Introduction

Derivative is a security whose value depends on the value of one or more underlying assets. As the name suggests, a derivative is depended on another product traded in the market. Besides, the value of the derivative is directly proportional to the market value of the asset or product it is associated with. There are several types of derivatives such as; stocks, bonds, shares, commodities, currencies, and interest rates. The trend assumed by these derivatives is typified by high leverage in the market forces. This essay strives to expound on strategies that I will implement to CBOE after being appointed as the new CEO.

Types of Derivatives

Derivative is a contract between the buyer and the seller to pay now and receive a reward in the future. Since the principle is paid up-front, the derivative market is coupled with many risks and uncertainties. There are several types of derivatives such as; futures, alternatives, swap and forward contracts.

Option Contract: this is a treaty that gives the right, but not the commitment to buy or sell the security at a future period. An option contract is further subdivided into two: a call option and a put option. A call option allows the investor to buy securities at a certain price in a specified time frame while a put option gives the right to sell the product at a certain price in a given time.

Future contract: This is a settlement that allows selling a certain amount of asset at a specified price on a given future date. These agreements are standardized and are often a facilitated by stockbrokers. The agreements are often traded based on a “futures exchange”. The person or a party that agrees to buy the principal asset in the future that is the buyer of the agreement is termed as long and the person or party that agrees to dispose the asset in the future that is the seller is termed to be short. Commonly, these terms mirror the expectations of the parties concerned i.e. the buyer expects or anticipates the assets economic terms is likely to increase whereas the seller expects the value of the asset will decrease.

Swap: a swap is an arrangement between two parties, where they agree to exchange an asset for another. Swaps are common among most modern companies especially in currencies and interest rates related transactions. On agreements, the swaps define the precise dates when the money flows, the way the money is paid and the method of computation. Moreover, when the agreement begins, the cash flow is evaluated using uncertain or random variable such as the equity price, interest rate or commodity price. For instance, a US company may borrow dollars at a preferential rate, but require Yen. Hence there arises a need to arrange to swap with a Japanese company that needs dollars.

Swaps have mutual benefit to both parties since they gain from interest rate savings. However, savings are not always guaranteed since at times, the movement of interest rates dictates which company benefits. Swaps can be invoked when speculating on changes in the anticipated route of basic prices or hedging out some risks such as the interest rate risk. The assessment of a swap assumes the Net Present Value, NPV, of the projected future cash flows. When it is first initiated, a swap is said to worth zero, but after being initialized, the swap value can be translated to either negative or positive.

Essence of derivatives

Investment in derivatives is one of the potent and most valuable options of holding money. Derivatives have multifaceted benefits and have a speculative edge of future market trends. Apart from ensuring future incomes, derivatives averse risks and provide investors with an escape route in times of economic down trends.

Derivatives are often used as an instrument to prevaricate risk, but at the same time they are used as speculative tools. For instance, an Asian, investor buying shares of a British company (using Sterling Pound to do so) would be bare with exchange-rate while holding that derivative. Investing in a derivative such as stock or share generates revenues for the future. On the other hand, investing in numerous derivatives diversifies investor’s portfolio balance and hence, hedges the risk in case one product stumbles.

There are several ways in which companies can hedge interest-rates risks. The most popular method is a fair value hedge; this is where a company faced with two interest rates opts to pay Libor plus something and to reset interest semi-annually. In this case, the swap receives variable and pay a fixed amount of money on the value. The received flat-rate payments are commonly used to settle the pre-existing floating-rate debt. The company is left with floating-rate debt an obligation with an extra derivative.

The second method of hedging is the product or product hedge. This occurs where a company entirely depends on raw-materials or products who whose demand is sensitive (The Options Guide). For instance, Airbus consumes lots of fuel jet; therefore, the company prefers hedging against the crude-oil price increase. However, the company ought to be very vigilant to enhance a clear forecast since in itself the exercise is costly.

Risk management is a core principle of any business and to an entrepreneur. The uncertainty and risk factor involve in the global market is escalating and financial advisors are encouraging entrepreneur to diversify their risk. While the organization derives much of its income in ensuring the company is investing heavily in alternative financial assets rather concentrating on its primary products.

Financial Crises and Derivatives Markets

The financial crisis has affected the operation of CBOE. Therefore, the inability to predict future market trends has affected the derivative market. The financial stagnation has been responsible for higher market rates and weaker currencies. The volatility in interest rates has made investors coy of committing their money in derivatives as a measure to mitigate imminent loss. The monetary value of an asset now is worth more than in the future if the interest rate increases. Since interest rates, inflation and power economic growth are affected by the financial crisis, as the chairman of the CBOE I have come up with measure to regulate the potential loss. This would be made possible by strengthening strong forecasting method to boost investor’s confidence.

