This study has been primarily conducted to assess the best Statistical Model that could be used for interpretation of Currency Returns under the Three required Models: Sharpe Model, Random walk model and VAR (α= 0.01).

Risk and returns have complimentary influences in the context of investments and tend to be positively correlated, and currency trading is no exception.Just as there is a presence of risks and returns in other investment portfolios, so these two factors loom largely in investment fields also. It has been found that the VaR Model is has the highest percentage return at 130.70 (Milad) and is thus most suitable for this application.

The detailed study is being attached below

Literature review

Currency risk refers to the risks related to volatility of floating exchange rates for fixed currencies. Devaluation risks and correlation across currencies are also associated with currency trading. It originates from the potential movements in the value of foreign currencies. Various economic factors like inflation, economic growth, interest rates and government policies have control over the value of currencies in international market. Forecasting of exchange rates of currencies is important for the following functions.

- Hedging decision

- Short term financing decision

- Short term investment decision

- Capital budgeting decision

- Earnings assessment

- Long term financing decision. (Sandler).

Currency hedging is a strategy for minimising the exposure of currency risk. During bouts of inflation, business firms can make profits from investment activity through hedging strategy. Currency hedging is used to reduce the risk related to investment in foreign currency as well as multicurrency business activities. Exchange rate forecasting is beneficial for the evaluation of investment opportunities and risks attached to trading in international business environment.

Risks relating to currency trading

Currency volatility: Low volatility of national currency relating to foreign currency indicates that it is subjected to devaluation risks due to which pegging with the foreign currency would not withstand volatile pressures of currency fluctuations.

Correlations: Correlation of national currency with foreign currency is used to identify the significant benefits from holding a well diversified currency portfolio. Generally correlation of currencies is ranging from 0.1 to 0.2. Blocks of currencies with high level correlation restricts the diversification of risks. Currency trading is also affected by devaluation risks. (Jorion 2003, p. 281).

Currency Risks related to Canadian dollar

Long and short positions are terms used to define market positions. Based on these terms, corporate assets and liabilities have to be on long or short term valuations.

Decisions on currency denomination of future revenue and expenses are generally based on operating or cash flow exposure management attitude which depends upon circumstances. Intangible assets also can be classified on long term or short term basis. Thus currency trading which involves intangible assets can be classified as short or long term depending on factors impinging the market. Currency traders are benefited from currency’s long exposure. Currency value will be increasing in future due to the competitive positions

Long and short positions in currency trading

A long position is the position in which investor expects to future rising in value of currency and then they have take decision to invest in such currency and the opportunity to sell the currency at higher price when its value is increased in the market

A short position in currency trading is the situation in which currency is selling out by the investor on the expectation of depreciating the currency value in future. In this case only the traders can make profit only when there is a drop in the value of the currency. (Hollar 2008).

A long position indicates anything which provide reimburse to the holder through increase in value and unfavourably affects the holder by a decrease in value. Whereas a short position indicates anything which provides reimburses to the holder by a decrease in value and unfavourably affects the holder by an increase in value.

Short positions in foreign currency have the same effect of long position in home currency because of the influence of exchange rate between the currencies. Thus a short position in home currency indicates a long position in foreign currency.

Currency risk is arise from the from the difference in the real interest rate paid for financing in the national currency about financing in one of the few hard currencies which are internationally used. Currency risks are related to country risk for the reason that in time of exchange crisis in the country, its hard currency obligation will be damaged. Then extend flotation in exchange rate will cause raise the currency risk even though it reduce country risk.

Canadian dollar’s average inflation rate is same as the United States since 1987. Thus the real interest rate with Canadian Dollar it is relatively uncomplicated. Even though there involves similar expected inflation rates the government of Canada have to pay about one percentage more for borrows in Canadian dollar than in US dollar. In the market, the US pay- Canada bills are treated as perfect substitute for US Treasury bills and therefore the yields are not differ from financing costs than a few point basis. The financing costs are constantly between 0.25 and 1.5 % point higher when treasury obligations are carried on in Canadian dollars, their value is floating against the US dollar. Canadian dollar exhibits volatility lower from 4 to 5 percent against US dollar. (Von 1997, p. 88).

Currency management tools

For efficient management of currency risks there involve tools such as currency futures, forwards and currency option contracts. Options refer to contracts that are useful for reducing the uncertainty resulted from the denomination of assets and liabilities in foreign currency. It provides more flexibility with right to the holders.

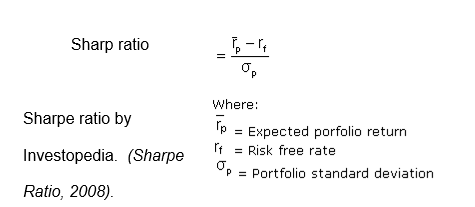

Sharpe ratio

Professor Sharper was endowed with the Nobel Prize for his CAPM model which is a financial model how the pricing of securities reveal future risks and returns. It is known that most investors would need to take risks commensurating with the returns they require. The higher the returns needed, the more the risks to be undertaken and vice versa.

Returns, in most occasions, even out the risks Sharpe’s theory evidences that market pricing of high risk assets helps them to fit an investor’s investment plans because the high risks are combined with lower risks, and so the risks could be spread over the investment base. (Brittanica: Capital Asset Pricing Model)

Passive hedging strategy is adopted by investors to reduce risk related to investment and thus to avoid losses resulting from adverse movements in currencies exchange rates. Defensive hedging strategy helps keep a variable exposure to currency related to the opportunities and threats in the environment of money market.

Active currency overlay strategies is meant for managing the currency exposure derived from a portfolio investment having exposure to international portfolio investment market.

Currency alpha investing is the strategy of generating positive active returns by way of undertaking the long and short positions in different currencies. In this strategy leverage is applied in investment decisions.

(Martini). The Sharpe ratio calculates return on a risk-adjusted basis by evaluating an investment’s return to the return on the one investment that’s considered essentially risk free: The bill is guaranteed by the full faith and credit of the Canadian government, making it virtually free of default risk, and it matures in such a short period that it’s also considered free of inflationary impacts.

To calculate the ratio, which evaluates return per unit of risk, it is necessary that one reduces t the return on a 13-week bill from an investment’s return and divide the result, called the excess return, by the investment’s standard deviation. The upper the ratio is, the better the possibility for a strong return. For illustration purposes, if the excess return was 7% and the standard deviation was 1.5, the ratio would be 4.66. But if the standard deviation was 2.5, the ratio would be lower, just 2.8, and thus the accompanying risk would be higher.

Similar to other measures, the Sharpe ratio reports what the risk has been in the past for investment categories, such as large- and small-company stock or a specific type of bond. That data can help make allocation and diversification decisions about perceived risk bearing capacity and tolerance and financial objectives.

The Sharpe ratio shows a portfolio return for investment decision and as a result of excess risk. The measurement of portfolio is higher than return, as good investment with high return will not have more risk. (Sharpe 1994).

A variation in Sharpe model removes the upward price on standard deviation to measure return for downward price. This ratio also measures the risk-adjusted performance.

The Sharpe ratio is finding out by subtracting the risk-free rate of the 10-year U.S. Treasury bond from the rate of return for a portfolio and dividing the outcomes by the standard deviation of the portfolio returns. (Dorsey 2006, p. 14).

Sharpe ratio is a best risk adjusted method to find out the yield in investment.

Sharpe Ratio = Annualised Return / Annualised volatility.

