Introduction

The Islamic Bank of Abu Dhabi (ADIB) is among the largest Islamic institutions of banking which provide banking activities in the ‘Unites Arab Emirates’ (UAE). Its principal activities involves Islamic financing, commercial, investments, and other banking activities in accordance with Shari’a as accepted by the Shari’a Supervisory Board and Bank’s Fatwa. ADIB offers numerous banking services like corporate, personal, institutional and investment banking. ADIB works across a network of 400 ATMs and 70 branches. Its headquarter is in Abu Dhabi town in the UAE (Martin Cihák 221).

The Islamic Bank of Emirates (EIB) is also among the leading financial organizations in the Unites Arab Emirates. It offers the earliest ever Islamic recognized Credit-Card in the area which enjoys global recognition at over 20 million outlets over 130 countries.

There is a lengthy historical relation between developments of conventional:

Profitable banking and religion. The earliest financial dealings began with keeping of gold in sacred temples. These financial practices expanded quickly enabling the antique Greeks to write tribute notes that were credited throughout Greece. Formal saving has now subsisted for almost decades dating to 1472. In comparison, ‘Islamic banking’ is relatively a new trend. As the first ‘Islamic bank’, Egypt’s Local Savings Bank (Mit Ghamr), was established in 1963. Since then, the real development of Islamic finance never begun till 1980s when countries from the Middle East experienced a huge growth in surplus finances. Since then Muslim investments have spread all over Asia and Europe, and Islamic money is still expanding.Express Islamic financing techniques, like Islamic bonds, are increasing popularity towards the West as an Islamic supported funds management. While numerous countries have huge Muslim populations, ‘Islamic banks’ often account for a negligible share of local saving. Nevertheless ‘Islamic banks’ are competing and gaining acceptance with their commercial correspondents.

They are also growing internationally with many nations, like Indonesia and Malaysia, now permitting, and also encouraging, the entrance of foreign ‘Islamic banks’. Further expansion is anticipated given the limited existence of ‘Islamic banks’ currently in various Muslim countries. ‘Islamic banks’ remain in a honored position to access huge Muslim people given their actions are found on the beliefs of the Shariah law or Koran. What are the exceptional features of ‘Islamic banking’? riba or Interest is evaded and

leasing, profit/loss or mark-up sharing contracts are frequently used instead of investing in gambling, pornography or alcohol are avoided according to the Koran. More significantly,

‘Islamic banks’ operate under Islamic religious and ethical ideals. They were not only established to provide Shariah found financial solutions but to also promote certain social aims such as supporting the poor and disadvantaged.

Thus’ Islamic banks’ generally have a Shariah panel to make sure that their bank practices agree on the Koran. For instance, as their social responsibility, ‘Islamic banks’ must pay a donation or ‘zakat’, to charitable reasons. Another special attribute of ‘Islamic banks’ is their capability to take equity contributions in their clients’ schemes. Such direct reserves can potentially help persons with limited funds (particularly developing countries), however with good ideas and projects, to obtain finance. Set these special characteristics one might suppose that the more vigorous a bank grow to be in these Islamic financing practices, the more successful it would be in attracting Muslim customers and so possibly the better its achievements.

Theoretical Background (Literature Review)

Islamic banking came into reality in 1963, on an experiment based on a small-scale in a small city of Egypt. The achievement of this experiment unlocked the entrances for a distinct and separate market for finance and Islamic banking and as a consequence, in 1970s the Islamic banking came into being at a moderate level and a many of full fledge Islamic banks were introduced in Asian and Arabic countries.. Having begun on a small-scale, Islamic banks and non banking financial organizations are now in process even on more demanding scale. Currently, Islamic banks are working in more than seventy countries with resources base of over $167 billion and a noticeable annual growth percentage of 20%-25%. In the credit bazaar, market share of ‘Islamic banks’ in Muslim nations has risen from 3% in the late 1980s to about 25 percent today. These figures and facts certify that ‘Islamic banking’ is as efficient and viable as the conservative banking. To stick to the knowledge of Shari’ah, Islamic Law – evade receiving and paying Riba, avoid Gharar, spending in profit sharing ventures, avoid spending in such dealings that

are impermissible and unethical, and making socially accountable investments – are the distinguishing tips as well as objectives of all ‘Islamic banks’. (International Monetary Fund. Monetary and Capital Markets Dept 34) How best these Islamic financial organizations have achieved and to what degree they have been victorious in achieving these objectives have been the query marks for the researchers, scholars, and the stake-holders. Where ‘Islamic banking’, on one side, is being viewed as a fastest rising market, on the additional side, it’s not free from problems, issues, and challenges. Numerous reading has been performed from the time when the beginning of the modern finance and Islamic banking. Conceptual issues underlying awareness free financing became the prime focal point of this previous study on ‘Islamic banks’. It is difficult to find enough reporting in the obtainable literature on the matters of viability of ‘Islamic banks’ and ability to pool risk, rally saving, and facilitate transactions. Nevertheless, there are few discoveries that have alerted on policy insinuations of eliminating interest costs.

