List of Figures

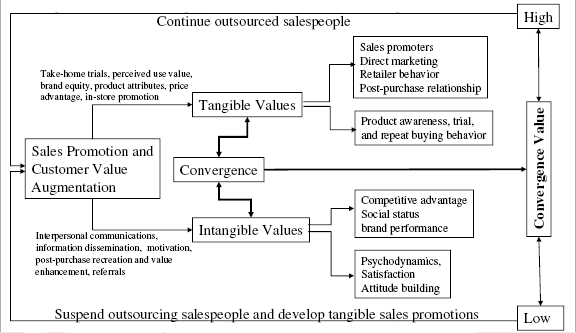

- Figure 1: Problem and Prospect of Outsourcing Sales Staff

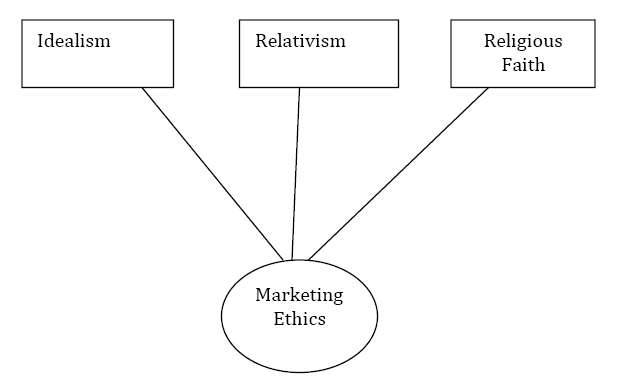

- Figure 2: Hypothetical View on Islamic Ethical Standard in Business Atmosphere

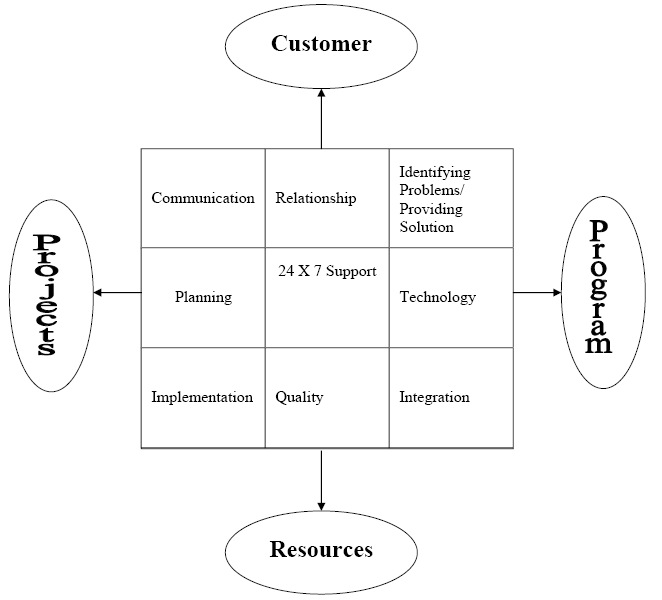

- Figure 3: Sales Staff’s Critical Role Model

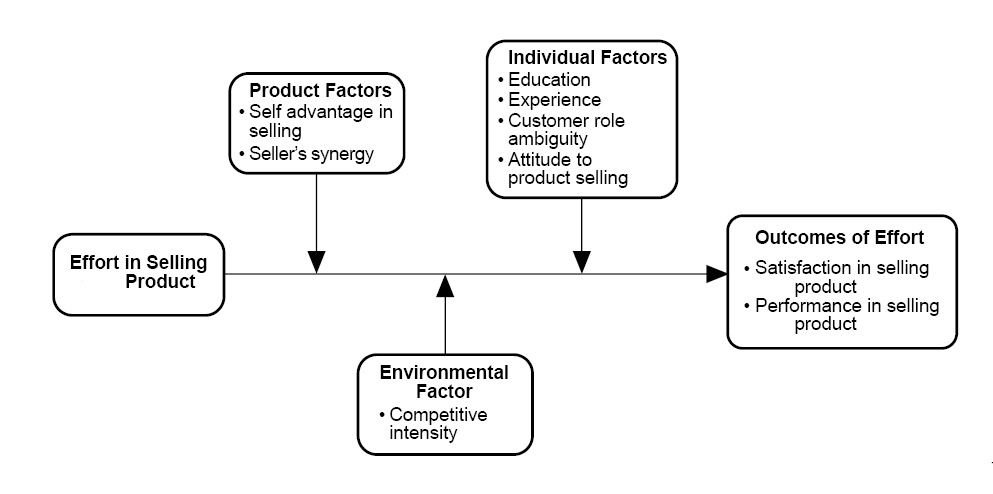

- Figure 4: Influences of Sales Staff’s Job Satisfaction on Job Performance

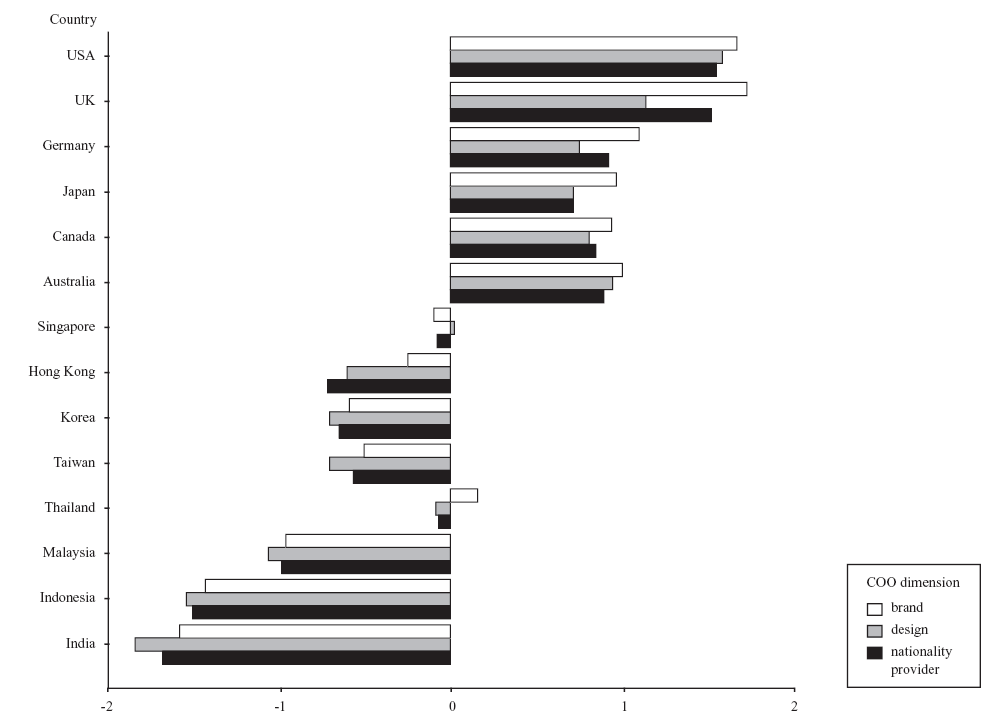

- Figure 5: Product Quality Factors versus COO Dimensions

- Figure 6: Consumer’s View on Social & Value Perceptions

- Figure 7: Connectivity between Service Quality and Customer Satisfaction

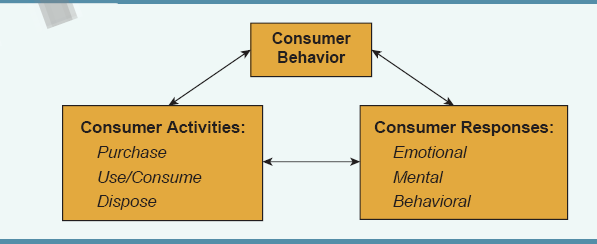

- Figure 8: Typical Consumer Behaviour

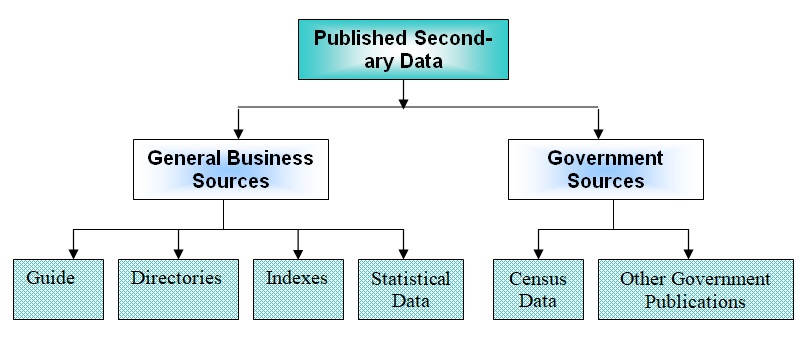

- Figure 9: Classification of Published Secondary Sources

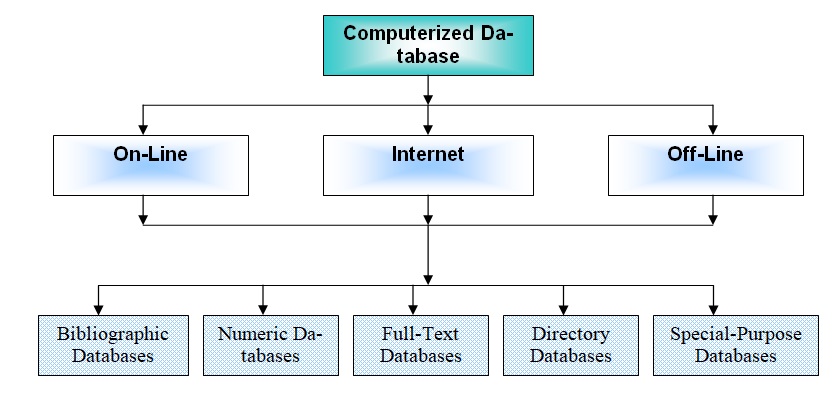

- Figure 10: Categorization of Computerized database

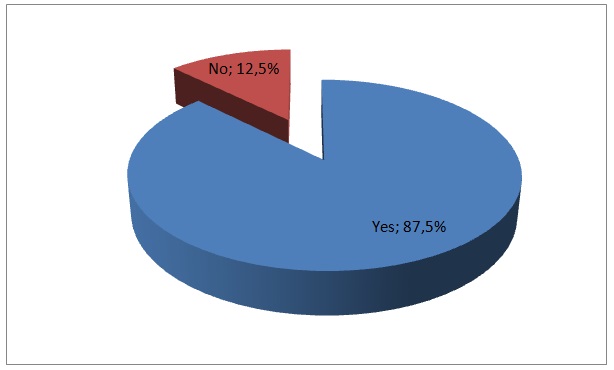

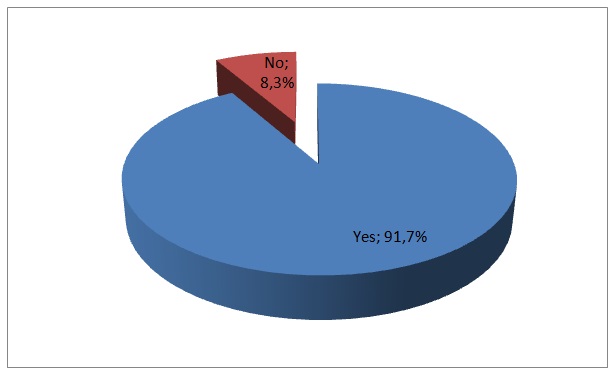

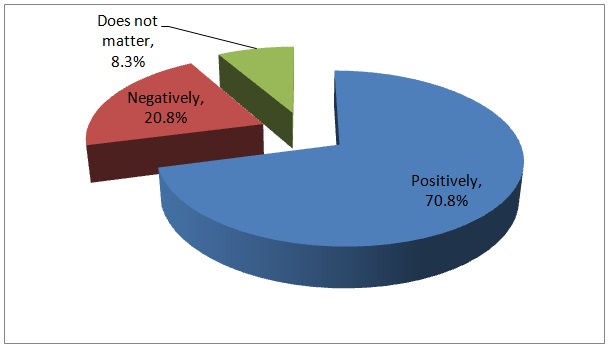

- Figure 10: Level of Satisfaction as an Employee of The Bank

List of Tables

- Table 1: Difference between qualitative and quantitative research

- Table 2: – Selected Respondents for interview

- Table 3: Relationship between customer behavior and customer loyalty

- Table 4: Rate services offered by sales agents

- Table 5 How was the experience

- Table 6 Test Statistics

- Table 7 Level of satisfaction as an employee of the bank

- Table 8 Test Statistics

- Table 9: Correlations

- Table 10 Noticeable relationship between customers accepting the credit card and sales staff’s convincing power

- Table 11 Test Statistics

- Table 12: How does the level of education affect sales staff capacity to sell the credit cards?

- Table 13: Reliability Analysis

- Table 14: – Contents of the questionnaire

Executive Summary

The objective of this dissertation is to present the coordination of shifting dynamics of the sales staff behaviour along with the consequential factors affecting customer’s responses. Here, the study ground is the credit card sales staff in Penang, Malaysia, and their associated customers of the location. The organisations concerned with the sales practice of credit card in Penang is most likely to use temporary staff, individual contractors, and outsourced employees. Due to the accelerating number of players in the market, there is a solid base of perfect competition and the sales agency is under pressure to gain a competitive advantage by dropping costs that lead them to use temporary employees or outsourced contracted staff for sales of a credit card. Such appointment of sales staff has generated huge scandal of unethical conduct with the customers and pointed serious ethical dilemma for the credit card industry in Penang.

This study identified that unethical behaviour of the sales staff is not only caused by the limitation of the personal attributes of the sales staff but there is an increasing number of organisational and legislative factors that lead the sales staff to align with unethical behaviour with customers. With the complex nature of customer behaviour, the ethical behaviour of the sales staff has absolutely interlinked with the customer’s responses including their trust in the organisation, customer orientation, and satisfaction maximisation that can generate a strong base of satisfied customers. The sales staff’s customer orientation is a vital area that is unavoidably needed to be addressed for successful business entries in the credit card industry of Penang and it has evidenced that unethical behaviour of the sales staff has harmfully crashed the effectiveness and profitability of an organisation. The paper has concluded with a vital recommendation to standardise the ethical standard with regulatory amendments.

Problem of Statement

Background of the research

