Introduction

Derivatives as a risk management tool gained prominence during the period of oil shocks which marked a time of extreme volatility and market uncertainty. In 1971 the erstwhile fixed foreign exchange system was abolished and a system of market foreign exchange set in (Taylor)1. But in India, the policy of market-driven foreign exchange rates was adopted in 1993.

In the beginning, the Indian rupee was pegged to an unknown basket of currencies, which was partially floated in 1992 and fully in 1993. This liberalization process helped in the introduction of derivatives based on foreign exchange rates and interest rates. However derivative use is still a highly regulated area due to the partial convertibility of the rupee. Currently forwards, swaps and options are available in India and the use of foreign currency derivatives is permitted for hedging purposes only2.

The primary purpose of this paper is to investigate and evaluate the foreign exchange risk management tools, especially hedging used by foreign banks operating in India. This paper investigates the options the foreign banks have to reduce risks in the Indian FOREX market. The paper will also try to establish a link between Libor and MIFOR rates and how MIFOR helps in controlling volatility in the FOREX market. The paper will also try to find if hedging with derivative instruments is a feasible solution to reduce risk.

Research Methodology

To conduct a thorough study of the risk managing techniques of foreign banks in the Indian market we first select four banks that operate in India. First, we will try to ascertain the usability of hedging as a risk dissipating tool in the FOREX market. We use SWOT analysis to ascertain the success or failure of hedging as a tool. Then we consider the Indian FOREX market and doing Porter’s five forces analysis we determine the competitive forces that are at work in the market and if multinational banks can gain acceptance. Our choices of foreign banks are Citibank, Standard Chartered, Barclays, Deutsche Bank, and HSBC.

We intend to review the FOREX trading patterns of the foreign banks and find out how they use hedging as a risk-reducing instrument. This paper tries to draw the current regulatory scenario in India for foreign banks dealing in forex hedging and try to ascertain if they are a boon or bane for the foreign banks. We will also try to ascertain the degree of participation of the banks in the FOREX market of India by studying the financial statements of the banks and their share in the FOREX market. The study is based on secondary data and financial data available from RBI and the financial statements of the foreign banks.

The paper is arranged in the following manner. We first study the theory of derivative tools and try to see how hedging a better or worse option is. Then we will study the current FOREX market situation in India and which tools are prevalently used by the foreign banks operating in India.

Foreign Exchange Risk Hedging

The trading between two or more currencies is called foreign exchange. The trading in foreign exchange occurs in either the spot market or in the forward. It is possible to hold these transactions for a long position, wherein foreign exchange is received or a short position which implies selling of foreign exchange in the future. Both holding and selling foreign exchange holds the risk to both the borrower and seller. These risks include interest rate risk, country risk, and exchange rate risk. Interest rate risks are those risks that arise due to the difference in the interest rates between the host countries and that of the currency in which the loan is denominated.

This inequality arises due to differences in inflation rates, liquidity of financial markets, the efficiency of intermediates, and risk of lending. Country risk implies the risk which arises due to adverse political developments and economic trends. Finally, exchange rate risk arises from unforeseen changes in currency rates. This implies that there is a potential loss that results from a change in the value of a currency.

There are various options that can be taken to mitigate these risks. The first option is doing nothing. By not taking any possible actions, it is possible to absorb the risk associated with an unfavorable exchange rate movement as and when they arise. This is the best option in case of small fluctuations but is ineffective the fluctuation is significant. The second option is hedging. This is the process of covering the risk of future foreign currency obligations. And the third option is to opt for a mixed strategy, where one uses the time between recognizing the risk and the time when he has to identify the lowest possible price.

Hedging

The question that arises is: what is hedging? Hedging may be defined as the process of managing risk to the extent that is bearable. In other words, it is insurance one takes against abrupt and unidentifiable fluctuations in the currency.

Instruments for Hedging

There are many instruments that are used to hedge against the risk that has evolved in the foreign exchange market. These instruments serve mostly the same purpose but differ in the details – for example, the hedging can be done with respect to time horizons for hedging, default risk, transactions costs, and market imperfections. These tools are used in different combinations to help to dissipate risk. The tools are:

- Countervailing Foreign Exchange Deposits: some investors use countervailing foreign exchange deposits to hedge foreign exchange risk. The prime feature of this system is the use of a loan in foreign exchange as security against loans in local currency (Holden and Holden).

- Foreign currency/Domestic currency Swaps: Swaps are a combination of forwarding and spot transactions. In this form, foreign exchange is swapped in exchange for a stream of payments between two parties either directly or through an intermediary. Usually, they involve a spot purchase and a sale of forwarding or vise versa of two different currencies. (Holden and Holden)

- Borrowing and On-Lending: in this case, a bank lends (unsecured) and FII then lends it again to a domestic borrower. Since all transactions occur in the domestic currency, there arises no risk of a volatile exchange rate. (Holden and Holden)

- Domestic Currency Guarantees by an FII: Here a domestic bank lends to the borrower and a foreign financial institution guarantees the principal. (Holden and Holden)

- Guarantees through a Secondary Market: In this instrument, the foreign bank provides a partial guarantee to a financial unit. Another organization that wants to operate on risk management principles buys a diverse portfolio and of such guarantees and manages the guarantees. Since the diverse portfolio manages both foreign exchange risk and default risk can be managed at a lower cost than a financial institution holding only a few guarantees. (Holden and Holden)3

