Introduction

Massive layoffs have become a common phenomenon in the corporate world. Companies do it in order to cope with temporary falls in demand or to increase their competitiveness. However, most of them copy their competitors without really thinking about the effectiveness of the strategy. It will be hypothesized that layoffs do not save money for companies, as the short-term and long-term implications of the tactic are quite unfavorable.

Historical Perspectives

In the 1970s and before, layoffs were done in order to cope with business cycles. The mining and industrial sectors were known for these trends. Workers were brought back when businesses recovered. In the 1980s, layoffs were executed permanently such that workers could not be recalled. Companies had been affected by a stagnant economy that persisted well into the mid 1990s. The US was going through one of the toughest recessions in history. This reached peak levels in 1982 and also coincided with persistent layoffs across several manufacturing businesses.

Eventually, this led to large-scale downsizing in the 1990s. At that time, the economy had improved dramatically, yet companies still continued to lay off workers. They did this in order to boost profit margins because they were threatened by increased competition from international firms. Corporations such as General Motors chose to downsize at a time when profits were still high. For example, in 1997, the company recorded a 35% increase in profit, yet that same organization promised to cut down on 50, 000 jobs in order to stay ahead of their competition. In that decade, more managers were laid off than ever before; lean production became a familiar term. In 1994, approximately 67% of all laid-off workers were college-educated white-collar workers.1998 was a fateful year for employees because 9, 000 of them lost their jobs in Xerox. 14, 000 were laid off in Raytheon. 15,000 lost their jobs in Motorola, an equal number of workers also lost their jobs in Compaq while 18, 000 AT&T workers became unemployed. Numerous layoffs took place in the late 1990s because there was a flurry of mergers. The banking sector alone accounted for three hundred and seventy mergers. The entertainment industry was also top on the mergers and acquisition list. Several layoffs took place in this sector as well.

In the 2000s and beyond, companies began laying off workers for a number of new reasons. The country started experiencing rapid technological changes that caused other methods of production to become outdated. As a result, consumers became more informed and this caused fluctuations in demand. Firms had to lay off workers because most of them became redundant when these patterns were altered. Businesses are facing immense global completion today and this prompts them to reduce the number of employees on their payrolls. Lastly, poor corporate governance has affected organizations negatively. Poorly administered companies often lay off workers in order to make up for those losses. In 2001, layoff numbers reached unprecedented levels. 1.5 million workers lost their jobs; which was the highest figure ever recorded in the previous decade. Human resource experts started to look for alternatives to layoffs and many suggested part-time work, early retirement or temporary redeployment. These solutions coupled with a stronger economy led to fewer layoffs in 2003. Layoff numbers reached record levels in 2007 when the mortgage crisis began. The bureau of Labor and statistics reported that in April alone, approximately 126, 047 workers lost their jobs.

Current Impact in Today’s Society

Several employees now consider layoffs as an inevitable part of their work lives. Companies keep modifying their workforce, which means that no single group is safe. However, certain industries are notorious for layoffs; the auto industry is one example. Automobile makers contribute significantly to the proportion of laid-off workers in the market today. Stakeholders argue that they need to do this due to technology change and overseas competition. To some extent, one can understand the manufacturers’ point of view. Business dynamics have changed, so the auto industry may be permanently shrinking. However, most layoffs today do not take place because of these reasons. The retail industry, financial sector, technology, education and many others keep downsizing workers because of temporary declines in demand. As soon as a recession ends, then those companies usually start to hire again. Their underlying motivation is either cushioning company profits or increasing it.

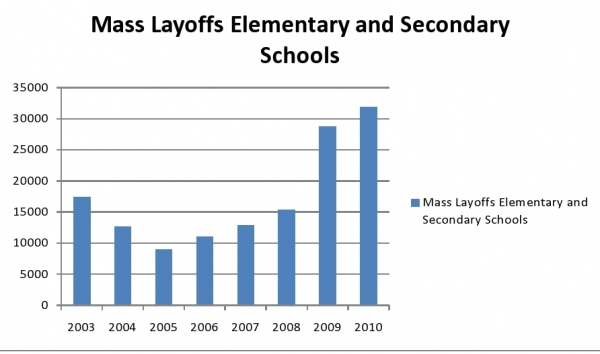

Shown below is a depiction of recent layoff trends in the education sector. The graph illustrates that layoffs are still a harsh reality today, and for some industries these numbers are going up.

