Abstract

The existing framework for taxation has enabled companies to transfer profits from high tax systems to low-tax regimes. Patents rights or trademarks calculations may be simply moved from one nation to another with a minor change in actual economic activity or profit accumulation. This thesis analysed the determinants of tax planning as it relates Apple Corporation. Tax minimisation is the action of organising a firm’s financial affairs to profit from tax benefits and decreases the tax liability without compromising tax regulations. To avoid the challenges in identifying tax variations, this study considers tax-planning activities.

It concentrates on the association between tax pre-planning and tax reform, although the legal facets of evasion and avoidance are not empirically analysed. The thesis explores tax planning procedures and tactics that multinational businesses utilise to circumvent tax obligations. The focus of this study is on Apple Corporation’s tax planning operations.

The study provides a comprehensive illustration of how a multinational firm manages its tax plan and re-test the current tax regulations in the US. A comprehensive literature review and statement analysis was conducted via a procedure of reiterative readings of several submissions and hearings from the US Senate being further processed during the investigation. The report also considered a counter analysis on behalf of Apple’s management and media releases. The thesis utilised analytical and descriptive research techniques to investigate the impact of aggressive tax planning on tax authorities, economy and revenue generation.

The thesis evaluated tax planning methods, concepts, and approaches. The research focused on the Apple tax planning practice and operations. The investigations by the US Senate concluded that Apple’s tax avoidance deprived the nation of tax obligations worth billions of dollars. Apple’s management made specific clarification and granted press releases about its tax obligations. During the last quarter of 2017, the company described its activities as transparent and devoid of any irregularities.

The management argued that it paid over 15 billion dollars as corporate tax obligations and did not short-change any tax jurisdiction. The determinants of aggressive tax planning could be personal, corporate or even national. Economic analysts believed that governments like Ireland, Bermuda, and the Caribbean Islands intentionally created the clause within their tax regulations to attract employment and revenue from foreign corporations.

The tax burden is a weighty and relevant problem in business operations and expenditures. Companies use tax-planning methods to raise their competitiveness. Further studies will continue to focus on how firms can face tax burden standard tax regulation rather than apply ambiguous and fraudulent strategies to minimise tax treatment for its net earnings. This thesis contributes to knowledge in several ways. First, this analysis is unique because the study reviewed several works of literature that delivers a thorough summary of tax planning concepts and methods.

For that reason, the study provides academics, economic analysts, tax regulators and auditors with detailed information associated with tax avoidance. The findings deliver an overview of the plan and methodological issues connected to the approaches of tax minimisation. Tax planning aims at decreasing the total tax vulnerability of an organisation. Therefore, companies can undertake unique business plans, which demand funds transfer by geographic region. Indeed, tax minimisation strategies allow individuals to move net earnings from one foreign account to another at a low cost through fraudulent manipulations.

Introduction

The tax plan entails strategic planning for exemptions and rebates in accordance with the Tax Act. Lawful tax planning is performed to decrease the total amount of tax paid to the authorities. Interest in corporate tax planning has quickened in the last decades as a blend of administrative, economic, and technical factors have fuelled public consciousness of corporate tax actions ( Alexander, De Vito and Jacob, 2020).

Public awareness of business tax avoidance has grown with practices such as adjusting the number of fixed assets, raising the quantity of debt, and reporting declines to become financial loss reimbursement (Oyeyemi and Babatunde, 2016). The organisation’s aims are to optimise profits that flourish the business owner. In optimising gain, there are constraints faced by the business, particularly taxes to the authorities that influence benefits earned from the market sales (Chytis, Tasios and Filos, 2020). Therefore, under tax planning, organisations are searching for methods to reduce charges paid.

The impact of tax planning benefits shareholders or companies whose tax earnings are decreased. The notion of tax reduction can be categorised as tax avoidance and tax circumvention (Chytis, Tasios and Filos, 2020). Tax evasion is done legitimately while tax circumvention is performed unlawfully (Chytis, Tasios and Filos, 2020). Based on these submissions, this paper will focus on tax planning strategies and its impact on tax deductions.

Businesses are permitted to use full advantage of allowances and provisions of the tax code to remove unnecessary tax burdens. Some investments might be more competitive in their tax plan and seem to exploit loopholes or create positive explanations of ambiguities in the tax law. Whilst this tax avoidance is legal, most analysts assert that tax circumvention is not the aim of any tax legislation. These tax planning strategy differ from those covered in the concept of tax circumvention, where companies influence their tax obligation (Riedel, 2018).

It explains why organisations extensively take part in tax planning to decrease their income tax because earnings tax costs will reduce the firm’s profit. Corporations elect to seek the services of a tax representative with the only goal of decreasing the taxes they are expected to cover (Armstrong, Glaeser and Kepler, 2019).

The authors argue that tax laws facilitate debt planning since it is considered as a legal tax avoidance program. Some businesses perform tax planning, but because of the benefits and pitfalls associated with tax reporting, these companies are hesitant to tackle tax planning. The reason is caused by specific variables in firm size and its capacity to conduct tax-planning activities. The relationship between tax planning and the company size has been studied in many works of literature (Oktavia et al., 2019). The research showed that large corporations paid lower tax duties because they adopted different measures in tax planning.

Problem Statement

The existing framework for taxation has enabled companies to transfer profits from high tax systems to low-tax regimes. Patents rights or trademarks calculations may be moved from one nation to another with a minor change in actual economic activity or profit accumulation. Consequently, the disagreements and poor coordination between the tax systems in the host and resident country may provide opportunities for businesses to take part in a tax reduction program (Barker, Asare and Brickman, 2017).

Ultimately, there are obsolete regulations that offer preferential tax treatment to individual income earned overseas, or that allow legal manoeuvring. Based on the above submissions, this thesis seeks to analyse the determinants of tax planning, whether lawful or unacceptable. The paper will examine the intent of multinationals as it relates tax burden, tax duties, tax avoidance or circumvention. The focus of this analysis will be on the global interest from the actions of US-based multinational businesses.

Much like international family names, their efforts gained a lot of marketing. Many governments’ inquiries have concentrated on the methods of transnational corporations. Based on these assumptions, the paper will examine the tax planning activities of Apple Corporation. The choice of the multinational company is based on the hearing in the US Congress that criticised Apple because of its processes to avoid tax duties. Many multinational companies from the US embrace identical tax reduction methods as Apple implements, and hence Apple investment could be deemed as a representative of several multinational firms.

Research Objectives

Tax planning is regarded as a dilemma with interest to citizens, professionals, government, and researchers. The activities of tax avoidance or circumvention might distort tax burden circulations and affect asset provisions (Rashid et al., 2015). Tax planning is the action of organising a firm’s financial affairs to profit from tax benefits and decrease the tax liability without compromising tax regulations. To avoid the challenges in identifying tax variations, this study considers tax minimisation activities.

It concentrates on the association between tax pre-planning and tax reform, although the legal facets of evasion and avoidance are not empirically analysed. Whenever there is prior intent to decrease the tax burden, the processes are called passive tax minimisation actions. In the lack of a previous purpose or goal, tax plan activities are deemed ‘effectual’, even though it can be reasoned that the actions of tax minimisation are impassive or dynamic. Depending on previous assumptions in different works of literature, any tax plan that is translated as a task could be described as avoidance or circumvention (Rashid et al., 2015).

Justification of the Study

Multinational businesses, specifically innovation and technology investments, use tax and earnings regulations to reduce their tax payment from the countries of residence. Prior studies show that the treatment sometimes cannot be justified because aggressive tax planning could be regarded as tax avoidance (Barker, Asare and Brickman, 2017; Kohlhase and Pierk, 2019; Kovermann and Velte, 2019). Although some works of literature assert that such tax activity agrees with the regulations of the states involved, and therefore it is legal (Barker, Asare and Brickman, 2017; Kohlhase and Pierk, 2019; Kovermann and Velte, 2019).

