Overview

Modern commercial banking, including conventional banking and Islamic banking, remains a major character in any economy. Financial services are vital for local, national, regional, and global commerce, and the banking industry is a key player in facilitating economic growth. Countries with robust banking systems are relatively developed. Banks offer a wide range of services to their clients. Specifically, lending is a main function of any commercial financial institutions (Malede, 2014). Banks tend to have large volumes of loans as assets, and strategic initiatives aggressively tend to concentrate on further opportunities to grow loan portfolios. Lending is a major segment in any commercial bank. As such, loan portfolios constitute perhaps the largest asset and the main source of earnings. Interest earnings, for conventional banks, contribute to a larger share of profit margins.

Banks typically attract deposits from customers cheaply and provide loans and grants to consumers to grow their earnings. In this case, liquidity, solvency, and profitability are controlled to ensure continuity of banks. For conventional banks, loans are generally based on specific terms and conditions, such as repayment periods, interest rates, security, and penalties in case of defaults or violation of an agreement. While conventional banks have structured their loans on interests, Islamic banks have do not rely on the payment of interest because Sharia law forbids it and, therefore, Islamic loans are structured using various techniques, including discounts, profit sharing, repurchase, sale or lease. These variations show distinct practices between conventional banks and Islamic banks. The purpose of this financial analysis paper is to explore differences between conventional banking and Islamic banking with reference to loan structures.

Conventional Banking Loan Structure

In conventional banking practices, lending is highly intricate, attractive and possibly rewarding component of a bank’s earnings. Effective management of loan assets needs sufficient credit culture, experienced credit, and risk team, and sound loan management. Conventional banks are under pressure to increase productivity and profitability amidst fierce competitions from other financial service providers, such as FinTech and Islamic banks. Lending is equally risky and, thus, a loan structure must account for such risks. Thus, credit officers must understand loan structures and related components to ensure efficiency in lending. A correctly structured loan portfolio presents minimal risks to a lender. In most instances, conventional banks strive to ensure that customer needs are met appropriately to minimize chances of default.

Loan Pricing Variables

Conventional commercial banks must determine the most appropriate loan pricing structure to ensure profitability and remain competitive. Thus, several primary drivers for loan pricing have been analyzed to determine how they influence decision-making. The borrower’s debt-service coverage ratio (DSCR) is important for consideration. The borrower needs to afford the proposed price of the loan. However, if a borrower is unable to afford it, then the bank can adjust the price or decline the loan application. The DSCR guides this decision because it shows cash flow available to cover current debts. This ratio assesses net operating income as a factor of debt due within the year, including principal amounts, interests charged, and costs of leasing among others. For a government, commercial banks evaluate amounts from export earnings required to cater for yearly interest and principal while in personal financing, banks use this ratio to assess income property loans.

Commercial banks prefer a DSCR that is greater than 1 because it shows that the entity, including an individual, a firm, or a government, has adequate incomes to meet current debt obligations when due. Conversely, banks shun any ratio below 1. They now require a sustainable minimum of 1.25 to finance a project without special funds or credit enhancements. It is imperative to recognize that banks may demand a minimum DSCR after assessing multiple macroeconomic factors. For a growing stronger economy, credit could be more readily accessible, and lower ratios could be easily accommodated. However, the same cannot be applied in difficult economic situations. Moreover, tendencies to lend to barely qualified customers could cause economic instability, as was the case in the 2008 fiscal crisis. Banks accommodated subprime borrowers with minimal scrutiny when applying for mortgages. When most of these customers were unable to finance their debt obligations, banks that had granted facilities collapsed.

Banks must also assess market competition and costs of funds when determining loan pricing. Notably, conventional commercial banks do not pay much interest on customer deposits. For instance, a customer maintains over $200,000 with their banks for several years, but gets modest interest in return. A checking account attracts no or little interests for the customer while savings accounts have minimal interests less than the US Treasury bond rates, implying that conventional banks have relatively low costs of funds. While access to and the need for facilities by entities are always present, banks must compete for customers as they sell loans. As such, they strive to differentiate loan products through various means of structuring, service delivery, and pricing by considering costs and risks.

Commercial banks also face loan program restrictions. That is, loan pricing is determined by specific projects or purpose of the loan. For instance, loans for special purpose programs, such as to fund emergencies, may have low interests. Further, the government or state majorly influences pricing for loans meant for credit enhancement programs and, therefore, banks cannot set their interest rates on such loans as they may wish. Social impacts also restrict loan pricing. Loans for marginalized groups, such as youth and women and other economically distressed groups have relatively low rates because of their intended social impacts on target groups.

