Introduction

In economy, inflation is the increase in the price levels of commodities. The rate of inflation in an economy has direct impact on the economic growth of the country. Positive changes in the economic development entail an improvement in the standards of living of people from that particular region. Inflation often leads to slowed or negative economic development (Financial services report, 2010). The causes of inflation are divided into two categories: causes from the demand side of the economy and those from the supply side. From the supply side of the economy, the UAE Central Bank has recently extended substantial financial backing to underperforming banks, intermediaries, and other financial institutions within the country to avoid further extortion of the economy and recapture the public confidence. Another prominent move evident in this context is the manipulation of the capital reserve requirements. In banks, capital reserve means the available securities, which can be lent to other financial institutions for dissemination to the public. In this regard, the UAE Central Bank has tried to regulate its capital reserves to ensure that the money in circulation is enough to normalise the situation. Secondly, there was a need to boost people’s power to purchase. Others include reduced savings, lowered direct taxes, positive change in population growth, and excess of illegal money in the economy. All these are factors that increase the amount of money in circulation in the concerned economy.

Factors that could lead to inflation from the demand side of the economy are those that negatively impact on supply levels. For instance, in some developing economics, a substantial rise in prices occurs when the demand for goods and services surpasses supply, thus causing a critical demand-pull inflation. In the UAE, the same demand-pull inflation affected the entire economy, which was the case that demanded the intervention of the Central Bank. Others include the laws of lessening proceeds, hoarding effects from consumers and traders, and the influences of natural tragedies. All these factors have the effect of increasing the initial price of commodities, consequently resulting in inflation (Hamia, 2011).

The UAE government has instituted different measures to counter the causes of inflation. This has occurred through different governmental bodies, especially those that regulate the exports, imports and the monetary circulations. One such institution is the UAE Central Bank. The UAE Central Bank is charged with the responsibility of controlling the level of inflation through various monetary policies. Evidently, the hands of the UAE Central Bank were tight due to the US dollar peg, and need to follow the U.S. monetary policy of low interest rate (Hamia, 2011). It consistently evaluates the current position of the economy and institutes the relative policies that ensure that the level of pricing for the different commodities remains steady. For instance, in response to the recent financial crisis, the UAE Central Bank has tried to regulate the monetary policies by controlling the credit and monetary conditions in the economy in attempt to utmost employment, steady pricing provisions, and modest long-term interest rates. Evidently, the public usually feel the pinch of financial crisis through these factors. This paper evaluates how the UAE Central Bank sustained steady pricing in order to ensure the economic development of 3.2% experienced in 2010.

Generally, during economic crisis, central banks can assume critical measures to restructure financial markets and restore public confidence. The recent financial challenges have affected the economies of numerous countries. Consequently, the concerned central banks have taken swift moves to help in the matter. The connection between price stability and the economic development of a country is measurable through the exposure to inflation, employment and interest rates, and other economic provisions. The research identifies the mechanisms underlying the changes in the economy of the UAE due to the shift in the level of prices, as discussed later.

The regulation of inflation in the UAE can be attained through diverse avenues. Some of these regulations do not concern the Central Bank but constitute a formidable provision. This study studies how the monetary policies within the mandate of the Central Bank can be utilized to avert inflation. The Central Bank influences the inflation rate in vast ways. It has the mandates to impose laws that help in stabilising the money market values, as discussed. Generally, the UAE has a Central Bank established to monitor the monetary issues and control other financial bodies, such as the commercial banks. As the uppermost monetary controller within a state, the Central Bank has basic influences on the financial service providers through its policies. For example, the UAE Central Bank has the capacity to regulate the commercial banks and other financial service providers to reduce or increase interests chargeable on loans lent.