The press has been mindful of the actions of some multinational companies such as Apple, Amazon, Facebook, General Motors, Chevron, Halliburton, and Facebook. These multinationals used original tax schemes to minimise their tax obligations. This thesis will explain and explore the tax planning procedures and tactics that multinational businesses utilise to circumvent tax obligations. The focus of this study is on Apple Corporation’s tax planning operations.

The study will provide a comprehensive illustration of how a multinational firm manages its tax plan and re-test the current tax regulations in the US. Apple Corporation was investigated by the US congress for possible tax fraud. Ever since that time, different works of literature, press statements, and evaluation by the IRS about Apple’s strategies have been published.

Literature Review

Overview

This section will discuss the concepts of tax planning, definition of terms, and various strategies of aggressive tax planning. The section will review theoretical, conceptual and empirical theories to support the research objectives. The author will review different works of literature as it relates to tax planning and its impact on tax deductions.

Tax Planning Concepts

This thesis will analyse the intent and reasons behind tax planning and provide insights using Apple Corporation. Therefore, the definitions of tax planning will be explained in this context. Tax planning reveals the taxpayers’ ability to organise his or her trade activities to reduce the burden of tax duties. Tax planning is defined as the adjusting a firm’s operations to defer, hide, lower, or remove the number of tax deductions payable to the government (Oats and Tuck, 2019).

Tax planning is recognised as the ideal option, in legal rules, to decrease the tax burden (Oats and Tuck, 2019). To comprehend tax minimisation theories, tax circumvention and tax avoidance ought to be distinguished (Auerbach et al., 2017). Failing to differentiate between these concepts can create severe legal implications on the proper tax planning.

Global tax planning standards are used to decrease a multinational tax obligation over the constraints of the law. It needs a comprehensive understanding of the various tax systems and treaties of the host country (Gokalp, Lee and Peng, 2017). Additionally, the tax systems of different nations ought to be understood because; a business’s tax liability may be decreased by relocating its head office to a foreign country. Therefore, tax planning contains unique structures to reduce the effective tax rate. The minimum tax costs within the tax strategy must be valid. Tax planning is crucial for businesses to lower the distortions brought by gaps in national tax systems that could cause double tax (Brune, Thomsen and Watrin, 2019b).

Thus, tax planning reduces the total tax of a multinational company. Another word associated with reducing corporate tax is tax avoidance. Consequently, the business environment influences the probability of a company to take part in tax planning. For example, businesses in trading, industrial production, customer goods, and solution investments are involved in tax planning than other industry investments in construction and infrastructure industries for the essence of the company and the restricted tax incentives presented to them (Olajide, 2017).

Taking into account that businesses approach tax planning differently, the disparities in tax payments often lead to abnormal tax burdens. For example, investments like mining or textiles in the US pay lower tax duties compared to pharmaceutical investments. Textile companies in the US have capital benefits, and the proportion of depletion allowances awarded to them.

In Malaysia, companies involved with the trading services and building, are challenged with a high effective tax rate (ETR) and the management of these organisations conduct aggressive tax planning using availed provisions under the law (Brune, Thomsen and Watrin, 2019b). Studies on businesses from the infrastructure and building sectors reported that a far higher ETR compared to other investments, implying that companies in these industries took part in less competitive tax planning (Wei Ling and Abdul Wahab, 2018).

Olajide (2017, p. 1954) claimed that it might be contested whether tax avoidance is legal since the ways of avoiding used vary between businesses. This circumstance continues as a debate among professionals, tax regulators, and taxpayers because that which is not acceptable for a single party could be acceptable to another group. For example, a decrease in stamp charges suggests a heightened incentive for taxpayers to circumvent payments, and the gap in rates for some investments encourage taxpayers to prefer one kind of trade rather than another to minimise tax liabilities.

Tax Avoidance and Evasion

Tax avoidance also does not imply that firms do something illegal. Lowering the corporate tax obligation is permitted in the law (Brune, Thomsen and Watrin, 2019a). These tax strategies affect the tax base of nations and influence business performance. As stated above, most tax institutions such as the European Commission and the OECD discover foundation issues through the competitive tax planning and a threat to tax earnings, tax sovereignty, and citizenship (Armstrong, Glaeser and Kepler, 2019).

The reasons for task circumvention depends on corporate tax rates and tax systems utilised to prevent double deductions. Studies show that many nations use more than one tax strategies to avoid double tax, specifically the global tax system, and the national tax framework (Armstrong, Glaeser and Kepler, 2019). Under the exemption tax system, the income of a multinational containing revenue earned overseas is authorised from the resident nation. To avoid multiple tax deductions, a credit facility is given as tax liabilities.

Under the territorial tax system, the organisation is mandated to pay tax on its profit after-sales. However, to prevent multiple deductions, a contribution to the exemption process is utilised. It means that income earned overseas by foreign subsidiaries is entirely or partly excused from the national tax obligation. This program is utilised in countries like the UK, Australia and the Netherlands. Under the territorial tax arrangement, foreign countries can repatriate their profits to different countries with no tax deductions (Rashid et al., 2015; Lenz, 2018).

However, under the global tax rule, profit repatriations can be taxed if the tax in the resident country is lower than the tax duties of the host organisation. Thus, multinationals in nations with a global tax strategy have fewer incentives to transfer profits to other countries with a reduced tax rate. By comparison, multinationals in nations using a territorial tax system have many incentives to repatriate earnings back home with the lowest tax rate.

Tax avoidance is interpreted based on the legal framework of the host nation. Tennant and Tracey (2019, p. 356) pointed out that Google used the difference between Irish and US tax laws to transfer 11.7 billion euros to Bermuda in 2014 and ended up paying only 2.8 million euros in taxes. The authors noted that Amazon moved its central business unit ownership to Luxembourg in 2006 and that Amazon’s UK office became a shipping company, while the Luxembourg office, which helped Amazon generate 7.5 billion euros in turnover, used only 134 employees. As one of the world’s most-watched technology companies, Apple continues to lead the innovation of technology products.

The company’s market value rises with the growth of stock prices. Apple’s financial situation will inevitably attract people’s attention. The US congress scrutinised the operations of Apple Corporation based on petitions filed against the tax practices of the organisation. The price of transfer pricing is challenging to implement, so regulators usually determine an acceptable range for transfer pricing with cost as an input variable (Barker, Asare and Brickman, 2017).

Multinational companies will choose a price that bears the lowest tax rate within the specified range. Therefore, faced with the transformation of the economic structure and the increasingly fierce market competition, multinational companies are forced to pay more attention to tax planning and incorporate it into an essential part of corporate financial management.

In general, multinational corporations have increasingly valued tax planning initiatives. Boeing’s headquarters moved from Seattle in 2001 to lessen the high local tax burden. Multinational companies create separate tax planning departments, while small and medium-sized enterprises hire professional tax planning companies to reduce expenses (Barker, Asare and Brickman, 2017).

This shows the importance of tax planning for business operations. Barker, Asare, and Brickman (2017, p. 12) confirmed that after the national tax policy is adjusted, relevant companies in the commercial market would have corresponding tax strategies. The study revealed that corporate tax planning had formed a more sophisticated theoretical system.

Business enterprises moved from minimising the amount of taxes to maximising the value of enterprises. However, most of the current tax planning studies are extensive, and researchers rarely conduct specialised tax planning studies based on the characteristics of various industries.

In terms of tax evasion, the organisation does not report on the prosperity and income that it earns. Additionally, the occurrence of negative opinion with tax laws forced the authorities to make firms unwilling to pay taxes. Tax planning must not be performed intending to defraud (Drake, Hamilton and Lusch, 2020).

Therefore, tax reporting must comply with stipulated accounting guidelines and under global best practices (Mgammal and Ku Ismail, 2015). An effective accounting practice is the actual evaluation of any tax-planning program. The kind of trade or the reason for such transaction may not be reported; however, the substance of business refers to raising the proof of legal records that reveal the intentions of each investor (Salawu, 2017).

