Introduction

Rationale of the Topic

The author’s discussion concerning retail industry and working capital management has been motivated by living amidst members who operated retail business. This, therefore, signals the presence of in-built experience and cohesion as well as eagerness to evaluate the management of various components of working capital effectively as it is an imperative section of establishing a successful business, especially when it comes to the retailing industry.

Relevance for MBA Study

Essentially, the development of this research is based on the need to explore the chance of raising profits in respect to the opportunities perceived from addressing the impacts of the working capital management. It may have positive effects in the retail industry if the root causes of profit making are established and the factors leading to losses due to mismanagement of the working assets and liabilities.

After establishing the impacts of a working capital management, plans can be put in place to ensure profitability in response to the knowledge attained. There is sizable and concrete information surrounding the tactical approach of using assets and liabilities to improve the profits made by firms. In essence, positive effects on profitability and liquidity of a firm are reliant on this management. Essentially, liquidity and profit making are inseparable in a successful business organization. Like firms, a retail business must ensure that the short-term obligations facilitating the achievement of the ultimate goals are tackled in absolute care.

Aims and Objectives of the Study

This study has a purpose of gaining clearer understanding of working capital management in the retail industry as well as making the suggestions imperative in improving the retail businesses within the United Kingdom as evaluated on five commerce centres from 2009 and 2013. In this regard, the research sought to attain the following objectives.

- Understand the overview analysis of the global current state of working capital management

- Explore the limiting and enabling factors that influence working capital management in Small and Medium Enterprises.

- Explore the firms’ management perspectives in relation to capital management by the SMEs

- Evaluate and classify the stages of adopting working capital management of the organizations under study using at least one of the existing Stages of growth models

- Evaluate the appropriateness of the working capital management by the firms under study

Literature Review

Description of the theories of working capital management

The definition of working capital

According to Lasher (2011), working capital refers to the assets and liabilities required in running a business and sustaining it on daily basis. The liabilities include generally payable and accruals, while the assets comprise of cash, inventories and receivables. An alternate definition from Bartlett (2014) states that working capital refers to entity’s short-term assets which are current assets convertible into cash within the entity’s operating cycle.

Why working capital management is so important?

In the business world, cash is a priority because a company that makes profits can become bankrupt if it is short of cash. Understandably, when a business has insufficient cash to sustain operations, it is vulnerable to fatal financial constraints (Bartlett 2014). In UK, the importance of cash was more evident when the shortage of credit led to a crisis in 2007 and 2008. The survival of a business operation is reliant on meeting its short-term obligations. The ability of an entity to meet its short-term obligations can be defined as liquidity. In other words, liquidity refers to how quickly the business’ assets can be transformed into cash.

Poor management of liquidity means that a business has a lot of cash tied up in capital assets or in working capital so that it is starved of cash to trade.

Typical example of successful liquidity management

- The company’s suppliers are paid in time.

- Borrowings are always easily replaced when they mature.

Typical examples of failure to manage liquidity

- When cash is often tight although the business is profitable.

- When working capital is a higher proportion of sales than for similar companies, and it is growing.

- When capital intensity is a higher proportion of sales than for similar companies, and it is growing (Finch 2011)

The consequences of cash in hand being insufficient

If the firm cannot pay the bill on time as it should, its relationship with its suppliers will be damaged. Consequently, there is a risk caused by reducing credit to the firm and stopping the current account because it can lead to the loss of business as well as the damage of cash flow. The banker of the firm will be affected when they realize its inability to meet payments. This may occur through market information, bounced cheques, or excess borrowing facilities. The larger inconvenience will be higher fees for future services and possible reductions in prospective borrowing limits (Finch 2011).

Benefit of liquidity management

1. Maximising shareholders’ value

2. Profit improvement

3. Capital allocation

Working capital management

Bartlett (2014) stated that working capital management is the administration and organization of the entity’s net working capital within the entity’s working capital policy, and cash flow needs and limitations. This term is used synonymously with liquidity management. According to Vernimmen (2005), working capital is totally independent of the methods used to value fixed assets, depreciation, amortisation and impairment losses on fixed assets. However, it is influenced by:

- Inventory valuation method

- Deferred income and cost (over one or more years)

- The company’s provision policy for current assets and operating liabilities as well as costs.

Working capital components

Inventory

According to Brigham & Houston (2002), effective use of inventory is a key component of working capital management. Inventories can be classified as provisions, raw resources, work in progress, and completed products, which are essential part of almost all business process. The level of inventory depends on sales which must be estimated before the budgeted inventory level is recognized.

The suppliers pay a lot of attention to make the available inventory once they receive customers’ orders to maintain and increase sales (Brigham &Houston 2002).

Every business needs certain level of stocks to maintain customers happy since they can have the inventories immediately once they want. Similarly, production can delay if the materials run out due to shortage of inventories. However, excessive inventories cause unnecessary costs to finance, which could be arisen due to a greater risk of obsolescence, theft, and damage as well as taking more spaces compared to spaces for smaller inventories (Sagner 2011).

Receivables

According to Parrino, Kidwell and Bates (2009), receivable includes trade and consumer credits. Trade credit can be defined as credit extended to another business while consumer credit means credit extended to customers. Business provides both trade and consumer credit since it tends to gain more sales and its competitive necessity to counterpart credit terms offered by competitors. However, the firms which cannot control its credit operation effectively can suffer large debts, loses and big interest payment to finance the receivable balance.

Payable and accruals

Firms are provided trade credit by their suppliers being offered attractive sources of finance. The firms are not required to pay interest for the credit purchase during the grace period. Typically, the firm takes the time for the payment until the end of the grace period. However, late payments can cause penalty charges and bad reputation recognised by suppliers since the suppliers will no longer sell on credit to the firm.

Cash (including marketable securities)

The firm must have cash to meets its financial obligations and to conduct the operation smoothly without the risk of running short. Nevertheless, the downside of possessing too much cash is to increase the costs of finance.

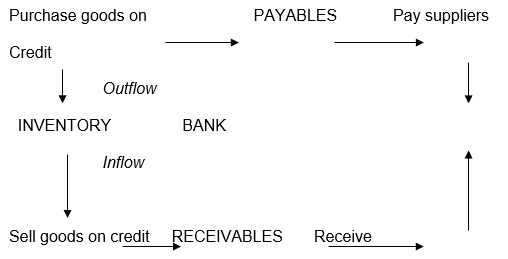

Cash conversion cycle (CCC)

The cash conversion cycle (i.e. the operating cycle or working capital cycle) indicates the period of time for which working capital financing is needed. When the cash conversion cycle is longer, the investment in working capital is higher (Waston 2010).

The time between the firm’s payment to its suppliers and when collecting the money from its customers is known as cash conversion cycle, which measures a firm’s financing gap and can be used to establish the amount of investment required in working capital. It is a time when materials are ordered and receivables are collected less the time over which payables are outstanding. When CCC is increased, the firm needs to finance itself. A shorter CCC represents the firm reduction in its short-term financing costs. It is a most popular tool for working capital management and the length of the cash conversion cycle is calculated as:

CCC= Inventory days+ Receivable days – Payable days

The responsibility of the management for working capital management is to ensure this cycle does not become too long. The action taken to reduce the operation cycle can be represented by the following steps.

