Introduction

Change and development is a process that successful companies continuously engage in. different proposals are continuously presented to the management. Proposals range from new product development to measures aimed at increasing the company’s presence globally (Watson & Head 2010: 162). Resource limitations would mean that the company cannot implement all the proposals that are presented to them.

The management is therefore charged with responsibility of exploring the existing proposals and making a decision as to which would benefit the company more. The factors often taken into consideration making such decisions include the proposals consistencies to the long-term plans of the company, possible risks, and availability of the resources necessary for the proposals implementation.

This process is often referred to as investment appraisal. Investment appraisal involves selection of the best and most profitable investments for implementation by the company. Additionally, this process facilitates avoidance of negative financial and strategic outcomes which may result from poor investment choices (Arnold, 2008: 167). A number of Investment appraisal techniques are available to companies’ management teams in coming with important decisions regarding the choice of investment. These include payback period, ARR, NPV and IRR.

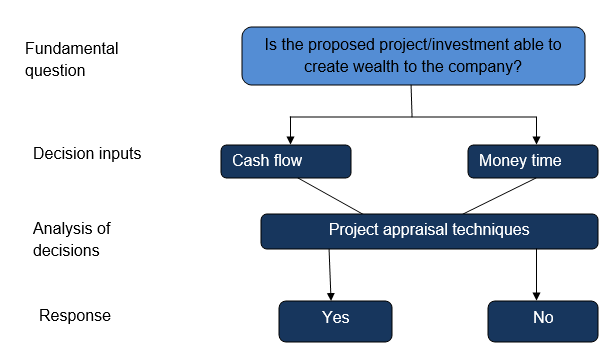

The ventures that a company may embark on that would require investment appraisal include expansion, diversification, cost saving initiatives, replacement of products/machinery and equipment, research and development within its area of expertise and in making of alternative choices on what to and what not to invest in. others areas include financing options i.e. benefits of purchasing an asset rather than lease the same, and compliance to standards (Watson & Head 2010: 165). Dales Foods Plc. case involves two acquisitions that would amount to an expansion project. The process of appraising these investments best illustrated by the diagram below:

Investment Appraisal and Financial Decision Making

Financial decision making is pillar to investment appraisal. Investment appraisal is considered as a component of financial decision making, where financial decision making includes investment choices/decisions, financing options, and dividend decisions (Watson & Head 2010: 166).

Investment decisions are useful in determination of viability of projects that a corporation intends to engage in. Dales planned expansion is an investment decision that the management has an obligation to critically analyze in order to come up with tangible evidence of the projects viability. For analytical purposes, financial decision making inter-relates with the other to form a bas for making of decisions. Decision on whether or not to undertake an investment is often dependant on the company’s financial constraints and opportunities faced by the firm.

Payback Period

Given the various challenges it suffers, payback period experiences some level of insufficiency despite being the most popular method among investors. Based on this method, an investment is acceptable if it has a payback period that is less or equal to an earlier pre-determined value (Watson & Head 2010: 167). Estimates of payback period are obtainable to number of decimal places when dealing with evenly occurring cash flows across the years. Usually a figure to the nearest half year or monthly is sufficient enough to facilitate decision regarding the investments being appraised. It simplicity and ease of application endears it to most managers.

Additionally, this method is easy to understand. Cash flows are used in calculation of payback period and hence it’s not subject to managerial preferences manipulation. Its preference for shorter payback periods makes it account for possible risk that the proposal may present (Arnold, 2008: 169). The method is however not without shortfalls in assessment of projects involving capital investment. Major shortfall is the fact that it ignores the money’s time value by giving cash flow equal weights in instances where they occur within the set payback duration. Discounted payback period is often incorporated to cater for this shortfall. The method therefore fails to give any tangible evidence as to whether the project in question adds value to the company (Little & James, 1974: 211).

