Introduction

An open economy struck by an exogenous adverse supply shock may be analyzed from at least two perspectives: fixed exchange rate regime, and floating exchange rate. Therefore, the possible outcomes of the regarded struck will depend on the economic regimes, as well as the inflation level of the currencies. The aim of this paper is to discuss the difference between supply-side policies, as well as aggregate demand policies. It is considered that the former is more suitable and desirable for regulating the economy struck, hence, the discussion part will be focused on confirming this point of view.

Discussion

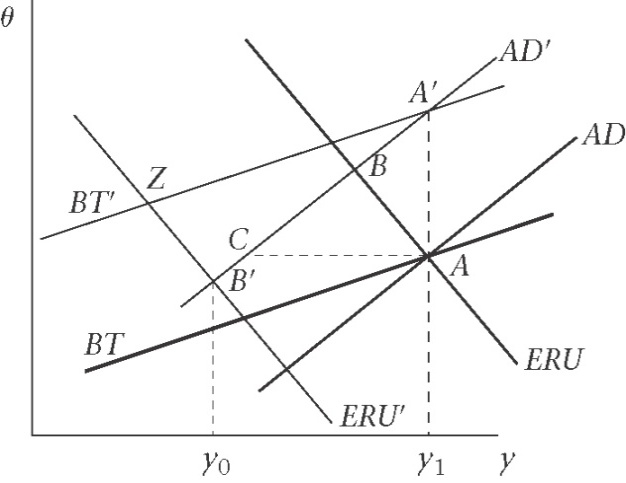

First, it should be stated that in the case of possible implications of the private sector in the consequences of a supply shock, the interests of this sector, as well as policymakers have to be reviewed. The AD curve will be shifted, as well as the BT and ERU curves. However, in the case of exogenous shock, the shifts will be complex, as several curves will be shifted (Figure 1).

Therefore, the first outcome that will be observed is the shift of the economic output. This will be decreased, and the next outcome will be the decrease in the inflation rates. However, this happens only if the economic system experiences a mere external trade shock. The open economy model is generally featured with extensive changes in the financial parameters in the case of a supply shock. Therefore, the key components of the regarded model are as follows:

- The Aggregate Demand curve may be used for demonstrating the real exchange rate as well as the economic output.

- The equilibrium Rate of the Unemployment curve is the indicator of the real exchange rate and the rate of economic output. Inflation stays constant regardless of the position of the ERU curve.

- The Balance Trade curve shows the balanced exchange rate and economic output level.

Fixed Exchange Rate Regime

In accordance with the research by Rodseth (2000), it should be stated that an increase in prices may cause a supply-side shock, while the ERU curve moves to the left. This is explained by the fact that economic output decreases, while the real exchange rate may stay the same. Therefore, the actual importance of exogenous supply analysis may be explained by the fact that such an analysis is associated with the values of supply and deficit rates, while the exchange rate is subjected to changes if it is not fixed. If the changes are negative, this may cause additional shock (Carlin and Soskice, 2006). Moreover, as it is stated in Mankiw (2007, p. 187):

The state of the business cycle is measured by the deviation of output from its natural level. The ERU and BT curves are sometimes regarded as the deviation of unemployment from its natural rate. Short-run fluctuations in output and unemployment are strongly and negatively correlated. When output is above its natural level, unemployment is below its natural rate, and vice versa. Additionally, unemployment fluctuates along with output, but in the opposite direction.

In the light of this fact it should be emphasized that the actual value of supply-side economic approaches is defined by the opportunity to decrease barriers for supplying goods and services. This is performed by adjusting income tax rates, increasing flexibility rates, and lowering prices. Therefore, in the case of supply shock, these measures may be more effective in comparison with aggregate demand policies. It is stated that an increase of money supply directly effects the loan supply levels. Consequently, investment interest levels drop. On the one hand, this may increase the employment opportunities, however, production levels should be expanded. Additionally, aggregate demand policies are closely associated with the stimulation of tax cut, which causes increased spending. This may be one of the factor for expanding production levels, while consumer goods production depends on the labor and skill categories. (Mankiw, 2010)

Considering the curves on figure 1, it should be stated that At C level of economic output, WPS is less then WWS; therefore, inflation will increase. Considering side-supply economic approaches, it should be stated that wage settings are performed periodically in accordance with price setting regulations. Therefore, wage changes are subjected to changes if prices are affected by external factors. Consequently, real price-setting wages are equal to real wage levels.

