Introduction

Austerity measures are those measures or policies put in place (by a government) in order to aid in cutting down the deficit. It also helps lower the spending. These measures ensure that the number of benefits offered to the people and the public services rendered is reduced. Governments require doing this in order to reduce the deficit spending. Other governments do this to increase the taxes. This helps them to pay back the huge debts that they owe their creditors (Firzli and Bazi, 2011).

Reasons for taking an austerity measure depend on various factors. One reason may be seen whereby a government is uncertain about its ability to repay its debt within the time frame provided. This is usually the case when the country borrows in a different currency. If it does not have the authority to pay using its own currency, then this would not be accepted. When this happens, banks may be suspicious and no longer trust the government due to its inability or unwillingness to pay its debts. This may cause the bank to decline to roll over the debts that the country has or may do so but demand interest rates that are abnormally high. It is then that inter-governmental institutions come in and demand austerity measures to be put in place. They ask for this in exchange for acting as a lender.

Effects of austerity measures on aggregate demand, output and employment

Many countries have tried to implement some of the austerity packages. This was an attempt to reduce the deficit by decreasing government spending and increasing taxes on commodities. All these are required to meet the ultimate goal, which is to reduce the budget deficit. They adopt this approach hoping that the strategy would restore the confidence of the banks. They also believe that improving the fiscal position of the country is possible. This is necessary for the long-term recovery of the countries into their original steady state. However, this venture and attempt to cut government spending in the fastest way possible is likely to yield more harm than good (Ian and Allen, 2010).

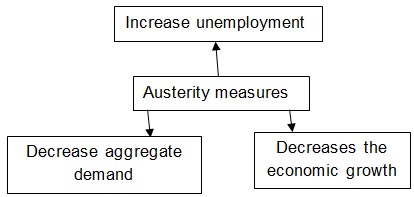

Austerity has several impacts on the economy. Such effects include lower aggregate demand, lower inflation, lower economic growth, competitiveness and budget deficits. There are various aspects that determine the impacts of these austerity measures. They include the monetary policy, labor market flexibility, global growth, central bank intervention and the exchange rate.

One of the impacts is that it leads to lower aggregate demand. When a government cuts on its spending and increases the taxes imposed on commodities, there is a tendency for the aggregate demand to decrease and the economic growth to decline. When taxes are increased, the economy of the country suffers greatly. However, studies have shown that some countries have had to postpone or suspend fiscal consolidation in the event that the country suffers a great economic loss (Ian and Allen, 2010). This was done in order to wait for the economy to stabilize. This has been seen as an exercise that is likely to yield good economic outcomes. On the other hand, some countries insist on committing to and maintaining the deficit-reducing venture until the economy lands into a recession. This usually leads to the need for another fiscal consolidation measure to be put in place in order to counteract the loss.

Another result of the implementation of the austerity measures is increased unemployment (Laxton and N’Diaye, 2002). When the output falls, companies are likely to employ fewer people and this leads to an increase in unemployment. As the government cuts down on its spending, this may also make some of the employees in the public sector redundant. Another disadvantage is the effects these austerity measures have on consumers. As these measures are aired on the media, the customers tend to be discouraged and they lose confidence in businesses they were once partners in. The fear instilled in the consumers also makes them concerned about the future of their jobs since they could lose them at any time. This encourages them to save more rather than spend.

Austerity measures also have a negative effect on output. Countries that can avoid implementing these measures immediately by providing short-term alternatives should try that and postpone such uncertain ventures. Examples of countries that can do this include the United Kingdom, Germany and the United States of America.

The processes of either increasing taxes or decreasing government spending both have an effect on the output (Christiano and Evans, 1996). The output is decreased and it is often referred to as the gross domestic product (GDP). Some experts have argued that austerity measures are not always bad since they might help minimize waste and become beneficial. There are different types of austerity measures and each yields different results.

Those austerity measures that are designed to increase the taxes tend to do more harm to the country’s economy than those measures that are designed to reduce government spending. The type of austerity measure imposed also has different effects on the level of unemployment. The measures that rely on the hiking of the taxes increase unemployment at a higher percentage than those measures that cut on the government spending (Bernanke and Mihov, 1998).

