A prospect model in relation to prospect theory is important in making of decisions especially those involving risks. The prospect model was developed in the year 1979 as part of a solution to various contradictions and shortfalls that were largely defined in the utility theory in specific situations. According to McDermott (2001), the prospect model’s most significant aspects entail the suggestion that revolves around the ability of an individual to do away with risks on their perceptions of current prospects and their take on various risks. Further, the model of prospect indicates that an individual is allowed to make decisions based on the various shifts in wealth in connection to total wealth incurred. This shift is defined as the shift point whereby new decisions are constantly made. In prospect model, decisions that are termed as risky are divided into two parts namely editing and evaluation (McDermott, 2001).

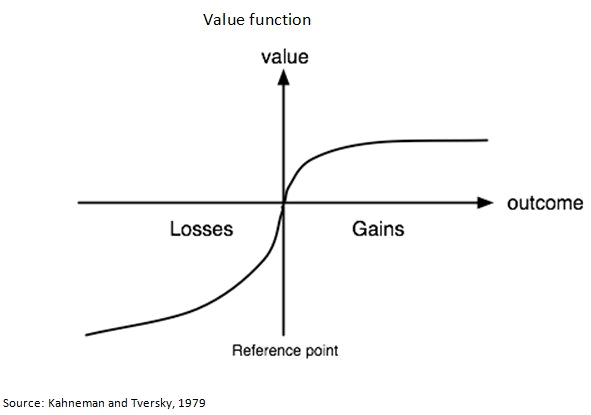

Wakke (2010) asserts that, the editing phrase comprises of initialization of coding by way of defining gains and losses in connection to reference point. After coding has been achieved, prospect identified to consist of identical outcomes are expected to be combined followed by cancellation of common components defined by each prospect. The second phrase calls for evaluation of the prospect model. The evaluation process here utilizes statistically analysis that measures and compares all risks defined in the prospects. Prospect model mainly is involved in introducing two indices that are widely used in comparing various prospects that is the decision and utility (Wakker, 2010). The named functions assist in differentiating utility theory and what is expected as prospect theory. This is described by the diagrammatic representation of prospect model below;

To have a wider view of what prospects model comprise of; it is important that one understand the various main factors that are connected to prospect model. These factors are namely; decision domain, price, sunk cost, project size, project determinants, structural determinants, hedonic value, presence or absence of any alternative course of action, psychological determinants of decision maker, social determinates of group determinants decision makers and finally, risk references (McDermott, 2001).

The above diagram gives a clear indication of how gain or loss decision greatly affects a decision that is termed to be risky. The value function described here takes an S-shape whereby it is concave and convex above and below the reference point respectively. In order to understand this model it is essential to give a tangible example. For instance, assuming that the one has a value of $10 and that the difference existing between the two prospective payoffs is assumed to highly depends on either their fall on low or high end of the said value function present. Here, the model will indicate that the $10 difference in a definable payoff is more valued on the lower curve that is $10 in comparison to $20 payoff that on the upper part of the curve which is $500 compared to $510 payoffs. From the above, it is evident that this same relationship holds true for all identifiable losses apart from cases whereby, the value lost is considered to be more extreme in losses quadrant compared to the value gained in a specified quadrant bearing in mind of the exact amount of dollar being considered.

References

McDermott, R. (2001). Risk-taking in international politics: prospect theory in American foreign policy. Ann Arbor, Mich.: University of Michigan Press.

Wakker, P. (2010). Prospect theory: for risk and ambiguity. Cambridge: Cambridge University Press.