Introduction to IAS

The International Accounting Standards Board (IASB) is an international accounting standard defining body, which works independently for International Financial Reporting Standards (IFRS). It sets the International Accounting Standards (IAS), which provide a global, standard method of accounting and reporting in many countries. Since 2000 when globalization became widespread and international holdings became the norm, many western firms and those from the East, invested in other countries, which followed their national reporting standards. To bring in standardization and uniformity and to avoid confusion, the IASB was formed. IAS prescribes the rules to enter accounting and financial information in financial statements and books of records. By following international standards, uniformity was brought and financial statements could be compared, followed with reliability and accuracy without misconceptions. IAS has issued 41 standards that cover different elements of financial reports. Examples are IAS 1, presentation of financial statements, IAS 38, intangible assets, IAS 41, agriculture (IAS 2017).

Criticism is raised about the utility of IAS. USA follows its own GAPP standards, and it expects everyone to follow these standards. While IAS prescribes rules for reporting, it is clear that these rules are prescriptive and do not identify frauds (Deloitte 2017). This paper discusses four IAS standards and examines how fludubai follows the standards. The four standards are IAS 1 – Presentation of Financial Statements, IAS 2 – Inventories, IAS 16 – Property, Plant & Equipment, and IAS 18 – Revenue.

Main objectives and scope

The objectives of IAS are primarily to bring uniformity and standardization in financial reporting. In a globally connected world, these standards define the manner and calculations for financial information, specify how calculations are made, so that investors across the world can interpret and understand financial information in the same manner. There is consistency in adopting global frameworks where concepts are financial statements are defined uniformly. As a result, an investor in China would be able to correctly interpret and understand financial information such as revenue, inventory, debt, assets, and other aspects. The scope of IAS is to allow many countries that had their methods of calculating the financial information to adopt standard methods. Earlier, investors had to spend efforts on understanding what data was included. IAS has removed this confusion and it is possible to interpret and use information consistently, irrespective of the nationality or location of a business entity. Some important objectives of the five-selected IAS are given below.

IAS 1 – Presentation of Financial Statements

Objective of the standard is to specify requirements to prepare financial statements, their format and structure, content required, the accrual basis of accounting, any concerns and risks, and the distinctions made. The financial statement is expected to give a comprehensive and full disclosure of the financial positions, the profit, loss, incomes, statements of cash flows, and other details. The scope is that the standard applies to financial statements, prepared for public and regulatory use, and for users who do not have resources to obtain tailored reports as per their requirements (IAS 1 2014).

IAS 2 – Inventories

These specify the requirements to account for different types of inventories and their valuation. Inventories are valued at the lower cost and net realizable value. The standard indicates the methods used to value the costs using techniques such as weighted average cost and first-in-first-out. The objective of the standard is to define the accounting method of treating and valuation of inventories. It helps to determine the inventory costs, considers these costs as expenses, provides for the write-down of net realizable value, and gives formulas to calculate costs. Scope includes inventories in various classes, held for sale as finished goods, stock pending in the manufacturing stage, various consumables, and other categories. It does not include material in construction contracts, financial instruments, and biological assets of agriculture (IAS 2 2003).

IAS 16 – Property, Plant & Equipment

The standard refers to the consideration given for different types of pant, property, and equipment. Costs are measured for the property, equipment, plants initially, and then evaluated using a revaluation model and further depreciated. This depreciated amount is distributed over the remaining useful life. The objective of the standard is to define how property, plant, and equipment are treated. The main issues are to identify and value assets, set their carrying value, depreciation charges, and any impairment losses from these assets. The scope of the standard is to account for plant, equipment, property. Exclusions are for biological assets such as agriculture, exploration assets for minerals, oil, gas, and other mineral rights (IAS 16 2014). For airlines, airplanes, owned by the airplane and on a long-lived lease, equipment on such airplanes such as radio and communication, engines, landing gear, etc. wherein, these items are not included in the lease contracts are included (IATA 2016).

