Introduction

Demco Communications is a new company that is not more than two years since its inception. The company deals with the manufacture and distribution of electronic software and hardware equipments. It has had problems with the payments system since most of its clients are not in the same geographic location. Other clients do not have bank accounts but would like to avoid the numerous bank charges during transactions.

Other than that, there are those that have bank accounts but would like to have something different. The market for the company’s products is readily available. The management needs to work hard to increase the number of transactions on a daily basis. It requires creativity, innovation, skills, and technology. The competition has gotten used to the status quo. It, therefore, means that to stay ahead of the game, one must inevitably re-invent and become more innovative.

Description of the Technology

Demco should come up with a new technology that involves handsets and financial software in the handsets. It is a mobile phone with a Subscriber Identity Module card with full registration in the name of the client. It can register a business name or individual’s name. The phone would mainly be applicable to transactions and communications. For companies, the firm would fix an entire system in the accounts and sales department.

It would also link it with the responsible managerial staff. The system would be able to update information anytime a customer sends an inquiry and alert the sales department. The salespeople would also be able to monitor how many times a customer logs into the system. The client analysis report would always be ready for the management to monitor the historical transactions from every client.

How the System Would Work

Whenever a client would want to start a business transaction with Demco communications, one would have to visit the company offices for a briefing and, if necessary a training. One would be required to buy the telephone handset with a particular SIM card and register it on the spot. The sales team would guide the client in the opening of an individual trading account in the phone with particular and easy to use features. If one already has a handset, then one does not need to buy a new one because other handsets can still work on it. It is the SIM card that is important. After the registration, the client would be able to link his or her new SIM card to the bank and Demco communications via personally created passwords (Shi 300).

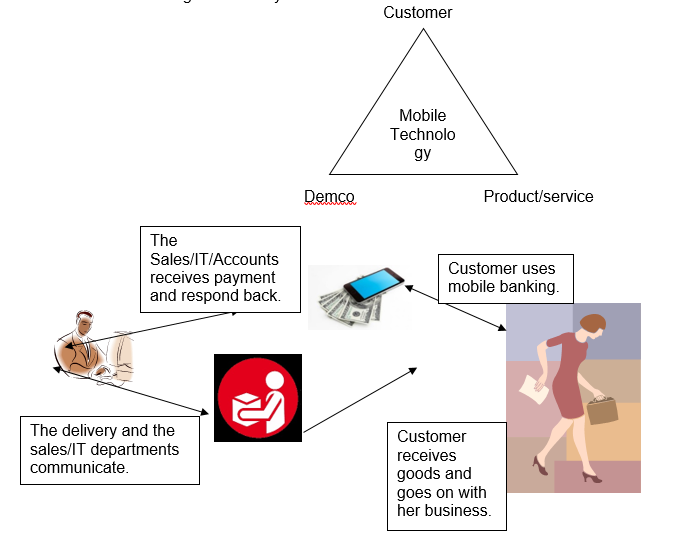

The diagram below indicates how the IT and the sales departments would operate. Once the IT/sales department receives the money, it sends a confirmation message back to the customer’s handset. The sales and IT staff then alert its delivery team to disburse the goods to the client. The delivery team then confirms the availability of the goods and the delivery prospects and modalities to the client (Krishnan 260).

When the customers are happy with the superior service, they will reach out to others, and this would help to increase the number of clients as the graphic below illustrates.

It would enable the client to monitor bank balances at the comfort of her or his home and or office. Whenever the customer would want to place an order from Demco, it would not be a must to call. The customer can just log into the system and place an order by filling the customer-friendly online form. The sales department would view the information from the sales department system, and the customer would receive a notification of the quotation, price, and delivery mechanism (Lerner 175).

The customer would have to pay by first loading his or her mobile account with money from the bank or at the very well distributed agency networks. When the client sends the money, the system will send him or her notification. It will show the amount of money one has paid, the order number, invoice number, and the goods one is purchasing (Barnes and Corbitt 257). According to the time specified by the customer, the goods would then be delivered at the location where the client and the management have agreed. The customer can also pay for the goods on delivery but with special arrangements.

The system would also keep updating the customer about any new products or product modifications. It would also be used to send birthday messages and invite the client for special forums. Demco would have to hire technocrats always to be ready to repair and improve the system to prevent any damage or collapse.

Incorporation into the Organizational Strategy

The management that had asked for the research needs to be aware of the modalities. There is a need for getting the communication and banking licenses from the government authorities. The executive would have to make very concrete decisions that would determine the future of the organization. If it approves the project, then it would be the first among many. Other organizations would also want to get information and start the business (O’brien A21).

After approval, the research and the management would have to begin the necessary activities for the effectiveness and success of the project. Demco would rediscover itself as one of the best customer friendly organization. The system would ensure that the clients who were still using the online banking tariff switches to the mobile banking scheme (Ashta 217).

Conclusion

The organization would use its time well to serve customers and monitor the transactions. It would also help the customers have ample time to deal with the group. Once the client pays, the money can easily be used for other transactions. The company can use the same technology to pay salaries to staffs. It can also use it to order raw materials and payment of business utilities. The system can then transfer the excess amounts to the bank account.

Many businesses struggle with customer outreach and maintenance of the same clientele. It is the cooperation between the sales departments and other departments within the organization that can bring success. Technology enables organizations to shorten the time, the distance, and break the available communication barriers. Customers love groups that make it easy for them to get their desired products and services. Therefore, by winning the customers hearts, one wins over the market. One can only increase the prospects of remaining in business by ensuring that the market develops interest in its products and services.

The graphic below displays the communication between the client and the company about the products and services. Once the Customer gets the mobile phone and the SIM card registration, communication can begin immediately. Transaction becomes efficient and easy for business growth. Below, there is also an entire transaction through the new system.

Works Cited

Ashta, Arvind. ‘Evolution of Mobile Banking Regulations’. SSRN Journal, n. pag. Web.

Barnes, Stuart J., and Brian Corbitt. ‘Mobile Banking: Concept and Potential’. International Journal of Mobile Communications 1.3 (2003): 273. Web.

Krishnan, Sankar. The Power of Mobile Banking. Hoboken: Wiley, 2014. Print.

Lerner, Thomas. Mobile Payment. Wiesbaden: Springer, 2013. Print.

O’brian, Kevin. ‘Mobile Banking in the Emerging World’. New York Times 2010: A21. Print.

Shi, Nansi. Mobile Commerce Applications. Hershey, PA: Idea Group Pub., 2004. Print.