Analysis target market

The Canadian ready-to-drink beverage market is highly competitive. There are different firms in the industry, which offer various protein products and other beverage products in the market. The industry classifies protein products under sport nutrition.

In 2009, the market recorded a slow growth. However, the slow trend changed from 2010 to present time. The industry grew from 9% in 2010 to 14% ($21.4 billion) in 2011. This was strong performance for the sport nutrition industry. The compound annual growth rate (CAGR) was “over 10% during the last decade, which was in line with the healthy food projection while the supplementary sector had recorded 5%” (Lane 1).

The industry consists of Sports Nutrition Supplements, which reached $3.6 billion in retail sales in 2011 (a growth of 10%); Nutrition Bars or Gels achieved retail sales of $2.8 billion (13% growth); Sports & Energy Drinks & Shots sales reached $15 billion (15% growth). There are also other protein and non-protein products in the market.

The industry leaders include Coca Cola, PepsiCo, and GSK while the major brands are Powerade, Gatorade, Vitamin water, and Lucozade. New entrants in the market are Liquid Nutrition Group Inc., Saputo, and Mix1 Life, Inc.

The Canadian sports nutrition industry has a wide variety of brands. There are both domestic and foreign brands for the mass market while other brands are in the category of specialised sports products for retail outlets. In the sport nutrition segment, there are four major players, which include “Weider Nutrition Group, Optimum Nutrition, Ultimate Nutrition, and Allmax” Nutrition (Euromonitor 1). These major players account for 44% of the total market share. In addition, all of these four companies dominate different product categories, but they focus on the most successful category, which is the protein powder. However, the four companies have different distribution patterns. Weider relies on the mainstream retail platforms, such as drugstores and online channels. Conversely, brands from “Optimum Nutrition, Ultimate Nutrition and Allmax Nutrition are mainly distributed through specialist retailers like GNC and online channels” (Euromonitor 1).

Profile of target customers

Active lifestyle consumers

These are the major consumers of protein products for muscle recovery, energy, and hydration. Therefore, the industry concentrates in this segment with a specific focus on hardcore and endurance athletes and bodybuilders.

Health conscious consumers

Canada has vibrant health conscious consumers due to growing cases of obesity. Protein products would appeal to people who are conscious about carbohydrate products and simple sugar products.

The mainstream consumers

These are mainly everyday consumers, including sports hobbyist audience and lifestyle consumers who are conscious about health.

Lifestyle consumers

This target market segment may also account for sport hobbyist users and recreational consumers. They use protein products for lifestyle purposes and for their desires for athletic figures. This target market consumes protein products to enhance their physical and mental activities, boost energy levels, promote protein consumption, and enhance body shape among other reasons.

Busy consumers

These are busy consumers and mothers who work for more than 12 hours in a day. They need ready-to-drink protein products in order to get enough amounts of protein without spending much time on preparing complex protein foods.

Teenagers and students

The target market segment consists of the main consumers of protein powders and shakes. Protein products will appeal to consumers aged between 12 years and 25 years (Consumer Reports 1).

Seniors

The target market would want to enhance their protein consumption, stay healthy, and remain in shape in old age.

Vegetarians

Protein products from plants appeal to vegetarians. The products shall consist of soy, peas, rice, and hemps among other grains.

Types of competition

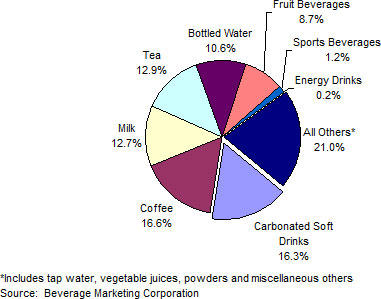

The industry is wide and has various products. Therefore, the company’s new protein brand will face competition from many well-established companies. The Beverage Marketing Corporation of Canada indicates that there are vegetable juices, tap water powder, and other miscellaneous products in the market as indicated in figure 1.

Marketing strategy and competitive edge

Although protein products and beverage market are highly competitive in Canada, the company plans to achieve competitive edge through different ways.

- Packaging: the company intends to use attractive, environmental friendly packaging materials for its products.

- Size: there will be products in different sizes, ranging from small, medium to large.

- Flavour: protein products would have different flavours to appeal to diverse consumer tastes and preferences, including unique tastes for vegetarians.

- Research & Development: highly developed products shall appeal to sports personalities and lifestyle consumers. On the other hand, organic or natural label protein products with natural ingredients like honey, milk, and basic protein would be suitable for health conscious consumers.

Protein products shall be free of sugar, allergens, gluten, and other chemicals to attract consumers who are keen on product ingredients.