IAS 18 – Revenue

The standard details the accounting measures to identify revenue from multiple sources. These sources include the sale of goods and services, ancillary products, income from royalties, dividends, interest, lease, and other sources. It is measured at a structured fair value of the assets for which cash or cash equivalent is received when required conditions are met. The objectives of the standard are to define the method of accounting for revenue that is obtained from different types of events and transactions. It considers gross inflow of cash and cash equivalents, receivables from the sale of primary goods and services, and secondary services such as food and beverage (IAS 18 2009).

Key definitions

Some important definitions related to IAS are given as follows (Ramin and Reiman 2013):

Accounting policies

These are rules, principle conventions, and practices used by the entity to prepare financial statements. IAS removes ambiguity in these definitions.

Amortization/ depreciation

The defined and set procedures to depreciate or reduce the value of an asset over the useful life.

Asset

This is a resource that a firm owns or controls due to past events and from which future economic gains are forecast.

Borrowing costs

Costs of interest and other than a firm incurs when it borrows funds.

Cash flows Cash inflow and outflow into the firm account or cash equivalent.

Consolidated financial statements: These are financial reports of a group of firms that are shown as coming from a single entity.

Liability

This is the obligation of the firm from past events, settled with cash outflow or other cash equivalents.

Revenues

It is the increase in cash flows, asset enhancements, and other economic benefits with a decrease in liabilities. Revenues can be positive, indicating profits or negative, indicating losses.

Inventories

These are goods and material purchased and maybe in the form of finished goods held for sale, work in progress, and other goods from which economic value can be realized.

Disclosures

Disclosures are voluntary and mandatory provisions where important information that impacts the decision making of investors is given. Mandatory disclosures refer to information that must be disclosed by law and regulations, while voluntary disclosures refer to information revealed that is beyond the required information. The extent and nature of voluntary disclosure depend on the regulatory and investment climate, industry, firm size, and governance and ownership structure. Some firms may donate to political parties, activists groups, IAS specified some voluntary disclosures, and these are presented below.

IAS 1

The standard requires mandatory disclosures about assets, liabilities, equity, income and expenses, contribution by owners and distributions to them, and cash flows. Components of the financial statements at a minimum require a statement of the financial position or the balance sheet, values for profit and loss, changes in equity, cash flows, explanatory notes, and accounting policies, and comparative information. All this information is for the end of a given period. The importance is given to the faithful representation of the cash flows and financial performance, condition, and definition, using accrual basis for accounting. Comparative statements, which show similar values for the previous one to five years, must be given (IAS 1 2014).

IAS 2

Inventories disclosures should reveal the accounting policy used for inventories, carrying amount of supplies, merchandise, work in progress, finished products, and classifications. Details such as the fair value less selling costs, carrying amount, write-down as an expense, and reversal of write-down considered for NRV along with notes on issues that made such reversal imperative. Other disclosures include the amount used as a mortgage for liabilities and the cost of goods sold. IAS 2 allows firms to report inventories to show operating costs, the nature of costs, and the amount of net change in inventories. Certain costs are not included and these include abnormal waste, storage costs, unrelated administrative costs, losses/gains from a foreign currency, and interest costs for purchases with deferred terms (IAS 2 2003).

IAS 16

Property, plant and equipment are recognized as assets when economic benefits are possible and when asset costs are measured with reliable methods. Costs include costs of initial purchase or lease, running and operating costs, and costs of servicing and parts replacement. When the cost of each part is significant, then separate depreciation is allowed. Equipment such as aircraft requires regular inspection, tests, approvals, and these costs are allowed for current and future expenses. Two costing models are allowed, cost model, where the assets are valued at costs less the depreciation and revaluation model where the asset is examined at a revalue amount as the fair value, less depreciation, on the date of valuation. Depreciation is allowed and spread over the useful life of an item. When an item is retired from service, it should not appear in the financial statement and any gain or loss is reported. Disclosures include measurement bass, depreciation method and rates, gross carrying amount, reconciliation details, restrictions on title, expenditures, contractual terms, and compensation (IAS 16 2014).

IAS 18

Disclosures for revenue must consider cash inflows and economic gains from the sale of goods, from providing services, cash from interest, royalties, lease and rentals, and dividends. Airlines sell food products and beverages on airplanes and charge extra for excess baggage and preferred seats. All income from these revenue streams must be considered and defined (IAS 18 2009).