- By collecting the receivable accounts quicker in order to cut the receivables.

- By turning over the finished goods more rapidly.

- By reducing the level of raw material inventory.

- By shortening the production period (Aramvalartham 1996).

Working capital policy

Working capital policy is decisions as regards to the target levels of each current assets account and the way in which these current assets are financed. To manage working capital is so important that the company needs to structure clear policies regarding the various components of working capital.

The level of working capital

According to risk return trade off, there are three measures regarding working capital management. Management typically follows one of these three working capital policies. First, there is an aggressive policy regarding the level of working capital means a company adopts to operate with low level of inventories and cash (Bartlett et al. 2014). The company using this policy intends to increase its profit since less cash are tied up in the current assets. However, it is the high risk strategy since the probability of shortage of cash or inventories supplies can be happened (Waston 2010).

If the company chose to carry higher level of inventories and cash balance, the company in question uses policy called conservative which is more flexible working capital policy and it gives rise to increase liquidity but it will cause reduced profitability.

Maintaining a level of working capital amid violent and conservative is called moderate policy.

Risk return trade off

According to Hampton (1989), the objective of managing working capital is to support the long term operational and financial goals of the business. Recognising the relationship between risk and return is involved. There are three elements to analyse trade off between risk and return when managing working capital. When working capital is managed, three elements must be considered for analysing the trade off between risk and return.

Insolvency

This can be happened when a firm has no ability to pay its bill and possibly declare bankruptcy. A firm with inadequate levels of working capital has to face this problem.

Profitability of assets

Holding different level of current assets will impact on the profits of the firm since higher level of inventory required higher costs of financing. However, a firm may have a wide range of goods to sell to create higher sales and profits. Therefore each level of cash, receivables and inventory needs careful consideration.

Costs of financing

To carry inventory, it needs financing. When the interest rate for financing is high, it will cost more. When there is large cash balance, it cannot earn the profit since cash cannot be converted into operating assets.

Ratio analysis

According to Collier (2012), ratio analysis is the most important tool used to analyse the financial statements. Ratio analysis can be used to help interpret trends in performance year on year; by benchmarking to industry averages or to the performance of individual competitors; or comparison against the predetermined targets. Ratio analysis can be used to interpret performance against five criteria:

- The rate of profitability

- Liquidity

- Gearing, i.e. the proportion of borrowings to shareholder’s equity

- How efficiently assets are utilized and

- The returns to shareholders.

The ratio analysis can help us determine how the firm’s performance has been changed over time and how it can be compared with other competitors in the same sector. There are three kinds of ratios (Hampton 2011). They are liquidity ratio which examine the adequacy of funds, the firm’s ability to pay its obligations when due; profitability ratio which measures the efficiency of the firm’s activities and its ability to generate profits; and other ratios.

Profitability ratio

Profitability ratio indicates how successful the managers of a company have been in generating profit. The ratios can be named as follows: return on capital employed, net profit margin, net asset turnover, and gross profit margin among others (Watson & Head 2010).

Activity/efficiency ratio

Shows how effectively a company has managed short-term assets and liabilities, i.e. working capital, and they are close-linked to the liquidity ratios.

Trade receivable days, payable days, inventory days, sales/net current assets, etc. For the working capital management, these ratios are very crucial (Watson & Head 2010).

Liquidity ratios

Useful overall indicators of liquidity can be calculated from balance sheet either stationary or management accounts. The most powerful are the current ratio, the acid test ratio and capital intensity.

Internal liquidity ratio allow the judgement as regard to how to cope with the short term financial obligations –working capital or current ratio, and quick ratio etc. (Arnold 2013).

- Working capital (or current ratio) is the ratio of Current asset and current liability

- Quick ratio (or acid test ratio) is the ration of current asset and inventory/current liabilities

- Capital intensity produces a unit value of annual sales; this is net assets divided by sales. Alternatively, this can be calculated by fixed assets or grossed fixed assets (which add back depreciation) as a percentage of sales.

- The current ratio measures how easily the immediately liquid and the quickly realisable assets could cover immediate liabilities (and world usually be expected to exceed them by two times).

The acid tests take the more cautious view of how quickly stocks could be turned into cash and discounts them (though it would normally be expected to exceed 1).

The more important consideration is probably what changes are occurring if the ratios are deteriorating, which can be cause for concern.

Gearing ratios

The gearing ratio reflects the balance between long term debt and shareholder’s equity. It changes as a result of changes in shareholder’s fund, raising new borrowings and repayments of debt (Collier 2012).

Needs for working capital

The manager can decide the requirement of working capital of the firms based on three factors.

Volume of sales

A firm needs to maintain its current assets in a steady proportion to support its annual sales. As the volume of sales become bigger, the current assets will also become greater. In general, the current assets will be held 20% to 40% of sales. When the firm has plans to increase revenue, management should also have plan for the growth accordingly.

Seasonal or Cyclical Factors

Most business experience seasonal fluctuations in the demand for their products or services. Such variation in sales will affect the level of variable working capital.

Technological Development

As the development of technology is improved, it will also affect the requirement of working capital, in particular, production process.

Firm’s Philosophy

The firm’s policies will affect the levels of permanent and variable working capital. If the firm collects its debts forcefully, then the level of receivable will be lower. Some firm may maintain larger cash level than those of similar firms that are willing to run with less liquidity (Hampton 1989).

Levels of working capital

Size of the entity

Larger firms need larger level of working capital than smaller ones.

When the smaller firm can easily be affected by the bad debts made by customers, the larger firm can survive since it can benefit of having wider range of resources.

Activities of the firm

The nature of the firm can affect the level of working capital. When the firm is providing services only, it may not require inventories.

Attitude towards profit

The carrying cost of current assets has cost to the entity. Therefore, a firm has comparatively large amount of current assets are likely to reduce the firm’s potential overall profits. Some firms have desire to take greater liquidity risk to enhance higher profits. On the other hand, other firms which do not maximise their profits do not deal with liquid assets aggressively.

Attitude towards risk

The opposite side of attitude towards profits include risk. If there is larger level of working capital, there exist lower risks because the inventory is available for meeting the customer’s needs anytime, which eliminates the risks of running out of goods and customer’s dissatisfaction. Similarly, cash supply the protection for paying due bills. Firms which reduce those risks are likely to carry more current assets than firms willing to allow the higher level of risk.

Estimating working capital requirements

There are three methods for forecasting working capital needs of an entity (Aramvalarthan 1996).

- Percentage to sales method

- Regression analysis

- Operating cycle Approach

Forecasting using percentage of sales method

Managers often use the percentage of sales method to compile forecasts. It is traditional and simple method of determining the level of working capital and its components. This method assumes sales as the biggest driver for working capital and it is determined on the basis of past experience.

This method is simple, easy to understand, and useful for projecting relatively short term changes in working capital. However, it is not suitable for universal application because the assumption of linear relationship between sales and working capital may not hold goods in all cases (Aramvalarthan 1996).

