Introduction

Statement of objective: Research Question

The principal question considered in this project is: Can a strategic move be undertaken which will increase the opportunity for sustained high performance in the insurance brokerage industry related to premium financing? The objective is to apply a formal framework to facilitate strategy development for this industry.

Personal Interest

The Canadian Insurance brokerage industry generates direct revenues annually over $3 billion. This substantial economic base has been experiencing several changes, which are affecting the nature of the brokerage industry. Three core factors are present which all lead to the increased tendency for the sale of insurance products to be more commoditized:

- Entry of established financial institutions like the national, Chartered Banks is beginning which is allowing purchasers of insurance to access these products directly bypassing independent brokerages.

- Brokerage consolidation has increased leading to the reduction of participants in the brokerage industry as well as more business volume/revenues being concentrated in the hands of fewer, larger players.

- Thirdly, the insurance market in Canada has undergone a “softening” in recent years which means that insurance companies have been more competitive in their pricing of insurance products which results in lower premiums for purchasers of insurance (insured’s), and therefore, lower commissions to brokerages.

Since the commencement of this project, an additional factor has arisen which put further pressure on the brokerage community in Canada. The credit crisis, which originated in the U.S. in 2008 and rapidly dispersed throughout North America and the rest of the world, led to a substantial collapse of the major world stock market index values. Insurance companies that invest their financial reserves heavily in stock markets have been badly affected by this deterioration. This forced them to seek other sources of revenues to maintain their position. A broker impacted by this as insurers are seeking to compensate brokerages for insurance sales at lower commission rates in order to preserve a bigger piece of the pie for themselves.

Because of the above noted factors, being able to identify a process through which a brokerage is better positioned to develop value innovation and separate itself from others in its field is becoming increasingly desirable in this arena.

The specific question being considered has become even more personally compelling to me over the last couple of years as I have created a business, raised capital, and invested heavily both financially as well as personally in this business based on the research undertaken through this question.

Dissertation Structure

During the course of this dissertation, the research questions have been answered through a series of steps. Different sources are used for the reliability of the research. The research is developed in such a way that first there is a table of contents followed by acknowledgements, executive summary, chapter 1 to 6, conclusion, reflections, references and appendices.

The chapter 1 describes the research questions and personal interest related with the project. The chapter 2 is the literature review which descibes the previous researches and works on the topic. In addition, the chapter gives an overview of the Blue Ocean Strategy. Different reliable sources are used for the construction of this chapter.

The third chapter is the research methodology. This chapter describes different methods used for the development of the research i.e. the type of sources, methods of conducting research etc. Different primary as well as secondary sources used are explained in this chapter.

The fourth chapter is the main body of the project. This chapter describes in detail the Blue Ocean Strategy and different factors related with this strategy. It also makes a comparative analysis in the industry, which is essential to identify the profitability of the industry.

The chapter five is the analysis and interpretation of the results which is the most fundamental section of the project. Here the analysis is done focusing on different concepts. The chapter six contains recommendations of the project based on the research conducted. This chapter summarizes the outcomes and makes recommendations from the discussion and analysis. After the recommendation chapter, the conclusion of the research is drawn.

Literature Review

Strategic development

A clear, focused strategy is supposed to be there with every organisation in order to achieve its mission. Focused strategies help an organisation in construction and bring into line its internal capabilities focussing with external threats and opportunities. In addition, it coordinates the board, staffs and constituents towards the objectives. Strategy usually includes the competitive moves and approaches that managers introduce into the process of an organisation. In constructing a strategic plan, management says, “among all the paths and actions we could have chosen, we have decided to go in this direction and rely upon these particular techniques in doing business.” (Seminars for Strategic Planner).

Strategic development is a very difficult process, as it needs keen attention and focus. There could have many paths and action for a mission and it is difficult to implement all. Developers should select only those, which are specific, focused, and reliable and goal-oriented. There are some learning modules in developing the strategic plan as follows:

The Strategic Management Process: An organization’s strategic plan is a collective strategies reviewed by different levels in organisational hierarchy.

- Establishing Company Direction: Company should be very specific in choosing the direction towards its ultimate mission by considering internal and external environment.

- Developing a Strategic Vision: Developing a strategic vision is a very important step in strategic development and this demonstrates about the future of the organisation.

- Setting Objectives and Crafting a Strategy: Setting the objectives is a tough stuff to do, as it needs sensible forecasting and designing a strategy is an analysis-driven exercise.

- Industry and Competitive Analysis: Judgment on the industry and competitive analysis will simplify the process of setting the objectives. Analysis is done through various analyzing tools.

- Evaluating Company Resources & Competitive Capabilities: A successful evaluation of company resources and competitive capabilities makes the strategic development process much easier as it gives a clear picture of the available resources and the constraints associated with it.

- Strategy and Competitive Advantage: Company should check the competitive advantages of the strategy before its implementation as the future of the company depends upon the proposed strategy.

- Matching Strategy to a Company’s Situation: Before implementing the strategy, the management should consider whether the strategy matches the company’s situations. The main two factors of the strategic plan are the nature of the industry and competitive condition and the firm’s own resources and competitive capabilities.

- The Business Strategy Game: This is a computer simulation activity that will improve the learning experience in strategic development due to the previous capacities and capabilities of the company. (Seminars for Strategic Planner).

- The Balanced Scorecard: This is considered as a tool for implementing strategy as it frames the organizing strategy of the company and step by step process. It provides common language for executives to give the clarification on strategy. It translates the vision to all levels.

Strategic Vision

“A Vision is a desired future state which a company hopes to arrive. It is the imaginative picture of future state of affairs that a firm wishes to achieve.”

(Description of (Strategic) Vision. Explanation).

Steps involved in Development of Strategic Vision of a business are as follows.

- Understanding the organization: To formulate a vision for an organization, we should understand the organization; we should know what is the mission and purpose of the organization, values, its character etc.

- Conduct a Vision Audit: It involves assessing the current direction and momentum of the organization. We should know whether the organization has a clearly stated vision, and if the organization is able to arrive at in the current direction as stated in the vision and whether the key leaders of the organization know where the organization heading to.

- Target the Vision: The step involves starting to focus on vision based on the organisations goal of its establishment. The organization should know what will be the vision, where the company want to be in the future, and what critical issues must be addressed in the vision to be in the position.

- Set the vision context: This step includes creating a vision for the organization, which include four steps. In the first step, categorizations of the future developments in the environment, which may affect your vision? In the second step, recording the potential for the future in all categories is done. Determining of the expectations that are likely to occur is done in the third step and lastly assigning a probability of occurrence to each expectation is done.

- Develop Future Scenarios: This step involves combining expectations into a few brief scenarios which include possible futures that are anticipated.

- Generate Alternative visions: This step involves generating visions from which a final vision is selected.

- Choose the final vision: Here you need to choose the best possible vision for your organization as the daily affairs is contributed to the vision. First, look at the properties of a good vision and what things make a vision to succeed. In the next step, comparison of the visions and determination of the possible visions is selection, which will be applicable to the broadest range of scenarios. Vision should be one, which is compatible with the organization’s culture and values. (Strategic leadership and decision making).

- Implementing the Vision: The vision is to be communicated to the organization’s stakeholders, inside the organization. The vision should be apparent and should be communicated to all members of the organization including the employees and management. The method used for communication may include disseminating the vision in written form, preparing audio visuals showing the outlining and explaining the vision, presentation of the vision in speeches, interviews or press releases by the leaders of the organization.

