Abstract

In this study, we inspect ineffective Conglomerate mergers and acquisitions in attempts for new evidence on whether this creates or destroys value for acquirers and targets, especially in the US banking industry. We contribute toward the literature of this study in three significant areas. First, we put in to assess the effect of Conglomerate mergers and acquisitions on the value of the firms through examining whether a takeover endeavor hints shareholder concerning the value of company management in addition to the value of the particular company venture within contemplation. It’s found out that offer pronouncement returns are partly, although not wholly, overturned through termination notice returns, proof that the merger bid itself encloses information regarding the value of the offering company.

Secondly, another contribution is made through examining the way merger and acquisition bids, as well as terminations, impact the comparative values of bidders trying to diversify and focus on takeovers. Our substantiation facilitates us to distinguish either the synergistic or agency outlooks of mergers.

We unearth important differentiation within the feedbacks of companies trying on focusing on diversifying mergers and acquisitions. The reverse of proposal proclamation proceeds with termination proclamation proceeds is considerably dissimilar for both focusing as well as diversifying firms. There is no reverse for diversifying companies though there is a partial reverse in support of focusing companies.

This presents substantiation in favor of both the synergistic and agency outlooks of conglomerate mergers and acquisitions. Synergies are apparent within focusing mergers whereas agency charges are apparent within diversifying mergers. Third, we examine the effect of conglomerate mergers and acquisitions on the value of the firms by means of data as of between 1991-2000 period to re-evaluate the significant subject matter of who wins and who loses as soon as mergers are completed. Previous studies investigative on completed mergers have depended absolutely upon data from the 1990s and 1980s.

Introduction

The marketplace for company control is one of the basic means of company control through which its managers are stimulated to take actions in the best interests of commonly detached shareholders. In case the company management falls short to maximize shareholder value via an adequately great level, potential gains encourage outsiders to warn or else essentially take steps in the direction of replacing serving management. The proceedings of these outsiders’ pilot toward increased firm value since shareholders revalue the company’s upcoming cash flows within the latest management or in superior stewardship through existing administration.

As Denis and McConnell (2003) affirm, that market designed for corporate control could have a “dark side,” as well. Management may perhaps slot in takeovers en route for maximizing individual usefulness instead of shareholder value. In most instances, these takeovers are negative Net Present Value (NPV) ventures that decline, instead of increasing the shareholder wealth.

Outcomes of mergers and acquisitions

Numerous studies on the consequences of mergers and acquisitions wrap up negatively. Rose (1988), in his study from a nationalized survey of 187 banks acquired between 1984-1985, accounted that small segments of the acquired banks experienced improved net earnings of about 17% for responding banks, 11% confirmed increased access to the bank by opening banking facilities for long hours, 15% of the banks provided a wider series of services toward their customers, as 6% recorded increased benefits within the service quality. He winds up that the success ratio following the acquisition was confirmed to be low, for the first two years following the completion of the acquisition. This is a much lower figure compared to a quarter of totally responding banks which reported momentous advancement toward their pre-acquisition objectives.

Rhodes (1986) evaluates the effect of acquisitions by reporting that;

- Acquired banks are neither more or less efficient compared to other banks, when they are measured by standard operating costs for every asset

- Acquired banks in general are either more or less profitable compared to other banks prior to and the following acquisition.

- There is no confirmation in regard to acquired banks growing faster as compared to other firms within the market before or after acquisition.

Rhodes concludes that these findings rarely back the assumption that mergers tend to eliminate the structure of bad management. Moreover, this assessment did not provide any confirmation that the standard performance of the acquired firm prior to acquisition is improved after acquisition (p.18)

Rose (1989) supports this wrapping up. In his study, he evaluated the operation of 160 national banks in the US between 1970-1985. He brings to a close:

- There was no evident improvement toward the profitability of merged banks either measured by return on assets or return on capital.

- Neither did the operating efficiency nor the risk exposure of the merging bank appear to improve after their acquisitions.

-

Importance of research

The purpose of this study will be to investigate if the conglomerate takeover creates or destroy value for the firms involved in this business.

