Market Structure

NIKE has sufficiently developed its competitive advantage within its domestic market. Nike is, currently, the leader in the sports industry, and is closely followed by Adidas and Puma. NIKE has 32% market shares in the industry in the year 2000 and it continues to increase every year (Bedsole et al, 2010). NIKE is beginning to capture new emerging markets as well, i.e. China, India & Brazil (Parker, 2011).

Strategic Grouping

In a holistic view, the overall sports equipment industry is illustrated by a number of strategic groupings. Major grouping in strategic terms for Nike are formed for manufacturing and promotion of its products (Wikidot, n.d.). The alliance depicts the partnership between two companies. For example, it has established a long term strategic alliance with Sojitz Corporation of America (Wikidot, n.d.).Another example is the recent strategic alliance between Apple and Nike for ‘Nike + iPod Sport Kit’ product. Nike has also formed strategic partnerships with celebrities such as Tiger Woods and Michael Jordon (Rodrigues et al, 2009).

Market Segmentation

Market segmentation is, basically, the classification of buyers. The major consumers of NIKE are sportsmen belonging to all kinds of sports / games around the world (Marketing Teacher, n.d). NIKE is able to get in touch with its expanded consumer base by using leading sports people as brand ambassadors and by targeting colleges and universities to develop product familiarity (David, 1996, p.171).

Strategic Analysis

Resources

Nike has the perfect mix of resources and potential to expand foundation competencies over other contending firms. NIKE’s resources consist of but are not narrow to being monetary, material, human, insubstantial and structural civilizing.

Threshold Resources

Nike focuses its threshold resources on the Environmentally Preferred Materials (EPMs), and defines them as materials that considerably subordinate force on the surroundings in one way or another as energy or waste. Changing to superior utilization of EPMs needs close up corporation with dealers, they distribute a long side all of Nike’s requirements (NikeBiz, n.d). it is from the environmentally preferred materials.

Physical Resources

Nikes major proceeds producer is footwear, which amounts to almost 54% of the total revenue but there are additional areas in NIKE’s product offerings that make available added profits. Clothing makes up around 27% at the same time as equipment amounting to approximately 6% of the proceeds (SEC, 2011).

Technological Resources

By 2009, Nike had the prospect to compete with Adidas which has only just created the lightest soccer shoe in the world (Kennedy et al, 2009).

Human Resources

Unlimited opportunities exist at NIKE to drive competitive advantage, and to fuel lucrative growth. Our leaders work day in and day out to ensure NIKE understands its potential by stimulating every one of our more than 30,000 employees to understand their position. HR professionals at NIKE, Inc. function as stewards of associations’ effectiveness, talent and change (SEC, 2011).

Distinctive Resources

An exclusive global license to promote footwear using patented “Air” technology also lies with NIKE Inc. Subsequent NIKE AIR® patents will not expire for a long time.

Core Competencies

Core competencies of Nike are created by accumulating its resources. Every market offering obtains productive performance oriented results (Kotler et al, 1999). For example, if they introduce a new product line, is this shoe easily copied by competitors? And is this shoe going to add in to better consumer value. All the resources and qualities will answer that question and form a vital competency.

Sports Brand

NIKE considers its “NIKE” and “Swoosh” design brand to be its most valuable resource with both of these registered in above 150 countries worldwide (Bedsole et al, 2010).

Distribution Network

NIKE has three major distribution centers which are situated in the United States for the brand products of NIKE which include NIKE’s Golf product line. NIKE was recorded to have one of the widest distribution networks supporting all its sales outlets in over 100 countries across the globe with over 20k retailers (Enderle et al, 2000).

Sports Marketing Resource

In the fiscal year of 2010, the changes in exchange rates had a more or less no impact on the demand of the consumers (Media Corporate, 2011). NIKE advertises heavily and not only affiliates its brands with sports players but picks up the best sports players in the industry.

Product Diversification

The Unique Selling Point (USP) of NIKE is to create innovative products at all levels of the company, brand, retail, product, events or even operations. NIKE wants to create what no other brand offers, hence forming the growth strategy of NIKE as well. NIKE has seven diverse, high-oomph brands. Each of the brands is powerfully associated to its consumers (Media Corporate, 2011).

Value Chain Analysis

Powerful work by Michael Porter recommended that the actions of a trade could be assembled in two captions (Tutor2u, n.d.):

- Primary Activities

- Support Activities

Value Chain Analysis is one method of recognizing which actions are most excellent embarked on by a trade and which are finest made available by others or already outsourced.

Primary Activities

Inbound Logistics and Outbound logistics

Nike delivers goods to more than 143 worldwide locations (Kotler et al, 1999). Nike’s logistics procedures are multifaceted, and engage three diverse product lines, namely footwear, clothing, and sports tools. NIKE works with different regions across the globe consisting of ocean carriers, global couriers, and air freight providers (Kennedy et al, 2009). NIKE manages its logistics function in-house rather than outsourcing it like its suppliers (Mishra, 2011).

Operations

Nike’s domestic built-up has put the “AIR” expertise in action in two of its facilities one in St. Louis, Missouri and in another Portland, Oregon. NIKE practically has all resources, a strong and committed team, industrial expertise, qualified technicians and the market leadership (Cheng, 2003).

