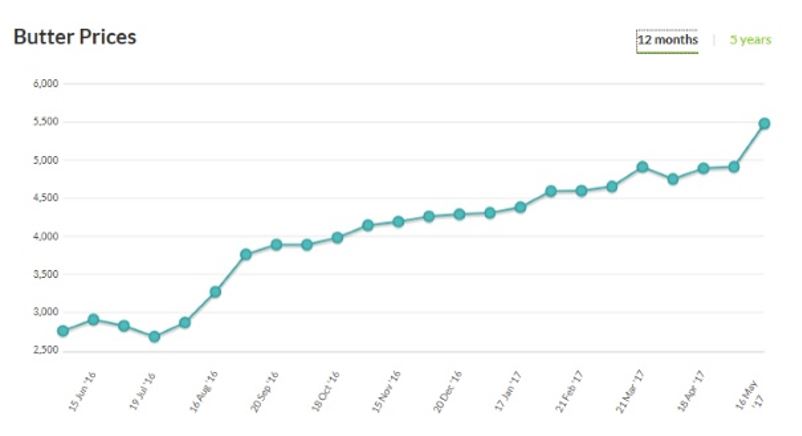

Current data on the butter industry in the United Kingdom points to a number of difficulties that companies such as Flora will have to overcome. According to the recent report prepared for Butler and Grierson (2017) for The Guardian, butter prices are expected to rise in association with dairy production shortages. Over the past year, butter prices have increased by twenty percent in the United Kingdom as farmers have begun to face dramatic challenges in addressing market demands (Poulter 2017). It is essential to mention that the inflated prices for butter are much higher compared to those of other consumable products; furthermore, there has been a noticeable shift in demand from vegetable-derived spreads to dairy butter, bringing more pressure on farmers as a result (European Commission 2015). Terazono (2017) from Financial Times also pointed out the problem, adding that the strains that the UK and Europe are currently facing have global origins. At the moment, Flora is significantly challenged by the astronomical demand for dairy butter that is undermining its overall profitability as a non-dairy butter brand.

With the increased demand for butter and the predicted growth of the global market for butter and margarine come significant marketing challenges that Flora will have to address. One of these, for example, is the challenge of appealing to the demographic of consumers who have not eliminated dairy products from their diet and prefer consuming butter made from milk (Food Standards Agency n.d.). As a brand, Flora (2017) has positioned itself as a company that promotes the consumption of plant-based butters and spreads that are “rich in omega 3 and 6 and lower in saturated fat than butter […] helps keep your family happy and healthy with a decision boost of plant goodness” (para. 1). Therefore, to cater to new trends in the industry, it is possible that Flora will have to branch out and begin to produce dairy-based butter; that said, a focus can be placed on cooperation with local farmers who produce organic milk that does not contain harmful ingredients. Other marketing challenges associated with the butter industry include finding reputable farmers-suppliers who can manage the rising demand for butter and establishing efficient supply chains to ensure that customers will always have Flora butter available to them.

Marketing Objectives

The following is a breakdown of marketing objectives that Flora will aim to accomplish:

Specific: the firm will address the growing demand for dairy butter through cooperating with local farmers while simultaneously raising awareness about the benefits of the non-dairy butter that Flora is already producing.

Measurable: the objective is considered accomplished when customers start purchasing the firm’s new butter produced from animal-derived ingredients at the same rate as Flora’s plant-based butter.

Attainable: the goal of addressing the demand for butter is realistic despite the current challenges in the industry; with appropriate management and the optimisation of business processes (including relationships with farmers-suppliers), it will be attained.

Relevant: despite the fact that farmers are currently experiencing pressure when it comes to addressing the spiking demand for dairy products, Flora is expecting to find reliable suppliers in order to offer the market a new product without compromising the popularity of the non-dairy butter that it also produces.

Time-based: it is expected that Flora will commit to addressing the identified problem within a year. If the prices of dairy products continue to increase and the demand for butter does not decline, the company will develop a revised action plan.

SWOT Analysis

Strengths of Flora butter are directly associated with the company’s attitude toward the production of consumable goods and the introduction of dairy-free alternatives to traditional butter. As a part of Unilever, a large company that manufactures more than four hundred brands, Flora has a large presence on the market and can capture large audiences. Another strength that Flora uses to its advantage is the human capital with a wide variety of skills that contribute to brand expansion and development, especially with the involvement of the company’s CEO, Paul Polman, who has previously worked for such competitors as Nestle (Rushton 2011).

