Market analysis

Zara, which deals in clothing and footwear retail, is a subsidiary company of The Inditex Group which was founded in Spain way back in 1975 by Ortega. The latter was considered as one of the wealthiest men during that time. Specifically, Zara specialties include low priced clothes for diverse populations and thus focus on audiences as opposed to individuals. It is located in most parts of Europe although most of its activities are concentrated in Western Europe. The company has expanded into other continents of the world as well, including Asia, America, the Middle East and some parts of Africa. Due to price considerations, the company stocks cloths and footwear products suitable for average income earners and thus does not emphasize on high prices for its clothing. As at 2008, the company emerged top of its competitors as the world’s largest in terms of retail business after the release of its quarterly results, with a revenue exceeding 2.2 billion Euros. One of the most favorable conditions during the 2008 period was the fluctuation and loss of stability of the Dollar. As a result, the company stabilized with more consumers shifting loyalty from other competitors to purchase its products. There is no direct emphasis on fashionable clothing due to concentration on price policy and hence fashion timing is unconsidered. These factors have continued to attract more customers, especially those who may not be able to afford expensive fashionable clothing that is available from Zara (Maguire, p. 185).

On the other hand, H&M, a company that was founded in Sweden, deals in clothing that is specially designed- fast fashion- targeting all segments of the populations such as women, men, children and teenagers (Islam, p. 25). Due to emphasis in design and particularly fashion, most of its products are more expensive, than what Zara offers. The company, with its offices located in Sweden, is directly responsible for designing, distribution and retail control and thus creates everything as envisioned. Its manufacturing aspect is directly outsourced to more than forty companies worldwide; located in Europe and Asia especially China. According to Pehlivan (p. 354) the company has more than two thousand stores worldwide with more than eighty six thousand employees. This puts it among the leading companies in the world as regards the clothing retail industry. Like its competitor Zara, its big market region concentrates in Europe where it covers almost all countries in Western Europe but extends to cover the whole of Europe. There are other market regions in the Middle East and North Africa that comprise a small percentage. Its Asian market region centers in China, Hongkong, Japan and South Korea. In America, the company only operates in North America, especially the US and Canada, with no retail stores in South America. Only Egypt is covered in the African market. From this coverage, it is evident that the company only seeks financially able clients, who can afford the expensive clothing sold under its brand name. Therefore, H&M suggest class in the market regions (Roncha, p. 68). Today, the company stands in the leading companies in the world as regards fashion design, distribution and retail. This thus puts in a suitable place for tough competition from other clothing retail companies at its caliber. As indicated below, its market has continued on an upward trend.

Dealing with clothing products in Europe is considered as a fast moving business. For instance, consumer behavior in Europe is quite stable and consequently the choice for regions around Western Europe for these two companies. Smith (p. 85) predicted that consumer behavior in Western Europe is slightly fluctuating due to stability of the Euro and thus is unlikely to change in a period of a half a decade. This positively affects companies located in Europe with their own stabilities. As observed in 2008, the Inditex group came top due to fluctuation of the Dollar which led to a drop of the then leading company in the clothing and fashion industry; Gap. Since then the Inditex has remained as the leading company in fashion clothing in the world. Following factors such as the continued economic recession that heavily affected the world in recent years up until now, the dollar has continued to experience frequent fluctuations and this has heavily affected many companies negatively, especially those located in the American regions, impacting a drop in sales. High income earnings in European countries make consumers able to purchase at any given time hence preference for Zara. Coupled with fashion consciousness among teenagers, men and women also increase the rate of purchase in Europe and America, hence preference for H&M.