Marketing & Sales

Nike brand equity turns into revenues from all over the globe that no other brand can compete with in the industry (Sharma, 2009). In 2009 only, NIKE consisted of approximately 32% of the market share in the sports industry while Adidas only amounted to 22% of the total market share. The NIKE brand name leaves a strong registration on the minds of the consumers (Carbasho & Skoloda, 2010).

Services

A customer who connects with this standard of living, it will automatically build up a much deeper association with the brand which in turn shows the way to more sales. Stefan Olander whose Nike’s global director (2007- 2010) for brand connections thinks that most of the company’s outlook on advertising spends will focus more on customer services, for example, giving them work out advice, building up online communities for interaction and local sports competitions (Pure Thinking, 2008).

Secondary Activities

Procurement

An integral part of Nike’s strategy towards corporate responsibility is to assimilate value and knowledge. Nike is provided leverages in shape of purchasing power through ensuring and communicating objectives relevant to sustainability with the prospect’s and suppliers (NikeBiz, n.d.). (IT IS OF Sustainability into Nike).

Human Resource Management

At Nike, teams are created with the vision of catering future business needs, bench strength and future leader development. Its talent strategy is based upon planning of vital assignments, mentoring accountability, and organized knowledge transfer through individuals and group team class rooms. Strategic priorities are focused towards talents assessment and leadership development (Corporate Responsibility Report , 2009).

Firm’s Infrastructure

New strategies and tactics are being executed in establishing state of art information systems, value chain system and logistics operations vis-à-vis with marketing and other functions (Kennedy et al, 2009).

Technological Development

Nike aims to continue working for athletes with innovative designs which helps those evading injuries and other discomforts (Borries, 2004). Nike for its designs, conceptual framework for products and materials, not only utilizes its professionals but makes use of different committees of research, athletes, advisors, trainers, and other experts (Kennedy et al, 2009).

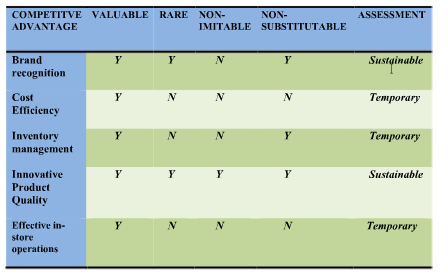

VRIN Framework

Valuable

Nike enjoys a competitive edge over other brands in terms of cost leadership (Mishra, 2011). Thecompetitiveadvantageofcostleadershipandefficientoperationsarenot sustainable but are rare in a highly competitive market. Nike cost leadership arises from it’s from its strategy of outsourcing (Dusen, 1998).

Rare

Nike’s core strength lies in its brands recognition and brand loyalty. It is valuable as well as rare. As Nike continues to enter within new markets, and also concentrating on segments such as female athletes its recognition and loyalty will continue rising.

Inimitable

Nike’s biggest advantage is that of its innovative product designs. A lot of technological and scientific research is done by Nike before launching its products for e.g. deployment of air sole. Although major competitors like Adidas are also working in the same sector, but Nike‘s product technology is non imitable.

Non-substitutable

Nike’s innovation and high product quality can be termed as non-substitutable. Its product in athletic footwear such as Air Jordan, Air Nike due to its design and quality are non-substitutable (Mishra, 2011).

References

Bedsole, B, Currie, M. & Stoker, B, 2010. Nike: A look inside. Web.

Borries, F.V, 2004. Who’s afraid of Niketown?: Nike urbanism, branding and the city of tomorrow. Episode Publishers. Web.

Carbasho, T. & Skoloda, K.M, 2010. Nike. United States: Congress. Web.

Cheng, M, 2003. Nike. Web.

Corporate Responsibility Report, 2009. NikeBiz. Web.

David, M, 1996. Marketing. 2nd ed. Blackwell. Web.

Dusen, S.V, 1998. The Manufacturing Practices of the Footwear Industry: Nike vs. the Competition. Web.

Kennedy, T. et al, 2009. Nike Internal Analysis. Web.

Kotler, P, Armstrong, G, Saunder, J. & Wong, V, 1999. Principles of Marketing. 2nd ed. New Jersey: Prentice. Web.

Marketing Teacher, n.d. SWOT Analysis Nike, Inc. Web.

Media Corporate, 2011. Nike, Inc Revenue Performance. Web.

Mishra, D, 2011. Nike, Competitive Advantages. Web.

NikeBiz, n.d. Environmentally Preferred Materials. Web.

NikeBiz, n.d. Integrating Sustainability into Nike’s Procurement Process. Web.

Parker, M, 2011. Power of the Portfolio. Web.

Pure Thinking, 2008. Nike’s new approach to marketing: services. Web.

Rodrigues, F, Souza, V. & Leitao, J, 2009. Strategic Coopetition of Global Brands: A Game Theory Approach to Nike + iPod Sport Kit’ Co-branding. Web.

SEC, 2011. Nike.Inc. Web.

Sharma, S, 2009. Nike marketing strategies. Web.

Tutor2u, n.d. Strategy: Value chain analysis. Web.

Wikidot, n.d. Nike Company. Web.