At the present moment, the demand for non-dairy butter is decreasing, which means that Flora is becoming less popular among consumers. The second weakness is associated with a relatively high price compared to rival brands that offer more affordable options to consumers.

In the environment of growing popularity of dairy butter, Flora has a potential to diversify and offer the market what it demands. With the use of social media marketing and special promotions, Flora can still maintain its reputation as a healthy brand but also provide dairy options for its new segment of consumers.

It is possible that with the rapid decline in demand for butter substitutes, Flora will have to undergo a complete change of positioning and start producing dairy butter. Another threat is the growing price of butter both in the UK and worldwide, which means that Flora will be unable to set affordable prices on its new product.

Target Market

Before analysing the target market of Flora, it is essential to mention findings that explain characteristics driving consumer preference for butter as a product. Krause, Lopetcharat and Drake (2007) found that quantitative consumer testing showed the most favourable characteristics of butter as good flavour and natural content, while negative aspects were associated with high prices and cholesterol content. Based on these findings, Flora will have to make adjustments in the quality of its butter as necessary. The target market for Flora butter includes almost every consumer demographic due to the wide popularity of the product. However, the key audience that will be addressed in marketing efforts includes families with children who consume dairy products on a daily basis. Since Flora has not yet branched out to produce butter made from dairy products, this customer segment can serve as an indicator for testing the viability of a new product. Because the second part of the marketing objective for Flora implies raising awareness about the benefits of non-dairy butter consumption, the company should also target its products towards health-conscious customers who have already eliminated dairy from their diets. Therefore, the targeting strategy of Flora butter will be two-fold: catering to the needs of a new customer segment that the company has not targeted before and reinforcing the reputation of the brand among customers who choose plant-derived butter over dairy.

Since prices of dairy butter are continuing to increase (Figure 1) and the market is expressing a demand, it would be ineffective for Flora to ignore potential business opportunities (Fletcher 2017). It is essential to note that the company should not compromise its vision for profit and only attempt to produce dairy butter from organic ingredients; this applies to Flora’s plant-based spreads, as well.