Basically, the Central Bank is the controller of economic stability and inflation in a given state. Through its direct control of financial service providers in terms of management of lending rates, it defines the amounts of loans to be given, as well as the duration of payback on these loans. It, therefore, acts as an indirect cushion to the consumers or the citizens who are the major dependents on commercial banks. Evidently, a notable current event in the financial crisis is the reduced interbank lending where banks do not trust each other with money in the financial arenas. In such circumstances, central bank serves as the last resort for the borrowing opportunities, which must be critically observed. Precisely, the research evaluates the strategies, monetary or fiscal, that are instituted by the central bank in order to keep the level of inflation at sustainable levels. It also evaluates when and how each of these strategies should be applied. The researcher will be interested in answering the following main research question.

- How does the Central Bank influence the country’s inflation rate?

- What relationship exists between price stability and economic development of a country?

Literature Review

Maintenance of price stability is an important role that helps strengthen economy of a country. The central bank of the UAE has several options that it can employ to counter the effects of inflation in the country. However, these measures are dependent on the nature of inflation and how it has resulted. Therefore, prior to any analysis on the corrective measures it adopts a brief understanding of the mechanism of inflation and how it arises would be vital. Inflation can be termed as the alteration in the level of the absolute pricing of a commodity. For some commodities the price of the price will experience significant increases while in others the price change may be relative. For instance on UAE, the price of electronics in the year 2010 decreased considerably while that of the food and beverages increased. This results in the discrepancies experienced in the inflation rates indicated earlier on. Besides the absolute price of a commodity, there is its real price. This refers to a commodities price when viewed in relation to the price of other commodities. Whenever the real price of a commodity increase, then its absolute price is bound to change significantly relative to the overall price level (Longnecker, 2008).

In answering the question of the most effective inflation rate to sustain economic development, one can consider the costs that are associated with inflation and the benefits that could result. From the perspective of the UAE citizens, businessmen and the government representatives, inflation should be the number one priority in trying to achieve economic recovery for any nation. In fact, it is perceived as more significant than cutting down the level of unemployment of eradicating poverty. The effects of inflation can be severe especially at heightened levels. Hyper inflation can actually be destructive the economy of any nation (Middle East Central Bank Governors, 2011). However, the social costs associated with inflation are an exaggeration by the financial institutions whose businesses operation thrives well in low inflation situations. Studies conducted indicate that at low inflation is actually beneficial to an economy. It can be essential in fueling the economy. For instance, if the level of prices change is matched by an equivalent change in the income of the citizens, the inflation level may perceive as inconsequential (Hancock, 2010). In practical situations however, it is impossible that the level of price changes will correspond to the income changes. The wages may match inflation and in other instances exceed it or the prices changes in the prices of the different commodities may vary considerably.

In the inflation incidences, there are losers and winners. For instance, the largest beneficiaries are the money borrowers. The fact that a large section of the debt is eroded by the effects of inflation serves their interest appropriately. Therefore, the government being a large debtor, often has little to lose from the inflation. However, other participants of the economy are bound to suffer significant loses. For example, people with fixed incomes that are dependent on the performance of the dollar; workers who cannot negotiate for a better pay that matches the level of inflation; lenders who institute fixed rate on their interests are some of the people gravely affected by the level of inflation. These are the people whom the UAE’s central bank seeks to protect as they are vital for the development of the economy (Karkouti, 2009).

According to views by different economists high rates of inflation, particularly hyper-inflation, can result in significant strain on individuals and businesses or even the siphoning of the country’s capital. However, there is no conclusive evidence that indicates that single digit inflation can result in hampering the economic progress of an economy (Alkholifey & Alreshan, 2012). In fact, there exists a link between the economic growth and small rate of inflation (less than 10%). For instance, despite UAE’s inflation of 0.9% in 2010, it still managed to register a growth rate of 3.2%. The argument advanced for this is not that single-digit inflation directly increases the economic growth rate, but modest inflation rates of 0.5% to 2% gives the sellers a margin to decrease their prices whenever it is deemed appropriate (Middle East Central Bank Governors, 2012). This happens without effecting changes on the supposed price of the dollar. Relative price adjustments are vital for any budding economy and such modest inflation creates such an environment. Therefore, when the Central bank of the UAE institutes its monetary policies, it does so regulate the inflation level to this beneficial level.