Blue Ocean strategy

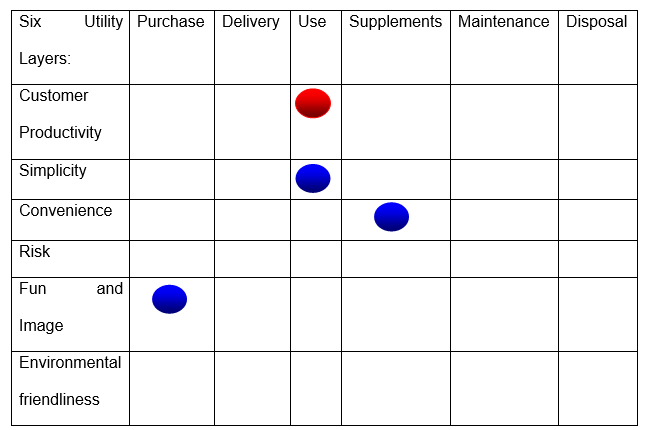

Blue Ocean strategy has been conducted as a long-term study of 150 strategic moves spanning more than 30 industries. The main aim of Blue Ocean strategy is not only to perform competition but also to create a new space in the market. It creates a new market demand among its customers as well as non-customers. The strategy offers a set of tools, techniques and methodologies to capture the new market space mainly the sequence of blue ocean strategy. It also provides reproducible and systematic methodologies to pursuit innovation by both new and existing firms. “BOS frameworks and tools include: strategy canvas, value curve, four actions framework, six paths, buyer experience cycle, buyer utility map, and blue ocean idea index.” (What is BOS)

The frame works are created in visual to build effectively the collective wisdom of the company thus executing an effective communication system. The framework includes formulation and execution of strategies of an organization. Value innovation, tipping point leadership and fair process are considered as the three conceptual building blocks of an effective Blue Ocean Strategy.

The strategies in terms of Red Ocean are entirely different from the strategies in Blue Ocean as the Red Oceans are concentrated on the existing market space or the well-known market space. In the Red Ocean strategy, the market and industry boundaries are well defined and accepted as it is the existing market. At the crowded market space, the production process and the cutthroat competition turn the Red Ocean bloody.

Difference between Red Ocean strategy and Blue Ocean strategy

Red Ocean strategy focuses mainly on existing customers thus maintaining customer relationship. Whereas in case of blue ocean strategies, It will take key policies to generate market demand as it is based on the non-customers. It gives preference to maintain all types of people, both customers as well as non-customers. Red Ocean strategy creates competition among its customers with the existing demand where as Blue Ocean creates irrelevant competition in the market by creating new customers. Red Ocean strategy maintains the existing level of demand of the company in the market whereas Blue Ocean strategy creates new demand from the market by identifying non-customers and converting them to customers.

PESTLE analysis of the macro environment

PESTLE analysis is the method of scanning the external environment of an organization. There are many factors in the organization which may affect the managerial decisions of an organization. The following are the important factors which are included in the PESTLE analysis.

Political factors

It refers to the degree of intervention of the Government policies in the business economy by the introducing new rules and regulations regarding the day-to-day affairs of the business. The political factors are mainly based on certain questions such as what types of goods and services are to be produced by an organization and at what price, what are the priorities in terms of business support etc… Political factors can influence many areas of business like quality of the product, education of the work force, health of the nation etc.

Economic factors

It includes all the factors which affect the overall economic growth such as rate of interest, changes in price level, inflation and the changes in demand. The economic changes cause a major impact on the organization’s wealth.

Social factors

The rapid changes in the social trends can influence the overall operational levels of an organization. The increasing level of population, the changes in the life style of people and the increase in standard of living of the society can have major influence on the social environment of an organization.

Technological factors

Introduction of new technologies and adoption of advanced technologies such as MP3 players, computer services and online operations can create technological advantages in the business.

Environmental factors

Environmental factors are the factors, which affect the environmental conditions of an organization mainly the external. The major environmental factors such as the changes in climate, and natural calamities influence the operational and distributional aspects of an organization. The changes in weather will affect the transportation and physical delivery of goods and services. The natural calamities such as earthquake, floods etc may cause the complete abandonment of a business.

Legal factors

Every organization must follow the legal framework of the country. There are several factors such as Government policies and political conditions which may positively or negatively affect the legal working conditions of an organization.

7- S Framework

The 7- S Framework of Mckinsey is a management model that describes 7 factors to organize a company in an effective way of combining the values, strategy, structure etc which the managers should take into account for successful implementation of a strategy.

Meaning of 7 – S:

- Shared Values: Shared Values means what the organization stands for and what it believes in the society.

- Strategy: Strategy means how the company prepares the plans to reach identified goals from its scare resources.

- Structure: Structure means the way in which organization’s units are related to each other.

- Systems: System means the procedures, processes and routines that characterize how the work should be done.

- Staff: The numbers and types of personnel within the organization who takes a major role in the organisational task constitute the staff.

- Style: Style means the cultural style of the organization i.e. how managers behave in achieving the organization’s goals.

- Skills: Human beings are different in nature in their capabilities and skills are the distinctive capabilities of the personnel of the organization as a whole.

Overview of Premium Finance Transaction

Typically, an insurance premium finance transaction begins with an insurance purchaser (insured) deciding against paying annual insurance premiums in advance, but rather spreading out the expense in monthly instalments. The insurance broker (broker) negotiates payment terms with a lender on behalf of the insured.

Once the prospective borrower is satisfied with the lender’s terms, a contract (premium finance agreement or PFA) is signed in which the borrower:

- Promises to repay the lender, with interest, the sum the lender advances to pay insurance premiums;

- Assigns to the lender, as collateral, the unused or unearned portion of the premiums;

- Appoints the lender as attorney-in-fact with authority to cancel the insurance policies, loss payments, and dividends (if any) on behalf of the borrower and thereafter to collect the unused portion of the premium if the borrower defaults.

The PFA is then submitted to the lender for approval. After the loan is accepted, the lender verifies the existence of the insurance policies with the insurance company. The lender then pays the borrower’s insurance premiums and expects the borrower to repay the loan as promised.

In the event the borrower fails to pay any instalment as agreed, after the expiration of any required cure period the lender exercises its power of attorney and cancels the policies on behalf of the borrower. The insurance company processes the lender’s request and forwards the unused portion of the premiums to the lender. The refund is applied to the borrower’s loan and should be sufficient to pay it off.

Research Methodology

Here’s link for citation to be used for this paragraph (Ospina).

The objective of the research is to utilize a formal strategic process to attempt to develop value innovation for the Canadian Premium Finance Industry. To achieve this, the research project used are both self-completion questionnaires and in-depth interviews coupled with an extensive literature review. The goal of incorporating several methods into the research was to aim for greater confidence in the findings. “As stated by Bryman (2004), the results of an investigation employing a method associated with one research strategy (qualitative) are cross-checked against the results of using a method with the other research strategy (quantitative), which should result in greater confidence in the findings.”

The Research methodology paper needs to consider the topic under discussion under two distinct heads, firstly, in terms of primary data, and secondly, with reference to secondary data.