All these instruments are not an exhaustive list of instruments but a few. These are used to hedge foreign exchange by banks. (Holden and Holden)

India’s Foreign Exchange Market

The Indian foreign exchange market has experienced exponential growth in the past few years. According to BIS Global survey, the share of rupee in the total turnover of covering all currencies increased from 0.3 percent to 0.7 percent from 2003 to 2007 (Gopinath)4. According to Gopinath, the total foreign contracts which were outstanding in all the banks’ balance sheets in August of 2007 was “USD 1100 billion (Rs. 44 lakh crore), of which almost 84% were forwards and rest options” (Gopinath: 2)

Porter’s Model

In order to fully understand the Indian FOREX market, we use Porter’s five forces model (Porter)5 to ascertain the competitive forces at work in the industry. Here we consider the Indian FOREX market as an industry. Michael Porter’s five forces model is designed to measure the degree of competitiveness in the industry.

Threat of substitute

Rivalry among existing competitors In the Indian market the Reserve bank of India, the authorized dealers, and the banks can do hedging (RBI Report)6. Apart from these, there are multinational banks that too have the authority to hedge. There are 183 banks and financial institutions in India. These include both Indian and foreign banks who are authorized to handle foreign exchange business. As it is not a very big market, hence strong competitors can control the market.

Bargaining power of Buyers

The bargaining power of the buyers is low as in the case of hedging tools, the hedgers transfer the risk to the speculators who are willing to assume the risk. Buyers have options of different hedging tools such as swaps, forward, options, and cross-currency transactions (Gopinath).

Bargaining power of suppliers

Suppliers have strong bargaining power, as there are a lot of buyers but few sellers. Here supplier is the RBI the sole authority in the FOREX market and hence has full control over the market forces (Mohan)7. Further, as the apex body in the FOREX market structure, RBI has the authority to regulate the markets in interest rate derivatives, foreign currency derivatives, and credit derivatives (Gopinath). Such regulations and authority to RBI reduce the power of foreign banks operating in the market considerably.

Barriers to entry

Barriers to entry are high. This is because dealing in the FOREX market is not completely open for all. Regulatory barriers are present which makes entry difficult. RBI defines two categories of players in the FOREX market, namely market-maker and users which indicate the position of the participant. A foreign bank operating in the Indian FOREX market is a market-maker. Such banks, in order to start operating in the Indian FOREX market, should be in a position to “mark to market or demonstrate valuation of these products based on observable market prices” (Gopinath: 3). Further foreign banks cannot hedge with all the investment strength they have. RBI regulation restricts them to operate with the resources they have in the Indian economy. These act as a barrier to entry for foreign banks in this market.

The above analysis shows that the FOREX market has few sellers but a large number of buyers. The remarkable changes that have been found in the Indian FOREX market are due to the remarkable changes that have occurred in the international markets. Reserve Bank of India (RBI) has established a very active market for inter-bank exchange. There are 183 banks in march 2007 financial institutions both Indian and foreign authorized to handle foreign exchange business (RBI)8. The Indian foreign exchange market has a “three-tier” structure (Bhalla)9. At the apex is the RBI, followed by the “authorized dealers” (ADs) who are the commercial banks given the authority to deal in foreign exchange, and in the third tier are importers and exporters are the exporters and importers. In the recent literature, a fourth tier has emerged which comprises Indian banks and foreign banks handling FOREX (RBI).

As a consequence of the liberalization of the Indian economy, foreign exchange inflow has increased substantially in the country. Further relaxation of trade barriers has facilitated the globalization process to set in. with globalization, the risk factor in business has increased considerably, especially with market-driven exchange rates. The necessity to manage risk has aroused the need to hedge. As the Indian companies’ inclination becomes more global, the FOREX derivatives market in India has to offer a basketful of hedging products for effective management of corporate FOREX exposure risk (Bhalla).

This trend was observed with corporates actively trying to explore the swap market. In India, the swap market has a range of alternatives such as principal-only and coupon-only swaps. The Indian corporate use them not only to create but also to extinguish FOREX exposures (Bhalla). The problem that was imminent in this case was the impact on the local FOREX markets because spot and forward hedges were being used to swap the corporate transactions (Goel and Gambhir). This led RBI to regulate the market with the following policies:

- The ADs offering swaps should try to match demand between the corporates to corporates.

- RBI restricted swap transactions to USD 10 million.

- When a contract is canceled it is not allowed to be re-booked. (RBI)

It was in 1996 that foreign institutional investments (FIIs) were allowed to hedge in the Indian market. In the foreign exchange market in India, there are certain products that are used as tools and are allowed to be used to hedge the liabilities in foreign currencies as long as they were acquired according to the RBI regulations (Goel and Gambhir)10. They are:

- Currency swap

- Coupon Swap

- Interest rate swap

- Interest rate cap or collar (purchases)

- Forward Rate Agreement (FRA) contract

But the FOREX market is still regulated in terms of hedging and the regulations for foreign banks in this market in India are (V.K.Bhalla):

- Rupee should not be used to make the contract.

- The foreign currency loan is used as a notional principal amount of the hedge and it does not exceed the outstanding amount of the foreign currency loan.

- The hedge should not mature after the un-expired maturity of the related loan (RBI).

