Dissertation Proposal

The purpose of this dissertation proposal is to present coordination of changing dynamics of the sales staff behavior along with the factors affecting the Customer’s motivation to respond to the credit card sales in Penang, Malaysia. The marketing practice and sales of credit card in Penang Malaysia are most likely to use temporary staff, individual contractors, and outsourced employees. The banking and financial sector of Malaysian has proven its solid base and resilience by encountering global financial crisis without any major shock, but the domestic economic challenges encompassing reformation, liberalization and perfect competition among the players (The Business Times, 2010). As a result, credit card markers are under pressure to gain competitive advantage by reducing cost that leads them to use temporary employees, or outsourced contracted staff for sales of credit card.

The marketing of payment card industry all-inclusive debit, credit, electronic card, and online payment have long been associated with customer’s loyalty program and the changing modern approach has adopted more emphasised on loyalty to using it as a novel tools for card marketers. To attain and sustain strong customer base, the credit card industry is eager with three-dimensional approach of customer’s loyalty such attitudinal, behavioural, demo-graphical loyalty approach. Thus, it is essential for the Credit Card marketers of Penang to concentrate on the behaviour of sales staff to ensure customers satisfaction (Insight Consultancy, 2009).

Ferrell and Ferrell (2005), Wood (1995) and Murphy (2002) added that the business world all stakeholders demand for ethical behaviour with one to another while the sales staff is at the top of such requirement to attract and sustain customers. The ethical behaviour of the sales staff has absolutely interlinked with the customer’s responds including his trust on the organisation, customer orientation, and maximisation to generate a strong base of satisfied customers. The sales staff and customer orientation is a vital area that inevitably need to address for successful business entries and it has been long evidenced that unethical behaviour of the sales staff has harmfully crashed the effectiveness and profitability of an organisation.

Cadogan et al (2007) pointed out the factors those influence the ethical behaviour of sales staff and categorised them into four classes. In such categorisation, the organisational factors kept at the top of privilege that generate and enforce standards. The second factor are the features of a sales staff like his physical appearance, gender, age group, work experience and moral standards and third factor is job features like predetermined targets, extent of reiterate sales efforts, competitiveness, of the market, and type of compensation either salary or commission or both. The fourth and most influential factor that particularly faced by sales staff situational dilemma and moral hazards with the customers that concerned with high risk of unethical behaviour of sales staff while such risk would be more concentrated connecting to the discrimination of compensation packages.

Temporary staff, contingent worker, or outsourced employees are categorised as the working class those have no not any direct or indirect contract for regular job, but sustain their livelihood by alternative works like on call service, independent contractor, or leased worker on no-work no- pay basis (Kohli et al, 1998). Due the increasing pressure of cost minimising and profit maximising, organisations are likely tend to engage growing number of temporary workers or renting outsourcing service. Such alignment of the organisations pointed to the lacking with the literature of temporary staff and urged for huge research in this regards.

Bass, Tim and Gene (2001) evidenced that the permanent staff negatively react toward the engagement of contracted, outsourced, or temporary staff. While the permanent sales people are familiar with the organisational norms and practice, the temporary or outsourced sales men are concerned with inferior stage of loyalty, associated risk with job uncertainty as well as ethical dilemmas including their morals and psychology.

There is enough research with the standard and quality of the sales staff behaviour and there is also very small number of recent research with the necessary reformation practice of sales staff behaviour, but the existing sales staff behaviour literature have not yet been addressed the dilemma of harmonising the value chain of the customers and sales staff simultaneously. There is no research agenda has yet raised to what extent the sales staff behaviour comply with customers loyalty for credit card sales in Penang Malaysia or how the customers undermine the standard of sales staff behaviour in Penang and impact on the customer retention strategy and as a whole on the marketing strategy. There is also no elaborate study concerning the credit card sales in Penang integrating with factors motivating customers for enhanced use of credit cards.

This dissertation proposal has taken up this issue and aimed to coordinating pact with the results those provide most advantageous solution for sales staff behaviour acceptable to the value chain of customers in Penang Malaysia and also acceptable to the academia and credit card marketers in this region. While the credit card marketers would be convinced, they will take appropriate step to make necessary changes of their sales staff behaviour code of conduct at their practice in this province of Malaysia. By addressing the research questions, it has also aimed to generalise the standard of factors those influences sales staff behaviour to ensure customers loyalty in the Asian emerging market like Penang, it also inspires the credit card marketers to enhance their investment to develop sales staff behaviour. Moreover, the proposed dissertation would demonstrate the strength and weakness of the sales staff behaviour in Penang, customer’s motivation towards the existing norms of sales staff behaviour. The proposed dissertation also argues for optimal solutions for coordination with the objectives of credit card marketers in Malaysia complying with standards of sales staff behaviour.

Why this is Important

Academia in the field of Economics and Marketing have engaged long effort to analyse the customers behaviour, but the area of sales staff behaviour has ignored with less significance even in the discipline of Organisational Behaviour. In the modern era their rising needs to analyse systematically sales staff behaviour and the concurrent literature of marking has kept its effort to scrutinise the factors those manipulate the ethical behaviour of sales staff.

Cadogan et al (2007) interviewing with hundred and fifty-four sales managers of Finland, engaged their efforts to establish a model for ethical behaviour of sales staff integrating with the managers and peers with strong management control over the organisational behaviour. The model argued that the sales manager would be rewarded for the successful outcomes; he must emphasis to increase the ethical standard of the members of his sales team. Individual achievement of the sales manager would inspire him to increase the sales staff’s job security, cooperation among the team members, generate new sales strategy, and increase ethical standards, which ultimately increase the profitability of the organisation. The model has given emphasised on the sales manager’s performance than sales staff, but does not identified factors that influence misbehaviour of sales staff.

Kraimer et al (1-8) conducted research with hundred and forty-nine full-time US workers about their awareness to the temporary positions based on hypothesis that the job security pessimistically supposed to the temporaries as a threat of losing job, but it does not generate that insight that the temporaries are exploited. With psychological approaches and supervisory assessment, they demonstrated that the job security of the staff would restructure the linkage between benefits and threats while the higher job safety measures ensure higher productive outcomes.

