Abstract

The effectiveness of fiscal policy is very wide and significant in modern economy. The concept of fiscal policy was introduced by Keynes. He worked out the policy under a recessionary economy and he became famous for his prescription. More then half a century most of the developed countries are following Keynesian fiscal policy. The effectiveness of fiscal policy has been reshaped the framework of macroeconomic analysis and market economies by saturating the basic concept of open economy. Keynes augmented that the GDP has been measuring with aggregate demand in short run and this is the perception already been in practice. The recession occurs due to demand diminishing very short in relation with the productive capacity of an economy. The solution or remedy can be found by creating encouraged demand with governmental interference. This is the standpoint of more or less all modern macroeconomic analysis. Fiscal policy is the tools in government’s hand to restructure the economy. To discuss about the effectiveness of fiscal policy this paper has first drawn attention on the basic concept of fiscal policy, its elements, function, measures and mathematical analysis. Then it goes to discuss the effect and effectiveness of fiscal policy with some empirical evidence of different countries. The limitations of fiscal policy, its effects in controlling inflation, the significance of IS-LM curve, achievement of full employment with determinant of managing governmental expenditure and tax has been discussed. This paper also enlightens on the fiscal policy of Kuwait an instance. Though the Keynesian economists are very much optimist about fiscal policy as a universal remedy, the present recession of 2008 and the impact of Bailout Bill of USA may raise question on effectiveness of fiscal policy.

Background of Fiscal policy

In 1930’s great depression Lord Keynes affirmed that governments ought to enhance spending and reduce taxes to make better their economies. Though the most other encomiast of that time believed that the market economy automatically would get better on its own effort devoid of government action. In disparity Keynes protested that an economy could suffer for an indefinite period with very high unemployment when the aggregate demand is not enough.

Keynes argued that monetary policy was ineffective and hopeless to make better the economy and overcome the depression. His strong logic was that the monetary policy depended on dropping interest rates but already the depression turned the interest rates tends to zero. Thus monitory policy has no tools to function on this situation. But enlarged government expenditure would create a chain response to an amplified demand for both workers and suppliers and boost the aggregate demand indirectly. At the same time reduction of tax would result more disposable income to the consumer’s hand. Keynes pointed out that the correct fiscal policy for the period of highly elevated unemployment should result a budget deficit. Both the UK and US government were not convinced with Keynes fiscal policy and tried to balanced budget until the World War II. Later on World War II, the Macroeconomics theoretician and policy makers compelled on Keynesian fiscal policy to achieve full employment by the tools of government spending and taxation management. US Employment Act of 1946 was entirely devoted on Keynesian fiscal policy.

Basic Concept of Fiscal Policy

Fiscal policy is one important macroeconomic policy. After the publication of Keynesian General Theory, the fiscal policy took the driver’s seat in the policy formulation of the governments to achieve their objectives. In contemporary economics, fiscal policy is quite ahead of monetary policy and other policies as instrument in the hands of the governments to achieve their desired economic and non-economic results.

Fiscal policy can be defined as the conscious strategy of a government so as achieve definite pre-determined socio-economic goals with the help of public expenditure, public revenue and the public debt. It can also be defined as the policy of the state, so as to achieve certain desired economic and non-economic objectives, and avoid undesired effects, with the help of revenue, public expenditure and public debt. Mrs. Ursula Hicks says, “Fiscal policy is concerned with the manner in which the distinct elements of public finance, while still primary concerned with carrying out their own duties (as the first duty of a tax is to raise revenue), may collectively be geared to forward the aim of economic policy”. According to the Otto Eckstein fiscal policy is nothing but “changes in taxes and expenditures which aim at short-run goals of full employment and price-level stability”.

Public Expenditure Policy

In modern economy self-controlled public expenditure has been relaxed with the surplus in general government financial equilibrium. There is an extensive propensity to decrease taxes in various countries and these movements can be easily run with potential economic growth. However, doubt with the true potency of fiscal positions argues to practice strong revenue growth may integrate a bigger repeated component. Thus the tax cutbacks are viewed with the possibility to improving inducement structures in the economy. But in longer run with demographic ageing, public expenditure limits to this tax reduction.

Government expenditure has influenced the national income in a greater extend. Government expenditures are dependable on population growth, political stability, economic environment, political philosophy social advancement, cultural viewpoint, natural disasters, war and uncertainty. It is quite difficult to take all these organs of governmental expenditure to measuring the national income. Thus the economists can’t provide such a model of national income where all this components of government expenditure has been taken in consideration.

Thus, the government expenditures are considered as an external element where, G = G0. In this condition the revised model of national income should be as follows:

Y = C + I + G … … … … (1)

C + Ca + cY … … … … (2)

I = I0 … … … … (3)

G = G0 … … … … (4)

Where:

- Y = National Income

- C = Total consumption

- I = I0 Independent Investment

- G = G0 Self controlled Government expenditure

With combination of the above three equation, the equilibrated national income may be modeled as:

Y = C0 + cY + I0 + G0 … … … … (5)

Or, Y – cY = Ca + I0 + G0

Or, Y (1 – c) = Ca + I0 + G0

Or, Y = (Ca + I0 + G0) / (1 – c) … … … … (6)

Equation (6) indicates equilibrated national income. Above equation indicates that when the governmental expenditure increased, the national income should be augmented. Simultaneously if the government expenditure reduces, the national income should decrease.

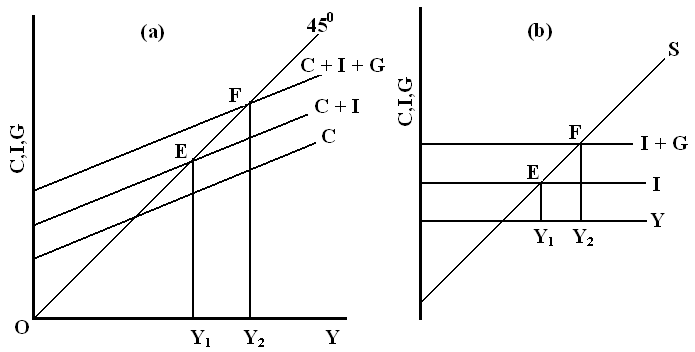

The relation between governmental expenditure and national income has been demonstrated as bellow:

As per figure 2 (a) governmental expenditure should be determined in the level Y1. Because in point E, aggregate demand is equal to aggregate supply, when government expenditure incorporated, the new aggregate demand would be C + I + G. Consequently national income should be determined in new point F; national income should be increased from Y1 to Y2 level. When the government expenditure decreases, the nation income should be reduced. In Figure 2 (b), the equilibrated national income has been demonstrated in point E without incorporating government expenditure. The changed national income including government expenditure has been demonstrated in point F. Here national income has increased from level Y1 to level Y2.

Public revenue policy

Taxes seriously influence the national income. It can restructure the national income by influencing consumption and savings. Taxes depend on different elements. It is quite difficult to determine national income by incorporating all the elements. For the convenience of discussion, here it is assumed that pubic are taxed to meet up government expenditure. Taxes are considered with two criteria such as (i) external element, where it is independent on the income level and (ii) influenced element, where taxes increase with the boost of income.

If the taxation considered as an external element the national income model would be as follows:

Y = C + I + G … … … … (1)

C = C + Ca + c(Y – T) … … … … (2)

I = I0 … … … … (3)

G = G0 … … … … (4)

T = Ta … … … … (5)

Replacing equation (1) with (2), (3), (4) and (5) the equilibrated national income would be as:

Y = Ca + c(Y – T0) + I0 + G0 … … … … (6)

Or, Y = Ca + cY – cT0 + I0 + G0

Or, Y – cY = Ca + I0 + G0 – cT0

Or, Y(1 – c) = Ca + I0 + G0 – cT0

Or, Y = (1/1-c)[Ca + I0 + G0 – cT0] … … … … (7)

The above equation No– 7, indicate equilibrated national income. If the taxation is considered as an influenced element, the national income model would be as follows:

Y = C + I + G … … … … (8)

Y = Ca + c(Y – T) … … … … (9)

I = I0 … … … … (10)

G = G0 … … … … (11)

T = d + eY … … … … (12)

Replacing equation (8) with equation (9), (10), (11), and (12); the equilibrated national income model would be:

Y = Ca + c(Y – d – eY) + I0 + G0 … … … … (13)

Or, Y = Ca + cY –cd – ceY + I0 + G0

Or, Y – cY+ ceY = Ca –cd + I0 + G0

Or, Y (1– c+ ce) = Ca –cd + I0 + G0

Or, Y = (1/(1– c+ ce)) [Ca –cd + I0 + G0] … … … … (14)