Positioning

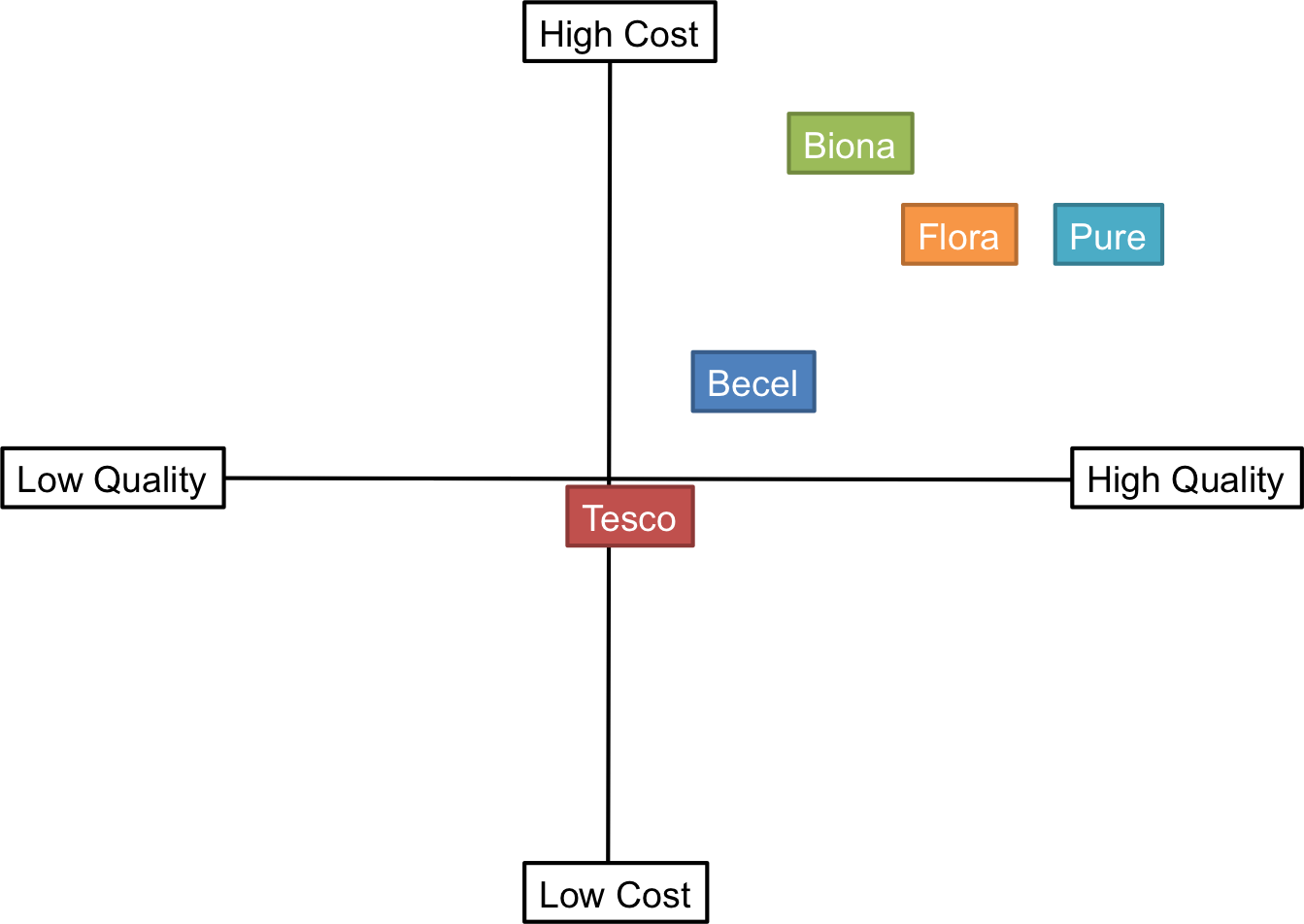

The current competitors of Flora that also produce dairy-free butter in the United Kingdom include such companies as Dairy-Free Pure, Biona, Becel, Vitalite, Suma, and Tesco. However, given the possible shifts in its strategy, the company’s positioning against the mentioned competitors can be classified as ‘past positioning,’ which can be seen in the perceptual map below:

