Financial statement analysis is a powerful tool used by many users to learn about the prevailing circumstance of the firm. It helps investors to make sound investment decisions. This paper seeks to carry out financial statement analysis of Lockheed Martin and General Dynamics to establish the most profitable company where investors should invest. In order to achieve this goal, the paper analyzes the financial statements of both companies and carries out a ratio analysis to establish the liquidity and profitability and leverage ratios. Investors should buy shares in General Dynamics because it is more profitable than Lockheed Martin.

A snapshot of General Dynamics

General Dynamics is one of the largest defense contractors in the US. The company is divided into four segments including Information Systems and Technology, Marine, Combat and Aerospace. It is headquartered in Falls Church, Virginia. The company is registered in the New York Stock Exchange as (NYSE: GD). It employees more than 90,000 workers worldwide and has been recognized as a global defense contractor, especially in building ships (“Annual Report: General Dynamic’s annual report 2014” par. 3). It is the major provider of warships and other marine services to the US Navy.

A snapshot of Lockheed Martin

Lockheed Martin is the biggest provider of aircraft for the US Air force. The company earns more than 85 percent of its revenues from the government as a defense contractor. It is registered on the New York stock exchange as (NYSE: LMT). The company has been recognized for its capability to produce high-tech spacecraft, electronics systems and integrated technology system. The company is known for its production of high-tech strike fighter jets such as F-35 and F-22. In fact, the F-35 project accounts for more than 15 percent of its revenues. It has a premier program The Orion scheduled in 2016 (“Annual Report: Lockheed Martin annual report 2014” par. 5). Although the company has been successful, a reducing in defense industry might pose a threat to the long-term profitability of the company.

Capital structure

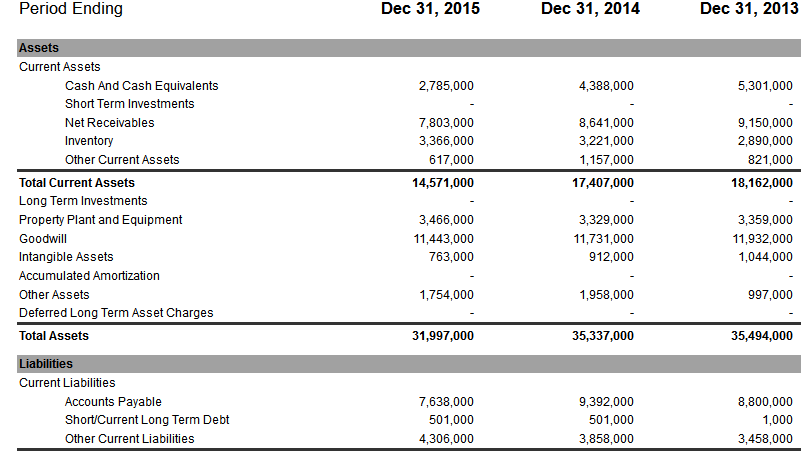

Capital structure refers to how a company funds its overall operations and growth using different sources of funds. Usually, companies fund their operations using either debt or equity capital. The capital structure of General Dynamics is made up of both debt and equity finance. General Dynamics had 482million equity capital and 2,898 long-term debts in 2014. Moreover, it had a retained earnings of 23, 204million which is an indicator the company is making huge profits.

Lockheed Martin’s capital structure consisted of 314million share capital and 3,877million long-term debt capital in 2014. Lockheed Martin had retained earnings of 14,956 million which indicates the company has been profitable. This is an indicator that both company’s the capital structure is made up of debt, equity and retained earnings.

Lockheed Martin

Ratio analysis

Liquidity ratio.

Solvency ratio.

Profitability.

General Dynamics.

Ratio Analysis

From the ratios above, General Dynamics has outperformed Lockheed Martin in liquidity ratios. For instance, the current ratio of Lockheed Martin in 2015 was 1.15 which is below that of General Dynamics at 1.17. In general, General Dynamics has outperformed Lockheed Martin due to its ability to diversify risk.

