Australia

Overview of the Banking Sector of Australia

Current Market

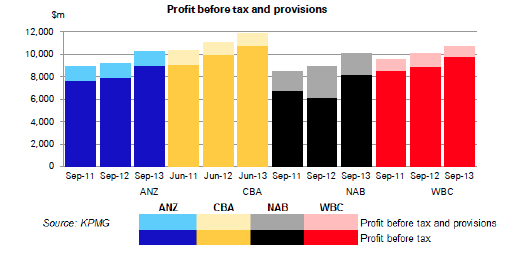

At present, the banking sector is the main contributor to Australia’s national economy; however, this industry has recovered financial strength from the adverse impact of economic downturn and experienced continuous growth from the fiscal year 2011. At the time of global recession, people were unwilling to take loans due to collapse of the property market, which hindered the progress of the industry; however, the government policy helped the major players of the banking industry to face different problems and increase income from interest revenue. Avkiran (2007) stated that banks were under constant pressure with several factors, such as, interest cuts by the reserve bank, and reduction of interest revenue; subsequently, the investors and other stakeholders gained their confidence due to taking different initiatives; however, the following figure gives more information regarding profit before tax and provisions of banking sector:

Competition and Key Players

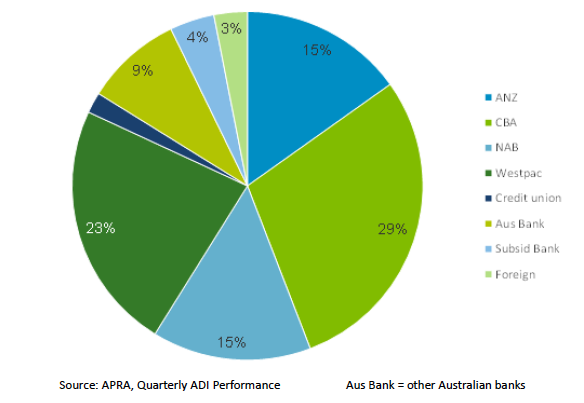

According to the report of KPMG (2013), four major banks are dominating the banking sector of Australia by holding 80% of total market share, for example, Westpac held 23% share, Commonwealth Bank of Australia occupied 29% share, ANZ and NAB captured 15% share each; however, the subsequent graph provides market share of the banks:

KPMG (2013) stated that this market is less competitive due to high-level of concentration and competitors use mergers and acquisitions strategies, for instance, Westpac merged with Bank of Melbourne and ANZ acquired a majority stake in NBN to become market leader; however, the government has taken few measures in order to evade further concentration in the baking sector. On the other hand, Edey (2010) reported that major players of this industry have endeavoured to bypass the provisions of the concentration restriction policy; however, the aim of the administration is to keep the concentration level in stable position though market researchers estimated that this strategy would remain more than 80% in the coming decade. At the same time, smaller banks of this industry are not able to compete with large four banks for which the smaller institutes are bound to boost their concentration actions while the securing activities diminish; therefore, the number of banks will reduce their constant consolidation activity as these institutes endeavour to secure the market. On the other hand, smaller banks in this industry are struggling to hold their competitive edge because of many external forces, such as, reduction of housing sector affects on the net interest margins of the smaller banks; in addition, global financial downturn will influence the banking industry as a whole (KPMG, 2013).

Market Forecast

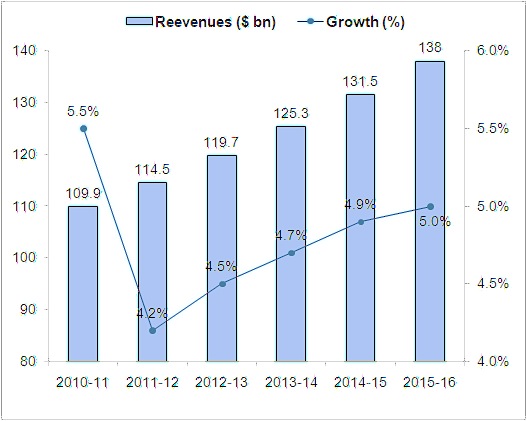

Australian Prudential Regulation Authority reported that the Eurozone crisis would adversely affect on the future economy and create a turbulence business environment; therefore, investors, consumers, and stakeholders would loss their confidence to invest in the property market and other financial sector (APRA, 2013; and Brown et al. 2012). In addition, the researchers expected that the governments in the Eurozone would reach an agreement to find out the path to boost revenue of financial sector, reduce debt levels, develop economic conditions, and attain common economic goals; however, the next figure demonstrates estimation of revenues in the banking sector:

From the above figure, it can assume that most of the financial institutes will experience solid growth and confidence level of the customers will increase to take loans for which revenue growth will be remained in stable position and it will reach US$138 billion (with 4.7% growth rate) in 2015-16; however, large four institutes will dominant the banking industry.