Malaysia is a federal state in South East Asia. The king is the head of the state while the prime minister heads the government. The country has three federal territories and thirteen states. The South China Sea separates the country into two regions of similar sizes, Malaysian Borneo and Peninsular Malaysia. It borders Brunei, Thailand, and Indonesia by land, and Vietnam, Singapore and the Philippines by sea. The statistics are given in 2010 showed that the population of the country is approximately 28 million people, with the majority (about 20.5 million people) living on the Peninsula. The capital city of this country is Kuala Lumpur. The country has several ethnic and cultural groups. However, it has enjoyed a relatively stable political environment.

The economy of this country has been very strong since it gained independence on August 31, 1957. The growth of the economy has been estimated to be an average of 6.5 percent per year for the last five decades. Some of the sectors that have constantly propelled the growth of the country’s economy include the tourism sector, commerce, science sector, medical tourism, and its natural resources. Given this attractive economy, the country has attracted a number of financial institutions both locally and from the international forum. These financial institutions play a very important in an economy where there is a huge flow of money, with most of the financial transactions done through the banks. Some of the local banks in this country that are partly or wholly owned by the government include Maybank, CIMB Bank, Agro Bank, and Bank Simpanan Nasional. Chinese businessperson in Malaysia privately owns Hong Leong Bank and Public Bank. There are foreign banks in the country, which include Citibank, Standard Chartered Bank, HSBC Bank, UOB Bank, OCBC Bank, Al-Rahji Bank, Bank of China, and Alliance Bank among others. Some banks, like Al-Rahji Bank, have specialized in Islamic banking, offering products that are specifically targeted at Muslims, while many others, like the Standard Chartered Bank, offer conventional banking to its customers.

Credit card, also popularly known as plastic money, has grown popular in recent years. The emerging technologies have made it easy for individuals to shop without the need to carry cash. It is now possible for credit cardholders to pay bills at the supermarket, petrol stations, hotels, and various other locations using the card. This is an easier and safer way for an individual to carry his or her money. Moreover, some banks offer a discount on their credit cards, making their customers who use the credit card pay averagely less as compared to when the payment is made on a cash basis. Banks have therefore rolled out massive plans on how to increase the sale of their credit cards. Standard Chartered Bank is one such financial institution, which has been aggressively selling its credit cards to its customers. However, some customers have been cautious with credit cards, preferring to use cash instead of credit cards. The case below shows one of the possible geneses of this caution.

Case Study

Ahmad, Basir & Kitchen (2010) presented a customer’s experience with the cheating of a credit card sales staff of the Standard Chartered Bank Credit Card that demonstrates the critical situation of the credit card sales and marketing in Penang and all over Malaysia. The story was like that, while the customer was shopping in the Curve Mall, a sales staff approached her to sign up for a credit card but the customer refused several times. The sales staff constantly followed the customer and continued sales approaches and, though the customer was irritated, the sales staff did not let him free until he forced her to sign up for a credit card. The sales staff said that by using the credit card of Standard Chartered Bank he would get many opportunities to enjoy a great discount in shopping at the Curve, 50% discount at Marche and Japanese restaurants in Penang, Malaysia and so on.

