Executive Summary

This study strives to find innovative ways to improve risk management performance in new petroleum companies. It focuses on highlighting the role of human resource practices in risk management and explaining how this field could improve risk management performance. The study has three main research objectives. The first objective is to review current theory on managing human resource performance in petroleum organisations. The second objective is to evaluate the current management practices in the human resource field and explain how it could improve the risk management performance in new petroleum companies. The last objective is to make recommendations on how to improve risk management performance in new petroleum companies.

The relationship between risk management practices and human resource practices was important in meeting the above-mentioned research objectives. Through a case study research design, this paper investigated the human resource practices and risk management programs of two leading petroleum companies in the United Kingdom and the United States – British Petroleum and ExxonMobil. This study shows that both companies have different risk philosophies. British petroleum had a high appetite for risk, while Exxon Mobil was risk-averse. Despite their different risk philosophies, both companies had ineffective risk management programs because they failed to recognise the role of human resource practices in improving their risk management performance. Therefore, although B.P and ExxonMobil are successful oil and gas companies, they have not fully exploited the potential of their human resource practices in improving their risk management effectiveness. Based on this weakness, this paper argues that “people” are at the centre of risk management practices. It also argues that human resource is as a key tenet of organisational management practices. Based on these relationships, this paper suggests that the success of risk management processes largely depends on the success of human resource practices. A further dissection of this suggestion infers that the success of risk management depends on the success of hiring, recruitment, training, and appraisal plans. To overcome some of the main challenges that undermine the risk management practices of petroleum companies, this paper recommends two strategies – decentralise H.R activities by increasing their penetration to the organisation’s risk management practices and improve employee recruitment strategies by using employee referrals to attract specialised talent. These recommendations help to overcome labour shortage problems that undermine risk management practices in petroleum companies. Similarly, they would help to stretch the outreach of human resource activities in petroleum companies by making them more instrumental (active) in managing the risks that petroleum companies experience.

Overall, this paper shows that current literature on risk management performance and H.R fail to address the complexities associated with people risk and their effects on H.R processes. This way, they fail to explain how leadership and decision-making failures affect risk management processes. This is why some petroleum companies have treated risk as a functional responsibility of their organisational practices. Future research should explore the link between “people risk” and explain not only how they affect H.R practices, but also explain how they affect risk management processes.

Introduction

Background and Objectives

The oil and gas industry has played an instrumental role in spurring economic, social and political growth in the 21st century. Its contribution stems from its large contribution to the world’s energy generation projects. While environmentalists would oppose the use of fossil fuel, the truth is that, in the short-term, stopping fossil fuel use would grind economies to a halt and render most modern equipments obsolete. While many people may understand how the energy industry contributes to their social or economic growth, few people understand the risk factors affecting it. Concisely, oil companies have many operational risks. This is why they require a risk management plan.

Risk management is an old concept in business management. Knight (1921) says it stems from uncertainty and the theory of error. These contexts (uncertainty and the theory of error) are important to the probabilistic risk analysis. Osabutey and Obro- Adibo (2013) and Ducatteeuw (2005) define risk as the likelihood of a specific consequence happening. Ducatteeuw (2005) adopts a broader definition of the concept by saying:

“Risk management is a term applied to a logical and systematic method of establishing the context, identifying, analysing, treating, monitoring and communicating risks associated with any activity, function or process in a way that will enable organisations to minimise losses and maximise opportunities” (p. 5).

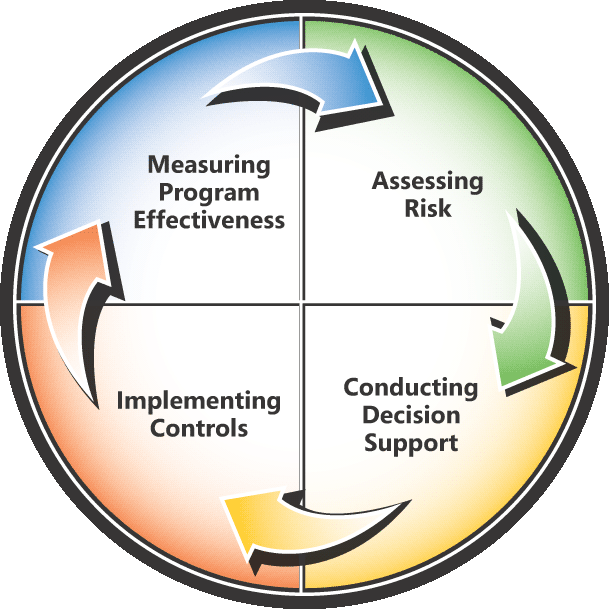

Risk management is as much about minimising the risk of uncertainties as it is about exploiting the opportunities for global trade (Tang 2006). Understanding the nature of risks and how best to manage them are the main goals of undertaking the risk management process (Osabutey & Obro- Adibo 2013). Risk management also strives to improve company performance through early risk detection and effective disaster management. Based on this definition, risk management is a critical part of a good management framework (Zimmerman 1987). Here, risk management refers to several iterative steps to manage an organisation’s operations. When undertaken sequentially, these iterative processes help managers in their decision-making responsibilities (D’aveni 1995).

Risk management does not operate in isolation; it is part of a wider organisational management paradigm that includes decision-making processes and monitoring and control processes (You, Wassick, & Grossmann 2009). The diagram below elaborates this interaction:

The risk manager is responsible for the proper implementation of the risk management program. His/her responsibilities may include developing an organisation’s risk management plan, implementing policies and procedures for risk management, educating employees about risk management, and investigating potential sources of risk (Holt & Andrews 1993). Their duties may differ, depending on an organisation’s activities or industry.

Pate-Cornell (1993) says the need for a risk management plan for petroleum companies cannot be underestimated. For example, the 2010 gulf oil spill shows the importance of petroleum companies to have an elaborate risk management plan because the disaster occurred after many risk management failures (Zolkos & Bradford 2011). Similarly, the company’s failure to have an effective risk mitigation plan led to its poor handling of the disaster (Zolkos & Bradford 2011). Indeed, independent reports by the U.S Coast Guard and the Bureau of Ocean Energy Management blamed British Petroleum (B.P) for the crisis and for its poor handling of the disaster. According to Zolkos & Bradford (2011), the investigative team:

“Found no evidence that B.P performed a formal risk assessment of critical operational decisions made in the days leading up to the blowout. B.P’s failure to fully assess the risks associated with a number of operational decisions leading up to the blowout was a contributing cause of the Macondo blowout” (p. 4).

Other independent review bodies also said that poor cost and time-review decisions by the company led to its poor response to the disaster (Zolkos & Bradford 2011). A deeper investigation of the disaster showed that the company failed to consider the hazards that the drill crews experienced and the potential risks posed by the company failing to maintain checks and balances that could have prevented the disaster from happening (Gale 2011). The B.P oil disaster was not the only incident that exposed the failures of petroleum companies to undertake proper risk management because other companies have suffered the same fate. For example, in 1988, there was a Piper Alpha incident involving Occidental Petroleum (Caledonia) Ltd. that killed more than 160 people (Pate-Cornell 1993).

Effective risk management systems increase the value of firms and decrease their likelihood of suffering huge financial losses arising from preventable, or natural, disasters. Particularly, employee health and safety is a top priority for oil companies because although economic losses are detrimental to their operations, human losses are more severe and detrimental to their image (Zolkos & Bradford 2011; Gale 2011). In line with this view, this paper investigates how to improve the risk management practices of oil companies. To do so, it samples the risk management practices of two of the largest petroleum companies in the world – B.P and Exxon Mobil. Similarly, it focuses on finding new ways of improving risk management practices by highlighting the role of H.R in this management field.

