Abstract

This paper analyses the conceptual framework under which Greek SMEs conduct their business. These include social, economic, policy, technological, and challenges, and opportunities that exist for SMEs. It also includes the support SMEs get from various partners.

A review of the literature regarding organizational culture shows that there are different organizational cultures classified according to different scholars. Organizational culture differs from one institution to another. They remain dynamic and reveal various relations that exist in Greek SMEs.

Introduction

Small and Medium-size enterprises (SMEs) have significant roles to play in Greece’s economy through job creation and provision of goods and services. Studies of SMEs show that SMEs contribute more than “the 55% of GDP and 65% of employment in countries with high, per capita, GDP, while more than 70% of GDP and 95% of employment in countries with low, per capita, GDP” (European Union, 2010). These records also indicate that Greece has more than 733,000 SMEs. However, almost 53.7 percent of these SMEs use free labor. The average numbers of employees in these SMEs are 11 people. Most of the laborers come from the family among self-employed people (EOMMEX, 2007).

The role of SMEs in Greece

Among European Union (EU) countries, Greece has the highest numbers of SMEs above the EU average. The country had a total of 742, 600 SMEs. SMEs sector employed more than 2.5 million people in 2010. The figure represented 85 percent above the EU estimations. The SMEs sector is crucial for the Greek economy because we can relate the direct importance of the sector in employment and productions of goods and services including value additions.

Greek SMEs are responsible for contributing a vast percentage of value-added services, exceeding other EU countries, and the EU average. Greek had 35.3 percent against 21.8 percent of the EU. In addition, these studies indicate that the sector surpassed large enterprises in value-added provisions. Large enterprises could only provide 14 percent of the value-added against the EU average of 33 percent. Large enterprises managed to create 28 percent of jobs in Greece. These figures suggest that Greek SMEs have a low capacity in the provision of employment opportunities. The sector only employed 2.9 persons on average against the EU standard of 4.2 people (Koufopoluos, 2010).

Tourism is the most important sector in the Greek economy. EU studies indicate that the SME services sector is smaller in Greece (34 percent) than the EU average of 44% in relation to the number of enterprises. This observation extends to SME job creation and value addition in the service sector. However, the Greek SME sector is active compared to their counterparts in other EU countries in terms of trade where Greek SMEs dominate at 42 percent against the EU average of 31 percent.

Between 2003 and 2010, the number of Greek SMEs reduced by 30,000. This trend also reflects the employment pattern in the Greek SME sector. The SME sector also experienced a job reduction of up to 135,000 jobs in a similar period. The same also applies to value-added provisions.

Analysis of the contextual framework of Greek SMEs

Social

The current Greek SMEs approach to a socio-cultural environment takes the wide approach of corporate social responsibility (CSR). This attempts to look at how SMEs are dealing with CSR issues. This implies that there is no doubt SMEs must take the CSR agenda seriously. It tries to establish how these businesses have conducted their affairs in terms of environmental, economic, and social considerations. These issues are finding their way into Europe’s SMEs strategies and core activities.

SMEs and social responsibility need a realistic approach by establishing the existing conditions. We must acknowledge the role and contributions of SMEs in economic, social, and environmental CSR issues. Unlike most corporate, SMEs do not promote these activities as CSR. The challenge lies in how policymakers can formulate ways of incorporating these activities and help SMEs strengthen them for meaningful full CSR.

CSR Europe is using varieties of strategies to ensure SMEs get the necessary support to implement CSR in their strategies. The support will ensure that the business community values the inputs of SMEs in CSR activities. The challenges for SMEs and CSR issues lie in the supply chain with regard to unpaid or underpaid workforces. Like any other large business, the SME sector also has interests in conducting responsible business activities.

CSR Europe assists individual nations through a strategic partnership with the main actors in the SMEs and in the areas of conducting responsible business. CSR Europe also tries to create awareness, train, and encourage, and contribute to further research concerning responsible business practices among SMEs. The main areas of focus for SME’s CSR include the following.

- Creating best business approaches for SMEs in CSR practices.

- Creating awareness and promoting the sector’s best activities.

- CSR Europe can use incentives as ways of encouraging the uptake of CSR activities among SMEs.

- Policymakers can promote mutual cooperation between the SME and mainstream sector.

Most SMEs show that they are already participating in CSR. This is according EC Report that indicates that 50 percent of the SMEs that participated in the survey already had engaged in responsible business practices. There are also exchange programs, encouraging dialogue, and enhancing capacity building so as to support SME’s CSR activities.