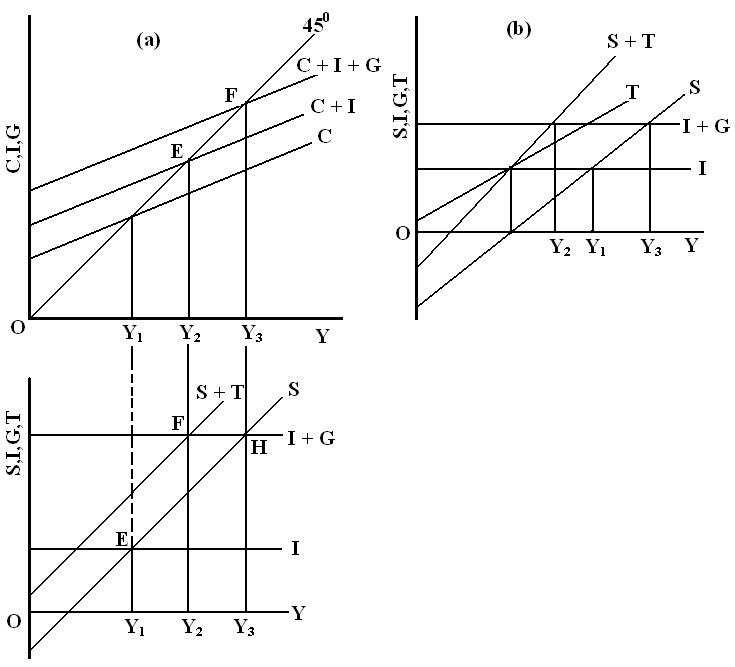

Above equation- (14) indicates equilibrated national income under influenced taxation. Figures bellow demonstrates how taxation manipulates national income.

In Figure 3 (a), on point E, without government expenditure the equilibrated national income is Y1, including government expenditure new aggregate demand line (C + I + G), consequently national income would increase from Y1 level to Y3 level. Including government expenditure self motivated expenditure increases in level (I + G) from I. So the new equilibrium point would be H. Now if the government imposes new onetime tax, the consumption expenditure should decrease and aggregate demand line (C + I + G) moves to the right alignment in (C1 + I + G). Consequently the nation income decrease from Y3 to Y2. This situation has been demonstrated in point F. The reason is that, though the self motivated expenditure (I + G) constant, but for incensement of taxation S line shifts to the left and turned in (S + T). It should impact the national income decrease from point Y3 to Y2.

In Figure – 3 (b), without taxation and government expenditure the national income is Y1, Including government expenditure the national income increase in Y3 level. Simultaneously increase of taxation may cause a decrease on national income in Y2 level. Here the resultants of taxation carry out bad impact rather then any positive result. In net consideration it can decrease national income in Y1Y2 level

From the above discussion it is very clear that net changes of national income depends on the interaction of government expenditure and taxation. It is deeply linked with Amount of Tax/Tax rate and shift in government expenditure.

Objectives of Fiscal policy

The following are the main objectives of fiscal policy:

- Economic Growth

- Full employment

- Price stability and

- Social justice

Economic Growth: Economic Growth is nothing but the enhance in the economic activities or economic variables over a period of time. In simple means, by reducing, a) direct taxes, a state can induce the investors or entrepreneurs to increase the rate of investment, which will automatically increase production, employment and income generation etc.

Indirect taxes, which will motivate the buyers (consumers) to demand more goods which will automatically increase the economic activities.

On the other hand bringing about an increase in public expenditure on infra structure etc., the government can accelerate the rate of economic growth.

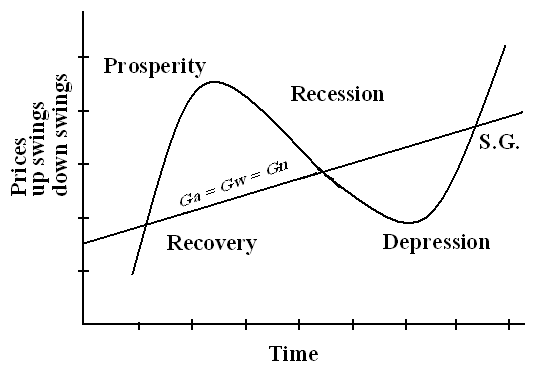

The economic growth concept is more of in the developed countries. They are concerned with the rate of economic growth. A number of studies were carried out, Harrod and Domar, initiated a new growth rate model independently.

Now it should explain the concept of gradual growth put forth by Harrod, which said could be achieved by equating Ga = Gw = Gn. The simple Schumpeterian phases of business cycles diagram is taken into account. The four phases are recovery, prosperity, recession and depression. According to Harrod economic growth must increase with a gradual or steady rate. Economic Growth must increase without the sudder up – swings (prosperity) and down swing (depression). For this advocated Ga = Gw = Gn.

Where:

- Ga = Actual growth rate

- Gw = Warranted growth rate

- Gn = Natural growth rate

‘SG’ is the steady growth rate, which is an increase slowly over a period of time without the upswings and downswings. Hence the aim of fiscal policy is help to achieve “Ga = Gw = Gn”.

The Full Employment: the Keynesian functional finance approach came to the help of President Roosevevelt to rescue the American economy from “the great depression”. President Hoover failed to stabilize the economy though many different measures were taken. It was the ‘deficit finance’ or ‘autonomous investment’ measures which helped the economy to revive.

Measures of fiscal Policy

In Macroeconomic theory there is no single that particularly used to measuring the fiscal balance. In practice depending on the analytical criteria, aim and objectives different alternatives are adopted to calculate the fiscal balance. The most common indicator of fiscal performances is the surplus or deficit of the national budget as a ratio or percentage of GDP. This is the idea of fiscal measure that is most widely practiced in both developed and developing countries. The structural elements of the fiscal policy such as governmental expenditure taxation and debts are actuated with quantitative indicators. The most difficult determinants are obviously bypassed with considerable analysis.

Qualitative approach for carrying out the fiscal policy, predictable move toward in attendance the deficit of budget could be formulated with following equation:

D = G + iB + i*EFg – T … … … … … … …… (1)

Here:

- D = Budget deficit,

- G = Government expenditures,

- T = Tax + non-tax revenues,

- i = Rate of interest on domestic debt,

- i0 = Rate of interest on external debt,

- B = Stock of government debt in local currency,

- Fg = Stock of government debt in foreign currency;

- E = Existing foreign exchange rate.

To reach on the objectives it would perused as:

d0– dt = (rt -nt) wt – dt

Here:

- dt = ratio of deficit and GDP,

- wt = Ratio of net value and GDP

- nt = Growth rate.

d – dt = (nt – rt)bt -dt

Here, bt = ratio of debt and GDP.

The nature of fiscal disparity, scope of government sectors, standing of the situation and the accounting method are the base of measuring fiscal balance. The most widespread measure of fiscal balance is concerned with government borrowing. It indicates the demand of financial assets by the government sector. This complete perception of fiscal balance could be functional for all point of governmental borrowing.

The calculations of modern fiscal balance represent the difference among the present government revenues and present government expenditures. The balances of the two point toward the governmental saving. The capital spending for purchase of assets lived more than one year is accommodated as capital transfer. Each and every other current expenditure would be incorporated. The outcomes of the present discretionary budget policy are measured by the non-interest fiscal deficit. Here the payments of interest are excluded.

The total payments based on interest should be subtracted from the full amount of expenditures that results the primary fiscal deficit. This fiscal deficit would demonstrate how the existing fiscal actions of the government impact on the disposable public debt. This is thus a significant indicator to estimate the prolongation of the budget deficits.

This can be obtained from the follows model:

D = G – T

Or, The primary fiscal deficit (or surplus) = Predictable fiscal deficit (or surplus) – interest payments.

The inflation diminishes the real value of the stock of government debt. Here the creditors are rewarded by superior rate of interest which is augmented as non-entry adjustment. In the ingredient of financing the deficit the paying off is evidenced as outflow of funds. It is a predictable impression of measuring fiscal balance on the whole public sector including the net demand of monetary resources by the government sectors.