Haron et al (2011) argued that the existing literature of employees has concentrated vast area sales staff linking their customer orientation, but not differentiated the permanent and temporary staff’s conflicting approaches. Small number of rear research has addressed on the difference of behavioural approach, performance, and working stance linking full-time staff with temporary staff by forecasting their attitudes and behavioural measures from the psychological consideration.

The policymaker spectacularly aligned for more improvement of sales staff behaviour to generate quick economic growth while the Malaysian scholars and academia have recently started to address the needs to improving performance of the sales staff behaviour and urged for major reconfiguration in the current sales process of credit cards. The banks and credit card marketers could be the major player in the sustainable economic growth of Penang by producing more job opportunities through investment for sales staff behaviour improvement, but there are enough gaps to address the compliance of sales staff behaviour towards customers loyalty though to some extends they are enjoying strategic flexibilities to improve performance.

On the other hand, sales staff behaviour policies of credit card markets are more concerned with progressively, more antagonistic and disorderly environments of the management structures at this stage, which is insufficient to facing the challenge of quick shifting in Penang while the society is arguing to represent optimistic technological needs, social psychology, encouraging incentives, and affirmative sales approach. In addition, the most noteworthy dilemmas is that the sales staff behaviour practice and policy in Penang has basically mistreated to take into consideration of the impact of prospective sales analysis while they have considered customers as the focal point isolated from sales staff behaviour practice and research.

Thus, there exists a major research gap to integrating the factors affecting the improvement of sales staff behaviour to complying with the customers’ loyalty coordinating with the value chain of customers and marketers for reconfiguring the standard of sales staff behaviour. The process of customers’ motivation could attain such gaps by identifying those factors to bring improvements of sales staff behaviour integrating with the value chain of and such studies would be able to quantify the short and long run costs and benefits for the contemporary the sales staff behaviour to enhance the management process improvements. Thus, for this dissertation proposal, it is important to look for literature search on coordination of sales staff behaviour and value chain models including customers motivating factors linked with the sales staff behaviour.

Current impediments

- Confusing nature of the sales staff behaviour practice within the credit card marketers and customers in Penang, Malaysia,

- Existing approaches of the sales staff behaviour and relevant value chain of the customers are not readily accessible for coordination of customer’s motivating factors for the decision maker,

- Existing approaches of the customers within the value chain of management requires extensive data those are not commonly obtainable to assess the status of sales staff behaviour compliance with the standards,

- The available data may not be relevant to a specified factors affecting the decision making of sales staff behaviour upon the concurrent situation of Penang,

- Existing approaches of the sales staff behaviour and regulatory value chain of management necessitate complex simulations those required larger effort to construct coordination among the factors affecting the customers’ decision-making process by reconfiguration of the standard of sales staff behaviour.

Goals & Aspiration

- To generate good grace available to support the improvement of sales staff behaviour connecting to the customers value chain and respond

- To support the verdict for any improvement of business environment within the territory of Penang that will attract elevating number of sales staff by accelerating huge employment opportunities,

- To minimise efforts and reduce complexities those are essential to support the competitive advantage for the credit card marketers to attracting customers in Penang,

- To make use of such information those are readily available among the existing the sales staff behaviour practice and customers value chain,

- To carry out the best research outcomes that could be done rapidly with appropriate system by engaging the new scholars and academia for further research in this area,

- To maintain an open-end framework of supervisory monitoring for the compliance of sales staff behaviour in context of customers loyalty programme in Penang and addressing the needs of customers to escalating those factors,

- To contribute with proper research outcomes to the Payment Card Industry and credit card marketers in Penang that will assist to formulate their policy of the sales staff behaviour.

What is Not New

- The basic concepts of the sales staff behaviour and customers value chain,

- The sales staff behaviour practice quality assessment process and management procedure,

- Technological process of improvements for the sales staff behaviour monitoring for both domestic corporations including customers,

- The available public and private research data of most recent the sales staff behaviour study with Asian emerging market of Malaysia and

- The progression simulation framework of the sales staff behaviour in Malaysia;

What is New

- The framework that has been presented for this dissertation proposal,

- The evaluation of factors that support Credit card marketers to complying with the standard of sales staff behaviour in Penang;

- A structured set of choices those keep contribution to reconfiguring the standard of the sales staff behaviour in Penang;

- A well thought-out set of coordination among the customers, marketers and sales staff;

- The structured initiatives for the improvement method by using sales staff motivating factors to increasing integrity with the Malaysians society and culture;

DSAM 1 has set out the code of conduct for Malaysian Direct selling that has been endorsed by The Ministry of Domestic Trade, Co-operatives, and Consumerism, which has mainly emphasised on the ethical selling and set out its strategic objectives to accelerating the sales staff behavioural practice. This code of conduct has provided the opportunities for the local and foreign companies to generate excellence at implication and practice and the proper research outcome of this dissertation would ultimately contribute the DSAM members and other marketers with highly qualified leadership to take the sales professionals and nation one-step forward. It has already set out the standards for sales staff for both domestic and foreign companies by ensuring the principles of accountability. However, there are also huge gap to coordinate with the customer’s perceptions, sales staff behaviour, and marketers objectives.

The proposed dissertation would critically illustrate the perceptions and attitudes of the factors affecting the standard of sales staff behaviour in Penang to complying with the customer’s loyalty when the policymakers and marketers are interested to elevating the same factors touching customer’s motivation. The proposed dissertation would be well accustomed into following six chapters and appropriate sub-chapters mentioned below and there should be some other sections such as Acknowledgments, Abstract, and Appendix with appropriate coherence with the topic area

Background of the Study Region

Penang is one of the thirteen states of Malaysian situated in the north part of Peninsular Malaysia including Penang Island and Seberang Perai with an area of 1030 sq Km. and the UNESCO for its long historical belongings of the human civilization proclaimed this area as the World Heritage Site. About two hundred years of British Colonial rule, Penang achieved independence in 1957, under the Federation of Malaya, as a state it has restored itself among the emerging multi-sector economy with highest emphasis on export of industrial supplies, manufactured raw materials, electronic appliance and established itself as midlevel income generating state (OECD, 2011). In 2010, it has estimated that the population of Penang is 1,773,442 with an annual growth rate of 3.05 % and the demography consist of majority of Chinese ethic group, the second largest are the Malays and rests are Indians. Within the last three decades Penang has remarkably turn down its crude birth, death rate, and mortality rate that has identified as key economic indicators demonstrating the development public health in this region (IPPTN, 2010).