Objective forecasting

Historic information can be used as guide to predict the future. Past results are analysed using mathematical models (mostly based on regression analysis) from which a trend is established to forecast possible future outcomes.

Subjective forecasting

In some instances, historical data relied on heavily with objective forecasting is unavailable or unusable. In this situation, the only alternative is to use subjective forecasting. In this type of forecasting, the individual or group estimates the future sales, which can then be used to derive working capital requirements.

Ukaegbu (2014) investigated that the relationship between working capital management and corporate profitability as measured by net operating profit and cash conversion cycles using the balanced panel data of manufacturing firms in Egypt, Kenya, Nigeria and South Africa. Ali (2012) examined the relationship between working capital management and profitability as measured by cash conversion cycle. The data used in the study are collected from the 1063 companies in Tehran stock exchange. The study used multiple regressions and Pearson’s correlation analysis to test hypothesis.

The outcomes show a significant negative association amid inventory turnover days and profitability. In addition, there is a direct significant relationship between number of account receivable days and profitability, direct significant relationship between number of account payable days and profitability, and there is a negative strong relation between cash conversion cycle and profitability (Ali 2012). The study concluded that working capital management has a great impact on the profitability of the companies and by decreasing receivable and inventory balance, the managers can create value for the companies’ shareholders.

Mansoori & Muammad (2012) discussed the effect of working capital efficiency on firm’s profitability. They have studied using the panel data analysis, pooled OLS and fixed effect estimation on a sample of Singapore firms for the period from 2004 to 2011. The study revealed that managers can increase profitability by means of effective management of working capital. Additionally, managers can improve firm’s profitability by decreasing receivable conversion period and inventory conversion period.

In Sri Lanka, Nimalathasan (2010) conducted a study to examine the impact of working capital management on profitability of the manufacturing companies for the period of 2003 – 2007. He used the ROA for the measurement for profitability. Using correlation and regression analysis indicates that cash conversion cycles and return on assets are negatively correlated. Moreover, while increasing level of inventory conversion periods (ICP), return on assets (ROA) will be increased. An increase in the number of day’s cash conversion cycle results in declining in ROA. The outcomes revealed that the manager can improve the profitability of manufacturing firm by means of lowering the day’s inventory and accounts receivables.

Saghir, Hashmi & Hussain (2011) conducted a study to investigate the relationship between working capital management and profitability. They collected the data of a sample of 60 textile companies from Karachi Stock Exchange (KSE) over the period from 2001-2006 and they observed 360 companies, using Pearson‘s correlation, model summary and ANOVA analysis. The researchers applied CCC and its components of receivable, payable, and inventory days as proxy as independent variables to analyse the study, while using ROA as dependent variables (Saghir, Hashmi & Hussain 2011).

They have found that the negative connection between profitability and CCC. In addition, the research revealed that less gainful companies take long to disburse their suppliers and benefit from its credit periods (Saghir, Hashmi & Hussain 2011).

Moreover, the study suggested that the firm needs to decrease their receivable balance to increase profits. Likewise the less profitable firm needs to reduce its inventory level to maximise its profit by decreasing its cash gap.

Ebenezer and Asiedu (2013) highlighted that most firms invested a large amount of cash in working capital after using correlation and regression tests on the data collected from Belgium firms. The investigations of Ebenezer and Asiedu stipulated that there was a considerable contrary association between the gross working income and the payable, receivable, and inventory days (Ebenezer and Asiedu 2013).

Ebenezer & Asiedu (2013) elucidate the effect of working capital management on the profitability of companies on the Ghana Stock Exchange. They used three measures of working capitals to examine the effect on profit by the working capital management. They identified the major components of working capital management such as inventory days, account receivable days payable days and cash conversion cycle have significant impact on the profitability of manufacturing firms. In 1989, Kamath conducted a study on retailing firms and his finding revealed that there is negative correlation between cash conversion cycle and profitability.

In Taiwan and Japan, Wang (2002) discussed that the relationship between liquidity management and operating performance and that between liquidity management and corporate values for firms in Japan and Taiwan. The result indicates that the aggressive liquidity management boost operating performance ,which means lesser investment in working capital can create more profits for the firm and also is associated with higher cooperate value.

Eljelly (2004) developed a study on the relation between profitability and liquidity by measuring the current ratios and quick ratio of the data collected from Saudi Arabia firms. Applying correlation and regression tests suggested that there is considerable negative relation linking the firm’s profit income and its liquidity. Additionally, the study found that the impact of cash gap has more influence on profitability than the current ratio on it as a measure of liquidity and the size of the firm is dominant at the industry level (Nzioki et al. 2013).In addition, the conclusion indicates that cash conversion cycle is less important at the labour – intensive sector for instance, services.

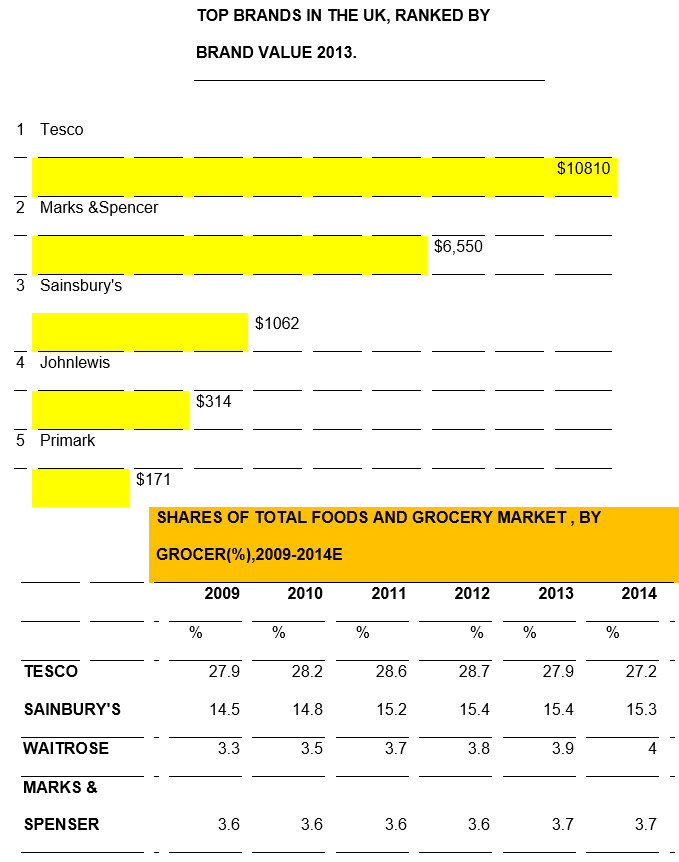

The UK economy and the retail industry

Since August 2012, when the UK prime minister launched the trade and investment program to support the retail industry, the sector has grown adversely and established decisive strategies that promote the economy of the nation. The program was aimed at delivering five hundred million pounds towards developing the industry until 2015. Primarily, the retail industry takes more than ten percent of the human resource employment, provides 5% of the total economic achievements, and issues about 18 billion pounds of tax annually. The initiated program allowed retailers to export and import products efficiently. In 2013, the overall income from exports was 813.2 billion whereas the imports accounted for 782.5 billion.