Legal, Economic, Technological (LET) Analysis

Legal Factors

Financial Regulation in Australia

Avkiran (2007) stated that sound, flexible, and sophisticated financial system in Australia allowed the foreign banks to enter in this industry to compete with domestic players as the financial regulation included equal terms and conditions for all financial institutions. In the recessionary period, this system becomes insecure for which the government of this country announced pull programs to offer different scheme for banks, for instance, the Financial Claims Scheme provided up to $1 million guaranteed deposits though this amount reduced by $250000 in 2011; moreover, Dubbed Guarantee Scheme used to big deposits along with wholesale financial support (Avkiran 2007). At the same time, the major objective of these programs was to prevent any possible outflow of capital from this industry and to make the banks capable of accessing offshore funds; however, the government withdrew second program in 2010 as the banks with AA rating could increase wholesale funds with cost-effective way without taking any support from government (Avkiran 2007).

Four Pillars Policy

In 1990, Paul Keating recommended this dubbed Pillar Scheme and the purpose of this policy was to restrict four major banks in Australia from mergers and acquisitions amongst themselves in order to secure a competitive banking environment. On the other hand, Stan Wallis scrutinised this policy and concluded that mergers and acquisitions strategies would assist the smaller banks to sustain in the market and compete with four large banks; therefore, this policy is still applicable for the banks with a rider situation (Worthington 2004).

Debatably, the “four pillar” strategy permits the formation of rivalry in the industry; nevertheless, as the strategy is restricted to the ‘big four’, there is no enticement to circumvent the eradication of the growing rivalry; in fact, restriction botched to lessen of rivalry from 2000; CBA, for example, eradicated Colonial-group, which was a rising leader in banking insurance (Worthington 2004). The strategy botched to restrain the takeover of Challenge-bank on 1995 by Westpac and the subsequent consequential takeovers in 1997 and 2008; moreover, the big four are opposing the strategy, as they believe it as a fake restriction of the range; however, fake restriction is believed to be the main constraint of global competitiveness by the four players in market.

Basel III Standards

In 2010, Basel Committee on Banking Supervision settled on the novel banking guidelines to prevent possible reappearance of recession; Basel III is a prerequisite, where the banks hold more substantial ordinary equity or Tier-One capital; now, it is notable that the banks have to keep tangible common equity is equal to four and a half percent of risk weighted resources. On top of this, the commercial financial institutions will be experiencing a compulsory condition to clutch additional capital preservation of two and a half percent; moreover, it will require compulsory reserve of seven percent of their weighted assets; however, it is notable that the banks will be subject to limitations on bonus and dividend payments.

National Consumer Credit Reform Package

According to the report of International Monetary Fund, this package includes NCCP Act 2009 and the NCCP (Fees) Act 2009; it incorporated duties of the lenders and conditions for the licensees to assess the financial capacity of the customers to repay; however, banks had to follow this strict procedure to sanction loans. However, the provisions of this package secured the creditors’ rights by introducing enhanced protection method and made the credit contracts from the third quarter of the year 2010; as a result, creditors would be able to take legal action and seek remedies for violation of terms or any other discrepancy under the National Credit Code (IMF 2010). At the same time, the credit providers in this country had to be registered and renewed license within the deadline to conduct business from the second quarter of the year 2011 (IMF 2010).

Competition Reforms in Banking

The government and other policy-makers had recommended different reform policy in order to reshape the financial markets and inspire the market players, for instance, the first suggestion permitted the banks and other relevant organisations in the financial market to issue covered bonds; however, ANZ issued such bonds in 2011 (Worthington 2014). The key purposes of the reform policy included develop market competition and emphasis the lending margins; reduce cost of credit for the future investment; in addition, it provided equal opportunities to all the banks to access credit at the same costs and increase profit margin by lending more money though it could raise market risk (Worthington 2014). The researcher and policy-makers have identified that lending more money and high loan-to-value ratio were the prime factors of global economic turmoil; at the same time, the US financial market had collapsed due to mismanagement in corporate governance system, fraudulent activities of the management and inadequate provisions in the legal framework for the banking sector (Worthington 2014).