Loan structure also depends on the type of loan. Today, commercial banks have developed multiple loan types to meet diverse needs of their clients. Nevertheless, the structure must always account for costs of providing the loan, revenue period, and transaction risks. Under term loans, borrowers can get commercial, capital, construction, and letters of credit among others. For individuals purchasing property, banks may lend up to 90% of the value based on terms of an agreement and security offered. Various repayment structures are offered to customers to help in determining loan repayment periods and amounts. Banks usually use even principal payment or even total payment schedules (Hofstrand, 2013). The even principal payment schedule is designed to offer a similar principal payment throughout the repayment period. It involves dividing the original loan amount by the repayment years. For instance, a loan of $10,000 when divided by 20 payment periods would result in a principal payment of $500 for every repayment. The unpaid balance attracts interest, which is determined for every payment period. Note that the unpaid balance declines with every principal payment and, thus, the interest amount of every payment declines. Eventually, a decrease in the total payment is observed as the interest declines while the principal remains constant. As shown in table 1, the total payment declines from $1,200 in the first year to $535 in the last year of payment (principal and interest included) (Hofstrand, 2013). The sum paid after 20 years is $17,350, consisting of the original loan of $10,000 and interest earned of $7,350 (see table 1).

Customers who opt for even total payment schedule end up paying more interest for the same loan with similar terms. Even total payment consists of declining interest payment and a growing principal payment. This implies that the total loan payment would be same throughout the loan schedule period.

Notably, the unpaid balance in the even total payment repayment schedule reduces gradually compared to even principal payment repayment schedule. Consequently, borrowers pay more with the even total payment repayment schedule because the unpaid balance attracts more interests.

In some cases, commercial banks may arrange for balloon payment with their borrowers. This term loan structure requires payments for a fraction of the loan while the huge balance comes due later toward the end of the repayment period. For example, a loan of $10,000 with amortization of 10 years may be scheduled with equal total payment for the first nine years, but huge balance is cleared in the last year of repayment schedule (see table 3). The last instalment consists of the loan balance and accrued interest for the year, which is paid once.

Commercial banks use the balloon schedule when borrowers have low repayment capacity in the initial years, but they can repay lump sum amounts after many years. In this case, borrowers opt for the best amortization and periods to meet their specific needs. In some instances, early repayments may not be done, but lump sum payment is expected later.

Commercial banks also consider interest rate risks when structuring their loans. In this case, they have fixed rate and variable rate. With the fixed rate, the interest rate is fixed for a pre-determined time, and no changes in the market rate can affect the rate and the repayment amount (ASB Bank Limited, 2013). Note that customers incur additional costs when they wish to reset their fixed rates and penalties for lump sum payments or early repayment during the fixed rate time. Variable rate is also referred to as a floating rate, and the interest rate and the repayment amount change based on prevailing market conditions. A decline in the interest rate leads to a fall in the repayment amount and vice versa. Banks often communicate such changes to customers in writing.

Conventional commercial banks also consider term or amortization duration for the loan. Loans with longer term lengths attract higher premium based on the principle of time value of money. Additionally, longer amortization of the loan period also has higher premium when credit or collateral risk is considered.

Apart from these components of a loan structure, commercial banks have devised various means to generate more profits from loan facilities by introducing loan processing fees charged upfront, loan servicing, prospecting, insurance, and legal fees and among others. The table below shows a loan amortization for a loan of $1 million with a term length of 1 year (12 month) offered at 20% interest rate per annum. All other related charges are computed except fees payable upfront.