The objectives of this study appear below:

- To review the current theory on managing human resources and performance in new petroleum organizations

- To evaluate the current management of human resources and performance in the new petroleum companies

- To make recommendations on how to develop the risk management performance in the new petroleum companies

Significance of the Study

Understanding the risk management practices of petroleum companies could help to minimise the environmental impact of petroleum companies. This statement stems from the commonly held belief that petroleum companies are the biggest emitters of greenhouse gases. The same concern also stems from the belief that petroleum companies are the biggest beneficiaries of the oil and gas trade. By improving the risk management practices of these companies, their global image would improve because the oil companies would have fewer environmental disasters. For example, there would be less oil spills and a more stringent adherence to employee safety concerns. Both outcomes could improve the image of oil and gas companies. They would also change the reputation of oil companies as “greedy” corporations. Lastly, the findings of this paper would be useful in improving the academic literature on human resource practices. Particularly, they would help to present a better understanding of the relationship between H.R and risk management.

Literature Review

Introduction

This chapter reviews existing literature about risk management practices in oil companies and explains the role of H.R in improving their risk management practices. Here, this chapter explains the nature of risks that oil companies experience and investigates the role of human resource practices in improving risk management practices. However, central to this analysis is an investigation of the types of risks facing oil companies.

Risks that Oil Companies Experience

Commonly, investors should understand the kind of risks present in an industry to evaluate whether they would be successful, or not (Jacoby 1974). Ordinarily, businesses experience common risks, such as management risks and financial risks, which affect the performance of almost all economic sectors. However, some industry-specific risks need special attention. The following risks outline specific risk factors that are present in the oil and gas sector.

Political Risk

Politics not only affect the operations of oil and gas industries, but other multinationals that double in other economic sectors as well (Jacoby 1974). However, in the oil and gas sector political risks affect the regulatory environment of oil and gas exploration (Parra 2004). For example, political factors would affect when, where and how a multinational oil company would explore or extract oil (Bowen 1991). Such political factors may vary across different states, especially when they have different interpretations of the same law. Nevertheless, oil companies that prospect for oil abroad suffer the highest political risks (Nelsen 1991). This is why many multinational oil companies prefer to prospect for oil in countries that are relatively stable (lower political risks) (Beattie 2015). They also prefer to prospect for oil in countries that enforce long-term lease agreements. However, some oil companies ignore these factors and trade in countries that have oil, regardless of the political risk posed (Pearce 1984). Experts often caution such companies from adopting this strategy because many operational challenges may arise from risk ignorance (Megill 1988). For example, there could be a sudden change of political alignment in the country that could cause an unexpected nationalization trend that pits locals against foreign parties. In such circumstances, an oil company may invest a lot of money in a country and end up with a deal that is different from the first negotiated agreement (Parra 2004). Sometimes, such risks may be obvious, especially in undemocratic and developing countries. When companies find themselves in such circumstances, Beattie (2015) says they should develop sustainable relationships with concerned stakeholders.

Geological Risk

Many of the world’s oil reserves are diminishing, or empty (Beattie 2015). However, the world’s energy demand has increased (Beattie 2015). These factors have forced oil companies to prospect for oil in unfriendly environments. For example, some of them drill for oil in the middle of the ocean (Beattie 2015). Unconventional drilling technologies have helped these companies to drill in these places. However, by doing so, they are vulnerable to geological risks. Geological risk refers to exploration risks associated with extracting oil from unfriendly environments (Lerche 1997). It also refers to the possibility that the oil companies would get insufficient oil. To mitigate this risk, they often seek the services of geologists who undertake frequent tests to make sure that the oil companies do not invest a lot of money in prospecting for oil where the quantity of oil available is not commercially viable (Beattie 2015). After their analysis ends, rarely are their estimates off. To assess their confidence levels, the experts often use technical terms to explain the nature of risks, such as “probable,” “possible” and “proven” risk (Covello & Mumpower 1985).

Price Risk

Geological risk is not the only factor that oil companies consider when prospecting for oil; price risks also affect their decisions to drill oil because it affects the commercial viability of their undertaking (Beattie 2015). Usually, high geological risks increase price risks because unconventional extraction techniques are more costly than conventional extraction techniques (Kobrin 1984). However, high prices do not always discourage oil companies from prospecting for oil because they have to look at the long-term price trajectory of their operations to know whether, or not, they should drill (Newendorp 1975). Since it is impractical to start and shut down a project, price risk is often a constant feature.

Supply and Demand Risks

Supply and demand shocks often affect the bottom-line operations of oil and gas companies. These variables are often critical to consider when formulating a company’s risk management plan because oil-drilling processes take a lot of time to complete and require many capital investments before investors can see a return (Noreng 1980). Similarly, it is difficult for oil companies to mothball their operations when the prices decrease and to increase the scale of their activities because of a mere price increase in oil products (Beattie 2015; Yergin 1991). These price movements stem from supply and demand changes that affect the decision of petroleum companies to undertake new investments, or not.

Cost Risks

All the above-mentioned risks contribute to cost risks (operational risks). For example, complex regulations and high geological risks increase operational costs (Lerche & MacKay 1999). If these factors merge with uncertain macroeconomic conditions, it is difficult for one petroleum company to control its costs effectively (Jones 1988). Furthermore, since human resource is a critical component of successful exploration and drilling activities, oil companies may have to contend with high operational costs to retain qualified workers (Beattie 2015). However, on the flip side, oil exploration has become an expensive undertaking with few players willing to partake in it (Vernon 1971). Their hesitation comes from high operational risks. Although the above operational risks are real, oil and gas exploration will not end soon. The demand for petroleum products will increase in the short-term, thereby providing good returns for investors that are willing to risk investing in the risky oil and gas industry (World Bank 2008). However, as they do so, it is important for them to understand the potential risks they experience when investing. Furthermore, it is pertinent for them to understand the role of H.R in mitigating these risks.

Role of Human Resource Management in Risk Management

Risk management is an elaborate process. It contains different tenets; some of which are outside the control of the human resource manager (Beattie 2015). However, human resource management plays a vital role in risk management because it has two instrumental roles:

- a source of risk (human incompetence)

- a risk management tool (human beings are excellent in managing risk).

To explain the latter point, Erven (2015) says:

“People use their ingenuity to solve unexpected problems, employees going the extra mile for the good of the organisation, a key employee redesigning her own job to avoid unnecessary delays in getting work done, or an employee persuading a talented friend to apply for a position in the business” (p. 1).

Here, human resource planning involves all personnel in an organisation. This means that full-time employees are not the only focus of analysis because seasonal employees, part-time employees, and family members are also part of the human resource team (Erven 2015).

Human Resource Paradigms

H.R is a critical part of risk management in petroleum companies because the mindsets of human resource managers (their beliefs, perceptions, knowledge and attitudes) affect how they manage market risks in the petroleum industry (Erven 2015). Here, H.R managers use existing H.R paradigms to understand their contributions to the risk management process (Hansson 2004). There are two categories of H.R paradigms in risk management planning in the petroleum sector. They appear on both sides of the table below:

Human resource managers often choose the H.R paradigm that would characterise an organisation’s human resource practice. These paradigms would engrain in the organisational culture to reflect its beliefs, values and practices (Markel & Barclay 2007). In turn, this culture would affect an organisation’s operations and decision-making processes. For example, if an organisation adopts a culture that believes in employee lack of concern for the business, the management would hesitate to seek employee inputs in the decision-making process (Erven 2015). Such a situation would then breed a culture of employee distrust and isolate employees from their employers (Markel & Barclay 2007). Comparatively a H.R paradigm that believes in employee concern for the welfare of the business would have the opposite effect. Here, managers would be more trustworthy to employees (and vice versa) (Markel & Barclay 2007). A culture of inclusion would also emerge in the same respect.