Economic Factors

Slowed Economic Growth

In 2010, the financial system of this country witnessed unexpected slump along with under performance of the financial market for which it was anticipated that the reserve bank would cut on the interest rates with the aim of strengthening demand; annual economic growth was only 2.3% in the fiscal year 2010, which was 0.1% less than estimated growth (Edey 2010). Australian economy is one of the fastest growing economies in the globe although economic growth rate decreased gradually, for example, this rate was faster than 1.6% in the USA; moreover, its economy experienced continuous growth due to the demand for the Australian commodities in Asian market (Edey 2010). In this context, the government of this country has taken several measures to save the economy from recession, for instance, decrease the budget deficit to curb public spending, focus on mining sector, and implement new projects to develop exports by 7% per year (Edey 2010). As a result, the government of this country was able to save the economic condition from recession due to positive attitude of the consumers; however, the next figure demonstrates GDP annual growth rate for the last four years:

Changes in Base Lending Rates

Target overnight cash rate (OCR) is the main short-term rate in this country and the reserve bank fixed it considering the open market operations; however, the reserve bank had passed some amendment on the OCR in the fiscal year 2008-09 and lowered the rate from 7.25% to 3% in 2009 (Brown et al. 2010). In addition, the reserve bank took six months to cut OCR rate along with implement the process of normalization and it increased twenty-five basis points each month after normalization; on the other hand, it had tightened the monetary policy to reach its objectives and influence the market interest rate (Brown et al. 2010).

The OCR rates raised 25 basic points in each month and jumped up to 3.5% by forth quarter of 2010 due to the normalisation initiatives taken by the Reserve Bank of Australia in May 2010 while in the previous year, the interest rate was very lower and OCR recorded at 4.75 %-4.50 percent due to debt crisis of the Eurozone. The instability in the lending rate, cash rate, short-term rate, and overall money market have trapped the Australian banking sector although some reforms and landmark banking regulation kept positive impact that resulted increase in the bank rates by November 2011. However, the next figure demonstrates average lending rates in more details:

The Australian currency reached its lowest level in context of US dollar in 2009 at the history of half on an era associated with high-risk aversion although it is a commonly appreciating trend, but it many not indicate real strength of Australian dollar, as the US dollar was weakening in context of global indicators; Euro is further strong and stable.

Monetary Policy Trends

The presumption of RBA illustrated that the US economy has overcome the recessionary impact; therefore, it would maintain a stable interest rate at 4.25 %, but such evaluation by amalgamating was not true; as a result, RBA was under pressure for policy shifting in 2010. The decision to keep the interest rate at 4.25 % has seriously influenced the domestic economy though rising inflation rate and growing food price forced the monetary policy and accelerated interest rate again (Reserve Bank of Australia 2010). Australia has adopted floating currency method administer its exchange rate and the central bank don’t take any monetary tools to put control over the underlying trend of exchange rate and the schedule banks independently negotiate with the customers. However, the following figure shows exchange rate trends in more details:

The International Monetary Fund (2010) reported that about twenty of the Australian official exchange dealers handle with 90% of the market and rest 10% by the remaining others among them most are foreign owned institutions with heavy foreign debt-servicing compulsion with damaging consequence over the value of local currency. A large part of the export remittance comes from commodity rather than service industry; however, the Australian dollar in concurrent days rising in relation to the US dollar with a steady motion, which was seriously fall down during the economic meltdown and it evidenced as A$1:57: US$1 during 2009 and raised at A$1.06: US$1 during 2012.

Technological Factors

Growing Role of Technology in Banking

It is important to note that scientific progresses cause both dangers and prospects for the mainstream banks of Australia; in addition, better technology has resulted competent service delivery, facilitated the construction of novel services, abridged the active barricades to access in various regions, and transformed the money matters in banking; it has the prospect to decrease costs of accessing information. According to Laker (2010), technological-transformation is a momentous power in banking segment as they both defy and strengthen the mainstay skills; moreover, considerable transformations will remain in the affected regions of retail payment schemes and developments of the fiscal service-allotment channels; moreover, banks have chosen to extend privately owned clouds; however, Westpac data-centre is domiciled at Fujitsu data-centre.

