Strategic Partner

The merger between Westpac Corporation and St. George Bank was a timely move that has helped the firm to become stronger in this competitive industry. As a strategic partner, I believe that this has made us stronger in the Australian market. The service delivery to customers has improved because customers of the two banks can now be served at various branches. This means that a customer who had an account with St. George Bank can now be served at Westpac Corporation Bank branches all over the country. Although some have argued that such mergers may affect the competitive environment, the current operational strategies that we have been applying show that we appreciate the competitive environment.

When the merger took place in 2008, the two banks were under a lot of pressure to maintain superior service delivery despite the prevailing economic crisis that was affecting the world. Consumer confidence was at its lowest, and shares of the firm were performing poorly in the market. The following figure shows consumer confidence at Westpac Corporation before and after the merger. As a strategic partner, I am concerned about the confidence level that the consumers have towards this firm. In the early and mid-1990s, the consumer confidence level was relatively high. However, this dropped as competition in the market became very stiff. In 2008, it reached a record low, a fact that was attributed to the economic recession.

Westpac Consumer Confidence Index

Following the merger of this firm and St. George Bank, it has been experiencing a consistent rise in its consumer confidence level. This is a clear indication that the merger has a positive impact on its performance.

Decision Making

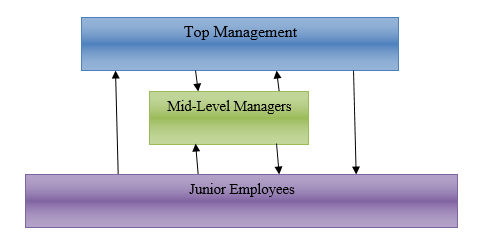

As a strategic partner, I have to appreciate that the issue of decision-making has become more complex following the merger. At St. George Bank, we had a management structure that was a little different from what is practiced at Westpac Corporation. I have noticed that since the merger, most of the strategic decisions are made from the headquarters of Westpac Corporation, and then communicated to us as a subsidiary branch. I have found this challenging because we were used to making our own strategic decision based on our analysis of the environment.

It is a fact that in making these strategic decisions, all of us are always represented. However, the truth is that St. George Bank is a minor partner, and we are always treated as such during the decision-making process. This means that we can only influence the decision-making process through our expert opinions, but the final decision is always made by the majority, who are basically the top management unit at Westpac.

It is important to note that although the process of decision-making has become complex due to increased population, the relationship between the executives of the two firms has been warm. There is respect between the strategic partners and the management embraces flexibility. In areas where St. George Bank is dominant, it is allowed to make its own decisions that it feels are relevant to the environment in that particular location. On the other hand, Westpac Corporation is also allowed some window to make its own decision that it feels are relevant to its market. However, we always make sure that our decisions do not contradict the strategic objectives of this organization. The following table identifies decisions that should be made at the branch level and those that should be made by the top management unit.

Levels of Decision Making

Business Knowledge

In the current competitive market, business knowledge is one of the most important weapons that firms can use to improve their marketing strategies. The merger between Westpac Corporation and St. George Bank has improved business knowledge in the larger firm. The skills and talents of employees and top management of the two firms have been brought together through the merger. I have been pleased by the manner in which the weaknesses of the two firms have been addressed in this strategic partnership. What is even more pleasing is the fact that the two partners have appreciated their weaknesses, allowing the other partner to come in address them as would be appropriate. This has boosted the prosperity of the unified firm.

Change Agent

Following the merger between Westpac Corporation and St. George Bank, it is important to appreciate the fact that change is inevitable. As a change agent, I would want to be realistic in approaching this issue because I know that sometimes change can be resisted by the stakeholders, especially if they feel that it may victimize them. However, we may have no other choice but to accept some of the fundamental changes that accompany such mergers. Some of these fundamental issues that will have to be addressed include the following.

Cultural shock

Some would prefer calling it a cultural change, but the fact is that there will be a cultural shift from what was practiced before in the two firms. The organizational culture that was practiced in the two firms will have to be blended in order to come up with a new culture that would be tolerant to the two sets of employees. This new shift will have to involve a consultative forum where the two firms will seek to identify the new organizational culture that would work effectively under the new environment.

Rightsizing

Another fact that has to be observed after the merger is the issue of downsizing or rightsizing. Some of the tasks may become repetitive if they are addressed at the two levels as it used to happen before. This means that from the top management to junior employees, it would necessary to identify these repetitive tasks and consider merging them into a single task to be addressed by an individual. During the process, some of the employees may be redeployed to other roles within the firm. Those who cannot be assigned to other tasks may have to be laid-off as a way of improving efficiency and reducing the cost of labor.

Adapting new practices

Some new practices will have to be implemented in this new arrangement. As a change agent, I appreciate the relevance of redefining a new path that should be taken in this larger firm. Some of the new practices that must be embraced include consultative decision-making, tolerance to diversity, and a high degree of flexibility. Flexibility would be important because the firm will be exposed to greater environmental dynamics than what the two firms had experienced before when they operated independently.

Employee Champion

Employees are the most important assets in any organization. As an employees’ champion, I am concerned about the activities that have taken place in this firm since the merger of Westpac Corporation and St. George Bank. When it was announced that Westpac Corporation was going to acquire St. George Bank, we as employees were full of anticipation of a good future. We believed that employment opportunities will be expanded at this firm. We also expected better remuneration following the expansion of the firm in the market. However, I have been amazed by the approach that has been taken by the relevant authorities. Our expectations have not been met by the relevant authorities. The benefits that employees expect are not forthcoming. We are worried that the path taken by the management is not in any way meant to improve our working environment. The firm has focused more on making profits than taking care of its employees.

