Entrepreneurship

Entrepreneurship is the process of creating new business opportunities and launching new ventures. Based on the available literature, entrepreneurship is seen as a powerful driver of competitiveness and economic growth. It is greatly admitted that entrepreneurship is a great tool of development worldwide; therefore, seen as means of overcoming the hard financial times that the world is experiencing. Essentially, problems of joblessness and financial crisis can be solved greatly by embracing entrepreneurship adequately. Entrepreneurial ventures are what give birth to new projects and business units within specific localities. Usually, entrepreneurship is considered an activity that creates wealth through the various ideas and opportunities involved. It is widely accepted that entrepreneurship is a powerful driver for economic developments as it promotes the well-being of individuals in the societies and communities of all nations through creation of jobs that consequently bring economic development (Audretsch, 1995, p.3).

Determinants of Entrepreneurship

Though considered as a catalyst to economies, entrepreneurship is a risk-taking process. As the competition grows, more innovative ideas are paramount. At the individual level, the concept of risk-taking and tolerance is not highly welcomed. Therefore, where there is less risk involved or loss aversion, many entrepreneurs are likely to venture into it. In cases whereby the level of risk is high, only optimistic individuals are likely to venture into entrepreneurship as they foresee the likelihood of success. Similarly, autonomous individuals are likely to venture into business because of the associated freedom in entrepreneurship (Bigus, 2004, p. 66).

Another factor that may lead to likelihood of venturing into business is the personal endowment of wealth (Armour, 2004, p. 22). Wealthy entrepreneurs are more likely to venture into business given that the risk of bankruptcy is lower. Similarly, wealth allows different individuals to become entrepreneurs as they can overcome comfortably the external financial constraints exhibited in all businesses (Dechant & Al, p. 2005, p. 751).

Essentially, propensity to venture into entrepreneurial activities is highly linked to the individual’s history of education and employment. Levels of education and training, often called human capital is a component of entrepreneurship. More specifically, education increases the ability of an individual to realize and develop a business through innovations. On the other hand, when an employment history of working is small, an individual is endowed by entrepreneurial firms as they consider one to be sufficiently all-rounded in the start-up of a business. In addition, entrepreneurial activities are affected by the individuals’ current jobs and may work as a hindrance to entrepreneurship. Therefore, endeavors to engage in entrepreneurship are highly affected by the current employment (Djankov, 2002, p. 79).

Culture, as Georgellis and Wall (2002, p. 202) point out, is an essential determinant of the kind of entrepreneurship one wishes to engage in. success and failure in business are greatly affected by the culture dominating the environment. Some cultures may disapprove of some businesses while others approve the same. Thus, the willingness of a certain individual to become an entrepreneur is culture-oriented (Audretsch, 2002, p. 99).

Gilson (1999) further explains that economy also plays a great role when deciding to engage in entrepreneurship activities. The economy of a nation may affect the availability of opportunities for entrepreneurship and innovations adequately. At macro level, economic growth is paramount. The growth of an economy, whether positive or negative has a great influence on all businesses; hence, the willingness to venture into one. On the other hand, for micro-businesses, the availability of finance is of essence (Ayotte, 2003, p.11). Usually, the amount of capital available determines the kind of business to venture into and also the willingness. Only those with enough capital and have means to raise the same are placed in a better position to engage themselves in entrepreneurship. Obliviously, finance is crucial when one needs to join the business world (Backes-Gellner et al., 2003, p. 31).

Legal variability is another crucial factor that affects the willingness to become an entrepreneur. Availability of limited liability, cost of gaining access and the completeness of the provided shield are some of the variables that affect entrepreneurship. Limited liability restricts an entrepreneur‘s risk to the amount of his initial capital in a firm. Similarly, the protection of intellectual property is equally important. The enforceability of covenants affects entrepreneurship in that the rate at which new idea is transmitted from one company to another. Labor market regulation is without doubt affecting the viability of small enterprises. Finally, taxation also has a great contribution when it comes to entrepreneurship. The level of income taxation significantly affects individuals willing to venture into business (Berle 1932, p.13).

