While carrying out qualitative research, one is likely to come across different or even conflicting points of view concerning the subject at hand. It is therefore very important for research to look into the different points of view before coming up with the most appropriate conclusion. It might not be very easy to work within conflicting viewpoints. It is therefore significant for the researcher to try and understand the different points of view concerning a particular topic. This could be done by looking into the historical aspects of the issue as well as analyzing the available data on the subject at hand. One’s emotions and opinion ought not to form a basis for making conclusions concerning the subject at hand. A researcher must remain open-minded while dealing with different points of view.

A good example of the different points of view concerning a particular subject is the regional integration of the central African states. Some hold the view that such integration would boost partnership between the member states while others are of the view that such integration would only lead to completion between the member states. Some of the supporters of the partnership point of view have cited the existence of untapped resources for instance in Congo. The region is characterized by underexploited mineral reserves as well as agricultural potential. It is argued that such potential would be exploited through integration. There are however those who are of the idea that such integration would only boost completion between the member states given that most of them produce similar goods. Most of them largely depends on oil and the integration would therefore mean more competition (Coplan, 2007). Such discrepancies can only be effectively dealt with by looking at the historical truths and the data available. It is also important to look at other regions that have had such integrations and the outcomes of the integrations (Rosse, 2007).

Synthesizing Perspectives

In the article; ‘Regional Integration in Africa,’ The CEMAC is mainly composed of former French colonies in central Africa. The grouping has been accorded much significance. The grouping is aimed at monitoring and implementing the appropriate measures in enhancing regional trade among the member states. CEMAC, therefore, puts much of its efforts into boosting the region economically in terms of trade among its members as well as finding a common market for the products of the member states. According to the writer of this article, regional integration has proved to be beneficial because the members have greater bargaining power while seeking the best markets for their products. The member countries have for instance benefited significantly from the high oil prices that have been witnessed in recent years. The countries have ensured that their prominent institutions including the banks adopt the set monitoring policies. The member states have also witnessed increased accessibility due to the improvements of the road networks which has been crucial in enhancing trade in the region (Adetulla, 2009). The region has in the recent past witnessed an increase in the flow of goods between the member states. The writer has cited the need for political will in fostering the integration hence reducing the poverty level in the region through economic growth.

Competition In CEMAC

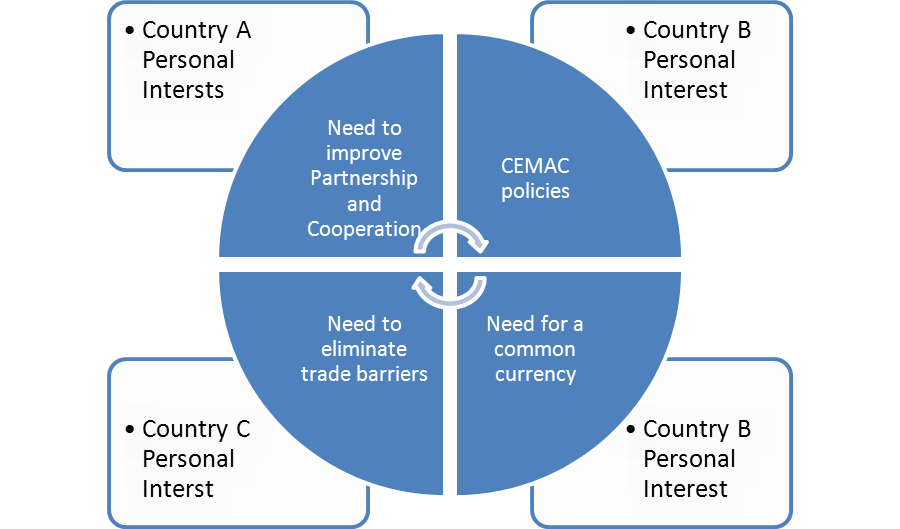

According to the IMF working paper by Samer Saab however, the integration has come with several challenges some of which work against the member states. According to the article, the integration has only led to an increase in completion. Institutions like banks for instance have witnessed unhealthy competition which has led to increased liquidity. There has been no significant cross-boarder monitoring of such institutions. There has been no significant increase in deposits as well as retail loans across the borders. The writer has observed that integration has been hampered by several factors which include; lack of a common currency, differences in the member countries’ institutional policies, and individual interests of the member states (Saab, 2007).

