Introduction

The United Arab Emirates is one of the leading information and communication technology (ICT) markets in the Middle East. According to Krouse and Jongsur (2003), the country has one of the most developed telecommunication sectors in the region, with a high level of telephone, mobile, and broadband penetration in the entire region. Although the fixed-line and mobile networks are dominated by two firms, the industry has witnessed the emergence of new market entrants in the recent past, a sign that the country is opening up to new players. The competition in the telecommunication market is very healthy and it promotes the delivery of quality services to customers at very reasonable prices. The growth of the local economy and the strong purchasing power are some of the strong indicators that the telecommunication market in the country is destined to grow further than the current status. However, there is always the fear of market failure that a firm entering this market must be keen to avoid. According to Alexander and Feinberg (2004), making a successful entry into the Emirati telecommunication market requires massive investment. The current players have set a very high standard in terms of quality-of-service delivery and new entrants must meet the set standards to attract clients. This kind of massive investment must yield results. It is, therefore, important for a firm to understand the local policies and any factors that may lead to market failure. In this paper, the researcher will focus on how a firm can avoid failure in Emirati’s telecommunication market.

The current status of competition in the telecommunication market

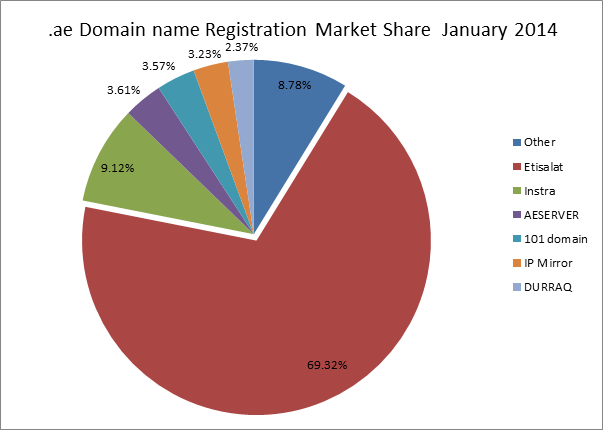

According to Ferraro (2010), the telecommunication market in the United Arab Emirates has experienced massive growth over the past decade following a government policy in 2006 that liberalized the market. The Telecommunication Regulatory Authority is the body mandated by the law to regulate this market by developing policies that have to be observed by all the players in the industry. The body has been working closely with government organs and private players to promote a level ground for firms in the industry as a way of promoting competition in the local market. Since its foundation in 1976, Emirates Telecommunication Corporation, commonly known as Etisalat, has remained a dominant player in this industry (Bremmer, 2010). It was the only provider of telecommunication services in the country till 2006 when a new firm, du, was established. Since then, other new firms have emerged in this market to take advantage of the growing demand for telephone and internet services. The figure below shows the current market share held by various companies in the country.

As shown in the figure above, Etisalat is still the leading provider of telecommunication services in the country. This government-owned firm has experienced massive growth over the years, especially when it was operating as a monopoly in the country. Currently, it has about 70% of the total market share in this industry. This leaves other firms to share the remaining 30% of the market share. As a firm that is either operating in the country or planning to enter this market, it is important to understand factors that have enabled this firm to remain dominant in the market. If this firm has unfair business practices that give it an undue advantage over its market rivals, then that may be a recipe for a failure of its market rivals. With its market dominance, it can use such unfair market practices to edge out its market rivals.

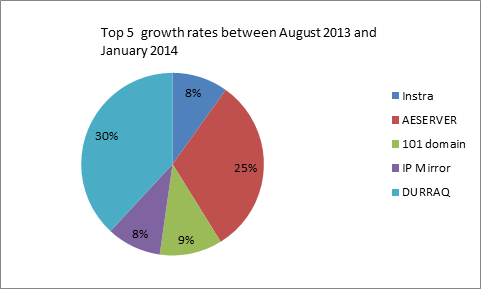

When analyzing the status of market competition in this country, it is important to evaluate the growth rates of firms as a way of determining their sustainability in the market. It will be of interest to determine how smaller firms are managing to grow in the face of stiff competition and market dominance by Etisalat. The growth rate will be an indicator of the ability of new smaller firms to penetrate the market and achieve success in an industry that many consider lucrative but very competitive. The figure below shows the growth rate of firms that were measured from August 2013 to January 2014.