BBC reported that retailers had positive expectations around August 2012 when the lobby group distributive centre survey had revealed 51% achievements on trade with only 14% failures from the assessed population (Economic growth forecast upgraded by BCC 2014). The intensities of sales had grown adequately in most business sectors including chemists, groceries and furniture among others. The UK has been having a changing retailing services demanding keen management to warrant success in the trading practises.

These practises are mediated by the application of the prevailing information technology especially with the use of internet in selling, buying and marketing goods and services. The use of internet has been growing adversely in the UK where customers shop online and evaluate products within the best internet markets. While incorporating the delivery of goods and services to merchants, most retailers do not have these services and therefore are potential targets in making the delivery of services easier and efficient. (Thuvarakan 2012)

Tesco PLC

According to Davies and Crawford (2014), Tesco is operating globally in countries such as India, South Korea and Turkey among others. It offers banking and insurance services to retailers through a subsidiary company. In the UK, this company operates more than 3000 stores, which acts as the centre for dispersing goods to the retailers. Some stores are used to handle customer complaints and demands and therefore has employees receiving and tackling information accordingly.

Their dispersion centre commands transport for shopping performed by customers to a specified location. The company has more than one thousand and five hundred click and collection points for the common customers and SMEs as well as one hundred and fifty grocery drives in Britain. The net income rose from below one percent to L63.56B prior to unusual items towards 25% to L1.92B. The calculations of revenue indicate that the Asia section increased by 3% to L10.28B where as Europe made a decrement of one percent to L9.22B. On the other hand, the United Kingdom depreciated by below 1% toL43.06B leading to the ROE decrement of one hundred percent to L9.2M

Johnlewis

The company operates in three segments: John Lewis, Waitrose and Corporate, and other. According to Ebenezer and Asiedu (2013), for the financial year end 26 January 2013, the company revenues increased 9% to L8. 47 B., while net income increased 11%to L151. 5M. Revenue reflects an increase in demand for the Company’s products and services due to favourable market conditions. John Lewis is also successful in E -commence like other UK retailers. The retailer enjoyed 31.4 percent on year growth online sales.

Methodology

This chapter explains what approach our research was done and what methods were used. The aim of this research is to working capital management with regard to the UK. We utilise the secondary data from FAME data base to examine the association between working capital management and profitability of 5 retail companies in the UK for a period of five year from 2009 t o 2013.Further our research methodology will utilise the quantitative analysis. We are using the quantitative method to analyse our problem using financial data collected from the FAME data base.

Sampling method

Purposive method was used as a way of soliciting respondent participation in the study. This method is preferred because the study has specific questions that it would like to answer at the end of the study. In addition, the method is founded on the cannon that the researcher set out to single out likely informants from the study (Raheman & Nasr 2007). As such, the researcher’s choice and judgment as well as the base in which SMEs participate in the study were used.

At the beginning of the study, the researcher obtained a list of firms from the relevant government data centre like the FAME database. This was helpful since it had various classifications that include the industry in which the retailers operate. Therefore, the researcher chose a list of businesses from the available list and made telephone calls to validate their actual existence and physical location. Also, the researcher sought the company approval to participate in the study. A corporate visit was made to the companies in order to request for an appointment with the relevant officials who could provide the necessary information (Nandi 2011).

However, the researcher made a pre-interview observation of the state of the organization state of retailing in order to ensure that the organization has the ability to provide information that is suited to meet the objective of this research (Raheman & Nasr 2007). Therefore, the participating organization must have adopted at least some elements of e-commerce such as the use of internet and email application. Another criterion used in the firm involved companies that had previously used the e-commerce platform, but it no longer uses it.

On the upper side, the organization should have the ability to conduct online payments and purchasing through their website or in collaboration with other ICT application. As such, the sampling criterion represents a sample that ranges from the least application of capital management to the most advanced one.

Data Collection Procedures

Document and Website Analysis

The researcher established and maintained a diary of the activities and the patterns of the management styles which were based on the information provided by their websites. Therefore, this will facilitate the researcher to make necessary investigations on the SME webpage content, its purpose and status in relation to the short-term liabilities and assets. For organizations that did not have informative webpage, other documents were used that included marketing materials, FAME database and CD-ROMs.

Direct Observation

The researcher obtained the permission to make unplanned visits to enable making of observation in relation to the function of capital management and retailing process without the company without potential changes in the normal schedules. The main focus was to evaluate the general statement that the managers made in relation to capital management and the ease of answering a random question that relates to it in their organization and its future.

Data analysis

The process of data analysis and data collection in interpretative case studies usually happens simultaneously even though they are explained in different sections. Therefore, the researcher analyzed the collected data systematically. The information that is obtained is analyzed using the themes as outlined by Shin and Soenen (1998). First, the data collected was reduced. Data reduction is the procedure in which data is selected, focused, abstracted simplified and transformed from its field remarks. This process is in operation throughout the whole process of the quantitative and qualitative study.

As such, data reduction begins as soon as the researcher embarks on collection process. As such, the researcher presented the interviewee with a verbal presentation on what the researcher understood to be the employee responses and companies’ financial data. A list of the responses against every respondent was tabled based on the research question that each response relates. The researcher, then, provided the organization with an understanding of the responses.

The data was used passed through various approaches of analysis referred to as deductive and inductive. According to Saunders (2009), deductive approach refers to the style where a theoretical or conceptual framework is developed to subsequently test using data. On the other hand, the inductive approach was applied to explore data and develop theories from the analysis according to the prevailing literature.

Descriptive analysis was applied to create sense from the data collected in the companies and FAME database. According to Saunders, Lewis and Thornhill (2009), descriptive statistics enable to describe (and compare) variables numerically. This was done first in the analysis. Relevant theory of cash conversion cycle, return on equity and the each appropriate variable were provided.

The initial sample composed of 5 companies for the period of 2009-2013. The variables used are as follows:

- ID: inventory days

- RD: receivable days

- CD: creditors days

- ROE: return on equity

- OPM: operating profit margin

- NPM: net profit margin

- CCC: Cash conversion cycle

The quantitative analysis was applied through Pearson style to tests whether the two variables are associated. Therefore, the study used Pearson’s correlation coefficient:

- Variables

- Dependent variable

- Profitability

- Return on Equity (ROE)

The dependent variables is profitability placed as Return on Equity (ROE)

According to Parrino, Kidwell & Bates (2014), return on equity (ROE) measures net income as a percentage of the stockholders’ investment in the firm. The return on equity formula is as follows.

ROE= Net income/ Total equity

This ratio is computed as Earning after tax and preference dividends divided by Shareholder’s funds.

Independent variables

The independent working capital variable comprises of receivable days, payable days, inventories days and CCC (Mohammad 2011).

Cash Conversion Cycle (CCC)

The term cash conversion cycle was first introduced by Hanger (1976) and many researchers have been using it.

The cash conversion cycle can be defined as the sum of receivable days and inventory days minus payable days.

Receivable days (RD)

Receivable days can be defined as the average length of time that is required to alter the receivable balance into cash, which can be calculated as receivable balance divided by annual credit sales and multiply by 360 (Mohammad 2011).

