Abstract

The main aim of this study was to determine the future of the dollar standards and whether it will be replaced by the Renminbi. The study focused on the capacity of China to strengthen her currency. The study explored various factors that could contribute to strengthening the Renminbi, in line with main objective. The study relied on secondary data and used a demand function in an OLS estimate for regression of the variables.

The study found out that unrestricted financial market could lead to a stronger currency. In addition, the size of trade and output also has an effect on the currency’s strength. It is therefore forecasted that come the year 2035, the Renminbi will overtake the other two major currencies, i.e. the dollar and the euro.

Introduction

Background of the study

Before the dollar’s status as the means of exchange, the Sterling pound persisted in the years before the 1920s. Observers claim that though the GDP of the United States surpassed that of the United Kingdom in the 1870s, it was only after the 1920s that the dollar gained the reserve money status at the end of the World War I (Zoffer 2012, p. 26).

This period marked dominance of the Unites States in trade and finance over the United Kingdom, years after it dominated in terms of the GDP. Most experts analysing the possibility of the Renminbi overtaking the dollar as international money uses this theory to predict the eventual time to be late in this decade or sometime early in the next decade (Prasad and Lei (2012 p. 26); Eichengreen (2011, p. 250).

The dollar has been the international reserve money for long, with many other currencies being tugged on it on the global scene. However, in the wake of the latest financial crisis and the changes in the global economy, this characteristic is increasingly under threat. On the stronger side of the world economy is the Chinese Renminbi, with this currency increasingly looking like the most likely one to eclipse the dollar.

A legal tender must fulfil a number of factors to be the international reserve means of exchange (Eichengreen 2011, p. 245). The Renminbi is well in line to meet most of them in the next few decades based on economic projections.

The steady growth of China over the last few decades and several policies made has pointed towards an attempt to move the legal tender to this international level. In order to understand the steps that China has made and the reasons the Renminbi is increasingly becoming strong on the global front, it is important to evaluate the possibility of this coinage surpassing the dollar as the international reserve means of exchange. One of the factors that are necessary for a dominant currency is the economic strength of the country of origin.

Between China and the United States, the country that prevails over the other will control the outcome. Some of the other conditions that China as the owner of a legal tender needs to fulfil include the opening of its financial system, making this coinage convertible and make its markets deep and liquid (Hartmann 1998, p. 431).

Problem statement

Although the position of the Renminbi as a formal coinage is not yet achieved and some people will see it occurring in the near future, the fact that it is not easily converted in most of the international transactions means that it still has a long way to go. The meaning of this is that the use of the legal tender to purchase goods or services in other areas of the world apart from China is not marked and foreigners are unable to purchase the Chinese assets while her citizens have limited access to the foreign assets (Prasad & Lei 2012, p. 26).

The main cause of the difficulty in converting the Renminbi to other currencies is the relative closed nature of the Chinese economy, which is built around export earnings. Eichengreen explains the prerequisites for the use of the Renminbi as international reserve money when he states, “Markets must first become more transparent. Monetary and fiscal policies must be sound and stable, and the exchange rate must be made more flexible to accommodate a larger volume of capital flows” (2011, p.247).

Purpose of the study

The purpose of this study is to discuss and analyse the position of the Chinese economy to take the mantle as the leading economy in the world. Countries that have the privilege of producing their currency, for use as a reserve currency have some benefits and costs that they incur by issuing it. The findings of this study will add to the body of knowledge with regard to the available scholarly articles focusing on the future of the dollar standards.

In addition, the study will help policy makers to adopt the best strategies for maintaining the strength of their currencies. In the current state, an American citizen can easily trade or participate in foreign trade with another country or their residents without the trouble of having to convert the dollar into the local currency.

Research questions

In line with the objectives, the following research questions were explored.

- Does China have enough size of output and trade to make its currency strong?

- Does China have a stable, open and unrestricted financial market to support its currency?

- Do the other countries in the world have confidence in the Renminbi?

- Are there network externalities that limit the Renminbi from achieving an international reserve currency status?

Aims/Objectives of the study

In an effort to discuss the future of the dollar standard by evaluating the possibility of the Renminbi replacing it, this study, therefore, explored the following objectives:

- To investigate the position of the Chinese in terms of size of output and trade in relation to the Renminbi;

- To investigate the position of China’s financial market with regard to whether it is stable, unrestricted and open enough to support the Renminbi;

- To research on the level of confidence that other countries have with regard to the Renminbi;

- To investigate the network externalities that limits the Renminbi from achieving the status of international reserve currency.

Organization of the study

The study is organised as follows: the first chapter gives the introduction, background, statement of the problem, research questions, and the aims/objectives of the study. The second chapter gives the literature review where a number of related literatures have explored. The third chapter is the methodology, and the fourth and the fifth chapters give the results and the discussions respectively.

Literature Review

Introduction

This review of the literature surveyed numerous research studies and peer reviewed articles that reflected current research, thoughts, and opinions focusing on the future of the dollar standard in relation to the Renminbi.

Research questions vs. findings from existing literature

In line with the objectives, the following research questions were explored.

Does China have enough size of output and trade to make its currency strong? Does China have a stable, open and unrestricted financial market to support its currency? Do the other countries in the world have confidence in the Renminbi? Are there network externalities that limit the Renminbi from achieving an international reserve currency status?

There is a relationship among the research questions and the existing literature due to the fact that the position of the Renminbi as a formal coinage is not yet achieved and some people will see it occurring in the near future, the fact that it is not easily converted in most of the international transactions means that it still has a long way to go.

The meaning of this is that the use of the legal tender to purchase goods or services in other areas of the world apart from China is not marked and foreigners are unable to purchase the Chinese assets while her citizens have limited access to the foreign assets (Prasad & Lei 2012, p. 26).

The occurrence of the global financial crisis in the 2008 and 2009 really revealed the lapses in the international monetary organizations which culminated to the global financial crunch and a feeble world economy. The most affected nations were the emerging economies which over relied on the stable economies for their sustainability through international trade.