RBI allows innovativeness in hedging products to satisfy definite requirements of customers. The designs of these products are derived from the cash and derivative market tools (Goel and Gambhir). These tools offer complex payoffs contingent on different factors. Some of the examples of these products are provided below:

- Accrual forward: in case of an accrual forward, spot stays within range for fixing every day and the holder obtains longer 1 unit of USD/INR.

- Forward Rate. Enhanced accrual forward: This instrument contract has two forward rates, which apply for different ranges.

- Higher yield deposits: This product can be developed to offer a comparable higher yield than on a traditional Rupee money market deposit. (Goel and Gambhir)

Risk Management in India

There is always a risk element attached to firms dealing with multiple currencies due to sudden alterations in exchange rates. Exposure may be defined as a constricted, predictable or conditional cash flow the magnitude of which is not definite at the moment and varies directly with the volatility in foreign exchange (Goel and Gambhir). As we have already seen, the procedure of identifying risks the firm faces and adopting instruments to avoid these risks by financial or operational hedging is defined as foreign exchange risk management. This paper is limited to discussion of hedging as the risk management tool.

Kinds of FOREX Exposure

Exchange-rate exposure may be defined as the sensitivity of the firm’s value, padded by the firm’s return on stocks, to an unexpected adjustment in exchange rate. Mathematically this is calculated by deriving the partial derivative of the firm’s value with respect to the exchange rate (Adler and Dumas)11.

The risk management technique to be adopted varies with the type of exposure and term of exposure. There are two types of exposure, vis. Accounting and economic exposure. The first type of exposure arises when the foreign banks have to state their net income in the parent bank’s financial report. There are risks which arise due to varying and volatile exchage rate. The second exposure to risk arises due to the bank’s share values in the domestic currency (in this case INR) to the parent cpountry’s curreny (say USD). Changes in the currency affect the value of the bank’s operating cash flows, income statement, and competitive position, and consequently the market share and stock price.

A short- term exposure, known as transaction exposure, arises due to adopting a fixed price contract in a fixed exchange rate market.

Why Manage FOREX Risk?

A question that arises in the context of exchange rate risk is that why is it required to manage this? The underlying assumption in the concept of foreign exchange risk is that exchange rate is determined by how efficient the markets for foreign exchange are and that the changes are not predictable.

Research in foreign exchange market’s efficiency has established a weak form of an efficient market hypothesis. From this it can be concluded that successive changes in exchange rates cannot be (Barclays Bank)12 predicted by analyzing the historical sequence of exchange rates (Soenen)13. But when we apply the efficient market theory in the foreign exchange market which has floating exchange rate research shows that all necessary information are reflected (Giddy and Dufey)14. These research shaows that exchange rates in a floating rate market react to information immadiately without any bias. For this reason one single party does not reap the profit.

Hedging: a Tool to Manage FOREX Risk

There are various opinion regarding hedging as a tool for risk management. Some believe it to be a speculative tool and others believe it is a very successful tool. Some banks hedge only on some of their risks while others are not aware of the how to managege the risks even when they are aware of it. Some companies believe that the shareholder’s profit can be increased by hedging the foreign exchange risk (Giddy and Dufey). There are different kinds of market risks which arise due to imperfections in the foreign exchange market which may be termed as positive transaction cost, agency cost, and probability of financial distress (Giddy and Dufey).

Some also argue that a firm which engages in hedging is less risky and can secure debt more easily. This negates the Modigliani-Miller(MM) proposition as shareholders are not in a position to utilize such tax advantages. MM argues that shareholders can hedge individually is wrong due to high transaction cost and lack of awareness about financial intricacies. There are various studies which shows managing foreign exchange risks can be reduced considerably using such risk reducing tools. It has been found that there exists a statistically significant relation between the absolute value of the exposures and the (absolute value) of the percentage use of foreign currency derivatives and prove that the use of derivatives in fact reduce exposure (Allayannis and Ofek)15.

Risk Management in FOREX

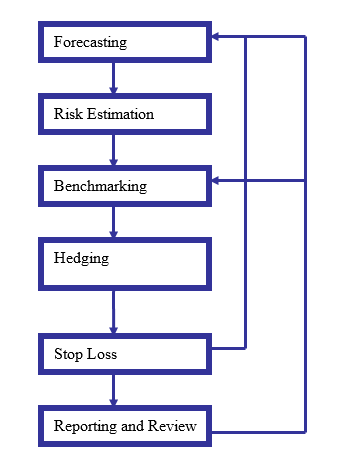

Once the bank recognizes its exposure to foreign exchange, it deploys its resources to manage risk. The risk management process is as used by banks to manage this risk is shown as below:

- Forecasts: once the risk is determined the bank first has to forecast on the foreign exchange rate trend. The period for forecasts is typically 6 months. Apart from identifying trends, one has to find the probability for the forecast coming true.

- Risk Estimation: Forecast is a measure of the Value at Risk which is the actual profit or loss. This is the risk that arises due to failure of market specific problems.

- Benchmarking: the next process is to make a benchmark level for the firm where it limits itself while speculating on foreign risk exposure.

- Hedging: once the benchmarking of domestic currency the basis of the benchmark the banks decides on a strategy to hedge. There are various financial instruments available for the firm to choose from: futures, forwards, options and swaps and issue of foreign debt.