At last, the customer signed up and within ten days, the customer received an SMS from the bank that his application had been approved and soon she received the card. Then the customer went to the Marche for dinner by using the card, and after dinner, when the customer went to make payment with the credit card of Standard Chartered Bank, the cashier did not give any discount. When the customer questioned this, the cashier informed her that the discount was a one-time and one-day promotional program that had expired long before. The customer also got the same shock with the initiative to get a great discount at the Curve Mall. The customer could understand why the sales lied to her, so she decided to cancel the card. While the customer arrived at the Standard Chartered Bank branch, expressed the cheating story of the sales staff, and asked for cancellation, the customer service department informed her that for each signed up application the sales staff are authorised to get a commission. If the customer cancels the card, it does not affect the sales staff, at once, the sales staff will get a commission, and the burden would be imposed on the customer’s account.

The sales agents who sold credit cards to the customers are paid based on the sales made. The more the cards they sell to the customers, the higher they are paid by the bank. As such, these sales agents have been very aggressive in their sales of the cards for them to earn more. This aggression of the sales agents has failed to pass the test of moral salesmanship. Some of these sales agents use dubious means to reach out to the customers in order to make huge sales. Some of these agents literally cheat in order to win the bargain with the customer, only for the customers to realize later that they were cheated. Others collude with other conmen to corn the users of the credit cards in a number of ways. This has caused a great worry among the concerned authorities as credit cards increasingly continue to get negative marketing despite their obvious benefits to the users. This study seeks to investigate the credit cards sales staff (of Standard Chartered Bank at Penang) behavior and how this behavior affects the customer’s responsibility.

Problem Statement

The world is changing in its social, economic, and political structure. Society has experienced radical changes, especially due to emerging technologies. Credit card has become so important in the banking sector. Despite some of the benefits that credit cards have to the holders, it comes with a number of disadvantages. Some of the notable disadvantages of credit cards include the ease with which some cybercriminals can use them to steal from customers. Other credit cards have hidden charges that make them a little more expensive than holding cash. It is also widely believed that credit cards always encourage excessive expenditure because there is the feeling that one is not using money. The behavior of the sales staff is another problem that makes the cards undesirable to many customers. The fact that some sales staff use lies and malice when selling the cards creates huge negative publicity for the cards. More customers feel that the cards are part of a wider scheme for the banks to rob them of their hard-earned cash. Because of this, many customers have been keen to avoid the sales staff, especially when it comes to the sale of credit cards. The bank has also been massively affected given the fact that some of the customers totally withdrew from the bank having felt cheated by the bank. This has not only reduced the asset base of the bank, but also its general profitability.

It is important to understand the profile of the sales staff of this bank in order to be in a position to justify their behavior. This research was conducted at the firm’s branch in Penang and all the employee’s Malaysian nationals. The firm has been keen on ensuring that there is a gender balance in its employment. For this reason, there is an equal proportionality of the genders among the sales staff at Penang. Most of the sales staff are middle college graduates, who are fresh from college. A few of them have bachelor’s degrees in the field of marketing. As such, these individuals were getting their first employment in this firm.

The researcher, therefore, wishes to unearth the relationship between employee behavior and customer response to what they are selling, which in this case is the credit card. The researcher wishes to use existing literature in this research to develop the argument, and the analysis of the primary data to support the entire study, especially due to some gaps that exist in this field in the literature.

Justification of the Research

Many scholars tried to find out the solution to the question of how staff behaviour in a certain company’s marketing practice could influence the customers in the credit card market to ensure the growth of the market share of that company, and how the appropriate marketing drive could increase sales revenue by increasing customers confidence. Some researchers have kept attention to stabilise the credit card market of Malaysia under the recent global financial crisis connecting the previous Asian financial crisis. Most of the remarkable contemporary researchers have concentrated on the marketing standards, customer relationship management, and regulatory reform in the credit card market, but no overarching research agenda has yet been proposed on whether the manipulated and unethical staff behaviour is a conscious drive of the credit card issuers for deliberated cheating or they value for customers respond.

Alboreca (1998) presented a study connecting the ethical and socially accountable marketing where the organisations find out the needs, wants, and interests of the customers and then strive to transmit a greater value chain to the customers through safeguarding and improving the customer’s satisfaction including the development of the society. Though there is enough debate with the marketing operation and social well-being, the corporate culture and both the internal and external environment have a vital influence on the customers and as a whole to the society, thus the marketing system has the opportunity to reshape the society in various contexts. As a result, the modern corporations are considerate to take into account of ethical marketing drive rather than aggressive marketing, while the ethical drives would pursuit to accomplish economic and financial goals of the company focusing on an assortment of micro-level factors of sales and marketing just emphasising on the sales staff behaviour. Most of the marketing literature has long been emphasised on the customer behaviour analysis to fix their marketing strategy but elapsed to integrate customer’s responses linking with sales staff’s behaviour.

Alt & Lieberman (2010) pointed out that both the customers and sales staff have a vital emotional role in marketing and sales while the companies have strong alignment with the sales staff emotions to promote sales, the customers are willing to see that the corporations would value to their emotions cordially. The interaction between customers and sales staff may contain positive or negative emotions, but the ethical treatment without emotional harassment could turn a negative attitudinal customer into a loyal customer, and the sales staff needed to have a well understanding to overcome and handle customers’ emotions. The rationale of this research is to analyse the roles of the sales staff behaviour in Malaysia experience by observing the real scenario of the Malaysian Credit card Market to evaluate to what extent the existing practice of sales staff behaviour is effective to retain customers and increase market share by taking into account of existing guidance introduced by the BNM.

In addition, this research has aimed to escalate the awareness of regulators to take control over the customers’ responses tools while the global financial crisis already socked the credit card Market of Malaysia and the policymakers are anxious to bring back the customer’s confidence. Moreover, this dissertation has aimed to assist the academia, regulators, policymakers, and customers with a better understanding about the lacking of sales staff behavioural practice and related fraudulent practice including its driving force such as non-holy alliance with the marketing managers and sales staff of the outsourcing agents of credit card marketing. Through this investigation and its outcomes, the credit card issuers and marketing companies will get a potential investment environment in the credit card market of Malaysia and get a better level of investor’s confidence, which will endow with the companies a practical advantage over the sales staff and marketing managers who are involved with the present unethical practice.

Research Objectives

The basis of this research is to change the current attitude of the customers, which has deteriorated because of the actions of some unscrupulous sales agents. The researcher therefore seeks to solve the following research problems by the end of this study.

- What is the relationship between the behaviour of sales staff and customers’ loyalty at the Standard Chartered Bank in Penang?

- What are the trends taken by sales staff in their effort to sell the credit cards to customers?

- What is the impact of dubious selling techniques (including cheating) by the sales staff on the customers?

- How may the future effect of this behaviour affect the bank

- What are the mechanisms that would help eliminate this negative practice by sales staff with the aim of restoring customer loyalty.

- What are some of the clear recommendations, both to the sales staff and to the management of the bank on how it can retain customer loyalty

Research Question

In every research, a research question always acts as the guideline to the researcher. In most of the occasions, a researcher will come across a lot of information, most of which may be interesting, but may be irrelevant to the research at hand. Research question therefore would therefore spell out the nature of resources that the researcher should look for the data. The following are some of the research questions that the researcher developed for this research.

- Is there a direct relationship between sales staff behavior and customers’ response to the item on sale?

- What are some of the general conducts of a sales agent that would make a customer buy or fail to buy a credit card?

- How would the management of Standard Chartered Bank at Penang ensure that customers acquire the credit cards in the expected volume?

From the above research questions, the following hypotheses were developed.

- H1a. There is direct relationship between sales staff behavior and customers’ loyalty to the bank.

- H2a. The behavior of the sales staff is closely related to the motivation they receive from the management of the firm.

- H3a. The possibility of the customers accepting the credit cards heavily depends on the ability of the sales staff to convince them that they are beneficial.

- H4a. The ability of the sales agents to sell successfully the credit cards to the customers depends on their level of education.

Importance of the topic

Finance as a topic is very sensitive. All other sectors in a given country depend on it for their normal operations. According to Cadogan, & Lee (2009), all the sectors in a given economy have a direct relationship with the finance department. This sector would facilitate the smooth flow of money from those who have excess and need to save to those who need the same to invest. When managed properly, Cheng (2010) says that it can lead to great development in various sectors of the economy.

