Barriers to imitation are always needed if you are a good entrepreneur can appropriate value from an innovation

Competencies in science, technology, and engineering are usually required to facilitate the invention of new products and processes; this implies that the underlying technological prowess that facilitates innovation is not adequate for entrepreneurs to profit from their innovations (Baron & Shane, 2005). Even though invention forms the initial phase of innovation, in most cases, it is not enough to facilitate commercial success (Allen, 2006). This means that entrepreneurs usually fail to appropriate the profits of their respective innovations.

An inference that can be made from the above observation is that the protection of the returns associated with innovation forms a strategic challenge for entrepreneurs in industries that are mostly technology-intensive. Innovations that have unbeaten commercially have relied on the creation of impermanent monopolies, this has facilitated the extraction of transitory Schumpeterian rents. In highly technology-intensive industries, entrepreneurs have to engage in persistent innovations to establish a competitive advantage that is sustainable (Baron & Shane, 2005). The basic argument is that the performance and business continuity of an entrepreneur or a firm is solely determined by their ability to appropriate the values from their respective innovations.

This poses the need to protect one’s innovation using the different types of barriers to imitation. There are diverse high-profile instances whereby entrepreneurs lost the value of their innovations mainly due to imitators. Examples of entrepreneurs who lost their innovation to imitators include RC Cola, who invented the diet cola and lost to coca-cola and Pepsi; Ampex, who invented the video recorders and lost to Matsushita; and MITS, who invented the PC and lost to Apple and IBM. This is attributed to the entrepreneurs failing to appropriate the returns of their innovations. Therefore, it is arguably evident that barriers to imitation are required if a good entrepreneur must have the ability to appropriate the value from innovation. Having discussed the need for barriers to imitation, the following section highlights the different types of barriers to imitation that entrepreneurs can use to protect their innovation (Leonard & Rayport, 1997).

There are diverse types of barriers to imitation that entrepreneurs have used to protect their innovation. One of the methods of barriers to imitation is the use of patents. Governments usually offer 20 years for patent protection towards innovators with the prime objective of serving as an inducement to encourage innovation and address the threats imposed by innovation (Marco, 2008). The underlying argument is that in case imitators copy the innovation without difficulty, there is a likelihood that the increased competition will serve to reduce the level of profitability associated with the innovation such that the innovators will not benefit from their worthwhile efforts. A prime setback associated with using patent protection is that the underlying technology behind the innovation has to be disclosed (Nussbaum & Berner, 2005).

The second type of barrier that entrepreneurs can use to protect their innovation from imitators is to use the resource-based view, which focuses on the exploitation of the core competencies of the firm. The resource-based view emphasizes superior access and exploitation of the firms’ input resources and its customers. A business enterprise that has the capability of obtaining high-quality inputs has the capacity of sustaining business advantages associated with costs and quality that other business enterprises cannot copy (Ulwick, 2002). Superior access to input resources by a firm is attainable by having control of the supply source using long-term contrast and ownership. The resource-based view also facilitates superior access to the customers hence increasing the value of innovation by the entrepreneurs. Also, having admission to one of the most effective distribution channels and the productive retail spaces will serve to enhance competitive advantage and hence increase the value of innovation. Controlling the scarcity of inputs is also another strategy under the resource-based view that businesses can exploit to protect their innovation (Ulwick, 2002).

The third type of barrier to imitation that entrepreneurs can use to protect innovation is the use of market size and making use of the scale economies. Imitation is also barred using a large minimum efficient scale compared to the demand in the market, and securing the largest portion of the market. This implies that the economies of scale can play an integral role in limiting the number of business enterprises that can fit into the market and impose a potential barrier to entry. The use of scale economies can also be used in discouraging small enterprises that are already in the market to expand and imitate the scale economies and the associated cost advantages of an enterprise that has already secured a large segment of the market. There are also intangible types of barriers to imitation, which include casual ambiguity, social complexity and reliance on historical state of affairs. Casual ambiguity is a scenario whereby the firms capacity in value creation are obscure and lacks precise comprehension by the competitors, and exploits the use of tacit knowledge (Kim & Mauborne, 1997).

It is impossible to create a new value curve for established companies

The value curve is a graphic representation of how a firm or an entire industry configures its operations with its customers; this implies that the value chain serves an effective tool for the creation of new market spaces (Baron & Shane, 2005). The value curve usually depicts the present state of affairs in the acknowledged market space, which provides a framework through which the firm can understand the existing trend of competition and the underlying factors that influence the state of completion about product and service delivery (Kim & R, 2005). To change the value chain of an established company, the firm should first reorganize its strategic focus from the existing competitors to analyze the current alternatives. Also, the firm should rearrange its focus from its customers towards its non-customers within its industry.