Ethical, Legal, Economic and Social Ramification of Layoffs

Ethical ramifications

Organizations must cope with a number of ethical implications after laying-off workers, and this is one of the most difficult consequences of them all. Layoffs differ from other kinds of job changes because employees are blameless. When a worker is fired because he or she stole or violated company policy, then no one can blame his or her organization. Additionally, some employees may simply change jobs because this is a natural part of attrition. However, when they are laid off, then the concerned company must deal with certain ethical implications.

Layoffs are often conducted in order to maximize profits. Firms normally assume that by trimming down their workforce, they will increase their rate of returns. Economic analyses have illustrated that this may not always be true. It is possible for financially healthy organizations to instate layoffs so that they can increase their rate of return. These firms can be ethically challenged because no economic need exists to solicit those plans. Such organizations are therefore harming employees by subjecting them to unemployment when it is not really necessary for them to do so (Gilbert, 9). In other words, if layoffs can save companies from bankruptcy, then it would be morally acceptable to lay off workers. The utilitarian school of thought urges stakeholders to assess the morality of a situation by the overall good that it generates. It also postulates that all possible options need to be scrutinized and the one that produces the greatest benefit should be selected. In this case, employers need to consider all cost reduction alternatives before they can choose layoffs. If other alternatives that can bring about the same result exist, then these should be selected. Companies have a myriad of other cost-cutting measures that they can use. These alternatives would not be as dire as layoffs because employees would still retain their jobs. Furthermore, managers would not have to tell workers that they have lost their places. Employees would also be happier because they would not have to deal with an excessive workload. The public would be happy because it could access high-quality services from service providers. In fact, the only people who may not be happy are company shareholders as their returns may not increase. Based on utilitarian principles, it would not be ethical to lay off workers in order to increase profit if other options can work just as well (Gilbert, 7).

In Kantian ethics, every person has rights and duties; organizations must keep these duties in mind when enacting any new work policies. Even if a decision can make other people happy, it should not violate another person’s right. Employees do not have a right to employment, but managers do not have a duty to lay them off either. Managers have a duty to their shareholders; nonetheless, if the company is doing well then it is not obligated to take action through layoffs. On this basis, it would not be ethical to carry out a layoff since the financial returns are not definite.

Business owners ought to be governed by the principles of fairness and justice as stipulated in Rawl’s ethics. Layoffs involve dismissing workers for doing a job properly. They also entail retention of employees who were doing the jobs just as well as the laid-off workers. Clearly, these actions violate the very principle of justice because they are not consistent and are not proportional to employee performance (Gilbert, 12).

Companies devastate families by subjecting them to layoffs because some dismissed staff could be breadwinners. It is particularly complicated for laid-off workers because they were already used to employment. Some of them may be unemployable in other industries; which means that they will not have another substitute to fall back on. Former employees may find the news intolerable and may be driven to violence. Layoffs also cause stress among remaining employees who may worry about losing their jobs. All these personal challenges are created by employers in the hope of improving future earnings yet that may not always be forthcoming (Gilbert, 10).

On occasion, the way in which the layoffs are done is deemed as uncivil by some employees. Managers may carry out layoffs poorly. They may not keep workers duly informed of the process or may not tell them whether they are likely to be affected by it. It always helps to tell all contributors whether their jobs will be cut, because it reduces the anxiety and under productivity that occurs during the layoff. Business owners should also allow affected persons to bid farewell to their workmates. They need to cushion the victims using a severance package. As much as these endeavors make a lot of sense, few companies implement them. This failure subsequently causes a lot of damage to the organizations’ reputation and the remaining staff’s commitment.

Staff members are also disgruntled by the excessive rewards top executives get after the layoffs. Surviving personnel may become cynical about their companies because owners may appear inhumane and insincere. For example, General Dynamics instated a mass layoff in 1999 where 12, 000 employees were affected. Later that year, executives took home bonuses that were equivalent to double their employees’ annual salaries. Market analysts are right to claim that layoffs destroy company trust and create cynicism if top executives refuse to share in organizational cost cutting; which is also an unethical practice (Downs, 15).

Layoffs often create negative externalities that companies may not have anticipated. For example, alcoholism, drug abuse, crime and smoking may increase in society if too many companies keep laying-off their staff. The same thing happens to organizations that act recklessly during their operations. Air and water pollution are some of the externalities that come out of such methods. Layoffs will impact society severely if these social ills increase.