- Primary sources

- Secondary sources

Survey was chosen as a quantitative analysis research tool primarily for convenience of both cost and distribution. A random sample of 250 Canadian insurance brokerages was selected from the insurance directories of the 9 English speaking provinces. The sample generated was from a total pool of 8,000. The survey was introduced to the sample by email and directed to brokerage principal (owner) where this was available and, if owner-contact was not available, then to the Controller, Chief Finance Officer (CFO), or Director of Finance. The email contained information which noted that participation was entirely voluntary and that any responses provided would remain strictly confidential. The message also explained the purpose of the research as academic in nature.

Main body of the project

Much “insight” into innovation and new market development appears to suggest that it is largely the result of random or chance events. Businesses stumble into the next opportunity or they succeed in spite of themselves. All these are neither motivating nor constructive in terms of providing an objective approach to developing business opportunities. Renee Mauborgne and Chan Kim of Harvard’s Business School have sought to overcome this limitation by developing a formal approach to new market development known as Blue Ocean Strategy.

Overview of K & M’s Blue Ocean Strategy

A Blue Ocean Strategy is the phrase coined by Mauborgne and Kim that details how a company can do things so differently that it moves into an entirely different marketplace, even a different industry. In Blue Ocean Strategy, they describe the red ocean as where most companies compete, seeking customers from the same market as their competitors. Kim and Mauborgne suggest that companies break out of the red ocean of bloody competition by creating uncontested market space in the blue ocean that makes the competition irrelevant. Red Ocean Strategy focuses on existing customers, and has the following traits:

Successful blue ocean companies include Callaway Golf, NetJets, Curves and Cirque de Soleil. However, companies have been creating blue ocean strategies for decades. Callaway went after non-golfers intimidated by the sport, gave them a club head so huge they could not miss the ball, and won over duffers in the process. NetJets took the speed and flexibility of the corporate jet and the lower cost of commercial travel and offered the best of both industries in fractional “timeshare” jet ownership.

How to create Blue Oceans

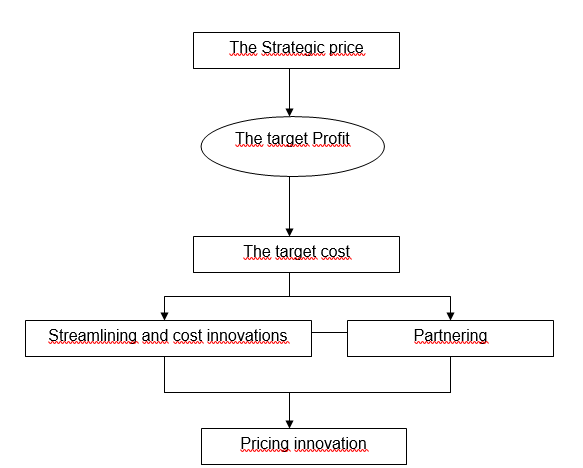

Value innovation is the cornerstone of blue ocean strategy and is not new. Porter and others have espoused innovation for decades. What is new is how Kim and Mauborgne suggest that innovation align with utility, price, and cost positions while overcoming the execution hurdles. They decry the value cost trade off which is so common today and provide useful tools that encourage thinking of alternatives instead of competitors, and non-customers instead of customers.

One tool is the strategy canvas used to create value. This diagnostic and action-oriented chart plots the current state of play (low vs. high activity) in the known market against the range of factors used to compete. The resulting value curve shows where the competition is currently investing and what they offer to buyers. This creates the current value curve. Once you have created that, look at each factor and decide which of four primary actions (eliminating, reducing, increasing, or creating) could be taken to create value to non-customers. These actions will dramatically change your value curve.

For example:

- What factors on the strategy canvas should be eliminated that do not add value? Casella Wines eliminated the aging and tanning qualities, two factors that intimidated customers.

- What factors should be reduced below the industry standard to avoid over delivering? Casella Wines limited their offerings to just one white wine and one red wine (Yellow Tail) to avoid customer confusion.

- What factors should be raised above the industry standard so that customers will not have to make compromises? Casella Wines raised the involvement of Yellow Tail retailers by providing them with Australian outback clothing, which helped make the wine seem friendly instead of intimidating.

- What factors should be created that are new to the industry? Casella Wines created new customer experiences for wine drinking; easy drinking, ease of selection, and a sense of fun and adventure.

Characteristics of Blue Ocean Strategy

Once these actions have been taken, look to see if your strategy has the three characteristics of a good blue ocean strategy. Does it have focus? Does it diverge from other players? Does it have a good tag line? Look to alternatives rather than the competition.

For example: Southwest Airlines chose to look at automobile transportation, not other airlines, as the alternative for comparison. By focusing on friendly service, speed, and frequent point-to-point departures, they were able to price against car transportation. They diverged by eliminating, reducing, raising, and creating value that differentiated their profile from the average airline. Their tag line: “the speed of a plane at the price of a car—whenever you need it,” was very compelling, and sales took off.

Canadian Premium Finance Marketplace using traditional Market Analysis

Kim & Mauborgne’s approach involves six steps. Each of these steps offers a systematic and repeatable process which can be applied in order to give businesses the best options for developing new opportunities. A brief description of each step follows.

Canadian Premium Finance Industry

The Canadian Insurance industry involves premiums in excess of $30B annually. It has been growing at a 5-6% rate over the last 5 years. Insurance is written throughout Canada. The overwhelming majority of this business is marketed from the insurance companies through independent insurance brokers directly to the end purchasers (insured’s). There are around 29,000 independent brokers throughout Canada. These brokers, in turn, promote insurance to over 1,000,000 businesses and over 10,000,000 households. The premium finance industry exists by providing opportunities for insured’s to pay over the life of the coverage. Clients are able to spread the cost of insurance over time and avoid large, onerous, lump sum payments.

Due to steady increases in insurance premiums over the last 5 years coupled with more prevalent access to financing for general purchases, the motivation and acceptance of premium finance options has grown substantially. Clients are becoming more used to the idea of paying for insurance over time opposed to all at once. For many commercial clients, it is becoming essential from the standpoint of cash flow to be able to defer payment of insurance premium for a period of time.

Recent industry changes

However, the review of factors, which have led to increased acceptance of premium financing by purchasers of insurance over the last five years, can be contrasted with current events. Several current economic and insurance industry events are occurring which are leading to a decrease in demand for premium finance services and an excess supply.

Specifically, the present trend in the insurance market is for premium levels to increase. This is referred to as a hardening market. The result is that purchasers of insurance may be seeing higher prices while their business conditions are more difficult. The general economic environment is quite dismal. Canada is achieving below average year-on-year GDP growth amidst a difficult credit environment, which is negatively impacting business’ capital expenditure decisions. These two factors alone lead to more demand from insured’s for the premium finance service. Their insurance expense is increasing and at the same times their ability to pay is decreasing. On the supply side, some market entrants to the Canadian premium finance industry have recently exited the marketplace due to the worldwide credit crisis.

The cumulative impact of these factors is an excess of demand coupled with a dwindling supply. Inevitably, price pressures for current premium finance companies have reduced compared to the past, leading to more profitability being likely for existing market participants.