Where does H.R Management meet Risk Management?

Over the years, H.R practices have evolved. Today, many multinational companies such as B.P and Exxon Mobil prefer to use modern H.R practices to undertake their activities (Enterprise Risk Management Initiative 2015). However, in the past, these companies relied on traditional H.R practices to manage the same activities (Bly 2015). Nonetheless, they never made much progress this way, especially in terms of risk management. For example, disaggregated H.R practices made it difficult for companies to manage risks (Bly 2015). This shortcoming emerged from the failure of traditional H.R practices to take a holistic view of risk management. For example, they often managed people risk within the H.R context only. They never showed how “people risk” would affect organisational risk. This link thrives in the relationship between H.R and risk management. In other words, H.R merges with other aspects of a business’s operations to create a comprehensive management framework (Markel & Barclay 2007). This is where H.R meets with risk management. Particularly, this interaction point occurs through H.R’s contribution to an organisation’s decision-making process. This relationship means that most organisational functions, such as public relations, investment decisions, and financing decisions (among others) rely on competent personnel to make them work (Markel & Barclay 2007). Here, H.R branches into several cohorts. They include “job analysis, writing job descriptions, hiring, orientation, training, employer/employee interactions, performance appraisal, compensation and discipline” (Erven 2015, p. 3). Understanding the relationship among these H.R facets help to understand the relationship between H.R and risk management (Erven 2015). In fact, the failure to understand how these H.R facets contribute to risk management undermines an organisation’s risk management process. This happens by penalising organisations for failing to understand the important role that its employees play in risk management (Erven 2015).

Implications of H.R to Risk Management

H.R is an integral part of risk management. First, it helps human resource teams to align with available risk management tools (Markel & Barclay 2007). Since the success of risk management processes depends on people’s competence, having properly trained and motivated employees are key requirements of effective risk management (Markel & Barclay 2007). Secondly, human-centred calamities (H.R calamities) can affect the efficiency of human resource practices. For example, divorce, death, or personal financial crises could affect people’s competencies when undertaking risk management plans. In fact, Erven (2015) says H.R risks are bound to affect even the most carefully made risk management plans. This is why many experts say risk management should anticipate H.R risks (human resource planning is an integral part of risk management) (Markel & Barclay 2007). Thirdly, human resource management and risk management interact through management changes. Management changes often increase a company’s risk profile. Through this relationship, human resource management (coupled with financial management plans and legal considerations) affects risk management plans. Therefore, successful management requires an effective understanding of all H.R tenets, such as hiring, performance appraisal, and job analysis (among others). Lastly, Erven (2015) says human resource performance evaluation should depend on risk management practices and vice versa. Indeed, risk management practices depend on competent personnel because even the best risk management plans could fail in the face of incompetent employees. This is why Erven (2015) says, “Risk management depends on explicit duties being specified in managers’ job descriptions, delegation of power and authority to manage risk following indicated guidelines, and responsibility at the action level of risk management” (p. 4).

Role of H.R Manager in Risk Management

An effective alignment between human resources and risk management requires organisations to have competent HR managers. Erven (2015) says the most important management skills are “leadership, communication, training, motivation, conflict management and evaluation” (p. 5). The role of a human resource manager is not only constrained to management, but leadership as well. Indeed, it is difficult to realise the potential of effective risk management without having effective H.R leaders. However, the delegation of responsibilities within a company’s management structure reduces the need for H.R leaders (Markel & Barclay 2007). Motivation and trust are important attributes that improve the relationship between H.R leaders and their subjects. Similarly, human resource teams should understand the value of an effective communication structure because it simplifies the functions of H.R managers. For example, conveying clear messages and listening to what others say are important attributes of human resource planning. Furthermore, Erven (2015) says:

“Interpersonal relations, interviewing in the hiring process, building rapport with the management team and with employees, orientation and training, performance interviews, conflict resolution and discipline, all require communication” (p. 7). Without proper communication with the human resource department and the entire organisation, most of the above-mentioned tasks would be complicated (Markel & Barclay 2007). Similar to communication, training is an important feature of effective human resource teams. Effective training programs would improve how people learn new skills (Markel & Barclay 2007). These training programs should align with the mission or goals of the sponsors. For example, in the context of this study, oil workers should receive specialised training to improve their risk management competence in the petroleum industry.

Human Resource Risks in the Petroleum Industry

This paper has already shown that risk management affects most aspects of business performance. It has also shown that human resource is a critical tenet of risk management. Much of the human resource risks in the petroleum industry centre on employee safety. Some researchers also say petroleum industries are preoccupied with lowering organisational risks more than employee safety risks (Markel & Barclay 2007). Some examples of employee safety hazards are employees failing to wear gloves, helmets or other protective gear. Handling dangerous, or contagious, materials is also another form of organisational hazard in the petroleum industry. In all the above-mentioned situations, the H.R manager would assess the probability of employee harm if employees engage in “unsafe” organisational practices/processes (Markel & Barclay 2007). To prevent harmful incidences from occurring, petroleum companies often engage in safety training (Enterprise Risk Management Initiative 2015). They also participate in job and equipment redesigning to minimise structural flaws that could cause organisational disasters (Enterprise Risk Management Initiative 2015). Other organisations focus on improving communication processes in the workplace to make sure miscommunications do not increase organisational risks (Enterprise Risk Management Initiative 2015). Commonly, many petroleum companies monitor the number of incidences that affect their organisational processes. This measure helps them to redesign their risk management plans.

Comprehensively, based on a review of existing literature, H.R and risk management have not recognised each other’s existence (they have operated in isolation). Furthermore, past researchers never acknowledged the impact that each of these factors had on each other. They also failed to realise their impact on organisational processes. However, based on the details highlighted in this paper, experts from both fields have started to adopt new strategies that recognise their responsibilities in both HR and risk management. However, this field is still unexploited. Furthermore, there is little information showing how H.R practices could improve risk management in the oil sector.

Research Plan

Introduction

This chapter of the dissertation explains the research methods used to come up with the findings. It explains several key methodological issues, including the data collection method, data analysis method, research design, research approach, and research strategy. Lastly, this chapter also explores the key ethical issues in this study. However, before delving into the details surrounding the ethical issues of the study, it is pertinent to understand the research strategy chosen.

Research Strategy

The two main research studies are quantitative and qualitative approaches. Different researchers outline different criteria for choosing the best strategy. However, Long et al. (2000) say the choice of research strategy depends on a researcher’s understanding of the nature of the study and its intended goals. The methods for knowledge construction and the comprehension of reality should also inform the research strategy (Long et al. 2000). This study focused on investigating risk management strategies in the petroleum industry. It did so by investigating the role of H.R practices in improving risk management performance. It also explored how both concepts (risk management and H.R) interact. Since H.R is largely a human-centred discipline and risk management is a scientific field, this paper adopted a mixed method research strategy (a mixed method research uses both quantitative and qualitative research strategies).

Why use the Mixed Methodology?

The main motivation for using the mixed methodology research design is because it provided a platform for understanding the research phenomenon; as opposed to using the qualitative or quantitative research approaches only (Wickham & Woods 2005). Indeed, instead of using either the qualitative or quantitative research approaches alone, the mixed methods approach provided a platform for the researcher to explore the H.R practices in risk management through a better understanding, or corroboration, of the risk management approaches in both case studies (Long et al. 2000). Using this research approach also helped to offset the disadvantages of using the qualitative and quantitative research approaches (in isolation) (Wickham & Woods 2005). The possibility of triangulation in mixed methods research was also another motivation for using the mixed methods research approach (Knafl & Breitmayer 1989). The triangulation technique helped to include different methods, data sources and researchers in the study (as would be the case when using secondary research). This way, it was easy to analyse the research phenomenon through different vantage points. This need is in line with recommendations by FRC (2015) who says the mixed methods approach is useful “When one wants to continuously look at a research question from different angles, and clarify unexpected findings and/or potential contradictions” (p. 2).