Emerging economies rely very heavily on international trade as it boosts the flow of capital which is a necessary condition for growth and development; they therefore suffered as a result of scarce international liquidity leading to the economic shocks.

Some of the other actions that China has engaged at that point towards an attempt to internationalise her legal tender include the stream of agreements with other nations such as South Korea, Iceland, Indonesia, Belarusian, Argentina, Malaysia, and Singapore, with other countries such as Thailand and Pakistan scheduled for the same (Prasad & Lei 2012, p. 29). Prasad and Lei (2012, p. 29) affirm that swapping of currency has enabled China to obtain Renminbi for dollars as payment for exports hence making Renminbi a legal tender of trade in many nations (2011, p. 19).

Review of empirical literature

The fall of the British Empire politically was followed by a demise of its currency’s role as a reserve currency. The United States also uses the privilege of having to own a reserve currency to dictate the desired political systems in the worlds. An example is the gradual weakening of the Panama economy with the freezing of her assets in the US banks and prohibition of dollar payments in this country to force a political change.

The procession of a reserve currency has a correlation with the prestige and political power that a nation enjoys on the global front. This case is portrayed especially in the period of the global financial crisis when the US offered liquidity in Europe and other emerging markets based on its position as the reserve currency (Greenwood (2011, p. 32).

The country could have opted to use the crisis to show its dominance in the global economy and exploit the privilege. Though this did not have enough effects as to overthrow Noriega, the power to inflict pain on others from possessing a reserve currency was clear (Dai 2013, p. 29).

Many countries across the world have demonstrated their economic dominance in the form of money; this has resulted in the need of each country to make her currency stronger. Different types of economic integration and trade amalgamations have emerged all over the world in the recent past. This can be highly attributed to the recent rise of globalization. This has called for countries lobbying for a uniform legal tender to facilitate their daily transactions.

There has been growing optimism on the side of the Renminbi; with some of the economic observers stating that it is not a matter of if it overtaking the dollar, but a matter of when that has to happen. Prasad and Lei (2012 p. 29) observes that, in 2010, the US was outdone by China in domination of the world economy (p. 16).

This was the foundation of the overcoming of the dollar by the Renminbi. He puts this as the theoretical timeline for the surpassing of the Renminbi on the dollar unless there are interruptions from other factors. An observation is also that the US-China index of dominance will be similar to the US-UK in 2020 as observed in the mid-20s when the dollar is said to have overtaken the sterling.

These observations point to an imminent rise of the Renminbi to take the place of the dollar as the main reserve coinage in the next decade. Looking at the changes in the international reserve money that have taken place in the past and comparing it to the likely change from the dollar to the Renminbi, there are obvious differences that emerge.

The transition from the sterling to the dollar was rather easy since the US had an open capital. However, Wang and Yi (2012, p. 89) argues that looking at Chinas financial markets, it is evident that it is a closed one, which is not good for the current day sophisticated markets, and this adds on to the relative difficulty in converting the Renminbi to other currencies (Prasad and Lei 2012, p. 29). These are some of the reasons that the takeover of the Renminbi as the reserve exchange may be difficult or even take longer than projected.

The dominance of the Renminbi has been complicated by the relations between the US and China that are not perfect. During the transition from the sterling to the dollar, the UK and the US were allies. As Castle (2010, p.439) observes, the two put efforts towards minimising the costs of the transition to both the UK and internationally. Trade is however an important determinant of the formal coinage status for any nation, and China is no exception.

In the recent past, the trade within Asia has been increasing; with the Renminbi is a significant medium for this trade. Should this continue to strengthen, the advantage will fall on the legal tender and position it to be a formal legal tender sooner than expected. Oberlechner and Osler (2012, p. 91) affirm that the current environment, however, is different, with the US and China not having similar cooperation and hence an indication of poor management of such a transition if it occurs in the near future.

The main cause of the difficulty in converting the Renminbi to other currencies is the relative closed nature of the Chinese economy, which is built around export earnings. Eichengreen (2011) explains the prerequisites for the use of the Renminbi as international reserve money when he states, “Markets must first become more transparent.

Monetary and fiscal policies must be sound and stable, and the exchange rate must be made more flexible to accommodate a larger volume of capital flows”. In addition, there is the need for China to come out of bank lending and exchange rates as the key drivers of the economy.

China, therefore, needs to ensure that the Renminbi is internationalised through the meeting of the foreigners demand for the money. A current account is the necessary means of ensuring that the coinage is available to the rest of the world. The legal tender should as a result be convertible. Based on these observations and necessary measures, this puts the transition from the dollar to the Renminbi in the not so near future.

Research gaps

Frankel (1995, p. 14) in his study concluded that the Euro might be the next reserve currency replacing the dollar. Their conclusion was based on the results of a regression analysis which predicted the foreign reserve holdings. The success of the Euro, however, was subject to various constraints, the main one being the number of economies willing to join the Euro economy in contrast to the United States. Another constraint was whether the United Kingdom would be willing to join the others with its huge financial market.

Their argument was based on the continuous depreciation of the US dollar as the reserve currency and the continuous appreciation of the Euro. The speedy appreciation of the Euro currency has contributed to the downfall of the US dollar by limiting some of its advantages that came with its dominance. He further challenged the monetary authorities to reevaluate the position of the reserve currency.

Some of the researchers and economic analysts have stated that the dominance of a nation’s currency may not be the main thing and that others just resent the dominance of a nation’s currency (Greenwood 2011, p. 32). One such example is when Charles de Gaulle while complaining of the dollar’s dominance stated that “dollars, which it alone can issue, instead of paying entirely with gold, which has a real value, which must be earned to be possessed, and which cannot be transferred to others without risks and sacrifices” (Kunz, 1995).

Some of the issues that drive the debate about the legal tender have in the past been mainly the development of policies in the origin country that affect the fate of the money and the whenever another money such as the Euro has posed a threat to reserve means of exchange that is the dollar.

The latter was exemplified at the beginning of this century when the dominance of the Euro was proving to be a factor in the international trade. In the wake of the global financial crisis and the rise of the Chinese legal tender on the global markets, the two factors stated above have recently resurfaced after a period of mere in existence.