The very notion of layoffs illustrates that firms may be conceptualizing employment wrongly. Organizations that think of their employees as costs will run their businesses differently from those that think of their staff as assets. The latter category of companies often focuses on how they can get the most out of their employees through restructures while the former group always thinks of how they can minimize their numbers by laying them off or downsizing them. It is ethically questionable to look at employees as costs because they drive the whole enterprise. Businesses need to reevaluate their company culture in order to make it more sustainable or benevolent.

Economic ramifications

Contrary to popular opinion, layoffs do not improve economic performance at the corporate or the national level. They tarnish a firm’s image because the public forms of a low opinion of the company. Some consumers boycott the company products, and this hurts profit margins. In fact, layoffs set off a vicious cycle that may lead to business closure. A case in point was Circuit City; an electronics retail store that was closed in 2008. The business started with 3, 400 layoffs, which consisted mostly of sales workers. The firm’s customer service went down and so did its level of innovation. Productivity plummeted and this paved the way for competitors like Best buy to emerge. Eventually, the retailer went bankrupt and had to close in 2008 (Newsweek, 12). Circuit City was an extreme casualty of the layoff phenomenon.

Statistics also indicate that the stock market performance of companies that lay off workers rarely goes up. Abraham and Dong-One (9) did an analysis of the effect of layoff announcements on shareholder returns and found startling results. The study was done through event analysis; it is a measure of the effect of events on organizations. In this procedure, one compares equity returns in the presence of the event with expected returns in the absence of the event. Equity returns are preferred to stock prices because they are more accurate. The surveyors used a series of equations, which related the abnormal return to a corporation in any given time with the actual returns to a corporation after the layoff and the expected returns if there were no layoffs announced. The value of that abnormal return is compared to zero. This investigation focused on firms that had made layoff announcements between 1993 and 1994. Samples were collected based on ability of announcements to reveal new information to stakeholders. A total of 368 organizations were utilized. Focus was given to the period just before the announcement and the period after, that is, ten days prior to the announcements and ten days after the announcements. After analyzing their results Abraham and Dong-One (15) established that cumulative abnormal returns went down with p values of less than 0.05. This shows that layoffs cause shareholders’ returns to diminish. Possible explanations include the economic condition of the firm during the announcement as well as the negative industrial relations that come out of the decision. Workers’ unions are inclined to treat layoffs negatively and this may strain relations between the organization and the company. Shareholders may anticipate these problems, and those expectations may eventually be reflected in the company’s returns. Although layoffs may increase company efficiency, shareholders still think of them as a negative thing. Similar results were found by Bhana (49) who established that share prices went down when layoffs were done; however, this was dependent on the information surrounding the announcement. If the layoff was done in order to rescue a company from organizational distress, then shareholders interpret this negatively. Share price decline corresponds with the above-mentioned situation. Organizations that made layoffs in order to increase company efficiency tended to report increases in stock prices. While this study somehow contradicts the one done by Abraham and Dong-one (8), one must note that Bhana (49) still found a negative drop in share prices. It is affected by the conditions surrounding the information; analysts call this the signaling effect. A layoff can be an indication (signal) that business conditions are not doing well so this leads to reduced share prices. The question one must ask is whether many companies are likely to implement layoffs when market conditions are dire. Statistics indicate that several layoffs occur when demand slackens, so it can be deduced that layoffs have an overall negative effect on shareholders’ returns from this report (Palmon et al., 60). Shown below is a summary of company share prices shortly after layoffs were done in 2011.

Organizations need to spend money on severance packages during layoffs. Out-placements also put dents in companies’ overheads. Taxes are likely to go up for corporations that have just laid-off their workers because of unemployment insurance. If a business has not been paying its vacation and sick pays consistently, then it must settle these bills before releasing its staff. Some employees may choose to fight back using lawsuits, and this would cost firms a lot of money. When demand increases, companies then need to hire back workers, and this would also strain their budget. Employers may not know that some employees are too valuable to the corporation. Because of that, business owners may opt to lay them off only to realize that their services are quite important. Eventually, they are forced to hire back those individuals immediately. Workers often retain the severance package they received prior to the layoff. Alternatively, some firms may choose to hire laid-off workers as contractors since their services are indispensable. Contractors often demand more compensation than employees so businesses end up suffering (Newsweek, 8).

