Executive Summary

The dynamic nature of the information technology industry has attracted world wide attention especially due to rapidly increasing innovations and industry overcrowding which has resulted in unhealthy competition among firms in the industry. Through extensive secondary research, the report analyzes the conditions prevalent in the industry by focusing on one of the major companies in the industry, HP which has been confronted by major challenges arising from increased competition and external debt despite its impressive performance and dominance in the industry.

HP has achieved impressive performance over the years and has also dominated a relatively larger market share for its products and services. However, the company faces major competition from other major companies such as IBM, Dell, and EMC Corporation. This calls for the need to device a strategic plan to acquire and maintain competitive advantage in the industry. This may be achieved through greater emphasis on policies geared towards maintaining competitiveness through utilization of the company’s key competencies, production of superior quality goods, extensive marketing and strategic business mergers and acquisitions.

Introduction

Hewlett Packard (HP) is a multinational corporation operating in over 170 countries across the world. It is one of the world’s largest information technology companies having been ranked among the top five companies in the global technological hardware and equipment industry in 2010 by Forbes Magazine. The company offers a complete and competitive technology product portfolio, infrastructure and business offerings that range from hand held devices to some of the most powerful super computer installations. The company provides consumers with a comprehensive IT infrastructure which constitutes of a wide range of products, services and solutions which are designed to meet the modern consumer needs.

Hewlett Packard was founded in 1939 by Bill Hewlett and Dave Packard with a starting capital of $ 538. During the following years, the company took off as a leading developer for technological solutions by increasing the number of employees in the company to facilitate in research, development and production. The company further introduced a business catalogue which provided information regarding its ever growing inventory products to consumers. As a result, the company achieved remarkable success in the subsequent years which led to its globalization in the late 50s.

The global technology industry is rapidly changing due to innovation and advancement in technology. Numerous companies have been established in the industry and are seeking to dominate the market through provision of superior products. Hence, for Hewlett Packard to maintain its competitive advantage, it has to identify the major and emerging competitors in the market, develop strategies to enhance competitiveness using its key competencies, exploit new and emerging market opportunities, and promote continuous innovation and improvement of its products and services in order to meet the consumers ever changing demands.

Data Collection Techniques

Data was collected through secondary research techniques where information from press releases, analysts’ reports, trade journals and business annual reports were reviewed. This was obtained through internet search where reliable online sources were used to gather data relating to Hewlett Packard and its competitors. Data was also gathered through an extensive library search and indexing to access written texts relating to business intelligence information for Hewlett Packard. In addition, relevant materials were also gathered from company’s websites among other related periodicals.

Secondary research was the most preferred method of data collection since in comparison to primary research; it was easier to collect data since it was readily available in form of printed publications and also from the internet. In addition, the ease in data availability saved on the time which ensured the business intelligence data was made available to the company in time to make the necessary organizational adjustment. Local secondary sources of data were especially more revealing hence provided a wide range of information which was necessary in formulating informed strategic plans for the future. Further, the secondary data obtained was informed by expertise and professionalism and this would not have otherwise been possible while using other forms of data collection.

However, this method of data collection did not provide any real control over data. Consequently, the data collected may not have specifically answered the questions that the study sought to answer. In some cases, secondary data gives rise to poor quality data which may result in false information which in turn may result in penalties or in some cases litigation.

Hewlett Packard company summary

According to Hewlett Packard company’s 2010 annual report, Hewlett Packard’s operations are organized in seven business segments; “services, enterprise storage and servers, HP software, personal system group, Imaging and printing group, HP financial services, and corporate investments” (HP Annual Report 2010). The HP enterprise provides IT products and solutions that enable business customers to effectively manage their existing information technology environments. These products serve to accelerate growth and minimize risk while reducing the overall costs of business.

HP offers a wide range of services which include consulting, outsourcing, and technology services to its clients. The company invests a considerable amount of resources in consulting and support professionals who serve the clients diligently and. HP provides a broad portfolio of storage and server solutions in order to match the combined product solutions often required by different customers across industries and regions. These include Industry Standard Servers and Business Critical Systems among other information technology solutions. The company further provides enterprise and service provider software and services such as Enterprise IT management software, information management and business intelligence solutions and communication and media solutions (HP Annual Report 2010).

The company has registered remarkable financial success over the years. Through its financial news, the company reported net revenue of $ 33.3 billion which was $2.5 billion higher than the previous years (HP, 2011). Hence, the company is one of the most impressive global performers in the information technology industry. In 2010, the company’s gross margin increased and the company was further able to deliver a 50% growth in organic Hp Networking as well as the earning per share outlook (HP 2011). This was primarily due to diversification of the networking products and increment in rate of service during the fiscal year. Currently, the company’s shares are trading at $ 41.43 although the company’s shares have been fluctuating in the stock market; the price provides shareholders with a relatively higher return.