- To investigate how the policy currently deals with mergers and acquisition developments in the banking industry.

- To investigate the impact of mergers and acquisitions in the banking industry that has been witnessed across the world, mainly in the US.

- To investigate the negative impacts of mergers and acquisition and find out why the business management seems to encourage within the US banking industry.

- To investigate how the policy changes should be undertaken or implemented in order to handle the issues related to mergers and acquisitions.

Thesis contribution

This thesis is like to help in predicting the incorporation of an interstate banking system in the coming future as well as facing the disheartening circumstances of the industry, given that majority of bank management and regulators are mostly putting into consideration mergers and acquisitions in their operation.

Literature review

Merger and acquisition

The types of M&A can divide into a merger, acquisition, and segmentation. The merger means two or more firms integrate their resources through a legally cooperative process and two or more firms merge into one firm. On the contrary, acquisition refers to a direct purchase of another company’s shares or assets and both companies will still exist. The following sections will provide a detailed explanation.

Merger

The merger is a common business tool in many industries which means two companies combine into a larger company. Such actions usually involve a stock swap or cash payment to the target company. When two or more companies merge together and only one company continues to exist, it calls a merger. On the other hand, when two companies merge together and establish a new company instead of the old companies, it calls consolidation. The merger is not only a tool for businesses to adapt to the competitive environment but also a good strategy for businesses to improve their economic efficiency. According to Kitching (1967), he proposes four major types of the merger. Each type represents the different ways of the merger.

- Horizontal

- Mergers between firms with identical Products and with approximately the Same customers and suppliers.

- Vertical

- Mergers in two firms which working at Different stages in the production of the Same good and in the same industry.

- Concentric

- Mergers between firms with highly Similar production, the same customer types and buying company but different technology.

- Conglomerate

- Mergers between two firms that have no buyer-seller relationship, technology are different from acquirers and do not deal with identical products.

Acquisition

The acquisition is a method to buy another company which is also known as a takeover. An acquisition can execute through the transaction of stock or assets. It often represents the form of transferring ownership. Sometimes, an acquisition may be friendly or hostile. The acquisition can be separated into different types based on the varieties of acquisition structure. Terence (1986) introduces two types of acquisition.

- Acquisition of stocks The acquiring company purchases the shares of a target company and tries to control the target company without stockholders’ permission.

- Acquisition of assets The acquiring company purchases all assets of the target company except for its stock.

Literature review

A number of earlier studies have analysed Conglomerate Mergers and Acquisitions vs. Non-Conglomerate Mergers and Acquisitions and also the value creation about M&As. Maquieria et al. (1998) analyse wealth changes around stock-for-stock mergers during the 1963-96 period. They find that those bidders in non-conglomerate takeovers reap significant wealth gains while bidders in conglomerate takeovers experience significant wealth losses. They find that non-conglomerate mergers produce real operating synergies while conglomerate mergers do not appear to produce financial synergies.

Delong (2001) focuses on bank mergers, classifying them by different geography and activity as proxied by stock-return clustering. He concludes that mergers of two different banks in the same geographic area or involved in the same activities can increase the bidder’s value by 2% to 3% which is more than the other types of bank mergers.

Porter (1987), Ravenscraft and Scherer (1987), and Morck et al. (1990) said that diversifying mergers and acquisitions are less likely to succeed compared with those related mergers. They find that the divestiture frequency is higher for unrelated mergers and acquisitions therefore diversifying mergers are a lousy investment than related M&As.

Lamont and Polk (2002) point out that conglomerate firms sell at a discount relative to firms operating in a single industry and attribute this to agency costs. In general, these companies examine the investments of conglomerates by SIC codes and compare those investments with industry values of Tobin’s Q measured across single-segment firms.

Datta et al. (1992) find that the relevance of industries of the acquiring and target firms is the main determinant of the merger and acquisition process because synergies are easier to achieve when firms have related business than unrelated business.

Morck, Shleifer and Vishny (1990) find that if the acquirer and target firms have come from the same industry will have higher stock returns than others because the acquirer can use the target firm’s resources more easily which can create higher synergy.

