Introduction

The real estate industry or “real property” is the key element of the economy, as this vital sector is a critical driver of any country’s growth. Residential real estate implies land, building, and air rights above the land and underground rights below it (Amadeo, 2021). The main difference between commercial and industrial real estate and pieces of land is that residential property includes only new construction and resale homes, such as single-family ones, condominiums, and vacation homes.

This research paper will evaluate the current market, specific demand and supply conditions, and related factors, examine the current role of government in the industry and suggest changes that would benefit market outcomes. The role of demand and supply elasticities and their impact on industry behavior will be discussed, along with profit-maximizing and loss-minimizing production rules and related challenges. An evaluation of the level of competition will be provided, and potential strategies for its improvement suggested. Finally, technological and global trends that are likely to impact the residential real estate industry will be outlined.

Evaluation of the Residential Real Estate Market

Evaluation of The Current Market and Demand and Supply Conditions

In contemporary realities, the residential real estate market in the US is volatile. The general tendency is high demand with relatively low supply. The main principle of dependency between demand and supply, with respect to the real estate market, is that when demand declines, supply does not decline, and so prices can fall very rapidly, but when demand increases, prices increase slowly because house builders gradually expand the supply (Cartier, 2020). There are the following major factors, which can affect housing market supply and demand and shall be considered.

The affordability of real estate and the purchasing power is directly affected by mortgage rates, and in the event, they rise so do the opportunities to buy a home and vice versa. The cost of building materials also can increase price as their costs are passed to buyers (Cartier, 2020). If there is a net loss of jobs in an area, people may need to move to other places or have less income that will increase supply and decrease demand, and therefore, prices. Then, local market factors such as positive and negative migrations influence demand and supply, respectively (Cartier, 2020). Finally, local and state-level legislation and rules, including tax incentives and development fees for builders, also directly influence the attractiveness for builders to produces new homes and for customers to buy them. Therefore, the residential real estate market depends on a number of factors that can affect the supply and demand for houses.

Explanation of Past and Forecasted Trends

The general current tendency in the US residential real estate market is high demand with relatively low supply. There was a historical maximum in new and existing homes sales in 2005, due to stable development of economy, that was followed with a rescission period started in 2006 and finished in 2009. The real estate market was influenced by several factors: the fallout of the entire global financial system, which resulted in millions of people losing their jobs that reduced demand for houses, and caused home repossessions (Pettinger, 2020). The other significant point to mention is Gross Domestic Product (GDP), 15-18% of which is contributed by residential investment and consumption spending on housing services, and this fact indicates that toward the fall in real estate industry, GDP declined.

Mortgage payments became more expensive caused by rising interest rates and accompanied by a fall in bank lending and, therefore, availability of mortgages. Simultaneously, there was an excess of supply in the housing market, while a fall in market rents made buying let an unattractive option (Pettinger, 2020). After the Great Recession was over, the market begun to stabilize, which proves the tendency to grow in the number of houses sold annually (Potter, 2021). It can be seen that a huge gap in early 2020 stopped the mentioned growth, and this past trend also has factors that contributed to the fall.

The pandemic, which is influencing the World, caused a situation similar to the one mentioned above. However, after the situation is stabilized, the residential real estate market perceived an increase in demand for houses. The builders of the property had to reduce the number of new homes built in 2020, while in 2021, more people tend to own houses, which resulted in an increase in their prices. The following statistics compare the 2021 year-over-year prediction and actual numbers. Existing home sales were expected to rise by 9%, versus 23%, while newly built home sales reduced by 19% instead of a 21% rise (Ramsey Solutions Authors, 2021). Home prices grown three times more than expected and reached up 23%. In 2020, total home sales in the US amounted to 6,5 million, and after the pandemic fall is overcome, the number is expected to grow. Therefore, the supply will increase over time toward the raised demand, and the prices will be significantly reduced.

The Current Role of Government in the Industry

The US government can implement a set of methods and instruments to regulate the real estate market to prevent the adverse situation called “market failure” and balance supply and demand. The primary one is legislation that formulates major provisions regarding property ownership. Then, taxation is seen as the method of regulating the current market. Property taxes can influence transfer, ownership, or income. It is known that the effect of taxation varies according to local market conditions, while property tax payment is a considerable part of local tax revenue (Manganelli et al., 2020). In addition, transfer transactions have negative consequences on prices, while income ones show a significant positive effect, as they are paid by the seller and not by the buyer (Manganelli et al., 2020). Varying the size of a particular type of taxes government can influence prices, supply, and demand.