Many researchers have dwelt on the topic regarding the future of the dollar and whether it will still suffice as the international reserve currency. One key thing to note about these researches is that they have brought about divergent results and opinions. Actually, studies or researches that were conducted prior to 2007 have hinted that the dollar could soon be replaced by either the Euro or the Japanese Yen as the reserve currency.

On the flip side, this study points out to the fact that many emerging economies are strengthening their currencies in a bid to achieve economic dominance; this will in turn shape up the entire global economy. In this paper, a major focus is in the attempt by the Renminbi to offset the dollar as the main legal tender on the global market. Possible changes in the reserve currencies and the global economy will also be a focus of this paper, as it attempts to simulate a possible fall of the dollar and the likely takeover of the Renminbi.

Another important undertaking in the research will be the evaluation of the net performance of the US economy in comparison to the Chinese one, and this will be pivotal in the determination of who rules what in the next decade in the financial market. Another important factor to consider will be the steps made towards achieving a global economy with the Renminbi as its main means of exchange. Hong Kong was one of the nations off the Mainland China to use the Renminbi as deposit in banks and this was followed in the year 2007 by the issuance of bonds by the China Development Bank (Kenen 1983; Kenen 1960).

Validity of the recent studies

Eichengreen (2013) points out the implication of the Euro’s crisis for international monetary reform. European Central Bank produces the study about the international role of the Euro and shows some evidences to imply that the international monetary system has already become tri-polar (i.e. USD, Euro and Renminbi) system. The shortcoming of the current framework proposes the new tri-polar international monetary system as well. Eichengreen’s results were estimated using a demand function and OLS estimation.

Another currency that has gained popularity is the Chinese Renminbi. The Renminbi is growing stronger and stronger and is threatening the Euro and the US dollar. The Chinese government is making close ties with many emerging countries in the world. The emerging economies will therefore have a great role to play with regard to the future of the reserve currency; this suggests that the Chinese Renminbi is a potential leader.

When the same has happened in the past, the International Monetary Fund resulted in special drawing rights (SDRs) in the 60s, which was a reaction to the fear of a collapsing dollar (Bank of England 1992). The anticipated crisis never materialised and the dollar held on as the globally accepted reserve coinage, until the 2000s when the Euro began to challenge it.

The dominance of the USD in the international monetary system

The recent economic crisis harmed the dollar’s reputation as the ideal reserve money, with most of the financial experts commenting on it and stating that the other currencies such as the Euro and the SDRs should instead be strengthened (Ocampo 2010). The US dollar has had the privilege of seniority in the market.

It has also been able to establish a firm foundation due to its exorbitant distribution across the world. This may be a benefit or a cost to the nation that has its currency as a reserve currency based on whether the times are good or bad for them. For the case America, good times means that they could earn a lot by having other nations take the notes from them in exchange with the goods and services produced elsewhere.

According to Chien (2012, p.23), over the years, the U.S has been earning extra foreign exchange from its foreign investments compared to the debts she pays. In bad times, however, the concept may also prove to be risky, with the nation suffering costs associated with it. Whalley and Wang (2011, p. 614) also support this argument by suggesting that the increase in the US treasuries held by foreigner’s depressed yields by 90 basis points.

China has risen to be a significant force in the global economy as a leader in export and import. The values of these trades in relation to the trade by other nations such as the US will be important to consider in the estimation of the coinage value, and thus a thorough look into the statistics governing this performance will be made available.

The analysis of the data obtained will then be done through the appropriate methods, and the results of this analysis discussed later in the paper. The analysis of the results once completed will then lead to the presentation of the data and results in appropriate graphs and other methods of presentation that will be deemed appealing and appropriate.

Reputation and political influence

Over the last 110 years, the economic position of a country has emerged as a major factor that determines the reserve coinage globally. The strength of an economy as determined by the GDP is not enough to guarantee this position but the external financial position and trade are significant measures in addition to it (Prasad & Lei 2012, p. 26).

By definition of a reserve means of exchange, the benefits, costs, and implications for the country that gets the privilege of hosting the money. Despite China being ranked as the second largest economy after US, its currency has not gained prominence as reserve money in the world.

Some of the prominent works along this area include Martin (2011, p. 52) and Humpage and Jacobson (2012, p. 10), with their research and literary works around the same. Any money that can be used outside its own country qualifies to be international money. If its use is more frequent, the definition could make it a reserve legal tender.

Dooley and Garber (2005) summarised the three main roles that a means of exchange should be able to perform, and related them to the preference that the countries and private institutions around the world prefer this money. The writers used different methodologies but arrived at the same conclusion that expansion in trade and output has a positive effect on the strength of the country’s currency.

Extra expenditure incurred

Despite the above-mentioned benefits to the country that provides the reserve currency, it incurs a number of costs as a result. These range from the simple responsibility that it has to bear for its currency and the costs it has to put in to ensure that the currency is guarded.

Based on the principle of seigniorage used above in the benefits to an economy with the reserve currency, the currency is considered attractive and special to hold, and this causes it to appreciate due to the resultant demand (Heller & Mohsin 1978, p. 631; Frankel 1995, p. 13). This feature makes the currency to be less competitive in the global economy.

Bergsten (2009) observes that the ability of a nation to finance current account deficits more easily can lead to “irresponsible government and private-sector behaviour, thereby contributing to financial instability” (p. 7).

One great example of such a scenario is the recent financial crisis that hit the world. Most financial analysts observe that the large current accounts deficits resulted in huge capital inflows, cheap, and easy money, which when combined with the absence of strict regulations resulted in the reckless financial behaviour and the crisis at the end (Prasad & Lei 2012, p. 29; Hung-Gay 1999).

The status of the reserve currency is also a burden to the nation with this privilege, and when it has to make regulations on the currency, the global repercussions have to be weighed first. The fear of many nations Dollarising is evident in the US, as this would make the nation take responsibility for any of the repercussions of this. The Sterling also experienced the same, and the interest rates had to be kept high throughout its reign with Britain’s defence spending ever increasing which was meant to preserve the strength of the sterling (Strange 1987).