Islamic Banking Loan Structure

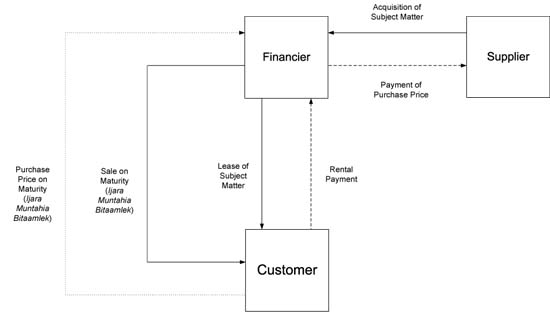

To assist in comprehending Islamic loan structure, certain elements of loans can be explored under different Islamic-compliant products, which are mainly leased or ijara, sale or Murabaha, and mudaraba and musharaka, classified as joint venture facilities. Ijara structures involve acquisition and operating facilities through Sharia-compliant bank (Sandstad, 2009). The bank and the investor finance a project with specific percentages. A funding firm is established to handle tax issues and to acquire and hold the title to the property. The firm is the lessee. The rent payable is compared to debt service found in traditional loan. However, the structure ensures that the lessor has the ownership before transactions, lease period is determined, the property must continue to exist during the ijara term, and lessor is responsible for insurance and maintenance of the property. Moreover, no acceleration of future rent is allowed (Jonathan Lawrence Partner, K&L Gates LLP, n.d).

Murabaha structure is the sale at a mark-up. In this case, the client gets cash amount required to finance a project. A client can obtain an asset by negotiating purchasing terms, such as payment and exact requirements with the seller. The client then approaches the bank to fund the asset. The client and bank then opt for Murabaha Agreement to buy the exact commodity as negotiated by the seller. The client will then make payments to the bank based on a deferred-purchase provision while the bank will make purchase arrangement with the seller for immediate full payment. The bank will receive the product and act according to the Agreement. Notably, the bank must possess the product and client is considered as the agent between the bank and the seller. In the real estate case, for example, a bank may take notional possession of the title at closing and then sell the property to an investor at a relatively higher price. However, if regulatory requirements limit participation of the bank, then the bank may appoint an agent to act as a transacting party that conducts the sale on behalf of the investor. In short, a client who wishes to purchase a product worth $50,000 may approach the bank and sign an agreement with the cost plus profit of maybe 10%. The client is therefore liable to pay the bank $55,000 in lump sum or installment once the product is delivered. Financial uncertainty is not involved because both the client and the bank understand all aspects of the transaction.

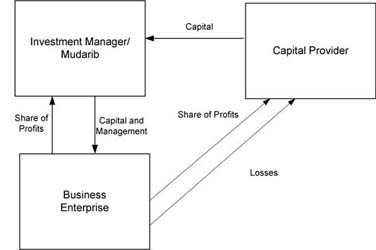

Mudaraba is a service provider and capital provider structure, which is a typically a joint venture drawn in the form of a limited partnership, a limited liability firm or a fund. Notably, one partner is responsible for service provision and management (mudarib or an equal of a fund manager). The other partner offers capital and cannot interfere with management of the firm.

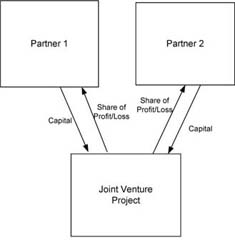

Musharaka structure accounts for multiple forms of partnership or joint venture arrangements. For instance, al-sharia is based on profit partnership, sharikat is founded on property partnership, and al-musharaka involves financing partnership. Profits are shared based on point systems, accounting for partners’ contribution, losses are distributed based contributions, and partners are not responsible for other partners’ liability, including guarantees. Much flexibility is present in allocating management responsibilities.

Conclusion

Loans remain the major source of revenues for both Islamic banks and conventional banks. They are high return assets based on the arrangement, either interest-based structures or Sharia compliant structures. Notably, these conventional banks and Islamic banks have different loans structures. Conventional loans are characterized by greater risks to the client, fluctuating rates, different repayment amounts based on the arrangement, and uncertainty emanating from market conditions. Conversely, Islamic loan structure is characterized by profit and loss sharing arrangements, less uncertainty, and pre-determined terms. Besides, all transactions must meet Sharia requirements to protect all parties from exploitation and unfair practices. Overall, Islamic banking tends to be less risky in terms of credit risk relative to conventional banking (Abedifar, Molyneux, & Tarazi, 2012). Loan quality, interest rates and expense in Islamic banking are less influenced by prevailing market conditions relative to conventional banking.

References

Abedifar, P., Molyneux, P., & Tarazi, A. (2012). Risk in Islamic banking. Web.

ASB Bank Limited. (2013). How loans are structured. Web.

Hofstrand, D. (2013). Types of term loan payment schedules. Web.

Jonathan Lawrence Partner, K&L Gates LLP. (n.d). Practical lending and security precedents Islamic finance. Web.

Malede, M. (2014). Determinants of commercial banks lending: Evidence from Ethiopian commercial banks. European Journal of Business and Management, 6(20), 109-117.

Sandstad, B. (2009). Introduction to Islamic finance – Part II. Web.