For established firm to pursue the aspects of value and cost, it must refrain from the conventional approach of benchmarking competitors in the current market space and choose between business level strategies that entail product and service differentiation and a cost leadership strategy (Kim & R, 2005). When the firm is changing its strategic focus from the present status of competition to the available alternatives and its non-customers, the firm must have an in depth analysis of the present state of the industry. This entails a redefinition of the problem that the industry lays emphasis on and then reconstruct the elements of the buyer value that outside the boundaries of the industry. An outcome of such an approach is that the firm is likely to provide better solutions to the existing problems in the industry compared to its competitors. An inference from the above is that it is possible to create a new value curve for an established company. The following section discusses how the Red and Blue Ocean strategy emerges and value innovation occurs when an organization can develop a new value curve that is different from the one that is traditionally used in the industry that it competes (Morris & Kuratko, 2002).

Competition in industries that are already overcrowded makes it difficult to establish a sustainable competitive advantage. This implies that the solution to such a dilemma is the creation of blue oceans that serve to create a new market space that is uncontested (Kim & Mauborne, 1997). Red oceans usually denote the existing industries, which have definite boundaries and that firms are deploying strategies to outperform their competitors to increase their share of the market. An increase in market crowding implies that profitability is reduced due into increased competition. Blue oceans on the other hand refer to industries that are non-existing, which represent the market space that has not been identified and has no competition. This implies that firms operating in blue oceans can create demand rather than fight over the existing customers for their share of the market. The blue oceans strategy is a potential business strategy for growth and increase profitability in a competitor environment (MacMillan & McGrath, 1997).

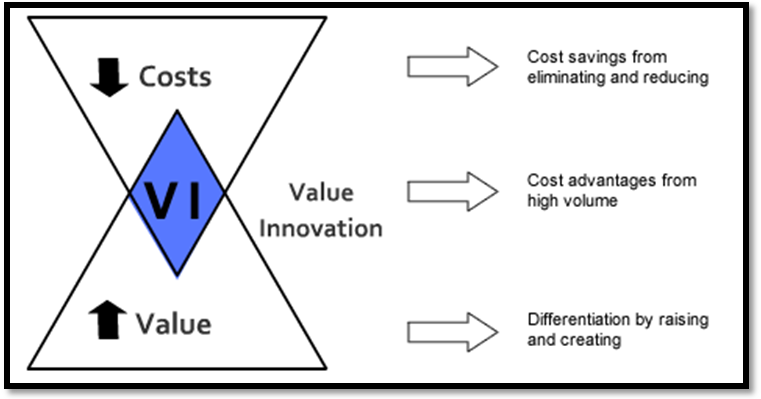

In contrast to the generic strategies established by Porter, the Blue Ocean strategy consents that differentiation and low cost strategy can be attained simultaneously. According to the Blue Ocean strategy, the actions undertaken by the firm usually imposes an effect on the structure of its costs and the value creation to its buyers (Morris & Kuratko, 2002). In the creation of a new value curve under the blue oceans strategy, costs are reduced significantly because the factors of competition are eliminated. Buyer value is also enhanced through the creation of the industry elements that were not in existence. With time, scale of economies implies a further cost reduction because of the increase in the volume of sales and the increased buyer value to the buyers that the firm in a blue ocean creates. This serves to facilitate the process of value innovation, which is facilitated the by the position of the firm in a blue ocean (Kim & Mauborne, 1997). This depicted in the figure 1 below.

The development of a new value curve for an established organization implies that the firm has managed to establish a market space that is not contested, thereby increasing the irrelevance of competition. Also, the creation of a new value chain for an established firm implies that the firm has the capability of creating and capturing a new demand and breaks the trade-off that exists between buyer value and costs, implying that the firm can achieve both differentiation and the low cost strategy at once (Baron & Shane, 2005). The basic inference from this observation is that the creation of a new value curve by a firm results to the emergence of the Blue Ocean Strategy. This is mainly because the creation of a new value curve is due to a reduction of the factors that are below the threshold of the industry standards, elimination of the factors that the current industry takes for granted, creation of factors that the current industry has never provided and increasing the factors are above the present industry standards.

A key “innovation issue” that an entrepreneurial organization needs to address to be a commercial success

It is arguably evident that the establishment of sustainable competitive advantage is a significant element of the business level strategies for firms across all industries and economies. The Research and Development strategy, which is an important business level strategy, primarily focuses on product innovation and process improvement. Also, it deals with the assessment of internal development, external acquisition, role or technology in organizational growth and other factors that may revolutionize the way an organization operates (Kim & R, 2005).