There are two common sets of explanations are proposed to infer why firms merge to diversify. The first argument is that diversification increases shareholder wealth. Some researchers support this explanation:

Williamson (1970) suggests that diversification helps firms to raise capital in the imperfection of the external capital market.

Myers and Majluf’s (1984) explanations for diversification are based on the information asymmetry hypothesis that claims if there exists information asymmetry between investors and firms, firms may choose to forgo positive NPV projects.

Lewellen (1971) finds that conglomerates have higher leverage because diversification can smooth the fluctuation of earning. If a tax shield from debt increases firm value, firms of a greater degree of diversification will be more valuable than those who operate in a single industry.

The second set of explanations involves agency problems between shareholders and managers. Shleifer and Vishney (1989) suggest that managers decide to diversify because they are good at managing other industries’ assets and diversifying into these industries will make them more indispensable to their own companies. Proponents of diversification said that managers of conglomerates are good at monitoring different business units than market forces, therefore this benefit is not offset by the agency costs.

Berger & Ofek (1995) discussed potential benefits of corporate diversification including greater efficiency, lower taxes, greater debt capacity, less incentive to forgo positive NPV projects, cross-subsidizations which allow poor performing segments to drain resources from better segments, misalignment of incentives between central and divisional managers.

There are a number of studies that have examined failed takeovers. Safiedeine and Titman (1999) examine a sample of 573 targets of unsuccessful takeovers which occurred during the 1982-1991 period. He finds that targets terminating attempted takeovers suffer negative excess returns of 5.14% around the announcement date of the termination.

Chang and Suk (1998) examine 279 failed mergers that occurred during 1982-90. They find positive excess returns for bidders offering stock and negative excess returns for bidders offering cash around merger terminations, each significant at the.10 level.

Denis and Serrano (1996) examine unsuccessful takeovers during 1983-89. They find that high management turnover following termination of the takeover attempt.

Roll (1986) introduces the hubris hypothesis of corporate takeovers. Roll asserts that bidding firm which is infected by the hubris hypothesis sometimes pay too much for the targets. Roll said that the hubris hypothesis predicts the combined value of the target and bidder firms should fall slightly. The value of the bidding firm should decrease and the value of the target firm should increase as the hubris phenomena appear in the bidding firm.

Doukas et al. (2007) imply overconfident acquirers would engage in more deals due to its overconfident characteristics. They find that overconfident acquirers would fail to get abnormal returns in contrast to rational acquirers. Besides, they discover the overconfident acquirers would have inferior long-term performance since they usually engage in more deals based on their first success.

Hypothesis development

Research Hypotheses

Theoretically, mergers and acquisitions create value by creating operating synergies, such as economies of scope and economies of scale. Economies of scope can be realized when two firms are in the same chain of supply combine operations, i.e., in vertical mergers. On the other hand, economies of scale can be realized when two firms are in the same line of business combine operations, i.e., in horizontal mergers. According to conglomerate mergers, there is a less theoretical reason for value creation.

Some researchers have theorized that financial synergies are created in conglomerate mergers by reducing the variability of the combined firm’s cash flows through diversification. It allows the resulting firm to borrow at lower rates than either of the two merging firms, so lowering its weighted average cost of capital. Also, Madj and Meyers 1987 said that the tax treatment of income whereby profits generate a tax liability but losses do not generate a tax credit.

However, according to the agency theory, it mentions that mergers and acquisitions can destroy value. It said that mergers, in general, and conglomerate mergers, in particular, result from principal-agent conflicts between shareholders seeking to maximize their wealth and firm managers seeking a larger empire or a less-risky firm (Jensen 1986). Denis and McConnell (2003) point out that the market also has a “dark side,” as well. Managers may engage in takeovers to maximize personal utility rather than shareholder value. In many cases, these takeovers are negative net-present-value (NPV) projects that decrease, rather than increase shareholder wealth.

As Theory offers competing answers about value creation related to conglomerate takeovers. In this paper, I look into the data of the banking industry in the USA to examine whether conglomerate takeovers would destroy or create value?