The statistics shown in the figure above are reassuring. It is a clear indication that achieving sustainable growth in Emirati’s telecommunication market is a reality. For instance, Instra achieved 30% growth while that of AESERVER was 25%. These are small firms that have less than 10% of the market shares in this industry. If they can achieve this rate of growth, then it is clear that even with the stiff competition in the market, a firm can still achieve success in this country.

Growth of the Emirati telecommunication market

According to Azhar (2003), when evaluating a market, one of the most important factors that one has to consider is its growth over a given period of time. A market that is recording impressive growth rates is promising to the existing and new firms because it offers room for expansion of the market share. However, when the growth has stagnated, then that can be construed as a warning, especially to new firms that are planning to enter the market, that achieving growth may require extraordinary measures that can outsmart the strategies of the dominant players. One was of determining market growth is to evaluate rates of expenditure in a given industry over a given period. Increased rates of expenditure may mean that the existing customers have increased the amount of money they are spending on buying products from a given market due to its increased relevance to them or increased income. It may also mean that the local population has been on the rise, pushing up the demand for the product offered by the particular industry. Irrespective of the cause, any increase in the expenditure rates in the market is a clear indication of the growth of the industry. The figure below shows the growth of consumer expenditure rates in the telecommunication market in three countries.

Compared to the neighboring countries, the expenditure on the telecommunication market has been on an upward trend since 2009. It has outmatched that of Israel and Qatar, making it the most attractive telecommunication market in the region. This growth rate is projected to continue till 2020. The projection shows that there is room for expansion among the firms operating in the country. With effective strategies in the liberalized market, achieving success is a possibility.

The Emirati handset market

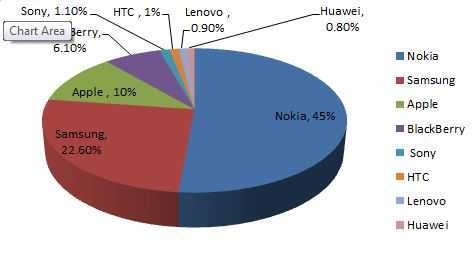

According to Melamid (2007), when reviewing the telecommunication market, it is important to look at the handset market because it’s increasing popularity in the modern society. Mobile phones have become a basic necessity for many people across the world. It is currently the most reliable way of communicating with loved ones irrespective of their geographic location. The voice call data providers heavily rely on the handsets as the device that their clients use to access their services. The providers of internet services also rely on the phones, iPads, iPhones, personal computers and other related devices as a means through which their customers can get their services. One way of determining the growth of the telecommunication market is by reviewing the development of the handset market. The figure below shows some of the leading brands of mobile handsets in the country.

As shown in the figure above, Nokia, Samsung, and Apple are the leading brands of handsets used in the telecommunication industry. According to Salma (2010), Nokia was once the most trusted and very popular brand in the market. However, Samsung and Apple have been gaining popularity in the market eating into the market share of Nokia. When analyzing the handset market in the country, the main interest is to look at the number of brands that are currently in the local industry. Other than the top 3 brands, there are other new brands such as Blackberry, Sony, Huawei, Lenovo, and HTC. This is a clear indication that the market is very attractive. This is further proof that the Emirati telecommunication market is very attractive.

Embracing the concept of sustainable development

According to Janka (2013), one of the main reasons why firms have failed to achieve success in the market is their lack of focus to sustainable development. In many cases, firms always concentrate on how to achieve economic success, forgetting that there are two other important pillars to sustainability in the market. Long term success in the market cannot be realized if the three pillars to sustainable development are ignored. The figure below shows the three pillars of sustainable development that a firm in the Emirati telecommunication market should embrace

The environmental pillar

The primary pillar of sustainable development is that of the environment. According to Touré (2012), this is the most ignored pillar despite its relevance. Many firms in the telecommunication sector always believe that their operational activities do not affect the environment as much as the manufacturing firms do. As such, they believe that they should not be held responsible for the degradation of the environment. However, Herb (2009) warns that this is a fallacy that these firms should avoid because the industry, just like the manufacturing firms, is responsible for environmental degradation. All the internet and voice data providers rely on mobile handsets such as phones and personal computers as the gadgets used by their customers. Without these gadgets, there is no way they can deliver their products to the customers. Mobile phones and personal computers have a devastating impact on the environment when it comes to their disposal. For this reason, they should be responsible in the fight to protect the environment.

