Introduction

In the recent past, the world has experienced a steady expansion of financial flows via the now porous national borders due to globalization. Financial institutions that incorporate investors and banks into their business have increased the geographical boundaries of their business activities. This way, they operate as mediators who avail money to borrowers in different countries. The concept of globalizing financial markets is marked by increased geographical penetration of developed security markets. New securities are established in such a manner that they appeal to a myriad of international investors. These two observable facts have translated into the liberalization of financial flow across borders. Considering the degree of globalization of financial markets and banking, an emerging question is whether the phenomenon influences the financial stability of a nation. This section discusses this issue as it applies in the UAE.

Globalization of Financial Markets and Banking

Through globalization, the financial subsystem, which entails capital flow and investments across borders, has significantly increased over the last two decades. International organizations such as the World Bank and the International Monetary Fund have acted as the major enhancers of the globalization of financial markets and banking such that nations can acquire loans in an internationalized banking system. The organizations have been central in boosting the internationalization of the financial system (Bucur, 2012). The issue of spreading various capital circuits across borders combined with the institutionalized financial structure has been having resulted in a global financial market whose effects are strongly felt in domestic markets, including in the UAE.

The globalization of the banking system and the financial markets has been increasing. This situation has led to borrowing alternatives that are accessible to different economic agents across the world. For example, different economic agents now have diverse ways of seeking finances for funding their current account deficits together with recycling their surpluses in their current accounts. With the current technological advancement, which permits easy and quick sharing of data, money transfers, and access to credit in an international arena, the phenomenon of globalizing financial markets and the banking system is unstoppable. Considering the high degree of globalization of financial markets and banking, and interpretation of financial stability in the UAE is necessary. The next section addresses this concern.

Interpretation of Financial Stability in the UAE

Awareness of the economic, social, and monetary implications of a crisis in financial and banking systems has compelled the development of international standards based on the global best practice in ensuring financial stability. Most of the efforts focus on streamlining financial supervision, reporting, auditing, and establishing legal frameworks for guiding best practices in banking and financial systems management (Alawode & Al Sadek, 2008). The goal is to reduce the risk of financial instability. Despite these efforts, there is no universally accepted definition of financial stability. Defining it depends on the deployed economic school of thought. For example, as quoted by Alawode and Al Sadek (2008), Mishkin defines financial instability as a state that occurs when the dynamics of monetary structures obstruct the information stream to the extent that the monetary scheme can no longer accomplish its task of availing financial aid to those who have creative investment prospects. While interpreting financial stability in the UAE by considering the degree of globalization of its financial and banking structures, this definition deserves an interpretation.

Although the definition is adopted in the discussion of this section, it pays attention to the role of intermediation that banking and financial systems play in the provision of credit to the economy. It emphasizes that information asymmetry leads to economic volatility. The implication is that shocks in the economy translate into disrupting the smooth movement of information. Nevertheless, in all banking and financial transactions, even in the absence of shocks, information flow failure causes disturbances (Alawode & Al Sadek, 2008). To this extent, it becomes evident that financial volatility occurs when shocks increase the level of information irregularity to the extent that financial intermediation fails to operate normally. This claim implies that globalization of financial and banking systems is only important in the UAE if it can provide people with productive investment opportunities with alternative sources of credit or channels of investments when the national economy experiences shocks that lead to increased asymmetry of information flow such that the systems fail to play their intermediation role.

One of the shocks that can cause financial instability in the UAE is output volatility. Although research has been completed on the UAE’s economic growth, its volatility is equally important to enhance financial stability. Meller (2013) reckons, “high output volatility discourages investment in a country and it increases the risk premiums and thereby the cost of capital in and of the country” (p. 477). The economic literature demonstrates that output volatility produces negative implications on the total output growth of a nation. Indeed, following the occurrence of any financial crisis, which is essentially a situation of high output volatility, economic growth slows down. Consequently, the resulting unemployment influences the poorest people in society. Therefore, avoiding high output volatility is critical in ensuring financial stability in the UAE. An emerging question is whether the globalization of financial and banking systems can help to accomplish the task.

While noting the necessity to reduce or avoid output volatility to enhance financial stability, the UAE needs to examine its degree of globalizing its financial and banking systems. Besides, while interpreting the UAE’s financial stability by considering the high degree of globalization of financial and banking systems, it is also important to benchmark from the experiences of nations that have highly integrated financial systems. For example, the US experienced declined output volatility from the 1980s. Meller (2013) asserts that between the 1980s and 1990s, some nations, including Argentina, encountered a deep economic crunch, yet they had opened up their financial markets. Learning from the recent 2007-2008 global financial crisis, the European Union member states were influenced in different thresholds by the crisis, yet they have ‘open’ financial markets. For instance, Portugal and Greece experienced severe economic crises while Germany recovered quickly from a mild downturn in its economy. This situation leaves the UAE with the question of whether globalizing its financial and banking system can reduce economic crisis/output volatility to enhance its financial stability.

