So-called “off the books” economic practices such as cash payments, undeclared taxable income, and the drug or illegal arms trade combine to create a “shadow economy,” money that changes hands “under the table,” beyond the purview of taxation controls and governmental regulations. Not all of these business practices can be categorized as nefarious; however, their pervasiveness does affect the liquidity, infrastructure, and stability of society. A strong shadow economy may also significantly restrict a nation’s capacity for growth. This paper takes an international look at some instances of the shadow economy as they occur globally. The countries under study include Spain, Russia, and Iraq. The essay focuses on six different articles, all of which detail the societal impact of underground or shadow economies, with a particular emphasis on growth.

Shadow economies represent widespread phenomena that occur in first-world nations as well as developing nations. Most societies attempt to control and restrict the expansion of shadow economies, as their unchecked growth results in serious long-term consequences that affect all strata of an individual society (Schneider & Enste, 2002). Robust shadow economies obfuscate the findings of official statistics and render results fickle. Given that most societies frame policies and programs based on official statistics, such as unemployment rates, official labor force, income, consumption, and policing, a thriving shadow economy affects how accurately social programs are funded and implemented (Schneider & Enste, 2002).

A large shadow economy also produces a major impact on taxation. According to Schneider & Enste (2002):

The growth of the shadow economy can set off a destructive cycle. Transactions in the shadow economy escape taxation, thus keeping tax revenues lower than they otherwise would be. If the tax base or tax compliance is eroded, governments may respond by raising tax rates—encouraging a further flight into the shadow economy that further worsens the budget constraints on the public sector (Schneider & Enste, 2002).

The dearth in the tax base often equates to the reduction of public services and further strain on infrastructure (Schneider & Enste (2002).

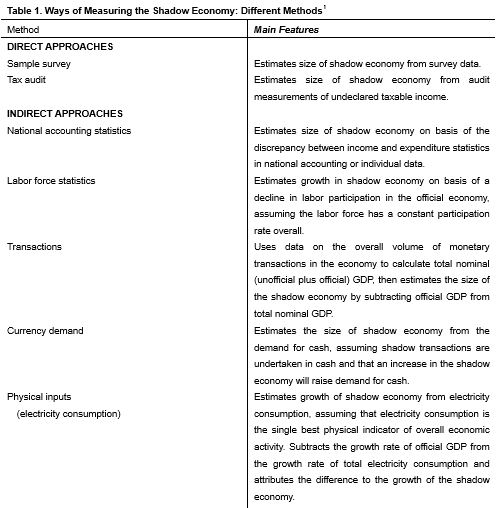

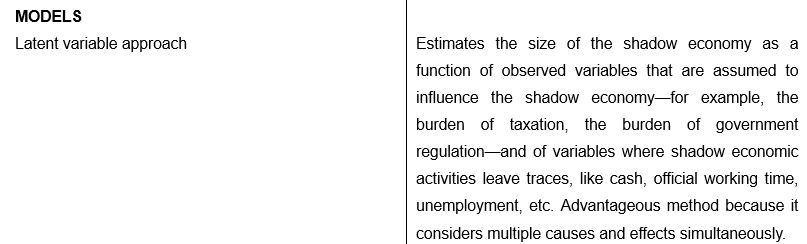

Measuring the shadow economy is a tricky business and requires a creative approach. In Table 1, Schneider & Enste (2002), break down the most common methods used to measure the shadow economy, with the currency demand and the latent variable approach being the most widely used (Schneider & Enste (2002).

A study was undertaken by Alanon and Gomez-Antonio (2005) of the University of Madrid used the theory of unobservable variables to “estimate the size of the shadow economy in Spain during the period 1976-2002” using structural equation models or MIMIC (Alanon & Gomez-Antonio, 2005). According to these economists the “methodology employed…simultaneously considers multiple causes of the existence and growth of the shadow economy, as well as the various effects it has upon specific indicators” (Alanon & Gomez-Antonio, 2005).

