Introduction

Theoretical framework

The purpose of this chapter is to provide evaluators with background information on this paper’s research proposal, therefore establishing a ‘framework’ by means of which it is possible to understand main aims of this study (Wilkinson, 1991, p.96).

Recently, international financial markets became tense after news emerging that US Dollar was at its rock-bottom against major international currencies, especially the Euro and the Japanese Yen. On 23 April, 2008, USD (US$) plummeted to record lows of 1.60 with respect to Euro (€) (Castle and Kanter, 2008), triggering panic buttons all across from Wall Street to London; investment companies to tourist bureaus – the Dollar, as speculation became rife, was now expected to continue its historic fall forever (Castle and Kanter, 2008); like a dethroned King, the Dollar, which is still considered the de-facto currency of international trade, it appeared that its long days of reign are now over.

At its record lows, the Euro quoted just below 1.602 against the Dollar before settling down for a modest 1.596 in Wall Street (Castle and Kanter, 2008); the main reason for this decline was attributed to rising crude prices in the international market. International prices were at its lowest at $119.37 per barrel (since then, it has even breached the $135 mark in recent times). Since the United States is a net importer of crude oil, spending more US currency for the import of oil always results in its decline against major international currencies.

The purpose of this research proposal is to evaluate the ‘real’ impact of the Dollar’s woes in international currency trading, and assess its long-term influence on major world markets, focussing on the European economy which is recovering from almost one decade of stagnation and inflation. The main question and concern on everyone’s mind is will the Dollar continue its free fall to such an extent that it no longer enjoys the current prestige it does? Of course, at the moment, it would seem that the Dollar is still the preferred currency for foreign exchange reserves; even ahead of the Euro which seems well placed to replace Dollar as the preferred currency for international trade (Reuters, 2007). Alan Greenspan, former Federal Reserve Chairman also feels similarly (Reuters, 2007).

The purpose of this research proposal is to qualitatively evaluate validity of such concerns, as applicable to present and future scenario. By means of substantial secondary evidence, it will be shown here that such concerns are only a market over-reaction and lack real substance. On the contrary, it will be shown by secondary evidence that the Dollar is already on its recovery path against international currencies, and experts project it to rise further against Euro to 1.25 from its present value of 1.5731 on 9 June, 2008 (Coinmill, 2008).

Rumours of the Dollar being dethroned from its privileged status won’t translate into reality anytime soon. Also, a strong Dollar will have a positive impact on the European economy; although concerns of inflation and unemployment may not disappear.

Problem statement

Since the Dollar has lost nearly 15% of its value against the Euro in last 12 months (Castle and Kanter, 2008), there is a need to understand its future implications for international trade and currency markets. The problem concern to be tackled in this proposal is: ‘What will be the future of US Dollar (US$) against Euro (€) and what does it hold for Europe’s economy in the long run, specifically between 2009 and 2012?’

Significance/Purpose of study

This topic was chosen because of its positive importance in the world of finance and economics. This is an important subject not just for experts, but also people in several different arenas: forex merchants, hoteliers, travel agencies, exporters and almost all lay individuals who need to deal with currency fluctuation on a day-to-day basis.

The Dollar has traditionally been seen as a symbol of stability for global business; whether or not this role/function will be fulfilled in the longer run could change the entire trajectory of future business plans. This subject serves the purpose of people from many different background, and should be seen as a significant area of research.

The implications of study in this research proposal cover a wide range of future action plans on the subject of currency markets. By debunking the rumour-mill myth that Dollar will be upstaged in the immediate future by Euro or other major currencies, this study makes a ‘bold, emphatic statement’: it will address the present and future needs of a wide variety of stakeholders. Here is a snapshot preview of what this study holds for different purposes.

- Impact on theoretical framework: This research will offer plenty of supportive evidence to debunk the myth that Dollar is collapsing with respect to other currencies. This bolsters the basic premise of the theoretical framework in more ways than one.

- Rationale for study: As a student of Finance, my aim in future is to gain internship in one of the major companies dealing with currency markets. A full-scale dissertation would enable me to achieve these personal goals, and shape my career in the right direction.