Examples from annual reports of flydubai airlines

This section presents examples of the three IAS standards from the financial statement of flydubai airlines. Information for the four standards is spread across multiple pages in the annual report. It is not feasible to present all pages. Hence, a representative snapshot from the report is given (Fludu 2017).

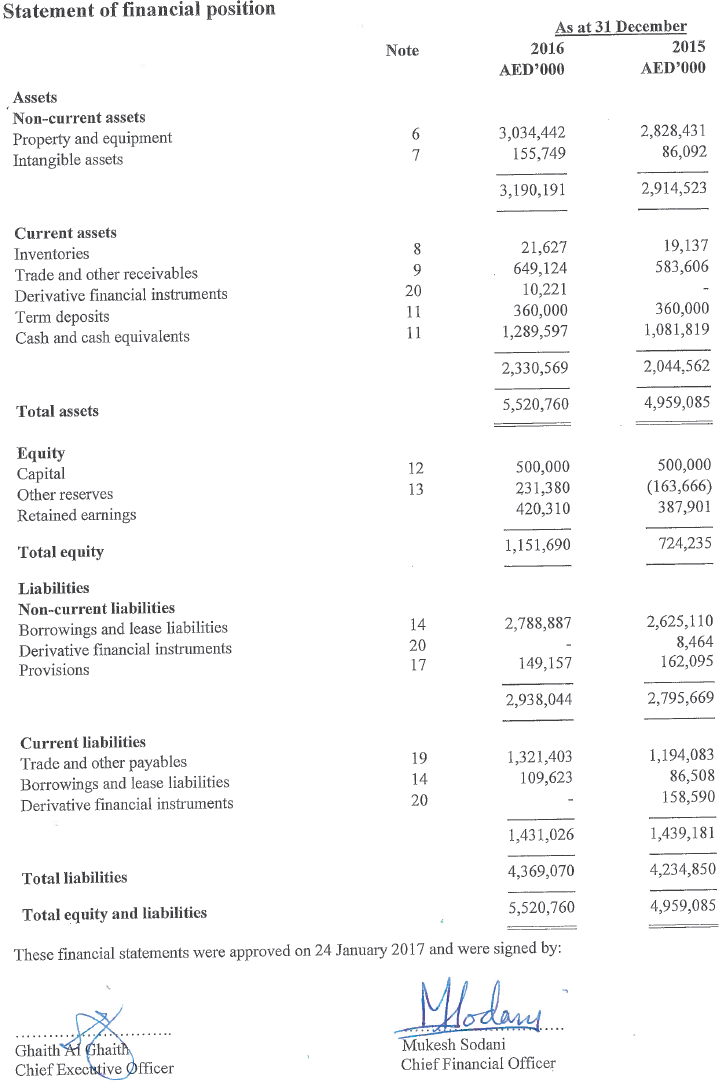

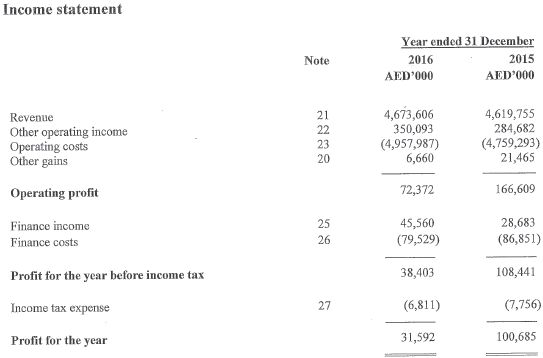

Example of IAS 1

Fig 1 illustrates a snapshot of flydubai financials. Information about important values and the financial health is given for 2015-16 along with note numbers where explanations are given. Investors can view this snapshot and then examine other parts of the report.