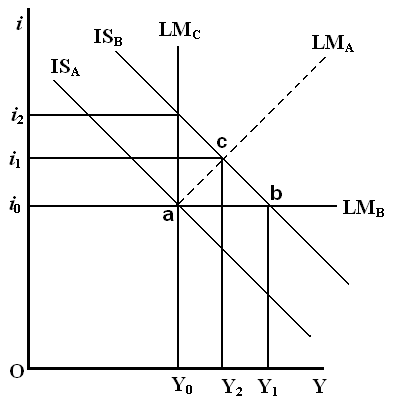

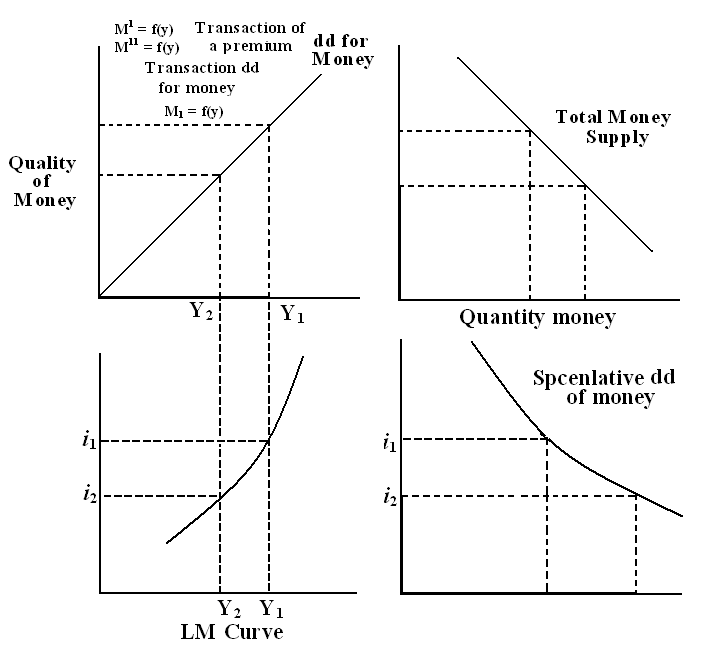

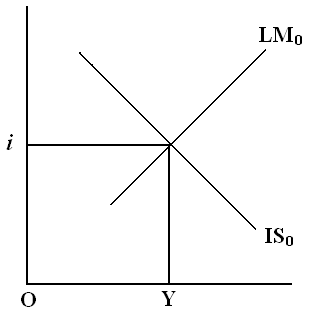

Effectiveness of Fiscal Policy with LM curve

Here the effectiveness of fiscal policy has been discussed in relation to LM curve. Slope of LM curve is capable to discuss the comparative effectiveness of fiscal policy for incensement of income. Let assume initial national income = Y0 Suppose government has increased his expenditure or decreased the taxation. Consequently ISA curve moves to the right and shifted to the position ISB. For this fiscal policy increase of national income depends on the slope of LM curve.

Firstly, if there is any liquidity trap in money market, LM cure should be turned in LMB. Within this process by complete multiplier the national income should be increased from Y0 to Y1. Secondly there is a normal condition in the money market. In this situation LM curve should turned in LMA. In this condition, extensional fiscal policy should increase income at Y2 level. But here the incensement of income may not follow with complete multiplier. Reason of it is that the demand for money is flexible with rate of interest..So when the rate of interest increases from I0 to I1 then there would be a declining affect on the economy. Consequently the economy shifts from point A to C in exchange of point B. Thirdly according to the absolute classical theory, the demand for money should be disequilibrium with rate of interest. In this condition LM cure should turned into LMC. Fiscal policy would fail to increase national income. According to the figure national income should be unchanged at point Y0.

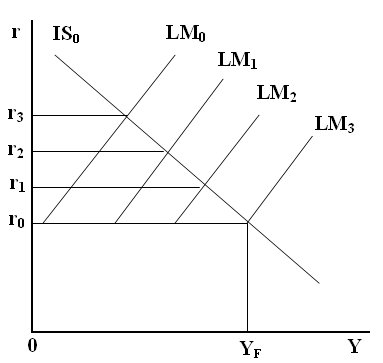

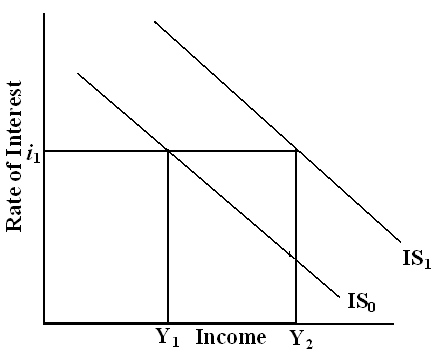

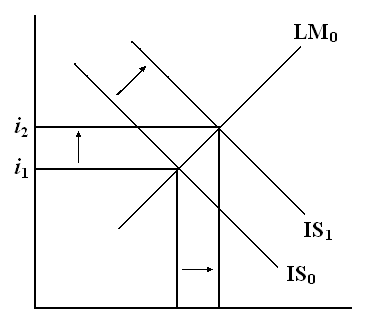

Effectiveness of Fiscal Policy with IS curve

Increase of national income with fiscal policy depends on the slope and location of IS curve. It has demonstrated bellow with figure. Let initial position of the economy at point A. According to the figure the given LM curve is LM0. Now the effectiveness of fiscal policy to increase of income should be more and more rising in relation to increase of the slope of IS curve.

Firstly, if the interest rate is completely rigid with investment, the IS curve should be upward rising. According to the figure LSA curve should be move to the right and shifted at LSA. Here the national income should be improved at Y1 point with complete multiplier process.

Secondly, saving possibly will inflexible in relation to income, in this context IS curve would be parallel with horizontal axis. According to the figure if the IS curve turns to LSA1, in that case fiscal policy would be ineffective to increase national income.

Thirdly, if the saving and investment are sensitive with the interest rate and income then IS curve goes downward to the right. According to the figure if the LS0 curve shifted to the LS1 by applying fiscal policy, then the national income should be improved at Y0. But the national income may not increase here by full multiplier system. Reason that the transactional demand of money should be increased due to increase in expenditure. Consequently the demand for money should be more then supply. Thus the rate of interest should increase and investment should be decreased and ultimately the economy should achieve equilibrium at point C.

Effectiveness Model of Fiscal Policy

According to the explanation of Keynesian IS-LM model we get:

δY / δC0 = δY / δI0 = δY / δG0 = Lr / D > 0 – – – – – – – – (1)

δY / δT0 = – CyLr / D < 0 – – – – – – – – (2)

δr / δC0 = δr / δI0 = δr / δG0 = -Ly / D > 0 – – – – – – – – (3)

δr / δT0 = Cyly / D < 0 – – – – – – – – (4)

The above inequalities (1) & (3) demonstrates that increase of self motivated expenditures effect on IS curve by a shift to the right. Thus the national income and rate of interest should be increased. Consecutively IS curve should be moved to the left due to increase of tax and that should result a decrease in national income and rate of interest.

On the other hand if the demand of money turned completely inflexible with context of interest rate, then Lr should turned into 0 (zero). In this condition fiscal policy should be ineffective to change national income and the model should be:

δY/δC0 = δY/δI0 = δY/δG0 = Lr/(Cr + Ir)Ly= 0 – – – – – – – (5)

δr / δC0 = δr/δI0 = δr/δG0 = – Lr/(Cr + Ir)Ly= -1/ (Cr + Ir)Ly > 0 – – – – – (6)

If the LM curve parallel to horizontal axis,.(rigid to the demand for money and interest rate)the classical theory should be fully effective. Here Lr = – α and Lr = 0.

δY/δC0 = δY/δI0 = δY/δG0 = 1/ [1- Cy(1- Ty)- Iy] > 0 – – – – – – – (7)

δr/δC0 = δr/δI0 = δr/δG0 = – Ly/[{1- Cy(1- Ty)- Iy}Lr] = 0 – – – – – – – (8)

If the LM curve kept unchanged and the IS curve turned vertical, it means if the expenditure is completely inflexible with interest rate, then Cr + Ir = 0. In this condition fiscal policy should be effective.

δY/δC0 = δY/δI0 = δY/δG0 = 1/ [1- Cy(1- Ty)- Iy] > 0

Thus the above investigation produced that the fiscal policy is effective in some situational context but ineffective in the reverse situation.

Fiscal policy under full employment

The principle instrument of fiscal policy is the public finance or budget. It involves purposeful manipulation of public expenditure, taxation and public debt. This is known as functional finance. Public expenditure, taxation and public borrowing have to be geared to fight inflationary and deflationary tendencies so that the national economy moves on an even keel.