The Chinese money is reported to have weakened against the dollar in the period around the year 2012. This resulted in the tailing of foreign exchange reserves that the nation thought of as being excessive at the time. The above considerations imply that a likelihood of the Renminbi taking over from the dollar as reserve money is possible, even if this is more likely to happen in the distant future. The Renminbi is a growing coinage with only a few nations allowing it as a means of converting currencies.

To achieve the internalisation of the same, it is imperative that the decision making process be based on a number of determinants such as the decision making process that is interlinked and outflows and inflows that are well regulated. The Chinese economy will have a significant role to play to oversee this possible change of guard, and so will the external markets and the US in particular.

The Chinese economy is in a better position to have the Renminbi achieve the reserve money status. The Renminbi today is not below the dollar in value owing to its gradual rise for six years in comparison with the dollar resulting in 30% rise from 2005 due to its modification by China. Lustig, Roussanov, and Verdelhan (2011, p. 3731) argue that the other measure that China needs to take is to fully de-peg from the dollar, and this will enable it to have its money as a legal tender.

These are dependent on the country itself, and the speed with which China is able to do this will ensure that the status of the Renminbi as a reserve money is achieved much faster.

In the special case of China, a dilemma is evident as to the desire to have the Renminbi elevated to reserve currency status. For a currency to be accepted as a reserve currency, the nation offering it must be open to capital inflows with the eventual elimination of any domestic financial repression (Stokes 2013, p. 10; Black 1989). If this is to happen, the buying of assets in this nation increases the strength of the currency and thus making it favourable for trade, but this would lead to a reduction in value leading to less export competitiveness on the global front.

China’s economy is focused on developing and maintaining export strength. This requires the country to reduce the buying of its domestic assets by foreigners, which would make the exports to depreciate. The Chinese financial economy is put into this dilemma, since if it gets the reserve currency status, it would have to allow foreigners to buy its assets thus losing on the export trade.

The main holders of U.S. government debt

The study examines the outstanding government debt in the US by relating the quantity to the holders as being domestic or international. Since the information is widely available, a sneak preview indicates that China is a significant factor in this debt, owning about 1.264 trillion dollars in the U.S. debt. It is also reported that China now owns 23% of the total of 5.616 trillion dollars that foreign countries hold.

Lipman (2011) analysis of a likely crisis and the inability of the nation with the reserve exchange to provide enough liquidity to the rest of the world to meet the demand led to the introduction of a new reserve legal tender by the IMF in the year 1970. It was called the Special Drawing Right (SDR) that tried to prevent the crisis, despite this not being forthcoming (Lim 2012, p. 674).

On government debt comparison, there were observations that the dollar declined in reserve holdings in the periods following the year 1970. This was marked by a corresponding rise in the Japanese yen and the German mark. The two currencies have bowed to the dollar especially in the period after 1990. The Euro has since increased in global reserve holdings after its introduction in the year 1999.

Changes to reserve currency status

In order to comprehend the likely change in the global financial economy from a dollar economy to a Renminbi one, it is important to evaluate the changes in reserve currency status over the last decades. Prior to the First World War there was no single reserve currency. However, the Sterling pound, German mark and French franc were the top currencies of the time.

Lobo (2011, p. 3) estimates that, in the year 1913, the sterling had a 38% share in reserve currency holdings by 24% and 13% falling to the French franc and the German mark respectively. These figures were not different from those in the year 1899 in which the three currencies had a share of 43%, 11%, and 10% respectively (Lobo 2011; Detken & Philippe 2002; Detken & Philippe 2000; Dooley, Saul & Donald 1989; Jenkins and Zelenbaba (2012 p.512).

The dollars first appearance was in the period between the first and second World Wars, and at this period, the sterling and the dollar had an almost equal share of the reserve holdings (Matsuyama, Nobuhiro & Akihiko 1993, 283). Lien and Li (2006) state that though the dollar surpassed the sterling as the reserve currency in the mid-20s, the period immediately after that saw the two currencies trading places in the top spot with this being marked in the year 1931 when the dollar overtook the sterling in the wake of Britain’s economic crises.

Some of the researchers and financial analysts to have followed the global financial markets state that it was only after the year 1954 that the dollar surpassed the sterling as a reserve currency. The period after that dominated by the steady rise of the dollar to a point of about 65% dominance in the year 1973 as Lipman (2011) states. The observation is also that the dollar had already overtaken the sterling on other grounds such as the value of liquid foreign assets.

Castle (2010, p. 439) has a slightly different interpretation that the International Monetary Fund projected that, before the World War, the sterling pound reserves were more than those in the hands of colonies by exceeding by four times. Before the end of 1947, the share had reached 87% in world exchange reserve levels. When the war ended, the proportion of reserve held by dollar rose above that of the sterling after ten years. After 1970, the reserves of dollars decreased while the German mark and Japanese yen rose in reserve share.

Summary

One of the major findings in the list is the consideration of a coinage based not only on the reserve holdings by governments, but also on the use in the private sector on trade (Kindleberger 1985). Tu, Dai, and Zhao (2013, p. 69) attempted to make a distinction between the term reserve currency and international currency, and they stated that reserve currency relates to the official transactions while the international currency term may be applied to even the private agencies.

As Eichengreen (2011) observes that it still makes sense for countries to hold their reserves in the same currency that they use to denominate their foreign debt and conduct their foreign trade, since central banks use the funds to smooth debt and trade flows and intervene in foreign exchange markets.

Over the last number of decades, the dollar has cultivated its place as the main reserve currency. In the years before the dollar’s dominance, the Sterling had its place, constituting close to 60% of the global trade, this despite the UK having only 30% of the trade (Castle 2010, p. 439).

With the end of this era, the dollar has a significant proportion of the debt securities, foreign exchange transactions, and is the exchange rate anchor for many of the world economies (Röthig 2012, p. 272). Röthig (2012) also states that the trade in most of the global commodities is priced based on the dollar with the criminal systems also using the same currency.

Research Methodology

Methodology gives a description of distinct methods or procedures that are to be used in analysing the data. These methods or procedures stand for a creative generic structure; thus, their order may be rearranged, or they may be combined or broken down into sub-processes.