Creditor days (CD)

Payable days refer to the average time taken between the purchase of raw materials and labour and the payment for them. This is computed as accounts payable divided by fee of the sold products times three hundred and sixty.

Inventory days (ID)

Inventory days can also be defined as the standard period needed to change the raw material into products and vend them to customers. It can be computed as inventory divided by annual cost of goods sold multiplied by 360 (Knauer & Wohrmann 2013).

Data display is the other second stage in data analysis. This process involves organization and compression of information that enables the researcher to make meaningful drawings and take the necessary actions. This may involve the use of matrices, networks, charts and any other tool that may make it possible to compact the information into a format that can facilitate advanced interpretation.

From the begging of the study, the researcher should always draw preliminary observation and meaning from the data that is provided. As such, the researcher keeps a note of patterns, explanations, possible configuration, casual flow and preposition and regularities. This is in accordance to the interactive cyclical process (ICP) that points out activity and data collection forms the ICP. As a result, the four stages had to be traversed in order to make acceptable conclusion.

The researcher organized the notes and the scripts that relate to the managers’ response to ‘what it meant in the organization’ and ‘what working capital management was’. Furthermore, the scripts and notes were organized to bring out the responses and the difference in each case study. Therefore, the organizations were based on the following themes namely the factors affecting working capital, critical factors that had the most significance in motivating positive change in working capital management, barriers discouraging its effective control, nature and business characteristic of the retailing and management perception and capability in taking advantage of capital management and influence of external environment.

In undertaking cross case analysis, the method of pattern clustering and contrast was applied. This was done to produce the matrices. The data was applied in pairs then later analyzed in-group based on the industry that each SME operated with aims of establishing differences and similarities presented by the data. The analysis was expansive to include the emerging issue that the researcher noticed in the data and developed a comprehensive conclusion. The new finding was captured and used to make a comparison with the information obtained from the industry stakeholders.

Research contribution refers to the ability of a given piece of work contributing to the intellect of people. Therefore, a good interpretive study offers a contribution to the field of information systems. This study makes a contribution in understanding various aspects in working capital management through answering the research question and fulfilling the study objectives. Therefore, the finding establishes the top inhibitors and enablers in adoption and development of e-commerce in SMEs. The responses obtained from the respondents are the most relevant practical implication because they explore the issue that affects the adoption of SMEs in totality and assists in ranking them. Also, this offers the chance to observe the nature and similarity of barriers and enablers that manifest in various retail businesses.

Analysis and Findings

Quantitative Analysis

This study must incorporate quantitative and qualitative analysis because the data will have the two aspects. This analysis will involve the computation of mean, mode, and variance of quantitative data. The mean will provide the overview of respondent’s general view about the problem. The mode will seek to analyze the number of responses with the highest number of responses to determine the intensity of each view.

Lastly, the variance will aim at investigating the distribution of the views in accordance to the respondents. In addition, the variance will provide the basis of computing the standard deviation that shows the deviation of view from the general overview as stipulated by the mean. Moreover, quantitative analysis will involve the computation of “p” test using ANOVA to determine the rejection of null hypotheses. In this case, the null hypothesis will be rejected when the “p” values are less than 0.05.

Qualitative Analysis

Qualitative analysis will be conducted in the following steps.

- Reading the responses carefully and coding them.

- Determination of the relevant themes and making a thematic summary.

- Interpreting the findings by analyzing the impacts of the responses.

- Triangulation of sources.

- Making conclusions and recommendations while compiling a draft report.

- Seeking the validation of feedback.

- Communicating findings to the relevant authorities for implementation.

Variables

The variables of the envisioned research will include various factors. In regard to the qualitative ones, the research will include variables such as gender, nationality and working level. In this case, oppression of migrant workers is mostly evoked by these factors. For example, the native employees discriminate between the migrants and native job seekers. In addition, ethnicity of the migrants is of utmost importance because the natives focus on it profoundly when mistreating the migrants. Gender is an additional variable which affect the treatment of migrants. This variable has been very relevant to the research studies concerning capital management.

There are various measures that will ensure the reliability and validity of the entire research. These measures ensure that the final results can be used in making relevant conclusions in regard to the topic of study. These measures are applied during sampling, data collection, and analysis. During sampling, the sample population will be collected using random purposive method. This implies that it will incorporate the ideology of randomization and purposefulness (Stein & Kohlmann 2010). Randomization will help in ensuring that the sample population is not collected in a manner that obtains biased results.

On the other hand, purposefulness ensures that the sample population includes the people who only have the relevant information concerning the oppression of migrant workers (Sheu & Tang 2009). In addition, the population will be stratified such that it has three stratification including migrants, church leaders, and government officials. This will ensure diversity of opinions in the data obtained.

During data collection, flexible questionnaires may ensure that the inquiries can allow for manipulation of question. The manipulation of questions allows inclusion of new themes and removal of irrelevant themes during the study. This implies that most of the issues conjoined to the problem are considered (Shibata & Kihura 2010). The questionnaire will have clear questions so that the query could lead to the same answer even if the question is posed severally.

Analysis of data can also be conducted in a manner that purports reliability and credibility of research. In this case, the analysts examined data during and after collection. This is known as parallel analysis. It ensures that the questionnaire is updated to include the relevant themes and exclude the irrelevant ones according to the opinions emerging from respondents.

It is evident that the research problem arises due to some issues regarding the social, political, and economic aspects. These aspects form the broad context of the entire research because the problem is the sole basis of research. Additionally, the discussion has shown that the research has considered the reliability, credibility, and validity of the results.

The Quantitative Tables of CATAR, CASR, ROA and ROE

Finding and Discussion

This section of the study shall present the finding that the research has made. Therefore, this will be the information that was gathered from decoding the meaning of the data that was collected. As such, since the data has now been transformed into information, the discussion section embarks on linking the finding to the existing body of knowledge. This will provide a practical explanation to the findings that the researcher has obtained.

However, the finding may not be explicitly explained by the existing body of knowledge since the research may come up with a new concept or theory that may not have been in existence. The researcher shall then present this new knowledge in this part and explain the meaning of the findings that have not been captured by the information that is already in existence.

Limitations of the Research Design

The data collection designed is based on the willingness to participate of the companies. However, the top management may agree to take part in the research but the managers who are supposed to be the respondents on behalf of the organization may not appreciate the research initiatives of the researcher (Ajanthan 2009). This can pose a threat to prolong the budgeted period that had been allocated to undertake the study. Furthermore, it is difficult to switch to another organization in the event that one of the chosen study cases fails to comply as earlier agreed.

The selection of the SMEs to participate in the study did not follow any scientific randomization process. However, the processes used judgmental sampling technique. This method is limited in its application since it is not possible to establish a pure random sample since randomness is affected by purpose. Therefore, it increases the effect of systematic error. The researcher will have to inspect the chosen organization to ensure they establish a range from the one with the highest adoption to the one with the lowest adoption. This may pose a challenge in making the differentiation.