Tax minimisation is the categorisation of an investor’s affairs in such a way that the tax accountant could either lower the investor’s tax burden or remove tax liabilities under tax guidelines. Tax planning is a process of discretion and foresight by the citizen that may decrease his or her tax obligation by the greatest extent under the law. Tax minimisation ensures that accruals of tax advantage and tax duties are effectively applied to prevent the penal provision.

Definition of Terms

Multinational Corporations

A multinational investment can be described as an entirety that engages in foreign direct investment (FDI) and other operations in more than one country. The level of a firm’s multinational status rides upon the quantity and dimensions of foreign affiliates, the number of nations where it controls or sells products and solutions, the percentage of its international assets, earnings and employment by its overseas subsidiaries (Kohlhase and Pierk, 2019; Kovermann and Velte, 2019).

Such status also includes the degree to which the firm’s operations like development and research (R&D) are globalised long with other facets regarding possession, management and funding. Operating its activities in different nations means that multinational corporations are subjected to governances and tax authorities.

Capital Assets

Equity, debt, and securities characterise the capital assets of multinational organisations. However, the ideal options to facilitate investments are equity or debt financing or a mixture of both. If a multinational business wants to increase funding from shareholders, the board must choose which securities to be issued (Rashid et al., 2015).

In selecting the best financing structure, multinational companies consider its affiliates along with the parent firm. In an ideal market situation, companies could use combinations of sources such as equity and debt in funding the investment without altering its value. Rashid et al. (2015, p. 111) assert that leverage affects the allocation of money flows between equity and debt, but does not change the entire worth of their company.

Tax Planning

Tax planning is the evaluation and analysis of firm or individual financial situation based on tax implications. Tax planning permits smooth organization of assets, earnings and interests. Tax planning helps the organization to prevent double tax or high tax deductions. Tax planning is defined as the adjusting a firm’s operations to defer, hide, lower, or remove the number of tax deductions payable to the government

Tax

A tax is an obligatory deductions imposed by tax authorities on individual and corporate earnings. The reasons for task circumvention depends on corporate tax rates and tax systems utilised to prevent double deductions. Tax evasion describes a scenario where an individual attempt to lower his or her tax obligation by intentionally suppressing the earnings or showing the earnings lower than the factual revenue by resorting to economic manipulations.

Tax Avoidance

Tax avoidance is the intent to circumvent tax deductions by legal means. Tax avoidance can be fraudulent when the motive and intent is a deliberate at to avoid compulsory charges imposed for doing business.

Company Tax Systems

As stated by Janský and Palanský (2019, p. 1060), company tax concentrates on the handling of incoming and outgoing investments. Charges that are related to cross-border lending choices are associated with income (Janský and Palanský, 2019). As cross-border investment must deal with two authorities and tax systems with various taxes on business income, there is a motivation for corporations to change earnings to low-taxed entities.

Residency

The foundation of tax for a business entity depends on residency. The residence of an investment depends on legal standards such as the location of registration, merger or the industrial relationship such as central control and management (Janský and Palanský, 2019; Joshi, 2020). Modifications in the tax management of residency status across geographic areas facilitate the anomalies contributing to the complexity that encourages tax planning among multinational organisations.

Accounting fundamentals and Formula Apportionment

Under the separate accounting principle, a firm’s net income is divided among its affiliate’s holdings. The cost of intra-firm trades is a challenging process in the organisation (Thanjunpong and Awirothananon, 2019). Thus, the separate accounts principle does not permit a shift of income from the resident country into another nation with the lowest tax revenue rate. Unlike the separate accounting principles, the formula apportionment allows the firm to transfer its net income to a region with smaller tax schemes.

This strategy does not change the firm’s overall tax obligations even though some multinational businesses attempt to change its net income via transfer pricing. Companies can still change earnings to low-tax nations by correcting their actions and the burden that allots profits to low-tax countries (Ozili, 2020). When an organisation operates in a dominated market (oligopoly) and adopts a decentralised strategy, its subsidiary could approve specific amounts in local markets.

In contrast, the parent company decides the transfer price. If the parent company sets a reduced transfer price for its affiliate, the affiliate becomes a low-cost company that sells in enormous volume (Amidu, Coffie and Acquah, 2019). In doing this, a more significant share of earnings is changed and taxed from the low-tax nations. This assumption suggests that transfer pricing is a tool that improves a firm’s profits and tactical value.

Double Taxation

Double taxation is the burden of equal taxes in two or more tax treatment to one investment about an identical business and a specific time. This kind of tax is detrimental to the global exchange of products, solutions and funds transfer. Thus, it is imperative to remove the challenges of double tax. To avoid this tax issue, tax regulators have encouraged the exemption credit and method systems (Kerste, Baarsma and Weda, 2019).

For example, think of a multinational firm with parent business ‘p’ and an affiliate headquartered in a residential country called ‘s’. The host and home nations might tax the affiliate’s profits under a double tax treaty. The host nation charges a non-resident dividend withholding tax called ‘ws’ on the affiliate’s net-of-corporate-tax earnings upon repatriation of the income in the parent country. Under the exemption rule, once the payoff is repatriated, the home nation will not be taxed. Based on this assumption, the ETR for this dividend equals 1 – (1 – ts) (1 – ws) or ts + ws – tsws.

Categorising Multinational Companies

The responsibilities of multinational corporations have expanded in the settings of an internationalised economy. As an economic justification, funding is more movable than labour, because investments could be established everywhere, whereas migration has impediments such as political, economic and cultural barriers (Kerste, Baarsma and Weda, 2019).

In terms of external components, multinational businesses allocate technology and capital to specific regions because of the influence of labour demand earnings. With the benefits in cost-efficiency and invention dynamism, multinational organisations enhance cheaper and productive solutions. The global community has no choice than to adopt it and supports such company updates. A multinational enterprise (MNEs) chooses places for investment based on expected yields by considering global synergies and preferences.

Manufacturing and commerce are organised within international value chains in which the various phases of the manufacturing process are established across different nations. These multinational investments include separate legal entities, which are situated in various countries, although the parent and affiliates are operated with the same economic policy. The need for a combined financial policy between the parent firm and its affiliates reveals the fiscal reality of MNEs (Armstrong, Glaeser and Kepler, 2019).

The fiscal fact explains why the US GAAP and IFRS standards require the removal of intragroup operations to regulate profits for the MNEs and its affiliates (Kovermann and Velte, 2019). These selected locations for most affiliates or subsidiaries are called tax havens. The OECD does not define or classify the characteristics of a safe have because it would create difficulties in the categorising resident countries (Fox and Wilson, 2019; Kovermann and Velte, 2019; Mohammadi Khyareh, 2019). Therefore, the regulatory body supplied the identifying variables to help in the framing of tax duties. There are just four accumulative or identifying variables.

- The existence of zero or nearly nominal tax of earnings.

- The absence of an active exchange of data.

- The lack of transparency.

- The absence of substantial financial actions.

Although accumulative, these identifying variables do not prevent or promote a case examination. Tax havens are used to lower the tax burden, increase the sustainability of investments, and elevated levels of privacy, tractability, and safety for operations overseas (Khouri et al., 2019). The current global tax system frequently leads to the discrimination of overseas trades and misrepresents competition. Initially, tax planning was adopted by these MNEs to stop double tax. In the trend, a multinational organisation could alter its investment earnings to the low tax authority to attain dual non-tax treatment of profits (Khouri et al., 2019).

As a result, MNEs could realise a dual non-tax treatment of its net income in the high-tax region and continue to market products and service to a high-tax population. The anomaly has been facilitated by two variables, which include intangible assets like intellectual propriety and the rising tax competition. Tax competition forces high-tax nations to embrace preferential tax regimes or to disable specific anti-avoidance rules.