With this regard, research methodology can entail elaboration of the generic processes and procedures; as well, research methodology can be elaborated through figurative means and can be adjusted to eliminate obscurity in the school of thought with tenacious conceptions or doctrines as they associate to a specific field or discipline of inquiry especially if the philosophical and/or principal of the presumptions that signify a specific methodology or a specific study is known as reasoning methodology (Snell & Dean 1992, p. 480).

The study relied on annual data from the IMF regarding the pertinent currencies held by the central banks. Actually, the central banks consider the data to be very confidential; therefore, the data is not easily available. The study used panel data (cross-sectional time series data) to estimate the variables.

Panel data was mainly preferred as it allowed the researcher to account for variables that cannot be observed; for instance, the country’s share of GDP, the inflation difference, the foreign exchange turnover, and the index of capital account liberalization. Panel data therefore justifies the heterogeneity of the variables. When using panel data, the variables under investigation can be incorporated into the model at various stages of analysis.

Panel data encompasses both the random effect and the fixed effect model. The estimation of the variables in this study was with regard to the random effects of panel data. In this kind of estimation, the variation of the variables is donned to be unsystematic and unrelated with the independent variable. One main advantage of the random effect model is that variables which are time invariant can be incorporated into the model, unlike in the fixed effect model (Snell & Dean 1992, p. 480).

The random effect model takes the following form: Yit = βXit + α + μit + εit ; whereby μit represents between entity error, while εit represents within entity error. The random effect model therefore assumes that the error term in the model is not correlated to the independent variable. With regard to this, the time-invariant variables can be used as the dependent variables.

The research strategy

First, with regard to the qualitative research, areas of study were chosen with determination, paying attention to whether the areas of study are in line with the features that have been predetermined. Next, the part played by the researchers was to obtain a higher critical care. This is mainly done in qualitative research due to the fact that there is every chance of the researcher assuming a transcendental or a ‘neutral’ position. Thus, this appears to be more elusive both in philosophical and/or practical terms. It is for this reason that the qualitative researchers are frequently pressed to mirror on their part in the research procedures and make things obvious in their research analyses.

Consequently, a wide variety of forms can be taken by the qualitative data analysis; the forms range within quantitative research in its coverage of meaning, signs, and language. Moreover, qualitative research procedures evaluate contextually and holistically, instead of being isolationist and reductionist. Nevertheless, transparent and systematic methods for analysis are ever considered as crucial for cogency.

Data collection

This study mainly relied on secondary data. Data was got from journals, scholarly articles, publications from the World Bank and the IMF. The study relied mainly on annual data from the IMF regarding the pertinent currencies held by the central banks. Actually, the central banks consider the data to be very confidential; therefore, the data is not easily available.

Data analysis

The collected data was analysed through regression analysis by deriving a demand function for the country’s currency share. The regression was with respect to a panel data analysis whereby data from the big three (the US, Eurozone, and China) were analysed. The study used panel data approach (cross-sectional time series data) during the data collection and estimation process.

Panel data was mainly preferred as it allowed the researcher to account for variables that cannot be observed; for instance, the country’s share of GDP, the inflation difference, the foreign exchange turnover, and the index of capital account liberalization. Panel data therefore justifies the heterogeneity of the variables. When using panel data, the variables under investigation can be incorporated into the model at various stages of analysis.

Validity and Reliability

Validity refers to whether an instrument actually measures what it is supposed to measure, given the context in which it is applied. Reliability is concerned with consistence of measures. The level of an instruments’ reliability is dependent on its ability to produce the same results when used repeatedly. To achieve validity and reliability, the data was checked for coding errors and omissions while coding into excel sheets. The database was also verified for accuracy and completeness of all the entries to ensure reliability of data is achieved.

The validity of the data represents the data integrity and it connotes that the data is accurate and much consistent. Validity has been explained as a descriptive evaluation of the association between actions and interpretations and empirical evidence deduced from the data. The canyon of validity is applicable to all guises of evaluation (which are both qualitative and quantitative) by coalescing scientific inquiry and rational debates to prove or disprove the outcomes and interpretations emanating from the data collected (Snell & Dean 1992, p. 480).

Summary

Research methodology can entail elaboration of the generic processes and procedures; as well, research methodology can be elaborated through figurative means and can be adjusted to eliminate obscurity in the school of thought with tenacious conceptions or doctrines as they associate to a specific field or discipline of inquiry, especially if the philosophical and/or principle of the presumptions that signify a specific methodology or a specific study is known as reasoning methodology. A section on the methodology in academic research of the researchers will always be generally de rigueur.

Findings, Data Analysis and Interpretation

Introduction

This section covers the analysis of the data, presentation and interpretation. The results were analysed using regression and correlation analysis.

Descriptive statistics

Experimental study of the reserve currency shares

For a currency to be adopted as the international reserve currency, there are various factors that contribute to its adoption. This section will therefore explore on those factors and how they can predict on the fate of the Renminbi in the years to come. Frankel (1995) has outlined four factors that determine the suitability of a currency to be adopted as the international reserve currency. The factors include: size of the country’s GDP and trade share, the country’s financial market, stability of the currency, and the number of countries which have already adopted the usage of the currency.

When a country has a bigger size in terms of the volume of its output and trade, it will carry along a competitive advantage due to the fact that the country’s currency will be widely used by the trading partners. Actually, the country with the largest output in the world is the US; hence the reason for the wide adoption of the US dollar. On the flip side, countries in the Euro region have since teamed up to produce a greater output that matches the U.S. The share of the Chinese’s GDP in the world has also escalated. Between 1973 and 2008, the Chinese’s share of the world’s GDP rose from 3.1% to 7.1%.

The financial markets of a country should be autonomous and highly developed for the country’s currency to be adopted as the international reserve currency. When the financial market is restricted and shallow, it would be to the detriment of the country’s currency. The Chinese’s turnover in foreign exchange has escalated over the past years. In 1998, the foreign exchange turnover has been just a mere $211, but in 2007, the turnover was a massive $9.3 billion. This is with regard to the exchange turnover data that was formulated by Frankel (1995).

