Background and motivation

A number of deficiencies exist in literature concerning the role of social capital in the process of technological innovation and economic growth (Noteboom, 1999). Commercialization of innovations by universities has taken center stage in the recent past. Bay dole act and a series of other university reform laws set the pace for Japanese universities to actively engage in industrial innovations. Japanese universities took a more proactive role in strengthening industry ties to commercialize their inventions. This has also led technological universities to embrace the concept of developing an in-house business support system to nurture early businesses. One of those support systems focused mainly on small startup companies with the belief that small and medium-sized companies are also major economic drivers.

Figure 1 shows a steady increase in the number of university startups notably after 3 years of adaption of the reforms took place. Most universities have therefore come to develop standard infrastructure that is geared towards allowing for the easy transformation of knowledge through learning into inventions and subsequently products and processes. Such infrastructures include but are not limited to, technology transfer offices, incubation systems, joint research policies with firms, and technological licensing (7)

In a similar token, the reforms brought about a similar trend in the increase of university-based patents as shown in Figure 2, this kind of trend brought about the concept of rating universities based on the number of patents or intellectual assets generated. This created a climate of prestige associated with the econometric measures of what was considered to be innovativeness.

The figure shows a significant upward trend in university-based patents. This is in response to its use as a gauge of performance. It was hardly surprising that patents became a standard measure of innovation with university-generated knowledge as the source. However, new data from the university annual index paints a slightly different picture see figure 3 below.

Figure 3: innovations by Universities in Japan (Figure in 000, Year 1998 – 2004)

The data presented are based on findings of 2004 university intellectual assets and university startup databases. Similar trends are recorded in the preceding years. It shows the R&D inputs and related outputs represented by patents. Based on the previous assumption, we would expect that an increase in the number of patents would also translate into a similar increase in the number of startups. However, by comparing the two representative regions in Japan in regard to University centered innovation environment we find that in the Kyushu region even though having much less in the number of patients compared to the Nagoya region, the Kyushu area has continuously produced more university centered startups. The table offers a tool for comparison of research funding to the university and the start-ups recorded. While Kyushu and Nagoya receive large amounts of funding for research, the output start-ups from the two universities significantly differ. Kyushu produces almost twice the number of start-ups compared Nagoya. The output gap is recoded between Kyushu Kogyo and Nagoya Kogyo. While the fund allocated to the two falls within a similar range, the gap in output is significant. Kyushu Kogyo produces more than thrice the start-ups produced by Nagoya Kogyo. However, no correlation is recorded between the number of patients recorded and the start-up’s output.

In the above case we that the number of patents is more in the Nagoya region than in the Kyushu region but the Kyushu region produces more university startups (ref 2004). The fact that patents are not correlated to the number of startups tells us that patents might not be a very indicative measure of innovative output. This does not disregard the importance of intellectual assets but rather this paper draws on the added importance of researching the exploitation of knowledge to create new products and processes as represented by the new startups.

What this new evidence points at is that the innovation now depends more on the efficient diffusion than on being the first to register or come up with the intellectual assets, even the OECD (1971, 1988, 1992) literature shifted from the emphasis on technical innovations to more of social innovations.

Theoretical background

Literature on sustainable competition and firm growth recognizes generation and use of knowledge as the pillar of competition. Furthermore, recognition is reinforced by growth of a new knowledge based and learning economies, of which are considered as key success factors. Innovation is widely understood as the process of adoption, adaptation, and novelty diffusion through markets and participating firms. It provides an essential source of economic dynamism. In recognition of the fact that innovation is key to competitive edge, various scholars acknowledge that it could be as well destructive. Innovation is critical to development, productivity and sustainability of nations and hence is fundamental to governments. Formulation of development policies must therefore provide room for innovation (Coleman, 1990). Effective diffusion of innovations should be the key pillar rather than registration of patents which may never come to be.

This concept of effective diffusion and social innovation can be traced to the works of Saxenian in her epic description of the Silicon Valley and the corridor of firms along the route 128 (Coleman, 1988). Saxenian introduced Granoveter, who analyzes different kinds of networks and their respective contribution to effective flow of information. This additional dimension has been used to try and see the effect it has on innovation (Burt, 2000). This paper proposes an integration of the network effect and regional idiosyncrasies in developing super structural dimensions as a framework of highlighting the importance of the social dimension in innovation process.

