Introduction

This is a case study of Marsh & McLennan Company. The case study researches on the five problems that are facing this company. The study goes a head explaining the strategic analysis of Marsh & McLennan by analyzing company’s SWOT analysis, Five Forces or value chain and the generic strategies. The study will also explain financial analysis as well as the problem solving options available for the company. Last but not least, the case study will provide the best recommendations for the company.

Problem Statement

Being an international company and having the desire to grow Marsh and McLennan Company (MMC) has experienced some set of problems. It is worth noting that a number of the problems they faced have been successfully handled while some have not. The problems that will be explored in this case study are bid rigging, price fixation, issues relating to kickbacks, competition and cultural diversity. For any organization to maintain it global status and continue to capture new customers as well as maintaining the existing one there is need for it to adequately address existing problems in a rational manner.

Bid Rigging Process

Marsh & McLennan Company has been working with major insurers in the world in the process of rigging the biding process for the causality of property insurance coverage. The brokers of MMC such as Guy Carpenter influenced which organization would engage in business with their customers concerning issues related to insurance. MMC went to the extent of dictating the price the transaction. The business plan of Marsh & McLennan Company was only interested increasing revenue from business with insurers who were willing to pay higher commissions. However, in the process of business transaction with regards to insurance, most of Marsh & McLennan Company clients ended up being misled. They were made to think that, they were being given the deal that was the best in the market. In contrary, the reality was that, they ended up paying a much higher premium. It is no doubt that the company was acted in their own best interest, not of their customers as it continued enjoying higher commissions at the expense of their customers.

Price Fixation

Price fixation is an agreement between players which are on the same side in a certain market to make a purchase or sell of a certain product commodity or service only at a price that is fixed. Price fixation entails an understanding between the two involved parties in which they ensure the existing conditions in the market persist in which prices are set to be in a certain level by having full control on availability of goods and services. Marsh & McLennan Company engaged itself in several scams of price fixation with the aim of manipulating the price market in the industry of insurance industry. It involved lots of conspiracy between sellers to ensure price coordination for the mutual benefit of their own. In the process of assisting insurers to renew certain policies, the company maintained an agreement with other players in the insurance industry to set higher prices to ensure that the former retained its business.

Acceptance of Kick Backs

A second and serious problem facing MCC is with regards to kickbacks. It has been defined as either payments or offerings of services with the target of influencing or gaining some favors from a company or even persons. It can be in one way being referred to as bribes. In the United States laws have been placed in place to address corruption and bribery. The laws have made it possible for individuals and companies involved in bribe be written off, jailed or face harsh penalties. Such things occur because; the giver wants to receive a favor in obtaining or even rewarding a kind of treatment that favors a connection with primes or during subcontracting.

It was proved that most insurers paid a lot of incentives to MMC in the controversial contingent commissions apart from basic standard commissions for the attainment of a particular business quota. It is worth to note that the company generated revenue also from contingent commissions especially in the years 2003. There was a case in which the company-MMC was taken to task by Blumenthal Inc. for accepting kickbacks in turn of influencing its customers to engage in business with Blumenthal insurance company. The kickbacks were thought of being secretly included in clients’ premiums. Being part of his investigation concerning abuses in the insurance industry, Marsh & McLennan Company was sued by Blumenthal in 2005. He claimed that, his investigation has resulted to around settlements amounting to 12 million US dollars with both brokers as well as insurers. The settlement ran in excess of $540 million as well as almost $40 million in civil fines. His first accusation involved Marsh & McLennan company along with the providers of insurance by the name ACE Financial Solutions INC. the two were involved in a deal of setting a scam, under which secretly, ACE paid a commission amounting to &$50, 000 to Marsh & McLennan as it steered the compensation of state workers contract to ACE that amounted to $80 million.

Competition

It is no doubt that insurance firms have perfect and imperfect competition. This is attributed to the lack of mechanisms that help in allocation of vital resources. Competition has thus seen to it that business entities, MCC not being an exception have derived new ways such as adopting technology, coming up with new products and service in order to remain in business. This kind of greater selection basically leads to price lowering, as compared to what the prices would have been of monopoly and oligopoly, (OECD 200).