The indices further show that the daily turnover for the Chinese is still on the lower side as compared to that daily turnovers of the other advanced economies, for instance the United Kingdom with a daily turnover of $1.4 trillion, and the US with a daily turnover of $664 billion. A country is required to be much more open and willing to join the wider global market. This is measured by the capital account liberalization index which was formulated by Chinn and Ito (2008). The Chinese still have a lower index as compared to the other advanced economies like the US and the UK.

A country’s currency should be stable enough for it to be adopted as the international reserve currency. When a currency is stable, very many international traders will opt to hold it with the surety that it will not just fluctuate when subjected to shocks. The strength of the currency can be measured by the rate of inflation in the country.

With regard to China, the average rate of inflation has been quite low in the past decade as compared to the other advanced economies like the US and the UK. On the flip side, China has maintained a higher standard deviation with regard to the rate of inflation in contrast to the other advanced economies.

A currency should also have a higher network of people using it; this can lead to its adoption as the international reserve currency worldwide. However it is not an easy and instant decision to switch from one international currency to another; it is rather a continuing process.

This study has therefore come up with variables to identify the determinants that contribute to a currency being embraced as the international reserve currency. These variables have been investigated empirically. With regard to the variables, the data for Germany and other countries belonging to the Eurozone have been merged in order to generate a series from 1974 to 2008. The estimated function for the demand was with regard to Frankel (1995). The demand function was as follows:

Logit (CS)it = β0 + β1 (GDP)it + β2 (ID)it + β3 (FT)it + β4 (CO)it + β5 (lag logit of CS)it + µit

Where: CS = Currency share, GDP = GDP share, ID = Inflation difference, FT = Foreign exchange turnover, and CO = Currency openness.

The study was based on a panel data with 35 observations that were done yearly. The panel data were from 6 countries, for instance, the US, the UK, Switzerland, Eurozone, Japan, and China. The specified equation is a logit conversion of the share of the country’s currency.

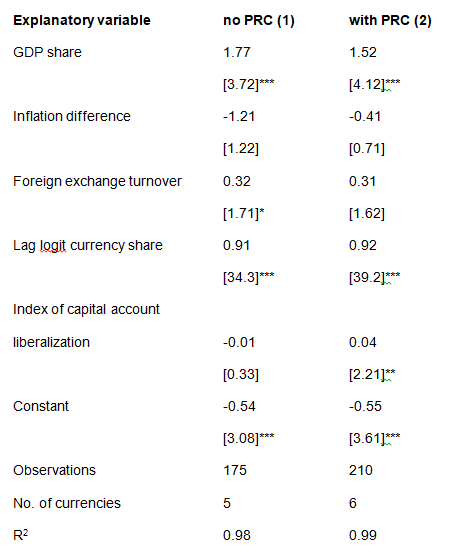

The demand function above was estimated by panel estimation with random effects. The regression results are shown in Table 4.1 below. The results represent the factors that determine the share of the country’s currency.

N/B:

The estimation was done with regard to random effects model.

* means significant at the 10% level.

** means significant at the 5% level.

*** means significant at the 1% level.

The values in bracket represent the absolute value of the z statistics.

In the results above, there is a column showing the figures for the inclusion of the PRC (People’s Republic of China’s) results and another column showing the exclusion of the PRC’s results. The results above are relatively the same, i.e. for the samples including the PRC and the samples excluding the PRC. Actually, the results indicate that the host country’s size in addition to the value of the lagged explanatory variable are significant statistically and affect the country’s share of currency positively.

The results further indicate that the country’s share of foreign currency is significant statistically in the two columns, though the significance is quite less in the second column. The value of the inflation difference is negative in the two columns and not significant. The value of the country’s share of GDP is higher in the first column and is statistically significant at 1%. The Renminbi still ranks poorly as justified by the value of the country’s capital account liberalization.

The results above can predict on the shares of the three currencies, i.e. the euro, dollar and Renminbi in the years to come. With every change in the country’s share of GDP comes a change in the country’s share of currency. This forecast is based on China’s growth in two aspects: the first one is with respect to the historical growth of China in terms of GDP between 1999 and 2008 which was at 9.5%. In the same period, China’s foreign exchange escalated by 3.4%.

The second one is with respect to a feeble growth pattern of the GDP at the rate of 6.0%. In both cases, the underlying assumption is that the all countries uphold a minimal historical rate of growth in GDP.

The prediction for the currency share of the dollar, the Eurozone and the Renminbi thus relies on two benchmarks: the first one is attributed to the assumption that China will uphold the high rate of growth pattern and therefore will have the largest share (31.1%) of the world’s GDP by 2035. This rate will be higher than that of the US and the Eurozone which are projected to be at 13.3% and 14.1% respectively.

The second benchmark is attributed to the assumption that both China and the US might both have a lower rate of growth pattern; this will make them have a somewhat analogous size of their economy come the year 2035. They will each account for 16% of the total GDP, while the Eurozone is expected to have a higher size at 17%. The results in column 2 in Table 4.1 above have been used to predict the future share of the Renminbi over a given period of time. A further assumption is made that China will maintain an average foreign exchange turnover like the US between 2011 and 2020.

If the growth rate for China is moderate, the Renminbi’s share is postulated to increase up to 2.7% come the year 2035. On the flip side, if the growth rate of China is quite rapid, the Renminbi’s share is postulated to increase up to 11.6%. The underlying assumption of these projections was that the sum of the dollar, euro and Renminbi will remain constant.

Therefore, the Renminbi is expected to be adopted internationally when China finally have a full convertibility of her currency and maintain a stable and efficient financial market. In addition, the global central bank is expected to hold at least 8% of the Renminbi as a reserve by 2035. It should however be noted that the growth rate of the Renminbi’s share is not in tandem with the rapid growth rate of China’s share of GDP. This can be attributed to the slow speed of international acceptance.