Though different countries may experience same inflation rates, the cause of the inflation may differ from country to country. In UAE, the central Bank strives to rectify inflation due to different reasons. First is the kind of inflation that relates to an increased spending. This is termed as demand-pull inflation. If the banks lower their lending rates and there is more up take of loans, then consumers and businesses are bound to have plenty of money to spend. This increase may not match of the availability of goods in the economy and could result in scarcity of products. Individuals and businesses will be competing to buy the goods since they all have the money. For the Central Bank to check this kind of inflation it institutes policies that counter the increased demand. This can entail the introduction of higher lending rates by the banks. However, the alternative of stimulating the supply levels could demand lower rates. Therefore, it must strike a balance between the two for policies to be efficient (Hancock, 2010).

The second cause could be increased labor costs. Whenever the salaries in the economy are increasing at a faster rate than the level of productivity, the increase production cost is transferred to the consumer of the product. However, this is subject to the reigning competitive forces. The remedy that can be institute by the Central bank to curb to this is advancement of policies that promote unemployment. The central bank is not responsible for other alternative measures such as the introduction of price controls or the regulation of imports.

Another form of inflation can be triggered by the appetite of companies to realize higher profits. If businesses realize they can achieve increase the price levels without altering the demand for their commodities they can easily do so. An increase in the raw materials critical for production in the economy such as oil products could also trigger inflation. Different economic players can fuel the inflation to greater levels while attempting to cushion themselves. For instance, companies can pass over the increased production costs of employees may demand a raise in their salaries to match the increased prices of different commodities.

The Central Bank may be the chief regulator of the inflation levels in the UAE but it is not the only regulators. The mechanism of altering the price level has various intrinsic aspects. However, policies instituted could take up to two years before their effect is felt in the economy itself. According to Hancock (2010), aspects of how Central banks counter inflation depend on the fact that it controls the supply of money, investments and transactions demand for money. It entails the increasing or reducing the demand as may be deemed appropriate. In a collection of bonds and capital, money can be viewed as an asset. For any investor to be content with the nature of their portfolio, the returns they realize must relate directly to the assets they have invested. Bonds and capital are used to yield liquidity services such as and consequently determine the amount of money available for circulation.

The UAE Central Bank ensures the prices are steady by instituting measures such as:

- Restriction on the money supply

- Monitoring the credit levels through the banks

- Placing financial ceilings on the banks and other finance drivers in the economy

- Controlling the fiscal policies and the amounts available for spending.

The above measures are best exercised by an independent Central Bank. Luckily the UAE Central Bank does not suffer from political interferences and hence institutes the relevant policies solely. So the important question is how the Central Bank comes up with the most appropriate interest rate that ensures there is portfolio balance for the county’s citizens while avoiding the excessive supply of money that consequently fuels the level of inflation. Two conditions are mandatory for the realization of this goal. First, it sets a credible inflation target. This target must be set relative to the general expectation of the public. For instance, public expectations of a future inflation should be countered by a reduction in its interest rate targets. However, it is crucial to note that the interest rate target does not match the actual interest rate. Secondly, the Central Bank factors in the effect of the set interest rate in the pricing mechanism of the economy.

Key to the pricing mechanism is the real interest rate. The shifts in this interest rate bring about the scarcity of products in the markets and the increase in consumer needs. Fishers’ connection between the real interest rate and that of the level of consumption is well depicted by the equation below, rr represents the real interest rate and p represents people’ time preference for present spending over future spending

rr= {(1+ p) (c2/c1)}-1 (Lincoln & Denzin, 2003).

If all the monetary alterations were to be withdrawn, the prevailing interest rate is referred to as the natural rate. The goal of Central Bank is to vary its interest rate goal so that it relates closely to the natural rate.