Standard Chartered Bank was chosen as the center of study because it is very popular in this region. It is one of the largest foreign financial units in Malaysia and has global coverage. The bank has some of the best ultra-modern facilities in most of its branches. Most local graduates in this country look forward to acquiring employment in this institution as it is considered one of the best employers in this region (Cheng, 2010). The bank is also one of the few in this country that has branches in countries outside Malaysia.

The choice of this bank as a preferred research topic was necessitated by a recent complaint by a customer over the negative experience she had after being lured by a sales staff to sign up for a credit card. The sales staff promised her many discounts on various shopping malls, hotels, and other institutions. This was an interesting phenomenon because, in the current society, every business unit has a responsibility of developing a long-lasting relationship with the customers. According to Hopkins & Laaman (2003), the world has seen drastic changes in the marketing approach. Unlike before when marketing was considered an operational activity focused on instant gains, the current society has seen a new approach where firms embrace social marketing where the aim is to attract and retain customers by offering quality products. Because of this, firms have currently become very truthful to their customers, always ensuring that they avoid any post-purchase dissonance. The current global market views customers as a very important part of the businesses and therefore should be treated as such.

It is therefore intriguing to find an institution as important as a bank basing its operations on lies in order to achieve quick gains. What is raising the urge even further is the fact that the reaction of the bank’s officials does not reflect any remorse towards the actions of their sales staff. The issue therefore was to find the reason for the existence and the resultant effect of such sales staff behavior when on their official duties. The researcher was interested in knowing why such an important bank in Malaysia could tolerate such habits. To achieve this, the researcher launched a study designed to investigate how customers respond to such behavior and measures that can be taken to ensure that customers are retained within the bank.

Scopes of the Study

In every research, there is always the limit beyond which a research may not go. As such, it is important for a researcher to define clearly the scope of the research in order to avoid the possibility of the piece of research being misinterpreted by the concerned authorities. In this study, the researcher conducted the research within the scope stated below.

- This study is relevant to the Malaysian market. The primary data collected was from the respondents at Penang, and most of the secondary resources were focused to the local economy. As such, the application of the research findings beyond this scope may not hold the level of truth it does locally;

- In addition, this paper has the chance to observe internal sales staff behaviour system in Malaysia considering the BNM’s guideline for Best Practice, Business Indicator Report, Financial Standards Report of Malaysia;

- This researcher also scrutinised with Hire-Purchase Act-1967, Moneylenders Act- 1951, Pawnbrokers Act- 1972, Banking and Financial Institutions Act- 1989, along with Islamic Banking Act- 1983,

- This paper concentrates on the principles of customer relationship management, international standards on marketing, objectives and principles of existing listing rules, performance in global best practice indices, taxation policy, and key standards to sound financial systems of Malaysian financial sector;

- However, this study has also scope to give the theoretical framework of staff behaviour, the effectiveness of loyal customers, the impact of the regulations on the credit card market, and the influence to resolve conflicts among in the Malaysian market;

- The entire dissertation will assist to give a fruitful, realistic and applicable suggestions and recommendations to improve the existing credit card marketing regulation to reduce sales staff fraud in Malaysia;

- In addition, the researcher has the opportunity to collect the primary data with the aim to analyse the significant roles and current position of sales staff behaviour in Malaysia credit card Market, and other relevant issues.

Definitions

This research was carried out in a Muslim nation hence there are some words that may not be common in the normal context of English language. The researcher, therefore, set this section for explaining these terms. Some words and phrases considered technical are also explained in this section. This was done to ensure that this dissertation remains relevant in the context from which it was conducted while remaining relevant to those in other parts of the world.

- Affected Class: a group of individuals who have been victims of misdemeanor of the sales staff of this bank.

- Affirmative Action: this refers to a set of procedures or programs that are always aimed at ensuring equity at a workplace, in an organization or in a country.

- Allah: God or the creator.

- CEDAW: Convention on the Elimination of All Forms of Discrimination against Women: an international body that fights any form of women discrimination across the world.

- Culture: a set of principles that guide the general way of life of a certain group of people.

- Discrimination: prejudice directed towards a certain group of individuals.

- EEOC: Equal Employment Opportunity Commission: a US based organization that ensures there is equality at workplace.

- Formal Complaint: a written complaint made by an individual against another or an institution alleging that stated unlawful acts were done against them.

- ‘Id: a festive day for the Muslims.

- Madrasah: a schooling system among the Muslims

- OFCCP: Office of Federal Contract Compliance Program: a unit within the US department of labor.

- Protected Class: a group of individuals who enjoy some privileges over others within an organization, a region or a state because of their gender, race, religion or any other demographical class considered superior to others.

- Quran: the Islamic holy book

- Reverse Discrimination: unfair or unfavorable practice mated towards the majority members of a given society or group.

- Systemic Discrimination: an employment practice that perpetuates use of different criteria to different employees seeking the same job opportunity, on the basis of gender, race or religion.

- Workforce Diversity: refers to a pool of workers with varied experience and from different backgrounds.

Summary

This chapter shapes the entire research. The background section gives focus to the topic of study. It introduces the topic and makes the reader understand the context under which the dissertation is based upon. It comes out clearly from the chapter that the Standard Chartered Bank is one of the leading banks in this region. It is also clear that due to the emerging technologies, more account holders are keen on ensuring that they use credit cards instead of walking around with cash. Banks across this region are therefore keen to attract as many customers as possible to use their credit cards, Standard Chartered Bank included. However, a new twist is brought up in the statement problem section that negatively affects the popularity of credit cards. It comes out that some sales agents use dubious means to attract bank customers to sign up for the credit cards. Wrong promises were made to the customers, leading to customers’ dissatisfaction. This affects the bank as some customers strongly believe that the bank colludes with the sales agents to dupe them.

The next chapter focuses on the review of relevant literatures in this topic. Credit cards are one of the most recent and very ambitious programs that emerging technologies have brought in the banking sector. As such, various scholars have comprehensively done research on this new technology. Various literatures exits on the use of credit card and its benefits to the customers. Literatures also exist on the strategy that various banks use to market credit cards to the customers. The next chapter therefore would analyze the techniques used by various banks, as well as how effective they are in attracting customers. The chapter also seeks to gather information on how the behaviour of sales staff affects customers.

Literature Review

Conceptual Framework of the Sales Staff Behaviour

Banking Industry in Malaysia

Malaysia is a federal state in South East Asia. This is a multi-ethnic country with the majority, about 51 percent, being Malays. Chinese make 23 percent of the country’s populace, 11 percent are the indigenous, 7 percent are Indians while other races form 8 percent. A report by Keller (2009) is one of the countries in Asia that is being increasingly industrialized, with an economy that has been stable for a very long time. Because of this, many people have found it necessary to open bank accounts with this bank as a way of conducting business easily. The tourism industry, among other industries, have hugely benefited from the banking industry.

The banking industry forms about 11.6 percent of Malaysia’s total gross domestic product. The industry has consistently experienced growth over the past decade, according to this scholar. Due to the attractive economic growth of the country, a number of banks, some locally owned, others being international banks, have thronged into the economy to tap from this rich economy. The country has held an open market policy, where foreign banks are allowed to invest in the country without any restrictions. This has contributed to an influx of financial institutions, making the market very competitive. Some of the local banks in this country include Maybank, CIMB Bank, Agro Bank, Bank Simpanan Nasional, and Alliance Bank, which the government have substantial shares in. other major local banks include the privately-owned Hong Leong Bank, Public Bank. Besides these local banks, the country also hosts a number of major foreign banks. Some of the major foreign banks in this country include Citibank, Standard Chartered Bank, HSBC Bank, UOB Bank, OCBC Bank, Al-Rahji Bank, Bank of China, Alliance Bank, and Scotiabank among others. The country also has a number of non-banking financial institutions. They include MBF, Malaysian building society amongst others. Hosts of other financial institutions also exist in this industry.

The banks in this country offer various products to their customers based on the social background of the customers. The country has various ethnic groups each having different cultural practices. In order to survive in this market, it would require the banks to design custom-made products that would best suited the customers. Given the fact that majority of the country’s nationals are Muslims, a number of banks have come up with Islamic banking to attract customers based on their faith. One of the defining features of Islamic banks that make it distinct from convectional banks is that they have different branches for male and female customers. They also have other unique features. Some of the prominent Islamic Banks include Affin Islamic Bank Berhad, Alliance Islamic Bank Berhad, AmIslamic Bank Berhad, Bank Islam Malaysia Berhad, Hong Leong Islamic Banking Berhad, Maybank Islamic Bank Berhad, and Standard Chartered Saadiq Berhad among others. Some of these Islamic banks are locally owned while others are foreign firms. Other banks offer conventional banking within the country.