The experiences of different nations as discussed above give rise to difficulties in establishing criteria for determining the necessary degree of globalization of financial and banking to guarantee financial stability within the UAE. Part of this difficulty is attributed to the disagreement between the experiences and academic literature on the impact of globalization on financial markets and output volatility/economic crisis. Supporting this argument, Meller (2013) reckons that economic academicians expect financial market globalization to increase the level of financial stability in an economy. Financial openness fosters effective and efficient allocation of savings together with investments across different geographical regions. For example, during recessions, globalization of financial markets and banking systems leads to higher accessibility of globally available capital and borrowing pools. However, this situation lowers economic volatility due to the reduced sensitivity of investments and consumption of various negative shocks that influence incomes.

Variables such as fiscal policies, monetary frameworks, and openness in trade explain output volatility. The globalization of financial markets and banking systems influences these variables. Therefore, where the globalization of financial markets and banking systems increases financial stability, the implication is that the UAE can have stable and reliable fiscal and monetary policies, which can withstand national economic shocks such that economic activities in the nation are not negatively impaired. Devereux, Senay, and Sutherland (2014) question whether focusing on monetary policies in a nation to enhance nominal stability translated into a high degree of globalization of financial markets and banking system. For stability to occur, it is necessary to decrease inflation rates. Devereux et al. (2014) assert that several studies have documented the ability of globalization of financial markets to decline inflation rates. This situation occurs through the shaping of behaviors adopted by monetary authorities or by direct market effects. Devereux et al. (2014) do not dispute the likelihood of globalization of financial markets to lower the inflation rate. However, the researchers posit, “monetary policy, which reduces the variability of domestic inflation, leads to an increase in the diversification of international portfolios, generating higher gross external assets and liabilities (Devereux et al., 2014). This situation underlines the importance of the UAE to re-evaluate the degree of globalization of its financial markets to minimize this effect.

Devereux et al. (2014) analyze how the variability of inflation relates to the number of external assets. The panel regression approach that the researchers deployed suggests a negative relationship between the two elements. Reducing inflation variability has the effect of lowering bonds and equity variability returns. Therefore, the research suggests the likelihood of a relationship between the position of external assets and inflation stability. Hence, the UAE should not over depend on evidence, which claims that globalization of financial markets and banking systems leads to financial stability through the stabilization of inflation. Therefore, such evidence should not comprise a primary reason for the UAE to consider globalizing its financial markets together with banking systems.

The UAE’s financial and banking systems play a pivotal role in the functioning of the economy. The systems make it possible for financial intermediation to occur in the country to enable funds to flow smoothly between borrowers and savers. This strategy ensures that the available financial resources in the UAE are effectively allocated to permit both economic growth and its development. Such smooth flow leads to financial stability. However, variability in inflation and volatility output may cause financial instability. This section has suggested that the globalization of financial markets and banking systems can help to avoid this situation. However, the UAE needs to consider the appropriate level of globalization of its banking and financial markets due to the deferent findings in both theory and current experiences concerning the effects of globalization of financial markets and banking on output volatility and inflation stability.

Possible impacts of a decision to move away from pegging the Dirham to the Dollar

Trade Deficit

In 2011, a debate re-emerged on whether Gulf member states could proceed with their policy of pegging their currencies on the American Dollar. One of the principal concerns for considering de-pegging the UAE currency on the US currency is that a weak Dollar increases import costs. The situation drives up inflation levels. Even though pegging Dirham on the US Dollar worked well for the UAE when the Dollar was strong following the low import expenses, which reduced inflation levels, incidents of the weakening Dollar value are costly to the UAE economy. Apart from inflation effects, this section considers trade deficit, economic growth, and financial stability possible effects of a decision to move away from pegging the Dirham to the Dollar.

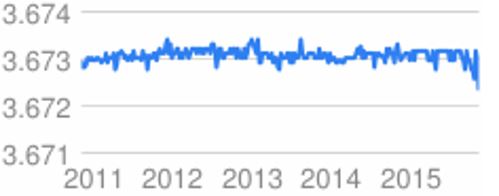

The UAE imports to and imports from international markets. A trade deficit occurs when imports are more than exports such that a net outflow of Dirham to international foreign markets is witnessed. A weak dollar increases the cost of imports so that Dirham flows out of the UAE economy. Therefore, nations from which the UAE imports hold a large proportion of its currency, which they may decide to sell at any time. This situation leads to a further increase in import costs, which in turn increases inflation levels in the UAE. Therefore, pegging Dirham on a weak Dollar increases the trade deficit since more money is used in purchasing fewer commodities from foreign markets. Hence, a decision to move away from pegging Dirham on the Dollar changes the UAE’s balance of trade equation. From 2007-2012, when the value of the Dollar had been deteriorating, the decision to move away from pegging Dirham against it was welcomed in an economic sense. The graph below shows the exchange rate from 2011 to 2015.