The risks related to investment are measured in terms of the volatility of markets. Thus Sharpe ratio is also known as return- to –variability ratio. It is best suited to evaluate the investment and trading performance of financial institutions. (Demystifying Responsible Investment Performance. 2007).

Sharpe ratio is a basic management tool for forecasting exchange rates. This tool was derived by Prof. William F Sharpe. According to this ratio the ratio of return to volatility is measured based on the risk- adjusted return of an investment. A higher Sharpe ratio is an indication of the more sufficiency in return for each unit of risk. (Sharpe Ratio).

An Introduction to Foreign Exchange terminology and techniques

In the context of foreign exchange, usually investors take the return on currency as a difference between the exchange rates of currencies. If there is no change in the values of underlying assets, in case the value of foreign currency rise in future against home currency for a specific period, then the return from such foreign currency investment will be profitable. This is due to the higher buying capacity of the foreign currency in the country than the home currency. In a situation in which the foreign currency’s value is less when compared to home currency during the investment period, then the investor will not be benefited from such investment due to the less purchasing power of foreign currency compared to home currency. (Martini. Currency Returns: The Sum of Two Parts. Page 2).

Investment in currency is not benefited from changes in exchange rate only. Every buying activity in one currency will result in the sale in another currency. Thus there is an interchange of interest rate to the investors. Interest rate between countries is always different. Thus the actual gain from investment in foreign currency depends upon the gap between the interest rate of countries, that is, whether the difference is positive or negative. When the exchange rate is constant and the foreign currency provides higher interest rate than the home currency, the return from investment in foreign currency is over returned than the domestic currency by the amount of difference in interest rate.

When the foreign interest rate is less compared to home currency the return from such investment will short fall than in domestic market investment. Thus it can state that return from investment in currency fund is the sum of differential in interest rate between different countries as well as the exchange rate change. Interest rate difference can know at the time of investment while the exchange rate difference is always uncertain.

Currency Return = Interest rate differential + Exchange rate change (Martini. Currency Returns: The Sum of Two Parts. Page 2).

Part of the business of estimating returns for each asset is to estimate how much unpredictability there is in the asset value. The unpredictability is the main feature of financial modelling. It was accepted that randomness plays a large part in financial markets; therefore, mathematical model of financial asset must acknowledge the randomness. (Willmott, P. 1998)

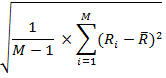

Return from day i to day i+1 is being calculated as below:

![]()

Where Si. Is the asset value on the ith day.

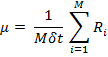

Denoting the mean of the return distribution is

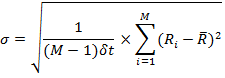

The sample Standard Deviation is given by

Where M is the number of returns in the sample (one fewer than the number of asset prices) and Ø is a standardized Normal variable.

Random Walk model

“The random walk model first developed by Bachelier (1900) states that changes in stock price between period t + k and period t are independent with zero mean and proportional variance; that is, the variance of monthly changes are four times the variance of the weekly changes”.The applicability of random walk in the stock prices is based on the assumption that the market is efficient and the stock price in any given time is indicative of all the information available at that particular moment. However, “A Random walk involves innovation that are from the same distribution, i.e., the same mean and variance, whereas, the variance of innovation in real data appears to change over time.” (Are Financial Markets Efficient? 2004).

Random walk is a variable path which does not shows a predictable pattern. If a price (P) of an investment moves in a Random walk, the value of ‘P’ in any period will equals to the value of ‘P’ in the period before plus or minus some random variable. “The Random Walk Hypotheses states that the present value market price is the best indicator of the future market prices with an error term.

In a well-organized market, it is not feasible to make profit based on the past information hence the forecast of future price provisional on the past prices on an average should be zero. (Pant and Bishnoi). If a market is efficient, then the market returns would be more random and unpredictable. If any model predicts the future stock prices fairly and accurately, then it could be assured that the market do not follow Random Walk.

This theory works on the assumption that the security exchanges are efficient market. An “efficient” market is a market where there are large numbers of normal profit-maximizers who are actively competing actively competing, and are trying to predict the future market value of the securities. Current information regarding the securities is easily available to almost all participants. In an efficient market, competition between the active participants leads to a condition where the actual prices of individual securities reflect the effect of information will be based on events that have already occurred and events that are going to occur in the future.

This means that the price of the security will be equal to its intrinsic value. The intrinsic value of a security cannot be determined since it depends on so many other variables. There is a disagreement between the actual prices of the securities and its intrinsic value of the securities. If the market is efficient, then the actual price of the security will randomly move around its intrinsic value.

The main concern of the Random Walk model is to test the hypothesis that the successive price changes are independent. Two approaches have been used for this. One approach depends largely on the statistical tools such as correlation co-efficient and analyses of runs of consecutive price changes. If the statistical tool is based on the assumption of independence between the variables, then there are probably no mechanical trading rules and it is entirely dependent on the history of price changes, which would make the expected profits of the investor greater than what they expected. The second approach is to test the independent proceeds by using different mechanical trading rules to find out which provide more profits. (Fama).

Changes that are about to happen in the stock prices are driven by new information available and this information can not be predicted ahead of time.

To generating Si+1 from Si, random walk strategy can be used. The formula for this is as below;

![]()

Where the drift rate is calculated by the following formula;

And the volatility is given by

Where δt is the time step, and a random number of Ø for each time step is

Value at risk strategy is a technique that utilizes the analysis from statistics regarding volatilities and historical market trends to approximate the likelihood that losses of a given portfolio will supersede a certain amount.

The random walk model uses the derivative to permit the investors to customize their exposure to the market. Investors can speculate hoping to gain large amount of returns with a small amount of investment in the stock market.

Derivatives are assets whose values depend on the price of another asset called the underlying. The simplest derivative is the future of forward contract which is a commitment to purchase an asset on a specified expiration date in the future (T) for a strike price (K). Then the investor makes a loss of S – K if the trading price in the market place is S.

A call option gives the holder the right over the counterpart of purchasing an asset on date (T) at a price (K). Then according to the random model the pay off is equal to S = max{S − K, 0} for a call option.

A put option gives the holder the right to sell an asset at a price (K) at a date (T). Then the trade off is similar to that of the call option, that is, S = max{S − K, 0} because in both cases the investor has chances of making profit and hence has to pay to acquire the contract. The error in this case occurs when an investor makes losses, that is, AS = min {K, 0 –S}.

Value at risk is a measure of the likely distribution value in a business. It is an indicator of the down side risk. The value at risk returns is calculated by taking the ratio of the Net Present Value of an investment (NPV) to the value at risk (VaR), that is, NVP/VaR. The result enables one to measure the value that the investment generates relative to other investments.

![]()

Where α () is the inverse cumulative distribution function for the standardized Normal distribution.

Risks in the stock market are correlated and the investor looks for the market situation that depicts the lowest risks. When the ratio is greater than one then, investment is deemed fit because the returns are also high. When the ratio is less than one then returns are not favourable and the investor looks for alternative investment areas. Error in the value at risk occurs due to wrong speculative values and errors arising in the calculation of the (NPV). The error is minimized by extending the period of the stock investment. An investor is therefore in a position to investigate whether investing in a certain stock at a particular time is worth the returns.

Value at risk model is used by banking institutions for analysing the sensitivity to market price movements. It is accepted as a standard tool for global capital adequacy. For the application of VaR the standard deviation and correlation estimate relating to the currencies are required. VaR is a standard tool for the measurement of risks existing in the derivative markets. It provides a probabilistic measure of the market risk of a specific currency in the money market. The approximate change in the interest rate as well as foreign currency exchange rates, with the changes in the market value of a port folio is measured as the market risk under this tool. Expected loss over a specific period is measured about a specified probability under this tool.