Disadvantages of the Mixed Methodology

Although the mixed methodology has many advantages, it is often a complex research design to use because it combines both the qualitative and quantitative approaches (Dillman, Smyth, & Christian 2009). Similarly, it takes a lot of time to plan and implement the research approach because of the multiplicity of qualitative and quantitative research design features. The multiplicity of research features also makes it difficult to build on the findings of one research method (qualitative of quantitative) by using another method to develop the findings (Wickham & Woods 2005). Similarly, using this mixed methodology made it difficult to resolve discrepancies that arose from the data analysis process.

Research Design and Rationale

The qualitative research strategy has many types of research designs. They include “inquiry, narrative, phenomenological, participatory action, grounded theory, ethnography, and case study” designs (Bound 2011, p. 1). Similarly, the quantitative research approach has many research designs, including descriptive, co-relational, quasi-experimental, and experimental research designs (Creswell 1998; Stake 1995). Based on the mixed method research approach used in this paper, it was plausible to choose a research design from any of the two research approaches. In line with this freedom, this study adopted the case study research design.

Why Choose the Case Study Research Design

Yin (1984) defines the case study research method “as an empirical inquiry that investigates a contemporary phenomenon within its real-life context; when the boundaries between phenomenon and context are not clearly evident; and in which multiple sources of evidence are used” (p. 23). Case study research is an elaborate research design that analyses specific research cases for purposes of coming up with a broader understanding of a research phenomenon (Creswell 1998; Stake 1995). Unlike other research methods, it is specific (Baxter & Jack 2008). Its usefulness to this study stemmed from its proficiency in investigating complex issues by adding strength to what researchers already know. This way, the research design adds detail to a research phenomenon in a contextual analysis by explaining different relationships within a research context (Patton 1990). Researchers have used the case study research design successfully over many years (Joia 2002; Soy 1996). Its use in social sciences has reported the highest success rate because it has provided a deep analysis of contemporary real-life situations and explained how people could use their ideas to solve real problems (Yin 2003). This is why Yin (2003) says researchers should use the case study research design in specific situations. In fact, he establishes three criteria for using the case study research approach. The first criterion stipulates that all researchers should use the case study research approach in situations where they cannot manipulate research variables (Yin 2003). The second criterion stipulates that all researchers should use case studies when their research focus aims to answer “when” and “how” questions (Yin 2003). Lastly, the last criterion for using the case study research design is when there is a blurred line between the research context and a research phenomenon (Yin 2003).

This study met all the three criteria above. For example, it met the second criterion because it recommends how to develop the risk management performance in new petroleum companies (notice the “how”). Similarly, it meets the third criterion because there is a blurred line between risk management and human resource practices (these two concepts overlap at some point). This is why the second chapter seeks to clarify the relationship between H.R and risk management. Lastly, this study meets the first criterion because the researcher cannot manipulate the research variables. Instead, the researcher’s responsibility is limited to observing the risk management practices of the two organisations and investigating how their H.R practices could improve their risk management processes. Broadly, the study strives to improve risk management processes through ideas and methods borrowed from effective H.R practices.

Criticisms of the Case Study Research design

The main disadvantage associated with the case study research design is its limited reliability and generalizability (Hellström, Nolan & Lundh 2005). This means that we could not use the findings of the B.P and Exxon Mobil case studies to explain risk management processes outside the petroleum industry. Some critics also believe that the nature of the study itself (case studies) introduces case bias to the research (Soy 1996). This is why they posit that the case study research design is only useful in an exploratory basis (Hancock & Algozzine 2006). Despite the presence of these criticisms, researchers continue to use case studies in different disciplines.

Data Collection

Data collection is an important process in research studies because it affects the quality of research findings. In fact, the quality of the research findings depends on the quality of the data collection process (Hancock & Algozzine 2006). Considering the importance of regulating the type of information to use in a paper, this study focused on using only reputable sources of information. The main source of data was secondary research information. Here, books, journals, and reputable websites were the main sources of information. This data collection technique was appropriate for this study because it saved time that would have otherwise been used in collecting research information from the field. This way, it was easy to get larger and higher quality databases to analyse the two case studies (O’Sullivan & Rassel 1999). By contrast, primary research information could not provide this advantage because it would have been difficult to obtain dynamic information within a short time (Hancock & Algozzine 2006). Furthermore, based on the nature of the study (to examine past risk management strategies), secondary data helped to capture past changes and developments surrounding the risk management practices of B.P and Exxon Mobil. Stated differently, other researchers had already done much of the background work pertaining to risk management practices of both companies. This attribute means that the research information used in this paper already has a high degree of validity and reliability (however, I evaluated the findings to ascertain their relevance to this study).

The relative ease of accessing secondary research information was also another motivation for using secondary research data. Certainly, unlike in the past when scholarly information was only available in public libraries and similar institutions, modern technology has availed this information in the comfort of our homes. This advantage did not only help to save time, but also money that we would have otherwise used to collect research data. The secondary research information was also useful in generating new insights for the study (Perez-Sindin 2015). This advantage emerged in many past studies because researchers often found out that analysing past data led to new discoveries that would be useful in present research studies (O’Sullivan & Rassel 1999; Perez-Sindin 2015). The same is true for this study because the recommendations outlined in this paper come from new discoveries that emerged from the data analysis process. The secondary information used in this study could also be useful in providing a platform for the future design of a primary research. This is why many experts encourage new researchers to use secondary research information to prepare for their primary research studies (Creswell et al. 2003). For purposes of this paper, the secondary research information provided an opportunity to evaluate the methodological and theoretical purposes of risk management programs in B.P and Exxon Mobil.

Disadvantages of Secondary research data

Although secondary research posed many advantages to this study, it still exposed the researcher to many reliability and validity issues. For example, it was difficult to sieve through the huge volumes of data to come up with appropriate research information to answer the research questions. This inappropriateness of data led to a lot of time wastage, as it was difficult to find information that directly focused on the two case studies chosen. By contrast, primary research often seeks information that directly answers the research objectives (Creswell et al. 2003). Certainly, creators of secondary research information could have designed their research to answer unrelated research objectives, thereby making it difficult to relate to the study context. This is why Perez-Sindin (2015) says that although secondary research data may provide a lot of information to researchers, larger volumes of information obtained is not synonymous to their appropriateness. Lastly, by using secondary research information, it was impossible to control the quantity of research information obtained. Indeed, the information available was impossible to change. Based on this limitation, there was a need to device new quality control checks for making sure that the quality of information used in this paper was valid and reliable. This paper will discuss these measures in subsequent sections of this chapter.

Data Analysis

Barney (1991) says the best data analysis techniques are those, which resonate with the nature of information collected during the data collection process. Since the only source of information for this paper was secondary data, the thematic data analysis method emerged as the most appropriate data analysis tool. Researchers use the thematic data analysis method to identify themes, or patterns, from a large volume of information (Mills, Durepos & Wiebe 2010). This process happens when categorising data according to different contexts and interpreting the emerging themes according to commonalities, relationships and overarching patterns. Theoretical constructs and explanatory principles were also instrumental in categorising the data into different themes. Although researchers commonly use the thematic data analysis method in qualitative research studies, it is not exclusive to one research group. Furthermore, researchers have used it in different fields and disciplines (Barney 1991; Mills et al. 2010).