However, the value of the Dollar has now risen.

In March this year, Mubarak Al Mansoori who is the UAE Central Bank’s governor welcomed the good news of the rising Dollar. Addressing a forum for the seventh global financial markets held in Abu Dhabi, he posited, “As an oil producer, we export oil and other services to neighboring countries whose local currencies are also pegged to the Dollar” (Bouyamourn, 2015). The implication is that a strong Dollar helps to offset some of the UAE’s losses in oil exports when global oil prices fall. Therefore, in the event of a strong Dollar, a decision to move away from pegging Dirham against the Dollar is inappropriate. Pegging Dirham on a strong Dollar has positive effects on trade deficits. It provides opportunities to recover losses due to trade imbalances so that the net deficit on trade reduces.

Bouyamourn (2015) asserts that UAE risks suffering a 2% trade deficit in 2015 due to falling oil prices. However, with a strong Dollar, a decision to move away from pegging Dirham on the Dollar will increase the trade deficit, as the UAE may not exploit the available opportunities to recover losses in revenue from oil exportation. For example, it can devalue its currency against the Dollar to increase revenues to fund its current account deficits. Selling oil worth $1000 at the rate of 3.67 Dirham per $1 implies that the UAE earns Dh3670 from oil exports. However, upon evaluating the Dirham at Dh4 per $1, equal exports volume would earn the UAE Dh4000. Considering that current accounts and fiscal policies are in Dirham, pegging the Dirham against a strong Dollar helps to reduce trade deficit when imports and exports are valued in Dirham with the Dirham devalued to compensate for the reducing international oil prices.

Inflation Rate

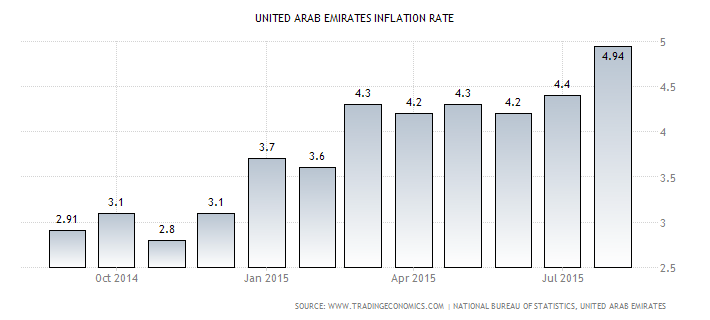

In 2007, the governor of the UAE Central Bank noted a potential new policy in the UAE’s pegging of Dirham on the US Dollar. The governor noted that pegging the Dirham on the Dollar (Dh3.67/US Dollar) has been a good policy in the past, but the weakening US Dollar was providing an indication of the necessity to reconsider the policy (Augustine, 2015). As the global financial crisis continued to influence the US economy, the Dollar continued to deteriorate. Hence, it was clear that the UAE’s Dirham would buy fewer commodities in the international markets when pegged on the weakening Dollar. The cost of imports would be higher such that products and services acquired from international markets would have inflated prices. In 2011, the decision to move away from pegging Dirham on the Dollar was almost certainly considering that the Dollar continued to deteriorate. The decision was necessary to curb the rising inflation in the UAE. The graph below shows the UAE’s inflation rate from 2014 to 2015.

Pegging the Dirham on a weak Dollar declines Dirham’s exchange rate when compared to other leading currencies such as the Rupee, Pound, and the Euro. For example, in 2007, such decline translated into losing the value of Dirham by between 16% and 20% when compared to the Sterling Pound and the Euro over 2 years (Augustine, 2015). The implication was the rising inflation and wiping out more than 9% of the UAE expatriate earnings. Despite the increased cost of imports, the UAE was compelled to reduce its interest rates by 0.6% in 2007 when the US reduced its interest rate by 0.75. This move increased inflation levels. A decision to move away from pegging Dirham against the Dollar in an event of a declining Dollar would lower or ensure steady inflation levels. However, the decision produces opposite effects on trade inflation in a situation of a strong Dollar, as is now the case. Consequently, despite the falling international oil prices, the decision is inappropriate now. The US Dollar is gaining its strength.