- Stop Loss: forecasts help determine the situation of the firm’s risk management. The risk management decisions of banks are based on forecasts. This step helps banks to rescue the firm from wrong forecasts. This requires certain monitoring systems in place to detect critical levels in the foreign exchange rates for appropriate measure to be taken.

- Reporting and Review: Risk management policies are reviewed based on periodic reporting. The reports which show hedging in the financial statements of firms are profit/loss status on open contracts after marking to market, the actual exchange/interest rate achieved on each exposure, and profitability vis-a-vis the benchmark and the expected changes in overall exposure due to forecasted exchange/ interest rate movements. (Adler and Dumas)16

Hedging Strategies/ Instruments

A derivative may be defined as a financial contract the value of which is derived from the value of some other financial asset, such as a stock price, a commodity price, an exchange rate, an interest rate, or even an index of prices. The main function of derivatives is to reallocate risk among financial market participants, in order to make financial markets more complete. This section outlines the hedging strategies using derivatives with foreign exchange.

Forwards: A forward is an agreement between two parties to buy/sell a specified amount of a currency at a specified rate on a particular date in the future. When the receivable currency depreciates, it is hedged against by selling a currency forward. When the risk is of currency appreciation, banks hedge by purchasing the currency forward. The main advantage of a forward is to obtain a modified option to meet the specific requirements of the firm and an exact hedge can be obtained. On the other hand, these contracts cannot be sold to another party when they are no longer required and are binding (Gopinath).

Futures: A futures contract is similar to the forward contract but is more liquid because it is traded in an organized exchange i.e. the futures market. When the currency depreciates, the currency can be hedged by selling futures and during appreciation of the currency, it can be hedged by buying futures. One advantage of futures is that there is a market for selling futures. Futures require a small initial outlay (a proportion of the value of the future) with which significant amounts of money can be gained or lost with the actual forwards price fluctuations. This provides leverage to the bank. One disadvantage of futures contract is limited i.e. only standard denominations of money can be bought instead of the exact amounts that are bought in forward contracts.

Options: A currency Option is a contract giving the right to buy or sell a specific quantity of one foreign currency in exchange for another at a fixed price. This is called the Exercise Price or Strike Price. As because options are fixed the price associated with the contract with respect to Maharashtra. When price reduces the uncertainty of exchange rate changes and reduces the losses of open currency positions. For contingent cash flows, options are a very useful hedging tool. When the currency appreciates, Call Options are used to manage risk, while Put Options are used if the risk is reducing.

Swaps: this is a contract in foreign currency where the traders exchange equal initial principal amounts of two different currencies at the spot rate. Over the term of the contract, the buyer and seller exchange fixed or floating rate interest payments in their respective swapped currencies. When this reaches maturity, the principal amount of the previous transaction is re-swapped at a predetermined exchange rate so that the parties end up with their original currencies.

The advantages of swaps are for firms who do limited risk management hedged position through the mechanism of foreign currency swaps, while leaving the underlying borrowing intact. This tool also helps firms to trade in floating rate of exchange.

Foreign Debt: the International Fischer Effect relationship helps in hedging of foreign exchange exposure by taking advantage of foreign debt. This can be exemplified through the example of an exporter who has to receive a fixed amount of dollars in a few shortly (Broll). The exporter loses money if the domestic currency appreciates against that foreign currency. But if the same money was hedged, he would a loan in the foreign currency for the same time period and convert the same into domestic currency at the current exchange rate. This theory assures gain realised by investing the profits from the loan would match the interest rate payment for the loan.

Choice of Hedging Instruments

The literature on the choice of hedging instruments is limited. To hedge foreign debt risk the most cost effective tool is currency swaps and the cost effective tool to hedging foreign operations risk are forward contracts (Goel and Gambhir). This is due to the reason that foreign currency debt payments are long-term and conventional. This fits currency swap contracts as they are long term in nature. But the revenues from foreign currency are short-term and unpredictable, in line with the short- term nature of forward contracts (Allayannis and Ofek)17.

Determinants of Hedging Decisions

The management of foreign exchange risk, according to the available literature so far, is a fairly complicated but helpful process. A firm, exposed to foreign exchange risk, needs to formulate a strategy to manage it, choosing from multiple alternatives. This section explores what factors firms take into consideration when formulating these strategies.

Production and Trade vs. Hedging Decisions

An important issue facing foreign banks is the allocation of capital among different countries production and sales and at the same time hedging their exposure to the varying exchange rates. Research in this area shows that the elements of exchange rate insecurity and the attitude toward risk are irrelevant to the MNC’s sales and production decisions (Broll)18. The revenue function and cost of production need to be assessed, and, the production and trade decisions in multiple countries are independent of the hedging decision.

This implies that the independence in FOREX hedging arises due to the presence of markets for hedging tools which simplifies the intricacy involved in a firm’s decision making as it can separate production and sales functions from the finance function. Firms avoid making decisions regarding future expectation as that aggravates risk.

Cost of Hedging

Hedging is takes place through two mechanisms, namely, the derivatives market or through money markets. In both the cases, the cost of hedging is the difference between the values received from a hedged position and that of the received if the firm did not hedge. When the market under consideration is efficient, cost of hedging is calculated by the difference between the future spot rate and current forward rate plus any transactions cost associated with the forward contract (Allayannis and Ofek).