Value at Risk (VaR) is a controlling tool to the investors and traders for determining the capital requirements and evaluation of their performance. VaR is an effective tool for the measurement of market risk for financial markets personnel. It is followed by non financial personnel also. The three basic approaches under the VaR technique are the following

- Historical simulation:

- The delta normal method and

- Monte Carlo simulation

For calculating VaR, certain approximations and estimates are applied. As a result there involves certain limitations with the VaR analysis. It is based on historical data relating to the market risk. The estimation based on this model can be biased even though the trader takes the estimated market variances of the exchange rate. (Xiogwei and Pearson 1998).

Returns versus risk are investigated through evaluation of the forecasting models. In this regard if the two models have a root mean square equal to one then the two models have accuracy in forecasting returns and risks. This means either of the two models can be used for forecasting. In addition a value greater than one shows that the forecasting model is greater than the random walk versus the value at risk models and is therefore more suitable for forecasting the returns and risks. If the root mean square error is less than one then there is no need to use this model because it can not give clear returns and risks involved in the investment.

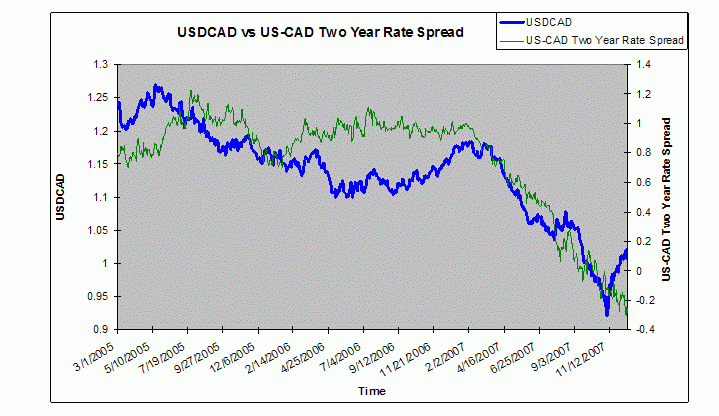

In 2003 Canadian dollar is best appreciated against US dollar. Canadian stock market is highly performed. The sharp rise in Canadian currency imposes dampening impact on the global investment market. Through the establishment of a currency strategy and understanding the impact of currency on the plan in terms of return and volatility the currency risk management can be efficiently carried on.

Currency exposure is the act of investment in non- domestic asset like fixed income or equity. Due to the lack of implicit or explicit return from this investment an assumption that currency exposure has no real long term expected return is held with the investors. In a shorter period the currency exposure influence the interim volatility of international investment portfolios.

Due to the complexities of foreign property rules, international assets exposure is accepted by financial plans to exploit the advantages available in international market. The increased exposure to foreign currencies resulted from this trend affects the financial activities’ rate and return features.

Currency volatility in Canadian economy shows that the combination of domestic equities with unhedged international equities is resulting in significantly less risk. The negative correlation of currencies and foreign equities produce limited risk.

The best way to managing the currency risk is passive hedging. By this approach the return volatility caused by the currency component of a foreign port folio has to remove. Exposure of Foreign stocks or bonds is allowed under this concept. Thus investors can invest in non- domestic market and thus the potential losses arising from Canadian dollar increasing value can be avoided. (Chrispin 2004).

Currency risk management

Introduction of the floating exchange rates in the economy has caused that transactions of goods, services, people, capital, or technology between nations is under the influence of changes in exchanges rates. Michael Moffett, Anant (Demaskey 1995).

The currency value of a country has an impact on its commercial operations. Currency markets are now accepted as a major investment area. Thus exchange rate has influential power up on the commercial relations. International transactions are based on the exchange rate of different currencies. A fluctuation in the exchange rate of currencies is attracted by commercial economic personals like exporters and investors. Currency market is characterised by the presence of all aspects of the world economy centred into a single, digestible value. Currency values are influenced by fluctuations in world markets and their interaction with international trade, investment, and monetary practices.

Exchange rate fluctuations are affected in transactions of external markets. In a market where the intercurrency transactions are occurred in large level, the changes in exchange rate will be greatly exposed in that market. International commercial operations are also shown the influence of exchange rate fluctuations in their total volume of transactions. Intercurrency transactions involve opportunity to generate cash gains through the application of currency hedging techniques.

Operating performance: – For the evaluation of operations of multinational firms, it requires extensive analysis techniques. For the evaluation of performance in multiple currencies a multi-tier evaluation process can be applied.

Investment risk: – Investment in a particular market is related to the economic developments in that market. The economic relation between the external market and other markets are also considered.

The expected return from investment is taken in to consideration before Capital investment in external market. It is related to the rate of return of investment currency. The investment decision is based on the required production level, expenditure requirements and the net cash flow as per the operations currency. The initial fund investment in operations currency is translated in to investment currencies to compare capital investment opportunities in other areas. Thus the investment decision is influenced by the translations exposure and currency risk.

(Eliot 2008). In the recent past, Canada has made much use of derivative. A derivative is any security whose value is derived from the price of some ‘underlying “asset. An option to buy US$ through contract one year from now is a derivative. The future value of the dollar at least in this case would depend upon the exchange rate between the CAD and the US$. It is seen that derivative could be used to reduce risks or to speculate.

To provide an example of risk reducing use, it is supposed that an Canadian importer‘s net income tends to fall whenever the US$ value rises against the CAD. This importer could reduce or obviate risk by purchasing derivatives that increase in value whenever the dollar declines. This is termed as a typical hedging transaction, and is widely used to stem currency fluctuations in the international trading markets. (Brigham and Ehrhardt).

Another way would be to hold a broadly diversified portfolio of stocks and debt securities, including international securities and debt of varying dates of maturity. However, derivatives can also be used to alleviate the risks associated with financial and commodity markets. Nonetheless, derivative can also be employed to reduce the risks associated with financial and currency markets. It is seen that one of the best methods, used all over the world, for reducing the interest rates, exchange and commodity risks is to hedge the future markets.

Since most financial and real assets transactions occur in what is known as the spot , cash where asset delivery is made immediately, futures on the other hand is a promise to call for the purchase or sale of asset at some future date but at a price that is determined today. The price being fixed, the risk of currency fluctuations is obviated, and this would be beneficial to all the parties concerned in the contract. (Brigham and Ehrhardt). Exposure risk managers can hedge exchange rate risk with either currency futures or currency options. It is generally suggested that hedgers should choose a hedge instrument that matches the risk profile of the underlying currency position as closely as possible. This advice, however, ignores the possibility that the hedging effectiveness may differ for the alternate risk management tool

Corporations engaged in international business transactions are commonly exposed to exchange rate risk. Since management is concerned with currency exposure, it can hedge the anticipated exchange rate risk either with futures or options. The choice of the appropriate hedging tool is generally influenced by the type of currency exposure (transaction, translation, or economic risk), the size of the firm, the industry effect, the risk preference of the manager or the firm and his/her familiarity with the available financial instruments and techniques. It is also suggested that a hedger should choose a hedge instrument that matches the risk profile of the underlying currency position as closely as possible. Hence, futures contracts are more suitable for covered hedges, while option contracts are best used for uncovered hedges.