For Greek SMEs to adopt, and implement CSR practices are positives step towards conducting a responsible business. In addition, the EU has singled out SMEs to help it “meets its 2010 goal of becoming the most competitive and dynamic, knowledge-based economy in the world, one that is capable of sustaining economic growth and social cohesion”.

Critics argue that the move to include SMEs in CSR activities is crucial and timely for the sector. Industry experts have noted that SMEs are the source of innovation and business drive that provides a nation’s economy a leading advantage. Thus, it is necessary that we understand CSR from specific SME reflections.

Economic

The Greek SMEs also suffered the financial recession of 2008 and the Euro crisis. In 2008, the financial crisis started from the low-security real estate loans in the USA that affected the powerful investment US groups. Some of these investors collapsed. The financial crisis had a domino effect as it spread to other areas of the world and affected all sectors of the economy. Greek SMEs were no exception (The National Observatory for the SMEs, 2008).

Now all financial analysts show a potential recession in the global and European economy the duration of the two years. Already at the EU level, we noticed decreased activities or shrinkage of the most powerful eurozone economies. At first, there appeared the Greek economy experienced a lesser degree of crisis according to various economists. This was because of the comparatively smaller degree of exposure to the international economy, and mainly to the limited exposure of the local banking system to the risky and composite financial products that caused the crisis.

The crisis slowly spread to the whole Greek economy including the SME sector. According to the periodical semester assessments of the European Committee regarding the situation and perspectives of European economies until 2010, the growth of the Greek economy in 2008 slowed down to 3.1 percent against 4 percent in 2007 (The National Observatory for the SMEs, 2008).

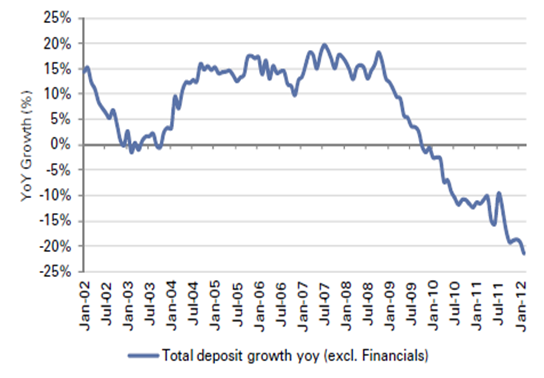

Greek SMEs became vulnerable to the financial crisis due to the increased cost of loans from financial institutions. This had short and long-term consequences. The generally reduced liquidity among banks became the trend in both local and global financial institutions. This situation proved difficult for SMEs to access loan facilities as banks introduced strict and rigid criteria for lending.

At the same time, there was a massive decrease in the level of consumption among consumers due to reduced income because of the loan (a number of employed persons have loans).

During the recession, SMEs experienced slowdowns of demand for the supply of services and the sale of products from other countries. For instance, there were slowdowns in areas such as exports of agricultural and industrial products, the provision of technical and financial services, participation in developmental programs and cooperation networks, the local construction industry, and implementation projects.

Significant management risks are the result of the current climate leading to the gradual decrease of the credit capacity of SMEs since SMEs had reduced capacity to meet their loan obligation. SMEs also undertook initiatives aiming at decreasing operating costs through decreasing the number of personnel. Analysts further argue that the post-euro adoption created a surge in capital flows, which resulted in a sudden stop of flows. This created account deficits resulting in crisis. Therefore, the investment opportunities in the Eurozone declined.

The spread of the global financial crisis affected the performance of Greek enterprises, particularly SMEs. In 2008, there was a noticeable decrease of the economic climate index by 9.5 units under the EU average and the Eurozone average. Likewise, consumers trust decreases, and provisions for the financial situation of households plummeted, increased unemployment, and low budgets to purchase expensive goods during the recession.

Policy environment

Greece has conducted a tax reform for its SMEs sector. This aimed at creating a fair operating tax system and strengthening businesses by decreasing tax factors for enterprises under its law on taxation, and increments of discounts for certain expenses of the social nature. Likewise, the country has improved on its investment law. This was the first time Greece drafted an investment law after consultations between representatives of the productive classes (SMEs and other large corporate). The investment law laid much emphasis on technologies, tourism, promotion of renewable energy sources, transports, and communications. The Greece government created an investment law that is simple, clear, and transparent law for both the SME sector and large corporate.

The investment law has been in use since 2007. Policymakers formulated it to meet the standards of the EU Regional Map for the period up to 2013 and assure high levels of support for all regions of the country with regard to the size of the small enterprise, the region, and the kind of investment. EU report shows that the results of implementing the law was positive and created “competitiveness of businesses, increased investment activities of SMEs up to investments of €19.3 billion, approved investment plans totaling to 4,773 with the approved amount of €10,487 billion, which created 24,941 new jobs directly, and others indirectly (EOMMEX, 2007).