Firms have come to appreciate the power of corporate social responsibility that focuses on the environment. As Stovall (2008) notes, many people would always ignore the constant advertisements on mass or social media. Some of them would annoy the target audience such as sending unsolicited messages to people. However, people cannot ignore initiatives taken by a firm to protect the environment. Coming up with and implementing policies meant to protect the environment is very critical in achieving sustainable development. In most of cases, main media houses would cover such events, giving a firm a positive image in the market. Such activities will convince the target market that the firm is not only focused on earning profits, but also protecting the environment for the future generation.

The social pillar

The social pillar is another important factor that a firm cannot ignore if it is planning to achieve sustainable success in the market. Luthans, Doh and Hodgetts (2012) say that many firms have failed due to their inability to give proper focus to the social pillar of the development. The social pillar is the community within which a firm operates. It includes the shareholders, top managers, junior employees, customers, the community within which the firm operates, and the government. Each of these stakeholders has a role to play in ensuring that a firm achieves success. However, some of their interests may be conflicting. For instance, shareholders’ interest is to earn more profits. The top managers’ interest is to see the firm growing to become a major regional or international corporation. Junior employees need better pay and good working environments. The government needs regular taxation and ethical business practices from the firm. Customers need superior products offered at considerably low prices. The community needs direct participation of the firm in local projects meant to uplift their living standards. The top management of a firm will need to find ways of balancing these conflicting interests without overemphasizing on the interests of any stakeholder at the expense of others.

The economic pillar

The economic pillar is always the focus of many firms. It is as important as the other two pillars of sustainability when it comes to avoiding market failure. A firm should come up with policies that will improve its efficiency in the market. The strategies should lower the expenses and increase profits of the products delivered to the market.

Role and scope of government intervention to tackle market failure

According to Kouzes and Posner (2012), the government has a major role to play in tackling the problem of market failure. As stated in the discussion above, a firm indeed has primary responsibility in ensuring that it avoids market failure by embracing strategies that can assure it of success. However, it is the responsibility of the government to create an enabling environment for the players in this industry to achieve success. First, we need to determine whether or not government interventions are necessary. According to Schneider and Enste (2002), government is a primary player when it comes to tackling the problem of market failure. Policies developed by the government define the nature of the relationship between firms and their customers. The policies also define how firms should relate amongst themselves. The goal of the intervention should be to eliminate obstacles that may limit fair environment for competition. All the players in the telecommunication industry should be offered a perfectly competitive environment where their success rates solely depend on their ability to meet customer needs and offer their products most efficiently. The government has a major role to play as a policy marker in the country. The government should come up with feasible options of promoting a sustainable telecommunication market. The following policy options may be appropriate when defining how the government should intervene.

Elimination of unfair market practices

The Telecommunication Regulatory Authority has developed a number of policies meant to promote fairness in the market for all the operators. For instance, there is a policy that prohibits the merger of the top industry players as a way of promoting competition in the local market. When dominant firms merge, they end up killing the existing competition. The larger firms can easily embrace practices meant to force other firms out of the market. Some of the leading firms in the telecommunication market are owned by the government. However, they are not receiving special treatment over other firms that are owned privately. This has also promoted a fair competitive environment.

Engaging in infrastructural development

The telecommunication market must be supported by adequate infrastructure to ensure that it achieves sustainable development. According to Lunt and Livingstone (2012), the government of the United Arab Emirates has played a major role in the infrastructural development in the telecommunication market. It has offered grants to firms that need to expand their infrastructure such as Etisalat. In some cases, it has invested directly into projects that are meant to improve telecommunication infrastructure.

Developing policies to attract new investors

According to Lerner (2009), the best way through which a government can tackle market failure is to promote competition among the local players. Competition forces firms to be creative in their product delivery. Although helping the players financially, especially during times of economic instability, may be important, the government should find ways of encouraging new players to enter the market as a way of fueling healthy market competition. The government liberalized this industry in 2006, and this has encouraged other firms to enter this market.