Hedging effectiveness of these two hedge instruments must be considered as well to evaluate the cost of obtaining the desired risk profile. Some empirical research has shown that the futures contract provides both an appropriate risk profile and a more effective hedge than an options contract for covered positions. If these findings also hold for uncovered currency positions, then the hedging decision involves a trade-off between the desired risk profile and hedging effectiveness. That is, a hedger would have to decide whether the extra risk protection afforded by the attractive risk profile of options is worth the loss in hedging performance. This study compares the hedging effectiveness of currency futures and currency options for both covered and uncovered positions. (Demaskey 1995).

Methodology

For this paper, it is necessary to keep in mind that the objective is to understand and evaluate the movement of the CAD and its interrelationship with the American $. The return on equity (RoE) is the best methodology since it figures out the returns derivable by shareholders on their investments taking into consideration the hedging factors and risks undertaken on currency trading. Further, it is also to be determined which strategy would be most suitable for this exercise whether Passive hedging strategy, Passive exposure strategy,

VAR (α = 0.01) value at risk, model Sharpe ratio or Random walk strategy

In this study, it is necessary to under the mechanics behind the movement of the CAD vis-à-vis other currencies, most prominently the US$. It is seen that the CAD has been linked with the US$, which has caused both concerns as well as advantages. In the present context, the US$ has weakened and this has been a boon for many American businessmen. The mechanics of currencies would work this way. If there is a fall in the value of US $ before the export payment is released, US exporters would be at losses. However, if the value of US $ increase, the exporter would be benefited, since the other side, importer would have to pay more US $ to clear the shipment.

However, since last year the Canadian Dollar has maintained large rising movement that has enabled it to gain much on the U.S dollar. But, financial circles are circumspect whether the good trend is going to last long or perhaps, these are signs that the currency CAD is finally getting close to stability, which it may not have realised since adoption of the dollar in the early 20th Century. Even though many theories have been put forth none has emerged convincing but sometimes they offer an insight to some of the factors that influence current economic trends and explain exchange rate movements

To comply with the aims and objectives, This research will suggest a forecasting spot rate in period t+1 which is depend on spot rate in period t, home and foreign interest rates, and hedge ratio. Anticipating the specific spot return to find the optimal currency hedging strategy for exchange rate financial management. At last, chose the best strategy by using the maximized currency utility function to compare the results of hedging decisions based on random walk (Brownian motion), Value at risk (VAR), and Black-Scholes models.

This research will use some models such as Random walk, Var and Sharpe to explore an acceptable currency exchange rate model. It was intended to forecast and simulate the risk and return with the chosen model. This will use by anticipating the currency return, given the information available in period t, by various hedging strategies that are practiced in the business world to reduce currency risk, based on the empirical results of some of the above models.

The ARCH model keeps into consideration the specifications of the mean equation and has a characteristic in discrete time and a moving average of p+1 is applied with an interval of one year thus the equation.

![]()

Where the error decomposes to σtet but et is normally distributed with a mean of zero and variance of 1 (Masaaki 2003, p.232). This method can be applied to predict rate of exchange over a very long period, and since from the past the Canadian dollar has exhibited some stability in the mean and variance of the exchange rate fluctuation then the white noise method is the most recommended. For instance if the current time is taken, then the forecasting model will take the form ![]()

Where t is the time and starts at t=0

This procedure assumes that the exchange rate of the Canadian dollar exchange rate will consist of a sequence of random variables which are mutually independent and identically distributed as the auto covariance will be independent of time.

For the spot exchange series of the U.S dollar it is needed to estimate the compounded exchange rate series which is given by ![]()

Where from this equation et stands for the spot exchange rate at time t which is specifically that day.

If the U.S dollar exchange rate of return is fitted then this doesn’t change the mean equation and the general form of the power conditional equation (APGARCH). Then the mean error term most likely contains outliers which need to be filtered. Recent research has shown that the U.S dollar ARCH and GARCH coefficients are statistically important with tests at a level of confidence of 5% but the stocks proved to be fleeting since the sum of both ARCH and GARCH coefficients that were estimated were more than unity (Robert & Kopp 2005 p.128).

Another important method is the Black-Scholes Option Pricing Model that proposes a method of valuing stock warrants by comparing the discount rate of warrant with time and the stock price. This method has proved to be very efficient in predicting the future stability and proof that the risk-free interest rate is the correct discount factor of the U.S dollar in comparison to the Canadian dollar (Neil 1997 p.68).. This model is given by ![]()

Where

C = Theoretical call premium

S = Current stock price

t = Time until option

K = Option striking price

r = Risk-free interest rate

N = Cumulative standard normal distribution

s = standard deviation of stock returns

![]()

Bonds and other securities can also be handled by the portfolio weighted duration approximation approach or cash-flow mapping and any number of the sections can be included in the VAR calculation and thus the sections can apply to both foreign and home

This methodology would also need to examine the following models to determine the best available under the present circumstances:

- Passive hedging strategy

- Passive exposure strategy

- VAR (α = 0.01 ) value at risk model

- Sharpe ratio.

- Random walk strategy

The main aspect to be considered is that the value attained, whether it is ≥1 or effectively≤ 1. In this case the value is √ mean sq = 1, it could be reasoned that risk and returns would be correctly deterministic and could be used for forecasting.

Similarly, if the √ mean sq > 1, then it could be said that then it could be logical to assume that a high degree of forecasting reliance could be placed. However, if the √ mean sq < 1, the reliability cannot be placed and it has to be rejected outright. Now the above models are to be considered one by one.

Passive hedging strategy

In the first place we take the Passive hedging strategy, which is comparatively easy to implement. But the underlying disadvantage with this system is that although it reduces losses, it also reduces the potential for gains. It is seen that sometimes passive hedging is less loss bearing; there are certain approaches, the first being the traditional approach – under this model , it is believed that currency is very much like any other investments- bonds, gilt-edged securities, etc.

Therefore, it is seen that application of passive hedging may sometimes not be yield the desired results, especially on long term basis. Therefore, if the currency fluctuation strategy is not correctly placed, it could create misjudgement later. Therefore, it could easily be said that the traditional methods need to be tempered with high risk evaluation to be effective on the long term basis. Therefore, it is seen that passive hedging may not be an effective solution for assessment of Canada’s risk: return ratio since unless risk is taken there could be not much of risks and innovative risk managers, even in the case of currency alpha, are inclined to modify it with diversified investments to add value and increase yield. (Francis 2006). The biggest gains in currency management will come from choosing the right currency.

A good negotiator should be able to get an initial price reduction of 5% or more against a volatile currency like the yen or the mark. The next most consequential decision is whether or not to hedge. Not hedging opens the buyer to dollar price fluctuations that are that are often around 20% in half year term. Most companies are reluctant to accept such uncertainties. This uncertainty is unacceptable to most companies.

The next choice is to select a hedging strategy. A recent article in the International Journal preferred a hedge strategy based on a Bayesian statistical analysis of probable outcomes. Over five years, actively choosing a hedge strategy would have saved 3.6 percent compared to paying in the supplier’s currency (yen) without hedging, and 1.8 percent compared to always hedging with forwards.

If buying in the supplier’s currency without hedging is unacceptably risky, and buying in dollars is excessively expensive, the choice is between hedging with forwards and hedging with options. If options were free, they would be the ideal choice, because they permit taking advantage of a stronger dollar and protect against a weaker dollar. However, options are not free, and almost always will be more expensive than forwards.

If the current trends are to be accepted, the dollar will weaken, and the choice should being terms of forward contracts. This cheaper version of option. If the market trends are not clear it should be made based on relative costs.