George Town – at the west coastline of Malay Peninsula, is the capital city of Penang has gained a significant prospect in the national economy of Malaysia by utilising its strategic geopolitical location for rising electronic industries during seventies to eighties and explored itself as a heavenly place of semiconductors industries including textile and garments. With strongly diversified multi cultural belonging of the area with equally rich in its heritage and history of Penang, with a inadequate quantities of universities in this area, the social and communities involvement in the direction of socio-economic progress with various academic agenda concerned with research expertises aimed to sustain in the national and global knowledge industry.

The Market Scenario: Credit Card Business in Penang

Ramayah et al (2002) pointed out that there were nine hundred thousand credit card users in Malaysia, which is growing at a speedy rate of 89.3% per annum, and it reached over several millions due to increased confidence at user level, political constancy, excellence in the economic growth, and social progress. During eighties Credit card sales in Penang, Malaysia were totally different from today, customers were willing to get the credit card from banks at all cost and they don’t mind paying very high annual fee, joining fee, etc. Those who have credit card during that time were considered financially successful and having prestigious status while the banks charged very high annual fee and joining fee. In nineties, credit cards turned into more accessible to the mass people while foreign banks entered into the credit card sales in Malaysia and the credit card market has intensified. Consumers still like to apply credit card and foreign banks started having lots of promotion to attract customers. Customers also started to own foreign bank credit cards with high annual charges and joining fees.

In 2000, the practice of credit card sales in Penang has changed a lot; all banks waived the annual fee and joining fee to attract customers. The competition among banks was intense especially the foreign banks and the customers became very selective and it was not easy to promote new credit card to customers of Malaysia. Thus, credit card sales in Malaysia turned as a curb crucial job and it necessitate to having very good sales people in order to convince customers to apply. During this time, customers do not really care about local or foreign banks but much more concern about the card features and benefits and the issuer banks urged for credit scoring of the applicants based on their historical data (Ibrahim and Wah, 2010).

Ibrahim and Wah (2010) added that due to the strong competition among the credit issuer banks, incredible number people enabled to achieve credit cards without any efforts and careless the bank investigation of their credit history. Presently, banks do have some screening procedures such as using credit scorecards to make decision and the credit card sales vendor who evaluates new applications must use a certain set of profiles of old good credit applicants or past applicants as a yardstick against which to evaluate new applicants who may be either new, bad or good credit applicants.

Thus, the credit sales in Penang, Malaysia turned into a very tough and complicated job while omission of annual fee and joining fee reduced the profitability for both the issuer banks and sales vendors. Customer’s trend towards the credit card sales staff has changed and they would like to avoid sales staff at road show, at shopping complexes and any other places. Most of the customers during this time at least own several credit cards without any hard effort and the credit card issuer banks are under serious pressure to reduce concerned sales cost to sustain in the competitive market of Malaysia. As a result, banks concerned with credit card sales, have started to use outsourced service from the private sector of Malaysia with very marginal credibility to the customers. The Outsourcing Companies is thus needed to have a very good sales strategy and tactic with dynamic sales staff in order to finding new customers and sign up them, which is a very tough job.

The paradigm of credit card sales by bankers in Penang has shifted significantly over the few decades. Many years ago, it was a very sophisticated and respected sales job for the last generation, but now it turned into a vicious job. In the previous decade, a lot of dynamic people who worked in credit card sales, already been promoted to top management position in banking, mostly heading the card sales division and overseeing the sales function in South East Asia. Unfortunately, these people have forgotten where their root and where they come from. They used to promote credit card in a very professional and ethical way to consumers last time but they allow the current sales staff to do it completely different way from what they did during their time. Showing the logic of survival to the competition and personal objectives they create pressure and made them found to do different unethical things and meeting the challenging target.

With the dream of career advancement, promotion, bonuses they entitle for achieving, the prefixed targets in exchange of a nominal commission rather thank any fixed salary.

Ancestors of credit card sates staff in Penang, who are now at the top management of credit card division, do not see anymore the needs for consumers to have a good perception towards credit card sales staff but arrogant to reduce sales cost. The number of outsourcing companies involved with credit card sales in Penang have dramatically increased and there exist an unparallel competition to offer lower bids to the banks for their credit card sales. To sustain in this unethical competition, outsourcing companies use low grade, less educated and poor paid or unpaid staffs on a nominal commission or target orientated payment basis deprived youths from the backward communities of the society. Such staff are not familiar with corporate culture and lead to different unethical happening and misconduct with the customers which ultimately injure the banks’ image have been tarnished as far as credit card sales is concerned. Consumers mostly try to avoid credit card sales staff nowadays for a number of reasons. Consumers generally have a very poor and negative perception toward credit card sales staff from banks and their outsource agencies. The bank always talk about how important to safeguard its corporate image but on the other hand, allow the unethical, inexperience and unprofessional frontline credit card sales staff from all channels to ruin it image everyday. The banks have all desperately derived to increase the number of their credit card sales without caring whatever sales method has applied to achieve their sales target. One of the mostly use sales tactic is hard selling and this method of selling has annoyed and irritated many consumers from all walk of life but the banks take no actions and indirectly supporting it because this method still can contribute significantly to certain target as required.

The Author’s Role in the Industry

The author is a Malay citizen having MSc in Marketing from the University of Glamorgan, UK and possesses CIM Postgraduate Diploma (CIM, UK) with almost two decades of marketing and sales profession in the banking and financial sector.