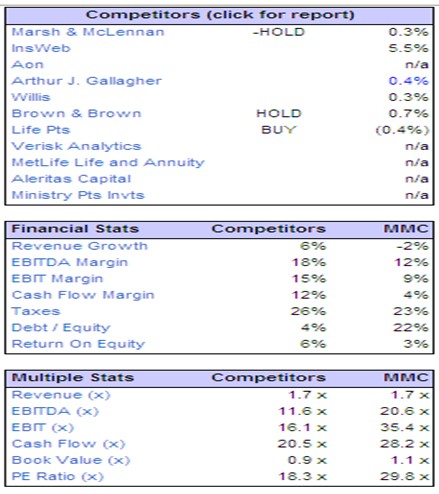

It has been shown that, the industry of insurance generates $85 billion as annual revenues. However, firms like Marsh & McLennan and Aon has been dominating the industry for the past few years. However, the industry has remained highly stratified, with around top 50 companies dominating 20% of the sector. However, due to problems emerging arising as a result of regulatory problems, major Marsh & McLennan Competitors as well as Marsh itself are largely at a competitive disadvantage to each other.

Disgrace linked to the company’s pricing of insurance plan

Insurance business has been dynamic in the recent past with regards to broking business.. According to Menon 38 the company has found itself being accused of going against antitrust arrangements when it received illicit payments in form of market service agreement, which led to the payment of funds for the services that were dispensed by Marsh in unjust manner, as a result, marsh ended up suffering serious losses in its share prices as well as materially due to downgrading of its senior subordinated debt. This negatively impacted on the company’s ability to finance its operation in the short-run considering the higher interest when borrowing money. It is worth noting that the company was at no time forced into engaging into such transactions. However, it is interesting to note that competitors for instance Hilb enjoyed such transactions. Given that Marsh had generated $800 million based on these contracts during 2004, it is clear that the losses as a result of not using these contracts any more have been great reputationally and material, and have further hurt them competitively when other companies in the industry can still agree to these contracts” (OECD 98).

Cultural Diversity

There have been also variations in the manner in which communities organize themselves, in their shared conception of morality, ethics, as well as their environmental interactions (Schwartz 240).

The instances under which Marsh & McLennan has ignored cultural differences as well as poor understanding of “foreign languages have cost several billions and billions of money in the recalled products as well as goodwill loss”, (Allan 678). In such a circumstance, such cultures have demanded marketing communication strategies which are presented to them along the achievements lines of their objectives. There are some countries which individuals do fear uncertainties, while others are too courageous to face any risk, such factors affects insurance companies. Discrimination is evident in certain countries such as Japan and most of the Middle East countries; men seem to have authority over women. In contrast, countries like Sweden, women have more power in buying decisions. Globally, there are different cultural standards being, thinking and acting, because of cultural diversification, has influenced Marsh’s workplace values as well as business communication (Ron par 4).

Strategic Analysis

Five Forces

Threat of new entry in the industry such as Arthur J. Gallagher & Co., Brown & Brown, Inc. and Willis Group Holding Public Limited Company has stiffened the competition. Entrepreneurs ranged as being average are not able to enter the consultancy and insurance industry, as a result, the threat of new entry is just among the consultancy and insurance company’s themselves. Marsh has ended up curving niche regions in which it underwrites insurance and consultancy. Financial institutions such as American Banks pose a serious threat to MMC since they offer customers with services and products similar to those offered by MMC. In U.S, even legislation does not hinder banks as well as other financial institution to start offering insurance services (Baker 189.

Suppliers strength; it has been noted that threat from those supplying capital might not be of concern but the problem is their ability to attract human resource. If for instance a talented insurance writer or even talented technology consultant is offering his service in Marsh Company, other big companies might entice the fellow company which is intending to move in the same business. The buyers’ power; those buyers who are just individuals cannot offer much threat to the industry, however, the buyers’ threat arises when “Large corporate clients have a lot more bargaining power with insurance companies. Insurance companies try extremely hard to get high-margin corporate clients” (Porter 109). This in turn to affect MMC will be a great threat to its existence.

Substitute Availability; in one way or the other, this looks to much more straight forward, because, there are enough substitutes in the industry of insurance and consultancy. Most large insurance companies such as AIG and AON are major competitors that offer customers similar products as Marsh Company. It is apparent that the type of insurance products and services being offered by the company might be offered by other companies. In the similar field of insurance and consultancy, on the other hand, the presence of substitutes is very few and far between. Organizations like March Company, which have ended up concentrating more on niche areas, hold a very high competitive advantage. Nevertheless, such kind of competitive advantage entirely relies on niche size, as well as whether there are any other barriers that hinder other firms from entering the niche (Valentin, 55).

