Introduction

Growth is a term that is used to describe the general positive nature of active facets of a society. In economic terms it’s categorized as either actual or potential. Economic growth refers to the steady increase in the GNP/GDP that is normally measured annually. Okun, (1962) says, “It provides an insight into the magnitude and general direction of growth for the overall economy”. Economic growth can be of two types; potential growth and actual growth.

Actual growth refers to the percentage increase in annual national output. It is used to publish statistics on growth rates. It is a real measure of how an economy is currently performing in terms of growth. If actual output exceeds its potential level, its implication is that the current available inputs are being over-utilized and inflation pressure is likely to build up. If the actual output is below the potential level, its implication is that some inputs are being idle and there is a chance that inflation rate will decline.

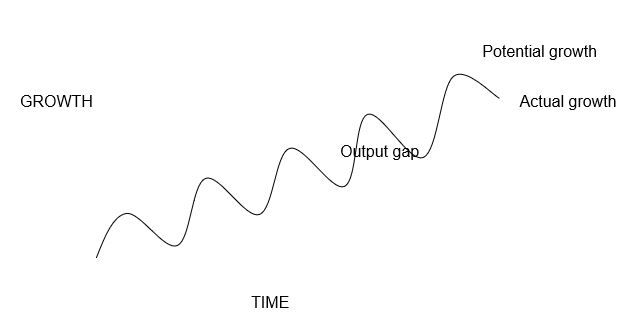

Potential growth is the maximum output that can be achieved when resources are fully employed; all factors are assumed to be constant and favorable. This state is not actually normally attainable in the normal operational situations. If the potential growth rate exceeds actual growth, there will be an increase in space capacity and an increase in unemployment. Potential and actual growth can be illustrated graphically as shown below;

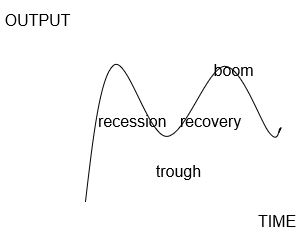

Actual growth could be affected by various factors which include; business cycles (recession, recovery, boom and trough), financial markets and institutions, monetary policy, fiscal policy, investment levels, consumer spending and international trade.

A Business cycle is a repeated cycle of economic movement where an economy moves through ups and downs over a prolonged time period. It normally comprises of five stages i.e. growth, recession, trough and finally the recovery. The business cycle can be illustrated graphically as shown below;

Kalman, (1960) says, “During a recession, consumers reduce purchases, especially for housing and durable goods, and business ventures postpone their spending on capital and try to cut inventories” (p.78). This causes the real GDP to fall as businesses fear making loss. At recovery stage, there is an increase in economic activities and businesses are more willing to employ capital and try to increase their inventories to meet the rising demand for goods and services by consumers. This has a positive effect on actual growth as spending on capital increases real GDP and hence increase in actual growth.

Another factor affecting actual growth is financial markets and institutions. Continuous problems in the financial market can slow the pace of recovery while policymakers will begin withdrawing the support provided during the financial crisis if market conditions are enhanced. This acts as a positive sign of actual growth as financial institutions to a great extent reduce their reliance on the Federal Reserve’s emergency liquidity facilities.

Another major factor affecting actual growth is the monetary policy whereby the monetary authority of a country controls the supply of money. Monetary policies can either lead to excess money in the economy which is inflationary or less money which is not healthy for an economy. It can be an important contribution to economic growth. Barro, Robert, and Xavier Sala-i-Martin (2004) say, “If monetary policy is done badly it can cause distortion in the working of an economy and therefore hinder growth”. Actual growth can be attained if monetary policy is done well and these distortions are avoided.

Fiscal policy as a factor affecting actual economic growth can either be short-run or long-run. It refers to the modes of taxation and regulated spending by a government, with the goal of attaining price stability, full employment of resources and general economic growth. Inappropriate application of fiscal policy tools such as over taxation and careless government spending is always anti-economic growth.

Investment levels also affect actual growth. Okun, (1962) says, “For growth to occur the level of investment has to be greater that the amount of depreciation.” Investment involves the acquisition of capital goods that produce consumer goods and services. With the accumulation of capital goods a country is able to increase its production capacity and hence an increase in GDP.

Consumer spending can also affect actual growth. It is determined by various factors such as interest rates and availability of credit, the level of real disposable household income, consumer confidence and changes in household financial wealth. The strength of consumer spending can cause a country to avoid recession. When a country avoids recession, it is more likely to achieve a higher actual economic growth.

International trade can also affect actual growth. When a country exports its income levels increases hence ability to buy, this in turn increases aggregate demand of a country, the reverse reduces the demand for the goods and services of the country in question. The difference between exports of a country and its imports defines the effect of international trade. When there is a trade deficit, the net export becomes a negative,” Reinhart, Carmen and Kenneth Rogoff (2009). Both negative and positive net exports have an effect on the actual economic growth of a country.