- Future interventions: Once enough ground on the topic is been created, it would be possible to evaluate primary research on the main problem statement (see chapter on conclusion and recommendations for more on this).

Research hypothesis

Hypothesis of research study presents a ‘declarative statement’ for the relationship between any two parameters of study (Kerlinger, 1979; Krathwohl, 1988). The main reason for choosing hypothesis framework in any new research subject is to streamline and validate conclusions made for study (Armstrong, 1974).

In this research paper, since the objective of our study is to placate any concerns on Dollar’s purported decline against Euro in the future, it would be proper to choose a null hypothesis to tackle this issue. The null hypothesis comes into play when there is no direct or relevant association between main parameters of study (Armstrong, 1974). In the interest of academia, the hypothesis should provide a complete visualization of the main research target, so that future research can be undertaken with ‘theoretical validity’ on one’s side (Kerlinger, 1979). Any questions and concerns deduced from null hypothesis will enable a direct, and focused research on different parameters of study.

For our theoretical framework, the null hypothesis to be validated by the end of study is,

- Hyp 1: ‘There isn’t enough significant correlation between present exchange rates of Dollar with the Euro, and future estimable values’.

- Hyp 2: ‘European economies will not benefit much due to Dollar rise’.

Literature Review

Data collection and Search strategy

In order to validate the findings of this proposal, current news articles were selected. Since, different points in our topic depend on latest news items, it was irrelevant to choose old data sources. An outline of Primary Research (not undertaken for this proposal) also has been mentioned in this chapter.

Currency data is subject to continuous change due to factors like different business environment, market volatility and international commodity prices (crude oil, gold, silver etc). The following website sources have been found highly reliable for present analysis of literature pertaining to currency market evaluation:

- Yahoo Business: One of the best websites to find out the latest in terms of currency markets all over the world. Information is up-to-date by the hour and highly relevant for any likely research changes in future.

- CNBC: The world’s most prolific business news channel has an online edition which gives up-to-date information on a lot of ‘scenarios’ concerning currency markets.

- Forecasts: Since the research aim has a lot to do with currency predictions in the long run, this website provides an excellent interface to achieve realistic prediction values. Most links have up-to-date information on latest financial information concerning currency markets.

- Bloomberg: Excellent resource destination for understanding case studies and their implications on currency markets. Most articles are latest and relevant to fluctuations in day-to-day currency exchange rates.

This proposal is also based on several minor sources mentioned in References.

In order to search for relevant information on the Web, Google search engine was used to achieve one-stop solution for all articles mentioned in this literature review. Since the primary aim of the proposal was to achieve results for null hypothesis I and II (refer previous chapter), it could have only been done by utilising appropriate search engine parameters. Since, our proposal aims to prove that the Dollar’s temporary decline against Euro wouldn’t be a permanent fixture, and that, there is enough scope for recovery; the Boolean parameters used were: “Dollar Euro recovery”, “Dollar Euro future”, “Dollar impact Europe” and simply, “Dollar Euro”.

The last search parameter proved to be a lucky draw because it opened hundreds of articles related to present currency crisis, and thus, automatically led to useful links as mentioned in this section. Indeed, a cursory glance into relevant articles generated enough data for compiling this review.

Review of data

Much of the apprehension that the Dollar is going to continue its slide against Euro and other major currencies, can be allayed by studies of current US Fiscal policies and long-term economic scenario analysis. As early as 12 Feb, 2008 when most analysts wrote off Dollar due to its declining trends in international currency markets, Jack Cooks of World Currency Options and President of Black Swan Capital, a Forex firm, predicted that the ‘anti-dollar trend might become a thing of the past’ (Cooks, 2008). He labels any rumour to the contrary as the ‘biggest red herring of this century’ (Cooks, 2008).

Cooks gives two main reasons why Dollar would eventually recover (which will be discussed again in this review:

- Economic problems in the heart of Europe; an ‘imminent slowdown’ in Europe would cause problems to its main currency unit (Cooks, 2008).