For sports protein consumers, products would have favourable concentration, whey protein isolates, and hydrosates. This market segment has maintained steady growth in the recent years.

The company is likely to focus on several plant-based protein products, as well as protein products derived from vegetables.

It intends to promote protein products, which are rich in amino acid and offer nutritional compositions that match whey.

Method of identifying and attracting customers

The company shall conduct primary market research before product developments to identify potential customers of its protein products within Canada. In addition, it plans to review competitors’ activities, their products and target markets. On this note, the company notes the importance of elements of marketing mix in marketing and attracting consumers.

Price

The company’s protein products shall be within the normal market range. Nevertheless, there would be premium products for the high-end consumer segment and low priced products for the low-end market segment.

Products

Product development is a critical part of the company’s operations. There would be products for hardcore athletes, who prefer powder products with energy enhancing concoctions. On the other hand, regular protein users require products with ease of use.

There would be product miniaturisation, particularly with the ready-to-drink category. The company shall adopt innovative methods of developing and delivering products. Such methods may include bars, chews, shots, puddings, powders, and blocks. Powder protein products target sports personalities, and this category is the fastest growing among all other protein product categories (Lane 1).

For professional athletes, the company intends to base its products on scientific discoveries to target early adopters. These are mainly products with cutting-edge ingredients. The company shall support its products with scientific findings to appeal to lifestyle consumers, who want safe products for healthy bodies.

Research and development (R&D) shall focus on clinical trials to enhance safety and efficacy on new protein products. This would ensure that the company delivers novel protein products to consumers. Its aim would be to overcome barriers associated with safety issues, human nutrition, and body performance.

In some instances, the company plans to choose the most effective mode of product delivery like tablets or pills based on consumer preferences.

Product safety

In the recent past, some tests have shown that certain protein products or supplements expose users to dangerous heavy metals (Consumer Reports 1). Some heavy metals found in the products exceeded the recommended range while consumption could expose users to high-levels of “arsenic, cadmium, or lead exceeding the limits proposed by USP” (Consumer Reports 1).

On this note, the company intends to ensure absolute safety of its range of protein products.

Place

The company shall selectively identify its retail outlets and partners. It would require all partners and retail outlets to meet specific demands on product display and placement. The company plans to develop boutiques outlets with the aim of offering best customer experience. Stores shall be in affluent retail places, busy streets, and near sports complex. For effective product distribution, the company would rely on the following places or modes of distribution.

- Voucher machines in gymnasium, schools, sport centres, recreational centres, groceries and supermarkets

- Retailers

- Wholesalers

- Vitamin Shoppe

- Agents and indeterminate agents

- Local drug stores

- GNC stores

Many athletes prefer specialty distribution channels. The company intends to observe any changes in the consumer base and introduce different methods of distribution and delivery systems to enhance consumer convenience.

Promotion

The company would use different methods to promote its protein products within Canada. It shall use professional sports personalities to promote its protein products. This would ensure that consumers associate the product with professionals and celebrities. The company will rely on both traditional and online media to advertise the product. These include television, magazines, newspapers, billboards, and radio while the Internet and social media would drive online promotions. The company plans to sponsor sports, engage in corporate social responsibility activities, and brand certain locations.

Selling approach

The company would engage in direct sales. Salespersons would be responsible for meeting sales target within a given period. Salespersons shall strive to solve customers’ problems and recommend best products.

Types of sales force and distribution channels

- Direct selling and personal selling

- Wholesalers

- Retailer outlets, including major supermarkets

- Drug stores

- Speciality stores

- Sales agents

Just like other companies such as CytoSport and MusclePharm, the company intends to review its products to customise them for specific distribution networks. It will promote different brands through different channels and focus on the mass market to capture the market share, increase revenues, and profitability.

The company plans to establish a strong online presence through its Web site and other sites that advertise protein products. This would ensure many consumers know about the company and its products.

Given the presence of the Internet, customers will enjoy the convenience of buying products and receiving them within the specified time. Moreover, the company shall provide complete product reviews and abundant information to help consumers make right choices. The Internet would also offer an opportunity for the company to provide real-time support to its customers.

Credit and pricing policies

The company might offer credit only to large distributors that have established good business relations.

On the pricing policy, the company would have both low-priced products for the mass market and premium products for the high-end market segment. Product prices shall be within the industry average.

Works Cited

Consumer Reports. Protein drinks: You don’t need the extra protein or the heavy metals our tests found. 2012. Web.

Euromonitor. Sports Nutrition in Canada. 2013. Web.

Lane, Janica. The Next Chapter in Sports Nutrition. 2012. Web.