The level of full employment- the classical economists were more concerned with the fuller utilization of resources in relation to the manpower resources. Though prior to the classical economists, the early thinkers put this concepts indirectly in the from of wealth (i) the physiocrats were of the opinion that, that country is the wealthiest country which processes huge amount of cultivable land, be (this is prior to modus prosperity more cultivable land, more employment more output and operate to the economy. (ii) The merchants on the other land concentrated more on the material aspects, in their opinion, a country is reached because of its material wealth in the form of gold, silver and other previous metal, etc. (iii) Adam Smith was the first to elaborate this concept in amore refined way, that a country’s wealth is nothing but the aggregate productive capacity of its citizens. As Adam Smith provide more emphasis on Laissaz-Fair economy and on the invisible hand concept. If the masses of a country is hardworking and productive than that country can be referred as the wealthiest. In modern concept the Japanese economy can be Adam Smith’s ideal, full employment developed wealthiest economy concept.

J.B. say a French economist evolved a theory of employment on the basis of supply creates its own demand. According to the classical economist that there always exists full employment, where as unemployment may occur due to business cycles and that may be temporary phenomenon. On the basis of this ideology many economists specially balanced growth approach, big, push and unbalanced approach theories emerged.

Marxist concept of full employment is rather a more radical and extreme ideology. Everything in his ideology presents that the profit is an exploitation of labour and justification for a complete change in the economic ideology that of Socialism. Marx in materialistic interpretation of economic history, exploitation of labour, the theory of surplus value the alienation theory, in almost all he laid more emphasis on the exploitation of labour and the short comings of capitalist economy. In his opinion equilibrium can be achieved only when, there exists full employment and fulfillment of human wants. Here equality is not given importance, it is only the basis needs of people and eqalitarian society is, taken into account. It is a very difficult problem which marks failed to bring about a solution as he was confused between cultural, political, social and economic equilibrium. Marks’s main ideology was that of socialists, but in general human beings have been bestowed with different types of intelligence and abilities. Human being is very intelligent and if utilized with proper means, than economical technical prosperity is not impossible.

The Keynesian revolution has emphasized more on the role of government without interfering in the economic activities of the people. The so-called welfare state concept with the help of important weapon of fiscal policy in the form of the theory of pump-priming was responsible for new economic revolution. Keynes attack on classical theory, and the functional finance approach, gave a new lease of life to political economic philosophy. Politicians with their hidden agenda moved with the weapon of discriminatory fiscal policy essentially in the form of deficit finance, to control and achieve their political objectives along with to same extent the objective of full employment. Keynes concentrated more emphasis on “Principle of effective demand” to raise the level of economic development. He took into account only certain rational assumptions of consumption function and investment function Keynes main set back was that of technological development. The role of the government as n investor, the regional intelligence, the cultural attachment and the zeal of the people to acquire richness or development is neglected. In Japan after than the Thnkgura regime, is 1869 the Meiji era encouraged foreign collaboration, where as the top five Zaibatsh, played pivotal role in economic development that country. Keynesians ideas’ regarding the rate of interest and the role of money is also vague. In modern economic system, financial institutions are unfusing huge amount of purchasing power (effective demand), which may collapse at any time.

The next state of full employment equilibrium in the second half of nineteenth century was that of the marriage of IS/LM curves. The so called goods market and money which brings about equilibrium on the basis of fiscal policy and monetary policy. The fiscal policy is responsible for goods market and the monetary policy for money market. The equilibrium can be altered as and when the policy maker’s feel to increase or decrease the policy weapons. One of the most important aspects of the modern economic scenario is that of fast moving ‘service sector’. Service sector has been dominating in the economics of the so called liberalized economics along with never ending acceleration of money supply. If the service sector out paces the primary and secondary sector than it may lead to more conflict in the form of inequalities of income and wealth. The history may repeat in the form of depression and economic chaos, in future, if not controlled properly, new revolution may emerge unless and until “full employment” concept is properly developed. The IS/LM curve theory has neglected the importance of service sector.

Evaluation of fiscal policy: Negative & Positive Impact

To improve the efficiency of productive capacity of the economic system by an optimum allocation of the productive resources in men, money and materials. These productive resources are so allocated and utilized that they make a maximum contribution to national output, income and employment.

The fiscal policy aims not only at maximizing national income and output but to bring about an equitable distribution thereof. It seeks to reduce ineqilities of income and wealth in order to promote general welfare of the community.

The overriding objective of fiscal policy is to increase employment opportunities in the country and to make the economy march towards full employment. Public expenditure, taxation and borrowing policies are aimed at increasing consumption, saving and investment. Unnecessary or conspicuous consumption is to be ruthlessly curtailed and mass consumption which creates employment should be stimulated by means of suitable taxation and by giving suitable direction to public expenditure. But side by side, all possible incentives should be provided for saving and even compulsion may be resorted to so that the incomes are not recklessly squandered. On the other hand, sizable portion of incomes should be saved towards capital formation. The savings must be channelised into productive investments. For this purpose, necessary mechanism must be provided like a sound capital market and healthy stock exchanges. Thus both taxation and public expenditure should be geared to economic growth and development.

To maintain economic stability and price stability is another important objective of fiscal policy. It must be so designed as to maintain a reasonably stable price level and to eliminate cyclical fluctuations. A suitable fiscal policy has to be formulated for an inflationary situation and for depression.

During depression there is wide-spread unemployment and fiscal policy must not only remove this unemployment but generate additional employment. The government should adopt a taxation policy which encourages private consumption and investment. Taxes are reduced to provide incentives for investment; public expenditure is increased through budget deficits which are financed by borrowing from the public commercial banks and the central bank of the country. During depression government spending assumes a great importance. It seeks to lift the economy out of the morass of stagnation. Public expenditure (pump priming) revives economic activity and compensatory spending by government is intended to make up the deficiency of private investment. Government increases its expenditure on public works and there are transfer payments like subsidies and relief payments.

During inflation, however, the fiscal policy has to be different. Through taxation and borrowing, the government must withdraw money from the income stream so that the purchasing power is taken away from the public. This will exercise deflationary pressures and tend to be bringing down prices. But the crucial thing is that the withdrawal of money from the income-stream should not be replaced by government spending.

Thus, the fiscal policy should remove both inflationary and deflationary pressures and make the working the working of the economy smooth and steady.

IS/LM framework of Fiscal Policy with Monitory Policy

To determine equilibrium with the help of fiscal policy and monetary policy

Fiscal policy came into forefront after the Keynesians revolution in 1936. It was Keynes functional finance approach, which helped in rescuing the economics, which was shaken by the great depression. Even today it is fiscal policy which has dominated the policy making of the government all over the world irrespective whether they are develop or under develop. On the other hand, monetorists still are of the opinion that economy is fundamentally to a greater extent based on fiscal phenomenon. Though, today it is the monetary revolution which has resulted in a greater degree of flexibility in the economies. For the time being it may be the monetary economics which is dominating in the form of the role of international financial institutions, the developed as well as the under developed countries financial institutions, flow of easy capital (portfolio as well as direct for a investment), the governments deficit finance policies, the innovation in banking systems in the form of ATM, credit cards, easy availability of loans for whether productive purpose or unproductive purpose, an the change in the habited and the motives, of demand for money has the resulted in the dynamism of the economies of the world. It is extremely difficult to envisage the collapse of international monetary economic structure, as well as the dominion of service sector in the economy in the days to follow.

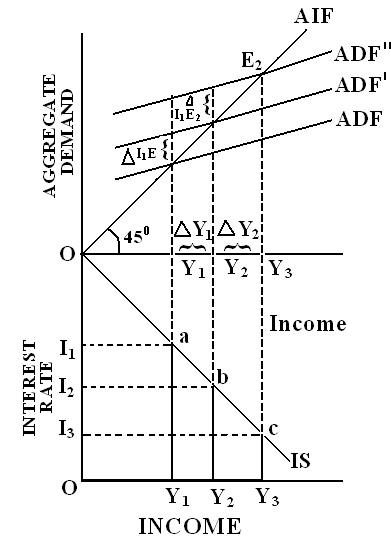

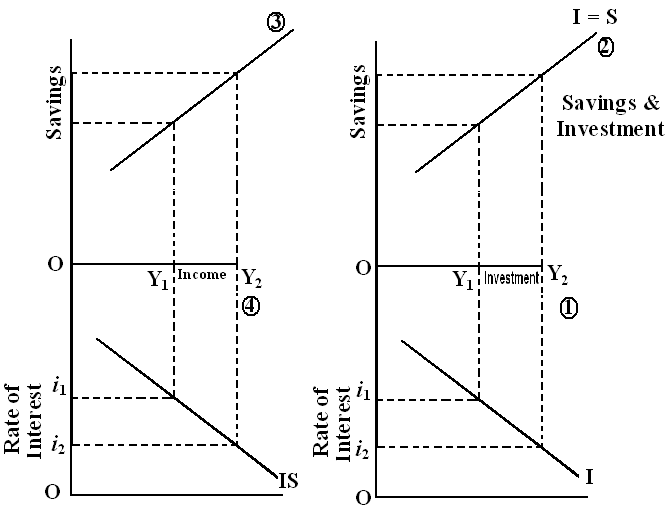

The economies of the world today are not fully dependent on only fiscal policy but a blend of both along with some adjustments. Is curve is obtained with the help of the fiscal policy or so called goods market. According to the diagram no 18:

- ASF = Aggregate Supply Function,

- ADF = Aggregate demand function,

ADF and ADF is increase in aggregate demand due to government spending (fiscal policy) that is ∆ l1 and ∆ l2 which is nothing but autonomous investment by the government.