Tax evasion describes a scenario where an individual attempt to lower his or her tax obligation by intentionally suppressing the earnings or showing the earnings lower than the factual revenue by resorting to economic manipulations. Under tax evasion, the client may provide an untrue statement intentionally, filing misleading records, the suppression of data on revenue earned, or fraudulent omission of material data in evaluations (Amidu, Coffie and Acquah, 2019).

Tax avoidance may not be easily categorised because of the need for separation in the tax process. There might be moderated rationale involved with tax avoidance. Tax minimisation performed according to legal demands defeats the intention of tax avoidance. However, tax avoidance is achieved by adjusting the event subtly to avoid any breach of tax legislation by exploiting the ambiguities in the tax systems.

Tax Minimisation Methods

Tax planning activities include a model for a detailed transaction or organised company planning. Therefore, tax planning could be a long-term or short-term activity. Short-term planning identifies year-to-year operations with intentions to accomplish restricted objectives. Long-term tax planning describes a series of activities that positions an individual for lower or zero tax obligations. Permissive tax planning describes any activity that is guided by tax legislation and regulation (Quentin, 2019).

The current law of the US tax systems permits several exemptions and incentives for taxpayers. Purposive tax planning describes activities or measures that circumvent tax legislations. Tax management is a component of the tax planning process. Tax management allows an individual to follow legal requirements to get tax deductions, rebates or aid. Tax management protects against prosecution and punishment by releasing tax duties under specific guidelines. Therefore, the analysis of tax planning is incomplete without tax administration.

Profit Shifting

Profit shifting is a type of tax planning methods. When an investor understands the processes of tax management and tax programs of its host nations, the next step is to adopt a tax strategy based on its operations. The tax strategy permits the organisation to reduce its tax burden or avoid double tax deductions (Barker, Asare and Brickman, 2017; Daniel and Faustin, 2019; Meshari, 2020).

Profit shifting or transfer is a tax planning technique used to circumvent or lower tax obligations. The investor can adopt this strategy by reporting earnings in different locations (Lenz, 2018; Kałdoński and Jewartowski, 2019; McClure, 2019; Møen et al., 2019; Neuman, Omer and Schmidt, 2020). By implication, the organisation adopts the debt and transfer pricing mechanism. The approach facilitates low-tax regulations without compromising its operations.

Debt Allocation

Debt allocation is another technique in tax planning. In accordance with tax legislation, debt capital is taxable. The yield on equity capital investors is not tax-deductible for lending business, whereas the return on debt funding is tax-deductible to the lending business. This treatment leads to an incentive for organisations to boost their debt capital. Due to the tax-deductible feature of debt capital, multinationals acknowledge the variable in tax planning (Barker, Asare and Brickman, 2017; Daniel and Faustin, 2019; Meshari, 2020).

Multinationals can apply the variable to alter earnings from the authorities with a high tax rate to regions with lower deductions. Organisations that allocate their debt capital in areas with high tax regimes and then locate the equity capital in areas with lower tax treatment can remove their interest costs against higher tax ratios.

This scenario creates a lower net tax obligation for the multinational corporation. The assumptions are consistent with the results in different works of literature (Barker, Asare and Brickman, 2017; Salawu, 2017; Daniel and Faustin, 2019; Chytis, Tasios and Filos, 2020; Meshari, 2020). Meshari (2020, p. 15) revealed that a firm’s internal debt is a vital component of the tax plan. Higher tax deduction rates raise the importance of external and internal debt capital.

An organisation could have more money than it could contribute if it improves its assets. The rationale that the provider can contribute more depends on the links with its subsidiaries and affiliates. A firm under this assumption is categorised as thin capitalisation. The impact of ‘thin capitalisation’ hampers the tax base of high tax regions because the systems encourage lower tax duties (McClure, 2019). Tax authorities can mitigate these challenges by enforcing countermeasures against ‘thin capitalisation’.

Thin capitalisation regulation restricts the number of interest payments on debt capital for tax obligations. However, effective countermeasures prevent overseas profit shifting through debt allocation (Hundsdoerfer and Jacob, 2019; McClure, 2019; Merle, Al-Gamrh and Ahsan, 2019).

Generally, tax regulators utilise two vital contempt to determine if an investment is ‘thinly capitalised’. Tax regulators could compute the debt-to-equity ratio using the ‘arm’s length principle’. Under the arm’s length rule, the organisation’s fiscal structure is compared with other parties of the transaction. The arm length amount of debt is the sum of debt a corporation could borrow from another party. Tax regulators can adopt the ‘safe-haven debt-to-equity ratio’ to test a firm’s debt-to-equity ratio. Generally, interest on the value of debt, which exceeds the safe-haven percentage, are exempted from any tax deductions.

Transfer Pricing

Multinational corporations could move or manipulate profits using ‘transfer pricing’. Transfer pricing contains costs charged for goods, services, by a single part of a business to a different location of the provider (Amidu, Coffie and Acquah, 2019; Møen et al., 2019). By charging inconsistent tax levies, a firm can change its income with an affiliated investment in another geographical area. Manipulative transfer pricing negatively affects the tax base and therefore, a danger for tax earnings and tax equity. The concern is shared with the OECD since they regulate the excesses of multinationals in trade transactions (Amidu, Coffie and Acquah, 2019; Møen et al., 2019).

To prevent losses with transfer pricing, tax regulators bodies have created regulations for transfer pricing (Møen et al., 2019). Corporations that comply with these regulations do so with ease. The guidelines are designed for all multinationals irrespective of product sales, affiliate location, and market conditions. Under these rules, transactions in various states are determined by the arm’s length principle, which could apply if the trades are among the investors.

Consequently, transfer pricing may be utilised as a tax-planning tool because it allows the management to determine transfer costs of special products, solutions or intangibles. A firm may allocate a higher price for an intangible asset transferred from a low tax jurisdiction to a higher tax authority. The strategy could lessen the global tax obligation of the multinational firm.

Tax Treaty

Most countries have signed several trade treaties or bilateral tax agreement to avoid double tax. Tax treaties ascertain which of those contracted nations may initiate the tax treatment. Multinationals use tax agreement to stop double tax deductions and improve the tax planning process (Thanjunpong and Awirothananon, 2019; Ozili, 2020). As a result, the management conducts treaty shopping to assess likely destinations with lower tax obligations and enticing tax incentives. The OECD defined treaty shopping as a legal framework that permits firms to enjoy tax relief schemes (Mohammadi Khyareh, 2019).

For example, a firm in country X with a high tax duty may not benefit for tax treaty arrangement. However, the firm may establish an affiliated investment in country Y. The country of its affiliate may have a tax treaty agreement with country D. As a result, the firm in country X will enjoy the treaty agreement between country Y, and D. Such manoeuvre may cause lower withholding tax, exemption of earnings, higher gains, double deductions or zero tax charges. To begin with, the person who owns the investment is not resident in the nation where the treaty exists.

Secondly, the investor has no financial activity in the region where the treaty hoping is found. Third, the earnings of the investment are subject to zero tax deductions in the nation where the treaty agreement is found.

Tax Havens

A tax haven is a legal jurisdiction or region that removes tax duties from companies or individuals or provides tax incentives to lure investors. These authorities provide to non-residents somewhere to escape or hide profits or other entitlements from any form of tax treatment. Tax havens are distinguished with the secrecy about banking advice they provide to shield investors from external tax controls (Merle, Al-Gamrh and Ahsan, 2019; Enofe, Embele and Obazee, 2020).

Tax havens normally refuse to enter tax treaties or arrangements with other nations to maintain and remain anonymous. These agents or principals are reluctant to exchange data with tax authorities of other nations. This absence of effective exchange of data is viewed as the significant criticisms of tax havens because it encourages prohibited practices like fraud or money laundering. By implication, a firm’s investment and trades might not have actual economic activity and therefore are tax-driven. Enofe, Embele, and Obazee (2020, p.56), argue that a fiscal competitive environment created tax havens.

These governments or tax institutions provide tax incentives to entice overseas investment. As a result, the management offers low tax prices or other appealing tax measures to draw capital and labour.