Often when UAE experiences a high inflation which the Central bank wishes to reduce, it uses a short-term interest on the credit facilities awarded by the financial institutions. To get the actual figure it modifies the above formula with the current and expected future price of the level as per the public.

Rt= {(1+ rRt) Pt+1* /Pt}-1

By altering this formula and making the future price level the subject, the Central Bank is in a position to use its make assume the direction of its inflation target, that is:

Pt= {(1+ rrNt)/ (1 + rTt)} P*t+1 (Longnecker, 2008).

Alterations in the natural rate (rrNt) must be matched by the relative changes in the Central Bank’s interest rate targets. Through the above formulas, the Central Bank manages to arrive at the best interest rate that counters the prevailing level of inflation. In the year 2010, the interest rate adopted by the Central bank and imposed on the banks was favorable. This is depicted by the fact that loans increased level of loan uptake by the banks by 1.3%.

The next issue is how the interest rate arrived at is used in effecting the price stability. The Central bank acts as the Bank of all other Banks in UAE. Therefore, it has the mandate to regulate the operations of these banks through the interest rates. High inflation, as explained above, could result from the increase in the demand due to availability of liquid cash. Usually, once this occurs, the Central bank immediately, works out the appropriate rate depending on its target inflation rate; it imposes the rate on the commercial banks (Al Khater, 2012). Banks are profit making organizations and they therefore apply the Central Bank rate as their base rate. All loans they lend out are then given at an interest rate that includes this base rate and their supposed profit margin. If the Central bank rate is high, the final interest rate on the loans will be relatively high for the borrower. They will be required to pay very high interest rates that do not match the returns on their potential investments. They will therefore shy away from taking loans and this has the effect of reducing the amount of money in circulation. A reduction in the case available for spending reduces the product demand and consequently brings down the price levels. This is referred to as deflation. In 201, the Central bank increased the lending the minimum lending rate to 1% from a previous 0.5% and this led to the decline in the inflation between 2009 and 2010 (Matsuda & Silva, 2005).

Other measures that are utilized by the central banks in order to trigger the same effects include the increase in the level of deposits by the banks. The Central Bank issues a policy, in which the financial institutions are required to keep a certain level of deposits with it. The banks are forced to dig deeper into their coffers in order to meet these targets. Consequently, the amounts of funds available for lending are reduced and this limits the amount money available to the public. Though the Central bank of UAE has the above power, its powers are limited by the fact that the country’s currency, Dirham, is pegged on the dollar. This is referred to as dollarization. The central bank of UAE uses this measure in order to ensure stability of its local currency and reduce the levels of risk. This has the effect of attracting foreign invests since they are confident in the performance of the currency. However, the disadvantage of the approach is that its results in the transferring the economic shocks of the US to the UAE economy. UAE is a large exporter of oil to other nations. Many of the industries in the economy depend on the oil for production to be realized. Whenever the prices of oil increase, this can result in inflation. Increase in the price of oil raises the cost of production. Companies pass these costs to the consumers by increasing the prices of the commodities. The non-oil sectors in UAE that apply this strategy include the tourism and the construction sector. In the year 2010, the oil prices increased internationally. This could have caused the inflation in food and beverages sector that increased the inflation. However other sectors such as communication that experienced a decline in the level of pricing offset the increase to result in the perceived 0.9%.

UAE is considered as one of the high income countries in the world, particularly due to its oil production levels and upcoming tourism sector. It has managed to sustain reasonable annual inflation rates of between 10% – 12%, that is considered as the optimum level that greases the wheels of the economy between 2008 and 2009. Consequently it had continued to experience an annual growth rate of above 3.2% per annum, which is commendable. However, this has been achieved through the contribution of the Central Bank. The Central bank checks the inflation level mostly by changing the interest rates as me be deemed appropriate. The effective rates of the banks on the loans then dictate amount of cash available in circulation. Reduction in the amount available for spending causes the perceived decline in the price levels. In case the money in circulation goes below particular levels, then the Central bank can institute alternative procedures that increase the money supply. This way the Central Bank keeps the prices in UAE stable. However, pegging its currency on the U.S Dollar sometimes often results in complication in instituting the relevant policies.