Company personnel may be overwhelmed by the amount of work that they need to do after a layoff. Job positions do not disappear after layoffs; they are simply transferred to the remaining workers. If the workforce cannot handle the pressure, then a company may be forced to refill vacant positions via premium wages. Such firms would end up spending more than they had hoped to save through the layoff. Several professions have experienced these challenges. The nursing profession recorded massive layoffs in the 1980s and 1990s. HMOs believed that it was in their best interest to lay off nurses, but none of them ever predicted all the negative repercussions that came after. Older nurses told aspiring nurses not to join the profession because they would be laid off anyway. So many hospitals were confronted by nursing unions that were trying to defend laid off nurses. The nursing community was severely demoralized and as a result. Many of them chose to try other professions. College students training to become nurses also opted for different courses. The natural result was a nursing shortage in many hospitals around the country (Allnurses, 1). Patients could no longer access quality medical care as attendants were just not there. Medical errors and hospital deaths increased massively; these were problems that had to be corrected immediately. It was difficult for administrators to lure back nurses thus prolonging the problem. Because of such dire consequences, organizations should think twice before laying off valuable workers in order to save money. This strategy can backfire on the remaining employees, the institution itself and the general public too.

Workers who survive a layoff often feel insecure about their jobs and this undermines organizational commitment. In other words, attrition rates are likely to go up after a layoff since employees would want to protect themselves from the same experience. Unless companies instate specific measures to support their remaining staff, most would end up leaving the company anyway (Koretz, 26).

Organizations tend to experience lower productivity after layoffs because of reduced employee morale. In fact, organizational cynicism normally increases after a layoff. Surviving workers are often selected based on their seniority. This implies that hard work and productivity are not really important when making these decisions. Institutions can lose high-quality employees if their seniority rankings are low. It is this very reason that causes most surviving employees to become cynical about their company. Many staff members may no longer see any relationship between productivity and job security because their survival is only dependent on their level of seniority in the organization. Such employees would not exert themselves, and this would hurt a company’s revenues. In fact, manufacturer’s data for 140, 000 companies illustrates that high productivity was more or less constant regardless of whether companies had laid off workers, or hired them. This analysis was carried out between 1977 and 1987, and found that although labor expenses went down, revenues per employee also reduced so this neutralized any potential economic benefits.

Layoffs may also impact a country’s economy negatively and this may bounce back to company profits. When employees get laid off, most of them just do not have enough money, so they are likely to reduce their expenditure. Even surviving workers may cut back on purchases in order to protect themselves against an unpredictable financial future. In the end, aggregate demand would go down, and business sales would follow suit. Business profits would be negatively affected, and this may prompt owners to carry out more layoffs thus perpetuating a vicious cycle.

Social ramifications

Laying-off loyal employees can be quite devastating because a high number of them will have formed a bond with their institution. In addition, others’ identities may be tied to their organization. These workers would lose an important part of their distinctiveness after a layoff. Others may slip into depression and eventually become liabilities to their friends and family. Suicide rates tend to go up after workers lose their jobs. If employees do not die from self-harm, others may simply succumb to poor health. Purchasing health insurance may turn into a luxury; unemployed workers often skip diagnostic services just so that they can survive (Downs, 15).

Once companies recover from a sales slump, they may need to rehire employees. These institutions may suffer from the loss of workers who had an in-depth knowledge of company operations. New employees who come to replace older workers may not understand the work culture or history of the institution. For this reason, corporations must start from scratch when rehiring. They need to relay information about work expectations, which may not always go well. Businesses that recall laid-off workers often find that the old employees no longer trust them.

Layoffs tend to enhance employee disengagement in several organizations. This means that surviving employees may actively damage organizations performance because of heightened mistrust. Percentage increases of employee disengagement range from 16-19%. Retailers are the biggest losers because cases of employee theft usually heighten after layoffs. Sometimes these numbers even supersede shoplifting losses (Newsweek, 7).

Business enterprises are valuable to the public because they render service. Once that service deteriorates, then consumers’ quality of life is likely to go down. Employees are central in rendering these services, so companies directly hurt the public when they take away a crucial part of the link. The airline industry best illustrates this example; after the twin tower bombings, customers were afraid of flying, and Airlines were uncertain about how long the situation would last. A number of them decided to lay off workers until their businesses recovered. As a result, companies had to cut down on essential services and flying became dreadful. 47 % of all premium passengers stopped flying because they no longer enjoyed the experience.