There have been ongoing public and private partnerships in developing the Greek economy. The partnership is a form of cooperation between the government and the private sector that strive at assuring design, financing, construction, maintenance, and or operation of public infrastructure and the provision of services. They promise fast development of infrastructure and the provision of adequate services at low costs.

Greece amended its export policy in order to accommodate SMEs. There are legal regulations of various issues that ensure that all pending issues become part of the modern SMEs export policies. There is also a strategic action plan for the promotion of Greek products abroad with the basic help of the country’s export promotion council. In 2004, Greece reformed its Organization for the Promotion of Exports. This action increased the Greek SME’s presence in more than 55 foreign countries during the 400 promotions.

Greece also has policies on promoting the sector of constructions, structural materials, equipment, and similar services. This also extends to the country’s IT sector for innovative and technological products. The country also has interests in promoting its food and beverage industry abroad. The country adopted specific measures of customs and tax nature in order to facilitate external commerce, and in particular, measures to speed up the process of returning VAT to the enterprises so as to support the SME sector interests abroad. Consequently, Greek SMEs have noted increased trade with foreign partners.

Technological

The level of innovation among SMEs reached 12.8 percent in the new enterprises during the year 2007. Some SMEs considered that the products and services offered in 2007 were new to the market. This makes Greece occupies the middle categories in Europe with a regard to innovation. Most SMEs, at 64 percent, do not exhibit any degree of IT innovation. However, this number is experiencing a decline since 2005.

During 2008, the Observatory of Information Society of Greece provided its research concerning the Society of Information so as to measure the basic and complementary indicators of the Greece initiative for action on IT innovation. The study covered the entire Greece and analyses the results of the role of new technologies in the country. The research consisted of six different mini studies that covered households, enterprises, E-Government, electronic learning, electronic health, and the cost of interconnection. In SMEs, the use of personal computers in enterprises employing between one to nine people increased in 2007 to 57 percent. Still, there is a steady increase to date as this has become the trend (Cohen and Kallirroi, 2006).

Greece SMEs have also adopted e-commerce to facilitate their businesses. They have purchase orders at 9 percent during the year 2007. In addition, a number of SMEs have an Internet connection (81 percent). This is a major achievement since the year 2005. SMEs transactions via the Internet with the public service increased to 10 percent in the year 2007 (Arapoglou and Palaskas, 2005).

Challenges and Opportunities for Greek SMEs

Currently, Greek SMEs have the euro crisis to manage. In addition, the global financial crisis of 2008 and the occurring financial situation tend to differentiate the priorities of small and medium enterprises. These forces have created tough economic conditions for SMEs as most SMEs now have to fight for their survival.

However, Greek SMEs are not a disadvantaged lot given that they operate mainly at home and can easily be flexible and adjustable in the changing conditions so as to get close to the needs of the customer. The challenges and opportunities in the sector shall provide valuable information for all the future indicators and needs for adjustments that the SMEs should seek in order to be sustainable, and enhance their competitiveness.

Adjustment is mandatory so as to counteract the negative consequences of future financial crises. In this regard, the sector should rely on measures taken by the country in order to face the crisis and support SMEs. The Greek government responded to the crisis by announcing a series of measures to support the economy. Therefore, SMEs should be aware of the developments and intent to exploit all the measures the country intends to implement.

Greek SMEs need adjustment to enable them to fit in the global markets. The reduced consumption power of the Greek consumers and the small size of the Greek market may partially balance by the promotion of Greek products in the global arena. Today, most SMEs seek involvement in the global markets as a crucial factor for their survival, the opening of new jobs, and their growth in numbers.

Greek SMEs have opportunities of ensuring continuous adjustment and use of methods and rules of emerging technologies and information systems. The idea to cut costs of operation due to the prevailing financial conditions, together with the advancements in business practices can provide the best incentives for the SMEs to incorporate IT into their operations. SMEs must keep track of emerging technological innovations so as to upgrade their systems and exploit the opportunities of new technologies.

Greek SMEs also have massive opportunities of exploiting research and innovation. The SME sector is likely to experience competition and other business challenges. In this regard, they have opportunities of developing new products and services through investing in research, technological development, and innovation (Drucker, 1985).

Greece also has a financial plan of NSFR designed for SMEs. SMEs should make frequent contact with bodies of business supports so as to stay informed with the current information regarding financing schemes and the occurring opportunities.