As determinants, Alanon and Gomez-Antonio used the following variables: the tax burden, with the understanding that “the greater the tax burden, the greater will be the incentives for individuals to remain in the shadow economy” (Alanon & Gomez-Antonio, 2005); regulation, under the assumption that “an excessive degree of regulation forces individuals to undertake certain activities within the scope of the shadow economy” (Alanon & Gomez-Antonio, 2005); unemployment; disposable income per capita, and waged employment, theorizing that “the greater the number of salaried employees in the economy, the lower will be the level of the shadow economy” (Alanon & Gomez-Antonio, 2005). As for indicators, Alanon and Gomez-Antonio employed several variables. The first was the “total money in the hands of individuals. Their hypothesis assumed “that in the shadow economy a considerable number of transactions are made in cash, to leave no trace of payments made and received” (Alanon & Gomez-Antonio, 2005). They also measured the growth of the Spanish GDP, under the assumption that “an increase in the size of the shadow economy may cause productive factors to move from the official economy to the shadow economy” (Alanon & Gomez-Antonio, 2005). Finally, the study measured excessive electrical energy consumption, the implied value being that by “estimating the electricity consumption necessary to produce the level of GDP declared in the economy…any excess [becomes]…an indicator of the electricity consumed by undeclared activities (Alanon & Gomez-Antonio, 2005). The economists’ data revealed four unique periods, “the first…characterized by the sustained growth in the weight of the shadow economy, reaching its relative maximum in 1983…maintained in stable percentages until 1988…[wherein]…a brief period of growth of the relative participation began, ending in 1992. In the remaining years of the 1990s, the weight of the shadow economy remained more or less stable…apparently interrupted in 2001 and 2002, which may reflect…the incorporation of Spain into the European Monetary Union” (Alanon & Gomez-Antonio, 2005).

Economists disagree on whether or not a shadow economy has a positive or negative impact on its society. As Schneider & Enste (2002) point out, there is an upside. “[A]t least two-thirds of the income earned in the shadow economy is immediately spent on the official economy, resulting in a considerable positive stimulus effect on the official economy” (Schneider & Enste 2002).

Echazu & Bose, (2008), however, illustrate the concern of corruption in “a shadow economy that faces predatory extortion from law enforcement agents” (Echazu & Bose, 2008). Since corruption in a shadow economy happens off the books, its victims have little to no official recourse, particularly if the aggressor belongs to the police force.

Ericson (2006) hypothesizes that a shadow economy erodes the power and legitimacy of the government. In the former Soviet Union, Ericson believes, the shadow economy was a major contributor to its downfall:

Its very existence and usefulness thus undercut…the ideology of the regime, the Marxist-Leninist verities underlying its legitimacy. The second economy further works [ed] against and undercut…regime priorities by exposing the incompetence and incapacity of the ‘all-knowing’ authorities. Its provision of alternatives weaken[ed] the ‘plan, production, and labour discipline’ so essential to the proper operation of the command mechanism (Ericson, 2006)

Shadow economies also create a certain degree of lawlessness that can be hard to contain and harder to punish. In Iraq, a “street-level hostage economy” generates significant profit in the shadow economy, says Dr. Robert E. Looney of MIT. Kidnappings account for 70 percent of reported criminal activity in Iraq:

In early 2004 an average of two people was kidnapped every day in Baghdad, with a typical ransom of about $25,000. Both figures have steadily increased with the development of sophisticated kidnapping gangs – at the end of the year, the average had risen to ten kidnappings per day. While the kidnapping of foreigners receives most of the publicity, hundreds of wealthy Iraqis, especially Iraqi women, have also fallen into the clutches of the kidnapping gangs. The gangs appear to be made up of criminals, unemployed soldiers, and former mukhabarat agents with little to lose and much to gain in Iraq’s security vacuum (Looney, 2005)

Albanian smugglers earn a thriving income in the shadow economy, ferrying “organized crime syndicates from China’s Fujian “snakeheads” to Nigerian prostitute traffickers to Iraqi blackmarketeers,” all of whom “rely on these human-cargo carriers to navigate this major smuggling route” (“Immigrant Smugglers in Vlore, Albania,” 2001).

In conclusion, the impact of a shadow of the economy on growth may be quite positive, since those who work in the shadow economy will likely shop in the legitimate one. However, there is a human price to be paid for the shadow economy – lack of security, and predation on vulnerable elements of society like immigrant women and children, who because they are victimized “off the books,” have very little opportunity to be seen, heard, or helped.

Reference List

Alanon, A. & Gomez-Antonio, M. (2005). Estimating the Size of the Shadow Economy in Spain: A Structural Model with Latent Variables.” Applied Economics, 37.9, 1011-1026.

Echazu, L. & Bose, P. (2008). Corruption, Centralization, and the Shadow Economy. Southern Economic Journal 75.2, 524-538.

Ericson, Richard E. (2006). “Command versus ‘Shadow’: The Conflicted Soul of the Soviet Economy (1). Comparative Economic Studies 48.1, 50-77.

Immigrant Smugglers in Vlore, Albania. (2001) Migration World Magazine 9, 9-10.

Looney, Robert E. (2005). The Business of Insurgency: The Expansion of Iraq’s Shadow Economy.” The National Interest 81, 67-73.

Schneider, F. & Enste, D. (2002). Hiding in the Shadows: The Growth of the Underground Economy. Economic Issues 30, 1-12.

Footnotes

- For a detailed description of the different methods, see Friedrich Schneider and Dominik Enste, “Shadow Economies: Size, Causes, and Consequences,” The Journal of Economic Literature, 2000, 38/1, pp 77–114.