An organization can opt to be a technological leader, in the sense it aims at innovation, or it can be a technological follower, in the sense that it imitates other innovations by other firms. Depending on the option that the organization undertakes, it can attain product differentiation or a reduction in the production costs. Such an approach places innovation at the core organizational success as an element of strategies for organizational growth in competitor growth. As a result, a key issue in innovation that emerges is how organizations can makes use of innovation to foster competitive advantage. This section discusses the use of innovation for competitive advantage as a key innovation issue, with a specific concern on the effects of innovation on profitability and growth in a competitor environment (Von Hipple, 1999).

Innovation is diverse and can be implemented at various levels within the firm through the development of new products and new processes, establishing new ways aimed at creating value for buyers and a renewal of the organizational process. This implies that innovation can be product-oriented, process-oriented or a change in the firm’s position and paradigm of operations. All these approaches when effectively implemented within the business enterprise lead to the establishment of competitive advantage and foster business growth (Ulwick, 2002).

One of the notable outcomes of innovation is the emergence of the Blue Ocean Strategy, whereby firms create a new value curve with the main objective of tapping the unidentified market that has no competition. This results to the aspect of value creation, which in turn means that the firm can make use of the increased buyer value and cost reduction for business growth. An inference from this is that innovation serves as an effective business level strategy that a firm can exploit to establish a sustainable competitive advantage and foster growth in a competitor environment.

With the economic downturns becoming common phenomena in the market place, innovation comes in handy as a solution to the business challenges imposed on the market. The bottom line is that business innovation is increasingly becoming a central element of the business level and corporate strategies (Marco, 2008). Also, innovation is becoming a business requirement due to the increase in the product development cycles and the perception that innovation can be exploited as a strategy for growth in a competitor environment. Innovation has also been applied to attain commercial success in emerging markets. In the recent past, emerging markets has presented a potential opportunity for global manufacturers, imposing the need to devise appropriate methodologies that can be applied to guarantee success in emerging markets.

This mainly entails addressing the dynamism in the customer requirements and demands, government regulations and cultural diversity. This implies that business innovation can be applied by global companies to help them adjust their strategies in human resource, products and service delivery and their supply chains. As a result, innovation in emerging markets helps in the addressing the challenges associated with gaining entry in such markets such as establishment of new value propositions, globalization of research and development, strategies used in talent management and complexities associated with global value chains (Kim & Mauborne, 1997). All these strategies can be deployed to foster competitive advantage using innovation at the various levels within the business including its operations, processes, technologies products and functions (Kim & R, 2005).

A key issue in using innovation for strategic growth in a competitor environment is ensuring that the business enterprises benefits from the potential advantages associated with the innovation. This implies that the business must protect its innovation from imitation to make its business value worthwhile and make significant contributions for strategic growth. Also, the business must constantly re-innovate to be ahead of its competitors (Kim & Mauborne, 1997). Therefore, innovation is increasingly becoming a key focus for the businesses that plays an integral role in differentiation and business growth. As a result, innovation should be integrated into the business and corporate level strategies for growth and competitive advantage. When a business enterprise can implement continuous innovation and adjust its corporate and organizational culture to accept innovation, this serves as the onset of developing sustainable competitive advantage in the present day business environment.

References

Allen, K.R., 2006. Launching new ventures : an entrepreneurial approach. Boston: Houghton Mifflin.

Baron, R. & Shane, S., 2005. Entrepreneurship : a process perspective. Mason, Ohio: Thomson/South-Western.

Kim, W. & Mauborne, R., 1997. Value Innovation:The Strategic Logic of High Growth. Harvard Business Review, pp.89-95.

Kim, W. & R, M., 2005. Blue Ocean Strategy: From Theory to Practice. California Management Review, 47(3), p.105.

Leonard, D. & Rayport, J., 1997. Spark innovation through empathic design. Harvard Business Review, Boston, p.145.

MacMillan, I. & McGrath, R., 1997. Discovering New Points of Differentiation. Harvard Business Review, pp.89-101.

Marco, C., 2008. Approptiating the Returns from innovation. Economic Growth, 18, pp.11-34.

Morris, M. & Kuratko, D., 2002. Corporate enterpreneurship: enterpreneural development within organizations. Fort Worth: Harcout College Publishers.

Nussbaum, B. & Berner, B., 2005. The Creative Future. Business Review Weekly, pp.58-62.

Ulwick, A., 2002. Turn Customer Input into Innovation. Harvard Business Review, Boston, pp.102-03.

Von Hipple, E., 1999. Creating Breakthroughs at 3M. Harvard Business Review, Boston, p.105.