The loan volume financed in Canada via independent premium finance companies is estimated between $2.3B and $2.5B annually. Unfortunately, no objective industry statistical information is available to confirm these numbers. However, three companies presently handle the majority of the volume. Around $2B or 80% of the national premium finance market is supported by four premium finance companies: Cafo, AIG Credit, Cananwill, and Insurance Pay.

Competition Analysis

Five factors are analysed in the Porters five forces analysis. They are as follows:

- Rivalry among competing sellers:

- Most participants in Canadian PF industry are similar in size independent of what their PF market share may be. Because of this overall similarity in size and capacity, no single player is able to make competitive moves, which will not be capable of being copied by other participants.

- New entrants to the PF industry typically focus on the smaller commercial premiums (those under $15000). This is done because there are more of them in terms of volume of contracts as well as the spread (difference between rates charged to clients and those paid) are greatest on these types of deals.

- The easiest and most straightforward classes of business are pursued first. This leaves several specialized areas available for a new entrant to pursue. Alternately, an existing participant may choose to expand its service offering into one of these specialized areas in order to leverage this additional service for some of the easier, standard business.

- Barriers to Entry:

- Specialized niche market:

- Access to capital and cost of funds (COF):

- Understanding of nature of the business:

- Access to suitable technology to administer operations:

- Access to distribution channel:

- Potential retaliatory action from established market participants:

- Competition from substitutes:

- Carrier Pay Plans:

- Customer’s borrowing power:

- General interest rate level:

- Brokerage’s willingness and interest in providing various payment options (informally) to their clientele:

- Brokerage Owned Premium Finance Companies:

- Power of suppliers:

- Funding source is the core supplier in PF industry.

- No one supplier is dominant.

- Other sources for funds exist.

- More may become interested in participating directly in the market.

- Power of customers:

- Brokerage consolidation is becoming more active. This will increase the negotiating power for a large group of brokers with large books of business. Either they will be motivated to initiate their own PF business or they will have a hammer with which to arrange favorable deals with existing PF companies.

- This consolidation leaves a niche market open to provide targeted services to the smaller, regional brokers who are not receiving a broad range of services. The large, established PF companies can cater to the broker networks and large mid market brokerages.

Industry Driving Forces

It describes what causes the industry’s competitive structure and business environment to change? Driving Forces are as follows:

- Internet and e-commerce: The internet and electronic banking capabilities influence the administrative burdens while handling PF business. Accessing quotes, contracts, and funding information can be expedited due to the internet. Additionally, gaining contact directly with insured’s can be enhanced by using websites and internet marketing. This is a direction that many independent premium finance companies are considering in order to expand the reach of their marketing efforts.

- Globalization of business: Large, multinational finance companies with expansive capacity for lending may seek out growth in the Canadian market. The major participants in the Canadian market are all US owned companies. Additionally, one of the latest entrants is a division of an Australian bank.

- Changes in the long-term industry growth rate: The demand for PF can be somewhat cyclical. As the insurance market hardens (rates increase), the demand for PF increases. Insurance companies are less generous with the services they extend for financing and clients have to come up with alternative methods of financing the increasing premiums. When markets soften (rates decrease), insurance companies may also throw in financing services to make their product more attractive. The general interest rate environment as well as the general business conditions can also influence the attractiveness of PF. In today’s market environment, premiums are softening or lowering which results in lower commission revenues to brokerages. This decrease on their profitability is leading brokerages to consider other forms of revenue generation.

- Changes in who buys the product and how they use it: Brokerages are less interested in providing a pure value added service without generating some revenue and profit. Brokerages are motivated by necessity to establish additional profit centers within their businesses.

- Product innovation: Companies that lead the way to providing additional financing arrangements for new or previously “un-financeable” premiums will gain competitive advantages. These may or may not become sustainable depending on competitor’s willingness to develop comparable products.

- Technological change: Enhanced electronic operating management systems can decrease the manual labor costs, thereby improving operating margins for technologically superior organizations. Additionally, improvements in technology may provide further service enhancements to gain additional loyalty and commitment from customers.

- Marketing innovation: Can alternative ways of promoting the PF service be identified which will spark buyer’s interests, widen industry demand, or increase product differentiation? Coupling the PF service with other financing arrangements, which may be desirable by a targeted market segment, may be attractive. Additionally, alternate marketing forms circumventing the standard distribution chain and targeting the insured directly may create a competitive advantage.

- Entry or exit of major firms: Several years ago, a major market participant (Insurex) exited the Canadian PF industry. They were acquired by another US company, which chose to discontinue Canadian operations. This provided immediate opportunities for existing PF companies to pick up the gap in supply. Additionally, the difficulties and inconveniences suffered by brokers due to the exit are still remembered. They are reluctant to change companies or use new PF vendors because of the concern of having a prospective vendor exit the industry. Furthermore, because of the current credit crisis, AIG Credit abruptly closed its doors in February 2009. This has resulted in about 25% to 30% reduction in overall industry supply in a very short period.

- Growing buyer preferences for differentiated products instead of a commodity product: Brokers typically follow the path of least resistance. They want to do things as quickly and easily as possible. Many brokers consider the substitute alternative of ‘carrier’ plans as easier to implement than working with a private PF company. Nonetheless, market opportunities exist for PF companies who are able to distinguish their service offering as not only administratively convenient to implement, but as capable of working as a sales tool to enhance the broker’s ability to close business. Other differentiating factors acting as buyer preferences include further revenue generating potential for brokers and additional services to offer and endear themselves to their clients.

- Regulatory influences and government policy: PF companies in Canada rely on particular provisions of respective Provincial Insurance Acts in order to obtain legitimacy and certainty of their collateral. The Broker Builder’s Legal Review of Premium Finance Regulatory Environment document for a comprehensive review of legal issues facing market participants shows the regulatory influences.

Industry Key Success Factors

Anyone considering entry into the premium finance industry should critically evaluate the significance of the below noted success factors. Additionally, a prospective market participant should give serious thought to where its strengths lie with regard to the below noted success factors.

- Flexibility and ease of use.

- Range of services offered.

- Cost of funds.

- A strong network of distributors

- Quality control know-how

- An ability to develop innovative products and product improvements

- Superior information systems

- Ability to respond quickly to shifting market conditions

- Superior ability to employ the internet and other aspects of electronic commerce to conduct business

- Managerial experience

- Favourable image or reputation with buyers

- Overall low cost.

- Convenient locations

- Customer service superiority: friendliness, trust, comfort

- Access to financial capital: capacity of lending capability

Industry Prospects and Overall Attractiveness:

The following factors describe an industry prospects and unattractiveness, thus helping in the selection of an industry to enter.

- Factors making the industry attractive:

- Continual rise in general insurance premiums:

- Low interest rate environment making financing charges more palatable:

- Specialized niche market:

- General trend towards greater acceptance of financing insurance and other general business expenditures:

- Factors making the industry unattractive:

- Participation by a few, large financial institutions who are vulnerable in the current economic environment may lead to reduction in credit facility availability to fund PF services.

- Once aware of PF market, the barriers to entry are not insurmountable to overcome.

- Regulatory changes may occur which impact the ground rules of the industry.

- Profit outlook (favourable/unfavourable)

The outlook for profitability for independent premium finance companies appears to be respectable. However, due to the current economic environment, risk aversion on the part of lenders has increased. Credit availability for businesses remains scarce.

Because of the above market analysis, companies would pursue one of the following as typical strategies:

- Focus on Either Price Competition being the low cost provider or focus on selling services to certain classes that are less price-sensitive.