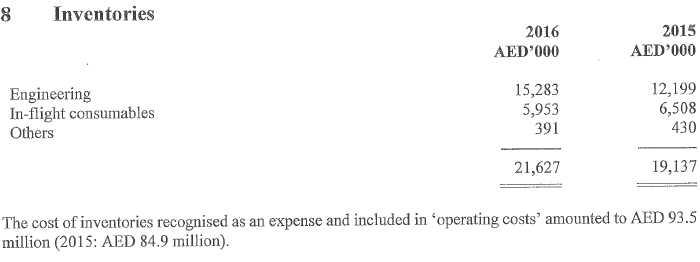

Example of IAS 2

fludubai does not give a detailed breakup of items in the inventory. Rather, it clubs all the items under this head and gives a single value for the combined inventories. A note explains the methodology used to calculate the inventory. Fig 2 illustrates the value of inventories.

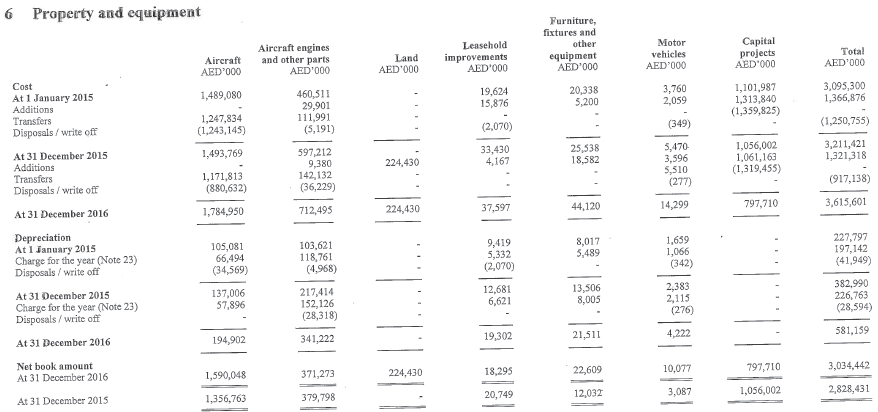

Example of IAS 16

Fig 3 gives information about property, plant, and equipment.

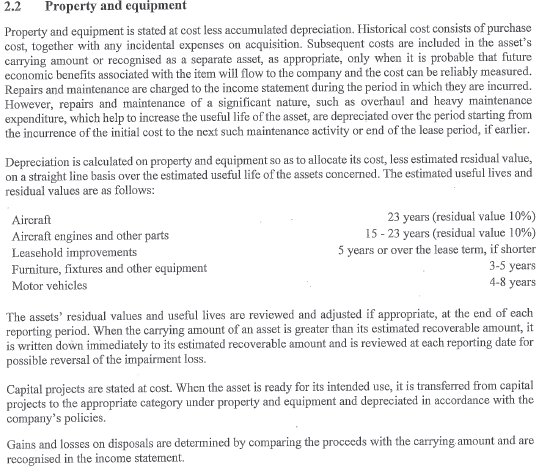

A detailed note about the method of calculating the assets is given in Fig 5.

Example of IAS 18

Fig 5 gives a detailed breakdown of revenue from various sources and segment.

Conclusion

The paper discussed IAS standards and examined four standards from the list of standards. The manner in which flydubai airlines applies these standards in the annual report was detailed. The report shows adherence to IAS specifications. However, disclosure levels for various accoutring heads are minimal, though they meet the prescribed standards. A point to note is that the report does not mention details of properties owned, of type and age of aircraft leased, and other important information. Therefore, it is difficult to compare the statements with other comparable airlines. flydubai is a low cost, budget airline, hence, the reporting levels may not be detailed, while all mandatory disclosures are made. The conclusion is that flydubai follows all requirements of IAS.

References

Deloitte 2017, IASB and IFRS Interpretations Committee, Web.

flydubai 2017, Financial statements for the year ended 31 December 2016, Web.

IAS 2017, International Accounting Standards, Web.

IAS 1 2014, IAS 1 – Presentation of Financial Statements, Web.

IAS 2 2003, IAS 2 – Inventories, Web.

IAS 16 2014, IAS 16 – property, plant and equipment, Web.

IAS 18 2009, IAS 18 – Revenue, Web.

IATA 2016, Airline disclosure guide: Aircraft acquisition cost and depreciation, Web.

Ramin, KP & Reiman, CA 2013, IFRS and XBRL: How to improve business reporting through technology and object tracking, Web.