- The null hypothesis in this paper: CARs for conglomerate takeovers are equal to CARs for non-conglomerate takeovers.

- The alternative hypothesis is: CARs for conglomerate takeovers are bigger than those for non-conglomerate takeovers, CARs for conglomerate takeovers are smaller than those for non-conglomerate takeovers.

Methodology

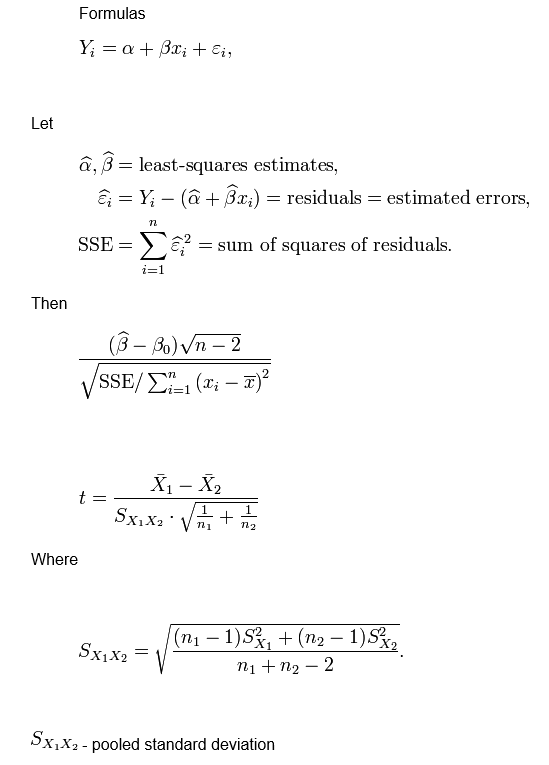

First, using the two-digit SIC code of the two firms involved to classify each proposed merger. If both firms have the same two-digit SIC code, then can classify the attempt as horizontal; if both firms have the same one-digit, but not two-digit SIC codes, then can classify the attempt as vertical; and if each firm has a different one-digit SIC code, can classify the attempt as a conglomerate. Then, using the standard event-study methodology to calculate portfolio excess returns for the horizontal, vertical and conglomerate. Using the market-adjusted return model to calculate abnormal returns:

- AR i,t = R i,t – R M,t ……………………….(1)

Where:

AR i,t is the abnormal return for portfolio i on day t

R i,t is the return for portfolio i on day t

R M,t is the market return for the equal-weighted CRSP index on day t

And then using the standard market model estimate return:

- AR i,t = R i,t – ( β0 + β1 R M,t )………………………. (2)

Where:

AR i,t is the abnormal return for portfolio i on day t

R i,t is the return for portfolio i on day t

R M,t is the market return for the equal-weighted CRSP index on day t

The intercept and slope coefficients β0and β 1 are estimated by ordinary-least-squares regression over the period before the merger announcement.

Calculate portfolio cumulative abnormal returns CAR i by adding the portfolio abnormal returns AR i over the three-day event window –1, 0, 1. We calculate portfolio cumulative abnormal returns (CARs) for our data of bidders and targets, and then form separate portfolios of bidders and targets based upon our classifications of mergers as horizontal, vertical or conglomerate. Then, test for significant differences in these portfolio CARs.

According to the synergy’s hypothesis, we expect the CARs for conglomerate takeovers to be smaller than those for non-conglomerate takeovers, as financial synergies are expected to be much smaller than real operating synergies.

According to the agency hypothesis, it makes no predictions regarding the relative magnitudes of gains or losses of conglomerate versus non-conglomerate firms.

Now, using equations (1) and (2) to estimate abnormal returns for each firm and calculate firm CARs and then will estimate a series of the cross-sectional regression model of the form:

- CAR i = β0 + β1 * Horizontal i + β2 * Vertical i + Σ βN *Control Variables + ε i

Where:

CAR i is the cumulative abnormal return around the announcement date of the firm I

Horizontal i is a dummy variable indicating horizontal takeover attempts

Vertical i is a dummy variable indicating vertical takeover attempts

Control Variables i are a series of control variables described below

β N, N = 0 to K are parameter estimates

ε i is a normally distributed error term.