During financial crisis, most investors prefer holding their money with insurance companies at the expense of in derivatives. To save the derivative market from the imminent demise, the market needs to deal with broken assets rather than dealing with the compound market. For a market to be sustainable, the Federal Reserve and central banks need to expand money supplies to avoid a deflationary spiral. Although it is difficult to influence the action of the Federal Reserve, lowering government expenditure, and increasing unemployment rates lowers aggregate consumptions. The most means of dealing with current scare such as creating currency as a means of dealing with liquidity trap.

Financial Innovations

The volatile nature of derivatives makes it difficult for policy makers come up with innovations and creativity. However, a few options are available through the market can be stabilized. As the head of CBOE I would generate a new product line to increase the market viability. The product that I would come up with is a contract on carbon emission. The new product line will strengthen entrepreneur to invest in emissions and ethanol on carbon emission. The ever- increasing carbon emission makes the venture viable and more promising. This venture proves to be viable and more suitable in making it since the global market is continuously emitting volumes of carbon into the atmosphere daily.

The other innovative venture I would institute is trading in credit derivatives. Credit derivatives are not traded by insurance companies because of the prohibitive statutes in the country. Credit derivative holds promise since most modern trade is carried out in credit terms. Since the market stock and bond market is waterlogged, developing a new product line will attract many investors. Besides, credit derivatives will provide me with an efficient way for a short term credit. It is sometimes challenging to borrow company bonds on a term basis. Hence, a short position is granted easily by buying a credit protection. One can also short definite credits as a hedge of present exposures to gain advantage or profit from a risky perception.

Both carbon emission and credit derivative are both sustainable and promising. The increasing consumption of petroleum products means an increase in carbon emission and therefore increased returns on the derivative. In carbon markets, the derivatives such as the swaps, futures and options are common. They allow an organization to determine the pricing of its product. On the other hand, an increase in credit markets makes the market to be attractive and more appealing to new investors.

Arbitrage investment

Arbitrage is an investment method that aims at taking advantage of price differences in a derivative market. The price difference comes because of market inefficiencies due to lack of perfect market conditions. Arbitrage involves buying of securities in one market and selling them in another market earning more returns compared to the risk involved. While arbitrage seems simple, several methods are used to ensure to serve the same purpose. Below are some examples of arbitrage; convertible arbitrage, index arbitrage, dividend arbitrage or bond arbitrage.

Convertible arbitrage is the most common and the method where the main security traded is the bond. In this case, the bond manager buys translatable securities, which are usually bonded. Typically, when puts are overcharged in comparisons to the calls, the arbitrage is forced to sell a naked put to mitigate the loss. This strategy is referred to as synthetic put. At times the call is overcharged in comparison to puts, the arbitrage manage is exposed and he is therefore compelled to sell naked call and buy synthetic call. The aggressive nature of the market makes it possible for the market to enjoy market equilibrium where the price of both the calls and puts are in tandem. Equilibrium in the security market is known as pull-call parity.

At times, the existing options in the market place are overpriced forcing traders to come up with alternative ideas of handling the market. The most common alternative is conversion and reversal. Conversion is a strategy that is used when alternatives are overpriced, whereas reversal is a strategy mainly used when alternatives are under-priced.

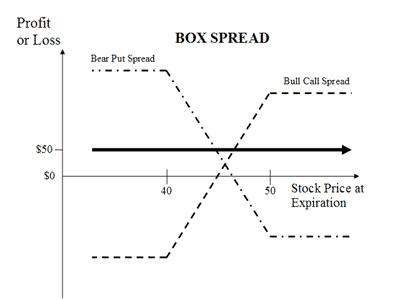

The Box Spread strategy is yet another common arbitrage strategy that involves buying a bull call spread in conjunction with bear put spread. In this case, both bull care spread and bear put spread have the uniform strike prices and ending dates. Generally, the long box is mainly used when the spread is under-pricing in regards to the end value. The foregoing formula for computing the expiration is shown below.

- Expiration value of box=Higher strike-Lower strike price

- Risk-free profit=Expiration value of box-Net premium

As CBOE boss, the most optimal strategy is the Box Spread/Long Box due to its simplicity and straightforward nature of the operation. The method is predictive and allows merchants to understand the market well. The predictable nature does not only help the CBOE staff to project the market variables with certainty, but it also easily understood by the investors (Jarrow 224).

References

Jarrow, Robert A. Modelling Fixed-Income Securities and Interest Rates Options. California: Stanford University Press, 2002. Print.

The Options Guide. Box spread (Long Box). 2009. Web.