The strategy is influenced by aggressive forces to provide substantial tax incentives, promote the inflow of funds, labour and dissuade the outflow of assets or resources. If a government does not create their tax coverage appealing, taxpayers will probably depart the nation and proceed to a more attractive tax haven. Capital and labour are transferable across regions with the introduction of the European Union (Merle, Al-Gamrh and Ahsan, 2019; Enofe, Embele and Obazee, 2020).

The absence of trade boundaries made it even simpler to move the capital to the regions with the most appealing tax law. It is beneficial to move capital since the adjustments in individual income tax permit labour movement. These tax safe nets believe their actions support the structural disadvantages such as technology development, political or economic instability. It is recommended that nations should promote applications to intensify the exchange of pertinent info in tax havens. If nations adopt a proactive strategy, it will mitigate the impact of tax havens.

Tax haven creates alteration in trade patterns because of the discrepancy with the actual economic activity and the hidden exemptions. Many financial activities that seem to maintain tax havens occurs in a different location. For example, most of the earnings recorded by US-controlled affiliates might have their financial operations either in the US or overseas (Merle, Al-Gamrh and Ahsan, 2019; Enofe, Embele and Obazee, 2020).

Lenz (2018, p. 0) cites that US multinationals shift income from foreign countries with corporate income taxes in zero-tax surroundings. These strategies for altering income comprise manipulation of transfer costs and the structuring of intra-firm interest or lending rates. The diversion of earnings from overseas locations to tax havens has consequences to the actual place of investment (Merle, Al-Gamrh and Ahsan, 2019; Enofe, Embele and Obazee, 2020). Furthermore, tax havens decrease tax revenue collections from capital-exporting nations.

Secrecy Jurisdictions

The expression of secrecy authority describes areas known as tax havens or offshore monetary centres. The explanation for secrecy jurisdiction are places that intentionally create regulations for the benefit and application of non-residents within their geographic domain (Merle, Al-Gamrh and Ahsan, 2019; Salehi, Tarighi and Shahri, 2020).

The jurisdiction is designed to undermine or threaten the tax laws of other countries. Under this jurisdiction, fraudulent users or clients would not be investigated, and their identity is concealed from prosecution. The definition suggests that secrecy governments assist individuals in violating the law without detection. By implication, secrecy authorities are complicit in the legislation breaking procedure.

Tax Avoidance and Data Opaqueness

Aggressive corporate tax lessens the standard of the data environment of companies, making information dissemination more opaque. Kałdoński and Jewartowski (2019, p. 101351) reveal that big book-tax gaps are correlated with ambiguity about a company’s principles and having an elevated gap in opinion among shareholders. The empirical evidence shows the negative effect of tax avoidance to corporate data transparency, with consequences for analyst conduct (Appolos and Kwarbai, 2016).

Although existing research assesses the connection between corporate tax circumvention and earnings administration, the outcomes are combined. Lenz (2018, p. 0) revealed a positive association between competitive tax reporting and financial coverage, implying that supervisors have a tendency to create fiscal and tax choices that promote financial report earnings and reduces income tax (Merle, Al-Gamrh and Ahsan, 2019; Salehi, Tarighi and Shahri, 2020).

Consequently, tax evasion is negatively related to sales management. Although contradictory evidence in the institution between corporate tax evasion and earnings management exist, this study believes the gap involving tax circumvention and earnings management is probably positive. However, the concurrent connection between the variables is perhaps damaging from the cross-section.

Empirical Analysis

This study postulate that supervisors are not inclined to take part in aggressive tax planning and earnings administration concurrently since any noticeable increase in the book-tax gap would encourage auditors to assume that the supervisors have inflated earnings or averted income tax obligations. To avoid the suspicion, supervisors may manipulate earnings in one fiscal year and evade income tax in another year to ensure the book-tax gaps does not increase when compared with tax avoidance coverages and earnings administration in the same financial period.

Although tax evasion may be utilised as an instrument to hide bad information, it is challenging to repeat tax circumvention from consecutive years without being discovered by tax regulators. Thus, to conceal negative information over a protracted period, supervisors will pursue tax circumvention in a particular calendar year and control its earnings management in the subsequent financial period. Tax avoidance can be interchanged with earnings inflation to conceal business operations (Appolos and Kwarbai, 2016).

Earnings manipulated in one fiscal year may attract attention when the slumping profits reverse in the following year. Nevertheless, a rise in cash flow because of tax avoidance actions might help mitigate the adverse effects of these earnings reversals. The alternating pattern of tax evasion and earnings management approaches across different fiscal periods may divert the focus and vigilance of tax regulations, thus enabling managers to make the most of fraudulent opportunities.

This covert plan would leave corporate info more opaque and ambiguous in the time-series. Thus, corporate tax circumvention will probably obscure the financial data utilised by economists in their earnings predictions, making precise forecasting harder.

The major drivers of analyst coverage would be the source and demand for expert services. The distribution of expert services depends on data processing and the cost of supplying these services. Tax reporters prefer to report news on transparent companies because it is less expensive to trace and test their operations (Alexander, De Vito and Jacob, 2020).

The authors reveal that earnings management actions reduce expert solutions as tax investigators apply additional effort and capital to assess and evaluate opaque financial disclosures. Forecast accuracy is a significant factor in an investigator’s wage and career. Brune, Thomsen, and Watrin (2019a, p. 967) reveals that earnings prediction accuracy is seen as a significant index of the forecaster’s talent, and the investigators who provide results that are more accurate are paid higher over other peers. Tax avoidance encourages ambiguous financial statements and earnings administration undertakings in the time-series.

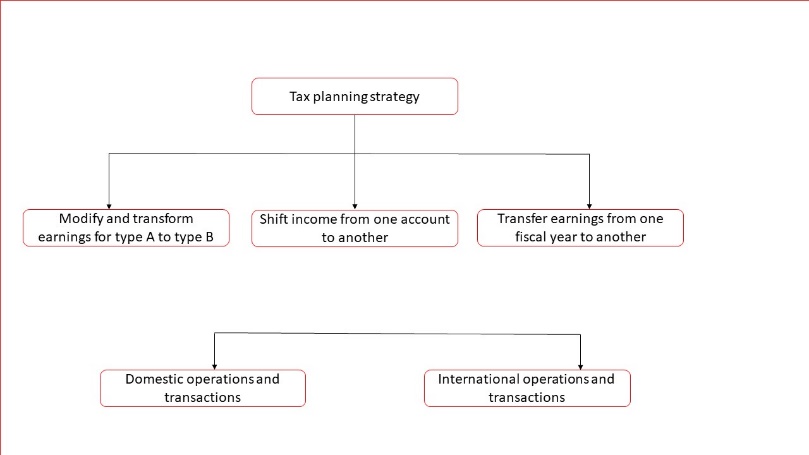

Decreasing taxes permit organisations to raise their earnings. To attain this aim, organisations use unique methods, which need a detailed understanding of tax systems and treaties of the host countries (Alexander, De Vito and Jacob, 2020). The primary practice of tax planning is to move revenues by geographic location. The evaluation of financial operations within an organisation influences the feasibility of the tax base between residence and host countries.

Nearly all countries use the principle where hidden costs between successful parties are not comparable to prices that could exist between separate parties (Alexander, De Vito and Jacob, 2020). Within this context, foreign companies could falsely charge high rates for goods from low-tax nations and vice versa (Alexander, De Vito and Jacob, 2020). Attention has been drawn to how some highly profitable corporations pay nearly zero taxes on the guidance of their host nation.

The ‘Double Irish’ arrangement entails two firms integrated in Ireland and the Netherlands. The USA categories the transacting investment as an Irish firm since the tax home is based on the authority of the US tax legislation. The tax planning policy through earnings shifting by geographical areas is associated with transfer pricing. Brune, Thomsen, and Watrin (2019a, p. 965) asserts that transfer pricing is a common type of tax planning that allows firms to manage and control their net income and tax obligations. This study chose to exemplify transfer pricing due to its enormous growth, particularly within the discipline of global taxes.