However, as of 31st October, the company had a total debt of $ 22304 million, which comprised of a long term debt of $ 15258 million and short term borrowing $ 7046 million (HP 2011). This has negatively impacted on the company’s operation since heavy debts are often associated with negative implications on company’s overall performance. Ychart information revealed that the Hewlett Packard equity debt ratio was 1.89 as at 19th March, 2011 (Ychart 2011).

Hewlett Packard SWOT analysis

Strengths

One of the greatest strength in Hewlett Packard lies in its strategic business position. HP is a multinational corporation operating in over 170 countries which has enabled it to penetrate a larger share of the market (Malone 2007). In addition, its brand name has acquired world wide recognition across nations as one of the world’s largest IT companies which have made it products relatively superior.

The company’s business strategies such as its strategic mergers and acquisition have played a major role in improving the company’s global performance. For instance, the acquisition of Compaq Computer Corporation in 2002, Mercury Interactive in 2006, and Electronic data systems Corporation in 2008 among others have played an important role in boosting the company’s performance in the global IT market. In addition, its comprehensive product portfolio has attracted consumers from varying industries making it among the most preferred IT products and service providers across the globe.

Weaknesses

Hewlett Packard strategy of financing assets through borrowing has put the company in heavy long term debts for years which hinder it from taking part in investment opportunities likely to generate growth for the company (Malone 2007). In addition, complaints have been raised over some of the company’s products such as dv series and dm3 which if not improved may result in massive consumer dissatisfaction resulting in loss of market share. Further, the company’s market share is also unevenly segmented.

Opportunities

HP, among other multinational corporations is exploiting the opportunities available in the cloud computing market which will transform a significant portion of the IT industry by making both software and hardware more attractive and efficient hence attracting a larger market share (Ambrust et al. 2009). In mid 2008, HP created a global multi-data centre for cloud computing, research and education and further developed the HP Cloud Assure which is designed to assist businesses to effectively incorporate cloud computing in business operations. There has been increasing demands for these products which may increase the company’s performance in the long run as the global spending on cloud computing is forecasted to exceed $12 billion by the year 2012.

Threats

HP Company is faced by a major threat of reduction in demand due to the forecasted fluctuations in the information technology market and economy slow down that was experiences during the financial crisis of 2007-2009. Indeed, Hewlett Packard experienced decline in its US and other global markets due to the prevailing economic slowdown during the period of the crisis. This was evidenced by decline in its stock values where in 2008, the company’s stock price fell from $ 50.48 to $ 36.91 per share (Taylor & Weerapana 2009).

In addition, the overcrowded and hypercompetitive environment presents a major threat to Hewlett Packard which has to ensure that it remains competitive in a highly dynamic and overcrowded information technology market. The company’s constant efforts to overcome competition from other major IT companies in the market may negatively impact on the company’s long term profitability.

Major Competitors

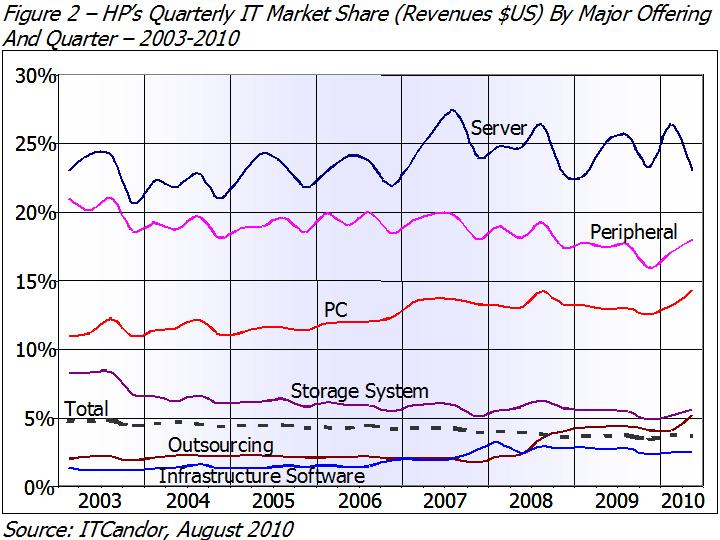

The greatest challenge facing HP is competing for the IT market share. Its market share for the years between 2003 and 2010 is as shown in appendix 1. Although the company has maintained strong market shares in its major products over the years, the company has to continuously battle for leadership in various markets which are dominated by its competitors. Since it has been widely recognized that information technology and its associated innovations could be instrumental in enhancing efficiency, productivity, competitiveness and growth in an organization, companies in the information technology industry seek to dominate the market through development of information technology capabilities that meet the modern consumer needs.