With long experience in the sales and marketing of banking industry, as a Sales & Marketing Manager, the author now owns an outsourcing sales agency for financial institutions, which named as ‘CMS Card Services Sdn Bhd’, a specialised independent contractor for credit card and merchant acquiring business for financial institutions and payment services companies. To further develop of the author’s professional skills and be recognized as one of the successful businessperson and recognised him as a remarkable leader in outsourcing business in Penang. At CMS Card Services Sdn Bhd, as Managing Director the author have been serving for the past 15 years deeply concerned with teamwork very closely with financial institution and have gained valuable sales experience in credit card and merchant acquiring business. Under the leadership of the author, the company successfully built up a strong and dynamic sales team to spearhead the credit card acquiring business while the group approval rate for credit card acquiring business is one of the highest in the market place. As a result, CMS Card Services has turned into one of the top personal sales contributor for financial institution in Penang.

For merchant acquiring business, CMSCS2 has acquired several thousand of retailers from various industries for a financial institution such as golf club, luxury hotels and lodging, restaurant, arts and handicraft, antiques, aquarium supply, supermarket, karaoke and pub, boutiques, travel agents, insurance, computer, home furnishing and accessories. Its service area for credit card sales also covered with consumer & electronics, pharmacies, auto dealers’ services, jewellery and watch, beauty shop, health services, education, major appliances and many other retail chain stores and small retail shops. It is notable that a group of professional with extensive sales and marketing expertise and excellent records of accomplishment in merchant and credit card acquiring business back CMS Outsource for more responsive to market needs and more dominants in the areas of business activity we engage in and this will continue to guide our future growth and expansion.

CMSCS aimed to serve the financial products and services outsourcing business practically to provide services to the financial institutions that wish to develop more flexible business models that support growth while containing costs and where sales productivity and profitability could be maximised through out-tasking along with a unique set of strengths, expertise, and skills to the partnership. It has also aimed to attain the highest level of customer satisfaction and excellent support through the employment of competent, knowledgeable, specialised marketing and sales expertise to run the business. We are more responsive to market needs and more dominants in the areas of business activity we engage in and this will continue to guide our future growth and expansion. Besides seeking to increase the wealth of the company CMSCS, its corporate culture rewards achievement, reinforce team spirit, which offers each individual person in the company superior opportunities for personal growth and development.

Through out the long coordination with the credit card industry in Penang, Banks find hard selling inevitable due to the current intense competition among banks while thread selling is based on law of averages, the more people they will visit, the more customers they will sign up, but along the way, many people got irritated by this sales approach. The hard selling approach adopted by banks and outsource agencies annoyed many. The hard selling method and tactic widely used in Penang by credit card sales force is like that they never allow customers to walk, block their way, keep talking to them although being told not interested at all. They follow the customers everywhere they walk in the shopping complexes and many other places until customer getting madly and some commotion may happen. Sometime they follow customers to their cars and not allow the customer to close the door and keep promoting the card or begging customer non-stop and keep begging to sign up, act of desperation. Even they do not bother threatening customers to sign up, humiliating customers openly if they refused to sign up and many more.

Under such a market scenario, the author and his company has aimed to stand against the confecting situation and urged to improve the ethical practice for credit card sales agency in Penang that do not adopt hard selling method and managed to outperform many sales channel from banks and its outsource. The banks know that customers are not happy with this hard selling tactic but no action has been taken because everyone need to achieve their sales target, right from sales staff, manager, outsource companies without measuring customers irritation. Rather than identifying this dilemmas as a significant limitation of the credit card industry as a whole, the vendors are considering hard selling as a successful sales strategy and the bank don’t mind to hire anyone who are hard working and willing to use hard selling technique, even though they are not qualify for the job and can’t speak well. Therefore, consumers as a whole generally have a very negative perception toward credit card sales staff and the position no more a respected job. Being the industry leader, the author considered the existing credit card sales behaviour as a raising threat for the industry and necessitates having immediate solution and this is the personal motivation of the author to be involved with this research area.

Local Legislation and Credit Card Business in Penang

Bank Negara Malaysia (2011) pointed out that it is obligatory for the Credit card issuing banks to bring into practice of fairness, transparency, and accountability to the credit card customers with their marketing approaches and offerings while the issuers have to ensure that they do not increase the credit limit without any proper documentation or customer’s request. The Credit card issuing banks also urged for not to going malpractice of taking any credit advance like “cheque payable” without the request of customers and they required to eliminate all hidden fees and publish all fees and payment terms in the advertising materials. The Central Bank of Malaysia has also pointed out that the Credit card issuing banks would strictly follow the applicant’s minimum income level at RM 24000 per year and may not allow more than two cards for the customers’ income level at RM 36000 and would replace the extra cards more than two by the end of 2011. At the same time, it would be restricted to increase the credit limit two times more than the monthly income while the guiding principal of the concurrent regulation is to facilitate the customers from all unethical burdens of credit card marketers.

Lian (2011) identified that the increasing necessity to protecting the credit Card and financial product customers from the challenge of innovating but complex financial instruments, escalating number of non-traditional bodies of financial product marketing, innovative business model together with delivery channels, irregularities of Information inflow, low profile of financial literacy and borderless and effective transaction without border barrier and suspense.

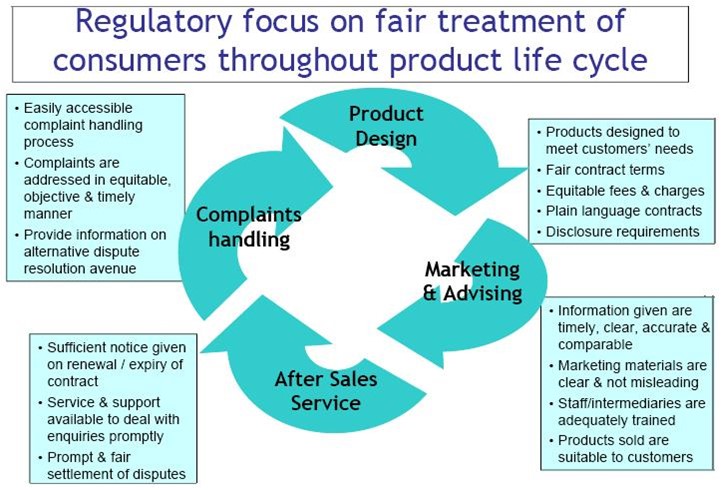

The regulatory authorise of Malaysia has scrutinised the credit card marking drives by the issuers and their vendors involved with nuisance and threats by debt collectors with the customers, imposing collection charge upon customers, confusing nature of advertisement, antagonistic and brutal marketing mix, unauthorised product line, annoying credit advance and unauthorised limit incensement. Credit card marketers in Penang also aligned with lacking of accountability, transparency, unclean terms, higher charges, fees and interest rate, hidden fees and violating customer’s privacy without any customer care. The regulatory concerns on credit card customer’s life cycle have demonstrated in the above figure.