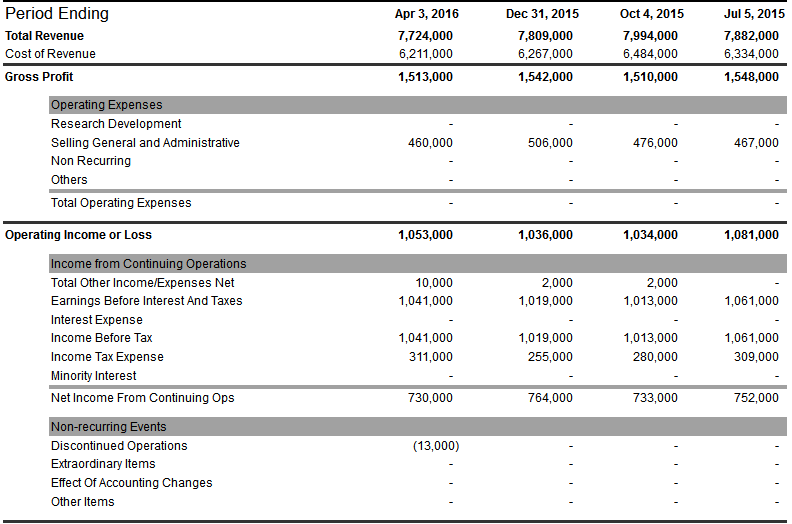

The profitability ratios show that General Dynamics had outperformed Lockheed Martin in 2015. General Dynamics had a return on asset of 8.80, which is above 8.36 by Lockheed Martin. However, in 2014, Lockheed Martin outperformed General Dynamics by 2.71. The profitability ratios show that General Dynamics is more profitable that Lockheed Martin (Rao 99). Therefore, investors should consider investing in General Dynamics because it is likely to pay high dividends than Lockheed Martin (Ledgerwood 220).

The leverage ratio shows that Lockheed Martin is high leverage. The financial risk of Lockheed Martin is very high. Investors should be concerned about the ability of the company to pay its debts (Vandyck 23). A high leverage company is likely to pay fewer dividends because most of the retained earnings will be used to meet its debt obligation.

Accounting principles

Both companies present their financial statement using GAAP including those of their subsidiaries. The companies eliminate intercompany balances and transaction in consolidated financial statements. The company makes estimates and assumptions, which affect the amount of balances in the consolidated financial statements. These assumptions are reported in the note to financial statements. Both companies impair their goodwill at least once annually whenever certain events occur that might affect the value of goodwill. These events might include factors such as deterioration of economic conditions, the decline in market capitalization and stiff competition that might influence the value of the company (Peterson and Fabozzi 78).

Which company should you invest?

According to the financial analysis result, General Dynamics is more profitable than Lockheed Martin. Moreover, General Dynamics has high profitability ratios which are an indicator that the company will pay high dividends. The leverage ratio also shows that Lockheed Martin is highly leverage which increases the risk of the company going into liquidation. Therefore, investors should invest in General Dynamics because it has a stable leverage ratio which is an indicator that it will able to meet its obligation as and when they fall due.

Works Cited

Peterson, Pamela P., and Frank J. Fabozzi. Analysis of Financial Statements. Hoboken: John Wiley & Sons, 2012. Print.

Vandyck, Charles K. Financial ratio analysis : a handy guidebook. Victoria, B.C: Trafford, 2006. Print.

Ledgerwood, Joanna. Microfinance handbook : an institutional and financial perspective. Washington, D.C: World Bank, 2010. Print.

Rao, M. V. Management Accounting. New Delhi: New Age, 2013. Print.

Annual report: General Dynamics annual report 2014. Web.

Annual report: Lockheed Martin annual report 2014. Web.

General Dynamics