- Creating superior and unique product through Product Differentiation

Neither approach is likely to bring substantially improved business results for a company. Focusing on benchmarking competitors appears to be a less fruitful approach to strategic planning. The either/or choice of cost v/s value should be eschewed. Business success is less derived from trying to do the same thing slightly better than existing competitors do. The goal is not to deliver more of the same or try to manage existing competitors.

Analysis and Interpretation

Kim & Mauborgne’s Blue Ocean Strategy has been detailed and the Canadian Premium Finance marketplace is reviewed in the context of their proposed strategy development structure. The goal is to compare and contrast the results from implementing K & M’s Blue Oceans Strategy relative to the results seen from the above “traditional” market analysis.

Strategy Canvas

Before you can determine where you are going, a fundamental step in every journey is the identification of where you are. This is the diagnostic purpose of the Strategy Canvas. The objective of this step is to delineate the state of the nation, as it exists today in a given marketplace.

Specifically, two principle variables are presented:

- Industry factors upon which current competition is based, and

- What customers receive from existing market offerings?

The approach is to present these variables on a graph with the industry competitive factors presented on the “x” axis. There is no hard and fast rule for a minimum or maximum number of competitive factors within a given industry.

On the “y” axis, the value customers receive from each of the identified industry factors can be rated. A line plotting the performance of a given market participant can, therefore, be created illustrating how that company delivers value to its customers across the recognized industry factors. Multiple lines representing different competitors within a market are overlaid upon each other to provide further depth of analysis. Each line represents for a given company the “value curve” or “a company’s relative performance across its industry’s factors of competition.” (p.27).

Applying this tool to the Canadian Premium Finance industry, we used a two-step process. First, we created the following table.

- Column 1 details all the competitive factors that influence customer-buying decisions. The sources of these are the Industry “Key Success Factors” identified in the “traditional” market analysis noted above.

- In column 2, we assign a rating to indicate how much a customer values this factor. H = high level of value, M = medium level of value, and L = low level of value.

- We identified the 6 – 10 “most valuable” factors to customers and presented them on the horizontal axis of the strategy canvas.

- Create a column in the first table and evaluate the level of offering a customer receives of each competitive factor from each competitor. Scoring is done as below:

- 5 = high level of offering

- 4 = medium high level of offering

- 3 = medium level of offering

- 2 = medium low level of offering

- 1 = low level of offering

- Calculate the average for each row of factors from the competitor columns and display the average in column 7.

- Plot these averages above each factor on the strategy canvas.

- Connect the dots to create the industry value curve.

The x-axis consists of factors, which the Canadian premium finance industry presently competes on in terms of products, services, and distribution. The y-axis displays how current market participants succeed or fail on delivering on the factors relevant to the industry presented on the x-axis.

It is important to avoid the mistake of discussing strategy changes prior to resolving differences of opinion about the current state of play. P84. Additionally, beware of the tendency of some executives to grasp tightly to the status quo.

Process of determining present relevant industry factors

- Bring together senior management team of the organization. Their input as to the relevant factors becomes the basis of a “first kick at the can” at drafting the strategy canvas. Then try to rate competitors on the factors, which can be identified. Use competitive marketing materials as sources for these factors.

- Use industry articles/publications which detail these potential factors (AB Ins Brkr article, and Cdn Ins article on Insurance Pay, also articles in the US….) This exercise alone can generate a realization that change of some kind is necessary.

- After the wake up call, the next step is to send a team into the field (p88). Great strategic insights are less the product of genius than of getting into the field and challenging the boundaries of competition (p88). Allow yourself to see what is invisible to others (p88). The field consists of customers, non-customers, former customers, users, buyers, alternative products.

- Then develop “new” strategy (ies) based on information discovered during the field exposure. Also create a compelling tag phrase for the new strategy (ies).

- Present the new strategies at a “strategy fair” (p90). Include management and members of external constituencies. This process is geared to help determine what of the “new” factors are relevant to the target market. Likely learn that some perceived competitive factors are actually marginal to customers. Most buyers have a common and basic set of requirements. If met, most other features are irrelevant. After this, it is now able to finalize new/desired/target value curve on the strategy canvas.

- Finally, cross-reference the new strategy with the criteria of a successful strategy (p93): focus, divergence, and compelling tag phrase. Goal could be to “substantially cut the operational complexity of its business model, making systematic execution far easier.” P93

Below given are the factors, which form the foundation of competition in the Canadian Premium Finance Industry as determined by our initial internal management review:

Rates

Rates refer to the cost associated with a premium finance loan. In other words, the finance charge is the amount that a borrower pays for the right to pay back the borrowed amount over time. The higher the finance charge, the higher the rate associated with a given premium finance loan. Because there is little financial motivation for a brokerage to offer premium financing, their main method of evaluating between competing PF vendors is to compare the ultimate cost of the loan to the brokerage client (insured).

Capacity

Refers to the availability of loans from a given premium finance vendor. Those vendors with larger capacity are in a position to accept greater loan volumes. This capacity may result in premium finance vendors willing to take on larger individual loan amounts or larger overall volumes resulting in potential operational efficiencies.

Product Flexibility (Technology)

How does the premium finance vendor make it easy for a brokerage to offer the premium finance service? Minimize administrative burden. Reduce need for formal credit application and review procedures. Integration with BMS, Web based quoting, Ease of issuing contracts are some other services.

Service Flexibility

How does the premium finance vendor make it easy for an insured to accept the premium finance service? Flexible repayment terms/structures, Continuous contracts, Treatment of endorsements, Amount of information required from insured to prepare a quote/contract shows the service flexibility.

Additional Services

What additional services does a premium finance vendor offer insurance brokerages?

Marketing Focus

To whom does the premium finance vendor focus its marketing effort?

Sales Staffing (Account executives and marketing representatives)

- Start Up/Set Up cost (software vendors)

- One piece of the puzzle. Still many areas a brokerage has to learn their own.

It can become apparent when multiple lines are presented that groups of companies show very similar lines. This indicates that these companies are competing on the same variable. For example, price. Alternately, the graph may show a group of companies pursuing some type of differentiation strategy in that they are showing high levels of customer value in a given area. Unfortunately, for the companies, the differentiation factor is the same across companies.

The value of the strategy canvas is twofold. First, it illustrates in a given industry where the competitors are distributed in terms of strategic focus. Second, viewing an industry like this provides clear notice that doing “more of the same” is unlikely to meet with substantially improved results. Only incremental gains at substantial expense can be anticipated.

The fundamental basis of K & M’s Blue Ocean Strategy is to unleash the power of the “and” to encourage businesses to seek ways to provide more value for less cost.

“You must begin by reorienting your strategic focus from competitors to alternatives, and from customers to non-customers of the industry.” P. 28.

The “Strategy Canvas” helps us to identify where we are as well as where we do not want to go. K & M’s “Four Actions Framework” is another analytical tool which helps businesses begin to answer the question of where do we want to go.

Four Actions Framework

The “Four Actions Framework” uses four questions to guide a business’ strategic thought as to how to develop a new value curve.

- Which of the factors that the industry takes for granted is eliminated?

- Which factors should be reduced well below the industry’s standard?

- Which factors should be raised well above the industry’s standard?