In the figure 8 the upper part of aggregate demand on y – axis and real income on x – axis, in the lower part it is interest rate on y – axis and real income on x – axis. ‘ASF’ aggregate supply function is given; the initial equilibrium is at point ‘E’ where ‘ADF’ intersects ‘ASF’. If we draw a perpendicular on x – axis we get ‘OY1’ as the income. Now, the government, through its fiscal economies increases the public expenditure to the tune of ∆ l1, which shifts the ADF and this through the multiplier effect increases the income increases the income from ‘OY1’ to ‘OY2’. In the same way as the government spending increases by ∆ l2, (ADF) bring equilibrium at ‘E2’ which results through multiplier effect to increase income up to ‘OY3’.

In the lower diagram it is the relationship between the rate of interest and the real income. To a certain extent it is based on the real return of investment.

In the lower part at Ol1 the rate of interest OY1 is income which is obtained from the perpendicular drawn from the upper diagram. In the same way when we draw perpendicular on x – axis of lower diagram through upper diagram, we get the points, i.e., Ol2 interest rate to OY2 income, and Ol3 interest rate to OY3 income.

When we join all these equilibrium points of ‘a’, ‘b’, and ‘c’, we get a line which is nothing but IS curve.

Let us explain this concept of ‘IS’ curve which is nothing but the classical concept of Il = SS investment demand = savings.

Y = C + S.

Income = Consumption + Savings.

According to the classical economists S = l

Savings = Investments.

C = f (y) Consumption is a C function of income

L = f (i) Investment is a function at a rate of interest.

Savings is a function of income.

S = f (y)

Therefore, Y = f (y) + f (i) → Y = C + I

Y = f (y) + f (y) → Y = C + S

Therefore, f (y) = f (i).

Therefore, ‘IS’ curve is derived on the basis of relationship between ‘income’ (y) and the rate of interest (i).

Shift in the IS curve

“The derivative IS’ curve demonstrates that the goods (product) market stability between the planned investments equal to the planed savings”. If at all the government plans to shift the complete ‘IS’ curve than this needs the fiscal policy frame up in the which the government has to the total planned investment. That can be shown in the diagram below.

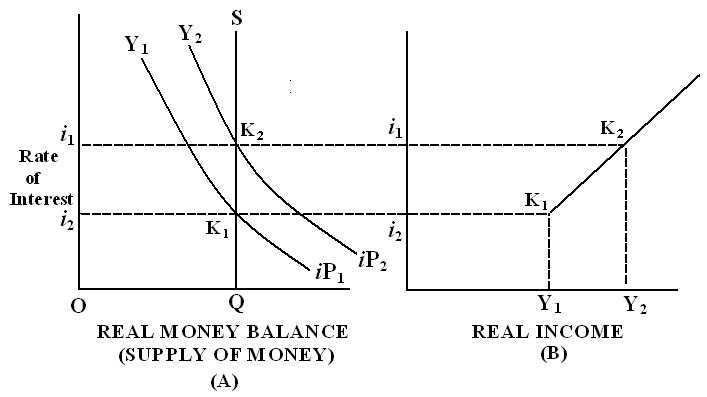

Money Market

The equilibrium money market is essentially the work of the central bank which must be framed or evolved under the monetary policy. The money market concept is developed on the basis of Keynesian liquidity preference theory. Keynesian liquidity preference theory which takes into account that the “interest is the outcome of demand for money and supply of money.”

In the diagram below on x-axis, in figure ‘a’ is the total supply of money (Real money balances) which is perfectly inelastic supply curve ‘QS’, (In the other words, the supply of money is fixed in an economy by the government). On y-axis the rate of interest is taken ‘LP1’and ‘LP2’ are two liquidity preference of a commodity which intersects at point ‘k1’ and’k2’ , on the ‘QS’ curve.

Now we extend this to diagram ‘B’. On the right hand side, x-axis is the real income of an economy, whereas on y-axis, interest rate is taken… i1, k1, is extended (as shown in the figure) to the figure ‘b’, in the same way we extend i2, k2 then we can join this two points k1, k2,we get an upward moving curve that is LM curve.

This LM curve is nothing but the relationship between the rate of interest and the real income. In other words, the lower the rate if interest is, the lower is the income (oi1→ oy1) and the higher the interest is, the higher is the level of income (oi2→ oy2).

Equilibrium of income and rate of interest

The aim of IS/LM curve is to obtain the equilibrium level of income and employment in the Keynesian sense. It is a blend of classical economists (IS curve goods market) and Keynesian economies (LM curve money market) so as to determines the desirable level of income and employment of the economy. In modern contemporary economics IS curve or goods market is completely based on the fiscal policy of that government, where as LM curve is based on monetary policy of the same government.

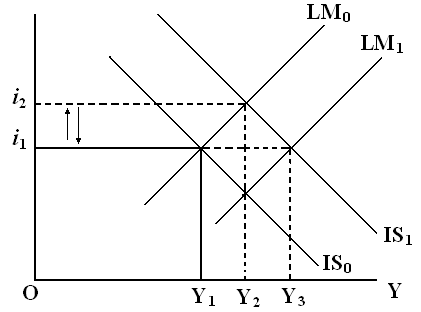

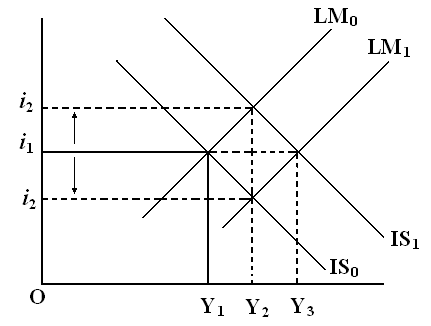

Crowding Out Effect

Crowding out effect is nothing but the exist of some private entrepreneur from the investment in the economy due to the fiscal policy measures (goods market). The main aim off the monetary policy is to bring about a reduction in crawding out effect so as to increase the level of income and output in the economy, without disturbing the rate of interest.

- in the above diagram initial economic equilibrium of income and interest rate is at point ‘E’ which determine ‘OI1→ OY1’ that is OI1 rate of interest and OI1 level of income and employment. That is given by IS0 and LM0 curves.

- Now the government increase public expenditure through its fiscal policy. This brings a shift in the IS curve from IS0 to IS1.

This leads to certain changes in the over all economic set-up. That is the rate of interest shifts from oi2 to oy2. Due to this there are certain repercussions on the economy that is the concept of “crowding out effect”

“Crowding out effect” is nothing but, the exist of private entrepreneurs from the economy due to increase in the rate of interest from oi2 to oi2. In the ‘E1E2’ is the crowding out effect.

- Now the government wants to minimize this crowding out effect. Hence the government resorts to the monetary policy (money market). In the diagram there is a shift of LM curve from ‘LM0’ to ‘LM1’ due to this monetary policy measures which intersects IS1 curve at point ‘E3’.

‘E3’ is the new level of economy income and employment of the economy, which shows that the ‘rate of interest’ is reversed back to ‘OI1’ from‘OI2’, but the economy’s income and employment level is increased from ‘OY1’ from‘OY3’. This is the net result of both monetary policy and fiscal policy, which has resulted in an increase in income with a minimum level of crowding out, by bringing about the pre-policy rate of interest viz. oi1.

In modern contemporary economic policy measures, the blend of fiscal policy and monetary policy is used so as to correct the economic disequilibrium.

Summary of the Problems, Criticisms and Complications of Financial Policy

The Problems of timing with Financial Policy:

- The Gratitude delay is the onwards time among the commencement of recession otherwise inflation and responsiveness of this episode.

- The Governmental delay is the difficulty in altering policy on one occasion the problem has been acknowledged.

- The outfitted lag is the time over and done among the alteration in policy and the consequent impact on the economy.

Political deliberation:

- The government has additional goals above and beyond economic stability, and these possibly would create inconsistency with stabilization policy.