Technological-transformation has affected the whole industry; it has lessened the expenses of the bank and has resulted in formation of a fresh price strategy that further unlocked novel means of financial service delivery; accordingly, there has been integration of new-fangled cost effective circulation means by the clients as opposed to conservative and reasonably valued financial service channels. In 2011, Westpac broadcast that it had finished the expansion of IT projects worth over one billion dollar; in addition, it undertook tactics to develop IT projects worth over two billion dollars in 2014; however, numerous Australian banks advanced their information technology communications, and the joint telecommunications budget in this industry of Australia amounted to ten billion dollars.

Internet Usage

The world has undergone massive change after internet has come into action; it has given a novel podium for the customers whereby they have admittance to user-friendly banking; the giant players of Australia in the banking sector have the electronic banking alternative; however, Westpac made a hub in Adelaide to process mortgages to augment business processing. On the other hand, it is notable that due to integration of ICT, working hours of permanent employees are significantly reduced because most of their tasks are now automated; moreover, as electronic-transactions are quicker and cost-effective compared to the conventional methods, banks have been endorsing automated banking mechanisms, for example, ATM, EFTPOS, credit card, and so on.

Mobile Banking and Mobile Apps

Some Australian banks have not accepted local-apps for their policies; Commonwealth bank utilises the Netbank-app (which is more or less shortcut to gateway); however, the portal is handy and its applications cannot be compared to local apps when it comes to speed; moreover, CBA is about to liberate its iPhone-app, while NAB is running native-apps for more than three years. In addition, Brown et al. (2010) stated that NAB is carrying out research on the prospect of developing native app for windows cell phone; however, because of the obligation to build up platforms for this function, internet- banking has witnessed huge augmentation; moreover, the bank is trying to focus on amalgamation of biometrics for corroboration with online-banking (Mohamad 2011). On the other hand, ANZ is not left behind in the app-banking industry as it has the GoMoney app for iPhone; the bank stated that more than fifty percent of its dealings are instigated via the online-banking podium; in addition, it estimated that the number of dealings deriving from the podium will be increasing for every year by ten percent. Nevertheless, the bank is in course of developing an android-based app; conversely, Westpac has chosen to attach to its primarily web-based banking as opposed to expansion of native apps, where clients can do any of the transactions using the web-based internet banking; moreover, St George bank has decided to compress its assortment of apps to the clients in Melbourne.

Other Trends

Stored Value Cards

It is important to note that smart cards store value, which is revived once a client exhausts the funds in the card; it has altering levels of complexity and features; most of the citizens use it like gift cards, telephone cards, and expenses in public transport; still, in Australia, its use is lesser compared to other countries.

Touch and Go

It is important to state that this is new in Australia, and it permits the cardholder to disburse for the services by touching the card against the payment terminal, which can detect a special chip installed in the card, but the technology is restricted to transactions under one hundred dollars; moreover, lack of verification system has led to safety concerns. For this reason, this technology is not quite satisfactory and it is not widely accepted in the Australian market by the mass people.

Conclusion

The global financial crises has left unfavourable impact both in the commercial and consumer confidence of Australia, where the economy has undergone huge stagnation of commercial-loans and growth-rate of home loans fell in a slow rate; however, the enhancement of the economic circumstances in Australia and introduction of IT infrastructure in banking sector will definitely kindle augmentation in the economy.