The availability of oil in UAE has helped improve the economy especially during those times that the oil prices shoot up. Other sectors can therefore exert little influence on the level of prices through transfer of costs. The United Arab Emirates is also a tourist destination, earning this country extra income.

Methodology

This chapter focuses on various aspects of research development. It includes methods of data collection, its analysis and presentation procedures. Every research project applies a certain research method to achieve its objectives depending on its goals. The methods used to conduct research in this project compared closely with the methods proposed in the project proposal. The chapter contains a number of components, which include research design, method of data collection, and instrumentation. The paper also evaluates the sampling technique, the sample size, and data analysis. Finally, the paper evaluates ethical considerations taken into account in conducting the study.

Research design

In an effort to understand the role played by the United Arabs Emirates’ Central Bank in sustaining price stability and the contribution of different economic sectors in the country’s economic development in relation to price stability, the researcher will undertake an exploratory study. Therefore, the researcher will incorporate an effective research design to attain the goal of the study. Research design refers to the framework used by a researcher in an effort to collect relevant data from the field. Bickman and Rog (1998) argue that the research design acts as an architectural blueprint in research studies. The selected research design has significant influence on the credibility, usefulness, and feasibility of a particular research study. Feasibility refers to the capacity of a particular research study to become complete within the existing time and resource constraints. Usability is concerned with ensuring that the research study successfully answers the research questions.

The research will adopt quantitative research design to improve the effectiveness of the study. Quantitative research design will be integrated in a bid to make the study more realistic because it facilitates using numerical and statistical methods of analysis (Matveev, 2002). Creswell (2003) asserts that this research design evaluates the study variables in their natural setting. Therefore, the researcher can gain more insight regarding the issue under investigation. The resultant effect is that the researcher is capable of developing a strong relationship with the respondents. This aspect means that the researcher can adjust the research design appropriately in accordance with the additional question that the researcher may ask during the data collection process.

Types and sources of data

According to Flick (2009), the quality of a particular research study is directly related with the data collected. A number of issues such as the source of data, its accuracy and reliability, form, and amount of data should be taken into account when deciding the source of data. There are two main sources of data, which include secondary and primary sources of data. Primary sources entail seeking data from the people while secondary sources entail sourcing data from previously documented works for example administrative records and from management information systems. People are the core sources of data with regard to primary sources. Secondary sources of data mainly include documented works such as administrative records and from management information systems (Flick, 2009).

This study will use both primary sources of data and secondary sources of data. The researcher will collect primary data systematically from representatives of the UAE Central Bank, and obtain secondary data from previous studies on the role of UAE Central Bank in sustaining price stability such as the Central Bank’s press releases and reports from the monetary committees. By using different methods of data collection, it will be possible for the researcher to conduct a comprehensive data collection process (Pearce & William, 2006).

Data collection and instrumentation

Data collection entails the process of preparing and the actual collection of data that will be used in conducting the study from the field (Flick, 2009). The study will employ a survey research strategy to collect the data. The decision to undertake a survey arises from appreciation of the fact that it is the role of a country’s central bank to ensure price stability. Collection of primary data will be facilitated by the use of a questionnaire. Both open and closed ended questionnaires will be used. In order to gain a comprehensive understanding of the extent to which UAE Central Bank is effective in sustaining price stability, the researcher will incorporate a focus group interview with experts from relevant bodies, which include representatives UAE Central Bank.

The questionnaire will be designed by formulating a number of questions, which the respondents will be required to answer according to their knowledge. The questionnaires used will be self-administered in nature. Consequently, the researcher will be in a position to eliminate the possibility of hiring interviewers, which would add the cost of the research. With regard to secondary data, the researcher will conduct a comprehensive review of records and reports on the same.