Policy Efforts

Recently, entrepreneurship has become a major focus as it has increasingly become a principal source of jobs and wealth. To respond to this, many policymakers and development practitioners have taken a keen interest in entrepreneurship by providing resources and activities to support it. The areas that policymakers focus on to enhance entrepreneurship are; financial tax, human capital, physical infrastructure, tax and regulatory climate, entrepreneurial climate and, business culture.

Human Capital

As Djankov, La Porta, Lopez-de-silanes and Shleifer (2002, p. 196) argue that the success of entrepreneurship begins with the entrepreneur himself. This means that the formation of new businesses requires people with great talents and individuals willing to take risks that are involved. For regions with high chances of entrepreneurial activities, often two approaches are used to develop human capital. The first approach involves all attempts to increase entrepreneurship through investing in research, promoting innovation, commercialization and engaging in educational institutions. The other approach involves the offering of support to available entrepreneurs through education, offering advice and, offering other services in the business development process.

Financial Capital

Regions rich in entrepreneurs usually have a strong capacity for venture capitalists or angel investors. In most cases entrepreneurs rely on debts as their sources of finance. According to a survey, most financial assistance programs were loan guarantees, direct loans and, loan participation. Only less than 10% of the programs attracted direct or indirect equity investments. Public policy focuses on debt financing as opposed to equity capital. Similarly, the availability of funding is important in all the stages of business development. This requires that all nations should focus on funding the companies at all stages to ensure their success.

Tax and Regulatory Climate

The tax and regulatory climate are policies developed by a nation and can affect entrepreneurship a significantly (Gilson, 1999, p. 580). Many researchers point out that public bureaucracies and regulatory policies acts may act as a hindrance to businesses and particularly, entrepreneurs. In many states, business start-ups are faced with a disproportionally federal regulatory burden as compared to macro businesses. On the other hand, entrepreneurial climate refers to the community’s willingness and openness to new ideas and taking risks as well as the extent to which entrepreneurs are appreciated, supported and recognized. Education system, political environment, corporate and, financial sector are some of the entrepreneurial climates that affect all businesses within specific localities.

Entrepreneurship in Saudi Arabia

According to Abdullah (2007, p. 56), more than half of the century ago, the GCC countries and particularly, Saudi Arabia were poor and loosely governed. All this changed when oil became a major focus of entrepreneurship in these countries and modernity was embraced. Within a short period of time since the discovery of oil wealth, Saudi Arabia had to cope with dramatic changes in the field of entrepreneurship. Worth noting, entrepreneurship in Islam is given a high priority and Saudi Arabia being one of the Muslim-dominated nations, entrepreneurship plays a great role. Like many other oil-producing countries, Saudi Arabia has abundance of opportunities in entrepreneurship. It is estimated that unemployment rate in Saudi Arabia is approximately 20%. Further, the research shows that 30,000 new jobs are created annually while there are more than 100000 Saudi’s seeking employment opportunities. Ironically, while 20% of the Saudi’s are unemployed, about 60% of the job opportunities are composed of foreigners (Almaeena 2007, p.89).

According to Power (2005), Saudi Arabia has emerged as one of the greatest places for entrepreneurial activities. By the end of year 2010, the country intended to join top ten lists of competitive nations. Small and medium-sized enterprises dominate the economy as they contribute to over 92% of the business available in Saudi Arabia. To promote and support entrepreneurship in Saudi Arabia, a program referred to as Saudi fast growth has been developed. This program ranks the fastest-growing companies or enterprises in accordance with their revenues. More than 70% of the fast growth CEOs are entrepreneurs who are founders of other companies and are still in their businesses. These world-class entrepreneurs are highly competitive as their revenues grow at about 43% annually which is more than ten times the rate at which the kingdom’s private sector is growing. This program has become a powerful source of inspiration for the coming generation of entrepreneurs (Atkinson, 2007, p.4).