It is often argued whether hedging should be indulged in the first place, since; in the long term currency fluctuation tend to even them out. It is only in the short run that currency fluctuations may influence earnings and returns. It has been seen in empirical studies that currency fluctuations does have scope for earning returns, especially in the short run period

A study by Bob Doyen compares risk and return from hedged and unhedged Equity portfolios. It specifically looks at the MSCI EAFE Index for the period January 1980 to June 1999. (Morgan Stanley Capital International Europe, Australia, Far East Index is the most commonly cited international equity index.)

From the above chart it is evident that that hedging reduces the volatility of the return since the hedged returns are only 15.29% as compared to 17.52% for unheeded return. Whether foreign assets are being held for the short- or the long-run, it is apparent that hedging can help improve a fund manager’s performance and thus deliver value to investors. (Youngren and Srinivasan). VAR: This technique is used to estimate the daily statistical deviation and the practitioner could determine the gain or loss that could be determined.

In simple terms Value at risk works under the assumption that the currency returns will be normally distributed as a random variable. A VAR strategy provides investors with a doze of maximum losses that could be expected from an investment over a fixed period with predetermined parameters with a testing period of 482 days and confidence level of 99%.

Forecasting techniques

Fundamental forecasting model

Fundamental forecasting model is based on the assumption that there exist historical relations between various economic variables in the capital market. Thus by establishing this relationship using regression analysis, a targeted exchange rate is estimated. It is considered as a useful method for several conditions. It is best suited to specific corporate purpose. Fundamental economic variables influencing the exchange rate are taken under this approach. The variables include GNP, consumption, trade balance, inflation rates, interest rates, unemployment, and productivity indexes. (Chapter 5: Forecasting Exchange Rates).

Regression Model in Forecasting USD/ CAD rate

This model is based on the following regression equation:

CADt = bo + b1 dGDP + b2 dRINT + b3 dINF t-1 + u

Where b0= is a constant, b1 indicates the fluctuation of CAD due to changes in dGDP, b2 indicates the fluctuation of CAD due to changes in dRINT and b3 indicates the fluctuation of CAD due to changes in dINF t-1, u indicates an error term. By taking the historical data, the regression equation helps to predict the coefficient values (b0, b1, b2 and b3). (Sandler). Through this regression equation the direction and strength to which the Canadian dollar will be affected by each of the independent variables can be estimated.

The regression coefficient b1 is expected to be positive since the variable input is the difference in real GDP growth of USA and Canada. Because of the stronger relative GDP growth in the US economy and higher demand for Canadian goods by the USA, the position of CAD will be improved. The regression coefficient b2 is expected to be negative, because of the difference in the short term real interest rate between USA and Canada. The regression coefficient b3 is expected to be positive because of the difference in the inflation rate between the two countries.

The stability of a currency’s exchange rate may be affected by strong currency substitution. As per the asset demand model of currency substitution of Girton and Roper in 1981, it is stated that the fluctuations in exchange rate in the money market becomes larger when the currency substitution is stronger. (Imrohoroglu 1994).

Thus with the improvement in money stock will bring exchange rate instability in the currency substitution. It will alter the inflation tax rate.

The currency substitutions between Canada and USA have thus economic implication. Due to the feature of small open economy the substitution of US Dollar is significantly less. The deposits of US dollar in Canadian economy are not act as a good substitute for the domestic Canadian currency when the transaction costs are considered. (Imrohoroglu 1994).

FX Hedging strategies

This strategy is based on the assumption that USD/ CAD rate is neutral in between 0.9724 – 1.0343 trading range. There involves two types of strategies under this. They are Active Layered hedging strategy and Disciplined layered hedging strategy. The first one is meant for sellers of USD / CAD rate. It is insisted that they should focus on resistance at 1.02351.0343. (FX Hedging Strategies: USD/ CAD Trapped in Trading Range by Forex Trading, 2008).

The risk involved in these procedures is too high, and the returns are too low. Therefore, it could be seen that this is not only in the case of their property. The study also needs to take into consideration the high cost of maintenance and operation of a random walk strategy and the method by which it could be facilitated in empirical situations. It is also seen that lowering of the US $ could also explain how and why the CAD rose sharply, and for a short time, remained at par with US$ value in the market. The strength of the US$ has its challenges and opportunities for all concerned. The robustness of the CAD helps it to acquire new technology but it also puts manufacturers under pressures,

The American dollar’s weakness was pronounced across most currencies Thursday as it dropped against the e euro, the British pound, the yen and Swiss franc.

It needs to be said that the exchange rate be watched closely so as the value of the Canadian dollar could be compared to the U.S. currency. In recent times there has been an increase in the dollar as against the falling US $ and it is not due to the innate strength of CAD. This is quite in evidence in the study and its aftermath. (Dollar briefly hits parity, highest level since ’76). Further the discussions on the findings could be seen in terms of the fact that the close linkages between the respective currencies of US$ and CAD has been a major reason for the rise in CAD against US $. Most economists who are Canada watchers are of the considered opinion that the linkage would be better off severed between US$ and CAD.

Coming to the next aspect, the fact an understandable goal for monetary policy (and a broader encouraging policy framework that includes sustainable fiscal policy), trustworthiness, and public accountability.

Laidler contended that such an articulate monetary order was not firmly in place in Canada until about 1995. This was four years after inflation targets were introduced and 25 years after Canada last floated the dollar. It was only when a clear monetary order was established that the Bank of Canada was in a position to use its policy independence to its best benefit by spotlighting on preserving the domestic purchasing power of the Canadian dollar through low inflation, while at the same time allowing the external value of the currency to adjust to shocks. (Concluding remarks).

There can be no contradiction that the United States’ economic performance over the last decade has been satisfactorily. Nor can it be denied that, over that same period, U.S. monetary authorities have chosen an inflation rate sufficiently close to Canadian preferences that it can plausibly be argued that Canada’s ability to choose its inflation rate has been of mainly symbolic significance. From here, it is a short step to arguing that Canadians could enjoy an acceptable inflation performance under some alternative monetary order that would incorporate a fixed exchange rate of some sort on the United States dollar. This argument, of course, does not take real shocks into account, and perhaps it ought not to be taken for granted that the United

States economy will always perform as well as it has recently. Indeed, their monetary authorities have sometimes seemed as surprised as anyone at the economy’s capacity to sustain rapid growth and low inflation for so long. (Laidler 1999).

Simple example regarding a trading investment could prove the aspect of VAR. Market value in US dollars today is known, but tomorrow’s market value unknown. The investment bank holding that portfolio might report that its portfolio has a 1-day VaR of $4 million at the 95% confidence level. This implies that under normal trading conditions the bank can be 95% confident that a change in the value of its portfolio would not result in a decrease of more than $4 million during 1 day. This is to infer that there is a 5% confidence level that the value of its portfolio will decrease by $4 million or more during 1 day. A 95% confidence interval does not imply a 95% chance of the event happening, the actual probability of the event cannot be determined.

The crux of the issue is that the target confidence level (95% in the above example) is the given constraint here; the output from the calculation ($4 million in the above example) is the upper limit loss (the VaR) at that confidence level.

Sharpe test

Sharpe ratios for currency strategies are roughly equal to those for stock indexes (buy and hold), and real-world institutional traders distribute their investment capital based predominantly on Sharpe ratios. That is, currency strategies can yield positive profits (similar to stock indexes) but lower than speculative investments in equity markets, so they are not agreeable for institutional investors who could otherwise productively invest in Foreign exchange markets (e.g., big international banks).