If the synergies hypothesis is correct, we expect to find positive and significant coefficients for the intercept and the dummy variables Horizontal and Vertical as well. If the agency hypothesis is correct, we expect to find a negative and significant coefficient for the intercept and insignificant coefficients for the dummy variables Horizontal and Vertical.

Data

Introduction

To accomplish this study, four diverse categories of data were collected, included everyday stock return statistics, yearly data categorizing banks within the industry, annual operation records on bank performance as well as provision and statistics of the time when mergers and acquisitions were made and terminated, and the dates it was made public within the financial press. Daily stock-return data was obtained from the Center for Research in Security Prices (CRSP) as well as annual accounting data from data on Standard Industry Classification (SIC) codes as of Compustat.

To discover the period over which mergers and acquisitions terminations were publicized, the data is from Zephyr database (Bureau Van Dijk) provides detailed takeover information including the announcement date. The OSIRIS database (Bureau Van Dijk) is used for access to accounting data if necessary and share price data is obtained from DataStream (Thomson). To be incorporated within the study sample, the acquirer along with the target had to be openly operated, and avail data to Compustat plus CRSP.

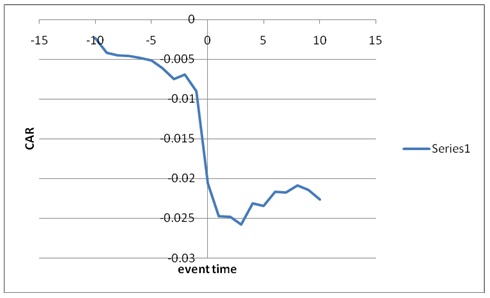

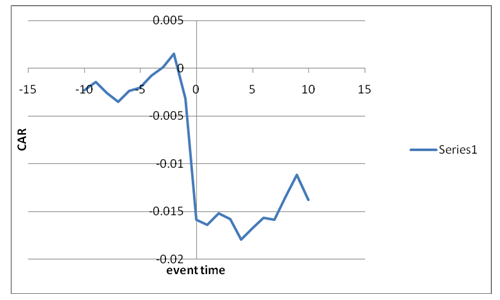

Table 1 shows the distribution of the average abnormal return) using event period standard deviation estimates of non-conglomerate, whereas Table 2 shows that of conglomerate (average abnormal return).

Analysis

Introduction

At first, the statistics in table 1.0 and 2.0, from the variables it can be pointed out that, in terms of size, measured by share capital, the null hypothesis of AARs bidders are on average about more times bigger for conglomerate takeover as compared to the non-conglomerate. Bidders are as well additional cost-efficient in regard to targets, for the most part for domestic mergers. On the other hand, targets have a larger loan and non-interest income to total assets ratios. Targets also have substantially less capital leverage than bidders (see Table 3 & 4).

Provided that CARS for conglomerate takeovers are smaller than those of non-conglomerate takeovers for a financially sound project, it can be concluded that, there is sufficient evidence to support that conglomerate takeover destroy the value of the acquired firm in the first period of its announcement then recovers thereafter (see Graph 1&2)

Contrasting the domestic as well as cross-nation mergers and acquisition, home targets have a tendency to have an improved credit risk report in contrast to the bidders, while within cross-border mergers and acquisitions the point of loan loss conditions is generally related for targets in addition to bidders. In some reverence, the financial aspects of bidders and targets occupied within home consolidation are alike toward those of cross-border transactions. The key differentiation relies on the magnitude and value of the assets. With this stipulation in mind, the data are investigative of the broad financial aspects of banks involved in home mergers and acquisitions in the US banking industry.

Motives for bank mergers and acquisitions

For bank management to resort to the solution of mergers and acquisitions, there are some motives that drive them into this act, this include;

- Market power: the acquirer could decide to raise the cost of the products (goods and services) they offer after the merger. This will only be possible in the case where the acquirer does well in minimizing price competition within the product marketplace by taking over (acquiring) some of its competitors.

