Executive Summary

We have carried out capital budgeting of mad manufacturing ltd. the analysis shows that the company can invest in the new product to earn a net present value of $ 11,869,970 and an internal rate of return of 60% that is viable using NPV and payback period. the weighted cost of 16.6%.

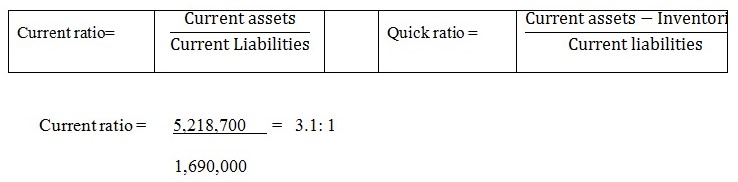

Clever clothing ltd unlike the sound of its name has a poor credit management policy have they borrow more and keep it in stock endangering the company creditworthiness. The cash conversion period of negative 23 days and the current ratio of 3.1:1 while the liquidity ratio is 0.69:1.

Introduction and Case Background

Mad manufacturing is planning to undertake a project that will increase its revenues. After man options, they are will to undertake capital investment on a plant to produce a product. While clever clothing has made a decision to evaluate their credit policy management.

Report On Mad Manufacturing Ltd

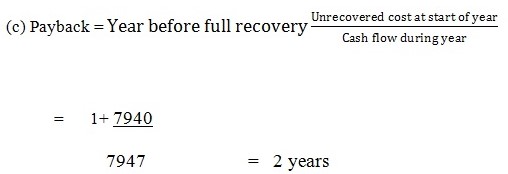

Mad Manufacturing should undertake this new project as it has a positive Net present value of $14,800.61, an internal rate of return of 60%, and a payback period of two years, therefore the project will increase the value of the company. The calculation of net present value, internal rate of return, and the payback period is done as follows:

- Net Present Value

The rate of return is set at 16.6%, due to an expected return of 11.6% plus a 4% risk premium.

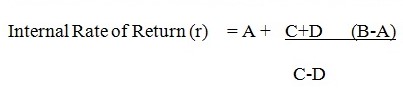

- Internal Rate of return

Using trial and error method the IRR will be calculated as follows:

A = Lower rate of return

B= higher rate of return

C = NPV for lower rate of return

D = NPV for higher rate of return

Have made the following assumptions for the purpose of calculating IRR

A = Lower rate of return = 16.6%

B= higher rate of return = 18%

NPV for lower rate of return = 11,869.97

NPV for higher rate of return

NPV = (10,200)+ 2260(.847) +7947 (.718) + 14010(.609)+ 7380(.516)+3138(.437) = 11,131.642

16.6 + 11,131.642+11869.97 (18-16.6) 11869.97-11131.642=60.21%

Capital Structure

Have used the book value figures for calculating the capital structure.

Cost of new capital

I have used market values in calculating the cost of raising new capital.

The MML should ensure that the sales price is given enough attention. Since it carries more risk as compared with other variables. This probably because its change also affects working capital and the number of units sold. The NPV changes by a big margin by a slide change in price. It can also be noted that the change in the unit of production has the same impact as a change in prices. This has been arrived at using the following tables.

Report on Clever Clothing company

Clever clothing limited give credit more days than it receives from customers. This means that they will find themselves in a financial crisis. Secondly, the company has poor liquidity because its current assets can not meet current liabilities using a quick ratio. Stock takes more time to be converted into cash. The company has DuPont of 16.41% which appears to be a good return on investment; however, this should be compared with an industry average. From the return on equity and cash conversion cycle, the company has the weakness of selling on credit than the credit they receive. They also hold large amounts of inventory as compared to other competitors. The strengths of the company lie in its ability to generate a good return on the investment of the shareholders’ funds.

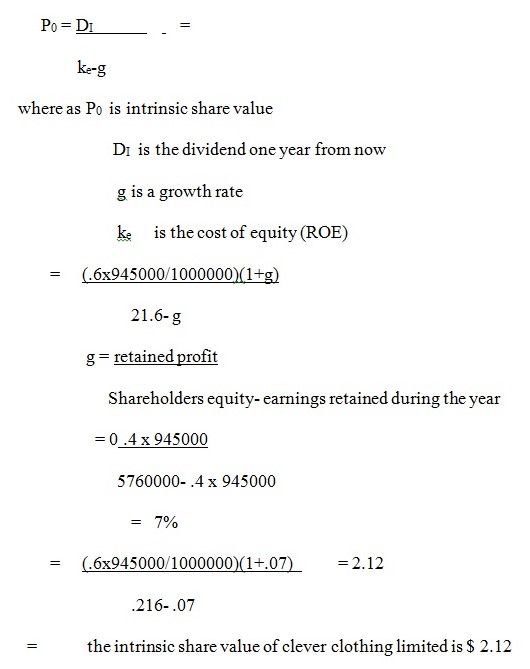

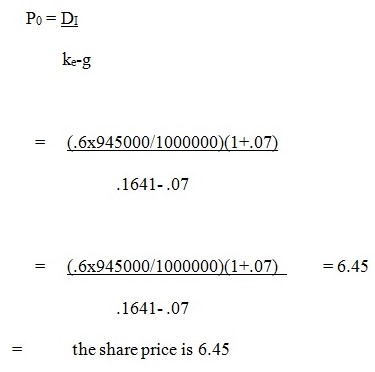

The company intrinsic share value is $ 2.12 using the company’s ROE while using the calculated roe the value will be $6.45. The company will have a high return using the calculated figure as compared to the company’s ROE.

The company liquidity position is measured by the current ratio and quick ratio. Their formulas are as follows;

The current ratio shows that the company can meet current obligations three times but unfortunately they have a large amount of inventory which takes 38 days to be converted to cash. This is not healthy for any business except the banking industry.

Quick ratio = 5,218,700- 4,058000 = 0.69: 1

The liquid assets can pay off current obligation times 0.69 which is far less the obligations. This means that the company is facing a liquidity problem.

1,690,000

The cash operating cycle is the length of time that elapses between a business pay for its raw materials and the business collecting from their customers for the finished goods made from the raw materials.

Cash operating cycle = raw materials holding period + WIP holding period +F.G. holding period + debtors collection period – creditors pay period

From the information provided it will be as follows= Inventory conversion period + receivables conversion period- payables conversion period.

The return on equity is 16.41% while the yardstick for the company is 21.6%. This means that the company is not performing well compared with the expectation. It means that the business is underperforming and soon they may not be able to meet the shareholders’ dividends.

The intrinsic Share value of clever clothing limited at the current 21.6%

Using the ROE provided the intrinsic value of clever is less than the book valuation of the share. This means that the ROE is undervaluing the share value.

You will find projects with such an internal rate of return.

The intrinsic Share value of clever clothing ltd at the current ROE of 16.41%

Conclusion

MML should invest in the new product as it will increase the shareholders’ value. the project return meets the required rate of return and has a payback period of 2years.

Clever clothing ltd has a bad credit management policy and a liquid problem. Companies with such policies find themselves in technical defaults which are always expensive. This can lead to so many costs including legal suits, poor creditworthiness ratings.

Reference List

Geoffrey A Hirt, Stanley Block, Foundations of Financial Management, R, Irwin, 2001.