The use of austerity measures is a stupid mistake

The various ways in which governments apply austerity measures in order to cut costs include the initiation of development projects, social spending and welfare. Other effects include the increase in taxes, increase in airport and port fees. The buses and train fares are also usually hiked in order to squeeze more money from the citizens.

In most cases, such measures yield negative feedback from the citizens and there have been protesting movements coming up to argue against these. People usually complain of decreased standards of living. An example of a country that has suffered this is Greece. Certain austerity measures were imposed upon Greece by the IMF and EU. This led to great outrage from the Greeks who lodged riots and protests (Kantouris and Paphitis, 2011). Later on, trade unions started a two-day strike in order for the government to reconsider its options. Many demonstrations followed and the main agenda was to pressure the parliamentarians into voting against those austerity measures. Unfortunately, the second set of the package was approved after more than half of the members of parliament voted for it. However, the UN officials discouraged the approval of the other set of measures as it could lead to the human rights violation.

Austerity measures have been subject to controversy since they tend to mainly affect the poorest people in the country. When critically reviewed, it would be noticed that many of the countries where these measures have been implemented were in those countries that had previously been under colonial rule. This has led to criticisms that the citizens of the countries in question are made to suffer the trouble of repaying the debts that their oppressors caused (Jürgen and Strauch, 2001).

Some have argued that the government should avoid increasing taxes or cutting down its spending. Instead, they should tax some of the non-profit corporations, universities and churches. They argue that these institutions are exempted from paying taxes for no apparent reason (Thomas, 2009).

Austerity measures usually lead to a decrease in economic growth and in the long run, the government usually ends up losing more revenue in tax. In economies where economic growth is stagnant, such measures may lead to deflation and this further increases the debt (Thomas, 2009). This could also lead to the freezing up of the credit market. When this happens, a country is said to have fallen into the liquidity trap. An increase in unemployment is also another almost certain result of the austerity measures.

Conclusion

Many countries have resorted to the use of austerity measures, which is a set of rules imposed and implemented in order to reduce the government’s deficit spending. These measures come in different forms and may include the cutting down of government spending or the increasing of taxes. The government may reduce the number of benefits to its citizens and reduce the services rendered to the public. These measures, in most cases, cause negative effects rather than positive outcomes. Some of the effects include the increase of unemployment, decrease in the aggregate demand and also negatively affecting the economy. These measures have always yielded negative feedback from the citizens due to the decreased standards of living. Countries should avoid putting in place such measures for the good of their citizens.

References

Bernanke, B & Mihov, I 1998. ‘Measuring monetary policy’, Quarterly Journal of Economics, vol. 113, no. 3, pp. 869-902.

Christiano, L & Evans, C 1996, ‘The effects of monetary policy shocks: Evidence from the flow of funds’, Review of Economics and Statistics, vol. 78, no. 1, pp. 16-34.

Firzli, M & Bazi, V 2011, ‘Infrastructure investments in an age of austerity: The pension and sovereign funds perspective’, Revue Analyse Financiere, vol. 41, no. 1, pp. 212-321.

Ian, T & Allen K. 2010, Austerity Europe: Who faces the cuts? Guardian News, London.

Jürgen, V & Strauch, R. 2001, ‘Fiscal Consolidations: Quality, Economic Conditions, and Success’, Public Choice, Vol. 109, no. 3, pp. 327–46.

Kantouris, C & Paphitis N 2011, Greek police, firefighters protest: The Boston Globe, Merriam-Webster, New York.

Laxton, D & N’Diaye P 2002, Monetary Policy Credibility and the Unemployment-Inflation Trade-Off: Some Evidence from 17 Industrial Countries, International Monetary Fund, Washington.

Thomas, L 2009, ‘New evidence on the interest rate effects of budget deficits and debt’, Journal of the European Economic Association, vol. 7, no. 4, pp. 858-855.