The emerging technologies are fast changing and they have affected the normal operations of banks within this country. The market is increasingly competitive, and as the researcher, it forces the banks in this industry to adapt to the emerging technologies in order to remain competitive in the market and avoid a possible face-out. Credit card has increasingly become very popular among various banks in this country. Some of the banks that have been active in issuing credit cards to their customers include AmBank Berhad, CIMB Bank Berhad, Citibank Berhad, United Overseas Bank Malaysia Berhad, Public Bank Berhad, HSBC Bank Berhad, and Standard Chartered Bank Berhad

Standard Chartered Bank is one of the leading international banks in the world According to scholars; this bank has been in this country for long and has mastered the local market. The bank has been keen to ensure that it attracts as many customers as possible through products that are customer responsive. It is one of the international financial institutions in this country that have been keen to implement social marketing, where long-term relationship with the customers is given priority. This bank has managed to attract a large market share, especially among the middle class and the rich.

In its ambitious plans to ensure that it remains competitive in the market, it has embraced the use credit cards by its customers. Kheng (2010) explains that Standard Chartered Bank has been keen to ensure that its customers are issued with credit cards which they can use instead of cash. When this product was launched, the bank would issue the cards to customers within the banking halls. Customers would get the cards from the bank. However, as the card became more common and its relevance became evident, the firm decided to use sales agents to sell the cards. This approach has proven very efficient for this firm because the sales agents would go to the field to look for the customers. These sales agents are paid based on the commission of the sale they make. This approach was favored by the bank because it made the sales staff very aggressive when in the field. However, due to greed of some of the sales agents, Kotler (2003) says that some have developed behavior that is unbecoming, and threatening the good and fruitful relationship that this bank has had with its customers.

Models of Sales Staff Behaviour

Stock and Hoyer (2005) pointed out that the modern literature of marketing has persistent on the market orientation while the organisational behaviour at the individual intensity connects with the interpersonal skills and communication among sales staff and customers along with the capabilities of a sales staff to gratifying the customer wishes correctly. Both from the managerial and an academic viewpoint, most of the scholars have classically persistent on the customer-oriented behaviours of the sales staff like considering the customers’ desires, assisting and influencing them by providing information, motivation and support without any sorts of pressure or misconduct.

Hochschild (1983) identified the dilemma of commercialisation of the human feeling pointing that the sales staff may take action in accordance with the prescribed manner of the organisation but they do not build up any positive attitude or real enthusiasm for the customer-oriented policies and practice though they pretend fake obviousness towards customers. The supervisory employees who manage the sales staff, it is their duty to conduct training to manage and neutralise the anger and frustration pointing to the nature and properties of emotional labour. While in the modern corporate world, the emotional labour is no more a private function but a public conduct purchased by an organisation and sold on the customers, sales staff have enduring emotional job and are no longer treated as individuals but paid, selected and managed to encounter with the customers at their emotional stage to commence sales.

Hochschild (1983) also argued that the feeling rules of the sales staff are no longer just an affair of private prudence practiced in the individual level but positively spelled out freely in public where the marketing and sales managers would guide the sales staff at their training programs and set out standard of discourse. The social exchange of sales staff has kept continuous pressure to broaden the limits of hiding places of individuals allowing less room for personal navigation at emotional stages while the entire structure of emotional exchange in the personal existence has just treated as an ostensible function for the interests and delight of the customers at commercial setting of profit motivation.

Jonesa et al (2003) conducted a rear research on market orientation and its impact on sales staff’s attitude to their jobs and customers under the emergence that the sales staff are the initial point where they get in touch with the company and consider that employee’s values and attitudes as the company’s real picture. In the imperial investigation, they continued investigation with the sales manager’s control over the sales staff’s perceptions and attitudes and presented their model of sales staff behaviour connecting the sales managers, organisation’s market orientation, and sales staff’s customer orientation along with job satisfaction and service quality (Jonesa et al 2003).

The above model of market orientation of the organisation and the sales staff’s customer orientation towards customer retention and service quality has demonstrated the conceptual framework of the influence and control of sales managers upon the sales staff’s awareness of organisation’s market orientation linking with customer orientation, attitudes, and job satisfaction comparing different relationships all together (Engel et al 1995). Meanwhile the model also included the role ambiguity, conflicting situations, service quality, managerial commitments, in the model because previous studies suggest that the job attitudes of salespeople, as service providers, and sales staff’s service delivery in due course while sales manager’s insight of the market orientation of the organisation has certainly related to the sales staff’s perception. Siguaw et al (1993) added that the agreement of orientations in the model has openly condensed and mitigated the role conflict and ambiguity by enhancing the job satisfaction of the sales staff along with organisational commitments (Hochschild, 1983)

Qualification of Salesperson and Customer prospect

Webb (2004) presented the procedure of the road to recovery the principle and practice of quality management for sales and marketing occupation pointing to the expansion of qualification criteria that would assist to winning the customers. The qualification of sales staff would drive them towards best possible practice in context of the organisation and such qualification criteria would facilitate the sales staff to identify solid predictions of the products and services along with a rule of cost-effective solution (Engel, Blackwell & Miniard, 1995). The sales course of action that the sales staff and customers of an organisation would pursue, the qualification of that sales staff would bridge them by occurring successful sales by designing both business value and sales process for the customers of that organisation. The business value mapping would support the sales staff to categorise which value he would convey to the customers in an assortment of marketing and sales purpose while his qualification criteria would make possible for him to recognize which customer needed which value.

Roman and Iacobucci (2010) pointed out that the sales staff would be familiar with qualification prospects such as somewhat he has already in practice by any existing process, some of them he will improve with his learning outcomes that possibly would enable him to get better sales performance ever before. Thus, the organisation could anticipate a reduced amount of confrontation from sales staff for qualification criteria and the organisation could look forward to business value mapping connecting the sales process design. Moreover, the preliminary qualification criteria could be occupied very soon with a small number of training session or panel discussion and could adopt on the sales drive devoid of burdensome escorts of the sales staff. At the same time, qualification criteria correspond to the introductory data for not only to attending sales calls but also to generating marketing strategies connecting the Customer Relationship Management (CRM) systems as well as just beginning innovative product line addressing the new customers and markets.

Pre-approach Customer and Sales Staff Preparation

Malhotra (2009) pointed out that if staff fails to demonstrate benefit and utility maximisation logic regarding the product or service to the customer then there is no cause to go to customer for approaching those products or services. The prospective customer either would reject the offer otherwise does not allow any further time for approaching while the customer ends up the offerings with frustration and no sales would occur. Thus, it is essential to have sales staff’s preparation before going further to the customer, he would first evaluate to what extent the customer needed to have utility from the product or service prospect and to what extent the customer is capable for spending a particular amount of money, and to do so, it will require to do some preparation. By identifying a prospect of the product or service, the sales staff gets ready for the sale, while the preparatory phase engross with two major function like pre-approach groundwork and generating calls to the customer for face to face interaction or over phone (Bowden, 2009).

Moncrief and Marshall (2004) presented seven steps of selling process while the classical views of marking approached six steps starting from the product prospect, pre-approach level before going to the customer, approaching or offering, demonstration, presenting arguments to incur sales and close the deal but the modern approaches haven’t agreed to end the deal and emphasised on relationship marketing. The pre-approach stage would incorporate with information congregation that generates essential learning outcomes of the applicable facts and findings regarding the prospect of the product or service that necessitates addressing customer’s desired situations. This stage would reveal the customer’s needs and their capabilities to purchase by providing information those would facilitate the sales staff to adapt and modify the appearance of the product prospect. The pre-approach would also represent that information which will prepare the sales staff more than enough serious with strategic errors for the duration of the presentation and ultimately the well designed pre-approach possibly will boost the sales staff’s confidence to encounter with the situation raised during the sales.

Domain of Sales Presentation, Demonstration, and Product Marketing

At this stage, organising affinity with the product and service prospects, the sales staff carry out the proper sales presentation with the intention of demonstrate and give explanation to what extent the offered product or services would congregate the particular requirements of the target consumers. Here the duty of the sales staff is to let customer to know the prospects with reference to the quality, aptitude, and accessibility of the offered product or service, to make sure that the demonstration has successfully educated the customer with better understanding of the prospects, the sales staff would positively make certain through communication. It is essential to organise the presentation with very attractive manner to draw the consideration of the product and service prospects whether it is automated or unstructured but would successful to influence customers decision making process (Kotler, 2003).