It is believed that the total order flow for Foreign exchange consists not only of leveraged investors (e.g., bank traders, hedge funds) as completely assumed in the textbook model of uncovered interest rate parity (UIRP), but also of unleveraged investors (e.g., mutual funds, pension funds, insurance companies) and nonfinancial corporations (e.g., international trade firms). When Sharpe ratios of currency strategies are relatively low, the Foreign exchange order flow becomes monopolised by non trading traders who have to trade for business operation reasons.

Portfolio shifts in the latter two groups give rise to gradual changes in their FX order flows because these groups have limited involvement in Foreign Exchange markets as they neither monitor nor trade in these markets continuously. (Miguel 2005). In a given context, it is believed for every given value of the standard deviation, the trader would provide the currency that could give the highest return. Thus it helps the traders to provide ranking to the currencies based on their expected return of standard deviation of the currency returns.

It is seen that the Exchange rate volatility regarding the US $ is around 11% for all countries except the CAD, which moves closely to US $ volume of around 5.4%. It is also seen that when compared to the US $, CAD exhibits high correlation with US$. The dual aspects of the CAD is seen in its high correlation with both the US $ and Aus $. “Investors in the Australian and Canadian stock markets are keen to hold foreign currency, regardless of the particular currency under consideration, because the Australian and Canadian dollars tend to depreciate against all currencies when their stock markets fall; thus any foreign currency serves as a hedge against fluctuations in these stock markets.” (Campbell 2007).

It is also seen that at the beginning of the 1999’s there were serious trepidation that unstable US $ could also cause conspicuous exchange rate fluctuations in Canadian exchange rate since US was their major trading partner, and a major portion of Canadian imports were from US. This was also seen as the prime reason why Canada abandoned its fixed exchange rate and opted for flexible exchange rate policy. However, it is well known that during hectic economic activities and also during slumps, there could be major upheavals in the exchange rate that could affect the exchange rate. A flexible exchange rate could fact a lower degree of vicissitudes, as compare to a fixed rate during such times and the adverse effects would be lesser in the case of flexible rates as compared to fixed rates.

This is because during times of falling values or depreciation of currency, there would be need for more CAD for importers to pay off import bills, whereas in case of exporters, more foreign exchange could be gained from clients against export payments. Again, it is also seen that when the question of imports are taken into account during appreciation of the currency due to market factors, there would be profits and gains since lesser CAD would be required to pay off import bills, but this could not be so in the case of exports.

Therefore, it would not be wrong to state that market conditions are important determinants in the currency fluctuations and business activities of firm under currency volatility.

As the dollar is tied to the commodity cycle, however, a recovery in the resource sector could put upward pressure on the Canadian dollar, which would harm producers’ revenues when translated from US to Canadian dollars. (DEMASKEY 1995).

If these are to consider the best method to follow, it could depend upon the market conditions and the surrounding economic milieu that recognizes that short term losses could become long term gains and vice versa.

The method that is being followed in this study would be in terms of comparing the different models and taking a decision based upon the best available method that could be used for determining the scope and applicability of the risks and benefits of Investments in CAD as against the USD. It is found that in present financial scenarios prevailing in Canada, both US$ and CAD are being used, but it is seen that the usage of US$ has come down substantially, since quite some time.

The methodology that would need to be followed would be in making a relative assessment of the models available and provide an opinion regarding which model would best suit the present study in terms of applicability and suitability. It would now be necessary to delve on the Random Walk Strategy to determine its application in this study of the risk and use of Canadian dollar as an investment vehicle.

It is seen that the Random Walk strategy was initiated in 1973 and has since gained world wide acceptance. According to this theory, it would well be impossible to outperform the market on a steady basis. The basic premise is that market moves are a series of random moves. Past and current market information cannot serve as authentic cues for the future movement of the currency markets and each situation has to be tackled separately. Information along the currency markets move so fast that it would well be impossible to profit from it, and even if an investor does, it could be just by chance occurrence and not based on scientific observations and factual analysis. (Random Walk Theory, 2007).

Past performances has judged that a buy and hold strategy outperforms most effort to time the market in absolute returns. In risk-adjusted returns, the argument loses some of its reliability. Buy and hold may take the speculation out of beating the market, but it does little to recompense for the risk associated with a continuous investment in the market. There is a direct connection with risk and return: the higher the expected return, the higher the associated risk. A portfolio with a timing strategy that seeks to move into risk-free treasuries when a bear market is signalled (Dow Theory for example), significantly reduces the amount of risk associated with that portfolio.

(Random Walk Theory, 2007).

Analysis & discussions of findings

Graphical representation of Time series Data

From the time series data given, we can plot a graph. The time series data shows an irregular growth and so we can predict the change that is occurring from one period to the next period. For this we can use First Difference of the series. The first difference of the series represents a series of changes from one period to the next. “If Y(t) denotes the value of time series Y at a period t, then first difference of Y at a period t = Y(t)- Y(t-1)” (Random walk model).

Even though the graph shows a high fluctuation during November, it has regained its more or less random position in the following months. So it could be predicted that the value of the currency will show only slighter fluctuations in the coming days.

Interpretation of Currency Returns under the Three required Models

The exchange rate and Canadian inflation targeting

To control the inflation in the economy, Bank of Canada adopts a strategy of flexible exchange rate which is free to regulate with developments in the Canadian as well as world economies. No specific target is fixed for the exchange rate by the Bank. As per the changes in the target rate of interest of Bank, the exchange rate also changed. Together with this international relative prices also altered and the net export and aggregate demand is also changed.

In a transmission mechanism exchange is the prominent factor. In case of changes in exchange rate without changes in domestic monetary policy the cause of the change is identified for taking corrective action. Formulation of appropriate policies to keep the inflation in a low, stable and predictable level is held with the Bank. The Bank has always take steps to prevent the currency’s substantial depreciation. The Bank aims to maintain low, stable and predictable inflation in exchange rate. It also takes care to keep the annual inflation rate of the consumer price index at 2 percent. Through this it ensures volatility of the prices of specific products.

The bank has followed the policy of low, stable and predictable inflation to influence the expectations of firms relating to future inflation. Thus in times of high fluctuation in exchange rate the firms are confident of bank’s remedying actions. For this the firms not alter their expectations of future inflation with the short term price fluctuations. It is a fact that to keep the actual inflation in a state of low and relatively stable position it has to keep the inflation expectations at a level of 2 percent target.

The exchange rate can be changed with increasing demand for Canadian goods and services from foreigners and changes in global asset port folios towards or against of Canadian assets. Exchange rate of currency is based on the global demand for the goods, services and assets of the country. World’s foreign exchange market is the centre of determining exchange rate. Exchange rate is mostly resulted from various economic shocks. Thus exchange rate changes are a useful source of information relating to developments of Canadian economy together with global economies.

The flexible exchange rates of Canadian policy, market forces are the determining factor of value of exchange rate. Due to this the time -invariant right value is not available in the exchange rate. Due to the reflection of changes in demand or supply conditions in the foreign exchange markets the current value of the exchange rate represents the right value.

The Bank takes the changes in exchange rate as a side effect of the changes in world markets which will also affect the Canadian economy. Thus it takes step to identify the sources of changes and identify at what extend the change has affect the future aggregate demand, output and inflation. (Ragan 2005).

Comparative Rate of Returns.

For the prediction of exchange rate of Canadian dollar with US dollar regression model is a constructive method. Under this method certain assumptions regarding the dependence of the value of Canadian dollar should be made for avoiding complexity in quantifying some factors influencing the value of currency. These assumptions are as follows.