Inquest for global competitiveness, Saudi Arabia is making dramatic moves in the entrepreneurship world. In 2005, Saudi Arabia was ranked as the 67th nation by the World Bank. Surprisingly, by 2009, it had climbed it’s way up to number 13. Out of the 178 countries doing well in businesses, Saudi Arabia was ranked 23rd for ease of doing business, the third for ease of property registration and, seventh for ease of paying tax. This was facilitated by the creation of new office for commercial that eased commercial registration within the shortest time possible. This means that Saudi Arabia is in the front line to support entrepreneurship through creation of climate that supports business and rewards innovations as well. The regulatory and tax policy that supports business growth coupled with efficient equity markets has created a favorable climate for entrepreneurship growth. In addition, cultural and education reforms in the country essentially promoted the growth of businesses more than ever before (Ba-lsa, 2007, p. 54).

Another program that has been formulated to attain the height of entrepreneurship in the country is the Bab Rizq Jameel (BRJ). This program specifically assists the young entrepreneurs interested in becoming self-employed. This initiative was established in 2007 by the community services programs of the Abdul Latif Jameel. It financed 5110 businesses and projects that resulted in a total of 41284 jobs for young entrepreneurs by 2009. Similarly, the program offered services like training, micro-project financing, SME financing, direct employment, taxi ownership among others. The loans offered by this program are payable within five years giving people more reason to engage in the business. Many banking service providers have shown interest in this program initiative including the development bank group that has signed a memorandum of understanding with the BRJ in an attempt to promote entrepreneurship

Constrains

The greatest constrain that hinders entrepreneurship in Saudi Arabia is the culture that seeks to underestimate the role of women in development. This is more common in the Islamic-dominated regions that disregard women in businesses. The population of women in Saudi Arabia is high, hence; the need to involve them in businesses. Fakkar (2007) continues to argue that women have been less involved in entrepreneurship and this trend has been dragging entrepreneurship in the entire country. There are many innovative and talented Islam women in Saudi Arabia who have the capacity to do well in business even more than the dominating men. Failure to incorporate them into business is a dangerous trend that constrains development and entrepreneurship in all nations (Minkus-McKenna, 2006, p.79).

As Hassan (2006, p. 206) deduces, the economy of Saudi Arabia has for a long time been dominated by big corporations that deal with oil products while paying no attention to the economic development. Small and medium enterprises contribute to about 28% of the GDP and surprisingly, they employ more than 80% of the working individuals. Due to the fact their services do not meet the international standards; these enterprises face challenges when acquiring bank loans. Small and medium enterprises considerably suffer from a lack of marketing skills and professionalism in maintaining financial records and conducting feasibility studies. There is a need to ease the country from over-reliance on oil. This can be achieved by only improving the entrepreneurial sector throughout the entire country. Therefore, all efforts towards a sustainable business development should be enhanced accordingly.