The credit card regulation in Penang involved many parties such as Central Bank of Malaysia, Finance Ministry, Politician, Cabinet, and stakeholders including issuers, marketers, and interest groups. Recently, the politician, Finance Minister, Central Bank of Malaysia have taken several unpopular initiatives to control credit card business in Malaysia, in the name of “To promote prudent spending” but from the credit card vendors viewpoint all these are bull shit, ridiculous, and with own agenda. The credit card vendors argue that the credit card matter is a very sensitive issue and affected many people while the politician, central bank, finance minister, etc always like to make stupid announcement, some comment totally not make any sense, very stupid and invalid comment to gain publicity at the expense of card vendors and making their job tougher. They have talked many things about credit card in the press, interview, and cabinet without proper evident and research.

Promote Prudent Spending in Penang

Jalil and Zafarullah (2009) investigated the prudent spending behaviour integrating the state governmental fiscal policy together with political influence institutional features, and legislative directives, identified that such spending has been enabled to pressure, convince the central government to reform, and restructure their financial decisions while the state government of Penang is under serious pressure of elevated spending and deficits. Being influenced with the situation the central government of Malaysia possibly will think to reform the existing legislation in the parliament or may administer the situation through central bank regulation. The significant issues laid behind this scenario are that during 1990 the economics of Malaysia was not doing well while the government of Malaysia took many initiatives to stimulate the economy.

The government has taken initiatives in order to stimulate the local economy and urged that the people need to spend more. One of the initiatives was facilitating the mass people through credit card spending, with the to encourage people to spend more, the government made it easy for credit card holders to pay less for what they spend on credit card. The government changed the credit card monthly minimum payment from 15% to 5%, it means that if an individual spends $1,000, he only need to pay $50 and the balance of $950 outstanding balance will be charged interest by banks. From this drive, the credit card sales were very popular, competition intensified in the market, and the credit card business has flourished until 2009. In the national budget of 2009, the government made a surprise announcement for Government Service Tax3 and mentioned that GST would be effective by 2010, where $50 will be imposed on each credit card own by cardholders. The central government of Malaysia claimed that the imposition of this GST would accelerate the ‘Promote Prudent Spending’.

Jalil and Zafarullah (2009) also added that the state government and central government both are aligned with same ideological ground in the fiscal policy for prudent spending but there were a protest and debate among the people against promoting prudent spending in Malaysia

After a week government proclamation, the Prime Minister of Malaysia admitted that the imposition of $50 GST has aimed to generate income for government, urged for not to make any question as it is a source of income for government, and will contribute further improvement. Due to the improvement of GST ruling, the credit sales business has seriously injured. By the operation of the GST, the credit card sales become more and more difficult and customers turned very reluctant to apply for any new credit card while the huge number of existing credit card holders were busy cancelling their credit card to avoid paying GST. There was a lot of debate flourishing regarding the GST ruling, while this author as the Managing Director of CMS Card Services Sdn Bhd called a press conference to show own disagreement to this new ruling. The Author strongly believes that in order to promote prudent spending, the government should revise the credit card monthly minimum payment from 5% to 20% or 30% and pointed out that by imposing the GST, it will not really ‘promote prudent spending’ but impose extra burden of liabilities upon the cardholders. However, the government dare not to touch on monthly minimum payment issue, no matter what happen, business still need to go on and all the stakeholders of credit card business in Penang working very hard to encounter further challenges.

Problem Statement

This first chapter of the proposed dissertation would introduce the construction of the paper organising with a study in widespread on the sales staff behaviour, endow with underlying principle and hypothetical agendas for the alleged research; poses on the research questions and affirms the limitations and scope of the study; delineates and specifies the terms used within the proposed dissertation. To address the topic: ‘Investigating customers’ responds to the sales staff behaviour: A study of credit card sales in Penang’, this cheaper would urge to raise research question as follows-

- To what extent the theoretical framework of the sales staff behaviour encouraged and developed Customers loyalty?

- How does the ethical behaviour of sales staff has differentiated among the permanent and temporary staffing?

- How does the sales staff satisfaction can ensure optimum level of customer’s satisfaction?

- What are the underlying factors those are Influencing unethical behaviour of sales staff in Penang?

- How the customers react to the overuse of marketing of credit card in Penang?

- How the sales of credit card in Penang would ensure the interest of customer, marketer and sales staff.

Relevant Literature Review

This literature review explores the theories of the sales staff behaviour; its different models with the aim to integrate with the customer’s motivation theories and let them to function under the factors those motivated them to sales of credit card in the market of Penang and to maintaining sales staff behavioural practice as per code of conduct of DSAM. Damnjanovic and Krulj (2006) argued that in modern ear in the emerging economy, the attention towards sales staff behaviour has significantly exploded due to a number of grounds and the most significant causes are like the landmark sales staff behaviour scandals taken place Penang. The most ordinary conceptual framework of sales staff behaviour has grounded as a method that defines how the business entries would run sustaining with salesperson behaviour.