Research Methodology

Financial Performance ‘testes’

In assessing banks’ arrangement, this study employed accounting proportions (ratios). There is a wide use of ratios in the literature. In addition, accounting ratios could reduce disparity of bank’s magnitude and make them at standard. In this study, to determine financial performance of the banks, this study used the following financial ratios grouped under the following categories.

Profitability Ratios

These ratios are used to evaluate the capability of a bank to make earnings as in contrast to its operating cost and other related costs sustained during certain time. The study used the subsequent ratios to calculate profitability of the banks.

- Asset on Return (ROA) = total asset/profit after tax. It shows banks conversion of assets to net earnings. High ratio shows high capability of the bank. The ratio provides meter for estimating the managerial efficiency.

- (ROE) Return on Equity = equity capital. This ratio shows how a bank can produce profit with the amount shareholders have spend. High ratios shows higher financial manifestation. Similar to ROA, the ratio also shows managerial efficiency.

- (PER) Profit to Total Expenses = total expense. This ratio shows profitability of the bank considering its total operating cost. A greater rate shows the bank could create greater profit given expenses.

- (ROD) Return on Deposit = total deposit. It exemplifies percentage return on every one dollar of client’s deposit. Similarly, it shows the effectiveness of the bank in altering deposit to net income.

Liquidity Ratios

These ratios measure the capacity of the bank to gather its short-term duty. As a rule, the higher percentage of this ratio exemplifies that it has larger margin safety to face its short term obligation. Amongst, the sundry liquidity actions, this test used the following ratios;

- (CDR) Cash deposit ratio = deposit. The bank is further liquidated if the value is sky-scraping.

- (LDR) Loan deposit ratio = deposit. There is more liquidity when the rate is low. The ratio shows effectiveness of purpose of arbitration of the banks, also known as (FDR) Financing Deposit Ratio.

- Current ratio (CR) = current liability. The ratio shows the capacity of firm to assemble current liability and current asset.

- Current asset ratio (CAR) = total asset. Indicates the composition of bank’s assets. High rate of this relation shows that bank has additional liquid assets than extended assets.

Risk and Solvency Ratios

The subsequent ratios gauge risk.

- Debt equity ratio (DER) = equity capital. The ratio indicates how a bank funds its course with debt relative to equity.

- Debt to total assets ratio (DTAR) = total asset. This ratio shows the percentage of assets funded with debt. The banks are caught up by risky businesses if rate is high.

- Equity multiplier ratio (EM) =share capital. It specifies how dollars of property have to be apprehended by every dollar of equity dealings. Higher value indicates danger of risk failure.

- Loan to deposit ratio (LDR) = loan deposit. Besides determining liquidity, it also shows bank’s credit risk. High rate shows possibility insolvency (Jaffer 543).

Efficiency Ratios

The subsequent ratios were employed to determine bank’s efficiency.

- Asset utilization ratio (AU) = total asset. It determines capability of the banks to make returns with its asset. Higher value, high productivity of bank’s assets.

- Operating efficiency ratio (OE) = total operating income. It explains how efficient the bank’s use their assets, revenues and minimizes the expenses. It shows how well a bank could lessen the expenses to improve productivity (Kettell 67).

Hypotheses and scope of study

The hypothesis will examine the impact of operational efficiency, bank’s size and assets management on bank’s performance.

- H1: there’s a positive and significant impact of operational efficiency, bank’s size and assets management on return on assets (ROA).

- H2: there’s a positive and significant impact of operational efficiency, bank’s size and assets management on return on equity (ROE).

- H3: there’s a positive and significant impact of operational efficiency, bank’s size and assets management on net special commissions (NSC). (Martin Cihák 450)

Methods and Techniques Adopted in the Study

Population/ Sample – The objective of this study is to evaluate the comparative financial performance of Islamic and conventional banks. To make an appropriate comparative study two Islamic banks are selected on the basis of almost having equal weight of invested capital and number of branches. To get substantiated results, the consolidated financial statements of both Islamic banks during the period of 2000 to 2005 were used.