Malhotra (2009) added that the demonstration is the central part of the sale procedure where the sales staff in fact point to convey the positive information as well as endeavour to change customer’s mind to the panorama of successful product demonstration to formulate visualisation into a customer’s mind. The most influential factors that are essential to take into account to arrange a product or service demonstration are the cautious practise to diminish the opportunity of all sorts of breakdown while the industrial sales staff has emphasised to take support of the technical personnel.

Customer Approach and Opening Sales Staff dialogue

After having the sufficient pre-approach information and satisfactory prospect of the product and services, the sales staff would drive to the next phase, which is the authentic approach of offering to the customer; this phase would often create or crack the complete arrangement of sales. In real life practice, if the approach fails, the sales staff possibly will not get any scope to offer a demonstration to exhibit to the customers to draw their attention to the product or service prospects that instantaneously inspires the customer’s decision-making criteria. The fundamental criteria of approach or product offering has consisted with several common decisive factor while in the preliminary approach would deliver with the sales staff’s own introduce to the panorama of the organisation that he represent arguing with strapping self image.

At the customer approach, the interaction between the customer and sales person would consist with pointing to the product or service prospects and it would be huge successful while the product or service is enough exceptional along with attributes to draw attention at one glance. The sales staff would switch on the sale with the point where the consumer would enjoy benefits and come closer to the offer through explaining the prospect of the product or service pointing to each advantage that would deliver with sales. In other words, it directs the prospective attention toward the benefits that the firm has to deliver. Moreover, within the customer approach, the indication of referral looms those were successful and generated strong customer base would be more effective in accomplishment of the listeners through prospects that is complicated to witness directly by the customer, for such referral it is essential to take prior permission from the past customer.

Achieving Objections and Problem-Solving Domain of Sales Staff

Bolvako (2011) argued that the achievement of objections and problem-solving domain of sales staff has organised pedestal on the theoretical framework of integrating mutually the consultative selling scheme along with the classical model with the tools of spelled out oppositions that generate from the customers concerns connecting with repeated benefits from the product and services. The functional plan that set up for objections has integrated with this domain while closing and satisfying customers’ needs at the next stage. Thus, this domain is a joint collaboration of customer and sales staff that ultimately indicate relationship-marketing stage.

Hopkins and Laaman (2003) positively argued that the grand sales staff is the great problem solver in the business world and the literature of marketing has exposed that individual sales staff who regularly expand his lexis through reading literatures and participating in different social events, playing games and solving crossword puzzles are more successful to gain problem solving capabilities (Lim, 2010). It has also evidenced that listening to classical music assists to increase mental stamina of the sales staff by stimulating the parts of their brain that boosts healing and motivating capabilities though the thing looks like unrelated to the sales drive but most of the successful sales staff has designed their regular life with such attributes and get tremendous outcomes.

Closing and Satisfying Customer’s Needs

AMA (2003) pointed out that subsequent to having come back with and overcome customers interaction, at this stage the sales staff would ask the customer to place his order from the assortments of offering. If the customer does not place order at once, there is nothing to dishearten or consider the entire efforts has wasted if not the sales staff get hold of customer’s assurance to purchase the offered product or services. The sales staff would keep in mind if the customer has satisfied with interaction and both for quality and the price, he must back, thus this is the stage to closing the deal with that customer and look for another. In practice there are quite a few techniques to closing the deal with customer, the sales staff would select any of them depending on their particular circumstances.

Bolvako (2011) mentioned that there are huge array of closing and satisfying customers’ needs while the direct asking for purchased has emphasised at the top and argued for not to wasting huge time for a single customer who is under uncertainty to make purchase decision. At the same time, contrary to the classic theoreticians, modern scholars have emphasised to keep room with customer for further negotiation with the aim to generate future sales based on the present relationship which would be right use to time and effort and resources.

Follow-Up and Relationship Maintenance with Customers

Bolvako (2011) explained that the function under this domain is to rely upon the major two resources from a lot of factors that involved for promotional activities of sales service along with product support keeping up a correspondence to the techniques of the engagement of customer service practice. Within the area of follow-up and relationship maintenance with customers, the sales staff’s activities would engage with a lot of entertainingly of numerous significant conducts aimed to ensure customer satisfaction, for instance sales staff would send thank notes and communicate with the customers to get feedback and follow-up the satisfaction of the customers who already served. The area of follow-up domain has founded with at least three essential elements like thanks giving, appreciation notes and regular scrutinising the status of customer satisfaction through handling customers complains and objections efficiently with the intend to bring their satisfaction.

The action of performing maintenance would be investigated with the tools that the customers usually adapt by means of the activity installation while such duty has also pointed out in the company’s job descriptions and the supervise integration has tailored to serve by the consultants for providing technical support. Such function of follow-up and relationship maintenance could also be delivered through technical workshops arranged for the customers by the company organised with technical sales staff who are nominated for consultation and providing suggestion. The effectual handling, writing up, and expediting orders by the sales staff are together called follow up while ensuring appropriate payment method, order management, and customer feedback have linked with the process.

Internal Coordination and Personal Development Sales Staff

Serdaroglu (2009) argued that the internal coordination area would perform internal harmonisation duties like information management with operational tasks, order handling, team management, sales staff performance, initiating training program, call recording including sample management where sales force automation is an effectual tool for group performance. To integrate sales force automation, it is essential to have a large database where the regular performance of the sales staff would be exchanged for not to overlap target customer visit and other sales function and it will ensure a high-quality operational system with a state-of-the-art database that supports both the groups and individual performance. At the same time, this process would also utilise for administrative purpose including booking, and management information system to develop further organisational strategies supporting the core value chain of the organisation.

The internal coordination is a system of straddling procedure that is essential to match up the commitment to employ market information to generate supervisory values for customers through order-fulfilment practice along with relevant customers’ service duties where sales force automation would positively enhance internal coordination dimensions. This process would keep extended significance on the personal development of the sales staff by organising training to improve the capabilities of the sales staff with accurate information and organisational values that would generate greatest potentials for personal development of the sales staff.

Determinants of sales Staff Ethical Behaviour

Roma´n and Munuera (2005) explored that the determinants of ethical behaviour of the sales staff and placed the mode of compensation along with control system at the top priority for significant determinants of ethical behaviour where the age of the sales staff is also another imperative factor to deliver ethical behaviour at the first tire. The educational qualification of the sales staff, his job satisfaction, conflict resolution method of the organisation and performance measures are also interlinked with the ethical behaviour of the sales staff at second tire. The significance of the second tire factors are less imperative than the first tire where ethical behaviour of the sales staff leads to inferior stage of conflicting role and superior intensity of job satisfaction without delivering higher stage of performance, their model has presented as follows-

Roma´n and Munuera (2005) argued that the reward and control system of an organisation is the most influential managerial factor that seriously have an effect on the sales staff performance and it has already determined that this factors significantly influence the customer-oriented selling which has strongly based upon ethical behaviour. There are huge researches with the reward and control system, and most of them have identified the relationship connecting the compensation system and ethical standard and acknowledged noteworthy relationship that the reward structure of an organisation appreciably prejudiced the ethical behaviour of the sales staff.

Cadogan and Lee (2009) studied the consequence of control system upon the sales staff’s ethical decision-making and their ethical judgments rather than their behaviour, added that the sales staff testimonies, and pointed out the relationship of control system ethical behaviour. It has been argued that the ethical behaviours would be engaged and motivated to attain sales staff’s individual goals connecting with organisational objectives. They advocated for salary, commission both for the sales staff’s compensation plan and for called attention to adopt an enduring orientation along with devote time and efforts to comprehend the future sales and enhance the ethical climates, and it has proved that the higher present salary of the sales staff produce more ethical behaviour.

Roma´n and Munuera (2005) added that the demographic variables like age and education are the alternatives that together traits and attitudinal features of the sales staff would produce ethical behaviour while the younger sales staff has more opportunity to motivate than older for ethical decision making and more educated sales force produce more ethical attitude.

Ethical Behaviour of the Permanent and Temporary Sales Staff

Defining Unethical and Ethical Behaviour of Sales Staff

Haron et al. (2011) clarified the unethical behaviour of a sales staff, as a most simple form that is the immoral performances relate to ambiguity role with extreme burden of sales target and intention to making prosperity in short cut leads to performing unethical behaviour. To reducing unethical behaviour of sales staff, most influential forces are involved in constant monitoring, support along with motivating and encouraging role to construct transparent performance roles. For more details, there are six key factors that promote unethical task of sales staff namely at the time of advertising, marketing, and conduct sales effort convey disingenuous presentation of the target goods and services. These factors involved with fail to knock with consumer’s desired goods and services and recommend as well lacking of proficiency to performing competently individual’s assigned duties integrating with the matter of inconsistency that minimise individual financial gains (Lo, 2010). The unethical conducts also make parallel to the supplementary personal benefits or individual performance rewards against one’s responsibilities, misrepresentation of individual expertnesses in the area of service delivery management and finally, endorse disparaging remarks about rival’s status as well as their products, services employees or agents.