Average rate of return (ARR)

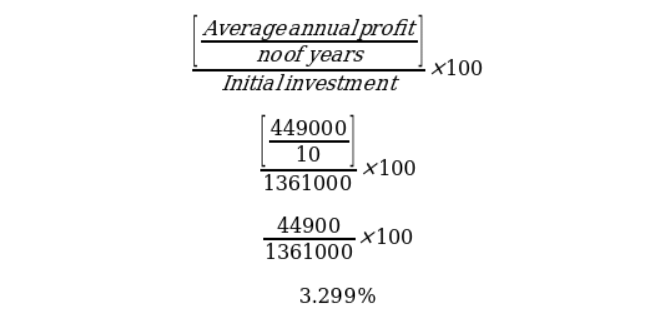

The term is interchangeably used with accounting rate of return. It acts as a tool for comparing the generated profit from an investment against the investment’s cost. It is calculate as shown below (Götze, Northcott & Schuster, 2008: 3):

It simply used as a measure (%) of the projects returns from its investments. While it relatively simple and easy to understand, it suffers sever flaws more so with regard to its non-consideration of money’s time value. However, it must be applauded for its ease of understanding by managers who may have difficulty with other comprehensive tools like the net present value (Götze, Northcott & Schuster, 2008: 7). Additionally, it expresses its value as a percentage, some of which endears it to commercial staff who are used to percentage expressions. Its calculation takes into consideration a number of factors which include the entire investment, average return and average depreciation.

Net Present Value

The Net Present Value utilizes discounted cash flow in project evaluation (Götze, Northcott & Schuster, 2008: 7). This technique accounts for the changing money value with regard to time. It allows for comparison of projects at varying interest rates and hence useful in appraisal of projects having the same costs. The present cash outflows value is compared to the cash inflows present values. Cash flows occurring in the course of the year are assumed to have taken place at the end of the period. Based on this technique, all projects registering a positive NPV are considered acceptable. In comparing projects, the one with the highest NPV value is considered more viable and hence acceptable (Modigliani & Miller, 2002: 271).

This project is advantageous given the fact that it takes into consideration the money’s time value. This is often an important aspect in corporate finance. This method is therefore more preferable in instances where there are no constraints on capital. However, the method is difficult to understand. Additionally, capital inflows and outflows are rather difficult to estimate yet they are fundamental to application of this method. However, this method’s applicability is limited by the fact that in real life situations capital is always restricted. This method additionally works on the assumption that the company’s capital is known and remains constant throughout the projects life (Modigliani & Miller, 2002: 278).

Internal Rate of Return

Internal rate of return refers to the capital cost/ rate of return required in discounting project cash flows. It is simply defined as an investments rate of return. Its calculation is similar to that of NPV (Götze, Northcott & Schuster, 2008: 9). However, while NPV calculation uses a pre-defined rate of discount, IRR finds a rate of discount which when used results into an NPV value of zero. The rate of discount represents the borrowing cost/investment cash. Rejection or acceptance of a project is dependant on whether or not the internal rate of return has a higher value compared to the rate of discount. The decision on basis of IRR is best summarized below:

IRR>rateofdiscount…………………… Accept

Dales Plc. Case study

Dales Foods Plc. intends to embark on a project of diversification and its individual expansion. They intend to acquire an additional farm, and a packing and distribution center. The facts of this investment venture are shown below: Dales Foods intend to make a bid of £750,000 for the land. Building costs for the new packing and distribution centre are estimated to be £600,000. All these costs will be paid in the year before commencement of operations at the new site. The market research they have already carried out has cost them £5,000 and they have also paid £6,000 in surveyor’s fees relating to the farmland and the building proposal. Dales intend their new venture to last for at least 10 years.

The initial investment cost is therefore supposed to be, £750,000+£600,000+£5,000+£6,000 = £1,361,000

The payback can be obtained on the basis of the table below:

From the payback period calculation table, the expected payback period is between the 8th and the 9th year. Based on the calculated payback period, the project can be conclusively said to be viable within the specified ten year period. By the end of the investment period, the amount used in the project will have been recovered and the company back to profitability.