Transfer pricing is meant to supply divisional supervisors with pertinent info regarding the price and sustainability of intra-firm relations. Since the growth index for branch managers depends on the revenue accumulation or profit maximisation within their departments, transfer pricing has an integral resource allocation role in facilitating the transfer of goods and services involving branches and subsidiaries (Kałdoński and Jewartowski, 2019).

From that perspective, the transfer-pricing goal is to ascertain the supply of reported earnings in the many offices of the firm (Kałdoński and Jewartowski, 2019). Planning entails complex contracts or negotiations where firms establish at least one subsidiary or affiliate to transfer income to more positive tax authorities.

Firms can reclassify and move their earnings into a low tax authority to circumvent or decrease the tax burden. Tax planning activity considerably lowers the taxable earnings of companies in high-tax nations (Kovermann and Velte, 2019; Mohammadi Khyareh, 2019). The authors reveal that tax income has noticeably dropped by eight per cent because of the growth in the tax rate.

The assumption can be inferred from the fact that companies are more enthusiastic about tax planning prospects when costs are assigned by high tax treatment. The plan for moving profits has been adopted by multinationals since there are unique programs of ETRs among nations (Fox and Wilson, 2019; Kovermann and Velte, 2019; Mohammadi Khyareh, 2019). Businesses in more than one tax regime are inclined to prevent tax.

Indeed, there have been transfers by geographic zones throughout tax minimisation activities when there were no tax rate discounts in the US and other European countries. Møen et al. (2019, p. 435) suggested that the tax duties of multinationals are lesser compared to their counterparts. The movement of earnings is connected to a tax tactic that transforms a citizen’s income to lessen tax on those specific earnings (Kałdoński and Jewartowski, 2019; Møen et al., 2019; Neuman, Omer and Schmidt, 2020).

The tax strategy of transferring profits is a challenging concern for tax regulators because of the negative consequences on the market environment. Neuman, Omer, and Schmidt (2020, p. 45) analysed the degree to which transfers of earnings between affiliates influence the tax foundations in Canada. The authors established a theoretical model where they discovered that taxable earnings for companies that can move income between members are significantly more portable compared to businesses than cannot transfer their earnings.

Figure 1 shows how transfer-pricing works between related multinationals and its affiliates. As found in Figure 1, the diagram illustrates how companies to move their earnings to lower tax regions adopt transfer-pricing approaches. As found in Figure 1, affiliate Q is located in a country with zero tax duties. In contrast, affiliate P operates from a country B with higher tax treatment as compared with country C. Under normal market environment, affiliate Q charges higher rates in trade operations with affiliate B.

The strategy is adopted to reduce the tax burden in country B. As found in Figure 2, tax-planning approaches are vital in international investments. An effective tax plan determines the level of tax relief located to each organisation. The board of directors creates a specialised unit to manage its tax planning activities.

Since the impact of an effective tax plan is a direct result of lower tax burdens, the outsourcing agents have become a gold mine for most multinationals. As found in Figure 2, an affiliate resident in a high-tax nation would likely sell or exchange its services to subsidiaries in a low-tax state. The likelihood makes it workable to move net income from one country to another. Consequently, investors could transfer the net income for one financial year to another. The capacity to make specific transfers based on the tax planning strategy encourages tax evasion or avoidance among multinational corporations.

Multinational businesses use the redevelopment strategy as an approach to tax planning. Oats and Tuck (2019, p. 570 showed that companies profited from tax the redevelopment strategy. These companies gained tax relief packages from the UK and the US. Under the redevelopment strategy, a multinational investment could change the residency position of an organisation.

For example, Trane Technologies Corporation migrated its investment portfolio to Ireland to enjoy its tax planning. Ireland provides tax benefits of holding firms, withholding tax, and derivatives. Janský and Palanský (2019, 1072) revealed that the tax burden is a key decision-making factor in choosing the location of affiliate investments. Changes in the contracts of mergers or partnership are prompted by the need to circumvent the tax burden on US companies. Stam and Verbeeten (2017, p. 110) underscores tax loopholes as a cause of exercising aggressive tax planning actions. The authors reveal that tax complexity facilitates the misrepresentation of tax regulations and creates uncertainties.

Method and Limitations

To get an in-depth grasp of the issue of tax planning, works of literature from several sources was examined. A comprehensive literature review and statement analysis were conducted via a procedure of reiterative readings of several submissions and hearings from the US Senate being further processed during the investigation. The report also considered a counter analysis on behalf of Apple’s management and media releases. The thesis utilised analytical and descriptive research techniques to investigate the impact of aggressive tax planning on tax authorities, economy and revenue generation.

The thesis evaluated tax planning methods, concepts, and approaches. The research focused on the Apple tax planning practice and operations. Although tax planning is a legal activity, the loopholes within its legislation can be manipulated to evade tax deductions. This research is limited to the rulings, press statements and actions of Apple Inc. before the investigative inquiry by the US Senate committee. The paper provides recommendations to mitigate aggressive tax planning strategies intending to manipulate tax deductions.

The finding of the thesis is limited to tax planning activities carried out by Apple. The congressional hearings and counter motions were summarised in the discussion section. Based on the limitations of gathering individual analysis as they occurred, the thesis relied on documents, works of literature and press statements to reach its conclusions on how tax-planning methods can be structured.

Though tax planning is legal, tax auditors manipulate the tax process and are attracted to legislations that enable tax deductions. This section summarizes the methods used for the thesis. A research design is a strategy adopted to investigate a study objective. The primary data sources include articles, books, journals, literature reviews on tax planning, press statements, and other materials concerning Apple tax scandal.

Based on this assumption, this study will use the descriptive method of analysis to review several works of literature on aggressive tax planning. The research design will assist the researcher in evaluating tax concepts, techniques, strategies and determinants. Google search engine was used to gather information on the study variables. The keywords for the analysis include tax planning, tax minimisation strategies, Apple tax avoidance, and transfer pricing. The research findings were based on the review of several primary and secondary sources.

Apple Corporation

Apple is a leading global investor in technology with over 150,000 employees. The company’s core merchandise includes iPhone, iPad, Mac systems, Apple Watch, iMac, MacBook and Macintosh. The Apple Group comprises both Apple Inc. and other subsidiaries or affiliates commanded in Europe and Ireland. As stated by this analysis, Apple Inc. established and managed several business divisions known as Apple Sales International and Apple Operations Europe. The technology giant acquired some investments such as AuthenTec, NeXT Software, Shazam, Siri Inc. and Beats Electronics & Music.

Empirical Findings of Apple’s Tax Planning

Companies such as Apple, Google and Starbucks utilised transfer pricing methods, and other tax strategies to decrease their tax base from higher-tax rate authorities to a lower-tax rate or tax havens. The empirical result reveals the determinants and intents of Apple Corporation.

The actions of these companies, which is influenced by technological advancement, globalisation and dematerialisation of the market, have prospered and eventually become a significant dilemma for multinational associations, tax governments and public opinion. Apple Corporation was indicted for aggressive tax avoidance on a commercial scale. The firm was accused of shifting profits to lower-tax destinations via aggressive tax planning techniques such as transfer pricing, double Irish, and tax havens, residency, secrecy jurisdiction, profit shifting and debt allocation (Wang, 2018).

The conclusion of a transfer cost and the localisation of its value affects the net earnings and its associated tax of companies involved. Transfer charges are regarded as a deductible fee in the resale basis for the company, which pays it, and it is inserted in the costs of the associated subsidiary receiving the payment. Thus, transfer pricing signifies the fundamental challenge for businesses, shareholders, government and tax authorities globally.