The Greek SMEs can also benefit from the creation of modern entrepreneurial culture. The global financial crisis and the recent euro crisis have made imminent the need to cultivate new business culture, and the adoption of a new model for sustainable business development. The new model should incorporate requirements regarding quality, extroversion, development of synergies and networks, social responsibility, and incorporation of new Knowledge among other crucial factors for the success of the SMEs (Baumol, 1993).

Support for Greek SMEs

Greek SMEs can receive support in the sectors of manufacture and tourism. The government can approve viable proposals that have the capacity to create new jobs and result in sustainable development in the SME sector. Such supports need both financial and policies in place to enhance their effectiveness.

The areas of commerce and services also need extended support from both the government and private partnerships. Greece has been experiencing increased entrepreneurial interests. This sector is crucial for job creation. The National Observatory for SMEs indicates that the area can create up to 36,651 new jobs.

SMEs can also benefit through programs of community initiatives and CSR activities. These programs can form the basis for SMEs to conduct socially responsible businesses. Recent studies indicate that some SMEs already have CSR activities. However, SMEs do not refer to these programs as CSR. Still, SMEs also lack the publicities that large organizations enjoy.

There are also sections of SMEs that claim they lack information to facilitate their business initiatives. They also cite lack of time due to the time-consuming nature of the application and prolonged application procedures. Some of the most popular initiatives among SMEs investors include supporting SMEs of the tertiary sector (commerce and services), supporting young entrepreneurs, supporting women entrepreneurs, and supporting of manufacture and tourist enterprises. There are also supports in areas of networking, technological promotion, and e-commerce that SMEs need.

Literature Review of Organizational Culture

Organizational culture in management and study of organizations focuses on attitude, values, beliefs, and varied challenges of an organization (Kizner, 1973). In this regard, we can define organizational culture as “the specific collection of values and norms that are shared by people and groups in an organization and that control the way they interact with each other and with stakeholders outside the organization” (Kotter, 1992).

In this context, organizational values also count. Values show the beliefs and ideas in an organization. Values must reflect what goals are worth pursuing with appropriate behavior standards members of an organization must adopt in their attempts to pursue these goals. Then we also have norms of an organization. Norms related to appropriate behavior standards provided by organizational guidelines or expectations. Norms are also responsible for controlling the behavior of members of an organization (Black, 2003).

Organizational culture is widespread in organizations as an attempt to comprehend human systems in organizations. Every element of organizational culture reflects crucial environmental issues affecting the system and subsystems. A number of factors such as globalization, competition, alliances, merger and acquisitions, and diverse workforce have enhanced the need for organizational culture (George and Zahra, 2002). Organizational culture has formed a fundamental part of organizational development (O’Donovan, 2006). We can look at how Greek SMEs have formed different organizational cultures using some of the classifications provided by Charles Hardy, Deal and Kennedy, and Geert Hofstede.

Task and role culture exist among the Greek SMEs. SMEs demonstrate clear delegation of authority and duties among the management and employees. However, this is not consistent in where the source of labor tends to be from family members, or where the labor is free. Still, these SMEs also reflect task culture where they form teams to solve certain issues facing them. This is how Greek SMEs have managed to hold many global exhibitions outside their home country. Task culture is prevalent in most areas of IT, construction, tourism, and other specialized services. Task and role culture enable Greek SMEs to enhance their business and provide new solutions to markets they serve (Hofstede, 1991).

The power structure and culture exist in Greek SMEs just like any other organization. However, most SMEs belong to the family. Consequently, the management and power structure of these businesses relies heavily on family members. Any decision to hire employees depends on the relation. This implies that the employee may be a family member or friend (Oza, 2010). There is little regard for professionalism consideration.

Such decisions affect SMEs significantly. In most cases, SMEs reflect the values and beliefs of their owners, which may drive them to growth or failure. However, conflict can happen if the business owner and employees do not share the same sets of values regarding the management of the business. Issues of power culture and structure affect businesses in positive or negative manners depending on how managements handle them (Cummings and Worley, 2005).

Uncertainty and risk due to global and euro crises have changed the way SMEs do business and their relationships with business partners such as financial institutions. Greek SMEs ‘ consideration for risks and uncertainty depends on the nature of the investment. At the same time, managing risks among SMEs has no single prescribed structure. This is due to different prevailing economic factors and the structural composition of SMEs. The crises led lending institutions to be more strict than before when dealing with SMEs.

Some factors like the financial crises have forced SMEs to attach importance to both the past and future financial situations. Short-term orientations mainly involve quick purchases and profits. SMEs have withdrawn from making long-term investments due to the unpredictable euro crisis.

The process culture is rampant in some SMEs with little or no feedback. This mainly affects the goal and the outcome. As mentioned above, process culture delays operations of the SMEs due to bureaucracies of their support partners such as the government. However, this process culture has created some of the most successful SMEs in the construction and IT sectors in Greece.