Researchers use the thematic data analysis to organise and analyse rich descriptions of data (Barney 1991; Mills et al. 2010). This process is elaborate because it stretches beyond identifying phrases or words within a specific data set to analyse their implicit and explicit ideas (Barney 1991; Mills et al. 2010). The coding process is an instrumental part of this process because it helped to develop themes from the raw data collected. It recognized important distinctions within the data collected and created a platform for encoding it before interpretation. The data interpretation process involved comparing theme frequencies and identifying themes co-occurrence. The process also included displaying relationships (graphically) across different themes (to understand the relationships among the different themes). Based on these processes alone, many researchers consider the thematic data analysis method as a useful tool for identifying the meanings of data across a large data pool (Barney 1991; Mills et al. 2010). This thematic data analysis method has a relationship with the grounded theory because the latter supports its assertions (Barney 1991; Mills et al. 2010). Stated differently, the thematic data analysis method helps to construct theories that stem from the data. Barney (1991) says this process aligns with the thematic data analysis method because the process involves reading transcripts and identifying emerging themes within the mentioned data pool. The process also involves comparing and contrasting emerging themes and building theoretical models from the same process. Some researchers also say that the thematic data analysis method has a direct relationship with phenomenology because it focuses on explaining subjective human experiences (focuses on understanding the perceptions, feelings, and experiences of human beings) (Barney 1991). This is why many social science researchers use it in qualitative research studies (Barney 1991; Mills et al. 2010).

The thematic data analysis process could occur in two ways – inductive or deductive reasoning. The inductive approach works by linking the emerging themes to available data because the main assumptions (leading to the creation of the themes) are data-driven (Barney 1991; Mills et al. 2010). This step means that the coding process is exclusive to a predetermined data analysis framework. Barney (1991) says when this process occurs; researchers cannot excuse themselves from their epistemological responsibilities. Unlike inductive processes, which are data-driven, deductive processes are theory-driven. In this regard, the deductive data analysis approach is less descriptive because the analysis occurs within specific analytical frames (Barney 1991; Mills et al. 2010). Therefore, such analyses are often constrained to a selection of one or two analytical issues (established before the data analysis process started) (Barney 1991). Researchers’ epistemologies often affect the type of data analysis chosen. This study used the inductive data analysis approach because it is data driven. This means that the main findings derived from this paper emerged from a detailed analysis of available literature about the risk management practices of petroleum companies. This approach was useful to this study because the main objective of the research was to find strong evidence to come up with ways to improve the risk performance processes in petroleum companies. Inductive reasoning helped to supply this strong evidence (but not absolute proof). This way, the inductive reasoning process helped to provide some proof of support for the findings derived from this research. New themes emerged after analysing different patterns across multiple data sets. The theme identification process happened after analysing how the themes contributed to answering the research phenomenon. The data analysis process depended after answering the research questions using the identified themes. The thematic data analysis process occurred in six phases that included a familiarisation with the data collected, code generation, and identification of themes within the codes. The last three steps included a review of the themes, a definition of the themes, and the production of the final report.

Research Limitations and Delimitations

Research limitations and delimitations refer to factors that may affect a researcher’s methodology and analytical processes (Economic and Social Research Council 2015). Research limitations often refer to issues that are beyond a researcher’s control. Comparatively, research delimitations refer to issues that are within the purview of a researcher’s control. Smith (2003) says it is important for researchers to mention all issues that limit their control in the study. In the same analytical breadth, Martyn (2010) says it is important for researchers to improve their analytical, self-reporting, and instrument utilization skills. The following limitations characterised this research.

Limitations

This paper has already shown that this research project used a case study research design. The cases involved two companies – B.P and Exxon Mobil. This means that the risk management practices outlined in this paper mainly relate to both companies. This finding is in line with the nature of the case studies because they relate to only one group of companies, or a set of organisations. The risk management behaviours could possibly not reflect the behaviour of similar entities in the petroleum industry. This means that the case studies sampled in this paper are only suggestive of what we may find in similar organisations in the petroleum industry. Therefore, it is difficult to make causal relationships from the sampled case studies. This difficulty arises from the possibility of having alternative explanations. Therefore, we cannot affirm the generalizability of the findings obtained from this paper. However, we need further research to evaluate whether the findings of this paper would apply to other organisations. Time was also another limitation of this paper because the research findings highlighted in this study explored the risk management practices of two petroleum companies, based on their experiences on the same. This way, it may be difficult to pre-empt some of the risk management practices of these companies. This limitation also emerged within the assumption that risk management would continue to be an important management tenet in the 21st century. It also emerged within the assumption that human resource (people) would continue to play an instrumental role in minimising risk exposures within the petroleum industry. For example, this paper assumes that human beings would continue to play an instrumental role in risk management, despite the technological changes that characterise the sector (and often replace human input).

Delimitations

The delimitations of a paper often arise from the limitations that arise in a study. The conscious inclusionary and exclusionary decisions made within the study plan also affected the nature of delimitations highlighted in this paper. Although this paper shows that study delimitations arose from the nature of the methodology and study design, the delimitations of the study emerged from specific choices made by the researcher when formulating the study design. The main delimitation of this study was the choice of research problem chosen. This delimitation emerged from the choice of objectives and research questions sampled in the study. Nonetheless, the nature of this delimitation means we could have explored other research issues, but still chose to find out how to improve risk management performance in petroleum companies. Particularly, the findings of this study were unique to improving risk management through an improvement of H.R practices. This means that there were other ways to improve risk management processes, but H.R practices emerged as the most desirable method for managing the research problem. Using other methods for improving risk management could have expanded the scope of the study and made it too problematic to understand because petroleum companies encounter many types of risk (see chapter two). For example, this paper has shown that political risk is a major operational risk for petroleum companies. Mitigating it would require the adoption of unconventional risk management practices, such as diplomacy, which may be too complicated to understand, based on the geopolitical characteristics of a region. Broadly, the study context was the main delimiting factor in this paper.

Validity and Reliability

Validity and reliability principles are at the cornerstone of scientific research studies. They are important to researchers because they define what people could use as scientifically proven facts (Martyn 2010). Reliability differs from validity because it refers to the possibility of replicating a study’s findings (Economic and Social Research Council 2015). This way, it would be possible for researchers to perform the same study under the same conditions and come up with similar findings. Comparatively, validity refers to a study’s ability to meet all scientific criteria for research to maintain the reliability of the findings derived in this study (Economic and Social Research Council 2015). The validity of the study stemmed from the focus on using credible sources of research information. Books, journals and credible websites were the main sources of data in this paper.