According to this view, the implementation of policies across the borders has particularly been difficult due to the member countries’ interests and the desire to outdo the other members of the block through competition. The region has been perceived to be deficient in the administrative cross-border administrative infrastructure as well as lack of economic complementarities. All these factors have played a major role in minimizing the flow of goods and even people across the borders of the member countries hence hindering integration. The customs union has not been successful in the region. Most of the key institutions in the region, the banks being the best example are either privately owned or owned by foreign firms. This has been a huge hindrance to the integration given that most of these institutions have minimized their lending to the governments of the member countries. Foreign banks in the region for instance own about 63% of the banking assets (Thiery, 2009).

Local institutions, therefore, face a lot of competition from foreign institutions. Foreign banks for instance have been known to be high performers when compared to the local banks. This is attributed to their well-developed mother institutions in their respective countries. Local institutions on the other hand have been characterized by underperformance and losses. The banks across the region have been characterized by a huge discrepancy in the liquidity ratio. There are those with huge reserves hence higher liquidity while others have been characterized by tight liquidity. This can be attributed to the lack of a substantial monetary policy for the member countries. The integration which is aimed at ensuring efficiency in the market was meant to ensure that the members benefit from stable credit institutions has been characterized by inefficiency and unhealthy competition (Hauner, 2006).

Degree of competition

The well-developed and efficient institutions have been known to benefit more from the integrated market at the expense of those which are still developing. The issues of price convergence have not been fully achieved given that there are still some significant price differences in the commodity prices across the borders. The integration has also been characterized by foreign competitors hence undermining the local institutions. There have been significant differences in the earnings of the countries within the region. Most of the well-performing foreign institutions have been capitalized. The differences in the profitability across the borders can be attributed to the disparities in operational efficiency as well as the amount of taxes levied on the profits across the borders as well as the weight of provisions. All these factors have undermined healthy competition among the member states (Saab, 2007).

Excess liquidity and limited investment and lending opportunities have been a characteristic of the CEMAC. Cross-border flows have been insignificant. Statistics from institutions such as banks have shown that these institutions mainly serve domestic customers which indicate minimal cross-border flows (Simone, 2011).

Joining Up Africa

According to the paper entitled; ‘Joining up Africa,’ By James Mackie et al, CEMAC was started for the nations that use the franc to ensure cooperation, for monetary and economic benefits. It is aimed at reducing the trade barriers that exist between the member states and formulating policies that harmonize the trade regulation among the member states. All these are supposed to ensure free flow of capital as well as labor across the borders of the member states as well as ensuring a common external tariff. The grouping has particularly been significant in ensuring food security within the member states, peace and stability among them, improved infrastructure whether the road network or the supply of electricity among the member states. It is also meant to ensure good governance among the states which would in the long run lead to development within the region (Muuka, 2008).

The integration is therefore supposed to raise the individual nations’ GDP. The grouping has been rolling out programs whose aim has been to ensure growth and reduce the poverty levels among the member states. Many efforts have been put in the transport sector be it road, air or rail transport as this would be vital in the integration process. The improved transport system is meant to ensure the free flow of goods and services across the borders. The integration is also vital in ensuring the exploitation of the underexploited resources within the region. It is supposed to eliminate the inequalities that exist through a special fund that is supposed to cater to the underdeveloped areas of the region. It enhances collaboration and enhances the negotiating capacity of the member states (Mackie, 2010).