- Euro is technically ‘weaker’ than Dollar – the main reason being most international currency traders still trust Dollar for their daily transactions (Cooks, 2008).

Cook’s expert predictions have the potential to become truer as we move further ahead into capturing real market picture after June. Much of dollar’s declining value was tagged with a corresponding increase in international crude oil prices (Amberger, 2008). It is well-known that the United States is a net importer of crude; any exhorbitant rise in oil prices has a negative impact on Dollar (Chauvancy, 2007). A considerable part of US crude supplies nowadays, comes from North Sea region in Europe which means the oil is drilled in Euros, and sold in US Dollars – a direct fall-out of which is an appreciation of the US currency (Amberger, 2008).

According to currency predictions made on and around the 4th of May, dollar was expected to fall to $1.52 within the next few daysi (it is currently at 1.56, not far, but at least, strengthening). International crude prices, after touching a high of $135 per barrel, have now declined to $132/barrel and in coming few months, it’s expected to stablise even further (‘Sydney Morning Herald’, 2008).

Apart from international crude prices, another factor which would impact dollar’s reversal against the Euro in coming few days – according to European Central Bank president Jean-Claude Trichet, European interest rates are set to rise in July (Reuters, June 5, 2008). This is because the EU economy is currently, at its slowest phase and in order to compete further, it will have to match strength of US financial markets. Currently, US interest rates are at 1% against EU’s 3% (Reuters, June 5, 2008). By raising them further, the EU will offset any major development on currency trading in coming days ahead.

The impact of Trichet’s statement could be felt on international currency markets the same day, as dollar surged ahead against the Euro at 1.53 from 1.60 (Arbel, 5 June, 2008). In order to further confirm US dollar rally against Euro in coming future, it’s worth taking a look into what ‘speculators’ are saying about present trend. The moment Dollar fell to 1.53 against the Euro, it led to a ‘maturity in speculation levels’ of the currency in international trading.

The Speculative Sentiment Index (SSI) for Dollar, currently, stands at parity with Euro at 1.00 which is a huge improvement over previous week’s value of 1.29 (Kicklighter and Sousa, 5 June, 2008). This is almost 1.95% change from previous speculative index. Since market speculators are in the thick of daily activities concerning currency trading, their predictions regarding the present fortunes of Dollar versus Euro offer plenty of real evidence to the ongoing trend.

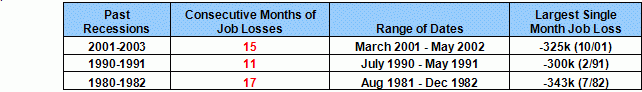

According to Terri Balkas, a currency strategy analysis at Yahoo Finance, another evidence in favour of further rise of Dollar against international currencies, is due to a drop in US non-farm payrolls by around 100K (Balkas, 5 June, 2008). The US non-farm payrolls is one of the most important parameters for further valuation of the dollar, because it’s an ‘indicator’ of recession in the long-term. Consider the table below. An indication that ‘past recessions’ saw almost 300K drop in non-farm payroll values, compared with 100K as of 2008, would go to show that the US economy has finally ‘escaped a recession’ and can look forward to a growth trajectory in coming days ahead (Balkas, 5 June, 2008).

Against this context of interest rates’ impact and non-farm payroll values, it is important to understand the basic concerns of US Dollar policy for coming few months. According to Hank Paulson, the Treasury secretary of Fed Reserve, as soon as Europe announced its decision to raise interest rates, he ensured a new ‘consistent’ policy for future Dollar trends (Economist, 5 June, 2008); the main theme of which is to prevent a ‘dollar route’ or further weakening of the Dollar against the Euro (Economist, 5 June, 2008). What this basically implies, is, now that the Dollar has breached a historic mark of 1.60 against the Euro, that value would become the lower denominator for future greenback policymaking (Economist, 2008). Basically, the Fed is taking the advantage of future rise in European interest rates, to shore its supply of US currency (Economist, 2008).