Ethical Considerations

Years ago, researchers often hesitated to expose their ethical dilemmas in research. However, the field has changed and common practice dictates that all researchers should disclose their ethical issues (Sales & Folkman 2000; American Psychological Association 2002). This is why Smith (2003) says “There has been a real change in the last ten years in people talking more frequently and more openly about the ethical dilemmas of all sorts” (p. 2). This study acknowledges the same principle as a requirement to meet institutional standards for conducting ethical studies. Studies that involve human subjects have the highest number of ethical issues (Sales & Folkman 2000; American Psychological Association 2002). However, since this paper did not use human subjects, few ethical issues emerged in the study. This view resonates with the views of some researchers who believe that secondary research studies have few, or no, ethical issues (Economic and Social Research Council 2015). However, many ethical committees differ with this view (Sales & Folkman 2000; American Psychological Association 2002). Therefore, there is a need to review the ethical considerations in secondary research. This review largely depends on the data sets used in the study. The main data set used in this paper comes from a collection of books, journals and credible Web Pages (see the data collection section). Based on these sources of data, the main ethical concerns were honesty and respect for intellectual property. These issues appear below

Honesty

The findings presented in this research paper were free from falsifications and misrepresentations of fact. This ethical principle emerged as a key tenet of academic research studies that should be free from deception (Martyn 2010). Here, the study only included clear and accurate records of the research findings to provide a platform where other people could make independent reviews of the research information. This process provides enough leeway for other people to give their views regarding the data obtained and the research processes used to get them. In line with the need to maintain honesty throughout the research process, this paper included properly recorded research results. This process occurred by making sure that there was a proper attribution of reports to their sources. This way, there were no false or misleading data included in the review. Comprehensively, the need to maintain honesty throughout the research process emerged because it was fundamental to good science and public interest. Indeed, as Smith (2003) says, the reputation of the researcher is not only what is at stake because the welfare of other people also depends on the honesty of the researcher. The case of Robert Sprague highlights the responsibility of researchers to their readers and users of their research information because he emphasised the need for proper representation of data, as it affected the health and wellbeing of all concerned users of information (Economic and Social Research Council 2015). If we extrapolate the analysis to this study, we find that the wellbeing of workers who work in the oil fields also depends on the honest work of researchers who explore better ways of risk management. By making sure that research findings are products of honest work, institutions also safeguard their reputations because none of them would like to be associated with deception, or a lack of integrity. These details show the importance of making sure that all research work is honest.

Respect for Intellectual Property

Using the findings of other researchers often increases the likelihood of intellectual property rights infringement (Thomas 2006). Such vulnerability emerges in this paper because this study mainly relied on secondary research information. Nonetheless, there was a proper citation of all the information used in this paper. This way, this paper acknowledges all the sources of data and their respective authors. Similarly, in line with the quest to protect intellectual property, there were no reproduction, or distribution of other authors’ works in this research.

Comprehensively, this study observed all scientific rules of research, including making sure that the paper used credible data, adhered to all ethical rules of research, and highlighted reliable findings. Furthermore, the research design and approach mirrored the nature of the study and its focus – the improvement of risk management performance in petroleum industries.

Findings and Analysis

Oil and gas companies are among the most transformative companies in the world because they are innovators in the use of modern technology to meet some of the world’s energy needs. Their expertise in using data analysis techniques to analyse prospective acquisitions, and capital expenditures is also unrivalled. However, these companies still lag behind other industry leaders in using quantitative rigour in human resource management to mitigate some of their management risks (Enterprise Risk Management Initiative 2015). As technology keeps changing and globalisation continues to change the dynamics of global trade, many employees working in the oil and gas sector are attaining retirement age. Understandably, there are not enough people to fill this labour gap because education institutions are not churning enough graduates to fill these vacant positions (Enterprise Risk Management Initiative 2015). Consequently, human resource departments are taking proactive measures to address this challenge by using data informatics to recruit and nurture the best talent (Dyer & Singh 1998). By blending internal organisational dynamics and external statistical variables, B.P and Exxon Mobil are positioning themselves to manage the volatilities associated with the energy sector. However, a close assessment of their risk management practices reveals the following

Case One: B.P

B.P is a household name in the petroleum industry. Its first exploration activities started in the late 1960s. Since then, the company has increased its prominence in the oil and gas sector and become the largest oil and gas producer in the US (Bly 2015). Similarly, it has become the largest oil supplier to the American military (Bly 2015). Under the leadership of Lord Browne and Tony Hayward, the company has soared to tremendous heights of success (Enterprise Risk Management Initiative 2015). In fact, under their leadership, B.P acquired smaller oil companies, such as AMOCO and ARCO, in 1998 and 2000 respectively (Enterprise Risk Management Initiative 2015). These ventures increased the company’s market share and propelled its status to “premium.” In the late 1990s and 2000s, the company also gained the reputation for adopting good cost-cutting measures and bottom-line maximisation (both of which helped to propel the company’s success). Its risk management framework appears below.

B.P’s Risk Management Framework

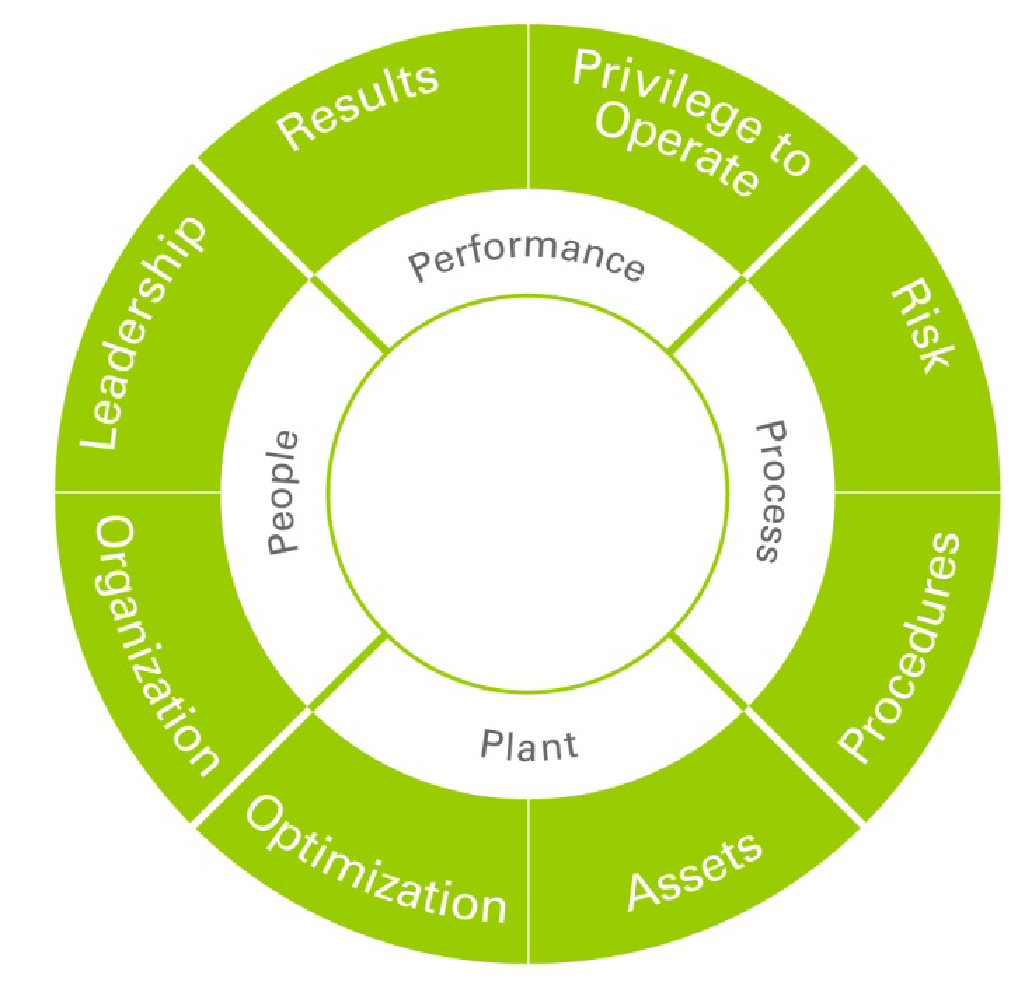

B.P’s risk management practices mirror the company’s company culture of risk-taking, cost-cutting and capital efficiency (Gale 2011). The company’s high appetite for risk is arguably among the highest in the petroleum industry (Enterprise Risk Management Initiative 2015). In fact, observers attribute the company’s success in the global scene to its high-risk appetite (Gale 2011). This feature has attracted both criticism and commendation in the same measure. However, in the context of this paper, its high-risk appetite makes it an interesting case study because it exposes the company to many risks. This outcome draws our attention to the need for a comprehensive risk management plan for the company (Enterprise Risk Management Initiative 2015). The diagram below shows the company’s operational risk management framework.