United Arab Emirates

Overview of the Banking Sector of the UAE

Current Market

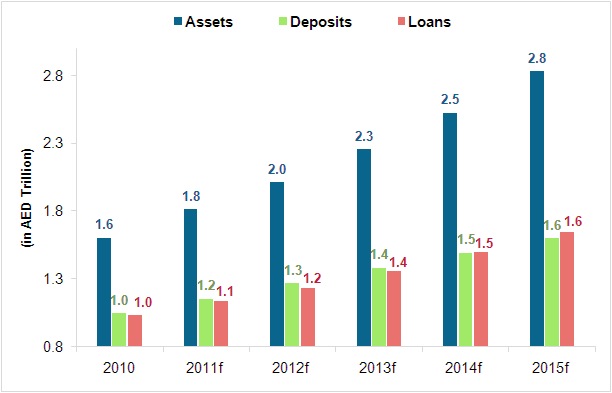

In era of 1960, foreign banks had dominated the UAE banking sector and intense activity in indigenous banking by both local and foreign banks created confusion in the entire banking system. In the 1980s, the Central Bank of this country had reformed banking policy in order to protect mismanagement and fraudulent activities; therefore, the national economy has facilitated from such reform initiatives. In 2000, the policy-makers focused on the concept of economic diversity with intent to increase sources of income (CBUAE, 2013); however, different strategic plans had implemented to coordinate tasks and remove problems from different sectors, for instance, flexible credit transactions process flourished the property segment. On the other hand, banking sector has faced problems related with credit default and non-payment of instalment, but such situation has changed due to a low interest rate, optimistic oil price in the world, and impact of diversified economy; so, these factors developed an outstanding business environment. At the same time, the national economy has risen by 30% in spite of adverse impact on economy after global financial turmoil in 2008; however, the following figure shows gradual development assets, deposits, and loans of banking sector:

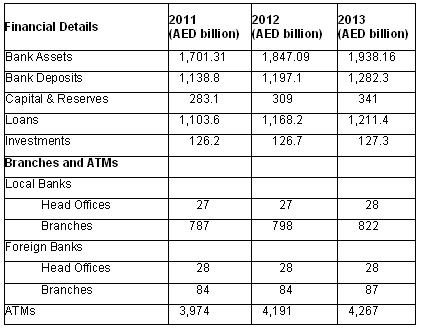

At present, 27 commercial banks serve the market; these banks operated 787 branches in 2011 and expected to increase up to 798 branches within a year; electronic units (27 units) remained unchanged in this period (CBUAE, 2013). Twenty-eight foreign banks are operating from different countries and these banks control 87 branches and 54 electronic units; moreover, the Deutsche Bank AG and the Industrial Commercial Bank of China started business operation in this country in 2010; investment banks include the Arab Emirates Investment Bank and the HSBC Financial Services; however, the following table gives more information:

In accordance with the report of the Central Bank of the United Arab Emirates, total assets of the banks had increased by almost 4.9% (AED 1847.09 billion to AED 1938.16 billion) in 2013 and the number of bank deposits had boosted by more than 7.1% and the number of loans had enlarged by about 3.6% in this period (CBUAE, 2014).

Competition and Key Players

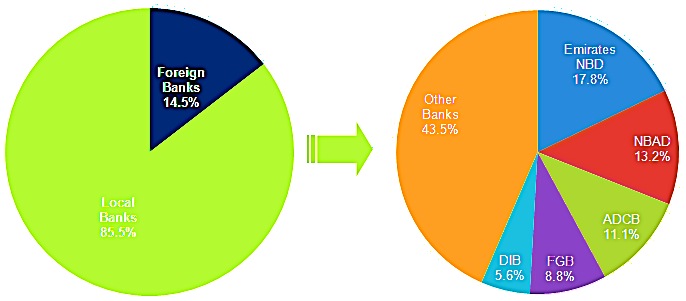

According to the report of CBUAE (2014) total 55 banks serve this market; however, 27 domestic banks and 28 foreign banks operate business, but domestic banks mainly captured 81.46% of the total market share of this industry; here, it is important to mention that only five banks are dominating the market by holding the largest shares in 2012. Furthermore, CBUAE (2014) reported that these five banks captured near 50% of the assets of this sector; however, these key players of this industry include Emirates NBD, NBAD, ADCB, the First Gulf Bank, and the DIB; however, the following figure shows market share of the main competitors-

The above figure shows foreign banks hold only 14.5% share, and the Emirates NBD holds highest 17.8% share; on the other hand, net interest margins decreased 4.04% to 3.83% from 2012 to 2013 (CBUAE, 2014).

Market Forecast

Following the impact of recession, the economy of UAE has been evidencing to attain better position from 2013, and the increasing number of declining loans in the banking sector going to increase with profitability along with boosting credit trends by means of amended policy and regulation of the central bank. According to the report of Siddiqi (2005), the recent data of the central bank illustrated that financial sector gradually improving their deposit and loan level at the rate 3.1% and the consequential inflation rate 1.5% in the measure of consumer price level.

