Brief Background Information

Harley Davidson, Inc. is an American manufacturer and distributer of motorcycle and related products. Headquartered in Milwaukee, Wisconsin, this firm has been successful in the motorcycle industry, expanding its operations to other regions in Europe, Asia, and parts of Africa. It is one of the few firms that were able to thrive in the face of 2008 global recession. In this study, the researcher will conduct an analysis of this firm to determine its current position and how it was able to withstand global recession.

Present financial performance and sales as per last year

The financial performance of this firm has been impressive over the last few years. In the year 2007, the net profit for this firm was $ 933,843. This was a slight drop from the previous year’s $ 1,043,153. The net revenue in 2007 was $ 4,208,016 while in 2006, this figure stood at 4,618,997. In Europe, the market share for this firm is estimated to be 9.6% while in the United States; it enjoys a market share 48.2% in this industry (Ryan & Wheelen, 2008).

Strategic Posture

Harley Davidson, Inc has specific values and policies which direct its operations in the market. The following factors have been very important in defining the success of this firm.

Mission

In its mission statement, Harley-Davidson clearly states that it seeks to fulfill the dreams of its clients by offering them a unique motorcycling experience through clearly defined market segments.

Objectives

The objective of this firm is to offer its clients high value products that will turn them into loyal customers of this firm. It has been keen on expanding its operations beyond the United States in its quest to become the leading manufacturer of motorcycle in the global market.

Strategies

This firm uses various strategies in order to increase the value of the shareholders of this firm. One approach that has been successful is the globalization strategy. The firm has expanded its operations to several markets beyond this country. The firm has also diversified its products by venturing into the financial industry. These strategies have assured it of a steady flow of income.

Policies

Harley Davidson, Inc has developed clear policies to guide its operations in the market. Under the leadership of James Ziemer, this firm has introduced policies which emphasize on the quality of their products. The firm also emphasizes on unique product delivery approaches in the market (Ryan & Wheelen, 2008).

External Analysis

The external environmental factors play an important role in defining the future of a firm. In this section, it was important to define external environmental factors that affect the operations of this firm.

Opportunities

The market offers a wide range of opportunities. The emerging technologies have made it easy for this firm to operate in the global market. As Cook (2005) notes, the global market offers a firm an opportunity to expand its growth. Elimination of trade barriers in many countries such as China has also enhanced the ability of this firm to operate globally.

Threats

The global market has a number of threats, top of which is the stiff competition from Japanese automobile manufacturers. The 2008 global recession is another threat, although the firm was able to overcome it. The increasing power of the buyers in the market and suppliers is another major threat to this firm’s profitability.

Societal Analysis

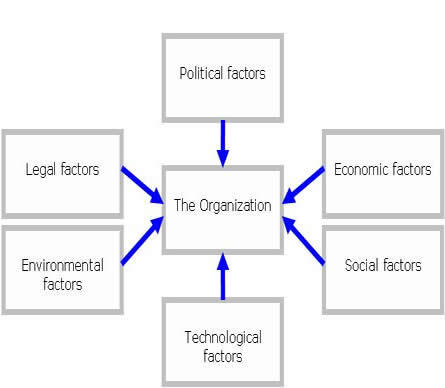

The management of this firm must also be keen to understand the following external environmental forces which may affect the firm’s operations.

Economic

The economic environment in the major markets of North America and Europe were affected by the 2008 economic recession. However, Harley Davidson, Inc has been able to capitalize in the growing number of the middle class in the Asian market. Its sales were not adversely affected by the economic recent recession.

Politics

The political environment may also affect the operations of a firm (Keegan & Green, 2013). In the United States, Western Europe, and Canada, this firm has enjoyed a prolonged political stability that has assured it of law and order in its market. The firm has also enjoyed operating in a market where the political class does not interfere with the operations of private firms. These factors have enhanced its performance.

Socio -cultural

The socio-cultural factors have not acted in favor of this firm. Harley Davidson has been relying on Baby boomers as its main target market. This market segment is aging, and they are considering the use of cars other than motorcycle because of the need for comfort. The firm has now focused on women. This is yielding fruits, but in other markets, such as in Asia, it will have to fight the belief that women are not supposed to ride bikes.

Technology

Technology has been one of the strongest pillars of this firm in the market. The firm uses emerging technologies to enhance its production and marketing strategies. Just-in-time concept has helped Harley Davidson, Inc to deliver high quality products to its customers in a reliable manner. Communication technologies such as the use of social media have enhanced marketing strategies of the firm.

Legal

The legal environment is another important aspect of the external environment. In the United States, there are laws which define how this firm should conduct its production, warehousing, and marketing activities. The law also defines issues such as copyright to protect designs and other intellectual rights. Other countries outside the United States also have their own laws that his firm must observe in its operations.

Environment

Environmental issues have become critically important to many firms as they try to ensure that their production adhere to the set emission limits. In the United States, the national government has set limits of greenhouse gases a firm can emit per given period. Many other countries where this firm operates also have these policy guidelines. Harley Davidson has the responsibility to protect its environment.