Strategic marketing, market segmentation and targeting

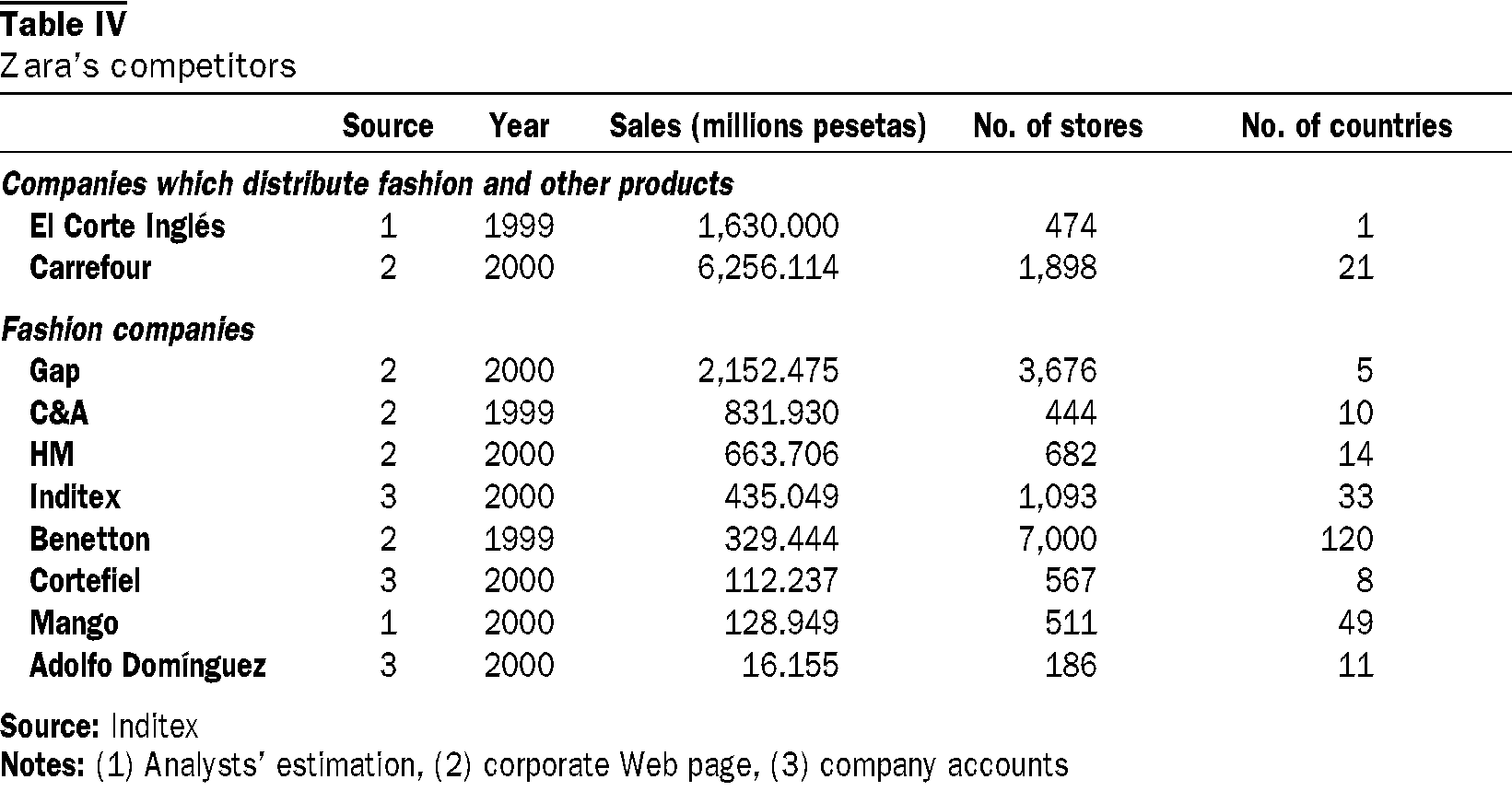

Strategic marketing is highly important towards company growth. Zara has employed a loyalty program for customer’s retention. It is also cautious in selling sites and thus prefers to produce less in addition to finding a perfect market site. Thirdly, the company believes in using a minute percentage in marketing, whereby, according to a report produced in 2009, it only spent approximately 0.3% of its total revenue on marketing campaigns (Dahlén, Lange & Smith, p. 58). Nowadays, the company has employed cheaper online and digital marketing strategies to help in minimizing of marketing expenses. Due to this, it has gained a lot of competitors and indicated below, its competitors were as shown;

Source: Inditex

Similar to takeover in technological takeover, H&M has not been hesitant to employ new technology in marketing. Adoption of mobile advertising campaigns whereby SMS messaging services are used has been given priority. Additionally, the company has campaigned through putting of banners in websites. In another dimension, it has engaged in community projects to enhance image. With its ethical fashion brand, the company recently announced that 25% of all sales from this brand would be channeled directly to such the fight against HIV and Aids.

Market segmentation plays a vital role for company stabilities. Under clothing, Zara has specialized in segmenting the market along lines of cost. With an understanding of economic harsh realities facing the world, resulting from economic recession and given that people encounter challenges in spending, Zara has specialized in less costly clothing for a majority. With specialization in relatively cheap clothes for men women and children, market segmentation for this company has taken a dimension of lines of costs. Zara should embrace innovation as a corporate strategy. Innovation may be defined as the development, harnessing and economic usage of new products, processes, and services. Non-technical and technical innovations such as enhanced management activities, organizational transformations, and better ways of creating products and services enable companies to respond more effectively to more complex consumer demands.