The banking sector experts expressed their expectation that the banking industry would recover gradually with increasing loan disseverment and expected level of loan recovery, new schedules of debt recovery and decreeing default rate (Al-Tamimi and Al-Ameri, 2003). At the same time, the policy ground has addressed to increase loan disseverment where an individual would be capable to borrow 20 times above his monthly salary; such direction of the central bank started a new flow in the baking industry and enhanced the limit in the lending market with reduced service charges that enhanced credit trend. However, the next figure demonstrates the banking sector of UAE:

Legal, Economic, Technological (LET) Analysis

Legal Factors

Political Stability within the UAE

The present ruler of Abu Dhabi is the acting president of UAE with full support of the seven emirates, the selection process also integrated facilities to provide the opportunity for the new generation to come into leadership, but the rulers are afraid of the democratic movement of neighbouring countries and aimed to depend on the armed forces.

El-Kuwaiz (1995) addressed that under political system, the monarchy families highly try for conservation of the state power at their hand by abolishing human rights, proper education, and freedom of expression and they are eager to enjoy the state power by inheritance. Like all other Arab countries, the people of UAE are also eager to have their democratic rights, women needed to out of house for education and rights to take part in the decision-making process and the sparking of democracy evidenced in the northern emirates where people demonstrated to reduce growing gaps and inequality.

The political unrest and sustainability struggle of the monarchy in the country have seriously hampered the economic development of the country and the most alarming scenario is that the terrorism in the name of Islamic extremist are increasing the security threats in this region.

Supreme Council and Federal National Council

The FSC is the highest body to practice both executive and legislative power in the UAE while FNC is an advisory body that consists with forty members and they monitor legislative process by scrutinising regularly. It is also noted that the verdicts and proposals of FNC are also assessed and evaluated before the implication; however, in some extent, the decision-making process integrates options of other bodies for political participation (DIFC 2013).

International Relations and Recent Turbulence in the Region

Most recent decades had aligned with the Western powers to overcome the vicious circle of Arab politics including threat nuclear program of Iran, at the same time, it developed foreign relation with China, India, Japan, and South Korea. It has signed different business agreement and memorandum of understanding with collaborating countries to enhance it oil market, security agenda, investment opportunities, expand bilateral cooperation for industrial and technological needs, and it also maintain good relation with the Asian other countries (EGF Hermes, 2011).

In recent years, UAE has no direct conflict with the neighbouring counties, but historically security forces inherited from the British peacekeeping force in the Persian Peninsula. The Arab Spring has destabilised political situation of the country and the security forces were engaged to rescue the royal families, but the GCC intervention with US support and commitment for reform stabilised the situation (EFG Hermes 2011). The UAE stands in favour of the USA regarding the US intervention in Iraq, Syria, Libya, ISIS issues and all the state crimes against humanity including fight against terrorism. It also developed good relationship with NATO with the aim to gain western support to the royal family and to the inheritance of monarchy.

Impact of Regional Crisis on UAE’s Banking Sector

The banking sector of UAE has already proved its existence as a most profitable as well as potential sector, but the influence of Arab Spring has remarkably deteriorated its performance by reducing it banking products in order to avoid risk associated with the political instability in the neighbouring countries. Most of the banks of UAE has kept embargo different banking products, some are decreased the lending levels by raising their interest rate, inter-banking charges also unstable although the governmental initiatives to improve the UAE banking sector into a secured hub financial in the world (EFG Hermes 2011).

Economic Factors

Outlook for Economic Growth

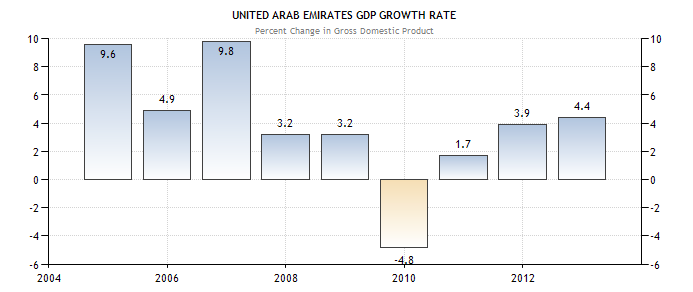

The overall economic performance UAE illustrated a stable economic growth, but during the financial downturn of 2008, the GDP growth seriously decreased at -4.8% and in 2009 at 3.2%, but due to increasing oil price economy had gradually improved and remarkably hampered again due to Arab Spring, the democratic movement in the Middle East region. However, increased oil price, political reformation before the violence, and integration of appropriate fiscal and monetary policy support the country to recover the economy and to reach in a stable growth by 2012 and 2013 while the GDP recorded at 4% 2012 and 4.5% respectively (CBUAE, 2013). The Central Bank of the United Arab Emirates provided data, which illustrated the real scenario of GDP-