Population and Sample size

Identification of the population from which to select the sample is critical in conducting a study. This element arises from the fact that the population ensures that all subjects selected have similar characteristics. According to Cohen, Morrison, and Manion (2003), population refers to the universal set of all objects under study. The accuracy of a particular study can be diminished by the occurrence of two main types of errors, which include type 1 and type 2 errors. Type 1 error occurs if the researcher discharges the null hypothesis of a particular study as wrong, whereas it is true. Type 2 error occurs when the researcher assumes that the null hypothesis is correct, whereas it is wrong.

Sampling design

The study will incorporate sampling technique in selecting the applicable sample in the study. A sample refers to a finite part or a representative of the entire statistical population. Cohen, Morrison, and Manion (2003) clarify that population includes the universal set of elements or objects under study. The target population in this study is composed of Central Bank’s employees from different departments and board members of the Central Bank’s monetary policy committee.

According to Aday and Cornelius (2006), sampling is taken into account because it minimises the cost of conducting a research study. Additionally, sampling also makes it easier to manage the research process. Decision to integrate sampling also emanates from the fact that it might not be possible to conduct a study on all the board members. The researcher will use ordinary random sampling techniques in selecting the study sample from the target population. Incorporation of basic random sampling will be motivated by the need to eliminate possible bias.

Data analysis

Methods of data analysis

Data analysis refers to the process of transforming raw data into refined useful information that can be of use to people. Before settling on a method of data analysis, it is important to the approach to be taken by the research. The research can take quantitative, qualitative or categorical approach. This research took a quantitative approach. Depending on the type and accuracy needed, data analysis can take a simple descriptive form, or a more complex statistical inferencing. The technique used in the analysis can be univariate analysis, bivariate analysis or multivariate analysis. In selecting the appropriate method, a researcher should ensure that assumptions relating to the method are satisfied.

In analyzing the collected data, the researcher will use appropriate statistical data analysis tools such as descriptive and inferential statistics in analyzing quantitative data.

In relation to the quantitative analysis, the most commonly used sets of statistics include mean, frequencies, standard deviation, median and percentages. The researcher will code and enter the quantitative data into Statistical Package for Social Sciences (SPSS version 20). Using SPSS, the researcher will use cross tabulation to present the information. The tabulation would help give a clear picture of the impact of the UAE Central Bank in maintaining price stability. The researcher will also use descriptive statistics such as mean, standard deviation, percentage and frequencies to describe the properties of the target population. Further, the researcher will use tables, figures, and charts to present the findings of the study.

Ethical considerations

The success of a research study especially where a survey is involved is not only dependent on the research design and statistical tools used. However, the human element should not be ignored because the quality of research findings is determined by the relationship developed. In an effort to ensure effectiveness in the process of conducting the study, a number of ethical considerations will be incorporated. The researcher will ensure that all the participants involved in the study are respected. This element is vital in increasing the independence of the research participants. The participants will also be protected from exploitation by adhering to human dignity during the entire process of conducting the study.

The researcher will ensure that there is informed consent to ensure that data collection is effective. This element will be achieved by making sure that all the participants understand what is involved by participating in the research. Through informed consent, it is possible for the research participants to make a conscious decision on whether to participate in the research or not. This means that participation in the research is voluntary. The participants will also be granted the freedom to withdraw from the study without any repercussions.

Limitations and assumptions

There are a number of limitations associated with research studies. In this study, the sample size used will be relatively small. Only 50 respondents will be selected. However, it is assumed that the sample selected will be representative of the phenomenon under evaluation. Additionally, the study assumes that the respondents selected for the study are well conversant with the importance of ensuring sustainable price stability within a particular economy. Consequently, the researcher will be in a position to make the right deductions. The small size of the sample will be considered due to time limitations and financial constraints. Collecting data from a large sample size would consume a lot of time and financial resources.

