AT&T, one of the largest mobile carrier companies, has agreed to purchase Leap wireless company. The deals are a series of procurements that have seen bigger companies buy off smaller upstarting companies that offer cheaper plans.

The move aims to maximize the telecommunication’s company dominance over the airwaves. The deal will cost approximately $1.2 billion. It will be the first acquisition the for Randall Stephenson, AT&T Chief Executive. Randall’s initial deal to buy T-Mobile was stopped by the justice department in 2011 (Gryta).

Concerned regulators are closely monitoring the AT&T deal. The company is hopeful, stating the odds are good and the regulators will let the deal materialize. This means that AT&T will have to give up the US wireless spectrum. Spectrum is the frequency through which mobile phone carriers can transmit wireless signals. Subscribers for the services are to face several changes because of the deals.

Providers that offer cheaper services are fast diminishing, while smaller players in the industry like T-Mobile are a growing threat to AT&T. These deals have also had effects on the stock markets, raising the prices. In July, more than a third of Leap’s shares increased to 7.98$ between 12th and 15th. This had no impact on the price for AT&T who are still purchasing the shares at 15$ each.

The company had its most active day on 12 July, with many of the investors hoping for stock gains before the deal was publicly announced. This gave the buyers a chance to purchase the shares, letting them set the price. Leap’s shares rose to 16.70$ in just a few hours due to this.

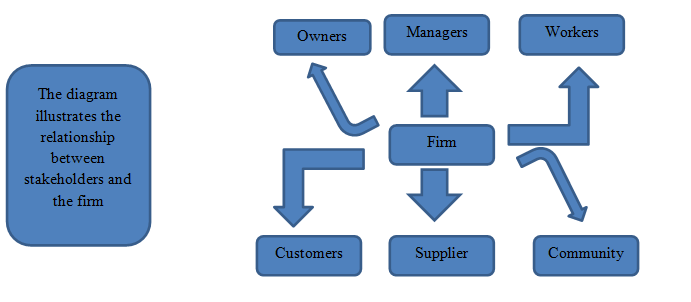

Stakeholders are individuals who have an interest in a firm or a business setup. They are affected by the firm’s activity, either directly or indirectly. According to AT&T stakeholder’s engagement, the company has diverse stakeholders. The AT&T stakeholders include owners, employees, customers, consumers, suppliers, analysts, public interest groups, non-governmental organizations, educational institutions, investors, and the community.

All stakeholders share certain responsibilities and interests within the company. In the AT&T and Leap deal, the stakeholders will be interested in the welfare, protection, and rights of the workers. These organizations and groups will be directly affected by the activity of the two firms.

The owners are specifically interested in the company’s profit margins. The workers’ main interest is in the wages they receive. The lenders are interested in getting refunds of credit owed. The community around the business is directly affected by the firm’s activities.

Leap had been focused on prepaid services, so their subscribers did not have to sign contracts; the plan expected them to pay monthly. They also enjoy the option of paying monthly. Because Leap lacks diversity and scale of its competitors and focuses on prepaid services, it has been losing subscribers.

AT&T boasts about 107 million subscribers. It hopes to maintain Leap’s subscribers by offering them network access. It also plans to gain more users in new cities. AT&T controls very little spectrum per subscriber, while Leap brings a spectrum that covers 137 million subscribers.

Jonathan Chaplin, an analyst with New Street Research, explains this. The move aims to improve its 4G Long Term Evolution (LTE) by expanding it and gaining more capacity. This will increase its usage and give it better connectivity (The Zacks Analyst Blog Highlights, 2013)

Analysts speculate that AT&T will increase its earnings and success by gaining more spectrum, LTE technology introduction, and better connectivity. After the deal is completed, AT&T will be better equipped to compete with other mobile service providers who offer cheaper alternatives to their subscribers.

In San Diego, Leap operated under Cricket prepaid brand. The brand covers 96 million subscribers and ranks sixth in the US. AT&T is planning to start its expansion by using Cricket to expand its prepaid operations (Gustin, 2013).

Young people and low-income earners mainly use Leap technology services. The acquisition by AT&T will create a gap in the market. When AT&T takes over, the subscribers will be misplaced, and this is because AT&T does not offer Leap’s unique services. The effect will leave the subscribers misplaced. The effect may lead to the withdrawal of subscribers, as well as the hesitation of potential subscribers to join.

AT&T may not get the success and expansion they expected. Although Leap’s stocks were going up, the takeover is under speculation because interested parties fell AT&T was trying to monopolize its services in the market by taking over smaller companies. The company might not be successful if Leap’s prepaid subscribers did not sign up for AT&T services. This is because AT&T does not offer prepaid services or contract- fewer plans.

Public sector regulators and interested parties are still forming inquires to stop the takeover. AT&T might not enjoy the much-awaited monotony it expected. The deal runs for approximately eight months. Anything can happen considering the attention it has created. The concerned parties are worried about AT&T already holding more than it can handle.

The acquisition of Leap by AT&T suggests the analysis of Stakeholders. In the analysis, power is the control and effect that stakeholders might have on a business. An example of power has voting rights. In the case of Leap and AT&T, the members in the power docket are the managers and the owners.

They can pursue their interests even in the case of resistance. Legitimacy is a socially accepted and desirable good; it is the valid claim a stakeholder has over a firm. This is explained further as “the who in the firm or what counts.” Urgency is defined as a situation that is time-sensitive. In this case, two situations can be described as urgency. This is when a claim is crucial to stakeholders or when it is time-sensitive.

Salience is the process through which stakeholders are examined to find out the level of importance and expectations from a particular firm. In the case of AT&T and Leap, the managers and owners will be highly prioritized because of the power they hold, the urgency, which in this case is the requirement for the action of the managers, and lastly the legitimacy, which is involvement of the managers, their relevance, and appropriateness.

Managers should ensure they are aware of all interests and concerns of their stakeholders. This includes the decision-making and operations of the firm. There should be good communication. The managers should communicate well with stakeholders and take account of their concerns. They should carry out processes that are sensitive to every stakeholder’s code of operation.

As a set, stakeholders should be treated with fairness irrespective of their power, urgency, and legitimacy. The AT&T and Leap deal will have to take into account their stakeholders’ interests in the process of the acquisition since the move will affect all stakeholders in both firms.

Works Cited

Gryta, Thomas. “AT&T to Buy Smaller Rival Leap.” Wall Street Journal, 2013. 18. Print

Gustin, Sam. “AT&T’s $1.2 Billion Leap Wireless Buyout Faces Static.” Business Time. 2013.

” The Zacks Analyst Blog Highlights: AT&T, Verizon Communications, Atlantic Tele-Network, Leap Wireless International and DTE Energy.” Prnewswire. 2013.