In responding to these forces, several research reports identified that there are nine ethical issues while the biggest organisational dilemmas obstructing staff’s ethical attitudes and accessibility of employee’s ethical behaviour identified four major catalysts that play behind, for instance, compare to usual compensation and reward. The settlement of claims pays significantly lower, without knowledge of an employer engaged with a part time business, discouraging feedback from prior sales staffs and discouraging practises of regional manager that obviously brought kickbacks from existing and potential rivals. On the contrary, defining ethical behaviour, hypothetically, it has emergent to familiarise with planned behaviour where sales staff’s performances are namely guided through three attributes like behavioural beliefs included behavioural outcomes and evolutions, normative beliefs involved with complying optimistic motivation and sound expectation and lastly, control beliefs attributed through execution of impede performances as well as conduct with perceived power. Alternatively, these three ingredients of ethical behaviour delivered either favourable or unfavourable attitudes, subjective norms to perceiving social pressure and persistence of control behaviour gradually. In experience of ethical ingredients there have several unavoidable control variables where age and experience are considered most significant (Haron et al. 2011).

Ethical Sales Staff Behaviour

Tweedie (2011) added that the ethical sales staff behaviour (ESB) has consisted with eight imperative attributes influenced the buyer and seller relationship and additionally, involved defining circumstances of sects of ethical behaviour. At earlier stage, ESB has influenced valued buyer’s trust and commitment conforming two crucial ingredients those delivered most strong sales leadership potentiality with consistent with the empirical model of constructing positive buyer seller association. Alternatively, buyer trust is a primary condition of resulting effective ESB during constructing significant block of buyer commitment and in gaining buyer trust, expert sales staff should demonstrate reliability as well as high integrity. Consequence of this, buy building foundation of trust buyers’ confidence have increased gradually hence their observable behavioural blocks easily grasp five circumferences since, buyer’s lower incline monitoring on ethical sales staff’s activities proportionately tends towards more valuable buyer seller affiliation thus make them save valuable time and anguish tasks.

Tweedie (2011) also pointed out that during the middle phase, ESB effectively influenced concept of the share of customer that denoted volume of consumer’s devotion for a particular firm as well as their particular product or service. In another word, percentages of share of consumer is equivalent to the economic advantages of reinvestment along with brand loyalty, but there have not any direct affiliation with ESB and share of consumer to build positive buyer relationship commitment proportionately by anticipating higher future returns. Another mid-level phase of ESB influences the buyer’s communication where ESB has passively knock buyer communication to transmitting judicious and on time delivering information from buyer to seller. Under this approach, buyer and seller’s affiliation advance communication conveyed rich benefits both the parties as well as effectively grow strong networks of buyer’s commitment and trust because buyers who trust on ethics of a sales staff more comfortably and frankly communicate and forced by a tendency sharing more information for a continuous relationship development. At last, ESB influenced for positive communication through word of mouth, which is an interpersonal communication mode to elaborating optimistic business reviews by buyers positive sharing with their associated peers; therefore, these interpersonal communications carried rather greater weight that recommended significantly optimal level of trust on the way of buyer trust (Tweedie 2011)

Engagement of Permanent and Temporary Sales Staff

Manpower Inc (2006) stated that in aggregate form, the engagement as well as managing employees has treated under workforce management that included both permanent and temporary sales staff of an organisation. Consequently, motivation and performance mobilisation of aggregate workforce has derived through a dozen of engagement forces where performance evaluation has concentrated on two key dynamics, for instance, clear vision of entire expectation and treated under a meaningful working atmosphere. Meanwhile, sales staff’s chief engagement forces are encompassed sequentially as utmost performance factors effectively patronized by proper treatment of entire staffs with respect that effectively as well as efficiently able to recover frustration and hence convey glowing reviews towards both employer and employees.

In order to supervise contingent employee’s expectancy executing best efforts to do an assignment as well as removal of ambiguous matters fix up an expectation parameter. Establishment of sense of belongingness so that employers would successfully able to pay significant leadership role as well as motivate sales staffs to convey utmost performances; therefore, staffs felt stronger emotional affiliation with their employer. To manage and administer the employees, most of the organisation has significantly suffered from lack of equal treatment practice and treatments, where the policies are either involved to hire the temporary employees through short time contract or outsourced from the different agencies that use freelancers. The usual tendency of the organisations is not permitting temporary workers, attending regular teamwork activities along with the permanent staff and it has delivered an unconvincing workplace attitude that goes out of the employee’s code of conduct.

The engagement of workforce of permanent category have enjoyed superior facilities than temporary employees, consequently, required tools and resources are also delivered following a discriminatory manner that resulted serious frustration of job security, but delivering equal work tools and resources effective to engaging all type of employees as well as boosts their performances. Promoting worker’s performance and engaging them for long both on job training and off job training can play crucial role where authority should be frank, responsible, honest, and appreciate two ways feedbacks for fair judgment along with encouraging critical forces of the organisation fluently. At the end of describing diversified employee engagement, strong team work, fair recognition, abandon opportunities for regular learning, development and progress, under stability to develop success of business effectively and efficiently and lastly, ensure proper security for the entire sales staff would recover all of workforce engagement difficulties (Manpower Inc. 2006).

Effect of Outsourcing Temporary Sales Staff

Erickcek et al (2002) mentioned that the outsourcing temporary sales staff is an essential ingredient of an organisation’s entire workforce to show their selling performances. The significance of prioritising temporary sales staff of an organisation is that there have abandon scope of practicing low skilled labour market working conditions like wages and benefits. In addition, many intensive case studies on diversified industries defined that outsourcing temporary sales staff either adversely affected or highly benefited in consistent with low skill labour market strategy. In brief, adverse effects of temporary sales staff’s compensation package would effective and unambiguous if numerous substitute agencies followed a long-term low skill labour market compensation policy; consequently, outsourcing temporary staffs get high compensation, wage benefits, and assign management functions. For instance, within last decade, number of outsourced temporary employment has increased by 10% and function of these employments had increased dramatically by means of innovative sales and managerial tasks.

Erickcek et al (2002) also illustrated the effects of outsourced temporary sales staff, this part has crafted numerous key issues involved with long–term substitution, low union status, loss of regular wages, potentiality to switch as permanent employee, employer’s motivation to hire temporary staffs. The reduction of employer’s constrains during employment form, screening core competency, ensure and restore quality of well tested systems, control of high employment costs, reduction of layoffs by prioritising enhance staff’s productivity and increase of entire organisational productivity, figure below presented the way by which outsourced staff provide competitive advantage for the organisation (Search Wise 1999).

Theory of Planned Behaviour

Alt and Lieberman (2010) explained that the theory of planned behaviour (TPB) is analytically a hypothesis on human behaviour that connected and concern on human attitudes with action. More specifically, the TPB accessed on the way of individual’s beliefs on a specified –behaviour, beliefs on social norms connected with specified–behaviour and belief on controlling approach regarding to the result of a specified–behaviour. In reference with this argument, the TPB has composed through three ingredients individual behavioural beliefs, normative beliefs and lastly control beliefs. In broader form, intention of the behavioural beliefs involved to assuming direct precursor of an actual action and in addition, empirically, effective for well supported in transmitting diversified behavioural approaches, social domains in relevance with advertising, marketing, communication, and cognitive social psychology. Recent overview on individual behavioural beliefs discipline articulated numerous features, such as, authentic, repeatable along with practicable social simulations. In defining normative beliefs, TPB mostly emphasise on decision-making procedures of public policies significantly including investigations of changes in the beliefs, values and interests whereas control beliefs are a motivation tool that engaged to recover depressing movement of human being with the society whole whether expectation of any action fail to convey positive result (Alt and Lieberman (2010).