The key focus areas of B.P’s risk management framework are leadership (operating leaders and culture), organisation (competence and contractors), risk (risk assessment and management), and systematic reporting and results (checks and balances) (Bly 2015). Leadership and organisation are people-based practices that affect the risk management framework. The focus on risk and procedures often affects the organisation’s processes, while the focus on results and privilege to operate affect the organisation’s performance (Bly 2015).

Despite the elaborate structure of B.P’s risk management framework, the company has failed to mitigate its risks well. These risk management failures emerge through notable disasters, such as the Deepwater Horizon Oil Spill. Indeed, as the Enterprise Risk Management Initiative (2015) observes, the Deepwater Horizon Oil Spill is possibly among the biggest corporate disasters to have occurred to B.P and the larger petroleum industry, at large. The disaster created a public relations nightmare for the company as it brought huge financial and legal costs to the company. In fact, the company spent $28 billion to contain the crisis and suffered the possibility of paying $18 billion more in penalties accrued from the disaster (Enterprise Risk Management Initiative 2015). The Deepwater Horizon Oil Spill was widespread. It affected the economy of the Gulf of Mexico and caused 11 deaths of B.P employees (Enterprise Risk Management Initiative 2015). Independent reports also show that the crisis injured 16 employees (Bly 2015). More than 4.9 million barrels of oil spill into the ocean, causing an ecological crisis that drew the world’s attention to the company’s activities and the possible environmental impact (Bly 2015). Tourism and fishing industries along the Gulf of Mexico withstood the worst of the crisis (Enterprise Risk Management Initiative 2015).

Based on the sheer extent of the crisis, experts have often questioned the series of risk management failures that led to the crisis in the first place (Bly 2015). Although the engineers at B.P could be the only people who understand what happened in Deepwater Horizon, evidence shows that the company has had a series of risk management failures (Enterprise Risk Management Initiative 2015). For example, in 2003, 2005, and 2006, the company suffered several pipeline explosions that stemmed from its failure to observe safety rules (Enterprise Risk Management Initiative 2015). In 2007, the company’s Chief Executive Officer (C.E.O), Tony Hayward acknowledged this fact and pledged to improve the company’s risk management processes (Enterprise Risk Management Initiative 2015). To fulfil this promise, he balanced portfolios between natural gas and oil assets. Although this factor makes it easy for the multinational to shift its labour requirements, as the market requires, it has still experienced difficulties doing so because of its failure to meet market needs, especially as volatility increases. Some observers believe this is the main reason for the company’s poor risk management record (Enterprise Risk Management Initiative 2015). However, independent reviews of the company’s risk management plan show that the following issues contributed to the company’s poor risk management processes.

Toxic Corporate Culture

The concept of Enterprise Risk management (E.R.M) only flourishes in a corporate environment where top-level executives appreciate the need for raising awareness about the risks and understand the importance of having an elaborate risk management plan to mitigate them (Bly 2015). Successive management teams in B.P have called for increased risk awareness and an improved risk management framework (Enterprise Risk Management Initiative 2015). However, few of them have delivered in this regard. This failure has undermined the company’s efforts to manage some of their most known disasters. For example, in 2010, the company opted to use cheap and time saving risk management strategies that undermined the company’s effectiveness in managing the crisis (Enterprise Risk Management Initiative 2015). This failure stems from the company’s quest to cut costs and improve its bottom-line. These factors are unique to the organisation because they are part of its corporate culture. To emphasise this weakness, the Enterprise Risk Management Initiative (2015) said:

“Senior B.P executives have also been ambitious in exploration and production endeavours while showing indifference towards engineering excellence and maintenance budgets. The majority of safety focus were on infractions that were highly likely with lower impacts with hardly any consideration of less likely, high impact risks” (p. 2).

According to the Enterprise Risk Management Initiative (2015), B.P failed in many key aspects of risk management. First, it says the company has a poor communication strategy that impedes the efficiency of its risk communication platform (Enterprise Risk Management Initiative 2015). This way, employees do not know or undertake their tasks (at least not on a timely basis). This inefficiency emerged through the company’s ineffective whistleblowing program because few employees reported cases of impropriety because they feared for their jobs and safety (Enterprise Risk Management Initiative 2015). Secondly, researchers say the company’s failure to identify “black swans” in its risk management portfolio increased its inefficiency in managing its risks (Bly 2015). These “black swans” are risks that have a low probability of happening, but have a high negative impact on the company’s reputation and image. B.P’s failure to identify these factors has increased the company’s vulnerability to economical, ecological and reputational damage. Bly (2015) says that the company’s poor scenario planning has also contributed to its poor risk management profile. This process would have helped it to envision new risk management procedures to undertake when a crisis happens. This fault emerged in the Deepwater Horizon Oil Spill because the company did not have well-established emergency procedures to undertake when there was a burst oil pipe. Lastly, Enterprise Risk Management Initiative (2015) says the company’s board of directors did not provide the right risk management guidelines, or oversight, in the risk management process. Their lack of proper oversight means that the board was too comfortable with the high number of risks exposed to the company. Similarly, it could also mean that the management board was uninformed about the company’s risk management practices. Nevertheless, the most important lesson in B.P’s risk management program is that, risk management is not only about risk avoidance, but also about knowing the right risks to expose the company. It is also about identifying the right precautions to take when operating in a risky environment (Bly 2015).

Case Two: ExxonMobil

In 2009, experts ranked ExxonMobil as the largest American company. They used its sales figures ($275 billion) as the main ranking criterion (Rogers & Ethridge 2013). Averagely, ExxonMobil reports an annual gross income of $90 billion. Since 2009, its sales figures have since increased to more than $341 billion (Rogers & Ethridge 2013). During the same period, ExxonMobil expanded its risk management system, which is characterised by a risk-averse philosophy (Rogers & Ethridge 2013). Arguably, this risk management strategy has discouraged many of the company’s executives from taking inappropriate risks (Deloitte 2015). ExxonMobil details a series of risks that characterise its risk management profile. It categorises these risks based on how they affect its production capacities. They include “project start-up timing, operational outages, reservoir performance, crude oil and natural gas prices, weather changes, and regulatory changes” (Rogers & Ethridge 2013, p. 578).

Similar to the company’s risk profile, ExxonMobil’s trading success largely depends on movements in oil and gas prices (Deloitte 2015). As a corporate duty to its stakeholders, the company outlines its risk management strategies (through an annual statement report). Based on the company’s past risk management practices, the company has always depended on its financial strength to mitigate its risks (Deloitte 2015). Its debt capacity and diversified portfolio have also helped to strengthen the organisation’s resolve to manage diversified risks. Protecting shareholder investments has been a strong priority for the company even as it struggles to manage some of its most notable technical and political risks (Deloitte 2015).

Based on a review of the company’s annual risk management reports, Exxon Mobil has not been effectively relying on its H.R competence to manage risks. For example, its 2009, 2010, and 2011 annual statements fail to mention the role of the chief risk officer in the company’s risk management plan (Deloitte 2015). Based on the sidelining of the risk management officer, Rogers & Ethridge (2013) say that someone sitting at the upper levels of management often undertakes his duties. This omission alone means that the company’s risk-averse philosophy has been largely dominant in the company’s risk management platform. However, experts agree that giving the chief risk officer more dominant roles in the risk management platform would improve the company’s risk management process (Rogers & Ethridge 2013). Based on such recommendations, observers agree that the company has not fully appreciated the benefits it could get by improving its human resource practices and merging them with its risk management practices.

