Data

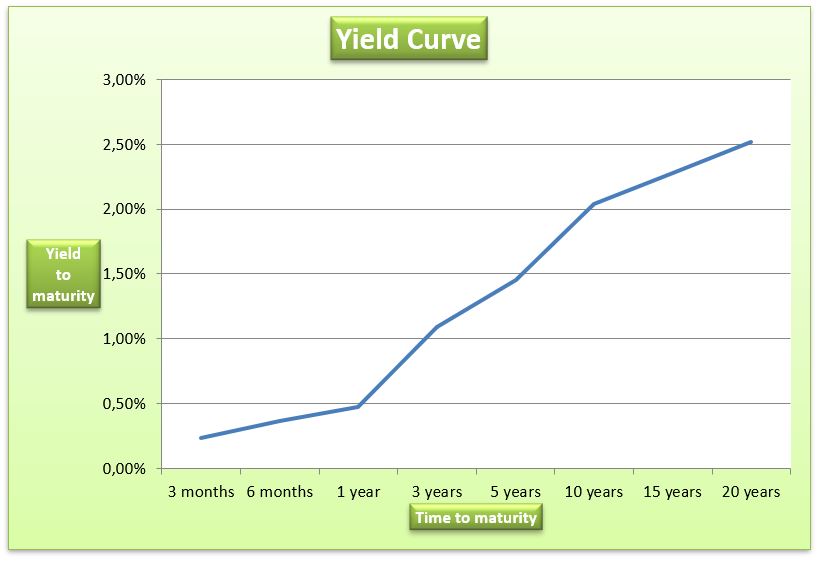

The paper seeks to evaluate the relationship between time to maturity and yield to maturity of bonds. In order to achieve this, data for various US Treasury securities will be collected. Information on time to maturity and yield to maturity of the securities are provided in the table below.

From the information in the table above, a graph will be drawn to show the relationship between time to maturity and yield to maturity. The graph is presented below.

Discussion

In the graph above, it can be noted that the line is upward sloping. This implies that there is a positive relationship between the yield to maturity of the bond and the time to maturity. It indicates that debt investors tend to earn a higher yield when they invest in long term government security than in short term securities. The upward slope also shows that that long term bonds offer higher yield than short term bonds. It is worth mentioning that the relationship between yield to maturity and time to maturity of bonds with equal level of risk is known as the term structure of interest rates. The slope of the yield curve is affected by a number of factors (Hahn & Lange, 2008). For instance, differences in the expected inflation rate have a significant impact on the slope of the curve. If investors expect inflation rate to rise, then the yield curve will have a higher slope. This implies that investors will have higher return when the inflation rate is expected to increase.

Based on the concept of expectation theory of the term structure, the yield curve can give information on future interest movements (Gitman, Joehnk & Smart, 2011). The theory states that at equilibrium, investors expect to earn the same amount of return whether they invest in long term Treasury bonds or a number of short term bonds. Since the graph above is upward sloping, it implies that the long term bond yields exceed short term bond yield. Therefore, investors expect the short term interest rates to rise. In this case, the investors will forgo the higher yields on long term securities and purchase a number of short term securities (Lajili & Rakotondratsimba, 2012).

Decline of yield to maturity

A fall in yield to maturity of a bond from 8.5% to 8% will increase the duration of the bonds. This is based on the fact that when the yield to maturity rate drops, the bondholder will receive payment at a slower rate than before the increase because on the fact that the present value of distant cash flows will not be overshadowed by the present value of the nearer payments.

The duration get closer to maturity date

The price of a bond will always get closer to its par value as it nears the date of maturity. Therefore, if the bond is trading at a price that is higher than the par value, then there will be a reduction in price over time. However, the price will not go below the par value. On the other hand, if the bond is trading at a discount then the price will increase until it reaches the par value. Finally, if the bond is trading at par, then there will be no changes in the price of the bond (Gitman, Joehnk & Smart, 2011).

Increase in market interest rate

Studies indicate that there is a negative relationship between interest rate and bond prices (Gitman, Joehnk & Smart, 2011). Just like all other investors, bond investors always seek to maximize returns received from investment in bonds. Even though bond investors are contended receiving a fixed rate of return, their level of satisfaction is also affected by other factors in the market. If the market interest rate rises from 8% to 9%, then the bond will be less attractive. This is based on the fact that the market offers a better return on investment than bonds. In this case, the bond will not be demanded by other investors because they will prefer to invest in securities that offer a higher rate of return. This is consistent with the axioms of consumption, which states that consumers will always prefer more to less (Gitman, Joehnk & Smart, 2011). In this case, there will be a need for the bond market to respond to the changes in the prevailing interest rate in order to make the bonds lucrative. Thus, the price of the bond will decline to a level that can match the same return that is offered by the market. The resulting effect is that the bondholders will also gain from an increase in market interest rate. Therefore, it can be noted that the inverse relationship between the market interest rate and bond prices is consistent with the law of demand and is best understood by analyzing how the market responds when the interest rate changes.

References

Gitman, L. J., Joehnk, M. D., & Smart, S. B. (2011). Fundamentals of investing (11th ed.). Boston, MA: Pearson.

Hahn, W., & Lange, D. (2008). Teaching bond valuation: a differential approach demonstrating duration and convexity. Journal of Economics and Finance education, 7(2), 13-19.

Lajili, S., & Rakotondratsimba, Y. (2012). Enhancement of the bond duration-convexity approximation. International Journal of Economics and Finance, 4(3), 78-91.