The UAE also gained remarkable reliance on the hydrocarbons sector that struggled with the decreasing price due to increasing oil price and the oil sector proved its highest position as the highest contributor to the GDP, but increasing public spending, boosting customer expenditure, and increasing number of large projects such as airport and industries enhanced the economic diversification (KAMCO 2011). In addition, the infrastructure development, non-oil sector expansion, and tourism sector growth have generated huge employment opportunity in the economy where Dubai World keeping a vital role to making the progress (Al-Tamimi and Al-Ameri 2003).

Fiscal Policy Trends

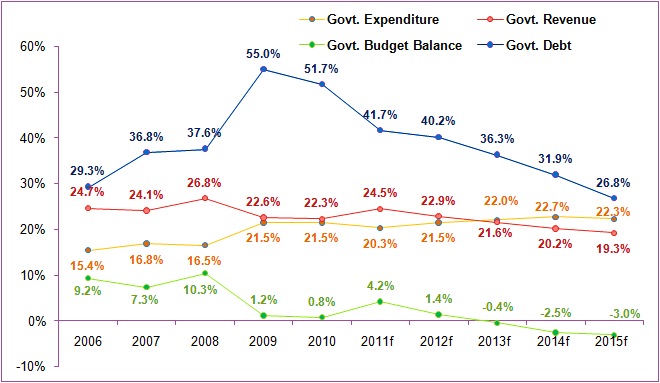

Within the GCC counties, only the UAE has introduced a federal system fiscal policy that resulted a strong safety net for the domestic financial system for not to experiencing any further downturn as a consequence of foreign vicious business cycle. However, the fiscal policy has successfully improved the steady growth in different sectors of the economy including housing and real estate sector, enhanced GDP growth, and strengthened federal integration among the emirates, policy-makers, and their inter-governmental relationship. The government of Abu Dhabi has evidenced as the highest contributor in the GDP, which is the three times of the national budget (KAMCO, 2011). The independent budget of the Dubai is 12.5% of the national budget on 2010 and now it is five times above than the national public spending, but the collective budget combines the financial stipulations along with evidence of the all emirates (CBUAE, 2010). However, the following graph demonstrates fiscal indicators from 2006 to 2015-

Kerr and England (2013) pointed out that fiscal policy of UAE has integrated diverse development initiatives aimed to boosting the stipulation of the available resources together with development of infrastructure in this region while the Dubai government engaged to incorporate different events in order to decreasing the pubic spending at 20% to 25% less by next fiscal year. Moreover, the governmental entries of Abu Dhabi generated limit for effectual serving the debt market of GREs where Dubai owns US$ 10.4 billion out of 16.6 billion that demonstrated the unparalleled economic strength of Dubai among the emirates. At the same time, the government has repeatedly incorporated various steps to enhance social spending through amplified subsidies for essential food items to safeguard the people from the negative impact of riding food price in the global market. In addition, the UAE has successfully stabilised its tax structure at a lucrative level that attracts the potential investors while the fiscal policy of the country has strengthened during the global downturn 2008- 2009 and coupled with the enhanced oil price that evidenced through the 3.5% to 5.5% GDP increase by 2014.

Monetary Policy Trends

The central bank of UAE kept its highest concern to continuously monitoring the trend of monetary policy and depending on the outcomes of the policy; in addition, the central bank put control over liquidity position of the schedule banks. The controlling tools used by the central bank has incorporated different offers such as provision of monthly expansion of temporary purchase rates that assist the liquidity levels available to the financial institutions, and electronic system of controlling Emirates inter-bank offered rates that stresses the banks to maintain perfection. Because of the dynamic monitory policy, the capital growth in the Dubai GREs has dramatically increased, and the volume of the governmental bonds enhanced and gained enough confidence of the potential investors in the capital market. Although the global recessionary economy has kept negative impact on capital-adequacy ratio at the rate of 13% in 2011, but the monitory and financial policy of UAE has succeeded in overcoming the crisis by 2012 to 2014 and resulted towards steady growth levels.