The study is limited to SMEs in the UK. In any finding, the conclusion is primarily targeted to address the issues that affect the SMEs. As such, this study shall not touch on the large corporation hence intentionally eliminating the large corporation from participation in this study.

In the data analysis, the process was tedious and highly based on the researcher’s judgment since he decoded the information obtained from the respondents. As such, human weakness of biases may affect the outcome of the finding slightly. Also, developing the themes that were used to compress was based on a model which has its own assumptions. In addition, the application of a hermeneutic circle requires high understanding of the subject matter. As such, the research was dependent on the extent of the researcher’s understanding and ability to seek extensive knowledge regarding the subject matter.

Audit Recording

Working Papers

According to ISA230, the auditor is obliged to document all the information that is gathered as evidence that will be relied upon during the formulation of the audit opinion. The evidence obtained is stored in terms of working paper sufficiently detailed and completed such that an inexperienced assistant can use to ascertain the work carried out by the audit team. In the papers, the auditor must record all the evident that are available to him at that time, the management view and the conclusion that is reached. However, standards working papers have been developed to improve on the accuracy of keeping audit evidence (Cerson 2008). The papers have been developed in a manner that each audit firm has its specification of reporting the found information.

The Permanent Audit File

The file contains document and matters that are of importance in more than one audit period (Kumar and Sharma 2005). The permanent file contains;

- Statutory materials that governs the process of audit

- Rules and regulation that governs the operation of the firm such as memorandum of association and articles of association

- A list of directors and service contacts

- List of company advisors, layers, bankers, values and stock brokers

- The organization history of reserves and share capital

- Accounting policies that are used on material accounts such as depreciation and inventory management

- Copies of continued importance to the auditor such as the minutes that were written in the appointment meeting of the auditor, indemnities and guarantees

- Address of registered offices and all other premises and a brief elaboration of the client’s nature of work that is carried out in the premises

The Current File

The file contains matters and documents that relate to only the current audit period. These matters and document are;

- A copy, signed by the directors, of the accounts and items that are being audited

- A file index that serves to outline the content of the file

- The description of the organization internal controls that is presented in the most suitable form such as a flow chart diagram or any other form that best suites the situation

- An audit program that outlines the details of the audit procedure and objective that relates to each item being audited

- Records that shows the question that were raised during the audit process

- A schedule of items in the statement of financial position and audit procedure that relates to each of them

- A schedule of all important statistics such as liquidity ratios and sales composition

- A copy of the minutes of directors or any other meeting that the auditor considered important to the work

- The management letter that sets out the weakness of the internal

- A checklist that is used to evaluate compliance to statutory disclosures

Audit Report

Report on Financial Statement

We have conducted an audit on the financial statement of Procter and Gamble Limited, which consisted of Statement of Changes in Equity, Comprehensive Income Statement, Cash Flow Statement and Balance Sheet as at 31st December 2013, a summary of accounting policies and other relevant information as set on pages BB to CC.

Directors’ Responsibilities for the Financial Statement

The company directors have the responsibility of preparing financial statement with the aim of giving a true and fair value of Procter and Gamble in accordance to the financial reporting standards and the companies act. Also, the director has the responsibility for such internal controls that they may find necessary in order to facilitate an enabling platform to prepare financial statements lacking material misstatement whether of fraud or error.

Auditor Responsibility

The role to issue an audit view is based on the results of the audit. We conducted the audit as per the specification of the acceptable and approved audit standards. The principles demand that the auditor should ensure that ethical requirement are met, planned and performed for the audit to gather adequate assurance on the financial report about whether they are freed from any fraudulent or non-fraudulent misstatement.

Audits involve carrying out various measures in order to collect prove about exposures and amounts in the financial reports. The steps conducted are determined by own judgment depending on the evaluation made in regard to the peril of material misstatements in the financial reports. In conducting a risk evaluation, the internal controls pertinent to the firm’s preparation of the financial report that capture a factual and fair value in order to generate the suitable audit procedures to the prevailing circumstances were considered. However, the evaluation is not conducted to issue an opinion on the effectiveness of the internal controls. In spite of these, we are convinced that the audit evidence obtained is sufficient to form the base of our audit opinion.

Opinion

It is our opinion the financial statement gives a true and fair value and financial statements meet the expectation of the company’s act and international financial reporting standards.

Other Matters

The report is made with the sole purpose of being used by the members of the firm in accordance as per companies act requirement and other legal provision and for no other purpose. The auditor will not assume any responsibility to a third party due to this report.

Content of Management Letter

The company Act does not require the auditor to issue a management letter. However, bet practices recommend that the auditor issues a management letter to the firm management with an outline of the internal control system strengths and weaknesses as well as material issues that arose during the review of the financial statement.

Sample Management Letter

In planning and performing the audit procedures on Procter and Gamble financial statement in accordance to the accepted standards and legal provisions, the audit team considered the internal control as a base to structure the audit plan design, procedure and procedure for the purpose of generating the audit opinion on the financial statement, but not, under any circumstance, express an opinion on the company internal control system.

However, during the process of conducting our audit, out audit team became aware of certain areas in your internal controls that can present an opportunity to improve on the company internal controls and operating efficiency. Unclassified network and information system was the most notable vulnerability in the controls. Our team noted the vulnerability mainly in department unclassified computer information system.

The vulnerability exposes the company to malicious alteration if data and unauthorized processing of the same. The management of the firm should consider implementing policies and procedures to improve network and information system security (Gill, Bigger & Mathur 2010). Moreover, it outlines other deficiencies and material weakness noted during the audit. Also, the document has recommended various measures that can be implemented to improve on the system.

We appreciate the professional and courteous assistance that your staff offered our audit team during the audit process. We will be glad to discuss and work together on the recommendation at any time.

An international business does carry out activities and transactions worldwide. It is involved in the buying and selling of products and services in various world destinations that have different currencies. In order to effectively transact, an international logistics company must determine the currency that it is going to transact with. It may decide to transact using the currencies of the diverse business locations, but this exposes it to challenges since it requires expertise in that area.

The company must be able to determine the currency needs of the business destinations, devise ways to avoid or tackle the arising currency risks, and therefore make profit from the endeavours. Failure to do so will require the company to behave as a currency speculator which may not be favourable as the company may lack the expertise required in that field. Moreover, the company has to reconcile its home country currency with the value of international currencies in order to abide by the proper financial reporting as required of companies.

The company also faces currency risks due to the currency fluctuations in destinations where it is doing business. Such currency fluctuations are known as currency exposure. Currency exposure can affect the company in many areas such as the profit and loss account and the balance sheet. It is upon the company to have the skills necessary to deal with the exposure where the business size in a location is considerable. For instance, the company may enter a contract with another company in a foreign country for an agreed period. If the currencies of the foreign country depreciate relative to the home currency before the actual payments are made, the company experiences a loss.

Qualitative method of assessment is used when the risk being evaluated does not lead to quantification or the amount of data that is needed to effectively quantify the risk is not available while the quantitative analysis is used in sophisticated projects where the precision required is high (Fabozzi 2010). Therefore, in order to get a consistent measure of risk that will offer credible outcome, for both qualitatively and quantitatively, various measurement scales are used.