- The political economy of the business sequence may knock off balance of the economy: The financial year when the election takes place has been illustrated by additional expansionary policies in spite of economic situation.

- Business cycles of political economy should be destabilized for lacking of choosing applicable fiscal policy.

Potential of setback:

- The regional and local finance policies may perhaps counterbalance the central stabilization policies.

- These would frequently pro-cyclical for the reason that the balanced budget necessities argue the local and central governments to elevate taxes under a recession as well as expenditure cut impacts on the recession maybe worse.

- Under an inflationary episode, the government would enhance expenditure or cut taxes when the budget is surplus.

Fiscal policy causes crowding-out effect:

- Crowding-out could take place with the governmental deficit of expenditure. It would amplify the rate of interest and trim down private expenditure that deteriorates the motivation of fiscal policy.

- A number of economists argue that modest crowding out would happen at some stage in a recession.

- A number of economists have the same opinion that government deficits should not happen at Fiscal Efficiency. This group also supported that the monetary authorities may possibly offset the crowding-out with raised the supply of money to provide somewhere to stay with the expansionary fiscal policy.

Fiscal Policy Practices in Different Countries

Keynes (1936) in his General Theory supported the public expenditure like a resource of economic enhancement. Keynes (1936) confined this investigation with the support of the multiplier. This proposal demonstrated that within a lower than full-employment environment a boost of governmental expenditures possibly will amplify income quite than price. This investigation was formed with his two core ideas successively. First one is rigidity of money wages and the next one is that the unemployment possibly will mark out disequilibrium among savings and investment. With the experience of European economy in contrast of the First World War Keynes has considered that the inflexibility of money wages would be a fraction of the institutional transformation. The assumption was supported by UK’s back to gold standard in 1925.

Limitation of Fiscal policy in developing Countries like Bangladesh

The following will be the main objectives in developing countries.

- To accelerate the rate of economic growth.

- To help build-up-basic and heavy industries.

- To achieve regional balance development.

- To help mobilize capital formation.

- To help develop infra structure.

- To bring about decentralization of the economy.

- To reduce the concentration of economics power in the hands of few.

There is enough scope debate about the effectiveness of fiscal policy in developing countries. There are remarkable percentage of unemployment and implied unemployment extremists. In the remote rural areas of Bangladesh there is numerous numbers of implied and direct unemployed both in agricultural and other sectors. A vicious circle poverty in a threaten measure. To irradiate this unemployment some economists suggest increasing governmental expenditure. Theoretically it may result to achieve the goal of full employment. But in practical the result is horrible.

Firstly, the taxation is not enough here in Bangladesh. The revenues that are gathered, that is not enough to meet the expenditures of development budget. On the other hand the structure of Tax system is very flexible. There are overlapping with the different taxes. For this reason it is not possible for the government to depend on the taxation to meet on the expenditures.

Secondly, In Bangladesh, within the administration there are both rigidity and inflexibility. Consequently increase of governmental expenditures creates inflation in the economy.

There many sectors in the economy of Bangladesh where the government has to take different subsidizing initiatives. But the government doesn’t get any positive respond from this sector, for different social and economic problems.

Fourthly, in tight of Keynesian idea some of the economists think that in the developing ountries like Bangladesh, the government can take extensive public works to eradicate rural poverty. In practical outcomes, these initiatives are temporary, it can only remove seasonal poverty but in long run it is ineffective.

Finally, it can be conclude that, the developing countries like Bangladesh for their continuous fiscal initiatives they have to send more then the normal. But in there countries scope of increasing taxes and the opportunity to go for public borrowing is very limited. Consequently they have to depend on create new money. This type of deficit makeup can cause inflation in such inflexible economy. At the same time there is the chance to increase interest rate with in the period of governmental borrowing. In such situation scope of excellence from the government expenditure should be decreased and there is a chance of bad affect both in money and capital market.

Fiscal policy in UK

According to the report of Monetary Union, in United Kingdom, the fiscal policy is more significant and effective than the monetary policy as a stabilisation system. It is essential to mention that UK emphasis on automatic stabilisers to maintain minimum standard for fiscal policy. As expenditure is increase with unemployment then it is very difficult for the government to balance the taxes and expenditures. Government has experienced with external forces, for instance, pressures from public and pressure form backbencher or opposition may influence to increase interest rate and taxes. However, UK is the homeland of Keynes; it was enthusiastic at following fiscal policy. From 1961, UK has adopted a multi-year budgeting system and UK was first country which follows this rule. They follow three strategies to adopt this rule and these are budgetary control, policy explanation, and expenditure effectiveness. When they follow these rules, Government takes advantages from the budgetary rules. Here, the most significant issue is that they analyze the next 3 years economic condition to provide current year fiscal policy. The Government takes decision after completion of Public Expenditure Survey and it was fixes the restrictions for the aggregate as well as the departmental expenditures. The PES is completely incorporated into the FSBR which was presented to Parliament.

Fiscal policy in EU

To solve recent budgetary problems of the EU member states EU takes several initiatives by Treaty or Directives. The extent of this problem is too high in Germany, Spain, France and Italy. Members of these countries provides reform proposal to change the fiscal policy in EU. The outcome of the debate in aspect of Europe’s fiscal policy structure is demonstrated that the entire situation will be unchanged if EU only interpret the terms of Stability and Growth Pact. Therefore, it is essential to amend the existing treaty provisions and pass new treaty and directives to punch a logical equilibrium among long-run sustainability with short-run flexibility. Few member states suggested that the present EU fiscal policy ought to abandon entirely. They also argued that the provisions of the Maastricht Treaty, specially the issue of extreme deficit practice, Stability and Growth Pact should change or abandon.

The Treaty provision should design after analyzing the current economic condition of EU member states. Here it is important to consider that UK follows Keynesian theory to develop their economic condition. On the other hand the fiscal policy is different in Germany, Portugal and other member states. Therefore, it is difficult for EU to provide the treaty provision which should be flexible for all MS.

- The EU fixed up deficit ceiling of 3% of GDP intended for the authentic government budget stability by the treaty provision. At the times when the Member states do not follow this rule or fail to provide rigorous exceptionality clauses then the higher deficit are measured excessive. It is common duties of a MS in the EMU take proper action to remove an excessive deficit and it is essential to reimburse deposit without interest of up to 0.5% of GDP, otherwise MS has to pay remedy for violation.

- For convenience of the Member states, EU fixed the rate of GDP. However, the Maastricht Treaty specifies that gross government debt must be less than 60% of GDP and if the member states allow more than 60% of GDP then it have to be declining at a satisfactory pace, if not, it will be treated as violation of treaty provisions. In this context, these MS has to explain the reason of violation of the treaty otherwise ECJ5 will take action against these MS. There are no exclusionary clauses available for the Member states. However, it is the drawback of the EU policy that ECJ may ask the reason of violation but there are no sanctions available for the violation of these provisions.

- In relation to the stability pact, the member states must aspire in support of medium-term budgetary condition of near to equilibrium or in surplus. EU has pursued the procedure of multilateral budgetary observation in order to certain the compatibility with their goals. Now the Ecofin Council6 is able to serve early warnings to MS. By this way Ecofin Council can scrutinize that whether the MS has exercised adequate fiscal discipline or not.

Fiscal Policy in USA

The New York Times (2008) reported that US Credit Crisis, the Bailout Bill was proposed by the US Treasury Secretary on Sept. 19, 2008; to buy back bad credits for an amount of for $700 billion aimed to gain the investor confidence. First instance the bill failed to get support of the House of Representatives. With little amendment the bill was passed for continuous market pressure. The background of the present recession is effect of continuous budgetary deficit of long back.

The US economy had gone all the way through a long deficit from the period 70s up to mid 90s of modern ear. The recession of 30s already recognized as great depreciation. The federal budget was in deficit from 1970 to 1997. The BEA7 significantly rehabilitated the procedure of budget as well as put forward in general spending limits in 1990. The objective to construct an analogous with monetary policy aimed to federal budget balance. For making sure about accurate implementation of the BEA generates a course of action named sequestration for discretionary budget items. The objectives of this of this practice are to equilibrium the expenditure with the spending limit.

The Present Recession & Bailout Bill in USA

The wide-ranging purpose of the current financial bail out bill is to purchase bad debts from the financially disorganized corporations for their growing up solid capital and possibility of common lending activities by serving nation and the customers. Nevertheless, the means of access in such a bill has characterized by a number of negative effects and moral defects within its previous and after completion such as:

- The aftermath situation is highly idealized by a huge scale of pillage by the bankers. Such economic condense will be resulted in arrangement of economy with massive fraud. Mass people doubt of passing the bail out bill of $700 million is the act of getting extra money by some bureaucrats like Paulson and his associates.