Individualism “refers to the extent to which people are expected to stand up for themselves, or alternatively act predominantly as a member of the group or organization” (Hofstede, 1991). Hofstede’s study puts Greece’s individualism score at 18.6 percent.

This means was evident during the euro crisis where most SMEs could not support themselves but turned to seek assistance from the government. The duty to serve the group is prevalent in most SMEs. This leads SMEs to form a partnership and organize trade exhibitions collectively. Still, the culture of collectivism is also noticeable in Greek SMEs ‘ participation abroad.

The culture of a person is rare in Greek SMEs. Most business owners do not believe that they are superior to the organization. This culture has enhanced cooperation and trade partnership among most Greek SMEs. They tend to pursue sector goals collectively. This is also important because each person brings various expertise and clientele to the organization, especially where professionals make decisions (Hall, 2010).

Conclusions and Further Research

Greek SMEs’ policies have the design of favoring social, environmental, and economic objectives that aim at ensuring the growth of the sector. The sector tends to adopt CSR into its business activities for responsible business operations. Greek SMEs also suffered during the global and euro financial crises. Consequently, some of these SMEs closed businesses as others only engaged in short-term transactions with the immediate outcome. However, most of these SMEs mainly operate at home; thus, they can easily adjust to their customers’ needs faster than multinational corporations.

SMEs’ policies mainly focus on promoting economic growth and improving the sector’s competitiveness in the global markets. Policies aimed at creating an enabling environment so as to tackle the sector challenges such as economic, social, and environmental. These policies also encourage and provide incentives for SMEs to implement them (Stoykov, 1995).

Greek SMEs require an integrated, balanced, and coherent method so as to maximize opportunities and mitigate the future crisis. This sector is responsible for provisions of a high number of jobs, innovation, and improving the country’s GDP.

Greek SMEs experience problems accessing financing due to the prevailing economic conditions. This is an area the government must address to enhance the growth of SMEs. SMEs should also have the ability to integrate know-how and develop high-value-added products and services. This will broaden the sector specialization and improve sharing of knowledge-based products and services. These SMEs must also integrate modern organizational and operational forms and abandon the culture of family-based ownership style. Instead, the focus should be on hiring professionals.

References

Arapoglou, V. and Palaskas, T. (2005). Regional innovation systems in the global non-internationalisation of greek smes. MPRA Paper 33570 (20), 1-16.

Baumol, W. (1993). Formal Entrepreneurship Theory in Economics: Existence and Bounds. Journal of Business Venturing, 8(3), 197-210.

Black, R. (2003). Organisational Culture: Creating the Influence Needed for Strategic Success. London UK: Dissertation.Com Publisher.

Cohen, S. and Kallirroi, G. (2006). e-Commerce Investments from an SME perspective: Costs, Benefits and Processes. The Electronic Journal Information Systems Evaluation, 9(2), 45-56.

Cummings, T.G. and Worley, C.G. (2005). Organization Development and Change (8th ed.). Thomson South-Western: South-Western College Publishing.

Drucker, P. (1985). Innovation and Entrepreneurship. New York: Harper& Row.

EOMMEX. (2007). Hellenic Organization of Small and Medium sized Enterprises. National Observatory for SMEs, 1, 1-78.

European Union. (2010). SMEs and Labour Market in Greece,chances and methods of the trade co-operation with Greek companies. EU Journal of Economic, 1(7), 1-21.

George, J. and Zahra, S. (2002). Culture and its Consequences for Entrepreneurship. Entrepreneurship Theory and Practice, 26, 1-6.

Hall, C. (2010). How SMEs can remain competitive in the face of crises. APEC SME, 10-48.

Hofstede, G. (1991). Cultures and Organizations: Software of the Mind. London: McGrawHill.

Kizner, I. (1973). Competition and Entrepreneurship. Chicago: The University of Chicago Press.

Kotter, J. (1992). Corporate Culture and Performance. Rockland, ME: Free Press.

Koufopoluos, D. (2010). Strategic Planning Approaches in Greek SMEs. Working Paper, 1, 1-19.

O’Donovan, G. (2006). The Corporate Culture Handbook: How to Plan, Implement and Measure a Successful Culture Change Programme. Dublin: The Liffey Press.

Oza, R. (2010). HR Challenges in SMEs. People Matter, 13, 4-6.

Stoykov, L. (1995). Corporate culture and communication. Sofia: Stopanstvo.

The National Observatory for the SMEs. (2008). Current Situation and Perspectives of the Greek SMEs. Annual Issue, 1, 1-93.

Appendix