Similarly costs which are expected due to hedging in the money market are the transactions cost added to the difference between the interest rate differential which is the expected value of the difference between the current and future spot rates. Both the tools produces similar results when the when the market is efficient. This is because interest rates and forward and spot exchange rates are determined at the same time. The cost of hedging melts down to pure transaction costs, and we assume efficiency in foreign exchange markets result in.

Factors affecting the decision to hedge foreign currency risk

Literature on hedging separates the firm’s decision to hedge from that of how much to hedge. Research provides evidence to suggest that firms with larger size and exposure to exchange rates through foreign sales and foreign trade use more of derivatives (Allayanis and Ofek, 2001). The following section describes the factors that affect the decision to hedge and then the factors affecting the degree of hedging are considered.

- Firm size: the size of the firm acts as a cushion for the cost of hedging or economies of scale. Risk management in FOREX involves fixed costs of setting up of systems and training/hiring of personnel in foreign exchange management. Moreover, large firms might be considered as more creditworthy counterparties for forward or swap transactions, thus further reducing their cost of hedging. The book value of assets is used as a measure of firm size.

- Leverage: According to the risk management literature, firms who have a high leverage have bigger incentive to engage in hedging. This is because it reduces the probability and the expected cost of financial distress. Highly leveraged firms avoid foreign debt as a means to hedge and use derivatives.

- Liquidity and profitability: Firms with assets which are very liquid or high profitability have lower incentive to engage in hedging. The reason behind this is low degree of exposure and hence low financial distress. Quick ratio is used to measure the liquidity which is calculated by quick assets divided by current liabilities. Profitability, on the other hand, is calculated as EBIT divided by book assets.

- Sales growth: this affects the decision to hedge. Due to this the firm’s hedging will be reduced and the probability of having to rely on external financing can be avoided. Hence this enables banks to enjoy uninterrupted high growth. As regards the degree of hedging, the single most determinant of the degree of hedging is exposure factors (Allayannis and Ofek). In other words, if it is assumed that the firm has intends to hedge, the decision regarding the magnitude of the hedge depends on the FOREX situation.

SWOT Analysis

We do a SWOT analysis of hedging as a risk dissipating tool.

Strength

The strength of hedging as a risk management tool for FOREX they are low risk, tax saver. The cost of hedging is low. The cost of hedging arises primarily from foreign exchange markets are pure transaction costs. The transaction costs include the brokerage or service fees charged by dealers. Indian market provides a strong equity market along with a stable currency against an ever depreciating US dollar (Bhayani)19. Indian FOREX market has a semi-regulatory framework where the apex body (RBI) intervenes in situations which cannot be controlled to stabilize currency fluctuations. For instance in early 2007 INR started appreciating continually against US dollars. Economists started predicting the fall of INR against US dollar was imminent. In such a situation, RBI intervened and stopped INR from appreciating further. This stance of RBI helped hedge funds to gain profit in the forwards dealing (Bhayani). RBI has implemented new tools such as Forward Rate Agreements (FRA), Interest Rate Swaps (IRS) and Interest Rate Futures (IRF) as hedging tools for foreign banks (Gopinath).

Weakness

Some firms foster the believe that hedging is speculating and hence risky (Allayannis and Ofek). Since the Indian currency fluctuates considerably and unpredictably hedging has high risk involved in hedging in Indian currency (Soenen). Opportunity Liberalization of the banking and economy of India in 1991. Lifting the ban on hedging in 2000 has provided an opportunity. As of October 2007, even corporate have been allowed to write options in the atmosphere of high volatility (Economic Times)20. RBI regulations do not allow foreign banks to hedge their funds to control the Indian FOREX market. When the INR is expected to appreciate, banks invest in either bonds or in equities, and “book profits” when the FOREX rate reaches the desired level (Bhayani)21. Recently the governement made an announcement to peg the exposure due to derivatives of froeign banks operating in India to $3.16 trillion as on 31 December 2007 (Mehra)22.

Threat

The first problem arises due to the existence of various market imperfections, namely incomplete financial markets, positive transaction and information costs. Foreign exchange management becomes an appropriate tool for corporate management which can be used to reduce the degree of financial distress, and agency costs and restrictions on free trade make (Giddy and Dufey).

Hedging Policy of Foreign Banks

CitiBank

HSBC

UK-based HSBC has around 20 foreign exchange trading desks, in Asia (HSBC). It is strong in Hong Kong and China. The bank offers competitive rates and fast execution in a wide range of currencies.

HSBC aims to provide the following (en quote):

- “The full risk management services to our corporate and institutional client base

- Suitable investment products to our investor client base

- Focus on delivering wealth management applications” (HSBC)25.

The HSBC mostly uses spot and forward transaction for hedging in the Indian FOREX market (HSBC). In India the bank provides flexible risk management services through assorted options in different currencies (Platt)26. HSBC’s hedging strategy for India during the period of rupee appreciation was “combined hedging” (The Hindu)27. The bank uses appropriate level of controls and authority to adopt a straight forward policy on risks and hedging.

Once the bank decides upon a strategy, it chooses the available instruments that is suitable in the country’s regulatory framework and then executes the strategy. They also advocate periodic review of performance. The key market parameters that HSBC stresses upon are spot exchange rate, forward premium differential, long-term forward premium and currency volatility (HSBC).