The forecast value of Dollar against Euro, as measured by an independent thinktank, the Financial Forecast Center, predicts the Dollar to continuously rise against the Euro in coming few months: from present values to 1.56 (in May), 1.49 (by the end of June), 1.45 (July), 1.40 (August), 1.36 (September), and finally, 1.32 (October) (Forecasts Center, June 9, 2008). Let us remember that these predictions are based on speculative sentiment index (SSI) values, and are subjected to enormous variation. This, however, does not take away credit from analysts’ who are predicting Dollar’s recovery in coming days ahead. Indeed, the US Dollar is on a quick turnaround path.

Apart from Euro, another currency expected to go down against the Almighty Dollar is Pound Sterling (£). Even a few weeks back, the British currency was pegged over the value of 2, a trend which is seen to have reversed recently (Guardian, June 4, 2008). At present, the Pound stands at 1.96 against the Dollar, a figure which might end at 1.90 by year-end (Guardian, 2008).

Fed’s Dollar Policy has already been endorsed by European Central Bank (ECB) (Lanman, June 5, 2008). The EU, which is currently facing its worst recession in recent years, looks forward to the prospects of a strong Dollar boosting its exports and turning around its economic fortunes (Lanman, 2008). Thus, it can be appreciated here that Dollar’s continued rise against major world currencies is being officially endorsed by some of the leading financial institutions in the world.

Now, let us scrutinise secondary evidence for Dollar’s continued rise projections in coming days ahead. According to the latest news in precious metals trading, Gold prices which had until recently, shot up to $900 per ounce, is already showing signs of decline in New York metals trading (Isostockanalyst, 2008). In a similar vein, copper futures have also declined after news went out that Fed is likely to keep interest rates steady (Vega, 2008).

Despite high inflation, a fall in value of such commodities is just one more evidence presented in this proposal which goes to corroborate and validate the basic theme of Hypothesis 1: There isn’t enough significant correlation between present exchange rates of Dollar with the Euro, and future estimable values. Indeed, the theory of Dollar rapidly declining against major currencies is no longer avoidable. The outlook of international markets, as of now, looks very positive, and this trend is likely to persist in coming days ahead. Indeed, all latest secondary data suggested in this proposal, point to the inevitable scenario in which the Dollar will continue to rally against the Euro.

Having taken a closer look into factors necessitating Dollar’s upsurge against Euro in coming days ahead, let us shift our attention to a more important concern: the impact of Dollar’s inevitable rise on present aspects of the European economy – our 2nd hypothesis. While opinions differ on this subject, many analysts still believe there are chances for the EU economy to accelerate its pace of growth in coming few months. How much will the Greenback impact this growth, can only be proved with study of present data at hand.

The IMF, on its part, is predicting a 1.25% growth rate for the EU in 2009, a figure which could accelerate to even 2% if certain growth policies are maintained (Sills, June 2, 2008). The only reason growth estimates are lower is because Europe is facing its biggest problem of inflation in recent years; mainly due to a rise in food, commodity and oil prices (Sills, June 2, 2008). The EU Consumer Price Index (CPI) has already shown a record increase of 3.6%, a factor which basically offsets any potential export gains due to the Dollar’s rise against the Euro (Sills, 2008).

More bad news follows from European emerging economies; Hungarian and Polish Central banks which warn of higher inflation rates, leading to European economies ‘hiking their interest rates even further’ (Finance.cz, 5 June, 2008). Hungary’s current interest rates are at a whopping 8.50% and Poland, which was having lower interest rates at 4.0%, the trends have started to worsen with future interest rates expected at 4.5%. Clearly, Europe is set for potentially troubling times in the near and immediate future. It would be quite a struggle to overcome unfavorable market sentiments.

Apart from emerging economies, it’s important to follow the picture in larger EU economies; Germany, for instance, is showing similar trends as Hungary and Poland – despite ZEW economic indicator stability (achieved in May, 2008), the country faces a race against time to maintain economic expectations in the face of inflationary problems which is eating through its budget (Finfacts Team, 2008).