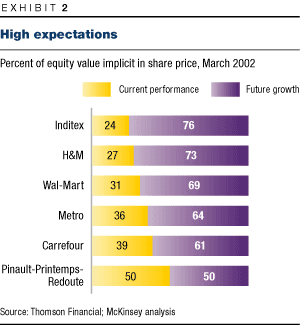

On the other hand, H&M has laid emphasis in market segmentation along the lines of fashion. With emphasis in fashion consciousness and with an understanding that the European, American and Asian markets are economically strong, H&M understands that consumers are able to purchase expensive clothing as long as they are fashionable. This has thus made the company stand out in the fashion industry, earning itself one of the top positions among its competitors. Brand equities of the two companies have remained stable as shown in the Figure below; Figure 3: comparing brand equities. Market segmentation is a demanding activity because of larger customer variability, varied product applications, and issues relative to identifying the major differences amongst customer groups. Theorists have attempted to explain market segmentation from different perspectives, by referring to variables that are strongly product based or those that relate to customer needs and orientation. In view of multiple productS, larger customer unpredictability and issues related with identifying the major differences amongst customer groups, the market segmentation process for Zara is quite demanding.

Source: Thomson Financial;McKinsey analysis

Positioning

Both of these companies experience intense competition in western European regions. While dealing in the same line of industry, the companies have established themselves as totally different brands. Both companies have employed the approach of multi-branding to reduce risks and thus attract specific consumers. For instance, Zara and other brands such as Massimo Dutti under Inditex have continued to show achievement of great levels in consumer recognition.

On the other hand, H&M has adopted the same strategy through introduction of multi brands as a new concept. H&M has also taken a new concept in marketing through competitive challenges against Inditex. It has also positioned itself en route for the lower end scale, meaning that it is well laid out to face resistance attributed to lower consumer confidence that is also attributed to changing economic times.

Competitive differences and advantages

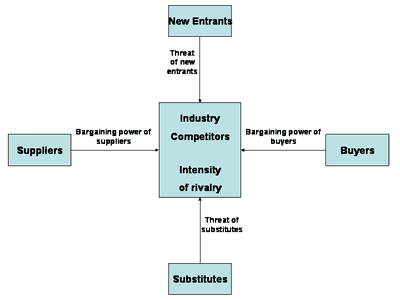

From the strategies taken into consideration by these individual companies, it is evident that Zara uses cost as a strategy in a competitive environment (Rangan 32). Through insistence on low cost clothing covering all ages and gender, the company has sought to defend consumer expenditure through production of fashionable clothes but at cheaper prices that most of its competitors. It has used this strategy to attract more clients at all times, despite economic recessions. According to the Porter model, the use of cost as a competitive advantage increases chances of consumer loyalties and retention in companies. This has led to great achievement of perfect results which have led to its acquisition of a top spot in the clothing industry. Distribution has thus been limited to economic strongholds and other regions of the world with caution in expenditure.

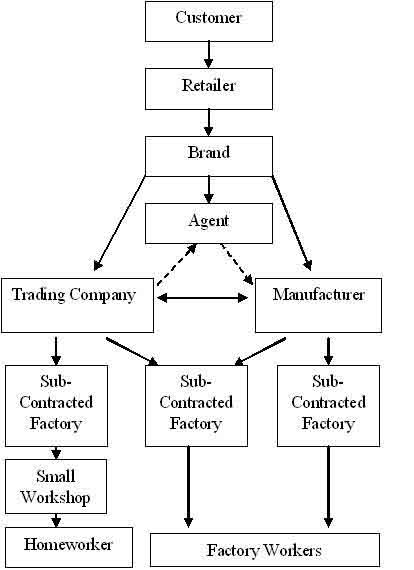

On the other hand, H&M has specialized in differentiation as a strategy for market recognition. According to Aboulian, Charnley & Watkins (46), the company has differentiated itself from companies such as Zara by recognition of fashion and thus the fashion conscious clients. In a competitive environment with many companies offering services in the clothing industry, H&M has found it important to stand out from the rest by adoption of fast-fashion clothing industry. This has enabled it to continue retaining clients throughout as long as it keeps pace of fashion trends. This advantage has suited the company in a market of economically stable consumers found in Europe, East Asia and the American regions. This has made it possible to distribute to only regions with economic stabilities (Sharma, p. 87).