HSBC in 2007 adopted a policy of combined hedging in India (The Hindu). This policy of combined hedge would provide interest savings on rupee debt, as well as provide natural hedge against exports, especially a loan in rupee is converted into US dollars. This kind of hedging in India constantly runs through the scanner of RBI and it allows foreign banks to hedge their exports-imports under the two categories – specific underlying and past performance (The Hindu). Exposure in capital account especially in forms of loans, bonds (both inflows and outflows) can be hedged on the basis of providing “specific underlying” (The Hindu). In the current economic situation of a slowdown, HSBC offers a mix by taking the portfolio approach.

Deutsche Bank

The bank has been in India since 1980 (Duetsche Bank)28. Deutsche Bank is one of the global market leaders in foreign exchange trading. It has over Rs. 5700 crore capital and 6000 employees in India. It has around 700 trading, sales and support staff, it operates 42 foreign exchange markets worldwide (Gordon 2007)29. Deutsche Bank primarily is famous for its specialty ‘theme based’ FOREX investment products. The bank is has its expertise at developing well structured currency investment strategies. It has created almost 38 foreign exchange indexes, with $26 billion in cumulative trading volume (Duetsche Bank). Almost 65 hedge fund managers presently use the bank’s FXSelect platform (Platt).

The bank made a new derivative instrument known as Harvest indexes which provides easy access to a diversified strategy of borrowing in currencies of countries where there are low interest rates and investing in currencies which yield higher-return (Platt). In May 2006 Deutsche Bank introduced an online retail foreign exchange margin trading service to customers worldwide. This system includes 24 currency pairs with streaming quotes on competitive spreads (Platt 2007). It provides hedging products to its corporate clients. It also has currency-risk products for cross-border mergers and acquisitions (Duetsche Bank).

The services that Duetsche bank provides to its clientele are:

- Advisory services along with hedge products to protect the client’s overseas assets from fluctuations in currencies.

- Trading and investment in FOREX for capital growth

- Spot, forward and FX option transactions plus margin trading and structured products (Duestche Bank)30

Standard Chartered Bank

Standard Charteretd is th emarket leader in Asia, Africa and Middle-east from where they derive 90 percent of their profit (Standard Chartered)31.The hedging instruments as used by Standard Chartered are forward exchange contracts, interest rate swaps, cross currency swaps and options (Standard Chartered). All hedges by the bank are accounted for on accrual basis. The bansiders a derivative as a hedge iff the instrument can be “clearly identified with the hedged item or transaction, it involves an external party and is effective” (Standard Chartered 8). A hedge is considered effective when the returns from it are witin a range of 80 to 125 percent32.

The services that are offered by the bank to its corporate clietele are:

- Corporates can make payment in foreign currency to their vendors.

- They trade in over 100 foreign currencies.

- They even have a global team who provides FOREX trading advisory in restricted or illiquid currencues.

- The facility of online treasurey helps to do transactions more easily.

The bank has a clearly state policy for hedging. The derivatives which are used for hedging are initiated by Asset Liability Management (‘ALM’). Interest rate swaps are used to hedge interest rate risk in the fixed rate asset book (including mortgages). The bank uses forward exchange contracts as a tool to swap foreign currency liabilities into rupees. (Standard Chartered)

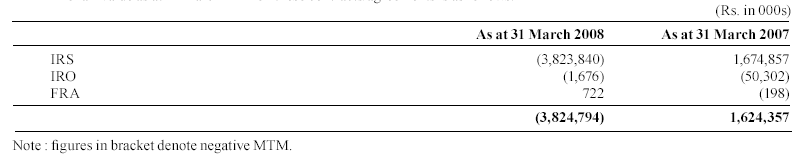

Table 1 shows the statutory disclosure for 2008 for Interest Rate Swaps (IRS), Interest Rate Options (IRO) and Forward Rate Agreements (FRA). As at 31 March 2008, the exposure on IRS, IRO and FRA are spread across different industries. But on the basis of the notional principal amount, the maximum exposure to a single industry with the bank is estimated to be 96 percent for 2007-08 which was 93 percent for 2006-07 (Standard Chartered).

Standard chartard has a unique policy of serving their clietele. They assess the risk that a corporate can take in order to determine the level of risk exposure they can offer (Mehra). The bank makes it a policy to serve only those companies who are open to take risks and would accept their “exotic instruments” (Mehra)33.

The bank launched the first Indian Rupee Foreign Exchange transaction via the Reuters Trading For Foreign Exchange (RTFX) electronic platform in India in 2007 (Standard Chartered)34. This service targets top-tier indian corporations and helps in developing the workflow for treasurers hedging their foreign exchange exposures. This was preceded by the introduction of the bank’s new online OIS INR Interest Rate Swap trading service in 2006 (Standard Chartered).

LIBOR and MIFOR Rate

Mumbai Inter-bank Forward Offer Rate (MIFOR) was used as a benchmark for swaps in the Indian FOREX market. In 2002 the RBI discontinued the use of LIBOR as swap benchmark and introduced MIFOR (Goel and Gambhir). In the beginning it was necessary to use foreign interest rate indices in the Indian domestic FOREX market. At the initial stage of the Indian domestic derivatives market, it was necessary to use foreign interest rate indices such as LIBOR due to unavailability of local indices.