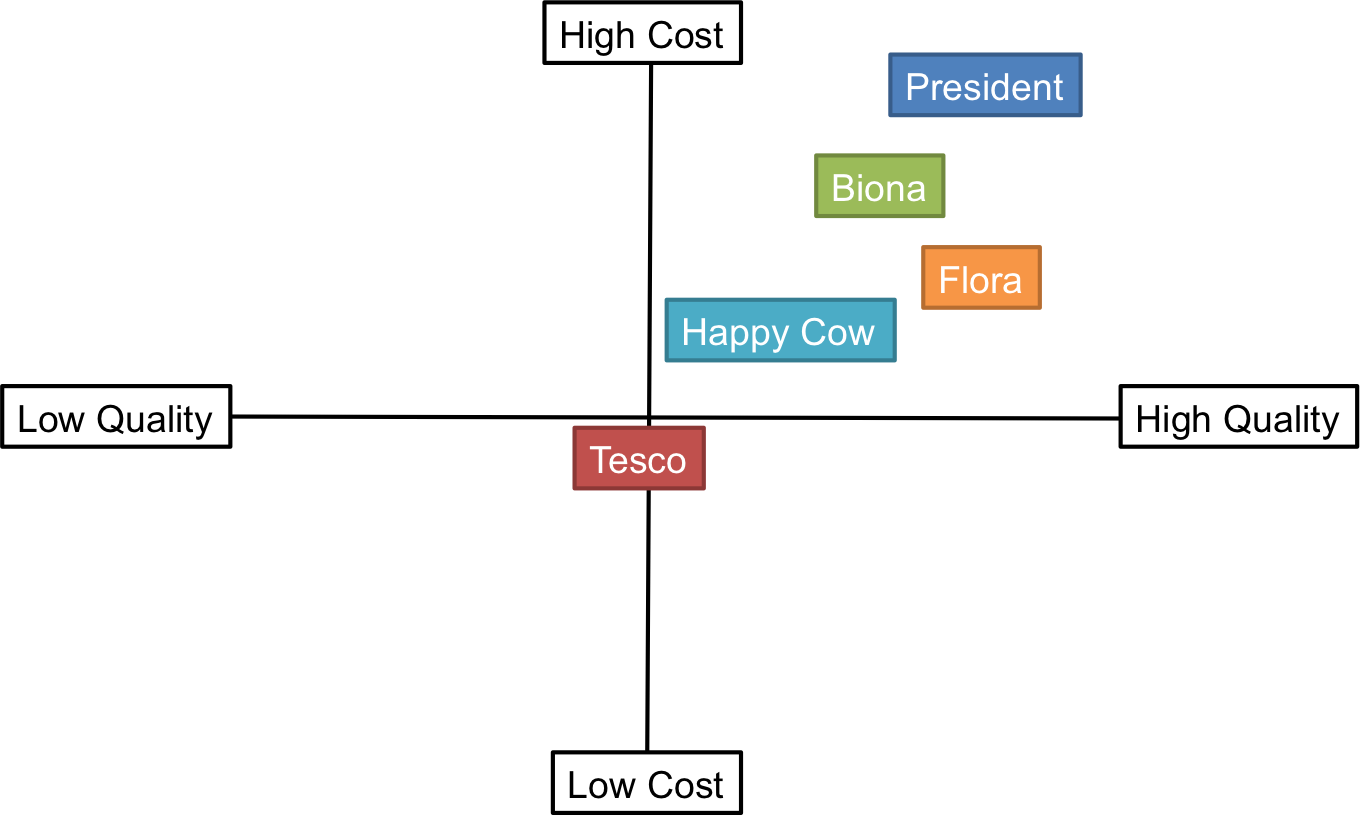

Manufacturers that supply dairy butter to the market include President, Organic Valley, Grove Dairy and Happy Cow. It is expected that the introduction of dairy butter in Flora’s product range will lead to the company positioning itself as a ‘compromise’ brand, providing options for dairy-free consumers as well as those who choose dairy butter over alternatives. The conceptual map below shows the positioning of Flora concerning potential competitors that only produce dairy butter:

As seen from both perceptual maps above, Flora is centrally positioned between high-cost and high-quality brands. In the new positioning, it is expected to experience the most severe competition coming from Biona and Happy Cow, companies that have opposing views on the production of butter and other products for consumption. Drastic changes in the brand’s name, pricing strategy or attitudes to business are not recommended. However, introducing a new product manufactured from animal-derived ingredients is a significant change that requires planning. First, Flora is advised to negotiate with local UK farmers on the appropriate supply strategies for the production of butter made from animal-derived ingredients (The Government Office for Science 2011). Second, Flora will develop an advertising campaign to introduce the new product to the market, a strategy that the majority of businesses use (Hand 2017). In its advertising campaigns, Flora is advised to rely on its expertise as a brand that was among the first to appeal to the potential health benefits of plant-based butter (Degun 2016). A vision statement for the new marketing campaign can be the following: as a brand with experience in making butter from plant-based ingredients, we are introducing our new product to the market, manufactured with love and care for the environment. Thus, Flora is expected to make important changes in its approach towards producing butter to cater to the rising demand for the product in the market.

Reference List

Butler, S & Grierson, J 2017, ‘Butter price at all-time high as dairy production curdles’, The Guardian. Web.

European Commission 2015, Short-term outlook for EU arable crops, dairy and meat markets in 2015 and 2016. Web.

Fletcher, I 2017, ‘You butter believe it. Price of butter has almost doubled in the last 12 months as Brexit and dairy inflation takes its toll’, The Sun. Web.

Food Standards Agency n.d., Understanding of food labelling terms. Web.

Hand, J 2017, ‘Marketing health education: advertising margarine and visualising health in Britain from 1964 – c.2000,’ Contemporary British History. Web.

Krause, A, Lopetcharat, K & Drake, M 2007, ‘Identification of the characteristics that drive consumer liking of butter’, Journal of Dairy Science, vol. 90, no. 5, pp. 2091-2102.

Poulter, S 2017, ‘Butter prices surge by 53% after huge increase in demand following studies that concluded the food is not bad’, Daily Mail. Web.

Terazono, E 2017, ‘Why butter prices are at record high’, Financial Times. Web.

The Government Office for Science 2011, The future of food and farming. Challenges and choices for global sustainability. Web.

Rushton, K 2011, ‘Unilever to shake up £5.1bn global advertising spend’, The Telegraph. Web.

Degun, G 2016, ‘Flora to launch £12.5 million brand repositioning campaign’, Campaign. Web.

Butter prices 2017, image. Web.

Flora 2017, About us. Web.