Intervention implemented through subsidies is essential for fairness, quality, and social balance in the housing market, improving and overcoming its inefficiency (Hubbard & O’Brien, 2021). Quantitative and qualitative methods of control, such as the refinancing rate and minimum reserve requirements, limiting the availability of mortgage loans, and others, also can be utilized to adjust the current situation at the housing market. Finally, the government can perform rent control, making it more attractive than buying. The outlined set of measures can significantly influence the situation in the market.

It is advisable to find a balance between the mentioned three types of taxes, considering the current economic situation to improve market outcomes with respect to taxation. Nowadays, making taxes, bearded by the builders, to decrease can be right action, intended to promote the creation of new property to fulfill the excessive demand but not to increase already high prices. It is possible to notice that the high demand for houses in the current residential real estate market resulted in high prices. It may be beneficial to consider establishing a subsidy program to ensure that people in most urgent need still can afford the mortgage. The current situation is not financially beneficial for the government concerning getting the maximal revenue from the real estate market. Still, interventions in taxation policies and subsidies policies can positively influence the industry.

The Role of Elasticities of Demand and Supply in the Industry

Elasticity is referred to as the description of changes in the behavior of buyers and sellers in response to changes in the prices of a product or a service. It implies, with respect to the residential real estate market, that the more inelastic the housing supply becomes, the more increase in demand translates into a rise in prices (Aastveit et al., 2020). This concept can explain why house prices differ across locations.

Considering the fact that the discussed market consists of several ones that differ in terms of geography and other attributes, such as distinct regulation policies implemented by the government, there is the phenomenon of significant differential regional house price performance. Therefore, elasticities of demand and supply are vital for understanding the dependence between demand, supply and the significance of their influence on the prices of houses.

It is known that there are factors that can affect elasticities and measures that can be taken to benefit the situation. For instance, the decline in supply elasticity can be related to tighter land-use regulations and precautionary motives, while the most vulnerable areas are known to be coastal ones (Aastveit et al., 2020). Considering that elasticity is formed of two determinants: change in quantity and change in price, the supplier can implement the following methods to ensure the optimal price elasticity of supply.

The spare capacity of materials can be useful to increase the building of houses in the shortest terms, while utilization of modern technologies can also facilitate the length of the production period (Aastveit et al., 2020). Factor mobility that implies moving resources into the industry is also a key factor that shall be considered to speed up the building process (Aastveit et al., 2020). Therefore, builders can utilize methods to ensure the optimal elasticity of supply, and thus, to prevent prices from rapid growth in the event of high demand.

Profit-Maximizing and Loss-Minimizing Production Rules

Profit is the financial benefit left after excluding all the costs from the revenue obtained. In terms of perfect competition, a theoretical market structure that firms sell an identical product cannot influence the price, resources are perfectly mobile, and customers have complete information, firms can apply to loss minimization rule. It implies minimizing economic loss through producing output that equates to marginal revenues and marginal costs, in the event price is less than average total cost (ATC) but greater than average variable cost (AVC) (Hubbard & O’Brien, 2021). Simultaneously, with profit maximization, price exceeds ATC, and a firm gains a financial profit (Hubbard & O’Brien, 2021). Consideration of the rules assists in deciding whether to produce a product or not and what output is sufficient to the current situation.

The mentioned concept has contributed another one that is “consumer and producer surpluses.” It implies the ability of the producer to manufacture an extra unit based on the marginal cost and the difference between what the consumer is willing to pay and the actual price. In the optimal situation, it is beneficial for both builders and buyers to produce or purchase houses, respectively. In the current market, when demand is at a high level, and, because of the inelasticity of the supply, prices are high as well, profit maximization strategy is sufficient to builders, and producing more houses in the shortest terms will result in a chance to obtain increased, in comparison to pre-pandemical period, revenue.

The Degree of Competition in the Industry

In the residential real estate industry, competition is not less significant than in any other area. Moreover, as property is the largest asset for most people, competitiveness plays a vital role in the US economy-boosting (Yale, 2021). With respect to the mentioned concept of a perfect market, the real estate industry is not close to it, as transactions costs, ease of entry, homogeneity of products, and profit maximization for sellers are not achievable.