It is a gradual process for the Renminbi to assume an international currency status. Due to the fact that China has a smaller currency share, the share of the Renminbi in the global central bank reserve in relation to the country’s share of GDP will have a marginal increase. On the flip side, when China’s share of GDP rises rapidly, it is expected that the share of the Renminbi in the global central bank reserve will accelerate rapidly too over a given time period. Actually when the major currencies continue to stumble, the Renminbi might take the advantage to quickly rise.

Conclusions and Recommendations

Introduction

This chapter presents the summary of the findings and discussion of the results in accordance to the objectives of this study. Finally, the chapter contains the conclusions and recommendations.

Summary of the study

The global economy consists of three big giants: the United States, The European Union and the Asian community. Over the recent years, the output of the Asian countries has steadily risen; this has a direct effect on the financial and economic position of the Asian community. It is therefore weird, though, that only the currencies from two giants (the US dollar and the euro) are regarded as reserve currencies. The Asian community feels that they have been ignored. Typically, a global economy composing of three big giants would function best when the currency for each giant assumes the international reserve status.

In line with China’s steady growth over the years and its continued economic expansion with regard to trade, it is so appropriate that the Renminbi should assume the status of an international reserve currency. This is due to the fact that China interacts with very many countries through international trade. For the Renminbi to achieve this status, China should maintain a stable and efficient financial system.

Discussion of the Findings

Based on the findings discussed, the major steps that the Chinese economy has had in the direction of having the Renminbi achieve reserve legal tender status include the engagement with other nations to allow it as a means of exchange within their economies.

This has contributed towards the international acceptability of the coinage, with the nations being especially those in the region of the Asian continent and the Indian Subcontinent. Chinas GDP as stated above has been steadily rising, with the market share of the global trade also increasing and doubling in the last few years. This is also a move to position the Renminbi as the reserve means of exchange.

The Renminbi is a growing coinage with only a few nations allowing it as a means of converting currencies. To achieve the internalisation of the same, it is imperative that the decision making process be based on a number of determinants such as the decision making process that is interlinked and outflows and inflows that are well regulated.

Lustig, Roussanov, and Verdelhan (2011, p. 3731) argue that the other measure that China needs to take is to fully de-peg from the dollar, and this will enable it to have its money as a legal tender. These are dependent on the country itself, and the speed with which China is able to do this will ensure that the status of the Renminbi as a reserve money is achieved much faster.

The Chinese economy is in a better position to have the Renminbi achieve the reserve money status. The Renminbi today is not below the dollar in value owing to its gradual rise for six years in comparison with the dollar resulting in 30% rise from 2005 due to its modification by China. The Chinese money is reported to have weakened against the dollar in the period around the year 2012. This resulted in the tailing of foreign exchange reserves that the nation thought of as being excessive at the time.

The above considerations imply that a likelihood of the Renminbi taking over from the dollar as reserve money is possible, even if this is more likely to happen in the distant future. The Chinese economy will have a significant role to play to oversee this possible change of guard, and so will the external markets and the US in particular.

Implications for Practice

According to Kai Shi (2012, p. 170), China is one of the six nations with the largest economies, and has only recently been ranked second after the US surpassing Japan and Britain among other nations. This growth is a pillar and an important factor in becoming a global power, and one way that the nations want to do this is through having the Renminbi as one of the reserve currencies. A striking characteristic of the imminent takeover of the Renminbi is the relationship that exists between the USA and China both politically and economically.

China has large a federal reserve in dollars, with the two countries being significant trading partners and rivals. The political systems are also antagonistic, and a combination of these two factors could see the transition from the dollar to the Renminbi as the authorised coinage taking a different shape from that observed in the transition from the Sterling to the dollar in the mid-20s.

Recommendation for further Research

The determination of whether the Renminbi is to become reserve money is dependent on the performance of the dollar. A number of crises have hit the American coinage over the recent years, with the recent economic crisis of the year 2008 proving to be an important factor towards this goal.

However, the Chinese financial performance has a greater role to play in determining the fate of this move compared to the role that the dollar and America as the owner have to play. A falter in the performance of the US economy and a poorly performing dollar could both combine to make the transition to the Renminbi money a faster one than expected.

Summary

The paper has the findings that point to an eventual takeover of the Renminbi from the dollar, and these are supported by the favourable response that the money has gotten from the world financial market, backed by strong policies and economic performance of the Chinese economy. Wang and Yi (2012, p. 89) argue that, although the money is in its initial stages of developing into a legal tender, the rate at which the Chinese authorities and the economies are embracing it and marketing it both regionally and internationally prompts a conclusion that it is the money to watch.

However, many currencies have come this close to dislodging the dollar’s dominance only to fall short of the expectations, and it remains to be seen whether the Renminbi will surpass this. The other major observation will be the period that the money will take to rise, since most of the financial analysts have put this time to be in the region of the next decade.

References

Bank of England 1992, ‘The Foreign Exchange Market in London’, Quarterly Bulletin, vol. 32 no.4, pp. 408- 417.

Bergsten, F 2009, ‘The Dollar and the Deficits’, Foreign Affairs, vol. 88 no. 6, pp. 20-38.

Black, S 1989, ‘Transactions Costs and Vehicle Currencies’, Journal of International Money and Finance, vol. 10 no. 4, pp. 512-526.

Castle, K 2010, ‘As the dollar sinks, will the yuan float? Thunderbird International’, Business Review, vol. 52 no. 5, pp. 439-455.

Chien, W 2012, ‘Sibos 2012: RMB will not become a key reserve currency’, Asia money, vol. 23 no. 9, pp. 23-23.

Dai, M 2013, ‘In search of an optimal strategy for yuan’s real revaluation’, Journal of Chinese Economic & Business Studies, vol. 11 no. 1, pp. 29-46.

Detken, C & Philippe, H 2000, ‘The Euro and International Capital Markets, Working Paper No. 19, European Central Bank’, International Finance, vol. 3 no. 1, pp. 53-94.

Detken, C & Philippe, H 2002, ‘Features of the Euro’s Role in International Financial Markets’, Economic Policy, vol. 35 no. 1, pp. 555-597.