Brand recommendations for Zara fashions

Seek new opportunities

One of the best ways in which a business can effectively sustain and maintain its growth in the competitive market is by ensuring that it sets up efficient growth strategies and seek new growth opportunities. Caro et al. point out that with developments in globalization, consumer’s tastes and preferences as well as behavior are increasingly changing and this greatly impacts on the performance of fashion shops (p. 71). It is on this front that Zara should seek new opportunities that are in the apparel market. Besides, research indicates that consumer behavior in the US as well as in Europe is changing faster, and this massively impacts on specialty retailers and department stores like Zara. Even though consumers of Zara products and its retailers in the market have regarded its commodities as the trendiest in America compared to H&M, changes in the market affects its sales and forces it to sell at a relatively low price. Therefore, it is recommendable that it seeks new opportunities of winning the loyalty of its customers through creation of new and innovative products.

To sustain a competitive edge, Zara fashions should seek to develop another central distribution facility in America. This will not only decrease logistics, but also aid it in delivering its fashionable goods in an effective and efficient manner. On the same note, the new central distribution facility should be channeled to link with its other distribution centers that are not well developed such as those in Mexico, Brazil and Argentina. Linking them will be an advantage to the company as its products and fashion products in America will be effectively and easily interpreted by Mexico, Brazil and Argentina. In addition, the new central distribution center will allow the other smaller distribution facilities to expand their areas of business with the extra funds they make through advertisement which is an important component for a business intending to penetrate in the global market.

Conduct e-business and internet retailing

In his publication, Caro and Gallien point out that in the global market arena, technology plays a pivotal role as businesses today have embraced e-commerce and internet retailing to boost their overall performance, perform marketing and sales activities effectively and competently. Internet retailing can be an opening for Zara to enhance its business activities especially in the US market (p. 258). It is on this front that I recommend that Zara fashion adopt internet retailing since Americans today prefer to purchase apparels as well as other products from their offices or comfort of their various homes and at a time they wish. Indeed, it is agreeable that Zara fashions does not akin to overexposure, but since it is intending to grow and expand its sales in the US market, the selling strategy that it should adopt and that will make it realize its goals and gain a competitive edge is internet selling. This kind of selling, as research indicates, will aid assist Zara to easily and speedily access and reach its consumers.

Management scholars in e-commerce point out that a company whose products keep changing may have difficulty using internet retailing effectively to market and sell its products (Caro & Gallien, p. 259). In agreement, direct selling or marketing using the internet may pose as a problem for Zara fashions since it may not competitively display online its ever changing products. As true as that may be, Zara will still be able to maximize its sales and make profits since online shoppers looking for their staple basics may in the end purchase some of the trendy Zara pieces or its moderate selections.

Offer specialized products

One of the sources of competitive advantage for Zara fashions has been its ability to offer specialized products internationally to consumers with different preferences. However, there is need for more specialization to be done for Zara products not only internationally, but also within a city and in different geographical locations. This will be advantageous in the sense that consumer demands for Zara products will be effectively met, and this will furthermore motivate consumers to buy products from their own regions. In other areas where Zara is experiencing Cannibalization due to the concentration of its shops within a city, appropriate planning should be done and product differentiation conducted in those locations in order to enhance shopper traffic. Through word of mouth, shoppers will be able to hear of new products reaching their locations and make purchases. Besides, differentiation will reduce cannibalization of the chain stores by limiting concentration of same products within a location.

Should it start up or add more chains?

From the perspective of meeting the growing market demands and its ability to make more products, Zara should add more shops. The sourcing and manufacturing levels of Zara have over the years expanded substantially. Through the help of its headquarter personnel and its purchasing office in Hong Kong and Barcelona, Inditex through Zara outsourced finished products, fabric and other inputs from the external suppliers, manufactured 40% of the finished products internally and sourced from Europe and North Africa approximately two-thirds of the items while one-third came from Asia (Bjork, p. 2). Zara itself had enough factories to carry out this process and it also had its own centralized distribution system. More chains are therefore needed to cater for the growing market needs. The plans that Inditex had for the year 2002 were to increase stores for Zara with 55 to 66 new stores. These stores were to be in Spain and outside Spain (Epiro, p. 7). Those outside Spain were to be 80% of the total added stores. Due to the growth in the global market today, more stores across the world would ensure more consumers are reached since Zara has accounted for a greater selling area due to such expansions.