- Valuation error of the stock market: the case where the acquirer has information advantage showing that the targeted firm is underrated, and if the acquirer could buy the target firm for less than its actual value, this implies that the shareholders of the acquiring bank will benefit from the merger.

- Tax reduction: the acquiring bank may minimise the tax liability of the merged firms down their aggregate non-merged tax liabilities.

- Synergy: the acquiror could minimise the product costs following the merger. This is only possible where a merger generates synergies via economies of scale plus scope, in addition to distribution and marketing charges.

- Improved target bank’s management: the acquiring firm may eliminate the incompetent management from the targeted firm hence improving its performance.

- Minimization of risk: the combined firms (banks) could reduce their joined risk if the merger generates diversification benefits. In most cases, this is possible in a situation where the risk of the merged firms is lower than their weighted average when combined firms prior to their merger.

- Manager-utility-maximization: the management of the firm will maximize the bank’s growth incase their utility relies on the bank’s size, risk, or reimbursement instead of maximizing only the shareholders’ wealth. It’s easy to obtain non-monetary rewards like power, prestige and perquisites in big firms. Larger firms could provide bank managers with the potential for job security.

In their study of mergers and acquisition in the US banking industry, Hawawini along with Swary observed these theories mostly through the event study approach, evaluating the operation of stock costs as well as the returns of merging banks to those of non-merging banks sooner than and subsequent to events like a declaration of mergers and their completions, in addition to the assessment of their survival of unusual returns throughout contrast of return on mergers of the banks under dissimilar sets of circumstances. The conclusion of Hawawini and Swary is as follows;

- The marketplace for bank mergers and acquisitions is proficient. The assumption of information that relates to the acquiring banks aspires and achieves the merger gains based on an underestimation of the aimed bank stock, which can’t be authenticated.

- Bank mergers and acquisitions generate net total wealth for the shareholders of the aimed banks exceed, relatively to the dollar failures sustained by the shareholders of the proposing banks.

- There is tentative substantiation to facilitate the abnormal returns linking the mergers of two banks which have low stock-return correlations are high compared to those linked with mergers of two banks by way of elevated stock-return correlations. This means that in some instances merging banks might intend and achieve the merger gains founded on a diversification gain.

- High abnormal proceeds are connected with mergers linking a poorly-managed aim compared to mergers relating to well-managed banks. This assumption holds when an incompetently managed target bank creates a chance or benefits if acquired and changed into well-controlled banks.

- There is the existence of facts that stock costs of competitors of merging banks respond positively in the direction of the announcement of mergers and acquisitions. In regards to market power theory, merging banks aim and achieve the merger proceeds in relation to the increasing market power plus the diminished competition which assumes weak proof.

- The synergy assumption is assessed indirectly in regard to other forms of an empirical study that articulates the existence of high potential synergistic benefits at smaller-sized banks. If this assumption is true, then there should be a high abnormal return linked to mergers relating to smaller banks compared to those involving big banks.

Existing evidence concerning underlying hypothesis

Market power

Studies concerning whether banks existing in concentrated marketplaces tend to be profitable for the reason that they combine so as to widen their market share. There is a clashing of ideas on issues on outcomes of soaring market share. Some have argued that this could contribute to diminished competition and high profitability for banks within the marketplace. While, others affirm that a more efficient bank is most likely to be profitable and be in a position to increase its market share at the cost of other less efficient banks, thus an optimistic correlation between deliberation and proceeds barely entails that a greater efficiency gap subsists between diverse banks within the similar market.

However, the argument is yet to be solved, but the majority have backed the market power assumption, besides its impact is small. Berger and Hannan (1989) suggested the affirmative association linking the bank concentration and their less competitive pricing. Hawawini and Swary, confirm from their assessment that there is an existence of a positive relationship between market share and performance, even though the size of market share impact on profitability is very low. (pp.5-6)

Diversification (minimization of risk)

The risk reduction sources within the banking industry may diversify funding sources and income. Big acquirers who happen to rely most on purchased funds could possibly be attracted to the purchasing banks which tend to have an important core deposit funding base. However, the deregulation of deposit interest rates has declined the price benefit of relying on core deposits, though; they are still over-valued because of their stable stability in relation to purchasing funds. Likewise, diversification of income either geographically or by customer category could overall minimize the credit risk of the asset portfolio of the bank (Hunter & Wall, 1989, p.4).