Summary

Given the fact that this study aims at establishing the role of Central Bank of UAE in sustaining stability of price, this research will be evaluating the relationship that exists between stability of price and economic growth a country. Effective integration of the above research methodology will contribute towards improvement of the research findings of the study. By selecting employees of the central bank as the respondents, there is a high probability of the research accessing information that will contribute towards improvement in accuracy of the research findings. The two research designs will provide the researcher with an opportunity to collect substantial volume of data from the field and thus improvement in relevancy of the research findings.

Validity and Reliability

Testing the validity and reliability of the data collection instrument will aid in ensuring that the research questionnaires are effective, for example, by eliminating errors and elements of ambiguity in the questionnaires. Incorporation of statistical data analysis tools such as Microsoft Excel and the SPPS software will make it possible for the target parties to interpret the research findings. By taking into account the various ethical considerations, this research will increase the effectiveness of the respondents’ participation. By following this methodology, the relevancy and accuracy of this study’s findings will improve substantially.

Results

Chapter 3 discussed the methodology of this dissertation. In the methodology section, the researcher outlined the steps taken during data collection. It was made clear that data was collected through questionnaires, which were distributed, to the employees of this firm.

The researcher entered the data gathered with the help of the questionnaire into the SPSS sheet in order to generate a number of values for this research based on the research questions. The research questions given in chapter one were used to develop hypothesis that this analysis seeks to approve.

How does the Central Bank Influence the Country’s Inflation Rate?

This was one of the questions that the researcher was in dissecting through this research. Before one could respond to this question however, he or she had to first approve that there is a strong relationship between central bank activities and the country’s inflation rate. The following hypothesis was therefore, formulated.

- H10: There is a direct relationship between Central Bank’s activities and the country’s inflation rate.

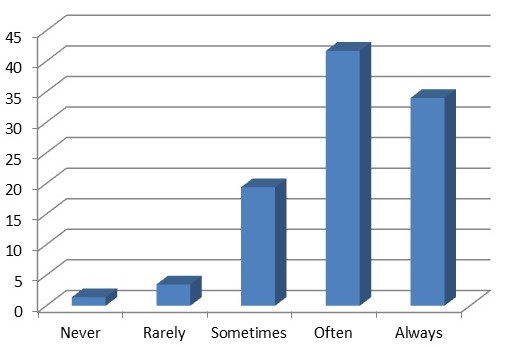

The table and the graph below show the results from the 50 respondents.

It is clear from the graph above that most respondents 50.4 percent agreed with the above statement while 22.2 percent strongly agreed with the statement. It is therefore evident that 72.6 percent of the respondents were in agreement of the fact that the activities of the central bank activities had direct influence on the countries inflation rate. Most of the respondents identified such activities as controlling monetary flow in the economy through interests charged to the commercial banks as one of the main controllers of the inflation. Other mentioned speculative actions of the central bank while a few mentioned demands for foreign currencies as the reasons that contribute to inflation.

What relationship exists between price stability and economic development of a country?

Price stability is one of the most important factors within an economy. In this research, the researcher is investigating the relationship that exists between price stability, and economic development of a country. The researcher therefore, formulated a research hypothesis below to help in this investigation.

- H2O: There exists a close relationship between price stability and economic development of a country.

The above data can be presented in a graph as shown below.

It is clear from the data displayed above that 75.7 % of the respondents were in agreement of the fact that there exists a close relationship between price stability and economic development of a country. The respondents cited business growth and investment rate directly depends on the price stability. This will directly have an impact on the economic growth of a country.

Reliability

Internal consistency is important for the survey since it indicates the extent to which the items in the measurement are related to each other. Cronbach’s alpha coefficient is the most popularly used index of internal consistency. This index ranges from 0 to 1, where a reliability of 0 means no relationship, and reliability of 1 indicates a perfect and positive relationship. Since the reliability declines as the length of the question increases, the questions would be designed to be straight to the point. The idea behind internal consistency procedures is that questions measuring the same phenomenon should produce similar results. In internal consistency reliability estimation, single measurement instrument is administered to a group of people on one occasion to estimate reliability.