Scope of the intervention

It is important to define the scope of government intervention. According to Browaeys and Price (2008), the government should limit itself to being the regulator and protector of all the firms in this market. Any direct attempts to develop policies that may favor one firm at the expense of others should be avoided. Its intervention should majorly focus on the protection of customers, protection of the state, and protection of all other players from unfair business practices.

Conclusion and Policy Recommendations

The Emirati telecommunication market is one of the most attractive ones in the entire region. The evaluation of the market done in the section above is the first step towards avoiding market failure in the country. It is now clear that the telecommunication market is experiencing positive growth. The evaluation has also revealed that the new entrants also can expand their market share despite the dominance by a few firms such as Etisalat. Individual firms have a major responsibility in fighting market failure. The telecommunication market in the country was liberalized and firms can now compete favorably against one another, a sign of market success. The government has made a number of interventions to promote this fair business environment for all firms. The following policy recommendations should be taken into consideration.

The government should enact policies that would help it to control price floors and price ceilings. Some firms may lower their product prices solely to drive away from the competition. This should be prohibited.

Government should consider taking over the responsibility of infrastructure development. This way, all the players will have the same platform to deliver their products.

References

Alexander, D., & Feinberg, R. (2004). Entry in Local Telecommunication Markets. Review of Industrial Organization, 25(2), 107-127.

Azhar, M. (2003). Economic Co-operation between India and the United Arab Emirates. Middle Eastern Studies, 39(3), 127-143.

Bremmer, I. (2010). The end of the free market: Who wins the war between states and corporations. New York: Portfolio.

Browaeys, M., & Price, R. (2008). Understanding cross-cultural management. Harlow: Financial Times/Prentice Hall.

Ferraro, G. (2010). The cultural dimension of international business. Upper Saddle River, NJ: Pearson.

Frauke, H. (2015). The United Arab Emirates: Statehood and Nation-Building in a Traditional Society. Middle East Journal, 59(3), 357-375.

Herb, M. (2009). A Nation of Bureaucrats: Political Participation and Economic Diversification in Kuwait and the United Arab Emirates. International Journal of Middle East Studies, 41(3), 375-395.

Janka, J. (2013).The Technology, Media and Telecommunications Review. Law Business Research, 3(1), 358-383.

Kouzes, J., & Posner, B. (2012). The leadership challenge: How to make extraordinary things happen in organizations. San Francisco: Jossey-Bass.

Kovacs, J. (2014). Economics and legal analysis of the United Arab Emirates’ telecommunication market. Budapest: Central European University.

Krouse, C., & Jongsur, P. (2003). Competition in the Interexchange Telecommunication Market. The Journal of Law & Economics, 46(1), 85-101.

Lerner, J. (2009). Boulevard of broken dreams: Why public efforts to boost entrepreneurship and venture capital have failed, and what to do about it. Princeton: Princeton University Press.

Lunt, P., & Livingstone, M. (2012). Media regulation: Governance and the interest of citizens and consumers. Los Angeles: Sage.

Luthans, F., Doh, J., & Hodgetts, R. (2012). International management: Culture, strategy, and behavior. New York: McGraw-Hill.

Melamid, A. (2007). The United Arab Emirates. Geographical Review, 87(4), 542-545.

Nuechterlein, J., & Weiser, P. (2015). Digital crossroads: Telecommunications law and policy in the internet age. Cambridge: The MIT Press.

Salma, S. (2010). The Architecture of the United Arab Emirates. Review of Middle East Studies, 44(1 (8), 78-80.

Schneider, F., & Enste, D. (2002). The shadow economy: An international survey. Cambridge: Cambridge Univ. Press.

Stovall, H. (2008). Recent Revisions to Commercial Agency Law in the United Arab Emirates. Arab Law Quarterly, 22(3), 307-330.

Suhaimi, A. (2008). The Influence of Classical Interpretation on the Law of Guarantees in the United Arab Emirates. Arab Law Quarterly, 22(4), 335-358.

Touré, H. (2012). Regulating broadband prices: regulatory & market environment. Broadband Series, 4(1), 1-50.