Outsourcing Sales Staff Behaviour Problem and Prospect

Rajagopal (2007) argued that the significant ingredient of entire workforce of an organisation, outsourcing sales staffs is featured with both prospect and problematic issues. To illustrating prospect of an outsourced sales staff, at earlier stage, it needs to notice that they have played a dramatic role on building inter–personal communication bridge along with enhance pre–purchase arousal motivation for organisation’s product or service; therefore, manufacturing and marketing department of an organisation enriched swiftly. Alternatively, prospect of an outsourced sale staff involved to defining and analysing core behavioural motivations of valued consumers that influenced assessing leisure shopping behaviour as well as investigation of empirical consumer values. In this way, outsourced staffs are the significant promoter stimulating consumer interests to buy product or service and additionally, influenced for product attractiveness. Meanwhile, consumer centred business organisations like financial institutions enthusiastic to appoint greater number of outsourced staffs for superior market coverage as well as boost sales volume make strongest competitive position in the industry.

On the other hand, outsourced staffs are typically termed as promoters to performing specialised target activities to expand service network of the organisation as well as disseminate organisation’s brand image to attracting more satisfied consumers and the outsourced staffs can be deployed organisation’s strategic distribution networks or the supply chain management. Another significant issue is direct interaction with the consumer during delivering services and outsourced staffs have wider scope of reducing cost structure and consequently enlarged equity of the organisation. Moreover, employment of outsourced staffs is also a matter of dilemma for several organisation for instance, narrow scope of post-purchase consumer relationship, wrong impression of company image as well as product and service, no clear direction of wages and salary along with fringe benefits and for more details following figure demonstrates problem and prospects of an outsourced staff (Rajagopal, 2007). Figure below illustrates the problem and prospect of outsourced sales staffing –

Standards of Sales Staff Ethical Behaviour

DHFS (2011) illustrated that the diversified attributes in marketing profession experts define the ethical standards addressing numerous performance qualities of technical skills. In sequence of this, sales staffs should to subscribe towards several ethical principles as well as standards to stimulating individual along with team or group decision-making procedures and actions as well. Typically, ethical principles of the sales staff are composed through three components integrity, value, and loyalty. In this way, effects of these three principles establish sales staff’s ethical standards that would encourages extreme devotion for an inflexible ethical behaviour, expansion of awareness as well as acceptance of ethical conducts and finally, emphasise on the key role of ethics during formulating selling decisions. These three motivations are worked for structuring ethical behaviour standards to stimulating entire sales department; in addition, ethical standards of sales staff are not assign to displacing organisation’s policies, but passionate to modelling considerations. However, it has common to all that every sales staff is officially recommended for striving a sound structure of acceptability and adherences in favour of these ethical standards.

Meanwhile, an organisation itself is an encouraging dynamic that significantly develop, publish and make enforceability for an ethics policy in favour of the ethical standards. In addition, ethical policies have to carve up with the entire sales staffs as well as external suppliers of the organisation (ILO, 2007). Alternatively, it should continue that virtually not all of situation does covered through ethical standards and guidelines where sensitivity to cultural diversity, laws, customs and suitable practices have taken places. Considering sales staffs ethical behaviour, there are ten chief ethical behavioural standards involved in perceived such impropriety, conflicts of interest (COI), issues of influence (IOI), convey responsibilities to the employer as well as superior. The other standards are building effective buyer seller relationship, construct sustainability as well as positive social responsibility, reciprocity, assembling applicable commercial and industrial laws, regulations along with trade agreements, building professional competencies with dealing of confidential plus proprietary information with loyalty (ISM, 2008).

Islamic Ethical Standard

In consistent with the case of the present research, this part has involved with Islamic ethical standards in selling financial products or services towards the Malaysian consumer in Penang. In order to engage with the Islamic ethical standards, here significant assessment has executed to draw the religiosity role as well as perceived ethical values to fulfil the demand of marketing and advertisement ethics of an organisation. Regarding this point, idealism, relativism, and religious faith have focused in the light of Malaysian business atmosphere. In this study, it has revealed that both factors idealism and relativism has moderated by means of individual’s religious belief and strength as well. In short, significant under stability of marketing ethics need to discover diversified cultures as well as inter–organisational practices. In reference with globalisation, marketing tasks have transformed and expanded rapidly since repeated change in consumer demand and because of the impact of globalisation, it becomes difficult to maximise profits in highly competitive atmosphere; therefore, companies required to cover greater geographical areas than before in terms of international sales. Attach with this truth, multi–domestic companies obligatorily required to focus on host country’s own religious practices, potential consumers’ perceptions and moderate judicious factors.

Ghani et al (2011) religions have influenced on the people to draw their ethical beliefs by distinguishing right or wrong and for the entire society. In considering this fact, business holders have also in emergent to learn that besides homogeneous societies and countries multi–cultural nations have ethnic groups with diverse religious beliefs as well as practice and hence, diverse moral values are also essential to consider in developing marketing ethics. To highlight the Islamic ethical standards, earlier facts need to account before developing in an Islamic country like Malaysia. For an example, Islamic nations have strictly prohibited alcoholic drinks and other product or service due to their religious directions and in numerous states of India prohibited marketing of beef products.

Sales Staff Ethic in Penang

This study has already addressed that Malaysia has three ethnics groups those have strongly influenced through religious beliefs, but in workplace that organised the sales staff’s ethics in Penang, Malaysia has not yet significantly influenced and moderated through religious radicalism. Alternatively, idealism and relativism is strong moderator by religion on composing marketing and advertising ethics. Literally, high marketing ethics possessed thorough high idealism and conversely, idealism is a positive dynamic whereas relativism focused on negative influencers. An assessment on 22–26 years sales staff’s group of Malaysia identified that they are keener to accomplish their job responsibilities and duties rather than practicing religious moderator. Moreover, young sales staffs are more enthusiastic to making money within first third years of their job experiences. At last, major portion of the sales group agreed that religious faith is obviously a significant moderator, but in their workplace and performing job responsibilities, religious belief have influenced at lower volume than their superiors do (Ghani & Rehman, 2011).

Sales Staff’s Satisfaction Connecting to Customers Satisfaction

This chapter has organised with following sections-

Critical Role of Sales Staff’s Service Delivery

Gima and Micheal (1998) illustrated the critical role of a sales staff in time of service delivery it has emergent to know about flow of service delivery management (SDM) as well as essential ingredients of the SDM. Before detail account of critical role of a sales staff, it is indispensable to have a look on essential service delivery elements those compose sales staff’s critical role as following diagram represents

Mehta (2006) explained in consistent with the Figure 3, consumer, resources, projects and program are the four core fundamentals those have treated as heart of SDM and the rest of nine ingredients patronised sales staff’s behavioural role that significantly crafted consumer satisfaction. Initially, to define critical role, crisp, clear and unambiguous communication is the most crucial responsibility of a sales staff with the fundamentals of SDM where consumer should get utmost priority and since valued consumers are considered SDM as primary solution tool. Hence, cordial relationship with consumer is of paramount importance. After effective communication and relationship, knock consumer’s crisis and recommend accordingly make the relationship durable as well as loyal.

Organised planning is effective for conducting project activities as well as scheduling of the sales staff and in addition planning is assign to define and structure execution procedure of scope of the sales project, constraints during selling, forecast assumptions of sales target, discover and pick associates risks of the project, endorsement plans and finally, resource planning. In executing 24 X 7 supports, it has emergent to attach with online business system where sales staffs should to proficient providing a clear guideline of consumer demand. Alternatively, 24 X 7 is appropriate for automation of sales services where CRM practice is much easier through attributing three core dynamics namely; frequently change requests, inquiry on desired services that carried potentiality of change requests and appropriate problem management.

All of this phenomenon should involve in analysing performance issues of SDM as well as potentiality of statistical techniques, scope of RFC deployment, work–log, and UAT. In the area of SDM, technology has covered significantly role by delivering ease B2C functions like ERP, SCM (Supply Chain Management), planning of production, managing contents, business intelligence and EAI (Enterprise Application Integration) and additionally, ensuring high return on investment. After adaptation of technology, growing companies as well as their sales staff should to implement modern technology and continuous upgrading them for a fruitful service management performance. Quality the key performance indicator of SCM along with the sales staff that proficiently reflect client’s expectations and rich benchmarks in consistent with the SLA (Service Line Agreements). Finally, integration of client application considering three forces namely, integration of gathered data and information, integration of application for a specific service and integration of available product and services (Mehta 2006).

Sales Staff’s Motivation and Compensation (Reward) System

Warner (2000) argued that strategically, compensating employees is an effective motivation tools that mobilise an organisation’s selling objectives as well as make flexible accountability to define individual differences along with deliver a fair perceived value, effort and entire procedures towards the available sales staff. On the other hand, sales person motivation via compensation as well as rewards have worked following a hierarchy of worst to best where worst compensation denoted as salary including only bonus whereas best compensation packages involved with a high flexible salary payment where pool, commission and bonus have combined together to motivate existing sales staff.