Competitive rivalry; the insurance industry as a whole, is becoming very competitive industry as compared to any other industry in the market. Marsh Company has created competitive advantage by having lower cost of doing business, high quality customer services as well as high quality products to; helping them beat their major competitors. The company did manage to utilize high return on their investment coupled with various products in trying to capture new customers as well as maintaining the existing ones. As time goes by, individuals and corporate are expecting to see more and more consolidations in the industry of insurance and consultancy. It has been proved that, very big firms like Marsh & McLennan have started preferring taking over or even merging with other insurance companies like Willis, other than spending the money in marketing and advertising it products, covers as well as other services offered like consultancy to individuals and cooperates (Porter 196). It is evident that merging and acquisition brings with it advantages but also disadvantages for instance the pooling together of resources place the organization in a better place to expand their market. However, it reduces competition bringing the risks of poor service delivery.

Generic Strategies of Marsh & McLennan Company

Cost Leadership Strategy

The company provides quality consultancy and insurance products produced at a low price, and keeps on selling them at an average price to gain higher profits as compared to other competitors. MMC gained market share longtime ago, and is among the top 50 insurance companies in the U.S that controls 20% of the insurance industry (Turner, 30). When there are instances of wars in pricing Marsh has the ability of reaping profits as its competitors for instance AON and AIG make losses. It produces cheaply as it has small but efficient and competent workforce, during price decline, Marsh has remained profitable (OECD 123).

Marsh has gained cost advantage through the improvement of operations, efficiency, searching for optimal service outsourcing of consultancy services and insurance brokers, as well as encouraging vertical integration decisions. Since in one way or the other, the company has succeeded in the attainment of cost leadership, it has gained the following internal strength; Marsh can access any amount of capital which helps it make reasonable investment in diversified assets for service provision. This advantage has ended up preventing other industry from effectively enter or compete favorably with Marsh (Porter 45). – VERY GOOD

Marsh Company is much skillful when designing its insurance products and consultancy services; this has enabled it to be much attractive in the market, hence gaining a very large market share. MMC has highly experienced people in its workforce. Such individuals know what to at the right time to win against their competitors. For instance, the marketing group is very marsh experienced in the creation of global marketing communication, as it is far much sensitive on cultural diversity. “On top of everything, the company has efficient distribution channels outsourced from insurance brokers.” (Porter par 4).

Additionally, it is no doubt that adoption of technological innovation has resulted to the insurance sector to be behind productivity as well as promotion of the products hence working against the existing competitive advantages the companies enjoyed. In addition to that, several companies that have been following focus strategy, and even narrowing down to target smaller markets, have even ended up having lower costs within their segments, hence “gaining reasonable market share, as compared to Marsh company, which has ended diversifying its operations ranging from insurance operations to technology consultancy services” (Porter 156).

Separation Strategy

The firm has in place services and goods that are unique that keep luring new customers as well as maintaining the existing ones. Such customers have perceived their products to be far much better as compared to any other product from different insurance companies. Though a times most of Marsh & McLennan Company clients have been being misled. For instance, they have been made to think that, they are being given the deal that is the best in the market. In contrary, the reality is that, they ends up paying a much higher premium. However, Marsh & McLennan adds value to its products by making them much unique in the market, hence “charging higher premium prices for such products”, (Tamer et al, 297).

Marsh & McLennan held the view that when premium prices are set to be high it will help offsetting cost incurred during production; this is attributed to why the company has found itself in trouble concerning price fixation. It is worth noting that the company whenever faced with extra cost for instance from increased prices of supplies, it passes the same to their customers. Since the company has somehow succeeded in differentiation strategies, it has ended up gaining the following internal strengths; the company can access the leading scientific research in the world, hence has lots of information on customer demands and desires, likes as well as dislikes. It has also has enough information on the upcoming insurance market as compared to other companies who might not have such capacity of accessing leading research services. “The company also has a highly skilful as well as creative service and product development team, which ends up coming up with unique products in the insurance markets every now and then”, (Obert 90).

The company has also outsourced a strong sales team, that is far much equipped with enough product and service knowledge, hence can successfully pass the perceived product strength to its customers with no problem. Last but not least, the company has corporate reputation because of its quality and innovation.