Germany, being the largest economy in Europe, mirrors the present scenario in the EU in all measurements of economic stability. Economic expectations for the entire EU has stabilized in May, with the ZEW indicator as below hovering at 1.2% (Finfacts Team, 2008). Despite economic stability, the concern for inflation remains strong across the EU. This trend is likely to continue in coming days ahead (Finfacts Team, 2008).

In order to diagnose the root cause of the EU’s inflationary bottlenecks, one must take a closer look into basic parameters which control the consumer price index in any economy. According to seasoned financial experts, the best way to gauge an economy’s durability against inflation is to monitor its latest situation in the retail and employment sectors (Finfacts Team a, 2008). Here are a few important details that emerge from such a focused study:

- Retail Purchasing Manager’s Index: (PMI). An indice which signals confidence in the retail market, Europe’s retail sales have shown a PMI of 53.1 in May, which was mainly attributed to the onset of Easter (Finfacts Team a, 2008). This is a huge recovery from April figures of 41.8 (Finfacts Team a. 2008). Despite a high PMI value, average sales in Europe have remained depressed over same period of time (Finfacts Team a, 2008). Indeed, these trends indicate a less-than-rosy picture of the overall scheme of things in Europe.

- Europe Unemployment Statistics impact: Most European economies are suffering anything between 8-13% unemployment levels (Finfacts Team a, 2008) – a fact which has negatively impacted any perceptions for better CPI. The EU has always had problems due to unemployment, and the huge social mess it generates. But, this time, the problem has been compounded due to issues such as shifting of centres of manufacturing from Europe to other parts of the world, particularly Asia (Finfacts Team a, 2008).

The EU’s many woes can be compounded by the fact that unlike the US, it lacks sufficient technology innovation to hold its own in the face of stagnation and inflation. The problem of Europe is that ‘it is not able to grow as fast as it should be capable of (‘EPI Helsinki Speech’, 2008). Decades of stagnated growth has drastically reduced the efficiency of Europeans, especially when it comes to out-innovating US-based companies which continue to have the highest number of patents in R&D projects (‘EPI Helsinki Speech’, 2008). The only way for Europe to rise above present inflation trends, is to bolster effort in matching America’s prowess in R&D where it’s been left far behind in last two decades alone.

Thus, a summation of points mentioned above corroborate and validate Hypothesis 2: “European economies will not benefit much due to Dollar rise”. In fact, there is hardly any correlation between short-term appreciation in US currency, and Europe’s ability to tackle its imminent problems of inflation, reduced consumer confidence, lack of innovation and high interest rates.

Primary Data suggestions

In this review, we saw different tools and methods which would enable a more detailed study of this research on Dollar’s future projection trends with respect to the Euro. This review provides a snapshot summary, a barometer perspective on the necessary tools and methods which will ensure confirmation of evidences gathered from secondary sources. Sampling techniques for such a task will be explained in next chapter. Here is a summary of main tools/parameters which would enable a focused study of primary data for currency rates measurement:

- Speculative Sentiment Index (SSI) measurement: One of the newest Forex tools developed by FXCM, it enables a daily-basis aggregate position tracking of speculative traders in currency markets (Moneytec, 2005). In this research proposal, we have used SSI secondary evidence to forecast the value of Dollar vs. Euro for a 6-month period up to October 2008. Further research on this tool would allow further consolidation of such research findings. SSI is generally used with sampling data.

- US non-farm payroll values: These values, as shown in research, have a significant impact on the Dollar’s forecast trends. Sampling data would consist of a larger number of census trends from Fed financial archives.

- ZEW chart, Retail Purchasing Manager’s Index and European Unemployment Statistics in detail, would provide additional inputs to accurately look out for any possible correlation between Dollar rates and present European economic situation.

Methodology

Restating Purpose and Null hypothesis

The purpose of this research proposal wass to evaluate ‘real’ impact of the Dollar’s current problems in international currency trading, and assess the long-term currency value projections using a host of methods/tools. The problem concern in this regard is mentioned as: ‘What will be the future of US Dollar (US$) against Euro (€) and what does it hold for Europe’s economy in the long run, specifically between 2009 and 2012?’