With an already overcrowded IT market, companies in the sector have to compete for the limited market share in order to remain competitive. Hewlett Packard encounters aggressive competition in all areas of its operations from other dominant corporations such as IBM, Oracle, EMC Corporation and Dell among others.

Hewlett Packard competes in terms of price, quality of products and services, brand technology, corporate image and brand reputation, distribution and diversification among other factors. In enterprise servers and storage, the company facing major competition from the global giant, IBM, and EMC Corporation while Dell poses major competition in industry standard servers and sun Microsystems. In imaging and printing, the company faces major competition from Lexmark International, Xerox Corporation, Samsung Electronic, and Canon among others (Pham-Gia 2009).

IBM, one of the most successful companies in the industry have managed to achieve such success through great emphasis on the development of new technologies and maintenance of effective leadership in business operations which brought with it a different vision and new business strategies which have played an important role in improving the companies performance. Indeed, in the third quarter of 2010, the company recorded revenue of $ 23.7 billion and a pre tax income of $ 4.6 billions its share price is also much higher relative to Hewlett Packard and currently stands at $ 154.18 (IBM 2011). Consequently, the company is better placed to attract a larger market share than it is for Hewlett Packard due to its market performance both in terms of profitability and stock price.

Dell also poses major competition to HP in a number of sectors. The company offers a wide range of products which include mobility products, desktop personal computers, software, and storage among other products and services (Dell 2011). Although Hewlett Packard recently overtook the company in terms of sales returns, the company continues to pose a major threat to HP in various sectors. The company’s key competencies include design, procurement, supply chain management, marketing and sales as well as customer relations and further emphasizes on outsourcing part of the product design and assembly of some product lines.

The company’s financial performance is also remarkable. Recently, the company reported revenue of $ 14874 million and a net income of $ 341 million in the first quarter of 2011, which was an increment from the last quarter of 2010 where the company reported revenue of $ 12342 million and a net income of $ 290 (Dell 2011). However, the company’s shares are currently trading at $ 14.25 which is relatively lower than the stock price for Hewlett Packard.

EMC Corporation threatens HP in enterprise service and software. The company engages in designing, manufacturing, sale and distribution of various storage and software offerings. It provides a wide range of technology solutions in the energy sector, financial services, health care, public sector, and telecommunications making it one of the major service providers in the world (EMC 2011). The Company also records high financial performance and for the whole of 2010, the company recorded consolidated revenue of $ 17 billion which marked a 21% increment from previous years; its shares are currently trading at $ 25.90 (EMC 2011).

Strategic implications

Evident from the findings, the prevailing competition in the industry and company’s debt are the major challenges currently facing the organization. In response to this, the company’s major focus should therefore be geared towards the maintenance of competitive advantage while ensuring that this does not reduce the company’s overall profitability as well as establishment of other means of financing the company other than borrowing in order to reduce debt.

In order to promote its competitiveness in the IT industry, the company should aim at continuously improving its product to ensure that they are more superior relative to those of its competitors in order to attract a larger market share. The company should seek to enhance its leadership quality to ensure that it is well equipped to drive organization change geared towards improvement of performance through increased focus on customer, quality and value like was in the case of IBM.

The organization should also engage in extensive marketing of its products in the global market in a bid to overcome competition being presented by its rivals. In addition, to reduce the volume of debt within the company, HP should seek alternative sources of financing which do not involve external borrowing. If these measures are implemented effectively, HP is likely to remain one of the most successful companies in IT industry in the long run.

Reference List

Armbrust, M., Fox, M., Griffith, R., Joseph, D. A., Katz, H. R., 2009. Above the clouds: A Berkeley view on cloud computing. Berkeley, University of California.

EMC Corporation, 2011. Company’s Official Website, EMC. Web.

Dell, 2011. Company’s Official Website. Web.

Hewlett Packard, 2011. Financial News: HP Reports Fourth Quarter 2010 Results, Hewlett Packard Development Company. Web.

HP Annual Report, 2010. The Annual Report of 2010, HP. Web.

International Business Machines, 2011. Company’s Official Website, IBM. Web.

Pham-Gia, K., 2009. Case Study: Hewlett Packard, Any Chance to Beat Its Global Competitors? Germany, GRIN Verlag.

Taylor, B. J., and Weerapana, A, 2009. Principles of economic: Principles of economics, global financial crisis edition. New York, Cengage Learning.

Ycharts Information, Hewlett Packard stock watch. Web.

Appendix 1