However, Marsh and McLennan Company’s insurance and consultancy Products along with services have ended up being imitated by other competitors like, the Hartford and Munich American Risk Partners. The company has also suffered a lot due to changes in customer tastes that have been occurring in the insurance and consultancy industry. This can be exemplified by the desire to have flexible arrangement in terms of paying premium. Furthermore, several firms have been have been concentrating on focus strategies, might end up even attaining even a greater differentiation strategy in their market share, compared with other companies like Marsh & McLennan company,.

Focus Approach

This plan will help the company to concentrate smaller markets in which it is trying to cut itself an edge and capture new customers. “The premise is that the needs of the group can be better serviced by focusing entirely on it” (Obert 68). Different insurance firms which have been using this strategy, in most cases enjoy a very high level of customer’s loyalty, as a result, other companies fear coming up openly to compete with them directly. Since Marsh & McLennan has not concentrated on this strategy, it misses out such competitive advantage.

Due to its wide market concentration, the company is always having large volumes, hence larger bargaining power with their suppliers, however, since the firm has been trying to pursue differentiation strategy, hence, has been in a position of passing its high costs to the clients who have very limited substitutes or even substitutes do not exist. Since the firm has not succeeded in focus strategy, Marsh & McLennan has not been in a position of tailoring a wide range of product development strengths, “to a comparatively small market segment, that they have enough knowledge about it, though the company has a very well skilled and experienced staff”, (Porter par 17).

Though the company does not suffer from focus strategy impacts, but it also enjoys some advantages due to its position of not incorporating focus strategy ideas in its operations. For instance, it does not suffer from imitations and charges in target market segments. In addition, it is very simple for Marsh being a broad market leader, to adapt its insurance and consultancy services to compete just directly with other companies that have bought the idea of focus strategy. Last but not least, firms which have focus strategy might face it rough when trying to carve out broad segments that they want to serve (Mintzberg 80).

Marsh SWOT Analysis

Strengths

Global presence; Marsh is a global company which has taken its offices to different places in the world. So in case of profit loss in one region, other regions ends up compensating for that lose. In addition, being global means having large market share resulting to increased number of clients, resulting higher income generation.

Diversified business risks; Marsh is a global professional service holding Co, which provides diversified businesses in risk, strategy as well as human capital. This shows that the company has diversified its risks in different business areas. In case of any shortfall in one area, other areas continue generating profits (mindbranch.com par 7).

The company has very strong growth prospects; according to business analysts, Marsh & McLennan has a very bright future, hence most investors keep on investing in the company, hence good financial position for any kind of borrowing or investment it desires to make. Also the bright future of the company allows it to gain confidence or customer loyalty.

Weaknesses

Declining market share; in the recent past, the company lost lots of clients due to its bad image which resulted from company’s illegal allegations. For instance, the company was engaged in price fixation scandals, bid rigging process as well as acceptance of kick backs. This ended up tainting company image hence loosing lots of market share.

Other weaknesses include; low return on equity, and declining operation margin. It is also important to note that the in ability of the company to retain its workforce works against the organization. Additionally lack of marketing expertise, we are not told whether or not the company has at their disposal those who can help to popularize the product. The company is well known and recognized as a giant in the electronic market and in production of new insurance products hence the target market may not be surprised by this new innovation. It does not have a well established internal distribution channels, they heavily relay on external suppliers.

Opportunities

According to Scott 200 good financial position; Marsh Company is in a very good financial position which guarantees the company a reputation for any loan and borrowing. With such capability, the company can invest intensively in marketing and distribution channels to win over its competitors

Skilled workforce; the company has skilled and talented workforce which can be moved and trained in other areas of business, hence the company has the capability of coming up with unique products in the market. Such products are highly charged to ensure the company covers their cost of production, yet clients have no choice as such products have little or even no substitute.

Technology development; since the company has enhanced technology in its service and product delivery, the company spending on marketing and distribution channels has drastically reduced. This is due to the introduction of internet and website services through which the company advertises its products and services. The company has also embraced online service provision, which enables customers to get whatever they want at any time at any place.

Global economy growth; though in the recent past the world has been faced with economic recession, but generally the world economy has grown significantly, as an effect, there has been an increase in the spending power. This means more people can now even take insurance cover. In addition, economy growth means more individuals have opened up business, and existing ones have expanded (Scott 186). Due to this, more people are looking for consultancy services in either technology or risk management. On top of that, such businesses need to be insured, hence increasing the number of clients.

