Introduction

Greece is one of the European countries that were adversely affected by the recent financial crisis. Its financial markets experienced a lack of sufficient credit facilities and liquidity (Althanassou 364). The government, on the other hand, had a huge budget deficit. At the moment, the government is heavily indebted since it can not pay all its debts (Althanassou 364). While most of its peers are already recovering from the effects of the crisis, Greece is yet to stabilize its economy. This implies that the policies used by the country in response to the financial crisis have not been effective. This paper examines the fiscal and monetary policies used by Greece during the financial crisis. The factors that led to the failure of these policies will be illuminated.

Response Policies

Monetary Policy

The following monetary policies were used by the Central Bank of Greece in response to the financial crisis. First, the central bank used open market operation (OMO) to improve the liquidity of the economy (Nelson, Belkin, and Mix 3). OMO involves influencing the availability of money in the economy through trading in securities in the open market (Roger 67). Thus the central bank sold various securities such as bonds and treasury bills to the public. The citizens and the institutions that bought the securities were to redeem their investments at a future date. The main reason for using this policy was to enable the government to raise money through borrowing from the public in order to finance its budget deficit (Nelson, Belkin, and Mix 4).

Second, the central bank lowered the rate of reserve requirement (Nelson, Belkin, and Mix 6). The reserve requirement is the percentage of deposits received by commercial banks held by the central bank (Roger 79). This policy enabled commercial banks to retain a greater portion of their deposits. Hence they had more funds to lend to their customers. Thus the main reason for using this policy was to improve the liquidity of the economy through credit creation.

Third, the central bank lowered its lending rate (Nelson, Belkin and Mix 7). The lending rate in this case refers to the interest rate at which the central bank offers short-term loans to the commercial banks. This was meant to encourage commercial banks to borrow short-term loans from the central bank (Roger 83). The central bank lowered the interest rate from 6% in 2008 to 5% in 2009 (Nelson, Belkin and Mix 7). The reduction in interest rate thus encouraged commercial banks to borrow more funds for credit creation.

Fiscal Policy

In order to reduce its financial deficit, the government resorted to austerity policies (Althanassou 365). Austerity policies help in managing government deficit through cost reduction and it was implemented as follows in Greece (Roger 123). First, the government reduced the salaries of workers in the pubic sector in order to save on its expenditure (Althanassou 366). The savings were used by the government to finance other development programs such as subsidizing healthcare. Second, hiring workers in the pubic sector was stopped in order to avoid increasing the deficit (Althanassou 367). Third, the retirement age was increased to 65 years (Althanassou 367). Thus the government was able to save the funds that were to be used to pay for the retirees’ benefits. The funds were instead used for other development projects. Finally, the government introduced more taxes and increased the rate of the existing ones (Althanassou 368). This was meant to help the government raise more revenue to fund its budget effectively.

The second measure involved the use of expansionary fiscal policy (Althanassou 369). In this case, the government increased its level of aggregate expenditure. The increase in expenditure was funded by the money borrowed from the public, financial institutions such as IMF and other countries such as Germany (Althanassou 369). The expansionary fiscal policy was meant to stimulate economic growth. The government intended to promote economic activities in the economy in order to increase its real GDP. This is based on the fact that increasing aggregate expenditure leads to a rise in national income (Roger 56). The increase in national income or real GDP implies that the economy is realizing positive growth.

Factors that Led to the Failure of the Response Polices

The above polices created new problems that undermined their efforts to realize the desired objectives. The new problems are as follows. First, the open market operations were used to raise funds for government expenditure from both domestic and foreign markets (Nelson, Belkin and Mix 3). Even though the funds were used to stimulate activity in the economy, little result has since been achieved. Besides, there was mismanagement of funds and inefficiency in the government (Nelson, Belkin and Mix 11). This undermined the government’s ability to collect enough tax revenue. Consequently, the government’s deficit increased instead of reducing. As at 31 December 2010, the deficit was as high as 12% of the country’s GDP (Nelson, Belkin and Mix 12). Besides, the government has not been able to service its maturing debts.