Personal Communications

Employees’ motivation does not just come from increased material benefits. The manner in which the management treats them also plays an important role in improving their morale. Communication is one of the most important factors that the management should consider when dealing with employees. Several cases have been reported where top management ignores communication from the junior employees. It is true that the firm has developed open communication policies that enable employees to communicate with their employers freely without unnecessary protocols. However, this still remains a policy in the paper several years after it was developed.

Communication is still rigidly structured where an employee is forced to communicate his or her message to the immediate supervisor. The supervisor has the liberty to ignore the information or twist it as he or she pleases before passing it to a higher authority. Such information rarely reaches the policymakers, but if it does, it will be too distorted to address the issue of the originator. We feel that this should not be the case. Personal communication should be improved based on the policies that were passed. I would recommend the following open communication strategy.

Managing Development

Employees of this firm are pleased about the developments that have been taking place since the acquisition of St. George Bank in 2008. It has been a pleasant experience to see how this firm has regained consumer confidence that was lost some time back. However, these developments have not been reflected in our number or the way we are treated as employees. As an employees’ champion, I am pleased with the developments taking place in the firm because I know the benefits of development will trickle down to us.

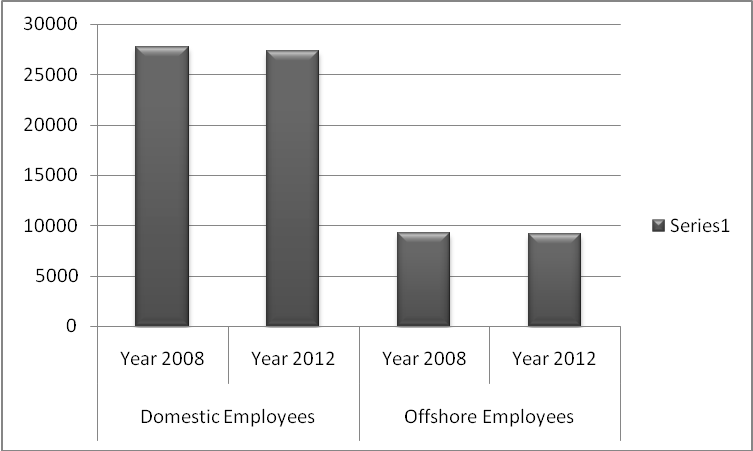

However, this has not been the case if recent cases of retrenchment are to be taken into consideration. I have been an employee of this firm for the last ten years, and I have noticed that the recent acquisition has been of minimal benefit to the employees. The table below shows the number of employees on 31st December 2008 and 2012.

Employees of Westpac Corporation

From the graph above, it is clear that between 2008 to 2009, Westpact Corporation has laid-off 400 domestic employees and 150 offshore employees. This is not what we expected. It is ironic that the number of employees is reduced in the face of developments that have been witnessed. This is not acceptable, and the management must find ways of reverting this unfortunate scenario.

Moral Assessment

As a champion of employees, I strongly believe that mergers are always counterproductive to the employees. I have observed that when two firms are merged, what follows is a series of retrenchments in what the managements refer to as downsizing or rightsizing. This is what has taken place in our firm. I do not see the moral sense in mergers and acquisitions because it reduces healthy competition in the market. I believe that firms should be left to compete in a fair environment as a way of promoting growth, rate of employment, and quality of service delivery. Mergers and acquisition is an immoral and cowardly approach to dealing with a competitive environment.

Administrative Expert

The merger between Westpac Corporation and St. George Bank was a strategic move that would help this firm gain a competitive edge over its market rivals. However, care should be taken to ensure that the intended benefit of this merger is realized. A number of issues must be addressed by the management to ensure that the operations of this firm become efficient. The following are some of the issues that the management should address.

Staffing

Staffing is one of the most important issues that have to be taken into consideration after the merger. As an administrative expert, I have been championing a possible reduction of the number of employees of this firm. This was after independent research that I commissioned in 2009 to monitor the efficiency of the employees. The report recommended a reduction of domestic and offshore employees by 1%.

I informed the top management of this issue, but it was reluctant in its implementation fearing a possible negative reaction from the employees, shareholders, and the public. The management was more concerned about its image than the efficiency of the employees. It took three years to convince the management of the benefits of a leaner workforce, and in 2012, the domestic employees were reduced 1% and the offshore employee population was also reduced by 1%

The figure above shows the percentage reduction in the number of employees in the year 2012 based on the recommendations I made.

Performance management

The performance of the management has been convincing over the last six years since the acquisition of St. George Bank. One factor that has improved the efficiency of this firm’s performance is the flexible approach that the management has embraced. Management at the local level is based on the prevailing environmental conditions as long as they are in line with the strategic goals of the firm.

Structuring

When the two firms were merged into a single unit, it was obvious that there was a need to restructure the management unit and various other positions that were handled differently at the two units. One of the issues that have been troubling the management is how to restructure some of the positions to avoid duplication of tasks. It took a long time to restructure the finance and human resource departments. However, they have since been harmonized, and the efficiency has been improved.

HR Technology

The human resource department has embraced the use of technology as a way of improving the efficiency of the workforce. Although I have had a problem with the representatives of the employees in this firm over the use of technology, they have finally come to appreciate that technology cannot be ignored if the firm is to maintain a high level of efficiency. We have increased the number of automated teller machines to improve efficiency.