Inflation Remains under Control

The most recent statistics illustrated that the country enabled to keep its inflation at an expected level, although during the recessionary period, the inflation rate was 2.8%, but after the crisis and following the oil price, it has decreased by 1.4% in 2013. On the other hand, the large range of infrastructure development has enhanced inflationary pressure; at the same time, the government is much aware to keep people apart from tax burden and to reduce excess pressure of inflation; however, the following graph illustrates the inflation situation in context of Average Consumer Price:

Exchange Rates to Remain Stable

The currency of UAE evidenced very strong in relation to the United States dollar, which is exchanged of at the rate of AED1 = US$0.27 and expected to become more stronger due to boosting economic growth and increasing investment (CBUAE 2013). Although the UAE has come out from the GCC monetary union, but it has not kept any impact on the exchange rate rather the direct economic integration has kept positive impact on the domestic interest rate with rising cost of living along with the reduced purchasing power of Dirham and this data presented as follows:

Technological Factors

Mobile Banking Gaining Popularity

The banking sector of the UAE has been keeping its continuous effort to integrate most modern technology in the globally available banking sector, mobile banking has turned into another popular banking concept globally of twenty-first century that came into introduction in UAE most recent years. Furthermore, the banking and financial sector of UAE has adopted the Internet technology along with M-banking facilities that generated enhanced positive response from the customers as they can access to their banking through the web account without going top the branches. It includes different services for the customers, such as, by visiting the website of the banks, the customers could check their account balance, bill payment, and deposit and transfer fund, chequebook resuscitation and so on (Habib Al Mulla Company, 2013). Following the success evidence of adopting IT technology in the governmental sector, the Roads and Transport Authority of UAE has integrated mobile payment system for car registration, parking, and renewal fees, the NFC solution adopted such system to exchange of data among the individuals working in the field through comparable devices via a common platform (Habib Al Mulla Company, 2013)

Preference for Credit Cards and ATMs

The Arabian Travel Market (2010) addressed a study conducted by the Visa International, which illustrated that the travellers in UAE have facilitated to withdraw large amount from the ATMs in local currency and could carrying huge amount in abroad from UAE. In addition, the survey conducted among eight GCC countries including UAE demonstrated that travellers on average withdrew US$ 1,749 higher than the other GCC counties, which is pointed to 44% above than the others; amongst the sample population, 79% agreed that they get enhanced opportunity to handle their cash here and could back the rest without any hindrance. Among the respondents, 53% expressed their satisfaction on the safety measures, 22% agreed that ATM points are user-friendly to funding their foreign trips, 67% mentioned that they like ATM cards, 28% chosen debit card 13% preferred to use their credit cards (CBUAE, 2013).

Payment of Zakat through ATM

It is most remarkable for the citizens of UAE that the government has fully automated the Zakat system and the people are allowed to make their Zakat payment through the ATMs, and the authority is responsible to distribute that fund for charity; as a result, people are facilitated to maintain one of their Islamic religion pillars with less effort. However, the government has established ‘UAE Zakat Fund’ to finance the religion, cultural and charitable organizations through an adoption of most innovative technology where people could make their Zakat through the debit or credit card (Governance Now, 2011). Furthermore, the secretary of Zakat Fund’ mentioned that the innovative system for ATM has developed in a method that could accept Zakat from the donors through Credit Card, Debit Card, Cheque, or cash and it could also calculate the actual Zakat amount depending on the wealth of the donor. At the same time, the Zakat Fund’ also improves their website as a standard where people could make Zakat payment through online and even with their mobile as part of their mobile banking (Governance Now, 2011).

Conclusion

The web of Arab Spring has no serious impact on the socio-economic condition of UAE, but government has strategically enhanced to integrate more people in the decision-making process as a shift towards participatory political system. Like all other GCC counties, the foreign policy of UAE has aimed to maintain good relationship with the Western counties and to safeguard the interest of the USA in the Middle East region. As an integral part of the global economy, the banking sector of the country was deeply shocked and the government was bound to reform this sector to bring the public confidence especially over the Dubai real estate sector. At the same time, the government continues to enhance public spending and federal budget surplus by increasing oil price, although in 2012, the public spending decreased due to economic diversification, but the GDP growth increased and oil price decreased in the next financial year of 2013.