Task Environment

In order to have a clear understanding of the economic environment under which this firm operates and its current position, Porters-Five Forces analysis will be necessary at this stage. The following forces will help in understanding the current position of this firm in order to help in making decision about the future.

Threat of new entrants

In the current liberal market where trade bottlenecks have been eliminated, one of the biggest threats that Harley Davidson faces in its home market is the entry of new players. Japanese motorcycle manufacturers such as Honda and Yamaha have made an entry into the American markets with great success. Other firms have also been penetrating this market, increasing the level of competition.

Threat of substitutes

As stated before, the Baby boomers were the major market segment for this firm. However, they are currently considering alternative means of transport such as car because their age cannot allow them to use motorbikes any more (Knight, 2006). This has affected sales of this firm’s products. Other products that offer alternative service to that of this firm include horses and emerging new models of cars.

Bargaining power of suppliers

The bargaining power of the suppliers of specific raw materials has increased as the motor industry keeps on growing. The growth of the motor industry means that these suppliers have a large market for their limited products, making it easy for them to dictate the market forces such as the pricing of their products.

Bargaining power of buyers

The bargaining power of the buyers has also increased. In the past, Harley Davidson faced minimal competition in the American markets. The emergence of Japanese motorcycle manufacturers has increased competition because these new entrants charge low prices. With the stiff market competition from various players, consumers have been empowered because they have a number of choices in the market.

Competitive rivalry

The competitive rivalry both in the local and international market is manageable. In the United States, Harley Davidson controls about 50% of the market share. In the foreign markets, the firm has a market share of about 10%. The market rivals have avoided direct confrontation with one another for the obvious reasons of possible price wars.

Internal Analysis

In order to determine the ability to manage external environmental forces, the internal environment of Harley Davidson, Inc will be analyzed in this section. The following internal environmental factors should be determined.

Strengths

The strength of this firm lies in a number of factors. This firm has enjoyed a long period of financial success, giving it a strong financial base to support its operations in the market. The long experience in this industry means that it has great knowledge about production and marketing strategies. This has enabled it to expand to the global market. Effective management unit is another strength that has enhanced success of this firm.

Weaknesses

Harley Davidson, Inc’s main weakness is its inability to maintain a highly diversified range of products. In 1996, the firm sold out its Transport Vehicle segments for fear of losing focus in its main product segment of motorcycle. The management has also failed to be aggressive in expanding the market to the emerging economies in parts of Asia and Africa.

Internal Environment Analysis

Harley’s strength and internal analysis above may not be sufficient without an analysis of corporate culture and corporate resources. These are very important internal environmental factors that define effectiveness of the firm’s operations in the market.

Corporate culture

Harley Davidson, through the corporate leadership of James Ziemer, has developed a set of values and beliefs that guide activities of all the stakeholders of this firm. He once described these values as passion for business, sense of purpose, and operational excellence. This culture has helped in defining activities of every stakeholder in this firm. It has also helped in enhancing integration between employees and top management.

Corporate resources

To achieve success in the corporate world, Aaker (2009) says that the corporate resources must be clearly defined. At Harley, corporate resources can be defined in two approaches as stated below.

Marketing

Huge market share of this firm can be considered an important corporate resource. This firm controls about half of American Motorcycle market and 10% of the world’s market.

Finance

Financial statements shown in the appendix clearly show that this firm has a healthy financial flow, especially through the sale of its products locally and internationally.

Recommended Strategy

Harley Davidson, Inc’s resistance to recession shows that the management has a unique capacity to operate successfully even in the face of a crisis. However, the management should consider the following recommendations.

- Harley Davidson, Inc should consider expanding to the emerging economies

- The management of this firm should increase its presence in the social media.

- The management should embrace emerging technologies in its production strategies to enhance its innovativeness.

Implementation

These strategies must be implemented in an effective manner in order to ensure that they are of value to the management. The management should conduct a comprehensive market research in the emerging economies in order to determine the appropriate market entry method that it can use. To increase its presence in the social media, the firm may need to hire experts in this field to help in developing a plan on how this should be done. The emerging technologies can be managed by having a team of employees in the field to monitor changing trends in marketing (Temporal, 2010).

Control and Evaluation

With an effective strategy that will increase its profitability, Harley Davidson will need a control and evaluation team responsible for monitoring the implementation of new strategies. This team will coordinate with departmental heads to determine the progress made in implementing various strategies. The team will also help in addressing challenges that may be faced in implementing new technological inventions or any other relevant issue.

References

Aaker, D.A. (2009). Strategic Market Planning. New York: John Wiley & Sons.

Cook, J. (2005). Understanding Marketing Strategy and Differential Advantage. Journal of Business Strategy, 49(2), 137-142.

Keegan, W. J., & Green, M. C. (2013). Global Marketing. Upper Saddle River: Prentice Hall / Pearson.

Knight, G. (2006). Entrepreneurship and Marketing Strategy. Journal of International Marketing, 8(2), 12- 32.