In a current market, it is possible to have a successful enterprise for building houses, as even existing ones do not cover the demand, and the issue is in the availability of resources such as materials and lands. On the other side, because of policies and regulations, firms cannot influence the prices that restrict their profitability and make it less attractive to invest in new houses building. It may be useful to establish interventions intended to lower transaction costs and lower taxes paid by the seller. In the situation when demand is high and government facilitates the builders, profit will be increased through the increased gap between revenues and costs.

Technological and Global Trends

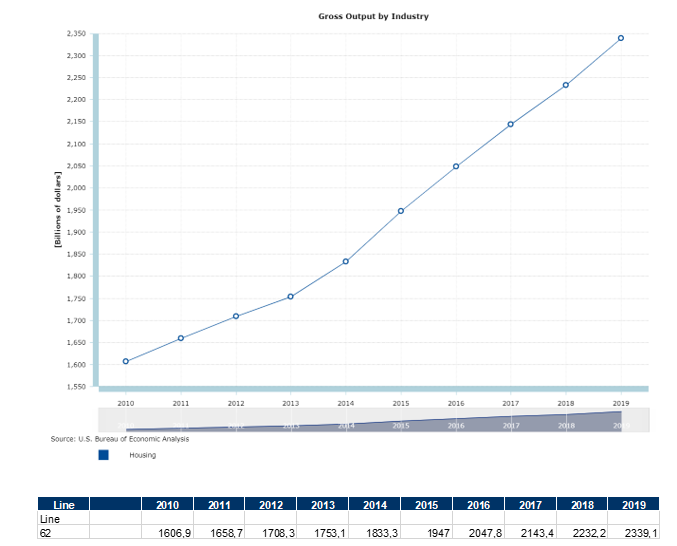

It is possible to outline existing tendencies in the current residential real estate market and evaluate trends that can potentially influence the industry. With respect to the annual outcome from housing, gross output is presented in Figure 1.

The general tendency in the market is rapid growth, as, in 2010, the gross annual output reached $1600 billion, while in 2019, it raised to almost $2350 billion. It does not significantly correlate with the evaluation of the industry outlined above, despite a shortening in the number of new houses built and sold (in 2013). This fall is manifested as a small, compared to other years, market growth in that period. It is explained with the raised number of old houses sold, and increase in renting.

There are several global trends that transform the residential real estate industry. Big data, the new technology that assists in obtained data analytics, is helpful for both investors and property buyers, as most of them use digital resources to guide them and assist in decision making (Auctm Authors, 2021). The right use of the data will be helpful for progressive companies that sell houses. The other technology, virtual reality, is capable of visualizing the houses for buyers that make it more attractive to purchase a property and easier for sellers to conform with the customers’ needs. Finally, artificial intelligence that participates in automated applications and performs customer support will distinguish the most progressive companies and benefit financially. Therefore, the market is rapidly growing, and modern technologies can assist both buyers and sellers in achieving their goals.

Conclusion

The situation in the current residential real estate market can be characterized by high demand and a low supply because of the pandemic that resulted in the economic fall, during which the building of houses was slowed that interfere with the current growth that results in increased prices. The government can improve the situation through adjusting taxation policy and subsidies providing. In addition, modern firms in the industry tend to utilize new technologies to comply with contemporary customers’ requirements. It can be forecasted that the market will rapidly grow further, while the prices are expected to be lowered.

References

Aastveit, K., Albuquerque, B., & Anundsen A. K. (2020). The declining elasticity of US housing supply. Voxeu. Web.

Amadeo, K. (2021). What Is Real Estate? The Balance. Web.

Auctm Authors. (2021). Impact of Technology on the Real Estate Industry. Auctm. Web.

Cartier, B. (2020). Housing Market Supply and Demand. Millionacres. Web.

Gross Output by Industry. 2021. Bea. Web.

Hubbard, G. R., & O’Brien, A. P. (2021). Microeconomics. (8th ed.). Pearson.

Manganelli, B., Morano, P., Rosato, P. & De Paola, P. (2020). The Effect of Taxation on Investment Demand in the Real Estate Market: The Italian Experience. Buildings, 10(7), 115-129. Web.

Pettinger, T. (2020). Cause of falling house prices. EconomicsHelp. Web.

Potter, S. B. (2021). The U.S. Housing Market: High Demand, Low Supply, Rising Prices. FactSet. Web.

Ramsey Solutions Authors. (2021). Housing Market Predictions 2021 & 2022: Will It Crash or Boom? Ramsey. Web.

Yale, J. A. (2021). Here’s Just How Competitive the Housing Market Is Right Now. Millionacres. Web.