The net present value calculation is best illustrated by the table below:

Interest rate: 10%

Present value (1,346)

The net present value after the ten year period is £449000. By mid of the 9th year the company will have recovered its investment into the projects and set on a profit gaining trend. The NPV value obtained is positive indicating that the project is worth undertaking and that it would yield successful results for the company.

Internal Rate of Return

Using an excel sheet, The IRR value obtained is 15 % Which is greater that the discounted rate which is 15% indicating acceptance of the project as being viable for the company.

Accounting Rate of Return

From the table above, the cumulative cash flow represents the expected profits of the company. The accounting rate of return is given by

The calculated ARR is 3.299% indicating that the project is viable and hence worthwhile. The positive value indicates that in the long run the project is likely to yield increased profits to the company. Despite the projects viability, indications show that the project cannot b able to sustain the desired 5-year payback period desired by the finance directors of the company. Additionally, the investment’s 3.299% average rate f return falls below the company’s projected 7% cost of capital indicating that the project despite generating profit within ten years is unable to keep the current pace of the business.

As mentioned earlier, other than financial analysis to establish the validity of an investment undertaking, other factors are also considered. These include capital availability, resource availability, the immediate needs and priorities of the company and risks involved in the undertaking.

Risks

Investment decision often resents a number of risks with it. Uncertainty is itself a prime risk that all new business ventures present. Undertaking a double acquisition is some thing that Dales Foods poses increased risk to the corporation. Other than being capital intensive, it exposes the corporation to increased debts, and impacts of economic conditions which remain uncertain. Additionally, it lowers the company’s cash flow enormously which may limit its ability to meet its operations. However, such risk can be minimized by implementing the project in phases rather than as a single package.

Financial obligations/funding

Funding availability is an important aspect that must be considered in any venture. Dales Foods being protective about its shareholding intends to source additional funds internally thus retaining any possible risk within the corporation. Such may have a large impact on the corporation in case of failure. However, with funds available, the, project is viable despite indications that t could slow down the company’s performance.

Priorities

Any Corporation has priorities of which it intends to accomplish prior to other factors. Fr instance, Dales Plc. Considers expansion a priority at the moment an hence ready for its implementation.

Conclusion

Based on the findings of this paper, the expansion ventures that Dales Plc. intends to undertake is profitable within the ten year period that the corporation intends to undertake the investment. However, the desired payback period by the finance mangers as well as the companies set return on capital are not achievable as the management may desire. This is essence means that the management have a choice of re-adjusting their projections to fall within the achievable limits of the project or quit undertaking the project altogether. However, based on its long term return findings, this paper proposes that the management re-adjust it’s projections to fit the limits set by the project and proceed with the investment.

This is in consideration of the fact that the large capital investment could result into increased revenues though reflected as a smaller percentage. However, the corporation should consider transferring some of the risk that such a project presents either through partnerships or through insurance covers.

References

Arnold, G., (2008) Corporate Financial Management, 4th edition, FT Prentice Hall.

Götze,U., Northcott, D. & Schuster, P. (2008). Investment Appraisal: Methods and Models. Berlin: Spinger-Verlag, p 1-46.

Little, I. & James A. M. (1974). Project Appraisal and Planning for Developing Countries, London: Heinemann.

Modigliani, F. & Miller, M. (2002). “The Cost of Capital, Corporation Finance and the Theory of Investment”. American Economic Review (American Economic Association) 48 (3): 261–297.

Watson D. & Head A., (2010), Corporate Finance Principles and Practice, 5th edition, FT Prentice Hall.

Appendix: Calculations Formulae

Where, N is the number of years, r is the internal rate of return, and n is a positive integer.

For IRR, the NPV formulae take the form,

.