- Kochan, Nick (2008) pointed out that it is already been delayed of such hazard since the state is seemed to save some of the selected companies as many institutions need help to survive whilst they cannot sprint properly and had been confined with endowment difficulties.

- The principal moral corruption can be observed the biggest payment of the top executives of the billionaire bankrupted companies. Devine, Miranda (2008) argued that Lehman brother’s chief executive Richard Fuld get $480 million. Likewise Waxman went on a $US 440,000 extravaganza counting $US 23,380 on spa treatments in late September from American International Group. Fuld, R (62), well-informed that his accountability was to play as the “villain” of Wall Street and did his best throughout his broadcast and he don’t suppose himself to feel sorry. The negative effects are just like playing the flute while Rome burns.

- This condition will be assumed to generate a serious inflation through the lending back of money at superior interest rates towards people.

- The major pre- plan negative effects of this policy can be observed by increase in interest rates from 2006 that shaped sub prime depression where people tended of not meeting their loans.

- Financial markets have been gravely affected by the huge risk adopting propensity of larger investment companies and the lack of adequate control of the legislators by the last 70 years.

- Excessive conveniences in housing loan tended to make supplementary supply that demand which reduced the price of houses making people ineligible of paying the debt etc.

Nevertheless, the state of affairs has been reached in such circumstances where the investment banks have strictly burnt their finger and in that case the authorities required to introduce theme of bad years experience through avoiding bad years and turn into conscious highly to maintain equity and loosing corruption.

Prevention in amalgamation of investment and commercial banking has distorted the right allotment of capital and prepared it difficult for commercial banks to maintain deposit as liabilities as investment banking is the bets of all time.

Nowadays, there exists a tight policy of the interest rate with high inflation and financial instability by the central banks. As a result of the current problem, banks believe mostly on wholesale funding that is affecting on capital negatively.

Because of the imperfect valuation of risks, many banks have not adequate capital. Consequently, a number of investment banks are being insolvent. As a result many investors, tended to invest in risk- free government treasury bills and because of negative balance of mortgage, there have been extreme shortage of liquidity and now such difficulty has been spread out from the investment banks to mutual, hedge funds and the commercial banks.

As the bail-out proposal has implemented morally, bank capital would raise at an optimistic level. However, uncertainty and political confusion would also affect a better capitalization of all banks.

Initially, the majorities have been against of this plan of about $700 billion in debt and for that reason they voted a lot. Another opposition came because of the dilemma of credit crunched people. As this project is seen as a fearsome step, the legislature should be forced to prevent the speculation involved in this. Putting up of a number of structures regarding rule for protecting the investors is another possible way. Some other modules are:

- Changing of debt- based financial policy for self- freedom from manipulation of Fed and the banks.

- In case of systematic crisis of banking system, it is necessary for a recapitalization of banking system for avoiding an exclusive and distractive contraction of debt while buying of toxic assets of the monetary system is merely unsuccessful process for the recapitalization of banking procedure.

Fiscal Policy of Kuwait

Current Situation

The Kuwait Times (2008) reported that the NBK9 has determined that the country is going through an inflationary stress. It also reported that the CPI10 of the country Kuwait has jumped at 10.1% in relation to the February of previous year. This CPI incensement occurred in two sector and they are food and housing sector. NBK also disclosed that this inflation fly accomplished the highest level ever before. The most horrible inflationary stress of Kuwait was in July 1982 when the CPI was skipped at 9.4%. The present inflationary pressures possibly influenced by the recent US recession. [The Kuwait Times, 2008].

Non-tax countries are those where the individuals are not taxed. Most of the oil producing countries is in this practice. Kuwait is also one of them where oil sector has contributed 50% of its GDP share. The Central Bank of Kuwait (CBK) has in practice of with monitory policy as well as the Ministry of Finance has allowed to practice fiscal policy to face the preset crisis surplus balance of budget. The US recession has a greater impact on the macroeconomic factors of Kuwait for close cooperation and US dollar pegging. Moreover other gulf countries like Saudi Arabia and UAE already started to contribute US recession by investing in defect fallen banks. It also influence the economy of Kuwait as an interregnal part of US recession 2008 and the Kuwaiti authority adopted the measures as:

- CBK (2008), in its annual report for the financial year 2007-08 Money supply (M2) has been raised 19.1% than the previous fiscal year and figured KD 20393.5 million which was KD 17130.1 million in 2006-07.

- CBK also mentioned that domestic interest rate has been cut at least 50 basis points reported on January 23, 2008. The interest rate shaped 5.75% instate of 6.25% of previous year.

- In 2007-08 the interest rate for consumers deposit for KD and USD declined 4.507% and 4.646% correspondingly next to 5.013% and 5.209% in 2006-07.

- In 2007-08 CBK practiced the Decree Law No. 147 to re-pegged exchange rate against USD. In the fiscal year 2007-08, the exchange rate of the USD next to the KD attained 280.02 fils which was 289.45 fils in 2006-07.

- In 2007-2008 CBK’s portion of balances use by cash credit facilities granted to the local banks in different domestic economic sectors raised by KD 21359.5 million which was KD 15822.4 million in 2006-07. This has expended bank credit 35% significantly.

- CBK applied monitory policy tools regulating domestic liquidity by means of balance of local bank’s deposit to CBK and declined at KD 2103.6 million which was KD 2762.1 million in 2006-07.

- CBK regulated to decline issuance of public debt instruments in 2007-08 and the exceptional balance of Treasury Bonds reduced at KD 2296 million which was KD 2296.2 million in 2006-07.

Other aspects exerting additional inflationary pressures on the economy of Kuwait is the US Federal Reserve decisions on the subject of its interest rates had exerted another pressure on the KD and other currencies of the golf region and inflation points for the previous period. This is particularly subsequent to the sub-prime crisis and the alarm of serious recession within the US economy.

In April 2006 the inflation situation of Kuwait was 1.4% and has been rising continuously. In August 2007 the inflation rate was 4.8%. The inflation of 2008 has gained double digit figure with a serious impact on people’s life. Food and housing sector have accounted overall 77%. The present inflation of Kuwait has extensively condensed the purchase power. In consideration of last seven years the Kuwaiti dinar has lessen at least 50% of its purchase power. The inflation situation of Kuwait just has touched the inflation pressure like other Gulf counties.

In regardless of the awareness that Kuwait is importing a great deal of consumers good. The inflation has impacted both on the locally produced and imported goods. The comprehensive level has been elevated for locally created goods. In December 2007 the level of inflation was 6.6% on locally manufactured goods and 5.8% on for imported goods.

In view of this fact on May 2007 the most significant is that the Kuwaiti dinar has gained 9% positive reception next to the US dollar. This gain has played a responsibility in preventive the impact of increasing import prices. In May 2007, Kuwait has de-pegged its exchange from the US dollar and shifted to an exchange basket. This is the significance of Kuwaiti fiscal policy and these regimes of currency basket still cleave to the dollar as a leading weight. Nevertheless the central bank wouldn’t give away the elements of the basket and keeps its weight unchanged. The dollar is expected to correspond to roughly 80% of the basket and the rest 20% are other currencies.

The Bank of Kuwait looks ahead to inflationary strains to keep on rising from some different resources in excess of last few months. It has affected the housing cost and has tracked to jumping upwards. Certainly the housing elements are accustomed just the once in each three months. In March 2008 it is predictable to demonstrate a substantial rise. On the other hand inflation of food items is continuously going up worldwide. The IMF has anticipated that the world food prices increased 18.2% in 2008 without any reduction for a moment to the next year.

Measures of Fiscal Policy in Kuwait

The monetary authorities have finished restrain inflation on one of their top concern. In May 2007 by de-pegged the KD from the US dollar. NBK has approved a few numbers of significant measures to hold up the credit growth. On the other hand there are restrictions to which monetary policy would be capable to function in such a speedy mounting economy augmented by far above the ground oil prices and increasing government expenditure. Beside that the most hazardous stapes for Kuwait government is to allow US Dollar for a lion weight of the currency bundle which is almost 80%. The tremendous mass that US dollar contains within the chosen basket in opposition to which the Kuwaiti Dinar has been pegged with, restricts the interest rates of Kuwait’ may depart commencing to US dollar rates which materialize doubtful to rise soon.

Moreover, the tools of direct price controls those are well thought-out to restrain inflation possibly will work under short-run excluding the long term. The IMF has lately distinguished for Kuwait that the load of additional measures to hold inflation possibly will have to plunge on fiscal policy. Preventive the growth rate of general expenditure would be essential to administer growth in household demand.