H.R Practices at ExxonMobil

In line with the global trend to outsource organisational processes, Exxon Mobil has outsourced most of its human resource practices to third parties, such as the professional Employer Organisation (Rogers & Ethridge 2013). It has also decentralised most of its H.R practices to in-line managers. These changes are in line with the organisation’s new vision to use H.R as a strategic partner in not only its risk management activities, but also in other organisational functions, such as financial management and marketing (Rogers & Ethridge 2013). Therefore, line managers are the de factor H.R managers in the organisation. However, from the traditional understanding of risk management, the use in-line managers as proxy H.R managers complicate the H.R process. Particularly, it increases the difficulty of HR controls. This is why Rogers and Ethridge (2013) say discussions that involve employees and risk management processes should consider this complication.

Comparison of B.P and ExxonMobil

Operational Differences

Based on the evidence accrued in this paper, oil companies, such as B.P and ExxonMobil have been fickle because of volatilities in the financial sector, which arise from widespread technological changes and other forms of operational risks. These risks (coupled with advanced technological changes) have made it difficult for B.P and ExxonMobil to match their human resource requirements with market needs. B.P differs from Exxon Mobil because it has balanced portfolios between natural gas and oil assets. Although this factor makes it easy for the multinational to shift its labour requirements, as the market requires, it is difficult for the company to continue doing so, especially as volatility increases. Smaller petroleum companies that have heavy investments in one area of operations, such as oil or gas, may not enjoy the same advantage that B.P or Exxon have because they would have to look outside the organisation to meet their market needs. Again, this task is tougher for these companies, especially as market volatilities increase.

Shrinking pool of available Talent

B.P and Exxon Mobil are highly dependent on skilled labour (the same is true for other petroleum companies). However, the increasing population of elderly workers and the insufficient number of new graduates entering the workforce has created a shrinking pool of talent for both companies (Deloitte 2015). Increased labour mobility and rapid technological changes have made it difficult for these companies to address this challenge. In fact, they have created a bigger crisis for both companies because they are engaged in a war for talent with other giant multinationals who are also seeking skilled labour from the shrinking pool of available talent (Deloitte 2015). To mitigate this challenge, ExxonMobil has uniquely taken proactive measures to compile more data on their small talent pool by using modern human resource practices like enterprise resource planning (ERP) to improve its H.R practices (Rogers & Ethridge 2013). However, the company has been unable to translate this information into useful and actionable data that could help it to improve its risk management processes (Rogers & Ethridge 2013). B.P has adopted a different approach to manage its human resource problems by using blunt human resource motivation strategies, such as giving their best performing employees pay increases and competitive incentive plans (Deloitte 2015). However, like ExxonMobil, the company has not realised a lot of success in this regard because its strategy has not helped it to acquire or retain talent (Enterprise Risk Management Initiative 2015). Risk management processes have withstood the worst of the above phenomenon because both companies continue to undertake ineffective risk management processes because of the lack of skilled personnel to enhance their operational processes or mitigate disasters when they happen.

Conclusion

The main aim of this research study was to offer a hypothetical representation for improving risk management performance in new petroleum companies, while developing people skills working in that field. There were three main research objectives in this paper. The first objective was to review current theory on managing HR and performance in petroleum organisations. The second objective was to evaluate the current management of human resources and performance in new petroleum companies, while the last objective was to make recommendations on how to develop the risk management performance in new petroleum companies. The key to this analysis was an investigation of how risk management practices linked with human resource practices. In the second chapter of this paper, this paper drew this link by putting people at the centre of risk management practices. It also highlighted H.R as a key tenet of organisational management practices. Based on these relationships, the success of risk management processes largely depends on the success of H.R practices. A further dissection of this statement infers that the success of risk management practices depends on the success of hiring, recruitment, training, and appraisal plans.

This paper shows that although B.P and ExxonMobil are successful oil and gas companies, they have not fully exploited the potential that exists in maximising their H.R plans to improve their risk management effectiveness. Particularly, after assessing the risk management practices of ExxonMobil, we see that the company does not involve the chief risk officer in its risk management plan. The in-line manager and people from the upper echelons of management undertake his duties. These practices show that the company does not fully appreciate the role of H.R in its risk management portfolio. Furthermore, its risk-averse philosophy prevents the corporation from focusing fully on how to improve its risk management practices.

Based on a review of the risk management practices at B.P., the London-based company has not done a better job at either preventing, or mitigating, risks. This paper has particularly paid close attention to the Deepwater Horizon oil spill as an example of the company’s failure to undertake effective risk management practices. From the same disaster, this paper has shown that the company’s risk management failures stem from a toxic corporate culture of bottom-line profit maximisation and a shrinking pool of available talent (the latter problem affects both B.P and Exxon Mobil). Particularly, it undermines efforts by both companies to maximise their H.R potential in risk management practices. Based on the limited contributions of H.R processes to the risk management practices of ExxonMobil and B.P, there is a lot of potential for both companies to use their H.R competencies to achieve better results in their risk management performance.

Recommendations

This paper has drawn the link between human resource practices and risk management. Based on this relationship, it has also shown that effective risk management depends on an organisation’s quest to take care of their employee needs (from the point of recruitment until retirement, termination, or resignation). Some researchers support this view. For example, Lam (2003) says

“An organisation seeking to extract the maximum value from its employees must carefully manage both the upside and downside risks throughout the duration of an employee’s tenure with the firm, beginning with recruitment and ending with the employees’ retirement, termination, or resignation” (p. 134).

Although operational risks may increase because of organisational inefficiencies in risk management, petroleum companies should have a clear framework that underscores the importance of employee value to the organisation. Subjective analyses would also help employees to manage some of the HR challenges identified in this paper. The same subjective analyses would help the organisation to manage the complex legal environment associated with recruiting, training and managing employees from different parts of the world. For example, while the performance appraisal could be an effective way for such companies to improve their H.R output, research shows that bias could still undermine the organisations’ H.R performance and risk management effectiveness. In this regard, strictness and leniency errors are likely to influence the performance of the petroleum companies, thereby undermining their risk management processes (non-performance factors would influence their ratings). Nevertheless, based on the risk management failures of B.P and ExxonMobil, we find that these companies have had trouble demonstrating the value of their safety training programs. Until recently, the value of these programs was limited to employee feelings and satisfaction (Almeida & Kogut 1999).

Companies that have had successful safety training programs have not had time to enjoy the benefits of their programs because most of their employees have been poached by other companies, or have had to spend a lot of money to keep these employees in-house. This paper has also explained that the small number of candidates coming from higher institutions of training exacerbates this problem. To manage this crisis in the petroleum industry, oil companies need to be innovative by using specific recruitment pools, such as referrals. This recruitment approach is important for the success of risk management programs because the current “broad” recruitment strategy does not provide the best candidates. Therefore, to lower their recruitment risk, these companies need to seek candidates through employee referrals. The downside to this strategy is the emergence of a less diverse employee pool. This means that the referral strategy is more important in recruiting seasonal employees (unskilled labour). Almeida & Kogut (1999) believe that hiring skilled labour, through referrals may not be the best approach because although prospective candidates may be willing to work in the organisation, they would not perform as well as those who get their jobs straight from graduate schools. Furthermore, since referrals do not create a diverse employee pool, the prospective employees would reflect this lack of homogeneity. This way, the petroleum companies would expose themselves to litigation risks of failing to comply with certain legislative clauses, such as the Civil Rights Act of 1964, which promotes equality in the workplace. Such faults would also affect their profitability.

Decentralisation of H.R Activities