- Which factors should be created that the industry has never offered? P29.

These questions push companies to pursue a reduction in cost and a differentiating strategy. By considering the first two questions, a business uncovers those areas, which had been pursued (and invested in) just because of the way it has always been. These areas offer little value to customers, but have been kept because other companies still pursue business in these areas.

Engaging in the last two questions encourages companies to determine where to focus resources in terms of pushing value higher in a couple of existing industry factors; but, more importantly, to focus on developing new factors which the industry does not presently deliver.

A business will begin to realize that developing answers to these four questions will begin to reveal an altogether new value curve. This value curve will appeal to not just the existing customer base, but will also offer the opportunity to engage altogether new market segments.

Applying these four questions to our project resulted in the following:

- Eliminate: Factors which imposed a burden on loan set up which were not essential to protecting a lender’s risk are identified. The value of eliminating these relative to the risk/consequence was weighed with the result that the following could be considered as items to be eliminated:

- Credit review of specific borrower/insured by lender,

- Need for PPSA (Personal Property Security Agreement) or Liens to be filed/registered against borrower.

- Communication and education of brokerage staff as to end borrower benefits.

- Reduce: Further factors were identified which could not be fully eliminated but could be reduced in order to reduce efforts and burden associated with setting up premium finance loans.

- Reduce complexity of loan application and details of information required.

- Raise: Factors, which widen the gap between pains of the past and potential of the future, are considered. Most of the items eliminated or reduced were associated with administrative burdens associated with establishing premium finance loans. The corollary of reduced burdens considered was to make easier the set up of these loans.

- Enable minimal work effort on the part of insured & brokerage to establish finance contracts.

- Enhance web-based application, which allows loan application and approval to manage quickly and easily.

- Ease of use.

- Create: New factors which were not part of the traditional approach:

- Redefining who the “customer” was. The target for the sale became the brokerage principal as opposed to brokerage staff issuing loan or insured directly.

- Communicate revenue potential for a brokerage. The profit model became one of allowing brokerage to double profit associated with existing business v. seeing the loan as a customer service tool only.

- Allow the implementation of the process to become nearly “touch less”..

The results of applying the above to the Canadian Premium Finance industry resulted in identification of some of the additional key factors.

Table2: showing various competitive factors and their values.

Using the Four Actions Framework and the Strategy Canvas allows companies to “see the future in the present”. P.41. Reviewing the existing industry competitors value curves presents a state of the nation as it exists which compared with the value curve resulting from undertaking the Four Actions Framework. From here, the strategy resulting from the Four Actions Framework can be objectively scrutinized against the 3 elements of a good strategy.

Development of “3 elements of a good strategy”

One of the core objectives of K & M’s strategic approach is to minimize the risk of new market development. An objective approach of evaluating results generated from the Four Actions Framework is an essential tool to ensure strategic undertaking with minimal risk and maximum benefit for the company.

K & M put forth that a sound strategy shares 3 common elements. Specifically, Focus, Divergence, and a Compelling Tagline. P 37.

- Focus includes both what will and what will not be pursued. The value curve, which results from the Four Actions Framework, should present a clear focus for a business. The focus of the new strategy becomes clear by the additional factors to be considered. Focusing on the revenue potential of premium finance loans for the brokerages directly is a significant departure from the traditional industry approach. Minimizing the cost to establish a brokerage-run finance program while expanding the scope of the service provide guidance as to the activities to be undertaken or not to be engaged in.

- Divergence indicates that the business strategy based on benchmarking or “copycatting” other competitors in the existing market space. Again, the value curve generated from the Four Actions Framework should indicate that sufficient divergence would result between the new value curve and that of existing market participants.

- A Compelling Tagline is required, as it becomes the basis to tie the new business strategy to marketing efforts. It can be used to evaluate what may seem like complex business decisions. “A good tagline must not only deliver a clear message but also advertise an offering truthfully, or else customers will lose trust and interest.” P. 40. The taglines considered for the strategy under consideration were “Unlock Profits Existing in Your Business” and “Convert Receivables into Revenues”.

Undertaking the Four Actions Framework resulted in identifying three core factors, which deemed as very important by the desired customer base, yet not delivered by existing suppliers. This gap between what are presently provided against what deemed desirable by customers is identified as the core strategic opportunity to pursue.

Principals of Blue ocean strategy (Six Paths Framework)

The Six Paths Framework is an analytical tool, which turns typical strategic planning on its head. K & M identified six variables that businesses typically consider when developing strategy. In order to differentiate from existing competitors, these factors are to be rethought and K & M present a different method to view traditional decision-making.

- There are mainly six principles including four formulation principles like reconstruct market boundaries, focus on big picture, reach beyond existing demand, get the sequence right and two execution principles like key organisational hurdles and execution into strategy.

Reconstruct Market Boundaries

Considered by K & M to be the first step of a Blue Ocean Strategy, reconstructing market boundaries allows a business a completely new field in which to play as opposed to being stuck in an existing crowded one. K & M propose a method business can use to assess various market opportunities they call the Six Paths Framework. P47.

“The challenge is to successfully identify, out of the haystack of possibilities that exist, commercially compelling blue ocean opportunities.” P47. Failing to identify key opportunities would result in chasing many potential opportunities, depleting scarce resources, and failing to focus on areas of strategic importance. BOS has created six paths to pursue. None of these requires special vision or foresight about the future. All are based on looking at familiar data from a new perspective. P48. Each of the six approaches involves bucking assumptions, which are typically pursued. P48.

Six Paths Framework

Look across Alternative Industries

“What are the alternative industries to your industry? Why do customers trade across them? P55. To focus on the key factors that lead buyers to trade across alternative industries and eliminate everything else. “In the broadest sense, a company competes not only with the other firms in its own industry but also with companies in other industries that produce alternative products or services. Alternatives are broader than substitutes. Products or services that have different forms but offer the same functionality or core utility are often substitutes for each other. On the other hand, alternatives include products or services that have different functions and forms but the same purpose.” P49

For PF, PF co, software vendor, direct bill are substitutes. Alternatives for BB are seen as other investment options for a brokerage (acquisition, staff, other consulting services to use, etc.). “In making every purchase decision, buyers implicitly weigh alternatives, often unconsciously.” P49. “Rarely do sellers think consciously about how their customers make trade-offs across alternative industries.” P50.

- Why do brokers trade across the alternatives of PF vendors & software vendors?

- Why do people pick PF vendors?

- Client driven = occasional use = when needed, want it fast and easy.

- Because their client needs financing and no other payment, plan available. If other plans are available, then the decision over which PF vendor to use is based on cost to customer/insured and how easy it is for my insured to apply/access, and what is in it for me (relationship, kickback, convenience for brokerage).

- Why do people pick software vendors?

- They are tired of seeing money go to PF vendors. They want to keep it for themselves. They realize they are working to make money for another party while getting little in return.

- They have resources: both capital and human to take advantage and responsibility for the opportunity of managing an in-house PF loan portfolio.

- They buy the story of potential profit and independence the vendor is selling.

Look across Strategic Groups within Industries

“What are the strategic groups in your industry? Why do customers trade up for the higher group, and why do they trade down for the lower one?”