The Canadian dollar is depending on the economic variables as described below;

Corresponding growth in US economy with the growth in Canadian economy is considered on a percentage of the two countries’ gross domestic product changes. The short term interest rate differential between the two countries is measured as a differential factor of the Three- Month Treasury rate of each currency and the rate of inflation. (Sandler).

The inflation rate difference between the US and Canadian currency is measured based on the consumer price index existed in the two countries. Thus for applying the regression model in forecasting CAD/USD exchange rate inflation rate as well as short term interest rate existing in two countries are required to be collected. In the regression analysis CAD is taken as the dependant variable. The following are the independent variable under this analysis.

- The Difference between the US real GDP growth and Canadian real GDP growth which is indicated by dGDP.

- The difference between the US real Three Month Treasury rate and the Canadian real Three Month Treasury rate which is indicated by dRINT.

- The difference between the US inflation rate and the Canadian inflation rate which is indicated by dINFt-1. (Sandler).

Random walk model

For the prediction of irregular fluctuations in exchange rate it is better to apply the tool of random walk strategy in which the risk is predicting based on the change that occurs from one period to the next. Based on the predictable pattern of the exchange rate series future exchange rate change can be predicted. Under the random walk model changes in exchange rate changes between two periods is indicated as the quantity Y (t) – Y (t-1).

For the forecasting model of future risk under this strategy is indicated as below; Y (t) – Y (t-1) = α , here alpha is the mean of the average change from one period to the next which is referred as first difference.

In Random walk model assumption that the current period’s value is differentiated from past value by a constant of average change between two periods is applied. Incase of constant alpha is equal to zero it is referred as random walk without drift.

Random walk with drift: If the model showing upward trend and is expected to continue in future also then a non- zero constant of alpha is included in the model on the assumption that the random walk is with drift.

Reference: Random Walk model, Decision 411 Forecasting. Web.

Prediction of risks related to exchange rate is not easy as it involves several factors that cause fluctuation in foreign exchange rate. The major constraints on the prediction of exchange rate are economic peculiarity of countries relating to national income, GDP growth, inflation in economy, and balance of trade. These factors are the major factor in determining countries currency value. Since these economic variables are not helpful or predicting exchange rate between currencies having identical inflation rates. To forecast the value of currencies it is assumed that currencies express the same nature of financial assets.

Price fluctuations in financial assets are based on future expectations on economic fundamentals and not based on current trend. The value of long term financial assets is highly related to future factors than the current data. When applying the asset pricing exchange rate model in currency value, future expectations of economic fundamentals are the major determining factor than the current fundamentals. Because of the random movements in exchange rate, there is no accurate prediction is possible with the existing data.

From the view of economists there is no specific relation between exchange rate and economic fundamentals. Thus forecasting model based on such relation is less reliable. Most of these model use past data and forecast on past data are reliable on certain percentage.

Reference: Why Are Exchange Rates So Difficult to Predict? By Jian Wang, Vol. 3, No. 6, 2008. Web.

There is a general concept among the financial experts that the prices on well established financial markets are showing random walk movement. Thus percentage change or return on a particular day is not related to price changes in the past. In a random walk movement of currency value, there is no correlation between past and future returns. In an efficient market where the information has a direct bearing on the market fluctuations, the price fluctuations are on random walks. Currencies showing random walk are more stable. Every small changes in currency value has created awareness among the investors about currency risk and thus suitable overcome measures can be employed in the economy. Thus future risks expecting on currency value can be minimized by avoiding crucial distortions in economy.

Reference: The Random Walk vs. Intuition by Ajay Shah. Web.

VaR Analysis

For the allocation of funds on various currencies, risks related to each currency have to be identified for proper decision. VaR analysis is a standard tool for the identification of risks with currency investment. It is used as the quantifying factor of currency risks. For measuring the currency volatility under normal market conditions VaR is taken as the base by financial institutions as well as money market personnel. IT is a statistical approach in which the risks are taken based on financial terms for a particular period. Its measurement is based on three concepts i. e. exposure, volatility and correlation relating to currency.

Reference: VaR Analysis by Risk Services, Risk Analytics. Web.

Following are the different models of VaR

Industry Standard VaR

This model provides correlation between different currencies and thus allows greater flexibility in application. It is a simple and accurate tool. In this model each investment security is analyzed on its exposure, volatility, and correlation with other securities.

Historic VaR

In this model actual returns from the security investment are taken in to account and assumption on risk and return are made based on this data. The volatility and correlation of securities are not taken under this model. It is useful for finding the skewness and kurtosis of specific portfolio.

Marginal VaR

There are two methods under this model; i. e. Simple removal method and sigma-Loss. In simple removal method, the risk associated with a portfolio due to the acceptance of a specific security is found out by way of VaR analysis. In Sigma-Loss method, marginal risk of a security is determined by taking the correlation of security through which relative movement in one security as per changes in other securities is analyzed. Thus expected return on each security about a specific market shock can be analyzed.

Factor VaR: – This method is used for finding the risks of a fund investment by using the betas as risk factors’ investment weights.

Reference: Risk Services; VaR Models. Web.

Forecasting Exchange Rates

Autoregressive Conditional Heteroskedastic (ARCH) model

Shown in Separate Attachment

The ARCH model is developed by Robert F. Engle, 1982 through his paper in Econometrica. Due to the simplicity and its feature of incorporating the empirical characteristic of financial asset returns it becomes more popular. (Diebold 2004).

VAR measures the market risk exposure related to the portfolio in a specific period and is expressed in terms of number. In this model the maximum expected loss within specific period is taken. Thus the time interval and significance level for the confidence interval are used for the calculation of VAR.

Market based forecasting model

In this model market based forecasts is carried on within the context of an efficient market approach in which either current spot or forward or future rates are taken for the prediction of tomorrow’s exchange rate. Thus there are two rates under this model; spot rate and forward rate. (Cairns 1997, P. 2).

Today’s spot rate is used for the forecasting of future rate. It is based on the general tendency that current value of money should reflect in the expectation of near future rate of that currency. Expected forward rate in the future will form the forecast spot rate on that period. Thus forward rate of a particular period a forecast of the spot rate of that period. Forward rate is expressed as follows;

F = S (1 + P); Where; P= forward premium,

Forward rate is influenced by the general expectation of future spot rate. Thus market based forecast can be made through the understanding of forward rate.

(Madura 2006). According to Charles St-Arnaud the future of Canadian economy will not be as bright as it is in the present state. It will reflect on the future exchange rate of CAD with USD. GDP figures of Canadian economy in the previous year shown that due to the weak external demand and strong position of Canadian dollar the economy is badly affected. Even though the strong labour market, increased purchasing power, and strong income growth, the domestic economy is in good position. Due to the high percentage of export income in the GDP of Canadian economy, i.e. nearly 35 % the global market conditions will affect the Canadian economy.

The appreciation in the USD and lower commodity prices will influence the Canadian dollar badly. It is expected that USD/ CAD rate will be increasing due to the influence of weaker commodity prices. Thus the risk of higher USD/ CAD rate is expecting in the future. (Kicklighter 2007).

According to Grey Smith, the overall Canadian economy should grow by 1.2% in 2008 and 1.9% in 2009 when compared to 1.7% and 2.6% in the previous year. As a result of weaker growth, inflation will be lower in 2009. (Stanley 2008).

Charts relating to MILAD – provided in attachment

Interpretation of MILAD:

It is seen from diagrammatical representation provided in attached charts that highest value is 130.707 provided by VaR, followed by Sharpe Model at 130.495 and Random walk model at 130.394.