Threats

Increased competition; due to the increased number of competitors in the insurance industry, the company has lost some of its clients to its competitors.

Rising of wages; since the living standard globally has risen, meaning more workers globally are demanding salary increase and Marsh workers are no exception. This means an increase in company spending. Though such costs might be passed to its client due to unique products produced, competitors like AIG have ended up imitating products and services offered by Marsh; hence “customers have substitutes to take. Hence the company has to incur some losses as it can’t pass all expenses to clients who have options” (IBIS World Industry Report 59).

Increasing interest rates; though the company is in a good financial position to borrow money from any financial institution, such loans are becoming expensive due to raising interest rates.

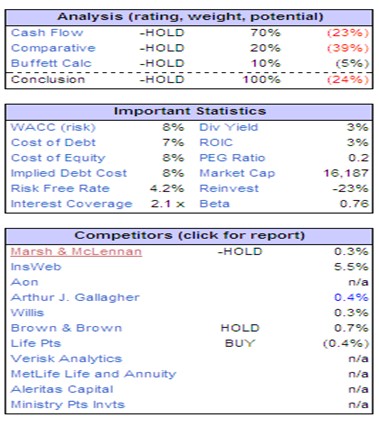

Financial Analysis

Marsh revenues have improved by 9% to around 2.8 billion by 2010. This might be attributed to the economic stability of the globe after the 2008-09 financial crisis, improved marketing strategies and going global where the company got a chance of expanding it market. MMC weighs 53.3% of the sum of all sales. It grew at a rate of 11.0%. This growth is much impressive considering the industry of insurance which at the moment is under a stated called soft Market, where completion and rivalry is much intense as well as declining insurance prices. For the two sections, the growth were 12.0% and 2.0% respectively. The sizeable consulting businesses Mercer and Oliver, which have been competing with the likes of Towers Watson & co, both reported a growth of 6 percent to report the rest of the sales in the company, (Docstoc.com, line1).

The company operated on $325 million as income; this is after incurring $28 million loss in the previous year. In the past few years, the company’s operations have been under constant flux, as well as containing many restructuring items for the sale of no-core assets in the process of settling some “lawsuits like the alleged handling of contingent commissions that were held in 2004 as well as ERISA class actions by last year” (Fuhrmann par 4).

The company revenue went up by 7.0% totaling 10.50 billion. On the same note brokerage grew by 9.0% as consultancy business went up 5.0%. The company recorded net income of $855 million, typically translating to $1.55 per share. It is worth noting that information with regards to cash flow was not made available by the company. Nonetheless, the finance department did project sales to grow by 2.0% in 2012.

The company’s share value increase is attributed to stable earnings as well as good performance of stocks in the market. The Forward P/E is quite high by now, as it stands at 17, as the uncertainties still exist “over how fast Marsh can grow organically going forward. It is seeing a nice recovery in its operations due to a stronger economy and having finally settled what seemed like an insurmountable number of company-specific problems and allegations” (Fuhrmann par 7 Further statistics are provided in the index page.

Problem Solving Methods

Ant-competition strategy

When dealing with competition problem, it is good for Marsh & McLennan to know its competitors such as AIG and AON very well. It should not deal with all the competitors, but just three or four major competitors. This in one way or the other will assist the company in breasting what the firm needs to do better in business, and ensures that clients have knowledge on the reason that is making them to choose Marsh’s products and services but not others. Marsh and McLean needs to ask if the competitors are effectively branded, and what are their offerings. This will be helpful when looking for research information. The company needs to identify the customers’ perception over competitor’s products along with services, and identify areas that they are doing better as compared to itself, in terms of quality pricing, as well as internet availability. Marsh and McLean needs to take more time assessing competitors’ websites to identify what they are offering and the site setup, as well as how friendly it is. As a result, Marsh needs to come up with a better one. After looking for all these information, should then make comparisons between its site and competitors sites. It should also look at “sales points – things that you can advertise having that the competition doesn’t” (Millions par 8). The company might also start offering unique products at a discount or even on offer. All these are potential sales points for Marsh Company that will act as reasons for clients to choose Marsh products, over its competitors’ products. The fact remains that, if competitors are not known in and out, it’s very hard to compete favorably with them.