Stock and Hoyer (2005) presented a behaviour model of sales staff linking with customer orientation to define the standard system of making certain that the sales and marketing will run by explaining the explicit and implicit belongings with attitudes of customer orientation and customers’ satisfaction. The model has developed by suggesting a positively motivating effect of compassion, dependability, capabilities, trustworthiness and attitude towards customer and a negatively motivating consequence of sales staff’s control in job independence. Such traditional views of the sales staff behaviour have aligned with the consideration of essential theorems for the practice of influencing customer’s decision-making in this era. The initial principal of this theory argues that while the purpose of companies aimed to maximising profit with the marketing efforts, the people who lead this job, must care for their own interests at first and then allocate the Pareto efficient for the others.

Ahearne and Schillewaert (2001) examined the reality to integrating the Information Technology to improving the standard of sales staff behaviour and pointed out that IT4 can play a fundamental responsibility to the strategic compliance of sales staff behaviour and improving the standards practice. It has argued that IT has an insightful as well as noteworthy impact in all relevant areas of business operations starting from performance measures of sales staff behaviour, consumer behaviour analysis, buying and selling to invoice generation to accounts maintenance including security measures. Thus, the marketers of credit card in Penang has the opportunity to make it compulsory integration of IT and identifying appropriate software to monitor the compliance of the sales staff behaviour by avoiding any manipulation by the staff.

Feinberg and Kennedy (2008) investigated the concurrent practice of sales staff behaviour as well as weighed up the efficiency within the promising orientation of sales person, marketer, and customer by discovering a wide-ranging strategy of performance; it has deliberated the applicable measures for practice. It has presented a rating matrix to measure the standard level of the sales staff behaviour and concluded that the companies with comparatively better compliance with sales staff behaviour generated better financial performance than companies who are non-complied. Thus, the higher compliance of the standard of sales staff behaviour is most significantly matters for Penang while the impact of compliance remains self-effacing for the companies, but obligatory for monitoring and implications. It has evidenced that the scandals of sales staff behaviour in Penang has created enough awareness among the marketers to reconstruct the code of conduct of sales staff behaviour.

However, Jaffa (2002) presented a landmark research outcome through a strategic marketing audit on US sales staff and raised the question to what extent the sales staff behaviour can keep its effort for compliance and monitoring global workplace and labour standard among the supply chain. Thus, by identifying the lacking of compliance of salesperson code conduct at supply chain of credit card marketers in Penang, it would be possible to suggest how to improve the workplace condition and standard of sales staff behaviour while globalization has provoked a brutal debate for best practice of lob standards in the emerging economy of Penang.

Thus, the proposed literature search would draw attention with concepts from growing transformation of the sales staff behaviour with customers orientation and marketing organisations, their business model and value chain, customers motivation in order to identifying the factors those influence the credit card companies to standardise the sales staff behaviour practice in Penang. This literature review would be organised based on theoretically responding to the research questions with the viewpoints of the prominent authors, researchers and most influential books, web resources and research Journals aligned with the most recent development of the sales staff behaviour.

Conceptual Framework of the Sales Staff Behaviour

The first chapter of the literature review would involve to finding the conceptual framework of sales staff behaviour that will help to identifying the domain of sales staff behaviour of Penang and to do so, this author considered to start from the sales staff’s prospect to satisfying customer’s needs, sales staff qualification, pre-approach customer, and sales staff preparation. To understand the sales staff behaviour, it is essential to clarify customer approach and opening sales staff dialogue, domain of sales presentation, demonstration, and product marketing achieving objections and problem-solving domain of sales staff, follow-up and relationship maintenance with customers internal coordination and personal development sales staff. The author also interested to enlighten on the determinants of sales staff ethical behaviour and concerned customers loyalty and considered to coordinate with following literature and theoretical discussion-

- Models of Sales Staff Behaviour

- Customer prospect and Sales Staff Qualification

- Pre-approach Customer and Sales Staff Preparation

- Customer Approach and opening Sales Staff dialogue

- Domain of Sales presentation, demonstration, and product marketing

- Achieving objections and problem-solving domain of Sales Staff

- Closing and satisfying Customers Needs

- Follow-up and relationship maintenance with Customers

- Internal coordination and Personal development Sales Staff

- Determinants of sales Staff Ethical behaviour

- Staff behaviour and Customers loyalty

Ethical Behaviour of the Permanent and Temporary Sales Staff

It has evidenced that the credit card sales staffs in Penang has aligned with unethical behaviour with their customers, where most of the credit card sales outsourcing agencies are using most of the temporary sales staff rather than permanent employees. Thus to analysing the standards of credit card sales staff ethic, it is necessary to look into the literature of ethical behaviour of the permanent and temporary sales staff. With this viewpoint, this part of the literature review would involve to defining unethical and ethical behaviour of sales staffs, the behavioural standard s of ethical sales staff, motivation of sales agents to the engagement of permanent and temporary sales staff, and the effect of outsourcing temporary sales staff. Here it is relevant to present the theory of planned behaviour, problem, and prospect of outsourcing sales staff behaviour, and the standards of sales staff ethical behaviour in Penang connecting to the Islamic ethical standard belongs to Malaysia.

- Defining Unethical and Ethical Behaviour of Sales Staffs

- Ethical Sales Staff Behaviour

- Engagement of Permanent and Temporary Sales Staff

- Effect of Outsourcing Temporary Sales Staff

- Theory of Planned Behaviour

- Outsourcing Sales Staff Behaviour Problem and Prospect

- Standards of Sales Staff ethical Behaviour

- Islamic Ethical Standard

- Sales Staff Ethic in Penang

Sales Staff’s Satisfaction connecting to Customers Satisfaction

To investigating customers’ responds to the sales staff behaviour in context of credit card sales in Penang, it is also emergence to query with the level of sales staff’s satisfaction while it is also important to look how their level of satisfaction influence to increase customer’s satisfaction. With this perspective, this part of the literature review would explore the critical role of sales staff’s service delivery, sales staff’s motivation and compensation system, sales staff’s job satisfaction and quality of performance.