In addition, the proposal also includes a series of null hypotheses which were corroborated and validated in previous chapter, using a combination of literature evidence and primary data suggestions such as SSI measurement, US non-farm payroll values and economic stability operators such as ZEW Chart, PMI and Unemployment data. The hypotheses are as follows:

- Hyp 1: ‘There isn’t enough significant correlation between present exchange rates of Dollar with the Euro, and future estimable values’.

- Hyp 2: ‘European economies will not benefit much due to Dollar rise’.

Population and Sampling

Let us evaluate each and every primary data parameter for its population and sampling methodlogy. This will help us prepare external validity for results which can be used later for a different set of values (Shavelson, 1988).

Speculative Sentiment Index SSI measurement

This is a statistical tool predicting currency exchange rates using historical trends and different set of economic parameters such as interest rates, commodity prices etc.

Experimental conditions for sampling SSI data will consist of analysing daily updates on exchange rates for a given time period (7 days) and comparing it with historical evidence data (90 days-180 days) to achieve approximate prediction of currency forecast rates in any given amount of time, using a priori probability sampling of currency values from a given set of values. This can be done using a free software tool downloadable from FXCM.

US non-farm payroll values

Instead of ‘sample’, one will have to look at ‘population’ trends over a long period of time. Data for all US non-form payroll values can be acquired from the Census website and compared for verifying suitable economic trends on recession, and consequently, currency exchange rates.

ZEW chart, Retail Purchasing Manager’s Index and European Unemployment Statistics

These tools would involve some convenient sampling from European financial and business publications. The objective would be to correlate the data with any fluctuations in Dollar rates.

Procedure and Time frame

The main purpose of primary data collection is to corroborate and validate the hypotheses, as was done in case of secondary data sources in literature review. In order to confirm with evidence, the following procedure will be helpful.

- Examining past case studies (journals, magazines, conference publications, trade publications and other research articles) for any knowledge/inputs on sampling/population techniques for various primary data parameters.

- Collecting sample information pertaining to all primary data parameters mentioned in this proposal.

- Analysing sample information for corroborating and validating our two hypotheses parameters.

The dissertation will consist of population/sampling parameters on currency rate values; gathering this data to suit our purposes can take anything between 2-3 weeks.

Analysis of information

The basic purpose of conducting research on our present set of hypotheses is to corroborate and validate them using statistical means. Recall Chapter 2 where SSI forecasts of dollar rates against the Euro were made using statistical means (confidence intervals). It might be convenient to use an SPSS software like Minitab for planned, methodical analysis of various statistical parameters in primary data research.

Limitations of Study and their solutions

Like every research study, this one too can face unexpected problems due to factors beyond the researcher’s control. It is with this thing in mind that relevant solutions are being mentioned.

- Problems with SSI software: Since SSI is a newly-developed software, it is forseeable one may face back-end problems due to product conditions like Trial version in which case, a Licence may have to be purchased. Since, there aren’t too many currency-forecasting software available on the Internet, one will have to rely on expensive, proprietary software. Research grant between $500-1000 would be of great help in this regard.

- Non-availability of US non-farm payroll values: It might become quite a difficult task to gather substantive data on US non-farm payroll values. No easy solutions are in sight.

- Non-availability/Redundancey/partial availability of ZEW chart, Retail Purchasing Manager’s Index and European Unemployment Statistics: Since all this data is subject to non-availability, I’ll have to look harder to achieve required data for the purpose of systematic evaluation. In any case, most of the information is accessible online but can only be gathered through membership of paid online publications/journals.

Currency exchange predictions, as depicted using different tools can ‘never’ be 100% accurate. There is always a chance for higher variability because of uncertainty involved in the game of currency speculation. The uncertainty is stabilised using what are called ‘parity levels’. According to SSI evaluations, the ‘parity level’ following Trichet’s announcement is 1.00, which is the highest in last 12 months.