Methodology

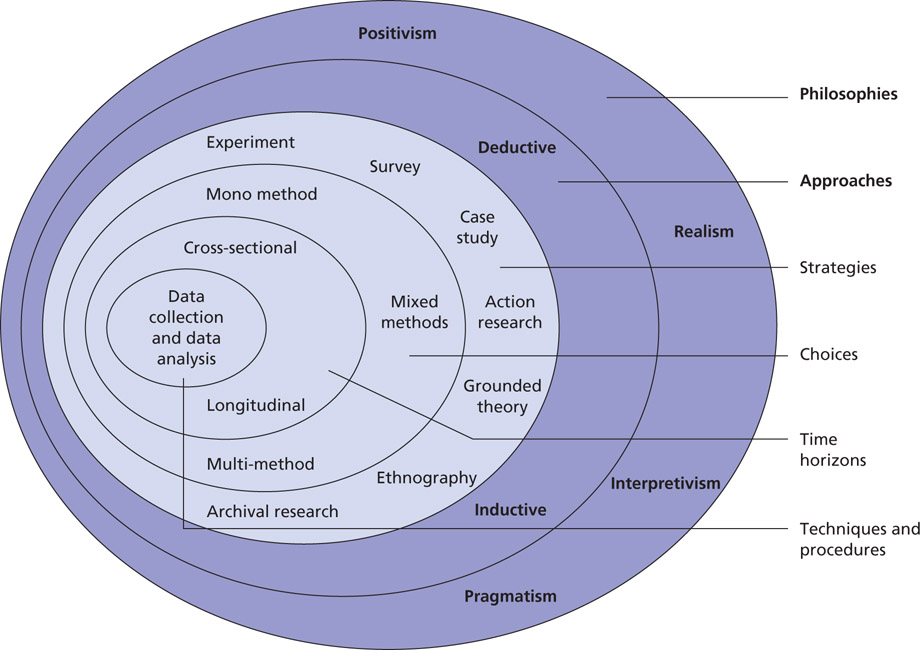

The purpose of this chapter is to present the details of the approach to the research. The approach should be illustrated to increase the validity of the research. The approach to the research was done considering a research onion. Therefore, the methodology chapter will be considered by a discussion of the philosophy of the research, the approach, strategy of the research, data collection, and the focus group.

Research Onion

The diagram below based on Saunders et al (2003) displays the research process, which resembles an onion.

A research onion was used to describe the methodology of the research. The research onion presents a clear framework of the methodology employed. As shown in the diagram above, it has layers representing every item consulted. Through each layer, the research questions will be answered. Using the outer layer, there are various philosophies considered as shown below.

References

Abdullah, S 2007, ‘Jowhara Al-Angari: strengthening Saudi Women’s Rights’, Arab News.

Almaeena, K 2007, ‘Saudi women are no longer standing in the shadows’, Arab News.

Armour, J 2004, ‘Personal Insolvency Law and the Demand for Venture Capital’, European Business Organization Law Review, vol. 1, pp. 1-25.

Atkinson, M 2007, ‘Telling it like it is’, Gulf Marketing Review, vol. 1, pp. 92-98.

Audretsch, D1995, Innnovation and Industry Evolution, MIT Press, Cambridge.

Audretsch, DB 2002, Entrepreneurship: A Survey of the Literature, Report prepared for European Commission, Enterprise Directorate General.

Ayotte, KM 2003, ‘Bankruptcy and Entrepreneurship: The Value of a Fresh Staart’, Working Paper, Columbia Business School.

Backes-Gellner, U & Werner, A 2003, ‘Entrepreneurial Signaling: Success Factor for Innovative Start-Ups’, Working Paper, University of Zurich.

Ba-lsa, MY 2007, ‘Have a firm goal in life – Nadia Al-Dossary’, Arab News.

Berle, A & Means, GC 1932, The Modern Corporation and Private Property, Macmillan, New York.

Bigus, J 2004, ‘Staging of Venture Financing, Investor Opportunism, and Patent Law’, Working Paper, University of Hamburg Institute of Law and Economics.

Dechant, K & Al Lamky, A 2005, ‘Toward an understanding of Arab entrepreneurs in Bahrain and Oman’, Journal of Developmental Entrepreneurship, vol. 102, pp. 123-140.

Djankov, S, La Porta, R, Lopez-de-Silanes, F & Shleifer, A 2002, ‘The Regulation of Entry’, Quarterly Journal of Economics, vol. 117, pp. 1-37.

Fakkar, G 2007, ‘Removing obstacles to women’s business’, Arab News.

Georgellis, Y & Wall, HJ 2002, ‘Entrepreneurship and the Policy Environment’, Federal Reserve Bank of St. Louis Working Paper, pp. 019A.

Gilson, R 1999, ‘The Legal Infrastructure of High Technology Industrial Districts: Silicon Valley, Route 128, and Covenants Not to Compete’, New York University Law Review, vol.74, pp. 575-629.

Hassan, J 2006, ‘Independent authority for SMEs likely’, Arab News.

Minkus-McKenna, D 2006, ‘Personal interviews with Saudi women entrepreneurs in Riyadh’, National Federation of Women Business Owners, vol. 1, pp. 21.

Power, C 2005, ‘Arabia retools’, Newsweek International.