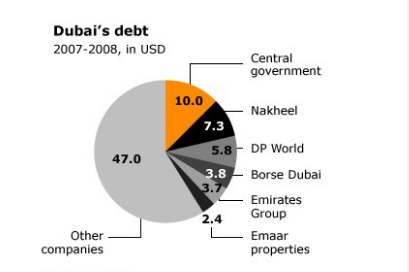

After progressive and sustained economic growth during several decades, the economy of the UAE plunged significantly in 2008. The inability of Dubai World to repay its debts and its request to delay the payments for half a year caused a further downturn of the economy (see fig. 1). The crisis had an effect on the UAE’s stock market and resulted in diminishing the country’s GDP. Thus, the UAE’s immunity to the financial crisis was limited and revealed the weaknesses of its economic system.

Main body

The economic crisis impacted various sectors of the social life of the country. For instance, a large segment of the UAE’s labor market was occupied by immigrants whose wages worsened (Abdulrazak and Soto, p. 211). Since migrant work was one of the primary resources for the country’s economic growth, its conditions were aggravated further by this additional factor.

The crisis also impacted skilled workers and professionals as prices climbed rapidly. Furthermore, Islamic banks were destabilized, their profit margins were narrowed significantly, and their cycles were undermined (Shayah, p. 736). In this way, the crisis showed that the Islamic bank system due to its peculiarities is relatively fragile.

Macroeconomic theories include several parameters that are too large to predict the behavior of a complex system. This combination with possibly lacking experimental data makes their predicting capacities limited and inaccurate to a certain degree (Onour, p. 3). Nevertheless, the crisis, seemingly, did not result in a surge of new economic theories and models, leaving the domain open to further investigation.

Conclusion

The economy of the UAE is known for the uniqueness and peculiarities of its banking system. Even though the steady growth that it exhibited was fluctuated by the 2008 crisis, the UAE managed to alleviate the dire consequences somewhat. The example set by Dubai may serve for further examination and as a case study for closing gaps in economic theories and models.

Works Cited

- Abdulrazak, Al Faris, and Raimundo Soto. The Economy of Dubai. Oxford University Press, 2016.

- Onour, Ibrahim. “The Global Financial Crisis and Equity Markets in Middle East Oil Exporting Countries.” Social Science Research Network, 2017, pp. 1–20.

- Shayah, Hazem M. “Economic Diversification by Boosting Non-Oil Exports (Case of UAE).” Journal of Economics, Business and Management, vol. 3, no. 7, 2015, pp. 735–738.

- “The 2008 Financial Crisis.” Fanack, Sep. 2015.