The most recent substantiation on the correlation between risk and diversification has been stated in the paper authored by Nellie and Stephen (1988). They studied numerous measures in relation to bank risk, geographical spread, rates of the certain asset portfolio and a standard number of branches of the bank per market. They concluded that;

- The magnitude of the bank and scope of the bank holding company’s involvement in non-banking activities usually does not have an effect on the risk.

- The effects of asset diversification lying on the risk are mixed and hence not clear.

- Banks having higher ratios of large-time deposits are comparatively risky.

- Geographical diversification as well as the total number of offices within the marketplaces decreases the risks and appears to have a specifically strong impact on declining the vitality in earnings. Although, the greater geographical dispersion, as well as the number of offices, tend to be connected to lower levels of return-on-assets and capital-to-capital asset ratios, entailing high risk. Banks could minimize their volatility on earning by venturing into the new marketplaces or by widening their networks (branches), however, all this will be subject to the expense of increased operating costs along with low profitability.

Economies of scale and extent

Hunter and Wall (1989) surveyed various studies with regard to economies of scale and wrapping up;

- Economies of scale come out to subsist, particularly in the variety of banks among total assets size below $5 billion.

- Costs have been exposed to be comparatively constant for banks having the asset of about $25 billion.

With this kind of consequences, Hunter and Wall wrap up:

- The wish to develop production efficiencies through economies of scale emerges to be a legitimate motivation for joining small banks.

- If a bigger bank size, with steady costs, boosts consumer expediency as well as enhances diversification of assets, these might be economical grounds for mergers between mostly big banks.

-

Conclusions

Provided that the bank has valid grounds for pursuing mergers, a merger is not essentially an efficient approach to achieve these goals. There is slight substantiation that reveals that mergers successfully improved the performance of merged banks, for a given short period after the merger (about 6 years following the merger).

Conclusions

On the foundation of the studies that have been undertaken, the following conclusions could be stated. Banking mergers and acquisitions are present along with a diverse strength. And the scope of all banks within the US banking industry within the market economies. It has been found out that, government regulation and liberalism, along with technology advancement and globalization have played a major role in the banking industry.

They created competition among banks as well as continuing pressure on the development of competition. The outcome of these changes is also a uniting factor in the banking sector and establishing the joint linkage for both domestic and international banking. The mergers and acquisitions of banks are a show of the markets and financial sector convergence of either national or international scop.

Presently, the transformations of the US banking industry result from many factors like gradual elimination of government control, political as well as cultural barriers, in addition to banks owners’ pressure for increasing the activity scale and profit growth. These effects influence the growth and development of US banks’ interest within the retail banking industry, which has changed completely. The differentiation along with the spread of the retail client proposal, the introduction of modern technologies which enhance easy access of retail banking services plus the advancing needs and expectations of this segment of the client need to be mentioned as the most significant changes.

Summary of results

In the US banking industry, banks that tend to have higher market share seem to have higher profitability compared to small banks. Also, banks with diversified geographical scope tend to have low volatility within their earnings. These are compelling grounds for banks undertaking mergers. Smaller banks with an asset value of lower than $5 billion, could resort to a merger so as to realize the economies of scale. Conversely, for larger banks, the reality of economies of scale is doubtful. Economies of scope appear to be a weak reality for mergers between banks.

Mergers and Acquisitions have been a very vital approach for the banking industry in the US, its importance appears to increase in the current years. The official estimation in the US concerns mergers and acquisitions ever since World War II indicates that about 6500 banks in the US have been merged, joined into current bank institutions, or taken over by holding organizations.

Extensions

Post analysis of banking in US trends encourages formulation and recommendations for the future. This thesis examines the effect as well as the causes of takeovers in the US banking industry within the bear of their effectiveness along with the process influence over and linkage with the system of banking in different states of the US. Moreover, at the national bureau, less literature was availed that devoted itself to banking market changes. So, it seems vital to embark on a study of these processes.