No authority, country, jurisdiction, or regions enjoy the tag of a tax haven. In 2013, following a US-Senate evaluation of Apple’s corporate tax reports, the committee tagged Ireland Bermuda and Cayman as hotspots or tax havens (Holtzblatt, Geekie and Tschakert, 2016). This term shows a deeper conflict that warrants more systematic evaluation and investigation.

The Irish scandal, where the Commission evaluated the US Senate report, revealed massive irregularities of Apple’s profits listed in Ireland without a tax authority. The occurrence of profit shifting had changed tax reporting to a global concern. Cobham & Janský (2019) reveal that the ratio of Apple’s profit that was announced by the authorities besides where the inherent economic activity happened rose from 5 to 10 per cent of foreign earnings in 2008 and 30 per cent in 2014. The investigators deployed varying degrees of specialist deals on tax harbour listings and offshore financial centres to evaluate several FDI (Cobham and Janský, 2019).

The investigators assert that the term ‘oversea funds’ was not in agreement with the trade reported or compared to the absence of a transparent legal foundation for multinational action. As this implies, tax havens and offshore fund demand an investigation of territorial effect. The challenge appears to be the way to proceed from an understanding that foreign is a common element of the world market to some definition that may be made usable for study and coverage functions.

As applicable to works of literature on Apple’s aggressive tax planning, loopholes in the US tax systems influenced the intent to avoid tax obligations. Various concepts of the US tax laws and offshore regulations revealed the determinants of these assumptions. The focus on secrecy is essential as Saad (2015) asserts that secrecy jurisdictions allow multinational investments like Apple Corporation to enjoy a jurisdiction’s regulations with the assurance that their actions are legal in the regions where the companies are situated.

Based on the analysis of this research, there are two crucial features, which define a secrecy authority. First, the secrecy authority creates tax laws that benefit non-resident corporations. Second, the establishment of legal covers that guarantees that non-resident companies utilising its tax scheme cannot be identified. By emphasising what makes them appealing, the secrecy jurisdiction concept relies on the evaluation of the relative benefit of these authorities in question. The path the secrecy authorities have selected to draw foreign financial activity is the supply of relatively favourable terms to non-resident users (Sundvik, 2017).

The assumption suggests a dependence on regulatory arbitrage such as tax laws. To achieve profit shifting operations, the firm is willing to conceal from tax authorities who might take countermeasures to mitigate the benefits of tax havens or secrecy jurisdiction (Purnamasari, 2019). A significant role of secrecy framework will be to facilitate developments or adjustments in the form of financial activity to pretend it occurred in another jurisdiction other than the concealed location (Cobham and Janský, 2019).

Based on the review of several works of literature and other secondary sources, the US Senate hearings inquiry with Apple found that Apple established subsidiaries in Ireland and transferred a net profit of over 30 billion dollars with no corporate tax deductions.

Determinants of Aggressive Tax Planning

To understand the determinants of Apple’s aggressive tax planning, this paper classifies tax havens into four cardinal features. A jurisdiction, which provides lower tax deductions or perhaps non-existent deductions, could be termed a tax haven (Rashid et al., 2015). The submission is consistent with the outcomes of previous works of literature that acknowledges the right of each jurisdiction to determine whether to impose direct deductions and to establish the right tax level (Amidu, Coffie and Acquah, 2019; Janský and Palanský, 2019; Drake, Hamilton and Lusch, 2020; He, Ren and Taffler, 2020).

Secondly, the local legal or administrative agreements that prevent assess to tax information with other authorities regarding taxpayers who profit from tax irregularities. Thirdly, questionable legal and regulatory practices. Lastly, the lack of prerequisite action since the deficiency of these requirements may show the effort of jurisdiction to attract investments and transactions, which are purely tax-driven. As stated by Fernández-Rodríguez, García-Fernández and Martínez-Arias (2019), nearly half of Fortune 500 firms managed and controlled over 10,000 subsidiaries in authorities or jurisdictions regarded as tax havens.

Over the last few decades, most Fortune 500 businesses established affiliates and divisions to evade tax in either the Caribbean or Islands such as the Bahamas. The researchers argued that such reverse strategy is influenced by the disposition of tax havens to conduct fraudulent activities in Europe. The current empirical analysis is consistent with the views of Daniel and Faustin (2019), which revealed that most multinationals transferred over four billion euros overseas. This study considers that Apple circumvented its tax burdens deliberately.

Findings

The findings of this analysis showed that Apple utilised several aggressive tax techniques to evade tax deductions on its net earnings in Ireland. The state aid was considered as tax fraud, which was backed by obscure tax jurisdictions in Ireland. Based on the submissions of the US Senate, Ireland awarded a tax judgment in favour of Apple’s offshore investments with ASI and AOE. The elongated state investigation performed by the Commission reasoned that taxable earnings of both subsidiaries in Ireland were not connected to the economic fact, obtaining no factual or financial rationale.

According to the Commission of inquiry, Apple in Ireland listed these earnings and their corresponding profits into its division belonging to ASI (Holtzblatt, Geekie and Tschakert, 2016). The findings showed that AOE and ASI were not resident in Ireland and had no physical existence or personnel. The Irish division, also taxable in Ireland, has been allocated only a fraction of the company’s net earnings (ASI). The remaining substantial profit was transferred to another head office without being taxed.

The findings demonstrated that Ireland provided criminal tax treatment for Apple Corporation. Based on the Senate rulings, the company was permitted to pay an effective tax rate of one per cent of its net earnings between 2003 and 2014 (Thomsen and Watrin, 2018). Under the EU tax regulations, member nations cannot grant tax relief to selected companies.

When this happens, the state assistance must be retrieved to mitigate the distortion of competition created by the anomalies and to fortify similar treatment with unique businesses. However, no penalties are known under the EU state rules for errant investment or multinationals. The Commission mandated the Irish state to recover the fraudulent tax relief from Apple Corporation that amounted to over $13 billion (Thomsen and Watrin, 2018).

Apple decided to relocate its investments after the management consulted with specialised tax agents. With help from tax consultants, Apple moved its jurisdictions to Jersey because the state granted similar tax laws like Ireland and the Caribbean Islands. Thus, Apple has continued to gain from tax reliefs at the expense of tax authorities using aggressive tax strategies.

The investigations by the US Senate concluded that Apple’s tax avoidance deprived the nation of tax obligations worth billions of dollars. Apple’s management made specific clarification and granted press releases about its tax obligations. During the last quarter of 2017, the company described its activities as transparent and devoid of any irregularities. The management argued that it paid over 15 billion dollars as corporate tax obligations and did not short-change any tax jurisdiction.

Contrary to the findings of the US Senate, Apple’s press releases attempted to convince the public that their net earnings outside the US were taxed. The management further claimed that its net profits in the US were taxed at 35 per cent. Based on the firm’s 10-K reports in cash equivalents and securities, Apple reported 250 billion as its overseas net earnings, which positioned the corporation as the most cash reserved entity with the Fortune 500 (Holtzblatt, Geekie and Tschakert, 2016).

Apple pledged to finance the restoration level and deposited the valued amount in an escrow account until the end of appeals. Many businesses pay lower tax obligations using aggressive tax planning. The outcome is influenced by fraudulent and obscure corporate agreements with tax havens and its authorities. Based on the findings, Apple Inc. transferred 93 per cent of its profits to non-resident subsidiaries (Holtzblatt, Geekie and Tschakert, 2016).

According to the Irish legislation on companies integrated in Ireland, tax profits are paid within the state. Therefore, firms can control and organise several non-resident divisions without paying their tax obligations. Based on these determinants, Apple management averted Irish tax residency by monitoring both Irish affiliates from the US using the Double Irish strategy.

The Double Irish Technique and the Apple Strategy

The Double Irish approach involves the Irish tax legislation, which makes it possible for a non-resident company to be verified and registered as an Irish firm. Under this arrangement, Apple Inc. registered two subsidiaries as Irish companies. The AOE and ASI became Irish integrated divisions. The avoidance position means an incorporated firm will be assigned a resident status and will enjoy other resident tax legislations.