MIBOR has become an accepted benchmark and has been started to be used as a floating rate swaps, in the Indian market as the FOREX market has expanded both in size and liquidity. MIFOR is essentially a LIBOR-linked rate (RBI). MIFOR may be defined as the costs of rupee funds in a foreign currency say US dollars. Aggregate of LIBOR and the forward premium on US dollars vis-à-vis INR supports comparison of costs of raising resources in foreign markets. In case of a fully arbitraged market, irrespective of the origin of the fund, i.e. domestic or foreign, remains the same. This is because forward premiums get neutralized in the interest rate advantage in the foreign currency.

The liquidity period of the dollar-rupee forward market is up to 12 months (RBI). If a bank wants to hedge beyond 12 months then MIFOR swaps in which the counter-parties exchange a fixed and floating rate change every 6 months which is based on prevailing LIBOR and the dollar-rupee forward premiums. This way a person who borrows dollars, can be locked in for a period of five years in the forward premium. Even though the MIFOR swap is a pure rupee swap, it provides protection against currency risk. Currency swaps are more risky than MIFOR.

Conclusion

India faces a dilemma as she ventures towards a more open market driven economy form a Nehruvian model of quasi-socialist economy. The short-term foreign debt India has is much less than the country’s overall foreign debt. Even in volatile conditions, the RBI has successfully kept the exchange rate stable except for in 1991 when the rate was liberalized and then recently in 2008 due to spiraling oil prices and double digit inflation35. Still, there are on-going debates about further opening of the foreign market in the country. Cynics also predict that if the growth in the derivatives market will be attract offshore markets for FIIs who intend to hedge their rupee risk abroad. This is a problematic situation for government of India. So the RBI still regulates the foreign exchange market especially the foreign banks so that the apex authority has power to control their movements in the FOREX market.

Recommendations

After a comprehensive study into the different hedging instruments that foreign banks use to operate in India we recommend the following strategies that could be considered for hedging. Currency swaps are the answer to those who are not able to access foreign currency liabilities directly. By means of a currency swap, a company which has a primary rupee liability on its balance- sheet, creates an off-balance-sheet foreign currency liability and undertakes to repay the foreign currency liability in exchange for receiving a rupee cash flow calculated (at inception) at a certain rate of exchange. The rupee cash in-flow would go to meet the company’s commitment on its on- balance-sheet rupee liability.

In other words, a currency swap is nothing but a re-arrangement of the capital account cash flows of a company and leaves the company with a net foreign exchange liability. And, if as per expectation, the foreign currency has depreciated against the rupee from the levels at the beginning of the swap, the bank makes its profit. The Indian FOREX market can be accessed is by hedging the underlying foreign exchange exposures.

As the domestic FOREX markets evolved it gained depth and volume by booking forward contracts. Swaps and options have been including along with forwards as new hedging options in India. Since the exchange rates are volatile so the obvious option in such a case if hedging options. The RBI has maintained that India’s exchange rate need to remain stable even if it is depreciating gradually (Narasimhan)36. Currently the rupee depreciated to over Rs. 42.50 (RBI). So in such a case the hedging instrument to be used is hedging of options. As the process of globalization sets in the Indian market, products being hedged even in the US market are can be utilized for the benefit of Indian FOREX market. Even though cross-currency hedging instruments are available, but the issue is they are not available in Indian currency. This problem needs to be altered for unhindered growth of the Indian FOREX market.

Bibliography

Adler, M and B Dumas. “Exposure to currency risk: definition and measurement.” Financial Management (1984): 41-50.

Allayannis, George and Eli Ofek. “Exchange rate exposure, hedging, and theuse of foreign currency derivatives.” Journal of International Money and Finance 20 (2001): 273–296.

Banerjee, Gargi and Sanjiv Shankaran. Foreign banks may have gained from derivatives sale. 2008. Web.

Barclays Bank. Annual Report. 2007.

Bhalla, V. K. Working Capital Management. Anmol Publications PVT. LTD., 2003.

Bhayani, Rajesh. “Hedge funds active in currency arbitrage.” Business Satndard 2007.

Broll, Udo,. “Foreign Production and International Hedging in a Multinational Firm.” Open economies review 4 (1993): 425-432.

CitiBank. CitiBank Online. 2008. Web.

Duestche Bank. Foreign Exchange and Commodities. 2008.

Economic Times. 2007.

Giddy, Ian H and Gunter Dufey. The Management of Foreign Exchange. 1992. Web.

Goel, Neeraj and Manoj Gambhir. “Foreign Exchange Derivatives Market in India − Status and Prospects.” ICICI Bank Report. 2005.

Gopinath, Shyamala. “Indian Derivatives Market – A Regulatory and Contextual Perspective.” Euromoney Inaugural India Derivatives Summit. Mumbai: RBI, 2007. 1-14.

Holden, Paul and Sarah Holden. “Foreign Exchange Risk and Microfinance Institutions.” The Enterprise Research Institute. Washington: MicroRate, 2004. 1-41.

HSBC. HSBC. 2008. Web.

Mehra, Puja. “Can companies blame banks for their recklessness?.” 2008. BusinessWorld. Web.

Mohan, Rakesh. Development of financial markets in India. Mumbei, 2007.

Narasimhan, C. R. L. “Hedging the foreign exchange risk.” 2008. The Hindu. Web.

—. “Hedging the foreign exchange risk.” 2007. The Hindu. Web.

Platt, Gordon. ” World’s Best Foreign Exchange Banks.” Global Annual Report. 2007.