Social Capital

Economists are increasingly showing interest in the role of culture in economic growth (Maskell, 1999). Incorporation social aspects into business dynamics, is gaining popularity. Social capital is understood as a set of informal norms and values which shape the behavior of the society. Therefore, it is a component of the Social Theory that is being considered as a key-element for the human and economic development (Pelikan, 2000). It appears in various forms including trust, norms, and network relationships.

Network Dimension of social capital

Burt notes that social capital is founded on relationships and that the relationships are created through exchange of knowledge amongst individuals (1984). In social systems networking is considered as a precursor to combination of resources more so with respect to knowledge (Nahapiet & Ghoshal (1998). It is vital to note that knowledge is a as well as precursor to innovation. Nahapiet & Ghoshal (1998) mentions that social capital constitutes valuable information source benefits. The social relation provide network for exchange of information and hence a reduction in time and investment required in gathering the information. Network ties influence access to parties for combination and exchange of information. Important channels of information transmission are derived from ties and hence constituting an important aspect of social capital capable of contributing to development. Networks are defined by density, connectivity and hierarchy within the systems (Lin & Dumin, 1986). Network and its structure therefore represent a facet of social capital which impacts on the range of information accessibly in facilitating innovation. Vast researches indicate that social capital is contingent on social networks; they are non-equivalent and not interchangeable. Networks provide appropriate conditions for access to embedded resources and hence their availability for innovation (Woolcock & Narayan, 2000).

Value aspect of social capital

Nahapiet & Ghoshal (1998) links views opportunity for exchange and combination of knowledge as a valuable dimension of social capital. This aspect gives rise to the value aspect of social capital. The values of the society shape their beliefs and hence the kind of innovation they pursues. Often the importance of attached values relates translates into the kind of innovation that a society chooses to adopt. Value interrelates to trust though. When trust is the basis of relationship, the society may be willing to sacrifice its values for the sake the relationship they have built a trust in (Torsvik, 2000). In general values may change and contribute positively towards achievement of development.

Value aspect of social capital explores the deliverables associated with the concept. Research reveals that social capital is a multifaceted area of study which requires a number of indicators to gauge value. The impact of social capital to the society offers a measure of its value (Lin & Erickson, 2003). For instance, when one university produces plenty of start-ups, the society is likely to draw some benefits from it and hence value. The impacts to the society offer a base value upon which innovation may be gauged (Nahapiet & Ghoshal, 1998). When a university develops ideas which help improve the agricultural productivity within its area of operation, then value is created and acts as a measurement dimension of the impact that innovation has had on the community.

Trust and norms

Literature evidence show that where trust exists, there is further willingness for cooperation and hence room for expounded innovation. Trust is constantly mentioned as a fundamental ingredient of social interactions. Trust and context are interrelated (Fukuyama, 1995). Trust is experienced in numerous contexts. Organizational trust is more than simply the personal trust that exists between individuals based on reputation and experience. Trust offers the basis upon which ideas are shared and hence new ideas are developed. Lack of trust promotes skeptism and hence limits collaboration and consultation amongst individuals/institutions (Lin & Erickson, 2003). On the other hand, it has been suggested that trust as a dimension of social capital diminishes opportunism probability and hence enormously reduce the cost of monitoring.

Discussion

Innovation, learning and technological advancement are currently viewed as systematic activities. They involve various players of diverse background throughout the economy. Significance evidence points to persistent innovative behaviors of organizations from different regions/nations (Teece, 1996). Effectively, these differences peg the ability of regional innovation players to generation, absorption and application of innovation based knowledge to their respective social settings. Commercialization of innovations has seen many institutions rush to register patents, most of which end up as non-starters. Such patents waste a lot of resources on research but yield little. Basically, they support the assertion that patents cannot provide a satisfactory measure of value. Rather starts-ups offer an acceptable starting point of measurement of the value of social capital. Start-ups directly impact on the society and create value for it. The economic impacts that the regional players input into economic growth has long been ignored. For instance, in evaluating the contributors to regions GDP, would often ignore the role of research institutions and instead focus on money generating activities. Ultimately, it must be acknowledge that those players who initiate a number of start-ups significantly contribute to societal development and should therefore be included in economic evaluations.