Results

The main aim of this research proposal was to validate our fundamental hypotheses on Dollar’s continued rising projection against the Euro, debunking the myth that Dollar is headed for an irreversible collapse and also to achieve realistic forecast on future trends for both currencies (between 2009-12). These concluding evidences are better achieved through a combination of secondary and primary data. In this chapter, we will present a ‘median forecast’ of 47 currency analysts in assessing the relative rise/fall of Dollar against the Euro, for the time duration 2009-12.

Above chart gives a Median currency forecast for Dollar against two major currencies: Japanese Yen and the Euro (Bloomberg, 3 May, 2008). It can be clearly seen from the chart that the Dollar is headed to a long-term appreciation against Euro. From its current low at 1.56, the Greenback will appreciate to 1.36 by Mid-November. Over a considerable period of time, this will actually improve to 1.25 by 2011-12. This is consistent with our theoretical framework claim that the Dollar is slated to appreciate against the Euro in the long-term and reach values of 1.25 under current market sentiments.

By now, it is possible to realise Dollar’s current acceleration scenario and its impact on world currency trading markets. Above chart (Fig.3) is just an indication for final results of forecasting. This solves the basic research problem, ‘What will be the future of US Dollar (US$) against Euro (€), specifically between 2009 and 2012?’ To understand its implications for the European economy, check last chapter.

Conclusion and Recommendations

Summary of main ideas

The subject of Dollar’s purported weakening against Euro is of enormous interest to finance students, forex agents, international tourists, hoteliers and practically, all people connected with foreign exchange dealings. Forecasting future exchange rates is a highly valuable skill which ensures long-term career prospects with many global firms such as Goldman Sach’s, Arthur Andersen & Co., Accenture, Berkshire Hathaway etc. By testing my knowledge in currency trading through practical applications, I’ll be able to boost my long-term resume.

This research proposal is based on the central premise which debunks the myth that thanks to present trends (as of June, 2008), the US Dollar will be replaced by more powerful currencies (namely, the Euro) in the near future; in order to dispute this claim, I presented a set of two hypotheses which were subsequently, corroborated and validated using secondardy literature sources and primary data suggestions. The hypotheses chosen were ‘null’ because of the need to disprove any validity between two independent variables. The hypotheses were as follows:

- Hyp 1: ‘There isn’t enough significant correlation between present exchange rates of Dollar with the Euro, and future estimable values’.

- Hyp 2: ‘European economies will not benefit much due to Dollar rise’.

Both hypotheses have been proved and the results summarised as given below. In order to understand the proper application of these theories, it’s important to study their practical applications using primary data evidence, which will be the main constituent of a full-fledged thesis on this subject.

Findings and Discussions

In order to illustrate the points which highlight both null research hypotheses, it was important to bring evidence which directly support/bolster the claims made. The following research findings were deduced using established methods to evaluate Dollar’s current exchange rate fluctuations w.r.t. the Euro. These are the basic tools which allow any possible evaluation of foreign currency data.

- Speculative Sentiment Index (SSI) measurement: One of the newest Forex tools developed by FXCM, it enables a daily-basis aggregate position tracking of speculative traders in currency markets (Moneytec, 2005). In this research proposal, we have used SSI secondary evidence to forecast the value of Dollar vs. Euro for a 6-month period up to October 2008. Further research on this tool would allow further consolidation of such research findings. SSI is generally used with sampling data.

- US non-farm payroll values: These values, as shown in research, have a significant impact on the Dollar’s forecast trends. Sampling data would consist of a larger number of census trends from Fed financial archives.

- ZEW chart, Retail Purchasing Manager’s Index (PMI) and European Unemployment Statistics in detail, would provide additional inputs to accurately look out for any possible correlation between Dollar rates and present European economic situation.

First two points (1 and 2) corroborate and validate Hypothesis 1 and the last point (3) corroborates and validates Hypothesis 2. All these findings have been proved through secondary evidence, and confirmed in Chapter 2. Using Average Median forecast information, it’s even possible to achieve a semi-accurate prediction of Dollar’s exchange rates w.r.t. the Euro. As shown in Fig. 3, forecasts for Dollar’s future rates vs. the Euro will allow the former to significantly appreciate against the latter, climbing to an all-time high of 1.25 by 2012.