Nonetheless, in Kuwaiti economy the space for fiscal policy is limited. The necessity for superior investment to improve supply restricted access in long run. thus, endure with to some extent privileged inflation would be obligatory At the same time control of price, decrease of tariffs, subsidies and relevant legislative measures should be accounted by the government. It can easily applicable as short terms treatment among the impact of upper prices on the consumer’s purchasing power.

Cut of Fiscal Deficit in Kuwait

Kawach, Nadim (2004) reported in The Gulf News that the IMF has been suggesting Kuwait to start privatizing the public institutions. They emphasized that the development of the private sector and exaggerated reforms of the economy should to decrease the reliance on oil and encourage growth. The IMF also mentioned that the conclusion of the war with Iraq had definitely played ostentatious role on the economic and fiscal situation of Kuwait’s and anticipated vigorous growth in economy for the next four years.

Differing with the IMF Kawach, Nadim (2004) mentioned that the Kuwait Iraq war has strained the economy of Gulf countries as well as Kuwait the prime oil producers. He also suggested that Kuwait needs to obtain measures to enhance revenue to make certain that the feasible expansion in its non-oil economy to respect its promise to create jobs for growing population.17 Thus the macroeconomic point of view of the IMF prescribed for Kuwait would stay behind positive for medium term due. IMF urged that the most significant challenges for Kuwait would be to speed up non-oil economic sectors to take up the speedily rising Kuwaiti labor force and dropping the budgetary dependency lying on oil revenue to preserve substantial equity aimed to the long run.

At the same time Kuwait has to design its strategy of structural modification and fiscal intensification to accomplish the objectives. The authorities are encouraged to avail the opportunity of the existing macroeconomic setting. The strategy possibly would incorporate with floating of private sector, encourage investment and diminish state involvement. More emphasize should be adopted on to progress the performance The speedy implementation of the strategy would contribute to overcoming budget deficit and gaining equilibrium budget.

To implementing the fiscal measures Kuwait it needed to reform its law. Already the government has proposed a Privatization regulation. Kuwaiti parliament would pursue the legislation to ascertain the legal structure for encouraging investment and private sector as well as foreign investment.

To progress the budget configuration by dipping current spending like wages and subsidies in combination with the civil service reformation have to urge. The adjustment of prices for goods and services produced by the public sectors on the way to cost recovery expected that the authorities would work with regional countries to introduce value added tax. The target of dilapidated non-oil deficit next to the gross domestic product by non-oil sectors would be most realistic assumption to mitigate the impact of volatility of oil revenue.

Complications

The most horrible complication for Kuwaiti fiscal policy implication is concerned with volatility of oil revenue and US dollar pegging. These two factors put in plain words that the high proportion of the US dollar influenced the economy like an external anchor. As the oil is invoiced by means of US dollar and the dowel steady revenues in KD goes well at the time stable oil price. On the other hand the standing of US dollar is a currency that consent to the oil producers to endow oil revenues in subterranean as well as liquid. In present world context US dollar involved maximum currency risk and opening higher risk-adjusted returns on ROI.

More often than not the peg to a single currency would have a preference to the attaching with a basket of currencies to ensure wider transparency. The ostensible peg with the currency of any more country along with a successful track record of very small inflation would consent to the open economy of small countries to affix household inflation potentials and monetary stability for import.

Very recently the plea of US dollar peg ongoing to weaken as slack monetary policies in the United States as well as the recession of the USA has impacted the optimistic oil price shock consequential in pro-cyclical monetary policies and inflation pressure on Kuwait.

Conclusion

The recent political economy of Kuwait faced to USA. For a real advancement the country need to reduce its dependency of USA at the same time it is urged to reduce the percentage to US dollar from its Currency Bundle and increase euro zone. The macroeconomic situation of Kuwait has remained within a controllable position to over come the budget deficit with the tools of fiscal and external accounts measures for medium term. The current unpredictability of falling oil price, account surplus, overseas asset position would argue this paper to suggest pursuing a precautious fiscal policy for Kuwait.

Bibliography

Auerbach J. Alan, Fiscal Policy, MIT Press, 1997, ISBN 0262011603, 2008. Web.

Auerbach J. Alan, The Effectiveness of Fiscal Policy as Stabilization Policy, 2008. Web.

Atkinson, Paul and Noord, Paul vanden (2001), Managing Public Expenditure: Some Emerging Policy Issues and A Framework For Analysis, Economics Department Working Papers No. 285, Organisation for Economic Co-operation and Development, PARIS, France. Paper No. ECO/WKP(2001). Web.

Battaglini, Marco and Coate, Stephen, Fiscal Policy over the Real Business Cycle: A Positive Theory, 2008. Web.

Begg David, Fischer Stanley, and Dornbusch Rudiger, Economics, 8th edition McGraw Hill, ISBN: 978-0077107758, 2005.

Calmfors, Lars and Corsetti, Giancarlo (2008), How to Reform Europe’s Fiscal Policy Framework. Web.

CBK (2008), Table 03: Factors Affecting Changes in Money Supply, Web.

Considine, John and Gallagher A.Liam, UK Debt Sustainability: Some Nonlinear Evidence and Theoretical Implications, 2008. Web.

Cyran, Robert (2008), US Bail-out: Having the Government Buy Assets at Inflated Prices is a Bad Idea. Web.

Damcevski, Jordan (2001), Analysis of fiscal policy, Ministry of Finance, Republic of Macedonia, 2008. Web.

Dewett, K. K. Modern Economic Theory, 22nd edition, New Delhi: S. Chand & Company Ltd., 2005, ISBN: 81-219-2463-4.

Emanuele Baldacci, et al, The Effectiveness of Fiscal Policy in Stimulating Economic Activity an Empirical Investigation, 2008. Web.

Entrepreneur.com, Inc., Global Investment House – Kuwait – Economic & Strategic Report- The year 2007 was another good, Financial Report, 2008. Web.

Hicks, Ursula K., W. (1965), Development finance; Planning and Control, New York, Oxford University Press.

Hockley C. Graham, Fiscal Policy: An Introduction, Routledge publication, 1992, ISBN: 9780415062770.

Hansen, Bent and Burke P. E., The Economic Theory of Fiscal Policy, Routledge publication, 2003, ISBN: 9780415313995.

Husain, Aasim M. Tazhibayeva, Kamilya and Ter-Martirosyan, Anna (2008), Fiscal Policy and Economic Cycles in Oil-Exporting Countries, IMF Working Paper, Middle East and Central Asia Department, Web.

IMF (2004), IMF Concludes 2003 Article IV Consultation with Kuwait, Public Information Notice. 2008. Web.

Jha, Raghbendra, Macroeconomics of Fiscal Policy in Developing Countries, 2008. Web.

Khan, Sharif F. (2008), AE Model to AD-AS Model and Fiscal Policy, Ontario: Queen’s University, Web.

Kawach, Nadim, IMF urges Kuwait to cut fiscal deficit, The Gulf News, 2004.

Kochan, Nick (2008) The Banking Crisis: Thinking the unthinkable, Published: 2008. Web.

Mishkin S. Frederic, Monetary Policy Strategy, 1st edition, The MIT Press, ISBN: 978-0262134828, 2007

Nelson, Charles R. (2006), Keynesian Fiscal Policy and the Multipliers, Web.

OECD Economic Outlook No. 76, V. Saving Behaviour and the Effectiveness of Fiscal Policy, 2008. Web.

Richard Hemming, Michael Kell and Selma Mahfouz, The Effectiveness of Fiscal Policy in Stimulating Economic Activity: A Review of Literature, 2008. Web.

Samuelson A. Paul and Nordhaus, (2006), Economics, 18th Edition, Tata McGraw-Hill Limited: New Delhi, 2006

Selassie, Abebe Aemro, Designing Monetary and Fiscal Policy in Low-income Countries, International Monetary Fund, 2006, ISBN: 9781589064966.

The Central Bank of Kuwait (2008), The Thirty- Sixth Annual Report, The Fiscal Year 2007-08, ISSN 1029-4589. Web.

The Kuwait Times, Fiscal policy, regulatory steps vital to ease price pressures, Kuwait, 2008. Web.

The New York Times (2008), Credit Crisis – Bailout Plan, Web.

Warin, Thierry (2005), A Note on International Fiscal Policy Practices, Middlebury College Economics Discussion Paper No. 05-20. Web.

Whitney, Mike (2008), Black Monday ?: Congress Rejects Paulson’s Bail out Bill, Media Lens Message Board, Web.