Damage control

It is true that Bid Rigging Process, Price Fixation, Acceptance of Kick Backs problems destroys the company reputation as well as company name, as an effect, in dealing with them the company requires damage control systems. The planning for damage control system does not in itself clean the company name completely, but it makes the company to minimize the real harm.

In such a situation, Marsh needs to involve the Public Relation (PR) team, in the process. It should at first get ready with the PR team, this department needs to be at the forefront when handling damage control. The team needs to comprise of individuals who are experienced and knowledgeable about the crisis that the company is dealing with, legal experts, departmental heads, as well as marketing individuals. In the PR team, there need to be a spokesman, “entitled with the responsibility of dealing with media, hence, needs to be available for interviews. Such a person needs to be a good public speaker along with tolerant to media nosiness” (Tamer et al, 297).

Transparency and honesty are other attributes that are of significance, this is because crisis are managed better if is unexposed to media, however, if media has accessed it, the company ought to act very first in responding. It should not avoid media at all, but give them transparent along with honest information. If for instance, the company is at fault, it should admit, and state efforts that are being made in resolving the crisis. If it was done by others, then is good to explain their level of involvement. If it was just rumors, it is good to say so, and move ahead to explain the claim supporting it with concrete data. Media on its part has ways of determining if the you are lying or not, so “it is not reasonable to lie, because if discovered, their business will be submerged in a very deep pit” (Graves par 3).

At initial stage, the company needs to make public statements that explain all aspects of the crisis, it should have, company’s take on things, as well as responses to the crisis. It should also send such like statements to the media. This process will tent to show that, the company is accountable and very responsive to the problems. It will also hold lots of water if the company apologies to the public.

The company can also write scripts, which mainly will be used by PR spokesman and other PR team members during interviews. Such scripts are much important as they will ensure that information given out is consistent. There is no need of memorizing them, but they should be delivered very spontaneous and very natural as possible.

It is not good to wait for the media to hunt the company, the company need to be a head of it, especially when the crisis is news making. This strategy is the most effective crisis management. This is based on the fact that, this shows that, the company is aware of the problems, and that it is very much willing to scrutinize it publicly, hence earning some marks there. So before reaching news desk and editorials, it is already public. “The company should contact several media organizations, and narrate the story to them, emphasizing on the efforts being made the resolve the problem” (Graves par 6).

Intensive Lessons

In dealing with problem of cultural diversity which affects company’s global marketing communication, the company has to turn into intensive lessons, teaching its global marketing communication team different languages and cultures. This enables the company to maintain position on the global market. This is because; the company will be seen as appreciating cultural diversity. It should also provide cultural sensitivity training which enables them to deal with issues like etiquette, communication styles, protocol as well as negotiation approaches. In the current competitive world, Marsh should appreciate cultural sensitivity as an important tool to them when forging longer and most prosperous relations, yet the progress has been too slow (Hofstede, 198).

The company should also employ individuals from different cultures throughout the world to work in their own respective regions and cultures; this will make the company to be perceived as one of their own, hence gaining good picture.

Recommendation

From the above list of problem solving options, damage control is the best option available for Marsh Company to deal with its current problems. With damage control mechanism, the company will be in a position of maintaining high company integrity and good image. A reputable company globally, will be perceived the best, hence winning customer loyalty. With this, cultural diversity will not affect the company in any way., as the company has to put in place its PR team, which is another expense to the company, but it is the best in the market, when faced with any form of crisis.

Additionally, the approach will help the company be in compliance with the laws, guidelines as well as procedures in doing its business. It is worth noting that corporate compliance will ensure that MMC is always in line with various provisions hence not in the wrong side of the law. This will give the company an opportunity to concentrate more on dealing with customers hence meeting their demands and needs rather than dealing with legal battles regarding the problems stated herein. More importantly, the initiative will definitely save the organization million of dollars that could be spend in solving legal matters as well as compensations.

Conclusion

In the past few years, Marsh &McLennan has been faced with lots of problems starting from price fixation legal litigation problems, high competition in the insurance market, effects of global cultural diversity as well as stigma attached to marsh’s insurance plan pricing. However, the company is trying to recover from such problems. Some of the issues that are helping the company to recover can be analyzed under five forces, Company’s SWOT analysis as well as generic analysis.