On the second part of research aim, it has been proved using Hypothesis 2 and Finding no. 3 (see chart above), that despite Dollar’s guaranteed appreciation against Euro in coming months and years, it may not be possible to translate it into increased economic growth for European countries. Most of the EU is suffering from imminent problems of inflation, reduced consumer confidence, lack of innovation and high interest rates. Unless, Europe sets its house in order, it’s virtually impossible to disprove null hypothesis 2: “European economies will not benefit much due to Dollar rise”.

Recommendations for study

This research proposal is a precursor to practical applications of currency trading (as described using various tools of trading such as SSI software, non-farm payroll units and economic inputs such as PMI) which I intend to pursue in my future dissertation study. Having consistently explained the vast scope/potential in this field of research and its benefits to large sections of society, and also towards my career goals, I would love the evaluation committee to consider a modest grant for me to complete this research successfully.

References

Amberger, J.C. ‘Dollar Reversal: Prepare for Oil and Gold Prices to Drop this Week.’ Today’s Financial News. 2008. Web.

Arbel, T. (2008). ‘Dollar Eases versus Euro after European Bank Comments’. Web.

Armstrong, R. L. (1974). Hypotheses: Why? When? How? Phi Delta Kappan, 54, 213-214.

Belkas, T. (2008). ‘Have we avoided Recession? Non-farm payrolls will tell Us Today?’ Web.

Castle, S. & Kanter, J. ‘Weak Dollar Weighs on Europe’. New York Times. 2008. Web.

Chauvancy, D. ‘Weak Dollar. High Oil have US over a Barrel’. CNBC News. 2008. Web.

Coinmill. ‘Dollar vs. 2008.’ Web.

Cooks, J. ‘This anti-Dollar trend is no longer your friend.’ World Currency Watch. 2008. Web.

Economist. (2008). ‘Does the New Dollar Policy Make Sense’. Web.

Finfacts. (2008). ‘Germany ZEW Indicator of Economic Stability’. Web.

Finfacts (2008). ‘Eurozone Retail Sales’. Web.

Guardian. (2008). ‘Pound to Stay under $2 as Economy Slows’. Web.

IsoStockAnalyst. (2008). ‘Further Dollar gains send US metals into tizzy.’ Web.

Kerlinger, F. N. (1979). Behavioral research: A conceptual approach. New York: Holt, Rinehart, & Winston.

Kicklighter, J. & Sousa, A. (2008). Web.

Krathwohl, D. R. (1988). How to prepare a research proposal: Guidelines for funding and dissertations in the social and behavioral sciences. Syracuse, NY: Syracuse University Press.

Lanman, S. (2008). ‘Bernake Throws weight behind Pauslon’s Dollar policy’. Web.

Moneytec. (2005). Web.

Reuters. ‘Euro could Replace Dollar as Top Currency: Alan Greenspan’. 2007. Web.

Reuters. ‘Dollar Drops versus Euro as Trichet Signals rate high’. CNBC News. 2008. Web.

Reuters. (2008). ‘Hungarian, Polish banks warn of inflation’. Web.

Seeking Alpha. (2008). ‘Analysts forecast Euro to Fall: Yen to gain’. Bloomberg. Web.

Shavelson, R. J. (1988). Statistical reasoning for the behavioral sciences (second edition). Boston: Allyn and Bacon.

Sills, B. (2008). ‘IMF raises Europe growth outlook: backs steady rates’. Web.

‘Sydney Morning Herald’. (2008). Oil Prices Fall on Comment on US Dollar. Web.

Vega, M. (2008). ‘Copper Futures Decline on global demand and dollar rally’. IBT Commodities and Futures. Web.

Wilkinson, A. M. (1991). The scientist’s handbook for writing papers and dissertations. Englewood Cliffs, NJ: Prentice Hall.