Conclusion

From the different points of view given about the regional integration of the central African nations, it is quite clear that the integration has its advantages as well as disadvantages. On the positive side, for instance, integration has played a very significant role in ensuring that the issue of excessive fragmentation of the economy is avoided. This ensures economies of scale, increases investment opportunities, and widens positive competition among the member states. It helps the economies to open to the world market; it enhances credibility especially given that the reforms are carried out among the member states. The integration has also been significant in boosting the bargaining power of the member states and reducing regional conflicts. The integration has therefore resulted in several trade gains. It has also resulted in the formulation of new policies that have ensured the realization of various reforms within the member states. The peace, stability, and security of the region have improved significantly (Bongyu, 2010).

On the negative side, however, the member states have been reluctant in ensuring the implementation of reforms hence aggravating the problem of regional imbalance. The member states have particularly been very reluctant in implementing the relevant policies that enhance regional integration. Competition from external players has particularly undermined the local institutions. From the various points of view, therefore, it is quite clear that regional integration has had both positive aspects as well as negative aspects.

Journal Entry

Several journal articles have been written concerning the issues of regional integration among the central African nations. While looking into the issue, several journal articles were available concerning regional integration. One of the journals used in this research is the international democracy watch. The article focuses on the CEMAC, its guiding principles as well as the policies that govern its operations in ensuring that regional integration of the central African states becomes a success.

“The subsequently created CEMAC was to replace and improve the customs union. 1999 ratified N’Djaména Treaty defined as main objectives of the Community to converge and monitor national economic policies, to coordinate sectoral policies and to progressively create a single market (CEMAC, 1999).”

The other article that has been considered for the study is the “African Development Review” which looks at both sides of the integration in terms of partnership as well as competition. It brings out some of the setbacks of the integration which has led to some of the failures that have been witnessed due to the integration. One of the quotations from the article which indicates the difficulty that the grouping encounters in implementation of the set regulations is;

Our decomposition shows that the part of the agreement that calls for further preferential reduction of tariffs is immiserizing, although given the low level of intra-regional imports; the quantitative impact is quite small. Improved access to partner country markets accounts for about one-quarter of the gains. We find, however, that about three-quarters of the gains come from the reduction of Cameroon’s tariff against the rest of the world. Moreover, our estimates for Cameroon’s unilateral trade liberalization show that it can gain marginally even more from full unilateral trade liberalization than it can from the implementation of the CEMAC arrangements (Bakoup, 2007).

This is just an indication of the individual interests of the member states which pose a challenge to the integration.

References

Adetulla, V. (2009). CEMAC. Regional Integration in Africa, 2-3.

Bakoup, F. (2007). The Economic Effects of Integration in the Central African Economic and Monetary Community. Africa Development Review, 3.

Bongyu, G. (2010). The Economic and Monetary Community of Central Africa (CEMAC) and the Decline of Sovereignty. Journal of Asian and African Studies, 3.

CEMAC. (1999). Central African Economic and Monetary Community. International Democracy Watch, 1-2.

Coplan, D. (2007). Relevance of African Traditional Institutions of Governance. Economic Commission For Africa, 4.

Hauner, D. (2006). Bank Effeciency and Competition in Low Income Countries. IMF Working Paper, 2-5.

Mackie, J. (2010). Support to Regional Integration. Joining up Africa, 2.

Muuka, H. (2008). Impediments to Economic Integration in Africa. Journal of Business in Developing Nations, 5.

Rosse, J. (2007). Testing for Monopoly Equilibrium. Journal of Industrial Economics, 1.

Saab, S. (2007). Banking Sector Integration and Competition in CEMAC. IMF Working Paper, 1-3.

Simone, A. (2011). The Urbanity of Movement: Dynamic Frontiers in Contemporary Africa. Journal of Planning Education and Research, 379.

Thiery, B. (2009). Competition and Effeciency in Banking. IMF Working Paper, 5.