Legal ramifications

Layoffs come with certain legal risks that may increase outflows if businesses ignore them. Given that this phenomenon is common in the country, workers are unlikely to find replacements soon enough. Those ones who are lucky enough to find them may not always get ideal pay packages such as health insurance and other benefits. All these factors increase the likelihood of litigations during layoffs.

The Worker Adjustment and Retraining Notification Act 2009 (WARN) is one route that laid-off workers can use in order to seek legal remedy for their losses. Employers with more than 100 staff members are obligated to give their workers 60-day notices of the layoff. Federal states have also created WARN Acts, which apply to smaller business owners and have stricter rules. If an employer fails to comply with these rules, then he or she is required to pay workers the equivalent of 60 days worth of pay or benefits. Furthermore, employers can also be penalized for failing to notify local and federal governments on the same. Entrepreneurs may not understand all these legal provisions and this may make them susceptible to litigation. Businesses may have to spend a lot of money in order to hire attorneys who may understand this process.

The US has plenty of discrimination Acts that prevent disparate treatment of protected employees. A number of them can be used against employers after carrying out a layoff. Discrimination law basically states that workers cannot be treated prejudicially when firing, hiring or promoting them. The Civil Rights Act, 1964 is one such example. The Act specifically prohibits educational institutions, federal governments and employers from discriminating against individuals based on their national origin, sex, color, religion or race. Former staff members may sue their company if they can prove that a layoff was unjustly done. Unless an organization has very strict methods of selecting layoff candidates, it may be difficult for them to avoid litigation based on discrimination. The Age Discrimination in Employment Act or the Americans with Disabilities Act may also apply during layoffs. The first legislation prohibits age based discrimination for employees over forty while the second legislation protects employees with disabilities. If a layoff was not justly done, then employees with these traits may choose to sue their former employers using discrimination laws.

Pregnant workers or new parents are protected by the Family and Medical Leave Act, 2008 during family-related absences. Firms that have 50 employees and above are obligated to provide their workers with up to 12 weeks unpaid leave in order to: give birth, adopt a child, attend to a sick spouse and child, or attend to his or her own health. Their jobs ought to be protected during that entire period. Such a piece of legislation can cause several employees to seek legal redress after layoffs by claiming that there were treated unfairly throughout their family or medical leave.

Laid-off workers can also use worker compensation claims, whistle blower laws and bad severance agreements to sue their former companies, which would create a lot of trouble for the organizations that carried out the layoffs. All these legal issues place firms in a very difficult position. They can either choose objective criteria to lay off workers or subjective criteria. The former method is better suited for legal protection, but it could hurt the organization financially because it may lose the most effective personnel. On the other hand, subjective criteria focus on the quality of workers left behind after a layoff, but it makes a firm susceptible to legal claims (Cameron, 6). Laid-off employees may allege discrimination or favoritism during the process, and this may prove to be quite disruptive to a business.

Recommendations on Possible Solutions

Since it has been shown that layoffs are not a very effective cost-cutting measure, then organizations need to embrace alternative solutions. One such method is job sharing. When demand for a product goes down, certain departments or divisions within a firm maybe affected more than others. Businesses maybe tempted to get rid of those workers immediately, yet they can still be of use to the organization in other departments that were unaffected by the slump. By encouraging job sharing, companies can still maintain their human capital, and this would insulate them from having to hire new employees when business conditions improve (Richtel & Leonhrdt, 20).

Companies also have the option of enacting pay reductions. During economic downturns or slow financial periods, employees would prefer lower pay than total unemployment. Organizations can cope with low cash flows by reducing their operating expenses. Since payroll accounts for a large share of these expenses, then firms can improve their cash flows by minimizing employees’ salaries. Many employees value job security, so this strategy can work well for organizations. Motorola has tried out this method and found it to be rewarding.

The main reason for company layoffs is low profitability. Companies can work around that problem by choosing other methods that will save them money; such as recruitment freezes. Recruitment consumes a lot of company resources as new employees need to be trained. Their productivity is also quite minimal because they are still in the process of learning. When companies avoid such unnecessary expenses, then they have a better chance of surviving an economic or cash slump (Richtel & Leonhrdt, 20).