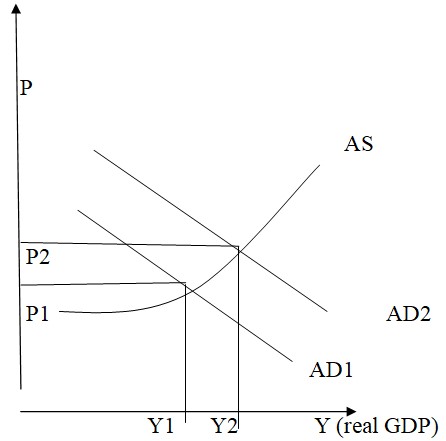

Second, the expansionary fiscal policy resulted into a decrease in the countries level of exports (Nelson, Belkin and Mix 13). Greece issued bonds in the international financial market in order to finance its expansionary fiscal policy. Thus the demand for Euro increased in the international financial market (Nelson, Belkin and Mix 13). As the demand for Euro rose, its value appreciated by 13% in the year 2009 when the fiscal policy was implemented (Nelson, Belkin and Mix 13). Consequently, the goods produced in Greece became more expensive in the international market than they were before the introduction of the policy. This is because those who imported Greece’s products had to purchase the Euro at a high rate in order to pay for the goods. The high price of the products led to a reduction in their demand. The appreciation of the Euro resulted into a reduction in the price of imports in Greece. This is because the importers purchased foreign currencies at lower rates in order to pay for the goods (Roger 167). The overall effect was a reduction in export and an increase in imports (Roger 168). Third, the expansionary fiscal policy led to an increase in inflation since the country was operating at full capacity (Althanassou 370). This is illustrated by figure 1 below. As discussed earlier, an increase in aggregate expenditure causes an increase in aggregate demand. Thus as the equilibrium income increases from Y1 to Y2, the price also increases from P1 to P2. The rise in price thus signifies an increase in inflation.

P: price level

Y: national income

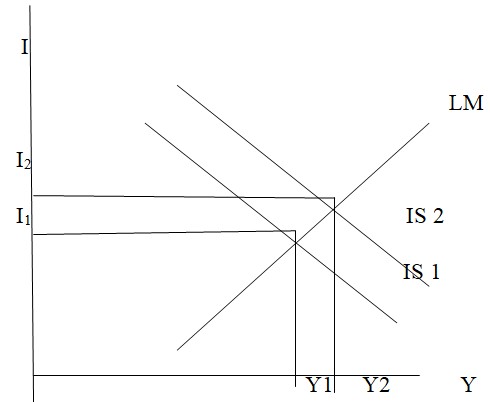

AS: aggregate supply

The increase in government expenditure also led to an increase in interest rates and this can be illustrated by figure 2. The effect of an increase in aggregate expenditure is similar to that caused by a reduction in savings (Roger 45). This effect leads to a rise in the demand for various products at different levels of interest rates (Roger 46). This means that the IS curve will move upwards if the government increases its expenditure and this is shown in figure 2 below. As the curve shifts to the right, the equilibrium interest rate will rise from I1 to I2. The increase in interest rate discouraged the private sector from investing. Thus the long-term economic growth objective was not realized due to the increase in interest rate.

I: interest rate

Y: national income

IS: investment-saving curve

LM: liquidity-money curve

Finally, the austerity measures resulted into the following setbacks in regard to economic growth. The freeze on recruitment in the public sector led to an increase in the level of unemployment. The reduction in wages or salaries of the public sector employees resulted into a reduction in the level of welfare and quality of life in the economy (Althanassou 371). This is because the affected citizens were not able to maintain their normal living standards due to a reduction in their disposable income (Roger 48).

Conclusion

Greece’s economy was adversely affected by the recent financial crisis as discussed above. In response to the financial crisis, the government of Greece and the Central Bank of Greece implemented both fiscal and monetary policies to stabilize the economy. Austerity measures and increase in government expenditure were the main fiscal policies used by the government (Althanassou 364). The monetary policies used by the central bank included, OMO, reducing reserve requirement and lending rate (Nelson, Belkin and Mix 2). However, these measures created new problems which include increase in unemployment rate, high inflation and increase in trade deficit.

Works Cited

Althanassou, Edward. “Fiscal policy and the recession: the case of Greece.” Review of European Economic Policy 44 (2009): 364-372. Print.

Nelson, Richard, Paul Belkin and Daniel Mix. “Greece’s dept crisis: overview, policy responses and implications.” Congressional Research Services 2 (2010): 2-15. Print.

Roger, Arnold. Macroeconomics. New York: Cengage Learning, 2008.Print.