Nominal measurement scale is regarded to be the simplest measurement tool. The scale groups events into categories and analyses them to obtain the risk (Besley & Brigham 2012). However, in this scale, the numbers that are used in this evaluation are only for identification purpose only. Ranking of importance of each category is also not applied and each item is analyzed individually hence items cannot be ranked, ordered or added (Fabozzi 2010).

Ordinal measurement scale is the other tool. The scale lists the events that are being analyzed in the order of their importance in a ranking order along the scale. Interval scale is based on intervals of equal intervals while the ratio scale is based on the relative assumption between the events that are involved in that one risk is considered to be a number of times more significant than the other. Nominal scale and ordinal scale are regarded as the qualitative scales while ratio and interval are considered to be quantitative in nature.

In most cases, quantitative approach is dominant over the qualitative approach. Therefore, quantitative approach has enjoyed more developments in techniques that are applicable than qualitative approach. Probabilistic technique is the main approach that is applicable in the quantitative approach. However, this is a general classification of specific techniques that use the concepts of probability. Value at Risk is one of the specific techniques used.

The method is founded on the assumption that the alteration of the value is not expected to exceed a given value within a set confident limit. The method is mainly applied in a situation whereby there are extreme ranges that have infrequent tendency to change such as the risk of incurring losses at a confidence level that is not expected to exceed 99% confidence limit (Gunn 2009). In some cases, the method is utilized in capital requirement rationalization through the estimation of the capital that is required to cover the possible losses. Moreover, the technique is used in market risk that is used by firms in trading to evaluate the exposure in which the organization is exposed to when the price of a security is altered (Gunn 2009).

Cash flow at risk is another probabilistic technique. The method has a high degree of similarity with the value at risk value. However, the distinction between the two methods is cash flow at risk is used to make an estimation regarding a change in the cash flow with respect to the expected cash flow within a certain confidence limit that is not expected to be exceeded in a given period (Gunn 2009). The method is highly applicable to businesses that are highly sensitive to the changes in cash flow that are related to the non-market price factors.

Earning at risk is another probabilistic technique. Similar to the cash flow technique, the method is conserved with measuring the change in the organization earnings that are not expected to be exceeded given a set confidence interval in a given period that is based on the normal distribution curve of the accounting earnings of the firm.

Loss distribution techniques refer to an approach that applies non normal distribution to compute maximal losses that may results from operational risks at a given confidence level (Fabozzi 2010). The analysis in this model requires that operation loss data must be linked with the cause of the loss.

Back testing refers to the comparison of the organization entity at risk with the corresponding profit or loss. The company will compare the actual profits with the output that is generated with their risk model output with the aim of establishing the quality and the effectiveness of risk assessment systems (Fabozzi 2010). However, this method mainly works for a financial institution and some service institution.

On the other hand, there are non-probabilistic techniques used. The methods involve the concept of distribution but they do not apply the likelihood of the occurrence of the event (Afza & Nazir 2008). The commonly used techniques are sensitivity analysis, scenario analysis and stress testing.

Sensitivity analysis is applied to evaluate the changes that are routine. The method is preferred in most cases due to its complimentary role to the probabilistic approach. Moreover, it is considered simple to compute and understand. Sensitivity analysis is applied in conjunction with operation measures (Hampton 2011). Sometimes, it is applied with equity betas.

Scenario analysis analyses the impact of an organization objective that is, as a result, of various events occurring. In most cases, this approach is utilized together with business continuity planning and projecting the effects it may have on the entire organization (Hampton 2011). Also, current market trends indicate that the scenario analysis has become an important tools that are used in linking risk, growth and return in that a risk is evaluated in terms of the value they add to the shareholders.

Stress testing is used to evaluate the events that have high impact on the organization. The method is a compliment to the probabilistic techniques in situations that an event has a low likelihood of happening, but has an extreme impact on the organization. Also, the technique concentrates on one event under extreme circumstances as opposed to paying high end attention to normal changes (Hampton 2011).

After effective risk assessments are conducted using the most suitable approaches, they need to be represented to be understood by the people that are intended to use the results. Two main methods are applicable namely the numerical representation and risk map (Christoffersen 2012).

Risk map refers to a graphical representation of impact and likelihood risk. The risks are depicted in a manner that shows which risks are most significant and those that have the least significance. Also, depending on the level of analysis that is carried out, it is possible to represent the overall risk likelihood and impact. Numerical representation is the representation of risk measures in monitory or percentage depending on the nature of the analysis.

Risk Response

The management will develop the best course of action to counter the risks that have been analyzed. There are various methods utilized to respond to the risks based on the outcome of the analysis. The main approaches are avoidance, sharing, acceptance and reduction.

Risk acceptance approach refers accepting the risk and its consequences. The strategy is mainly applied when there is no way to mitigate the risks. Risk avoidance is a management technique that aims at eliminating risk through eliminating any hazard event. Risk sharing is a strategy that spreads risk among numerous units while reduction refers to the management practice that aims at minimizing the effects of risks (Hampton 2011).

However, there are considerations that the management will have to make before settling on the risk approach. The most crucial consideration that is considered is the cost benefit analysis relating to the proposed approach. As such, the benefit must outweigh the costs in order for the adopted strategy to have a positive impact on the organization performance. The reason is that the positive value translated to the value added to the shareholders.

Control Initiatives

These are the measures in which the organization develops in order to ensure that the responses a company develops are implemented to the latter (Christoffersen 2012). Control initiatives happen in all levels of the organization and therefore they include diverse activities such as endorsement, approvals, reunion, protection of possessions, separation of duties and operation management review (Christoffersen 2012).

Information and Communication

Information and communication are as critical as any other phase of integrated risk management strategy. Therefore, in order to realize success in the process of managing the organization risk, the management has to disseminate adequate information that will outline the objectives and expectation of each employee clearly. As such, this will eliminate confusion and develop a supportive environment that is essential in implementing the management plan. Moreover, information and effective communication reduce the instances of resistance in relation to change since people are informed of the action that needs to be taken and understands clearly the reason the course of action was taken (Christoffersen 2012).

However, when guaranteeing information and communication success, the organization has to ensure that strategic and integrated system are developed and working efficiently. The need is necessitated by the fact that flow of information will play a critical role in information and communication. As such, the company needs to invest on the system depending on the level of the risk sophistication and its risk management philosophy. Also, the investment in this system ensures that adequate content of information based on the amount of information employee needs to perform the duties effectively is available in the right form and timely manner.

Monitoring

It would be a waste of resources in the event that a company develops an enterprise risk management plan, but fails to establish a mechanism to monitor the implementation and the functioning of the plan. Therefore, it implies that monitoring is needed to ensure that the plan is functioning and working as intended (Christoffersen 2012). However, in the event that the plan fails to meet its intended expectation, the evaluation process comes to detect and report the deficiencies in the plan. The action facilitates for the improvement of the plan.