In this connection, it would be significant to customer orientation of sales staff, customer-convincing appearance of sales staff, sales staff function and customer trust and how sales staff satisfaction optimising customer’s satisfaction. This episode of the literature review would be grounded with following heads-

- Critical role of Sales Staff’s service delivery

- Sales Staff’s Motivation and Compensation System

- Sales Staff’s job satisfaction and quality of performance

- Customer Orientation of Sales Staff

- Customer Convincing Appearance of Sales Staff

- Sales Staff Function and Customer Trust

- Sales staff satisfaction Optimising customer’s satisfaction

Factors influencing unethical behaviour of sales staff in Penang

The most crucial of this literature review is to be to investigate with the factors influencing unethical behaviour of sales staff in Penang. The credit card sales staff of Penang are very demonstrate different irrational behaviour with the customers, which has raised question to the Malaysian regulatory authorities regarding their role of safeguarding customers from the immoral attitudes of the sales staffs. The regularity authorise and local legislation also interested to overcome the critical credit card market situation for which it is essential to identifying those factors driving credit card sales staff towards immoral sales activities. With this motivation this part of the literature review would delivered with following theoretical discussions-

- Supervisory Influence

- Role Ambiguity in the job

- Moral Obligation & behavioural control

- Extreme Sales Target

- Lower profile of socio- Cultural orientation

- Lack of Education

- Lack of Motivational drive in the Job

- Regulatory Control over the Private sector employees

Customers Reaction towards Overuse of Marketing Effort

The core motivation of this dissertation is to scrutinise with the customers respond towards sales staff’s behaviour in Penang, Malaysia for the credit sales effort where excessive marking and sales drive has seriously injured the market connecting with customers respond. To examine with the current market scenario of Penang for credit card sales it is obligatory to look into the literature of consumer ethnocentrism, social and value perceptions of the customers, green marketing ethics and social responsibility, service quality and customers satisfaction. In this context, it is also consistent to discuss the traditional framework of customer behaviour, connecting e-customer behaviour model towards e-marketing, excessive marketing and its impact, and the ultimate solution towards the existing dilemmas of marketplace. This part of the literature review would be well thought-out with following sub heads-

- Consumer Ethnocentrism

- Social and Value Perceptions

- Green Marketing Ethics and Social Responsibility

- Service Quality and Customers Satisfaction

- Traditional Framework of Customer Behaviour

- e-Customer Behaviour Model towards e-Marketing

- Excessive Marketing and its Impact

- Solution towards Marketplace

Credit card sales staff and Customers in Penang

From the core essence of this dissertation’s topic area it is emergence to come in the conclusion regarding the sales staff behaviour and concerned respond of the customers in Penang. To do so, this part of literature review would engage with the analysis of job resources and job demands in Penang, cultural diversity, working teams work design and stress of sales staff, values, attitudes, and job satisfaction in Penang. In this connection significant to give explanation to the sales staff‘s perceptions of Malaysian managers, the organisation system, human resource policies of credit card companies, individual behavioural foundation, strategic approach to CRM at credit card companies in Penang. This part of the literature review would construct on the following sub heads-

- Job Resources and Job Demands in Penang

- Cultural Diversity in Penang

- Work Teams Work Design and Stress of sales staff in Penang

- Values, Attitudes, and Job Satisfaction in Penang

- Sales Staff‘s perceptions of Malaysian managers

- The Organization System Human Resource Policies of Credit card Companies

- Individual Behavioural Foundation

- Strategic Approach to CRM at Credit card Companies in Penang

Research Methodology

Research approach

The purpose of this chapter is to provide a clear perception about the formulation of this study and give idea about the process and data sources of the dissertation. However, the main dissertation would follow Malhotra’s research approach to organise the paper.

Primary Data Collection Process

At the very beginning, this paper would design a questionnaire with 25 easy questions related with the sales staff behaviour Practice in Penang. This questionnaire would be printed and distributed among 120 respondents to gather data from them though it is highly likely that 25% respondents may not response on time to the questionnaire. As a result, the response rate has expected to be 75% that means at least 90 respondents would provide the complete form of the questionnaire. This dissertation must exclude data errors and any other mistakes that hinder its value for the purpose of the research and refining the collected.

Primary and Secondary Data Source

Required primary data would be gathered by conducting interview to the selected respondents (Malhotra, 2009) and (Saunders et al, 2006) of Penang. At the same time, the paper would be used secondary resources like official documents and government documents, which include the Ministry of Domestic Trade, Co-operatives, and Consumerism, and other related agencies, and the sales staff behaviour report if there is any. On the other hand, many unofficial documents, such as, emerald journal articles, newspapers and conference papers would be considered in order formulate the paper.

Sample

As primary data collection is interrelated with time and cost factors, it would be wise to consider small number of respondents. In order to obtain fruitful outcomes, this dissertation would choose 100 respondents who are employees of credit card companies, their management, and academia of Penang.

Data Analysis Method

After collecting primary data from target groups, the researcher would check all the survey reports once again to eliminate the irrelevant and inappropriate information with other errors from the research paper. In addition, the researcher would refine left primary data regarding the customers’ responds to the sales staff behaviour to evaluate and compare with previous driven similar research. After careful consideration of the results of the survey reports, the researcher will compare and contrast the data by representing graphical charts.

Critical Appraisal

Atkins and Sampson (2002) exposed that the Critical appraisal is a course of action for quantitative research that logically investigative research substantiation to measure the legitimacy, strength, and validity of the outcomes as well as its relevance and applicability to the present research or in support of decision making for any further upcoming case study. Both for scientific and social science research, modern pundits and theoreticians emphasis on critical appraisal as a crucial tools for evidence-based assessment of previous researches in the relevant area that take account of the procedure of systematic verdict, appropriate measure and well-organized action on evidence of helpfulness for further research.