Dooley, M & Garber, P 2005, ‘Is It 1958 or 1968? Three Notes on the Longevity of the Revived Bretton Woods System’, Brookings Papers on Economic Activity, vol.1 no. 1, pp. 147–209.

Dooley, M, Saul, L & Donald, M 1989, ‘The Currency Composition of Foreign Exchange Reserves’, IMF Staff Papers, vol. 36 no.2, pp. 385-434.

Eichengreen, B 2011, ‘It May Be Our Currency, But It’s Your Problem’, Australian Economic History Review, vol. 51 no. 3, pp. 245-253.

Eichengreen, B 2013, ‘Number One Country, Number One Currency? Number One Country, Number One Currency?’, World Economy, vol. 36 no. 4, pp. 363-374.

Frankel, J 1995, ‘Still the Lingua Franca: The Exaggerated Death of the Dollar’, Foreign Affairs, vol. 74 no. 4, pp. 9-16.

Greenwood, J 2011, ‘The RMB as a Potential International Reserve Currency’, International Economy, vol. 25 no. 4, pp. 32-32.

Hartmann, P 1998, ‘The Currency Denomination of World Trade after European Monetary Union’, Journal of the Japanese and International Economies, vol. 12 no. 3, pp. 424-454.

Heller, H & Mohsin K 1978, ‘The Demand for Reserves under Fixed and Floating Exchange Rates’, IMF Staff Papers, vol. 25, no. 1, pp. 623-649.

Humpage, F& Jacobson, M 2012. ‘Is the Renminbi Challenging the Dollar’s Reserve Status?’, Economic Trends, vo. 1 no.1, pp.10-13.

Hung-Gay, F 1999, ‘Chinese Banking: Challenges and Opportunities in the New Millennium’, Business Forum, vol. 24 no.3/4, p.2.

Jenkins, P & Zelenbaba, J 2012, ‘Internationalisation of the renminbi: what it means for the stability and flexibility of the international monetary system’, Oxford Review of Economic Policy, vol. 28 no.3, pp. 512-531.

Kai Shi, N 2012, ‘Adjusting the Currency Composition of China’s Foreign Exchange Reserve’, International Journal of Economics & Finance, vol. 4 no.10, pp. 170-179.

Kenen, P 1960, ‘International Liquidity and the Balance of Payments of a Reserve Currency Country’, Quarterly Journal of Economics, vol. 74 no. 1, pp. 572-86.

Kenen, P 1983, The Role of the Dollar as an International Currency. Occasional Papers no. 13, Group of Thirty, New York.

Kindleberger, C 1985, ‘The Dollar Yesterday, Today and Tomorrow’, Banca Nazionale de Lavoro Quarterly Review, vol. 38 no. 1, pp. 295–308.

Kunz, D 1995, ‘The Fall of the Dollar Order: The World the United States is Losing’, Foreign Affairs, vol. 74 no. 4, pp. 22-25.

Lien, D & Li, Y 2006, ‘Spot-futures spread, time-varying correlation, and hedging with currency futures’, Journal of Futures Markets, vol. 26 no. 10, pp.1019-1038.

Lim, S 2012, ‘A Local Currency in a Dollarised Economy’, Modern Economy, vol. 3 no. 5, pp. 671-674.

Lipman, K 2011, ‘Law of Yuan Price: Estimating Equilibrium of the Renminbi Michigan’, Journal of Business, vol. 4 no. 2, pp. 61-90.

Lobo, J 2011, ‘What is the future of the US dollar?’, Journal of Corporate Accounting & Finance, vol. 22 no. 6, pp.3-10.

Lustig, H, Roussanov, N, & Verdelhan, A 2011, ‘Common Risk Factors in Currency Markets’, Review of Financial Studies, vol. 24 no.11, pp. 3731-3777.

Martin, F 2011, ‘Hong Kong and the Globalisation of the Renminbi’, Washington Journal of Modern China, vol. 10 no. 1, pp. 52-69.

Matsuyama, K, Nobuhiro, K & Akihiko, M 1993, ‘Toward A Theory of International Currency’, Review of Economic Studies, vol. 60 no.1, pp. 283-307.

Oberlechner, T & Osler, C 2012, ‘Survival of Overconfidence in Currency Markets’, Journal of Financial & Quantitative Analysis, vol. 47 no.1, pp. 91-113.

Ocampo, J 2010, ‘Building an SDR-Based Global Reserve System’, Journal of Globalisation and Development, vol. 1 no. 2, pp. 243-344.

Prasad, E & Lei, Y 2012, ‘Will the Renminbi Rule?’, Finance & Development, vol. 49 no. 1, pp. 26-29.

Röthig, A 2012, ‘Cross-Speculation In Currency Futures Markets’, International Journal of Finance & Economics, vol. 17 no. 3, pp. 272-278.

Snell, S & Dean, J 1992, ‘Integrated Manufacturing and Human Resource Management: A Human Capital Perspective, Academy of Management Journal, vol. 35 no.1, pp. 467-504.

Stokes, D 2013, ‘China’s Currency Goes Mainstream’, Canadian Business, vol. 86 no.1/2, pp.9-10.

Strange, S 1987, ‘Will the Renminbi Rule? Presistent Myth of Lost Hegemony’, International Organisation, vol. 41, no. 4, pp. 551–74.

Tu, Y, Dai, W & Zhao, X 2013, ‘RII: A New Index for Assessing Internationalisation of Chinese Currency’, Annual International Conference on Operations Research & Statistics, vo.1 no. 1, pp. 69-75.

Wang, Z & Yi, Y 2012, ‘The Characteristics And Heterogeneity Of Conductive Effect On Currency Mismatch From Exchange Rate In China And Asean Countries’, Economic Computation & Economic Cybernetics Studies & Research, vol. 46 no. 4, pp. 89-119.

Whalley, J & Wang, L 2011, ‘The impacts of Renminbi appreciation on trade flows and reserve accumulation in a monetary trade model’, Economic Modelling, vol. 28 no.1/2, pp. 614-621.

Zoffer, J 2012, ‘Future of Dollar Hegemony’, Harvard International Review, vol. 34 no. 1, pp. 26-29.