Discussion and Conclusion

The Central Bank of UAE plays a pivotal role in the country’s economy. It is clear from the discussion above, that the country looks upon the Central Bank in maintaining price stability. Inflation is very dangerous to the country and to the economy, and therefore, it is the role of the government to ensure that it is controlled. The analysis in chapter four above confirmed that there is direct relationship between central bank’s activities and inflation rates. The researcher was able to establish that inflation is always caused by either increased demand for products within the economy, or increase in supply of money. Central bank plays an important role in controlling such inflations. One of the best ways through which this bank can reduce this inflation rate is by reducing money supply within the economy. This can be achieved by increasing interest rates to the commercial banks.

It was also established that there exists a close relationship between price stability and economic development of a country. Development of this country therefore depends on price stability. As was noted that price stability depends on the activities of the central bank, it can be concluded that economic development of the country strongly depends on these activities of the central bank. The following are some of the recommendations to the central bank on how to manage inflation.

Recommendations

- Bank rate policy: this is an important monetary control tool that can be used during inflation. During inflation, the central bank should increase the bank rates to the commercial banks. This will force the commercial banks to increase interest rates to loans they extend to the public. This will discourage borrowing, and as a result, it will help reduce cash flow within the economy.

- Cash reserve ratio: during inflation, the central bank should consider raising cash reserve ratio. This will in turn decrease the commercial bank’s lending capacity; hence reduce flow of money in the economy.

- Open market operations: When there is inflation, the government should sell the securities and bonds to reduce the flow of money in the economy.

References

Aday, L.A., & Cornelius, L. (2006). Designing and conducting health surveys: a process of knowledge construction. New Jersey: Routledge.

Al Khater, R. K. (2012). The Monetary Union of the Gulf Cooperation Council and Structural Changes in the Global Economy: Aspirations, Challenges, and Long-term Strategic Benefits. Web.

Alkholifey, A., & Alreshan, A. (2012.). GCC Monetary Union. Web.

Bickman, L. & Rog, J. (1998). Handbook of applied social research methods. Newbury: Sage.

Cohen, L., Manion, L., & Morrison, R. (2003). Research methods in education. Comprehensive guide. New York, NY: John Wiley and Sons.

Creswell, J. (2003). Research design: qualitative, quantitative, and mixed method.

Financial services report. (2010). Financial Services Industry Report: UAE, 2(1), 9-23.

Flick, U. (2009).An introduction to qualitative research. Thousands Oak: Sage Publication.

Hamia, M. (2011). Measuring and modeling core inflation for three GCC countries: Kuwait, Oman, and the UAE. Journal of International Finance & Economics, 11(2), 1-30.

Hancock, M. (2010). Central bank to tighten lending criteria under new rules. MEED: Middle East Economic Digest, 54(41), 19.

Karkouti, M. (2009). Dubai — getting by with a little help from its friends. Middle East, (400), 54-55.

Lincoln, S., & Denzin, N. (2003). Strategies of qualitative inquiry. Newbury Park: New York: Routledge

Longnecker, M. (2008). An introduction to statistical methods and data analysis. New York: Cengage Learning.

Matsuda, K., & Silva, T. (2005). Second language writing research: perspectives on the approaches. Newbury Park: Sage Publishers.

Matveev, A.V. (2002). The advantages of employing quantitative and qualitative

methods in intercultural research: practical implications from the study of the perceptions of intercultural communication competence by American and Russian managers. New York: Russian Communication Association.

Middle East Central Bank Governors. (2011). MEED: Middle East Economic Digest, 55(27), 38.

Pearce, D., & William, G. (2006). Mixed method of data collection strategies. New York: Cambridge University Press.

Appendix

Kindly attach the questionnaire.