Starting with five forces, it can be explained that, the insurance industry by itself does not allow new entrepreneurs to enter, since most insurance companies have curved the niche regions under which they operate, hence new entrance needs lots of capital to penetrate the market, however, the threat is just among the insurance companies by themselves. On the other side, the power of suppliers in the industry is too low, can’t affect the industry. On the other hand, individual buyers won’t affect the market as such but the real threat comes from the corporate buyers. In the insurance industry, there are enough substitutes in the market. On top of all these, the industry is very competitive (IBIS World Industry Report 45).

Having in mind that attractive insurance services and products as well as consultancy services are competitive advantage, the company has managed to cut itself an edge in the market by strategically positioning itself. Though a time it gets bellow average profitability, but it continues generating superior returns. The company has leveraged its strength in a manner that its strengths fall under cost advantage and differentiation. The application of such strength three generic strategies, namely cost leadership, focuses, as well as differentiation (Obert, 21).

Considerably, the company has enshrined the strength, weaknesses, opportunities as well as threats it faces in their day to day business activities. This SWOT analysis presented unbiased of the firm’s main strengths along with weaknesses, as well as available opportunities and threats. This in one way or the other has helped the company to understand its competitors, customers and its partners very well as well as building competitive strategies (Hill, & Westbrook, 50).

To prove the matter that the company is recovering, Marsh & McLennan financial analysis shows a great improvement. There has been a rise in its share price which has resulted to higher company’s income. Though this has shown improvements, but is will be good if investors can wait to see sustainability in the company before investing more in it.

On the other hand, though there are several options through which Marsh can solve current problems, the best option available is damage control mechanism. This method will ensure that the company has maintained its integrity and improved its image in public. As a result, it is the best marketing strategy that the companies need to emulate.

Works Cited

Allan, David. “Global Marketing and Advertising”, International Marketing Review. 23.6 (2006): 677 – 680. Print.

Baker, Michael. Marketing Strategy and Management. London: Macmillan.1992.

Docstoc.com. Marsh & McLennan Companies, Inc. (MMC) – Financial and Strategic Analysis Review, 2010. Web.

Fuhrmann, Ryan. Marsh & McLennan Regaining Respect. 2011. Web.

Graves, Patricia. How To Plan for PR Damage Control, 2011.

Hill, Lauryn. & Westbrook, Russell. “SWOT Analysis: It’s Time for a Product Recall”. Long Range Planning. 30.1(1997): 46–52. Print.

Hofstede, Geert. Cultures Consequences: Comparing Values, Behaviors, Institutions, and Organizations Across Nations. 2nd Ed. Thousand Oaks CA : Sage publications, 2002. Print.

IBIS World Industry Report, “Direct Life, Health and Medical Insurance Carriers in the US: 52411“, 2007.Print.

Menon, Sreedhara.” Antecedents and Consequences of Marketing Strategy Making”. Journal of Marketing. 63.1(1999): 18-40. Print.

Millions, Daniel. Dealing with Competition, 2007. Web.

mindbranch.com . Marsh & McLennan Companies, Inc. – Financial and Strategic Analysis Review. 2009. Web.

Mintzberg, Henry. “The Design School: Reconsidering the Basic Premises of Strategic Management”. Strategic Management Journal, 11.1(1990): 171-195. print.

Obert Grant. Contemporary Strategy Analysis. Oxford: Blackwell Publishing. 2005. Print.

OECD. “Competition and Related Regulation Issues in the Insurance Industry”, 1998.

Porter, Michael. Competitive Advantage: Creating and Sustaining Superior Performance. New York: The Free Press, 1985. Print.

Porter, Michael. Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York: The Free Press. 1980. Print.

Porter, Michael. Porter’s Generic Strategies. 2010.

Ron, Welsh. How Cultural Differences Affect Your Global Marketing Message, 2005. Web.

Schwartz, Shalom H.. Values and Culture”, in Muro, D. Carr, S. & Schumaker, J. (Eds), Motivation and Culture. New York: Routledge.1997. Print.

Scott, Armstrong.”The Value of Formal Planning for Strategic Decisions”. Strategic Management Journal 3.3 (1982): 197–211. Print.

Tamer C., Gary K. & John R. International Business: Strategy, Management, and the New Realities. New Jersey: Prentice Hall, 2007. Print.

Turner, Steven.Tools for Success: A Manager’s Guide. London: McGraw-Hill, 1999. Print.

Valentin, Evans. “SWOT Analysis from A Resource-Based View” Journal of Marketing Theory And Practice. 9.2 (2002): 54-68. Print.

Appendix