Procedure and Instruments Used

The consolidated financial statements gathered from the official website of Emirates Islamic bank and Abu Dhabi Islamic bank. To measure the financial performance; profitability and liquidity ratios are used. In order to see these Islamic banks performed over the period of 3 years from 2000 to 2005, the yearly profitability and liquidity ratios these Islamic banks are compared with yearly profitability and liquidity ratios of conventional banks. Moreover the combined mean of profitability and liquidity ratios are compared with combined mean of conventional banks. To get the significant differences among the calculated results the paired sample t-test is used.

Empirical Analysis

In Profitability Analysis

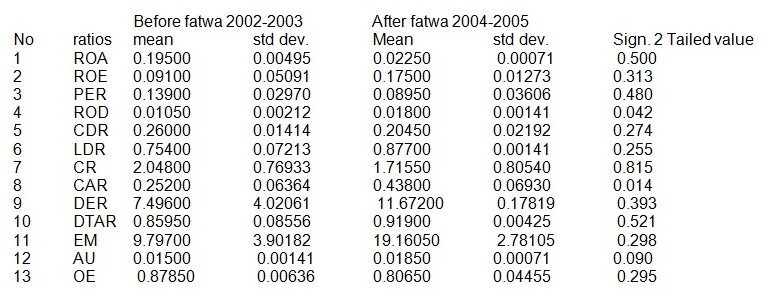

In terms of the examination of profitability, all tryouts of profitability of ‘Islamic banks’ other than ‘ROD’ illustrates that no significant dissimilarity in financial performance linking periods before/after fatwa. As exemplified below, (ROD) only shows statistical disparity. The standard ROD of ‘‘Islamic Banks’’ before fatwa is (0.0105) weighed against to 0.018 in the period after fatwa. It shows that, after fatwa, the increase of profit of ‘Islamic banks’ is relatively upper than deposit fund escalation. The escalation in year 2004 and 2005 are 289.41% and 92.93% correspondingly, whereas enhancement of deposit funds of ‘Islamic banks’ are 117.8% and 14.26% respectively. However, the significant rise of profit doesn’t create other ratios, such as ROE and ROA, signifying significant disparity between the two periods. The foundation for this may be the escalation of profit followed by escalation of other accounts, such as assets, and equity (Hennie Van Greuning 39)

Liquidity Analysis

In terms of inter temporal scrutiny of liquidity, as shown below, all ratios of Islamic banks, apart from CAR of Islamic Banks; point out that there is no noteworthy difference linking the period before fatwa and after.

Efficiency Analysis

In state of inter temporal scrutiny, all ratios illustrate no noteworthy disparity. As shown below, the mean average of ratios is relatively equivalent linking two periods. Similarly, interbank comparison also shows that all efficiency actions indicate no significant disparities between Islamic banks.

Risk Analysis

The disparity of ratios of these banks in the period prior than fatwa with period following fatwa does not show statistical difference. Hold on information below, after fatwa, means standard of all solvency and risk ratios (DTAR, DER, EM, and LDR) are superior to before fatwa.

Table: Financial Performance of these Islamic Banks Before and After Issuing of Fatwa

Conclusions and Recommendations

Islamic banks have expanded significantly in recent years because of increasing petrodollars inflows, following the oil shocks. These banks are growing at a rate of 15% per year since the early 2000s. And wherever they settle, the authorities try to implement adequate regulation in order to enable them to integrate the banking system of these countries. It is within this context that our study is inserted to measure and understand what explains the efficiency of these banks.

Works Cited

Hennie Van Greuning, Zamir Iqbal. Risk Analysis for Islamic Banks. Washington: World Bank Publications, 2008.

International Monetary Fund. Monetary and Capital Markets Dept, International Monetary Fund. Middle East and Central Asia Dept. United Arab Emirates: Financial System Stability Assessment. Washington D.C: International Monetary Fund, 2007.

Jaffer, Sohail. Islamic Retail Banking and Finance: Global Challenges and Opportunities. London: Euromoney Books, 2005.

Kettell, Brian. Case Studies in Islamic Banking and Finance. New Jersey: John Wiley & Sons, 2011.

Martin Cihák, Heiko Hesse, International Monetary Fund. Monetary and Capital Markets Dept. Islamic Banks and Financial Stability: An Empirical Analysis, Issues 2008-2016. Washington D.C: International Monetary Fund.