This article states that in the economy, there is a bad tendency to use collected data from a small window of time to understand economic experiences. It says that instead of using a small time window dating back to 1980 to understand these experiences, the window should be extended to at least half a century or more. This paper seeks to study debt and banking crises, currency crashes and inflation by employing the use of a wide-ranging long-term historical database. Based on historical analysis, this article details the differences and similarities between various international debt crises. The dataset was constructed with material from diverse sources, the work of several scholars and data from several countries obtained from official country sources. The data included currency crashes, domestic and external debts, dates of banking crises and debt to GDP ratios among others. The article explains both the total global and individual country debt cycles using the datasets and three tested theories.

The first hypothesis states that banking crises occur once external debts surge. The authors conducted an analysis as to what factors including nonperforming loans and bankruptcies that better mark banking crises onset. Though the authors sporadically found data of failing businesses and non-performing loans due to banks hiding their problems, they used the little data they found to mark banking crises by two event types:

- Banks that were closed merged with other banks or taken over by other public sector financial situations added to the public debt.

- Banks that were assisted by the governments on a large-scale also led to increased public debt. The governments resulted in borrowing money from other states thus the cycle led to increasing of their external debt.

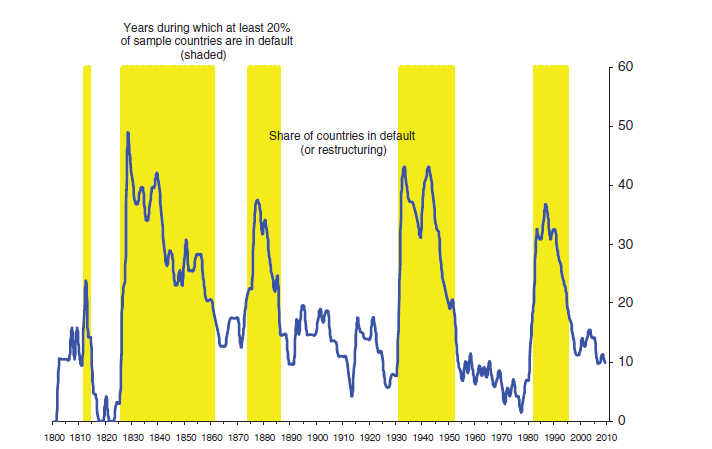

The second hypothesis states that both domestic and international banking crises often occur before or accompanies state debt crises. In this case, a banking crisis, predicts debt crises. The authors report that a banking crisis is also caused when a government takes on large debts from private banks eventually undermining the solvency of both private and sovereign borrowers. The author’s state that over the years as countries became independent they borrowed from other countries to fund their economic growth. It has led to public debt following a lengthy and recurring boom-bust cycle. The bust case involved higher incidences of sovereign debt crises. The below graph uses datasets to show the global sovereign debt crises between 1800 to 2009. The countries were either in a state of default or restructuring. From the graph we can see, there are five peaks showing the boom-bust cycles. Debts continued to rise after a default.

Using the historical datasets from various countries, the authors concluded that the frequency of banking crises precedes debt crises.

The third hypothesis states that before an external debt crisis, public borrowing surges because governments always have hidden liabilities that are much higher than the documented external debt levels. The hidden liabilities include private debt that becomes public and domestic debt. The authors conclude that countries end up in debt crises because they believe this time it is different (TTID), mentality. The attitude does not allow them to apply whatever they learned in the past simply because they think, different times different circumstances. The below diagram shows how countries expose themselves to an enormous financial crisis. If a country borrows money from other states and the economy growth declines, this leads to a banking crises once the recession hits.

In conclusion, the authors suggest that banking crises are strong pointers of state debt defaults though not essentially predictors of such defaults. The authors hint that the complex factors behind these banking crises phenomena cannot be explained by a strict economic based approach. An invitation to multidisciplinary research provided by the dataset suggests some explanations of these difficult banking crises phenomena using cultural and political factors that lie beneath. This article offers an early warning system of financial crises by providing possible implications for broadly defined financial stability objectives. The idea of this paper is to learn and record the links and historical patterns between state crises and banking crises.