Table showing 12 month highest and lowest values of Different Currency Risk evaluative models.

From the above it could be gleaned that VaR peaks at 130.706 and could thus be considered as the appropriate strategy be pursued.

Conclusion

The following is the result of the statistical study conducted for assessing the best method to be deployed for evaluating currency risks. It could be tabularly represented as below:

Comparative Rate of Returns.

From the above it is amply clearly that test has justified use of VaR strategy as most appropriate strategy for this study, based on the fact that the return for this model is rated at 2.81.

VaR is an effective implement for measurement of risks existing in derivative markets. It provides a probabilistic measure of market risk of a specific currency in money market. By use of this method, the approximate change in interest rates as well as foreign currency exchange rates, with the changes in the market value of a port folio is measured as the market risk under this tool. Expected loss over a specific period is measured with relation to a specified probability under this Tool.

Value at Risk (VaR) is a major tool to the investor’s stock traders for determining the capital requirements for investment portfolios and also subsequent evaluation of its performance.

VaR is a useful and effective tool for the measurement of market risks for personnel engaged in money and financial market transactions.

The idea behind this study was to consider whether currency returns are linked to risks and the result of the provided by the VaR methods quantitively proves that this competes with the other strategies considered that is the random walk and Sharpe theories.

Risk and returns are complimentary in investments and currency trading is no exception.Just as there is a presence of risks and returns in other forms of investment portfolios, so these two factors emerge in the investment avenues also.

This paper has considered the VaR as the most appropriate model since it has the highest valuation, both under conventional and also from the results of MILAD (See attachment 1 ) The comparative 3 way plotted Chart 5 provides highest value for VaR, while being compared to conventional methods as is evident from the graph attached.

Bibliography

Article. [online]. Vol. 26. Web.

Are Financial Markets Efficient? (2004). ECON 422: Investment, Capital and Finance. Slide 12. P. 12. Web.

BRIGHAM, Eugene F., and EHRHARDT, Michael C. Financial Management: Theory and Practice: The Financial Environment: Markets, Institutions, and Interest Rates. [online]. P. 156. Chapter 5.

Conditional Mean and Variance Models. (2008). The Math Works. P. 8. Web.

Canadian Dollar Currency Futures and Canadian Dollar Currency Options. (2004). T &K Futures and Options Inc. Web.

Concluding Remarks. A History of the Canadian dollar. Web.

CAMPBELL, John Y., SERFATY-DE MEDEIROS, Karine., and VICEIRA, Luis M. (2007). Chapter 4: Global Currency Hedging. P.19. Web.

CHRISPIN, Gregory. (2004). Managing Currency risk – The Canadian Perspective. Ssga. Web.

Chapter 5: Forecasting Exchange Rates. Web.

Cairns, Andrew J. G. (1997). Descriptive Bond-Yield and Forward-Rate Models for the British Government Securities Market. P. 2. Web.

Dorsey, Thomas J. (2006). Evaluating Risk and Return: Look Sharpe. Path to Investing. P. 14. Web.

Demystifying Responsible Investment Performance. (2007). UNEP Finance Initiative: Innovating Financing for Sustainability. Web.

Disyatat, Piti., and GALATI, Gabriele. (2005). The Effectiveness of Foreign Exchange Intervention in Emerging Market Countries: Evidence from the Czech koruna. BIS Working Papers: No. 172. Bank for International Settlements. Web.

Diebold, Francis X. (2004). The Nobel Memorial Prize for Robert F. Engle. Wharton. Web.

Demaskey, Andrea.L. (1995). A Comparison of the Effectiveness of Currency Options in the Context of Foreign Exchange Risk Management. Emarld. Vol. 21. P. 40-51. Web.

Dollar briefly hits parity, highest level since ’76. (2007). Web.

Eliot, Richard. (2008). Currency Risk Management. Valore International. Web.

FX Hedging Strategies: USD/ CAD Trapped in Trading Range by Forex Trading. (2008). Forex Investment and Currency Trading. Web.

Francis, Gavin. (2006). New Approaches to currency management. BNY MELLON: Asset Management. Web.

Fama, Eugene F. Selected Papers. No. 16, Random Walks in Stock-Market Prices: Random walk model analysis in stock market. Web.

Hollar, Richard. (2008). Currency Trading Articles 4: Currency Trading Long and Short Positions. Forex on demand: Foreign currency Trading. Web.

Imrohoroglu, Selahattin. (1994). GMM Estimates of Currency Substitution between the Canadian Dollar and the U. S. Dollar. Questia : Journal Article. Journal of Money, Credit & Banking. Vol. 26. Web.

Imrohoroglu, Selahattin. (1994). GMM estimates of currency substitution between the Canadian dollar and the U.S. dollar. Questia: Journal.

Jorion, Philippe. (2003). Financial Risk Manager Handbook. John Wiley and Sons. P. 281. Web.

Kicklighter, John. (2007). USD/CAD 2008 Outlook. Daily FX. Web.

Laidler, David. D. (1999). The Exchange Rate Regime and Canada’s Monetary Order. [online]. Bank of Canada: Banque du Canada. Web.

Manganelli, Simone., and ENGLE, Robert F. (2001). Working Paper No. 75: Value at Risk Models in Finance. [online]. European Central Bank. Web.

Madura, Jeff. (2006). Market Based Forecasting. [online]. International Finance Management. P. 276. Web.

Miguel, Villanueva O. (2005). The Financial Review 2005: FX Dynamics, Limited P articipation, and the Forward Bias Anomaly. (Foreign Exchange). Web.

Martini, Giulio. Active Currency Management: The Unexploited Opportunity. [online]. Bernstein Journal: Perspectives on investing and wealth management. Web.

Martini, Giulio. Currency Returns: The Sum of Two Parts. Active Currency Management: The Unexploited Opportunity. Bernstein Journal: Perspectives on investing and wealth management. Page 2. Web.

Pant, Bhanu., and BISHNOI, T.R. Testing Random Walk Hypothesis for Indian Stock Market Indices. Web.

Ragan, Christopher. (2005). The Exchange Rate and Canadian Inflation Targeting. Bank of Canada Review. Web.

Random Walk Theory. (2007). Stockchart. Web.

Random walk model. Decision 411: Forecasting. Web.

Sharpe, William F. (1994). The Sharpe Ratio. The Journal of Portfolio Management. Web.

Stanley, Morgan. (2008). Morgan Stanley: Canadian Dollar Could Be at Risk. Seeking Alpha. Web.

Sandler, Ralph. Forecasting Exchange Rates Within the Context of an International Financial Management Course. Web.

Sharpe Ratio. (2008). Investopedia. Web.

Sharpe Ratio. Web.

Von, George M. (1997). Regulation and Supervision of Financial Institutions in the NAFTA Countries. [online]. Springer. P. 88. Web.

Youngren, Steven., and SRINIVASAN, Sayee. Using Currency Futures to Hedge Currency Risk. [online]. Chicago Mercantile Exchange. Web.

Xiogwei, Ju., and PEARSON, Neil D. (1998). Using Value-at-Risk to Control Risk Taking: How Wrong Can You Be? [online]. Page 5. Web.

Random Walk model, Decision 411 Forecasting. Web.

Why Are Exchange Rates So Difficult to Predict? By Jian Wang, Vol. 3, No. 6, 2008. Web.

The Random Walk vs. Intuition by Ajay Shah. Web.

VaR Analysis by Risk Services, Risk Analytics. Web.

Risk Services; VaR Models. Web.