Economic Growth

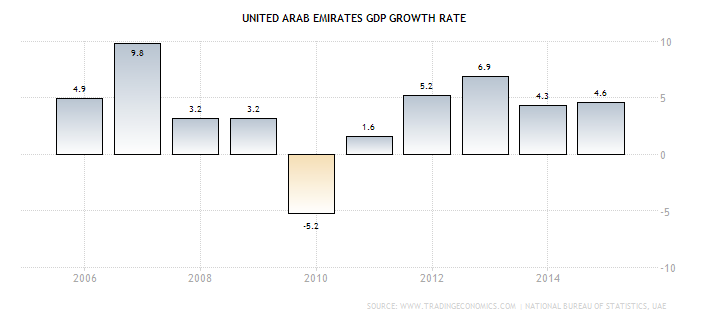

Economic growth implies the increasing ability of the UAE’s economy to produce services and goods for domestic consumption and export markets as measured and compared in two or more periods. It serves as an indicator of the living standards of any nation. A high GDP indicates a country that is doing well in terms of its economy. As shown below, the UAE’s GDP positions the county among the most industrialized in the globe as evidenced in the high living standards.

To boost living standards, all nations develop their monetary and fiscal policies to encourage high economic growth. Indeed, the UAE pegs its Dirham on the Dollar since international oil prices are mainly set in terms of the US Dollar. Hence, a decision to move away from pegging Dirham on the Dollar has an impact on the economic growth. It subjects the UAE economy to the fluctuation of an alternative currency since the exchange rate of the currency with the US Dollars varies from time to time. This effect is magnified in case the decision would lead to pegging Dirham on a less stable currency compared to the Dollar.

The UAE investments are rated in US Dollars. During the forum for the seventh global financial market held in Abu Dhabi this year, the administrator of the Central Bank of UAE cited this case as the single most important reason for not de-pegging Dirham to the Dollar. Governor Mubarak noted that the Dollar is important to the UAE since it guarantees the nation’s economic stability to mitigate any fluctuations in economic growth (Bouyamourn, 2015). Economic growth requires a nation to possess a high purchasing power. Pegging Dirham on a strong Dollar has the benefit of enabling the UAE’s economy to sell oil in US Dollars. The move not only compensates for the reducing prices of oil in the international markets but also boosts the nation’s purchasing power.

Financial Stability

The global credit crunch defined 2007 to 2008 economic business cycles in many countries. It was initiated by the spring 2007 housing crash in the US. It later developed into what can best be described as the liquidity crisis of global economies during late 2007. The damage done to developed world nations’ financial systems is irreversible (Andreas, 2010). The crunch weakened the global economy. The problem was initially treated as an isolated case that was only considered affecting a few companies but later turned out to be a major dilemma that required national intervention across the globe. During the global financial crisis-era (2007 to 2008), the profitability of financial organizations reduced, although loss-bearing abilities remained strong.

The effects of the crunch were felt in many nations, especially those that pegged their currencies on the dollar, including the UAE since the financial stability of the US came under intense threat. An arising question is whether the UAE necessarily had to continue pegging its Dirham on the weakened US Dollar, despite the nation’s investments being in the form of Dollars. The primary reason for pegging Dirham on the US Dollar is to benefit from the ‘piggyback’ effect of the US economy, including its financial stability.

In case the US fiscal system performs well, the UAE benefits through Dirham. What can happen if the US economy is doing poorly such as during the recent global financial crunch? This question gives rise to consideration to de-peg Dirham on the Dollar, something that never happened. During the financial instability (2007-2008 global financial crisis), the UAE suffered from problems of high output volatility, which led to high inflation. Therefore, a decision to peg Dirham on a weak US Dollar has a negative implication to the financial stability. The UAE suffered from financial stability problems that were experienced in the US via its Dirham.

Conclusion

The UAE pegs its currency, Dirham, on the US Dollar at the rate of 3.67 per Dollar. This case means that it benefits from the ‘piggyback’ effect in the US economy. However, the poor performance of the US economy after the 2007 global financial crisis gives rise to a debate on de-pegging the Dirham on the Dollar since the UAE experienced an increasing inflation level and rising trade deficits that were associated with pegging a currency on a weak foreign coinage. The section has argued that the decision to move away from pegging the Dirham on the US Dollar was appropriate in the event of a weak Dollar. However, such a decision is currently inappropriate in the UAE since the US Dollar has gained strength.

Reference List

Alawode, A., & Al Sadek, M. (2008). What is Financial Stability? Bahrain: Central Bank of Bahrain.

Andreas, A. (2010). The credit crisis and operational risk- implications for practitioners and regulators. Journal of Operational Risk, 5(2), 123-135.

Augustine, B. (2015). Dollar Peg at Crossroads. Web.

Bouyamourn, A. (2015). Dirham Sticks to the Greenback. Web.

Bucur, C. (2012). The Globalization of the Banking Sector–Evolutions and Predictions. Economic Insights Trends and Challenges, 64(1), 73-81.

Devereux, M., Senay, O., & Sutherland, A. (2014). Nominal Stability and Financial Globalization. Journal of Money, Credit and Banking, 46(5), 921-959.

Meller, B. (2013). The two-sided effect of financial globalization on output volatility. Review of World Economics, 149(3), 477-504.