Investment

There is need for Zara Company to do more significant investments in areas North America, South America and Asia. These areas have greatly developed and hold for the company a large customer base due to the immense populations and market positioning. Other areas like the Middle East are profitable and worth having many stores and products for consumers. In the mentioned regions, expansion efforts could be made because of the higher than expected demand that would be able to cater for operating costs and it would offer the brightest prospects for a significant and sustained growth. Besides, Zara can add more chains through joint ventures in areas where it has difficulty in obtaining licenses to open new stores. Entering a joint venture has been a source of gaining a competitive edge that it uses to triumph over its competitors. For instance, Zara formed a joint venture with Percassi, an Italian group specializing in fashion retail and property in the year 2001 to enable it expand its stores in Italy (Diderich & Barker, p. 8).

Seek new expansion methods

Finally, Zara should formulate strategies that will aid it in overcoming challenges that faces many apparel shops in the fashion industry. Zara’s competitive advantage has been seen in the manner in which it has been able to exhibit a potential for sustaining its growth. However, there is need for the company to sustain this in order to effective and favorably compete in the global market. Therefore, Zara should continue conducting its functions by elevating its operating income, develop a unique and strong business model and seek expansion opportunities within the retail industry. This will assist it in making rapid expansions to different countries. It is imperative to point out that its brand has increased it fame among many nations in Europe where it is known as a shop that offers well priced and consistently trendy apparel every week (Donahue, p. 11). However, this is not the same in the American market where it is not popular with people. Therefore, the company should continue to innovate and re-invent itself to meet the needs of the American market as well as the global market.

Conclusion

To sum up, the analysis of H&M and Zara fashions have clearly indicated that both companies have been able to sustain their growth and compete effectively in the global market arena due to their diverse business strategies. Of great importance is the management strategy at Zara which has precipitated its growth and performance. It has a good management team, strategies and policies and a well established international expansion strategies, committed workforce, viable market for its products and a well established distribution system. The analysis has clearly indicated that Zara has made progress towards implementing social strategy that involves dialogue with local communities, non-governmental organizations, subcontractors, suppliers and employees. The paper has also emphasized on key recommendations that if embraced and adopted, will not only enhance its general performance, but also ensure that it enjoys competitive advantage not common among its rivals.

Works Cited

- Aboulian Lucy, Patrick Charnley & Watkins Hannah. “Case review: Adidas AG, Adidas Benelux BV v Marca Mode CV, C&A Nederland CV, H&M Hennes & Mauritz Netherlands BV, Vendex KBB Nederland BV”. Journal of Brand Management 16.3 (2008): 213-215.

- Bjork, Christopher. “Zara wakes up to online sales”. Wall Street Journal 2010.

- Caro Felipe, Gallien Jeremie, Díaz Miguel & García Javier. “Zara uses operations research to reengineer its global distribution process”. Interfaces 40.1 (2010): 71-89.

- Caro, Felipe & Gallien, Jeremie. “Inventory management of a fast-fashion retail network”. Operations Research 58.2 (2010): 257-274.

- Dahlén, Michael, Lange, Fredrik & Smith, Terry Marketing Communications: A Brand Narrative Approach. Chichester: Wiley, 2008. Print.

- Diderich, Joelle & Barker, Barbara. H&M And Zara enter new markets. WWD, 2010.

- Donahue, Wendy. “Zara spills a few secrets:… and prepares to open 2 stores, at long last, in downtown Chicago”. Chicago Tribune, 2009.

- Epiro, Stephanie. “Zara Eyes Australia, South Africa”. WWD, 2010.

- Islam, Muhammad & Deegan, Craig.. “Media pressures and corporate disclosure of social responsibility performance information: a study of two global clothing and sports retail companies”. Accounting and Business Research 40.2 (2010): 131- 148.

- Maguire, Marion. United colors of Benetton: a company of colors and controversies. München: Grin-Verl., 2003. Print.

- Marsh, Emilie. “Zara helps lift Inditex 4th-Qtr. Net”. WWD, 2010.

- Pehlivan, Ceyhun Necati. Financial Analysis and Valuation of INDITEX: A Business Valuation. New York: Springer, 2011. Print.

- Rangan, Kasseri. Transforming your go-to-market strategy: the three disciplines of channel. Boston: Harvard Business School Press, 2006. Print.

- Roncha, Ana. “Nordic brands towards a design-oriented concept”. Journal of Brand Management 16.1-2 (2008): 21-29.

- Sharma, Mayank. Product Management: Product Lifecycle and Competitive Marketing Strategy. New Delhi: Global India Publications, 2009. Print.

- Smith, Dickson. International directory of company histories, Los Angeles: St. James Press, 1999, Print.