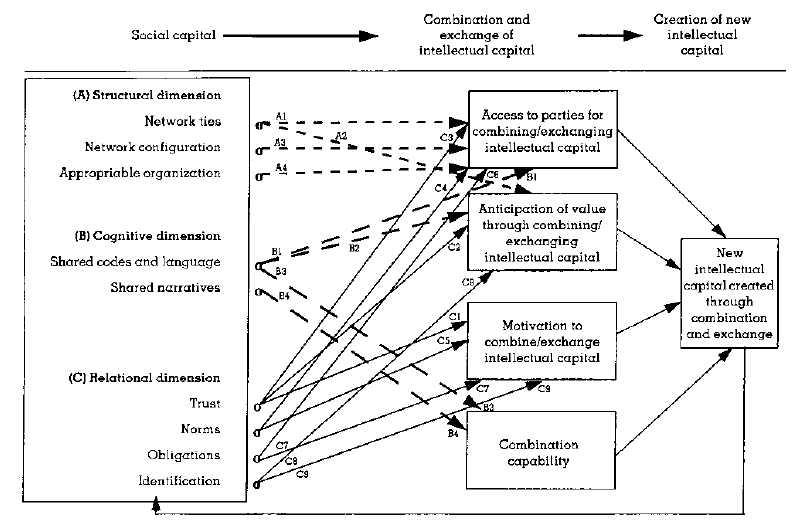

Fig 4 below defines standard innovation systems with respect to technological advancement.

The diagram is based on the relation between the three discussed dimensions to growth of innovation and development. The diagram identifies intellectual knowledge as the factor that brings together the three mentioned dimensions. Each plays an individual role in bringing together intellectual capital knowledge and hence development of innovations. Trust creates the platform for growth of network ties and hence transmission of information for purposes of innovation. Additionally, it facilitates growth of value through contribution of all parties involved. Likewise network aspect allows flow of information from various specialists and ultimately a build up of intellectual knowledge for innovation to occur. The diagram generally indicates that for as much as social each dimension brings individual contribution towards innovation, the work together to create an even more conducive atmosphere for innovation.

Conclusion

Every society is built around relationships. Bringing the concepts of social networks into innovation systems analysis facilitates understanding of the interactions between them Social networks are vital in explanation of the logic behind political and institutional alignments between organizations and their environs. They also facilitate understanding of the guiding idea to innovation. Behaviors of institutions are generally constrained by the prevailing social interactions (Coleman, 1988).

References

Burt, Ronald S. (1984). Network Items and the General Social Survey. Social Networks 6:293-339.

Coleman, J. S. (1988). Social capital in the creation of human capital. American Journal of Sociology, 94, 95-120.

Coleman, J. S. (1990). Foundations of social theory. Cambridge: Harvard University Press.

Fukuyama, F. (1995). Trust: the social creation virtues and the creation of prosperity. New York: Free Press.

Higashino, D. (2005). Changing environment for Japanese venture business. Japan Economic Monthly, 2005, pp. 1–10.

Lin, N. & Dumin, M. (1986). Access to Occupations through Social Ties. Social Networks, 8, p 365-85.

Lin, N. & Erickson, B. (2003). Social Capital: Advances in Research. NY, Transaction-de-Gruytal.

Maskell, P. (1999). Social capital, innovation, and competitiveness. Oxford: Oxford University Press.

Nahapiet, J. & Ghoshal, S. (1998). Social Capital, Intellectual Capital, and the Organizational Advantage. The Academy of Management Review, 23 (2), pp. 242-266.

Noteboom, B. (1999). Innovation, learning and industrial organization. Cambridge Journal of Economics, 23, p.127-150.

Park, S.H. & Luo, Y. (2001). Guanxi and organizational Dynamics: Organizational network in Chinese Firms. Strategic Management Journal 22: 455-477.

Pelikan, P. (1992). The dynamics of economic systems, or how to transform a failed socialist economy. Journal of Evolutionary Economics, 2, pp. 39-63.

Pelikan, P. (2000). Institutions for the Selection of Entrepreneurs: Implications for Economic Growth and Financial Crises, Working Paper.

Teece, J. (1996). Firm organization, industrial structure, and technological innovation. Journal of Economic Behavior and Organization, Vol. 31, p. 193-224.

Torsvik, G. (2000). Social Capital and Development: A Plea for the Mechanisms. Rationality and Society, 12(4), 451-476.

Woolcock, M. & Narayan, D. (2000) Social Capital: Implications for Development Theory, Research, and Policy. The World Bank Research Observer, 15(2), 225-49.