If aggregate demand economic measures are applied, the economic system may be subjected to stagflation. Hence, if the output level decreases, the inflation rate may rise. This is explained by the fact that the actual importance of supply-side approach is defined by the tax policies that are generally applied. Therefore, as it is stated by Rodseth (2000), the key benefits of this approach are as follows:

- Lower inflation. Shifting aggregate supply will cause lower price levels, therefore, in the case of supply shock, supply side policies will help to regulate cost originated inflation.

- Lower unemployment. Natural unemployment levels may be decreased if the actual regulation policies are associated with controlling the frictional and wage unemployment levels.

- Improved economic output. Aggregate supply may be increased is supply side policies are adopted.

- Improved trade levels. This is explained by the export level increase.

Flexible Exchange Rate Regime

In accordance with Mankiw (2007) the following statement should be emphasized:

The exchange rate between two countries is the price at which residents of those countries trade with each other. If we consider the adjustment under fixed and flexible exchange rates, adjustment costs required under exchange rate depreciation are higher than under a fixed exchange rate.

Therefore, considering figure 1, inflation rate at A’ point will be higher, and the exchange rate depreciation will cause stagflation. This may be explained by the fact that higher prices will require higher trade balance, while ERU curve will shift to the left. It is stated that rigidity level of the relative wage levels will be able to improve economic stability in the case of possible exogenous supply shock. However, thee demand level should be associated with the relative price and wage level.

As a rule, the model with flexible exchange rate regime is regulated with transfer payment that are performed in the form of welfare benefits. However, these benefits re not included in general governmental spending, while these spending are not regarded as a part of production force of the government. In the light of this fact, it should be stated that simple transfers from one group to another is the necessary mechanism for improving economic output.

Considering the necessary components of aggregate demand such as international trade, and currency trade, it should be stated that aggregate demand level is defined by the values of trade surplus. As for the matters of supply side politics within the frames of flexible exchange rate regime, the economic output within the frames of this regime should be subjected to deregulation and reduction of income taxes. Therefore, the reduced taxes will cause increased aggregate demand, while the ERU coefficient will be decreased.

Adjustment Plans

Supply-side plans

- Define real and potential outputs considering inflation and output gaps

- Monetary policy adjustment

- Stabilize economic parameters

- Regulate impulse response factors

Aggregate Demand Policies

- Adjust the optimal interest rates

- Set the supply-demand equilibrium (mainly short-run)

- Define and stabilize the prices for resource markets

From the perspective of supply shocks, supply-side approach is more effective and potential, as there is an opportunity to influence the economic mechanisms directly, while aggregate demand approach is associated with suiting the necessary equilibriums, and further stabilization of the prices. Therefore, aggregate demand principles are not suitable for supply shock solving measures. Considering the values of economic output given in figure 1, the AD and ERU curves should be regulated from the perspectives of monetary and exchange rate policies. Therefore, the actual importance of regulation measures are closely linked with supply-side regulation approaches. As a rule, the regarded adjustment plan is modified in accordance with the international trade policy requirements, while regular supply and demand principles are regulated by economic output and inflation rates.

Conclusion

Supply side regulation approaches are regarded as more suitable for the possible consequences of an open economy struck by an exogenous adverse supply shock. This is explained by the fact that these approaches offer more flexible and direct regulation tools, while aggregate demand policies are not able to offer such opportunities.

Reference List

Carlin, W., Soskice, D. 2006. Macroeconomics Imperfections, Institutions and Policies. Oxford: Oxford University Press.

Mankiw, N. G. 2007. Comments Presented at Federal Reserve Conference Price Dynamics: Three Open Questions. Journal of Money, Credit & Banking, 39(1), 187.

Mankiw, N. G. 2010. Questions about Fiscal Policy: Implications from the Financial Crisis of 2008-2009. Review – Federal Reserve Bank of St. Louis, 92(3), 177.

Rodseth, A. 2000. Open Economy Macroeconomics. Cambridge, England: Cambridge University Press.

Appendix