Conclusion

Enterprise risk management is a complex undertaking that a company needs to invest adequate resources. However, despite its complexities, it is one of the most important aspects in ensuring the company is shielded from hazardous events that may jeopardize the company ability to compete and operate in extreme cases. Therefore, any organization should develop adequate resources to ensure that an applicable framework is developed, implemented and monitored. Therefore, ensuring that the firm operates within its tolerable risk-limits and the decision made by the management are aligned to the established tolerance. This will ensure sustainability of the business.

References

Afza, T & Nazir, M 2008, Working capital approaches and firm’s returns, Pakistan Journal of Commence and social sciences, vol. 1 no. 1, pp. 25-36.

Ajanthan, A 2009, Working capital management (WCM) and Corporate profitability (CP): A study of selected listed companies in Sri Lanka, The international journal of business and management, vol. 1 no. 2, pp. 10-17.

Ali, A 2012, Working capital management: is it really affects the profitability, Global Journal of Management and Business research, vol. 12 no. 17, pp. 75-78.

Aramvalarthan, S 1996, Estimating working capital requirements, The management accountant, vol. 31 no. 10, pp. 768-771.

Arnold G (2013), Corporate financial management 2nd edn, Pearson Education Limited, England.

Bartlett, G, Beech, G, Hart, F, Jager, P, Lange, J, Erasmus, P, Hefer, J, Madiba, T, Middelberg, S, Plant, G, Streng, J, Thayser, D & Rooyen, S 2014, Financial management : Turning theory into practice, Oxford university press Southern Africa LTD, Cape Town.

Besley, S & Brigham, E 2012, Principles of finance, South-western Cengage learning, USA.

Brigham, E & Houston, J 2012, Fundamentals of financial management, South –Western Cengage Learning, USA.

Cerson, S 2008, Audit committees: a guide to good practice, Auditing and Assurance Standards Board Melbourne, Victoria.

Christoffersen, P 2012, Elements of financial risk management 2nd edn, Academic Press, Amsterdam.

Collier, P 2012, Accounting for managers: Interpreting accounting information for decision making, 4th edn, John Wiley & Sons Ltd, UK.

Davies, T & Crawford, I 2014, Corporate Finance and financial strategy, optimizing corporate and shareholder value, Pearson, UK.

Ebenezer, A & Asiedu, M 2013, The relationship between working capital management and profitability of listed manufacturing companies in Ghana, Internal Journal of Business and Social Research, vol. 3 no.2, pp. 25-34.

Economic growth forecast upgraded by BCC 2014. Web.

Eljelly, A 2004, Liquidity and profitability trade-off: an empirical investigation in an emerging market. Intl. J.Commerce and management, vol. 14 no. 2, pp. 48-61.

Fabozzi, F 2010, Financial Risk Management, John Wiley & Sons Inc, Hoboken.

Finch, B 2011, Financial times briefings: critical financial issues, Pearson Education Limited, Prentice Hall, England.

Gill, A, Bigger, N & Mathur, N 2010, The relationship between working capital management and profitability: evidence from the United States, Business and Economics Journal, vol. 2 no 2, pp. 1-9.

Gunn, S 2009, Risk and financial management in construction, Gower, Farnham, England.

Hampton, J 1989, Working capital management, John wiley & Sons Ltd, USA.

Hampton, J 2011, The AMA handbook of financial risk management, American Management Association, New York.

Hanger, H 1976, Cash Management and the cash cycle, Management Accounting, vol. 57 no. 13 19-21.

Kamath, R 1989, How useful are common liquidity measures!, J.Cash manage, vol. 9 no. 3, pp. 24-28.

Knauer,T. & Wohrmann, A 2013, Working capital management and firm’s profitability, Journal of Managerial Control, vol. 24 no. 7, pp. 77-87.

Kumar, R & Sharma, V 2005, Auditing: principles and practice, Prentice-Hall of India, New Delhi.

Lasher, W 2011, Financial Management: A practical approach. South-Western Cengage learning, USA.

Mansoori, E & Muhammad, D 2012, The effect of working capital management on firm’s profitability: Evidence from Singapore, Interdisciplinary journal of contemporary research in business, vol. 4 no 5, pp. 472-479.

Mohammad, A 2011, Working capital management and corporate profitability: evidence from Iran, World applied Science Journal vol. 12 no. 7, pp. 1093-1099.

Nandi, K 2011, Impact of working capital management on profitability (A case study of National Thermal Power Corporation ltd), The management accountant, vol. 46 no. 1, pp. 22-27.

Nimalathasan, B 2010, Working capital management and its impact on profitability: A study of selected listed manufacturing companies in Sri Lanka, Information Management, vol 6 no 3, pp. 76-82.

Nzioki, P, Kimeli, S, Abudho, M & Nthiwa ,J 2013, Management of working capital and its effect on profitability of manufacturing companies listed on Nairobi securities exchange (NSE), International Journal of Business and Finance Management Research, vol. 13 no. 2, pp. 35-42.

Parrino. R, Kidwell, D & Bates,T 2009, Fundamentals of corportate finance 2nd ed., John Wiley & Sons Inc ,New Jersey, USA.

Parrino, R, Kidwell, D. & Bates, T 2014, Essentials of Corporate Finance , Wiley& Sons Inc, New Jersey, USA.

Raheman, A & Nasr M 2007, Working capital management and profitability –Case of Pakistani Firms, International Review of Business Research Papers, vol. 3 no.1, pp. 279-300.

Saghir, A, Hashmi , F & Hussain, M 2011, working capital management and profitability: Evidence from Pakistan firms. Interdisciplinary journal of contemporary research in business, vol. 3 no. 8, pp. 1092-1103.

Sagner, J 2011, Essentials of working capital management, John wiley & Sons Inc, NJ.

Saunders, M, Lewis, P & Thornhill, A 2009, Research methods for business students, 5th edn, Pearson Education limited, England.

Sheu, S & Tang, F 2009, Using snowball sampling method with nurses to understand medication administration errors, Journal of Clinical Nursing, vol. 18 no. 4, pp. 559-569.

Shibata, Y & Kihura, K 2010, Questionnaire survey of physical properties of urea preparations, Nishi Nihon Hifuka, vol. 70 no. 6, pp. 634-638.

Shin, H & Soenen, L 1998, Efficiency of working capital and corporate profitability, Financial practice and education, vol. 8 no. 23, pp. 7-45.

Stein, H & Kohlmann, B 2010, Comparison of two sampling methods for biomonitoring using aquatic macroinvertebrates in the Dos Novillos River, Costa Rica, Ecological Engineering, vol. 34 no. 4, pp. 267-275.

Thuvarakan, S 2012, Impact of working capital management on profitability in UK Manufacturing Industry, MSc. Dissertation, London South Bank University, London.

Ukaegbu, B 2014, The significant of working capital management in determining firm profitability: Evidence from developing economies in Africa, Research in international business and finance, vol. 31 no 3, pp. 1-16.

Vernimmen, P 2005, Corporate finance, John Wiley & Sons Ltd, England.

Wang, W 2002, Liquidity management, operating performance and corporate value: evidence from Japan and Taiwan, Journal of Multinational Financial Management, vol. 12 no 3, pp. 159-169.

Waston, D & Head, A 2010, corporate finance: Principle and practice, Pearson Education Limited, England.