Strategic groups = groups of companies within an industry that pursue a similar strategy. Strategic groups generally are ranked in a rough hierarchical order built on two dimensions: price and performance. Each jump in price tends to bring a corresponding jump in some dimensions of performance. Most companies focus on improving their competitive position within a strategic group. P56. Curves = example. What are the strategic groups in your industry? Why do customers trade up for the higher group, and why do they trade down for the lower one?

Look across the Chain of Buyers

“In reality there is a chain of ‘buyers’ who are directly or indirectly involved in the buying decision. Challenging is an industry’s conventional wisdom about which buyer group target can lead to the discovery of a new blue ocean.” P. 61.

“What is the chain of buyers in your industry? Which buyer group does your industry typically focus on? If you shifted the buyer group of your industry, how could you unlock new value?” p. 65

Lambin considers market orientation as broader than customer orientation. He proposes market orientation as a business philosophy involving all participants in the market and all levels within the organization.1

Lambin’s hypothesis is that market-oriented firms allocate their limited resources to the following ends:

- To collect information about the expectations and behaviors of the different groups

- Use information from a) to design market oriented action plans.

- The plans from b) involve all levels of the organization.

The result is that information obtained in order to analyze and develop plans, which are in turn, used to guide activities while considering how all the groups within an organization work together.

Lambin views all participants in the market are included in 5 groupsi:

- Customers

- Distributors

- Competitors

- Prescribers, and

- The macro-marketing environment

Customer Orientation

A focus on the customer presents the core of the “traditional” marketing concept. What does the customer want? Customer satisfaction is the essential element of this orientation. The customer may have various roles, which should all be considered: user, payer, or buyer. A customer orientation is often viewed as developing solutions for a customer’s problems.

With regard to premium financing, the customer’s problem is the cash flow burdens associated with substantial insurance costs. This is especially the case for certain commercial insurance purchasers whose insurance costs represent a high portion of fixed costs. For example, golf courses, professionals (doctors, lawyers, architects), and trucking or other transportation businesses. For these types of clients, premium financing offers a much-needed solution to the problem of lump sum insurance payments.

Historically, premium finance companies have put forth onerous application requirements for purchasers of insurance to qualify for these types of loans. Broker Builder has reviewed in depth many of these loan application requirements and determined that the nature of the security/collateral for a premium finance loan allows many of these to be redundant. Because of studying the customer’s needs and experiences in the traditional marketplace, Broker Builder developed a new loan application process for insurance brokerages to offer their clients. This new approach protects the premium finance lender while making it easier for those seeking the loans to qualify and access them.

Distributor Orientation

A distributor or “reseller” orientation revolves around supporting efforts of those who help to promote the vendor’s product to end users. If the reseller is not appropriately respected and considered, then their commitment to promoting the vendor’s products is likely to be reduced. This group is more and more being considered as customers in and of themselves. Some needs of distributors, which are to be considered, include freedom to price and promote merchandise, adequate trade margins, protection from undue competition, support from manufacturers, and efficient order fulfilment.ii

This orientation represents a key point of differentiation for Broker Builder. Traditionally, independent premium finance companies depend on insurance brokerages to promote loans to customers of the brokerage. Without appropriate consideration and motivation, a brokerage’s willingness to offer and promote premium finance loans is substantially lessened. Broker Builder’s business model is the first of its kind in Canada to provide insurance brokerages with a comprehensive ability to participate directly in these types of loan transactions. Broker Builder enables a brokerage to set up a separate entity which is owned by the brokerage strictly for offering premium finance loans.

The new premium finance entity provides the brokerage with an additional source of substantial revenue and profit generation. The brokerage gains financially and from the perspective of offering a more customer oriented approach to these types of loans. Paramount to Broker Builder’s approach is recognition of providing the brokerage as a distributor sufficient motivation to broadly extend the offering of premium finance loans to its customer base.

In short, Broker Builder’s business model transcends the standard premium finance company model by making Insurance brokerages the actual customer as opposed to the purchasers of insurance. The purchasers of insurance to Broker Builder become the end users. The reframing of the traditional premium-finance industry approach is a direct result of a market-oriented perspective.

Competitor Orientation

Competitors include both direct and substitute competitors. A firm’s competitive advantage is defined largely in part of a review of competitive offerings. A balance is struck between focus on driving away competitors and satisfying customer needs. Rigid focus on competitive offerings results in the development of products and services, which may not serve the needs of customers.

Broker Builder faces competitive forces from two principal forces. First, there are those companies, which provide services that are similar to theirs and encourage insurance brokerages to establish their own in house premium finance program. These competitors are direct and contrasted to substitute offerings, which are represented by independent premium finance companies. Additionally, another available substitute offering is the payment plans which insurance companies offer customers directly.

Broker Builder regularly surveys the competitive landscape and maintains competitive synopsis for each of the competitive types mentioned above. These are reviewed and updated quarterly. Additionally, marketing materials and sales efforts incorporate responses to competitive forces.

Prescriber Orientation

Prescriber refers to groups or individuals who advise, recommend, or prescribe others to use certain goods and services.iii The most blatant industry, which involves prescribers, is the pharmaceutical industry. Here drug manufacturers focus on selling to the doctors prescribing the drugs more than on the end users. Broker Builder participates in the business-to-business environment, where prescribers involve consulting firms who are hired to recommend certain services. This type of orientation assumes that a business will identify and cater to the opinion leaders who influence decision making on purchase of desired customer groups.

Two specific influence groups are present in Broker Builder’s industry. These groups include banks, which offer lines of credit to the insurance brokerage owned finance companies for the purposes of being used to extend premium finance loans, and the regional insurance brokerage associations, which govern and guide some activities. Broker Builder proactively pursues strategic alliances with both of these groups. They have been successful in promoting as an approved vendor for the only Canadian national bank, which offers a specialized line of credit program to insurance brokerages for premium finance purposes. This alliance provides Broker Builder with introduction to a number of prospective customers.

Macro-Marketing Environment

This environmental consideration involves reviewing factors outside the company and industry. The PESTLE approach is used to outline these factors. A business with this orientation develops an ability to monitor these variables. Environmental variables can offer both opportunities and threats to a business.

Broker Builder is primarily concerned in this regard with monitoring political and legal environments. Political influences affect the general insurance industry and recent circumstances have led to pressures for legalising the maximum amounts that can be charged to purchasers of insurance for premium finance loans. To date, this is applied in a few regions within Canada, and applies only to certain classes of personal insurance.

These changes do not extend to commercial insurance transactions which are the core of Broker Builder’s business. The legal environment is reviewed regularly to monitor any common law decisions, which arise from disputes associated with premium finance-loan transactions. A proactive monitoring system for these areas is pursued which results in the identification of risk factors. Regular attention to the monitoring efforts acts as an early warning indicator for Broker Builder.

Broker Builder conducts its business plan with an appreciation for the fact that change is the only constant factor. As such, no rigid planning is in place to try to manage the unpredictable environmental influences. Instead, risk factors are set out, reviewed, and contingency plans developed on a frequent basis.

In summary, Broker Builder appreciates that many forces, both within the premium finance industry and externally in the general business environment, exist which present both opportunities and threats. Broker Builder does a respectable job of considering these factors and building a strategic marketing plan, which accommodates these impacts as best as possible.

Accepting that pursuing a market orientation provides the firm with the opportunity for improved business performance, it becomes natural to suggest several market driven strategies for Broker Builder’s management team to use in the future. The following outlines some suggestions for strategies which are separated by the market participants.