Porter, M.E. Competitive Strategy. Free Press, 1980.

RBI. Comemrcial banking at a Glance. Statement No. 1. New Delhi: RBI,, 2007.

—. Foreign Exchange Management (Foreign exchange derivative contracts) Regulations, 2000 Notification No.FEMA 25. New Delhi.

—. “Fuller Capital Account Convertibility.” RBI Report. 2006.

—. Report of the Internal Technical Group on Forex Markets,. New Delhi, 2007.

Soenen, L.A. ” Efficient Market Implications for Foreign Exchange Exposure Management.” DE ECONOMIST 127. (1979).

Standard Chartered. “Standard Chartered Bank Launches Indian Domestic Online Rupee Trading Service.” 2007. Press Release. Web.

—. “Standard Chartered Bank-India Branches.” Economic and Political Weekly 2008: 1-42.

—. “Standard Chartered Branch – Indian Branches.” 2008. Standard Chartered Bank. Web.

Taylor, S. Mastering Foreign Exchange & Currency Options: A Practical Guide to the New Marketplace. Pearson Education, 2003.

The Hindu,. “Combined hedging is best bet for exporters to manage rupee swings.” The Hindu, 2007.

Toffler, B. and J. Reingold. Final accounting: Ambition,greed, and the fall of Authur Anderson. New York : Broadway Books., 2003.

V.K.Bhalla. Working Capital management. Anmol Publications PVT. LTD., 2006.

Footnotes

- Taylor, S. Mastering Foreign Exchange & Currency Options: A Practical Guide to the New Marketplace. Pearson Education, 2003.

- RBI. Commercial banking at a Glance. Statement No. 1. New Delhi: RBI, 2007.

- Holden, Paul, and Sarah Holden. “Foreign Exchange Risk and Microfinance Institutions.” The Enterprise Research Institute. Washington: MicroRate, 2004. 1-41.

- Gopinath, Shyamala. “Indian Derivatives Market – A Regulatory and Contextual Perspective.” Euromoney Inaugural India Derivatives Summit. Mumbai: RBI, 2007. 1-14.

- Porter, M.E. Competitive Strategy, Free Press, 1980.

- RBI. Commercial banking at a Glance. Statement No. 1. New Delhi: RBI, 2007.

- Mohan, Rakesh. Development of financial markets in India. Mumbai, 2007.

- RBI, Foreign Exchange Management (Foreign exchange derivative contracts) Regulations, 2000 Notification No.FEMA 25. New Delhi.

- Bhalla, V. K. Working Capital Management. Anmol Publications PVT. LTD., 2003.

- Goel, Neeraj, and Manoj Gambhir. “Foreign Exchange Derivatives Market in India − Status and Prospects.” ICICI Bank Report. 2005.

- Adler, M and B Dumas. “Exposure to currency risk: definition and measurement.” Financial Management (1984): 41-50.

- Barclays Bank. Barclays Bank. 2008. Web.

- Soenen, L.A. ” Efficient Market Implications for Foreign Exchange Exposure Management.” DE ECONOMIST 127. (1979).

- Giddy, Ian H and Gunter Dufey. The Management of Foreign Exchange. 1992. Web.

- Allayannis, George and Eli Ofek. “Exchange rate exposure, hedging, and theuse of foreign currency derivatives.” Journal of International Money and Finance 20 (2001): 273–296.

- Adler, M and B Dumas. “Exposure to currency risk: definition and measurement.” Financial Management (1984): 41-50.

- Allayannis, George and Eli Ofek. “Exchange rate exposure, hedging, and theuse of foreign currency derivatives.” Journal of International Money and Finance 20 (2001): 273–296.

- Broll, Udo,. “Foreign Production and International Hedging in a Multinational Firm.” Open economies review 4 (1993): 425-432.

- Bhayani, Rajesh. “Hedge funds active in currency arbitrage.” Business Satndard 2007.

- Economic Times, 2007.

- Above.

- Mehra, Puja. “Can companies blame banks for their recklessness?.” 2008. BusinessWorld. Web.

- Banerjee, Gargi and Sanjiv Shankaran. Foreign banks may have gained from derivatives sale. 2008. Web.

- CitiBank. CitiBank Online. 2008. Web.

- HSBC. 2008. Web.

- Platt, Gordon. ” World’s Best Foreign Exchange Banks.” Global Annual Report. 2007.

- The Hindu. “Combined hedging is best bet for exporters to manage rupee swings.” The Hindu 2007.

- Duetsche Bank. “Duetsche Bank Group in India.” 2008. Duetsche Bank. Web.

- Duestche Bank. Foreign Exchange and Commodities. 2008.

- Standard Chartered. “Standard Chartered Bank Launches Indian Domestic Online Rupee Trading Service.” 2007. Press Release. Web.

- Standard Chartered.”Standard Chartered Branch – Indian Branches.” 2008. Standard Chartered Bank. Web.

- Mehra, Puja. “Can companies blame banks for their recklessness?.” 2008. BusinessWorld. Web.

- “Standard Chartered Bank-India Branches.” Economic and Political Weekly 2008: 1-42.

- RBI. Report of the Internal Technical Group on Forex Markets,. New Delhi, 2007.

- Narasimhan, C. R. L. “Hedging the foreign exchange risk.” 2007. The Hindu. Web.