Limitations

- There will be a limitation of time allocated as the study program is tightly scheduled.

- This study is only limited to a few banks within the banking industry in the country. However, it is assumed that the sample chosen will give a general overview of the state of operation and announcement of mergers and acquisitions in the US.

- The instruments to be used for data collection are interviews and may not be accurate as the findings will depend on the respondents’ commitment to the and interviews.

- Financing the research will not be easy as the researcher will meet all the costs.

Conclusions

On the basis of this study, within this article, the most significant propensity of mergers and acquisitions for bank development in the subsequent years include;

- Intensification of a tendency towards business consolidation and establishing large banking segments for both domestic and international magnitude

- Establish and expand the international banks with the seat in the US.

Growth and development of competition of banking service market.

The unity of these tendencies shown within the US banking consolidation approach which in the nearest future could lead to the establishment of many banks similar to a pan-european character in Europe. With growth and the development of activity scope, modernization of the merger offers and profits increments among the largest banks will be in a position to compete with international banks.

References

Berger, P., and Ofek, E., 1995, Diversification’s Effect on Firm Value, Journal of Financial Economics 37, 39-65.

Chang, S., and Suk, D. 1998, Failed Takeovers, Methods of Payment, and Bidder Returns, The Financial Review 33, 19-32.

Datta, D. K., G.E. Pinches and V. K. Narayanan, 1992, “Factors Influencing Wealth Creation from Mergers and Acquisitions: A Meta-Analysis.” Strategic Management Journal, 13, 67-84.

DeLong, G., 2001, Stockholder Gains from Focusing versus Diversifying Bank Mergers, Journal of Financial Economics 59, 221-252.

Denis, D., and Serrano, J., 1996, Active Investors and Management Turnover Following Unsuccessful Control Contests, Journal of Financial Economics 40, 239-266.

Doukas, John A. and Dimitris Petmezas, 2007, “Acquisitions, Overconfident Managers and Self-Attribution Bias.” European Financial Management, 13:3, 531–577.

Kitching, J., 1967, “Why do Mergers Miscarry?” Harvard Business Review, 46, 84-101.

Hawawini, G. & Swary, I. 1990, Mergers and Acquisitions the US Banking Industry: Evidence from Capital Market, North-Holland.

Hunter, William C. & Wall, Lary D. 1989. Bank Merger Motivation: A review of the Evidence and an Examination of Key Target Bank Characteristics. Federal Reserve Bank of Atlanta Economic Review, pp.2-19.

Lewellen, W., 1971, A Pure Financial Rationale for the Conglomerate Merger, The Journal of Finance 26, 521-537.

Maquieria, C., Megginson, W., and Nail, J., 1998, Wealth Creation versus Wealth Redistribution in Pure Stock-for-Stock Mergers, Journal of Financial Economics 48, 3-33.

Morck, R., S A. hleifer, and R. W. Vishny, 1990, “Do Managerial Objectives Drive Bad Acquisitions?” Journal of Finance, 45:1, 31-47.

Roll, Richard, 1986, “The Hubris Hypothesis of Corporate Takeovers.” The Journal of Business, 59: 2, 197-216.

Rose, Peter S. 1989. Profiles of US Merging Banks and the Performance Outcomes and Motivations for Recent Mergers. Boston: Kluwer Academic Press.

Safieddine, A., and Titman, S., 1999, Leverage and Corporate Performance: Evidence from Unsuccessful Takeovers, The Journal of Finance 54, 547-580.

Travlos, N. G., 1987, “Corporate Takeover Bids, Methods of Payment, and Bidding Firms’ Stock Returns.” Journal of Finance, 42:4, 943-963.

Terence, E. Cooke, 1986, Mergers & Acquisitions (Basil Blackwell, New York, NY).

Williamson, O., 1975, Markets and Hierarchies: Analysis and Antitrust Implications. Free Press, New York.

Appendices

Average abnormal returns (using event period standard deviation estimates)

Table.1.0: Non conglomerate.