Applying to the company, analysis of the groups is as follows

Customers

As mentioned under the distributor section to answer a), Broker Builder has altered the traditional premium finance customer/distributor roles. Broker Builder focuses on promoting its services to insurance brokerages directly. To this end, further market-oriented strategies suggested include the following:

- Insurance brokerages require continuing education courses in order to maintain their licensing. It is suggested that Broker Builder develop and have several certified continuing education courses which will allow them to market their services to desired customer base in exchange for providing needed education hours to brokerages.

- Devote an increased percentage of revenues to research and new product development. Continuously look for ways to add true economic value to the operations of insurance brokerages.

- Work on developing additional relationships with major banks in order to facilitate an insurance brokerage’s access to desired credit and terms.

- Review technology and look at improving features and functionality of Broker Builder software in order to make the Turn Key business solution offered easier to implement for brokerages.

Distributors

Additional methods of distributing Broker Builder services are considered. Potential for franchising the business model exists. Additionally, new geographic areas are developed by setting up subsidiaries in new regions, both domestic and potentially international markets.

Competitors

Ongoing competitive intelligence gathering is suggested. Develop a formal process to regularly monitor and survey the competitive landscape. Amending sales representative’s job requirements to include monthly submission of competitive updates from customer conversations is suggested.

Prescribers

This is a key area where Broker Builder has been able to develop some competitive advantage. Moreover, several other opportunities exist which will allow this advantage to become further entrenched. Several consulting organizations, which offer various business improvement services to insurance brokerages, exist. We will encourage Broker Builder to take efforts in developing strategic alliances with these companies. Specifically, creating a quid pro quo where Broker Builder and the consulting firm respectively promote each other’s services to their own client base is suggested. Additional financial incentives are provided for referrals provided to Broker Builder from the consulting organizations, which are converted into customers for Broker Builder.

The macro-marketing environment

A premium finance association has slowly been developed over the last couple of years in the Canadian marketplace. This association is led by several independent premium finance companies. Participating in this will allow Broker Builder to remain abreast of key issues that premium finance companies are experiencing. Additionally, the opportunity to shape legal environment affecting the operations of Broker Builder is enhanced through this effort.

Purchasers, users, influencers are the key persons in a market. The following questions help to understand the macro-marketing environment in which a firm operates.

What is the chain of buyers in your industry? Who are the target buyers in the PF industry?

In PF industry, buyers consist of:

- insured

- brokerage

- principal

- producer

- csr

- other

What are each of these buyers’ motivations, wants, and needs? How are they served today? Do most competitors focus on a given type? Push v. Pull: Typical focus of PF industry has been upon insured’s. PF from a brokerage perspective is a reaction to request from insured only. PF industry focuses on pushing brokerages to offer more when the brokerage is interested in not only promoting service but offering service as a reaction.

The PF industry only covers a small slice of existing insurance purchases. BBC believes that by focusing on providing incentive and motivation to a brokerage to offer PF, the brokerages will in turn pull much more business opportunity for the PF service.

The present PF industry does little, if anything, to address directly the concerns of the brokerage principal. It could be argued to do so tangentially by acting as a sales “tool” which helps to close deals, which might otherwise be difficult to achieve. By doing this, the PF service indirectly assists with achieving the principal’s goal of generating more revenue for the business. However, we consider this as a clear area for developing a BOS. A focus on buyer could allow a modified PF service to create a “new” strategic factor to be developed.

Who are overlooked potential buyers?

The overlooked potential buyers are as follows:

Insured: These are the purchasers of insurance. Their motivation is to spread out the cost of insurance over the period of coverage. Paying for insurance up-front as a lump sum can create onerous cash-flow burdens. The standard PF industry today is based on the existence of these types of insured’s. Where a purchaser of insurance is unable to afford the lump sum cost of insurance and no insurance company offers directly a payment plan, the purchaser of insurance is forced to reduce desired coverage, go without coverage completely, or borrow funds from another source to pay for insurance. None of these is desirable or even feasible options. The premium finance lender, therefore, provides a valuable service for these insured’s.

Brokerage Producer: These are the sales staff for the brokerage. Their motive is to close the sale of insurance to an insured and collect a commission. Their compensation is the same regardless of how an insured arranges payment. The only benefit to the producer of facilitating a premium finance loan is that it helps close the insurance sale. As such, a producer is rarely willing to communicate or inform a potential insured that premium finance loans are available unless the client has expressed an interest in deferring the cost of coverage.

Brokerage CSR (Front line staff): These are staff that deal with most day-to-day inquiries of clients. They manage the flow of paperwork for the insurance process. They prepare premium finance quotes and contracts for the insured’s. They also assist in collecting any required information from the insured as part of the loan application. They are not motivated with any financial incentive to offer the premium finance loan. They will do as directed by their producer or brokerage management. Their primary focus is to minimize the workload on themselves. Their goal is to make it easy, quick, and touch less to prepare premium finance quotes/contracts for the insured’s.

Brokerage Principal: This is the business owner(s): They are motivated by several concerns: a) how do we generate more revenue/profit for the business? B) How do we differentiate our service offering from competitors? C) How do we create further independence for our business?

Can we do like Novo Nordisk and shift the PF industry landscape from a lending provider to a business improvement specialist? “Many industries afford opportunities to create blue oceans. By questioning conventional definitions of who can and should be the target buyer, companies can often see fundamentally new ways to unlock value.” P64

Look across Complementary Product and Service Offerings

“Untapped value is often hidden in complementary products and services. The key is to define the total solution buyers seek when they choose a product or service. A simple way to do so is to think about what happens before, during, and after your product is used.” P. 65

“What is the context in which your product or service is used? What happens before, during, and after? Can you identify the pain points? How can you eliminate these pain points through a complementary product or service offering?” p. 69

“Few products and services are used in a vacuum. In most cases, other products and services affect their value. But in most industries, rivals converge within the bounds of their industry’s product and service offerings.” P65. Untapped value is often hidden in complementary products and services. The key is to define the total solution buyers seek when they choose a product or service. P65. “A simple way to do so is to think about what happens before, during, and after your product is used.” P65.

What is the context in which your product or service is used? What happens before, during, and after? Can you identify the pain points? How can you eliminate these pain points through a complementary product or service offering? p69.

Before: Requirement for additional information. Extensive application process

During: Credit checks,

After: Policy verification, PPSA,

Look across Functional or Emotional Appeal to Buyers

“Does your industry compete on functionality or emotional appeal? If you compete on emotional appeal, what elements can you strip out to make it functional? If you compete on functionality, what elements can be added to make it emotional?” P. 75

“Some industries compete principally on price and function largely on calculations of utility; their appeal is rational. Other industries compete largely on feelings; their appeal is emotional.” P70. “Yet the appeal of most products and services is rarely intrinsically one or the other. Rather it is usually a result of the way companies have competed in the past, which has unconsciously educated consumers on what to expect.” p70. Industries have trained customers in what to expect. When surveyed, customers echo back: more of the same for less.

Relationship businesses such as insurance have relied heavily on the emotional bond between broker and client. They are ripe for change. Some companies are doing away with traditional brokers. Customers would not need hand-holding and emotional comfort that brokers provide, if the company did a better job of paying claims rapidly and eliminating complicated paperwork.

Look Across Time