Potential growth can be determined by two major factors which include: an increase in resources such as labor or capital and an increase in the efficiency with which these resources are used through advances in technology, improved organization or improved labor. An increase in capital could lead to an increase in production capacity hence increasing a country’s potential growth. In the case of technology, its advancement leads to more economical ways of producing output that better meet consumer needs.

Potential growth/ supply side policies

This refers to micro-economic policies designed to change the supply-side potential of an economy by improving the economy, making markets and industries operate more efficiently hence contribute to more rapid growth of real national output. In order to achieve sustainable economic growth without an inflation rise, the supply-side performance must be improved (Jorgenson, Dale, and Kevin and Stiroh, 2000). The supply-side has two approaches: policy on the product market and labor market. The supply side policies in the product market are those policies that are output directed. Such market is the market for consumer products and products that can be used for other productions. The supply side policies in the product market are meant to ensure that the right quality and quantity of products are provided. The supply side policies for labor market refer to policies that are designed to improve the quantity and quality of the supply of labor. The supply side policies are meant to make the labor market more accommodative to help solve unemployment problems in the growing economies.

Actual growth / demand side policies

These are the economic policies that are made specifically to help bust the aggregate demand in any given economy, these busts the output as well hence better consumption. The demand side might have some shocks which include; a capital investment boom, a pre-election government spending spree, a sudden and significant rise or fall in exchange rates etc. These shocks affect the rate of growth of aggregate demand in a country. For economic growth demand policies that facilitates growth of output are always advocated for i.e. capitalization to facilitate industrialization which will in turn bust productivity hence output.

Output gap

This refers to the difference between the actual output of an economy i.e. output that is realized in reality and the achievable output under efficient or full capacity i.e. output that is achievable when economic resources are fully employed/at full employment. When potential growth minus actual growth is brings a positive then increased output is realised and negative when the reverse is true. “In order to determine the output gap economists need to measure the true level of aggregate demand and aggregate supply depending on the parameters considered,” (Kydland, Finn, and Edward, 1990). Negative output gaps exist when aggregate demand is well below potential of an economy’s productivity. Negative output is very harmful to the economy since it discourages economic growth. Countries who strive for economic growth always advocate for policies that are geared towards getting positive output gap.

Conclusion

According to Okun (1962), economic growth has various strengths and weaknesses fiercely debated by economists, environmentalists and other commentators. “Some of the economic benefits of economic growth include;

It leads to higher living standards and greater prosperities for individuals” Kalman, (1960). Without growth there would be poor living standards and higher rates of poverty.

- Growth leads to a rise in employment. A sustained growth in a country helps to bring about a large rise in total employment.

- The confidence of an enterprise is also developed thus creating a positive impact to the growth of a business enterprise. This will help the business grow in terms of profits and returns.

- Growth also acts as an accelerator effect of growth on capital investment. Economic growth does not come risk-free, it has risks ranging from financial to foreign exchange risks and including natural risks (Kalman, 1960). These risks may at times be beneficial and most of the time they are detrimental to the health of the organizations of a country as well as the economic growth of the country in question. It has various costs associated with it which include;

- Economic growth has a risk of demand-pull or cost-push inflation especially if demand grows faster than long run productive potential.

- Rapid and drastic economic growth normally results into social evils and environmental pollution due to increased consumption of natural biofuels.

- Growth may come with unequal distribution of income and wealth among individuals in a given state. It could increase the gap between the rich and the poor.

From the above costs and benefits, it can be concluded that growth should be that which is sustainable, economical and self sustaining to the economy of the given country. According to Barro, Robert, and Xavier Sala-i-Martin (2004), to the Brunt land Commission on Environment and Development, 1987, sustainable growth is “growth that meets needs of the present without compromising the ability of future generations to meet their own needs.” In other words it’s called sustainable growth, growth that is free from the entire negative externalities like pollution poor economic growth.

References

Barro, Robert J., and Xavier Sala-i-Martin (2004), Economic Growth, 2nd ed., Cambridge, The MIT Press.

Jorgenson, Dale W, and Kevin J. Stiroh (2000). “Raising the Speed Limit: U. S. Economic Growth in the Information Age,” BPEA, 1:2000, 125-211.

Kalman, R. E. (1960). “A New Approach to Linear Filtering and Prediction Problems,” Journal of Basic Engineering, Transactions of the ASME, Series D, 82: 35-45.

Kydland, Finn E., and Edward C. Prescott (1990). “Business Cycles: Real Facts and a Monetary Myth,” Federal Reserve Bank of Minneapolis Quarterly Review.

Okun, A.r M. (1962). “The Gap between Actual and Potential Output,” Proceedings of the American Statistical Association. Reprinted in EdmundS.

Reinhart, Carmen M. and Kenneth S. Rogoff (2009). This Time is Different: Eight Centuries of Financial Folly. Princeton.Princeton University Press.