Although the Irish Finance Act 1999 modified several exceptions to this principle, among which empowers affiliate B to be termed an offshore resident, despite being integrated into Ireland. Under the Double Irish technique, an investment cannot be classified as a resident entity for tax treatment if it has a multinational status and conducts sales in Ireland. Therefore, an investment can be categorised as a related firm if the organisation is controlled by an EU resident or operates in a country with multiple tax treaty like Ireland (Holtzblatt, Geekie and Tschakert, 2016).

Thus, since Ireland has a double tax treaty with the US, affiliates like Apple Operations Europe and Apple Sales International could be categorised as an Irish resident company. Therefore, these affiliates will be integrated into Ireland, and the subsidiaries will be taxed as a resident firm. Since the US tax legislations are derived from the origin of earnings in contrast to the state of incorporation, corporate income tax is levied on all national businesses and overseas corporations that have accounts within the tax jurisdictions.

The definition of a national company includes corporations that are owned and created in the US. Thus, the gap in this residency tax legislation created the loophole that empowers the Double Irish technique. By integrating affiliates abroad, the parent provider makes sure that its earnings will not be reported or taxed by the US revenue regulators (Kerste, Baarsma and Weda, 2019).

Under this arrangement, Apple’s subsidiary in Ireland was granted the rights to a tax haven, and the entity enjoys special treatment in accordance with the Irish law. The area of command and management depends on the strategic operations of the organisation. For example, if an affiliate termed ‘Affiliate B’ derives its control and activities from the Caribbean Island, then the net income of the business cannot be subjected to the tax treatment and would not be classified as a resident of another country.

When the company is established, licensing provisions involving intellectual property will trigger profit transfer and other aggressive tax planning. In return, the affiliate B may release lower tax exemptions to the originating firm. This sub-license allows the second affiliate S to exploit the tax rights. By implication, profits from domestic sales will be paid to affiliates S. Affiliate S will subsequently transfer funds as royalties to affiliate B while the remaining net earnings are deposited in an offshore tax haven.

The illustration of Apple Inc. was manipulated with the double Irish with a Dutch Sandwich technique. The grade of tax circumvention undertaken by Apple was massive as it triggered a series of petitions and recommendations by the Senate committee of investigations to inspect overseas profit shifting, secrecy jurisdiction and tax code. Apple became one of the most profitable businesses in the US with robust operations in research, marketing and development. Apple also has essential international holdings subsidiaries and affiliates; most specific is the Irish services.

Although the organisation is resident in the US, over 200 billion dollars of its net income and asset resides abroad. The business framework utilised by apple is complicated and leads to a separation of revenue between the US sales office and offshore divisions. The technology giant established several subsidiaries and affiliates in different geographical areas.

However, these new investments conducted its operations remotely. For example, Apple Operations International (AOI) is a non-resident affiliate in Ireland. The management accrued billions of dollars with no physical presence in Ireland or employees. It is obvious the parent organisation enforced specific tax methods to move its earnings without being taxed.

The effect of the control of operations of the US is that the firm has no tax residency. AOI became the recipient of earnings got from overseas sales and investments. Such capability permitted the company to accrue funds without paying tax in the US. This technique is an essential measure in the tax avoidance scheme since tax earnings in the US might incur a 35 per cent tax (Valderrama et al., 2018). The analysis revealed that Apple Inc. contracted third party investors to manufacture products from the organisation.

Based on the agreement, the ASI management resold the products to ADI and AS at very high costs. Apple Sales International made a significant income, which was transferred to AOE’s offshore accounts as dividends. Under this technique, the company assessed the loopholes in the US tax policy, intending to circumvent its tax obligations (Thomsen and Watrin, 2018). Setting up affiliates in this manner exploited tax treatment between the US and Irish regulators.

Apple Inc. understood the permissions under the US tax laws. For example, the percentage of interest in the US is not a reflection of the ratio of the firm’s R&D. Regardless of the R&D operations in the US; Apple’s activities were reported overseas. Thus, the company enforced limited sales and services within the host country to avoid or circumvent tax obligations.

The Double Irish and Dutch Sandwich techniques encourage tax avoidance by cross-border transactions between associated entities. In reality, the constitution of these tax regulations has no significant business purpose aside from tax avoidance because the strategies are artificial and contrived (Jones, Temouri and Cobham, 2018).

However, any investigation of this legislative evaluation is specific. The apparent separation of its income in the US and overseas offers a base argument that there was a significant business purpose of the agreement. If Apple had moved its earnings abroad, the motive would be contrived compared to shifting its net profits. The analysis suggests that GAAR standards exposed the company’s activities.

The debate over whether there has been tax avoidance activity is more specific because the investigation revealed trade operations and manipulations of transfer-pricing principles. Therefore, the exploitation of Apple transfer pricing principles equates to tax avoidance. Valderrama et al. (2018) revealed that the business managers’ rationale and intent influence the tax minimisation strategy. The findings suggest that the cost of personal and public expenditures influence the need for aggressive tax minimisation strategy.

The outcome shows that individual intent and the cost of business operations are the determinants for the tax planning adopted by most organisations. Wang (2018) analysed factors that encourage aggressive tax minimisation strategies within an organisation. The author studied private and public listed companies to determine the cost of operations of both types of business ownership. The sample populations were companies in the US. The results revealed that the cost of services (fiscal report) is a significant determinant of whether the firms would run aggressive tax minimisation strategies.

Gangl et al. (2019) surveyed some tax managers and discovered that 70 per cent of the participants refused to apply aggressive minimisation strategies because of their reputation and business image. The authors found that economic accounting motive is just one of the significant factors when contemplating a tax minimisation strategy. Research by Klemm and Liu (2019) assessed several tax minimisation strategies by resident and non-resident companies. The result demonstrated that relative to both ventures, tax minimisation strategies by resident organisations were lower compared to non-resident firms.

The authors conclude that resident organisations were evaluated based on their tax contribution to the economy, which makes them open and willing to comply with tax rules. The reviews are consistent with the Apple evaluation. The thesis suggests that non-resident companies were motivated to use aggressive tax minimisation strategies based on personal interest, cost of expenditure and operations (Khuong et al., 2020).

Jones, Temouri and Cobham (2018) analysed tax planning under four economic zones. The findings showed gaps in tax treatment among specific regions. The authors suggest that the type of corporate ownership contributed to tax minimisation technique. In overall, the researcher believed that tax regulation is an essential determinant within organisations.

Most organisations like Apple Inc. studied several tax laws in various countries before the management established its affiliates and subsidiaries in Ireland. The option to adopt the Double Irish with Dutch sandwich was based on the loopholes within the tax laws. Although the tax scandal has been recorded in the US, the scale of such fraud cannot go undetected for an extended period.

Comprehensive examinations on current works of literature show that tax minimisation behaviour generates explicit and implied outcomes. Explicit results involving cost derived from the strategy and its impact on investors were recorded. Based on the previous submission, Apple Inc. gained billions of dollars from its aggressive tax minimisation strategies between 2009 and 2014. The study recorded implied outcomes such as the decrease in the firm’s tax shields, which altered the firm’s decisions. Another implicit effect is that Apple Inc. became restricted by international inquiry and inspection of the tax jurisdiction and the resultant judgement to repay the undertaxed earnings. The situation brought reputational harm to Apple’s management, affecting an investor’s flow.

Blaufus et al. (2019) examined the market response following the tax scandal of Apples’ tax avoidance coverage and discovered that the firm’s stock price drifted negatively by −1.03 per cent. Further examinations revealed that the scale of exposure after a series of inquiries was massive, and its impact on the management was severe. Study by Igbinovia and Marcella (2019) on tax avoidance and shareholder’s wages revealed that most organisations conceal their account statements when they adopt aggressive tax planning strategies. The findings are consistent with the outcome of this research because Apple Inc. was accused of non-disclosures about its subsidiaries, affiliates and operations in Ireland.