Organizations can also reduce work weeks and restrict overtime payments. If a business is slow, it does not make sense to keep workers around company premises. It would be better for firms to release them so that they can save on costs. They may later reengage them when their cash sales increase. In Austria, the government passed a legislation, which allows shorter work weeks that last for four days. In the arrangement, employees are required to take three-day work weeks (if their firms choose to) then reimbursements occur. The method has proven to be quite effective in cost-cutting and perhaps the same thing can occur in the US. However, this country would need to alter its laws in order to accommodate shorter work weeks. An organization such as Nevada Casinos is already implementing this; it has the results to prove that the method is worth trying. Even federal and state government institutions have not been left behind. The state of Maryland forced its 67, 000 employees to take unpaid leave in 2008; that number represented 83% of the state’s workforce. Staff members could return and continue with their jobs while the state cut back on its payroll outflows. The principle is based on the assumption that all businesses are susceptible to downturns, yet employees need the security of their jobs. Shorter work weeks merge these two concerns by assuring staff of their employment without necessarily rewarding them for it. Consequently, companies end up saving and employees still get their paychecks, even though the amounts may be smaller (Richtel & Leonhrdt, 20).

Instead of sending workers home for three days in a week, some organizations may choose to instate less-drastic measures such as extended unpaid holidays. In such a plan, workers would be required to prolong their holidays without pay so that firms can recoup those losses. Computer manufacturer, Dell is already doing this; the strategy has prevented mass layoffs that would have occurred during financial downturns. Honda also has a similar system in place although it uses voluntary vacation time. Companies that operate daily have the option of doing shut-downs at certain times of the year in order to minimize operational expenses. Cisco is already implementing such a system and has saved a lot during those closures.

Conclusion

Layoffs do not save money for companies because studies have shown that share prices tend to go down. If managers are informed about this, then they would minimize their over eagerness for layoffs. This trend makes organizations susceptible to litigation; they also have to spend a lot on severance packages, rehires and contract payments. Layoffs tarnish a company’s public image; minimize service quality, and initiate a vicious cycle of more layoffs. All these factors demonstrate that the concept is not a good idea for them.

While the phenomenon may be harmful to businesses, it is even more devastating to employees. It imposes economic challenges to workers who lost their jobs; others may be susceptible to anger, depression and other psychological disturbances. The method is ethically questionable because firms have other options for achieving the same goal. What is even worse is that executives rarely share in these cost-cutting measures.

Surviving workers are also impacted by these decisions; employee loyalty and morale tend to go down after layoffs. Such personnel often feel insecure about their jobs and may try to look for replacements, as soon as they can. Companies can lose their best staff if they do not do something to deal with organizational cynicism. Remaining workers often find it difficult to cope with work pressures and this severely impacts their productivity. Cases of workplace stress are also common. The evidence is overwhelming; layoffs cause more damage to surviving and laid-off workers, shareholders, managers and the public in general than other cost cutting methods. Enterprises should look for alternatives because they would be spared from the short and long term detriments of layoffs.

Works Cited

Abraham, Steven and Dong-One, Kim. “Layoff and employment guarantee announcements: How do shareholders respond?” Oswego Economics Department Working paper 2002: 1-26. Web.

Allnurses. Effects on nursing shortage: layoffs. Restructuring of 1990s and 1980s. Allnurses dot com, 2006. Web.

Bhana, Naya. “Layoff announcements, share price reaction and long term financial performance on the JSE securities exchange.” Investment Analyst Journal 56(2002): 43-58. Print.

Bureau of Labor and Statistics. Mass Layoffs archived news releases. 2011. Web. BLS.

Cameron, Kim. “Downsizing can be hazardous to your future.” Human Resources Magazine, 1991. Print.

Cox, Jeff. Layoffs: once a boon to stock prices now a burden. CNBC, 2008. Web.

Downs, Alan. Corporate executions: the ugly truth about layoffs. NY: Amacom, 1995. Print.

Gilbert, Joseph. “Sorrow and guilt: an ethical analysis of layoffs.” SAM advanced Management journal 5(2003): 4-13. Print.

Koretz, Gene. “The Downside of Downsizing: new evidence of layoff’s damage.” Business week, 1997. Print.

Newsweek. The case against layoffs: they often backfire. Newsweek.com, 2011. Web.

Palmon, Oded, Huey-Lian, Sun & Tang, Alex. “Layoff announcements: stock market impact and financial performance.” Financial management journal 26.3(1997): 54-68

Richtel, Manny & Leonhrdt, Dan. “More companies cut labor costs without layoffs.” The New York Times, New York Times, 2008. Web.