Strech (2011) pointed that the critical appraisal provides the opportunity to the researchers to make sense on the relevant previous research evidences to identify most significant gaps among those and the present research and prolonged practice. Thus, such systematic reviews or critical appraisal are predominantly applied in the modern research as a dynamic methodology aimed to present a competitive study or brief snapshot of the prior research and provide the reality and validity of the research objectives, process, sample size including the outcomes apprised with standard of research quality. Thus in the dynamic methodological ground of quantitative research, this author has aimed to present a critical appraisal on the customers behaviour, sales staff behaviour and credit card sales in Malaysia to finding if there is any positive relation among the present research with the previous researches that will hep to study design and allocation bias. A set of critical appraisal has listed in the following table –

Critical Appraisal Table

Depending on the above critical appraisal, this research proposal has aligned to conduct a quantitative research through a set of 100 sales staffs of credit card sales agents in Penang, Malaysia. The researcher also aimed to investigate with the customers perceptions associated with the selected sales staff to identify further dilemmas of credit card sales in Penang. The questionnaire would be generated with the prevailing theoretical aspect and concerted practical dilemmas from broader consideration with target interviewees might bring realistic outcomes with different observation and opinion whereas specific questions would lend a hand to the respondents to discuss with a particular issue of Penang. Here, it is significant to state that the researcher emphasised more on questionnaire because key

Results & Findings

This is the most imperative chapter among other parts of the proposed dissertation, as it will be based upon the primary data and evaluation to bring the suitable solutions for measuring the effectiveness of sales staff behaviour to address the factors affecting the customers’ decision making to complying with the standards of the sales staff behaviour in Penang. To analyse the collected data here the Microsoft Excel would be used to represent the outcomes graphically those would represent the research, new motivation to reconfigure the sales staff behaviour.

Discussion

This chapter would enlighten to argue on the ‘to what extent the customers respond to the sales staff behaviour: a case study of credit card sales in Penang’, which is essential to assess by the marketing community of Penang to draw the attention of the prospective marketer, which directly effect to increase sales and accelerate economic growth. This discussion also argues on the findings that also contribute the new sales staff who are interested in get entry in the credit card market of Penang market to formulate their entry strategies to draw impending attention towards the emerging economy and eager to explore their career in sales in this region.

Key Recommendation & Conclusion

The final chapter of the proposed dissertation will scrutinise all the discussions of the previous chapter to draw significant conclusion and to point out key recommendations in favour of the factors upsetting the decisions of credit card marketers to appoint their sales staff in Penang with compliance to the code of conduct of the sales staff behaviour. Within this research, success and failure sales would be identified by the customer orientation and by customer’s respond.

Research Schedule

Reference List

Ahearne, M, & Schillewaert, N. (2001) The Effect of Information Technology on Salesperson Performance. Web.

Atkins, C. & Sampson, J. (2002) Critical Appraisal Guidelines for Single Case Study Research. Web.

Bank Negara Malaysia (2011) New Measures on Credit Cards to Promote Prudent Financial Management and Responsible Business Practices. Web.

Bass, K. Tim, B. & Gene, B. (2001) The Moral Philosophy of sales Managers and its Influence on Ethical Decision Making. Journal of Personal selling & Sales Management XVII.2 (2001): 1-17.

Cadogan, J. W. Lee, N. Tarkiainen, A. & Sundqvist, S. (2007) Sales manager and sales team determinants of salesperson ethical behaviour. European Journal of Marketing, 43(7/8).

Damnjanovic, V & Krulj, D. (2006) Important factors for salesperson evaluation. Web.

Feinberg, M. & Kennedy, J. (2008) The Effect Of Self-Efficacy And Adaptability On Salesperson Orientation And Customer Orientation And On Job Performance And Customer Satisfaction. Journal of Business & Economics Research 6(11): 1-6.

Ferrell, O.C. & Ferrell, L. (2005) What Your Mother Never Taught You: How to Teach Business Ethics. Web.

Haron, H. Ismail, I. & Razak, S. H. A. (2011) Factors Influencing Unethical Behavior of Insurance Agents. International Journal of Business and Social Science 2(1): 1-17.

Homburg, C. & Stock, R. M. (2005) Exploring the Conditions under Which Salesperson Work Satisfaction Can Lead to Customer Satisfaction. Journal of Psychology & Marketing, 22(5): 393–420.

Ibrahim, I. R. & Wah, Y. B. (2010) A Comparison of Predictive Models In Classification Of Credit Card Applicants. Web.

Insight Consultancy. (2009) The Changing Face of Card Loyalty. Web.

IPPTN (2010) The State of Penang, Malaysia: Self-Evaluation Report.

Jaffa, E. B. (2002) The Marketing Audit: Your Magnifying Glass to Increased Revenues. Web.

Jalil, A. & Zafarullah, A. (2009) The political economics of the Malaysian subnational governments’ Fiscal behavior.

Kohli, A. K. Shervani, T.A. & Challagalla, G. N. (1998) Learning and Performance Orientation of Salespeople: The Role of Supervisors. Journal of Marketing Research 35(2): 263-273.

Lian, K. S. (2011) Bank Negara Malaysia: Consumer Protection & Market Conduct Regulation. Web.

Malhotra, N. K. (2009) Marketing Research- An Applied Orientation. 5th ed. Prentice-Hall of India Private Limited.

Murphy, P. E. (2002) Marketing Ethics at the Millennium: Review, Reflections and Recommendations. Web.

OECD (2011) OECD Reviews of Higher Education in Regional and City Development The State of Penang, Malaysia.

Ramayah, T. Noor, N. Nasurdin, A. M. Choo, L. H. (2002) Cardholders’ Attitude And Bank Credit Card Usage In Malaysia: An Exploratory Study. Asian Academy of Management Journal, Vol. 7, No. 1, 2002.

Saunders, M., Thornhill, A. & Lewis., P. (2006) Research Methods for Business Students. 4th ed. London: FT Prentice Hall.

Stock, R. M. & Hoyer, W. D. (2005) An Attitude-Behavior Model of Salespeople’s Customer Orientation”. Journal of the Academy of Marketing Science, 33: 536-552.

Strech, D. (2011) How factual do we want the facts? Criteria for a critical appraisal of empirical research for use in ethics.

The Business Times. (2010) Challenges in Financial Sector. 2010.

Wood, G. (1995) Ethics at the purchasing/sales interface: an international perspective. International Marketing Review 12(4): 7-18.

Footnotes

- Direct Selling Association of Malaysia

- CMS Card Services Sdn Bhd

- GST

- Information technology