Ryan, P. & Wheelen, T. (2008). Case 16: Harley Davidson Inc. Thriving Through Recession. Dubai: University of Dubai.

Temporal, P. (2010). Advanced brand management: Managing brands in a changing world. Singapore: John Wiley & Sons.

Zarrella, D., & Zarrella, A. (2011). The Facebook marketing book. Beijing: O’Reilly.

Appendix

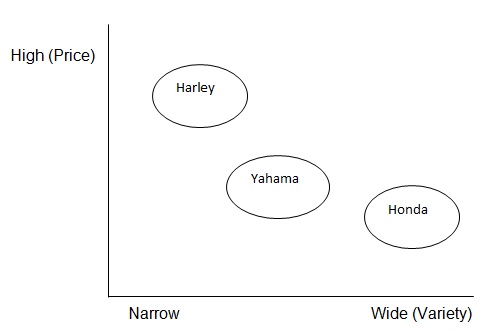

Strategic group mapping of the company

The strategic map above shows the position of Harley Davison in the market in terms of variety of product it offers and the pricing strategies. It has the most expensive products in the market compared to the two global competitors. This is so because of its high quality products. In terms of variety, its competitors offer more products. Haley has concentrated its efforts on the manufacture and sale of motorbikes. However, companies such as Honda have expanded their lines of products besides motorbikes to include generators and other light machines.

PESTEL Framework

PESTEL framework explains how external environmental factors act in unison to influence operations of a firm.

As shown in the figure above, a firm may need to align its operations to these environmental forces in order to avoid their disruptive impacts when ignored.

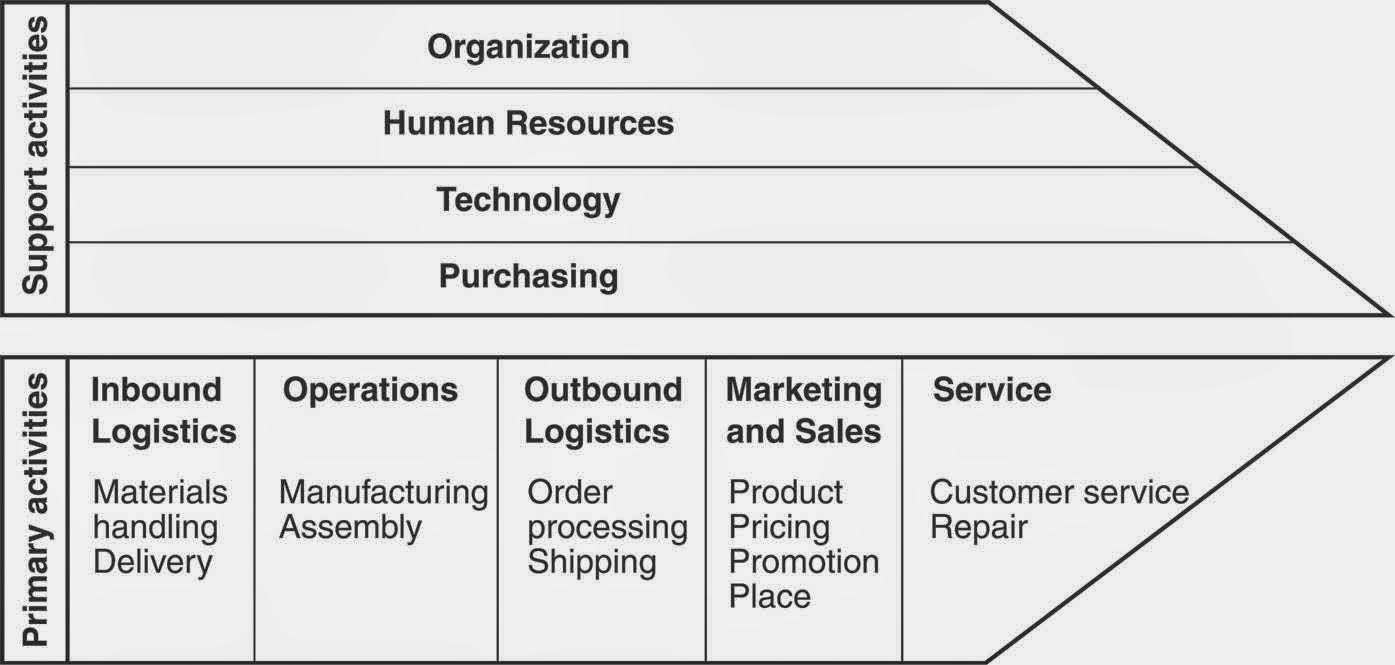

Value Chain Analysis

The value chain framework below shows activities that Harley Davidson cannot ignore when it comes to offering its customers superior value in the market.

The frame shows a series of activities that work very closely to ensure that customers get maximum value out of their purchases. Value management starts by getting high value raw materials, using relevant technologies and highly skilled individuals in the production process, using efficient supply chain modes, and using the right delivery approaches to ensure that the product reaches the customers.

Financial Statements